Palletizer Market Report

Published Date: 22 January 2026 | Report Code: palletizer

Palletizer Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Palletizer market, covering current trends, forecasts from 2023 to 2033, market segmentation, regional analysis, and major industry players. The report aims to highlight growth opportunities and challenges within the sector.

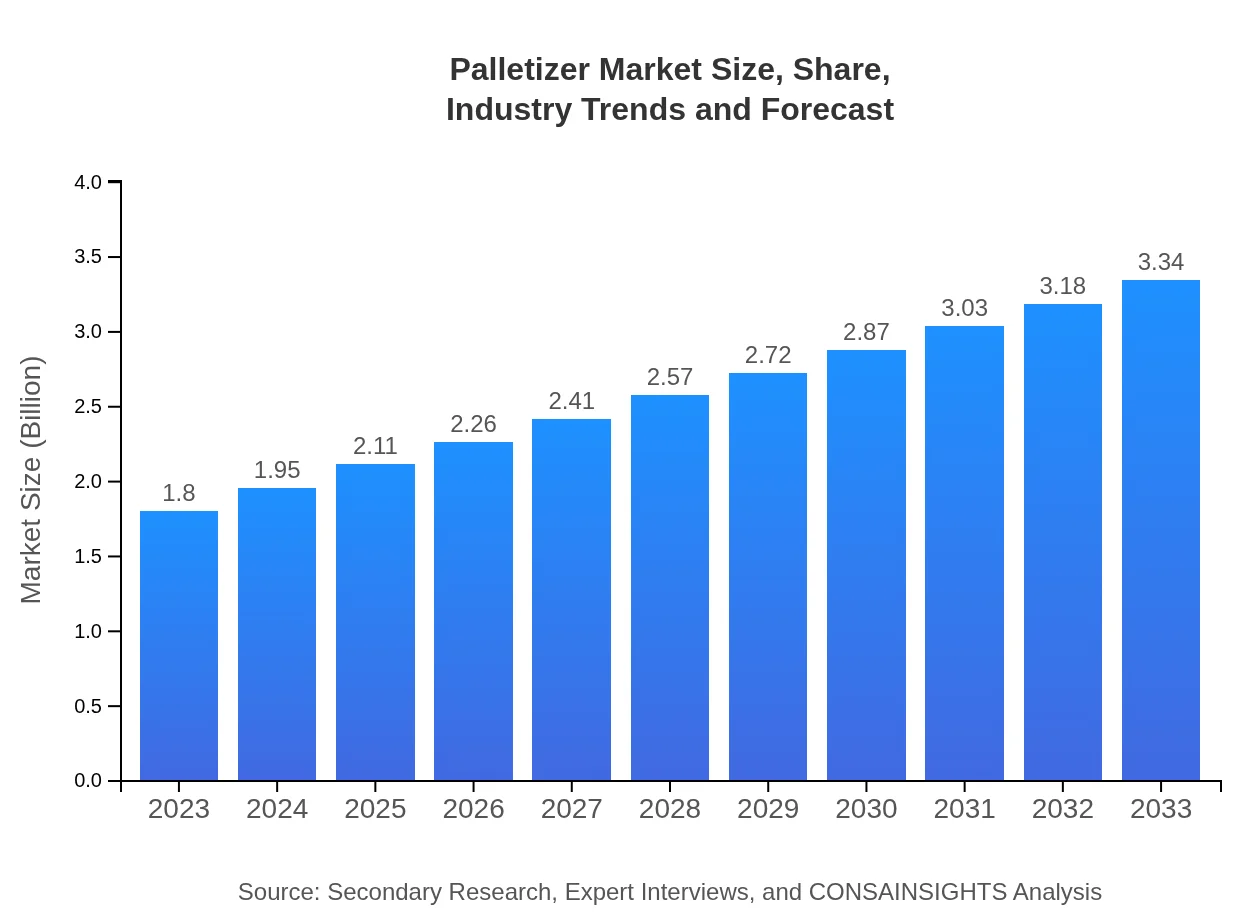

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | KUKA AG, Schneider Electric, Fanuc Corporation |

| Last Modified Date | 22 January 2026 |

Palletizer Market Overview

Customize Palletizer Market Report market research report

- ✔ Get in-depth analysis of Palletizer market size, growth, and forecasts.

- ✔ Understand Palletizer's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Palletizer

What is the Market Size & CAGR of Palletizer market in 2023?

Palletizer Industry Analysis

Palletizer Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Palletizer Market Analysis Report by Region

Europe Palletizer Market Report:

The European Palletizer market, valued at $0.53 billion in 2023, is forecasted to grow to $0.98 billion by 2033. The region's stringent regulations and focus on efficiency in sectors such as food and pharmaceuticals are key growth drivers.Asia Pacific Palletizer Market Report:

In Asia Pacific, the Palletizer market was valued at $0.34 billion in 2023 and is expected to grow to $0.62 billion by 2033, reflecting a strategic shift towards automation in manufacturing hubs like China and India, bolstered by investments in infrastructure and technology.North America Palletizer Market Report:

In North America, the market is poised for significant growth from $0.67 billion in 2023 to $1.25 billion by 2033. This growth is encouraged by a robust e-commerce sector and a strong push for supply chain optimization through automation.South America Palletizer Market Report:

The South America Palletizer market is estimated at $0.12 billion in 2023, with projections of reaching $0.22 billion by 2033. Growth is driven by increasing exports in agricultural products and heightened demand for efficient logistics solutions.Middle East & Africa Palletizer Market Report:

In the Middle East and Africa, the Palletizer market is expected to increase from $0.15 billion in 2023 to $0.27 billion by 2033. Economic diversification and investments in logistics infrastructure are essential contributors to market expansion.Tell us your focus area and get a customized research report.

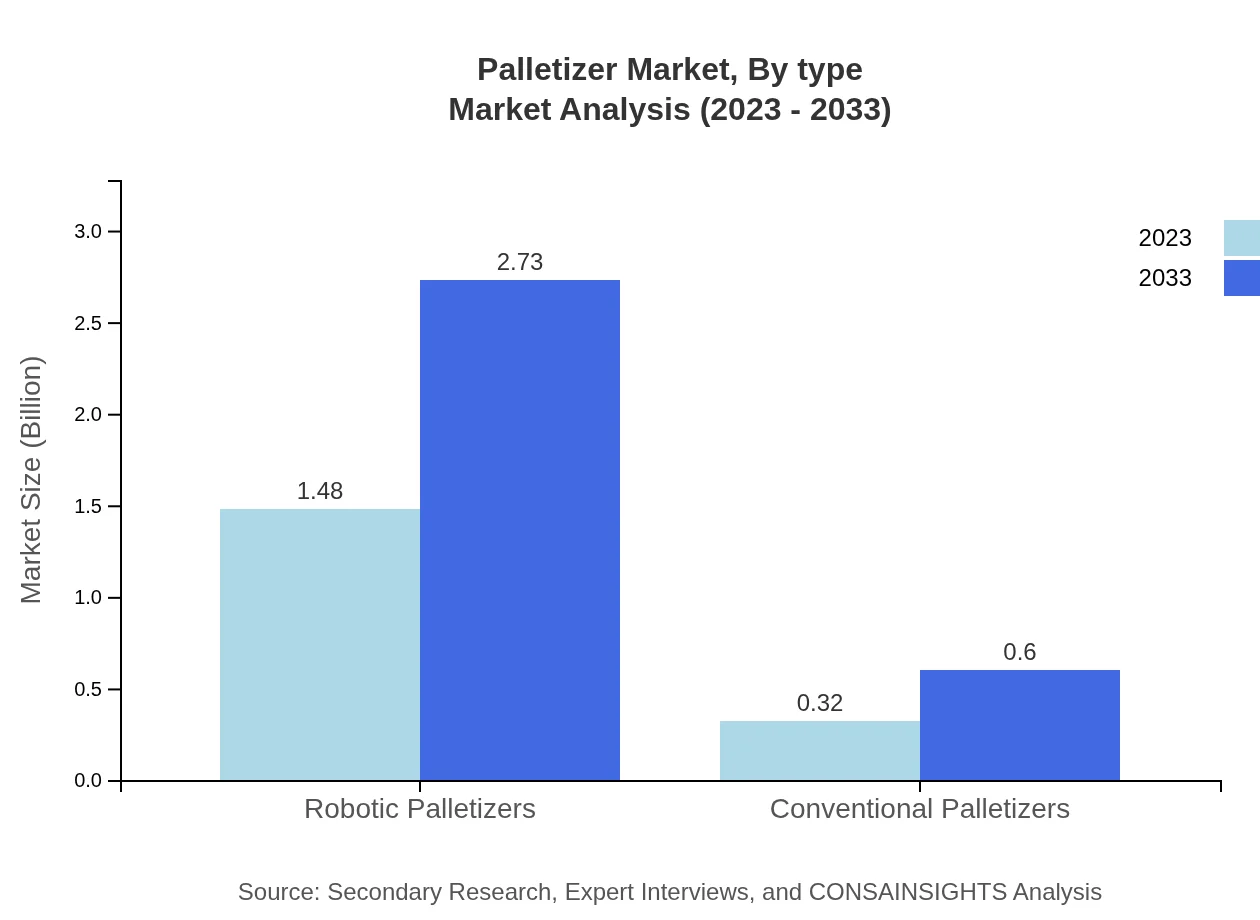

Palletizer Market Analysis By Type

Robotic palletizers are rapidly gaining traction in the market, growing from $1.48 billion in 2023 to $2.73 billion by 2033, accounting for 81.98% market share. Conventional palletizers, while trailing, are set to increase from $0.32 billion to $0.60 billion.

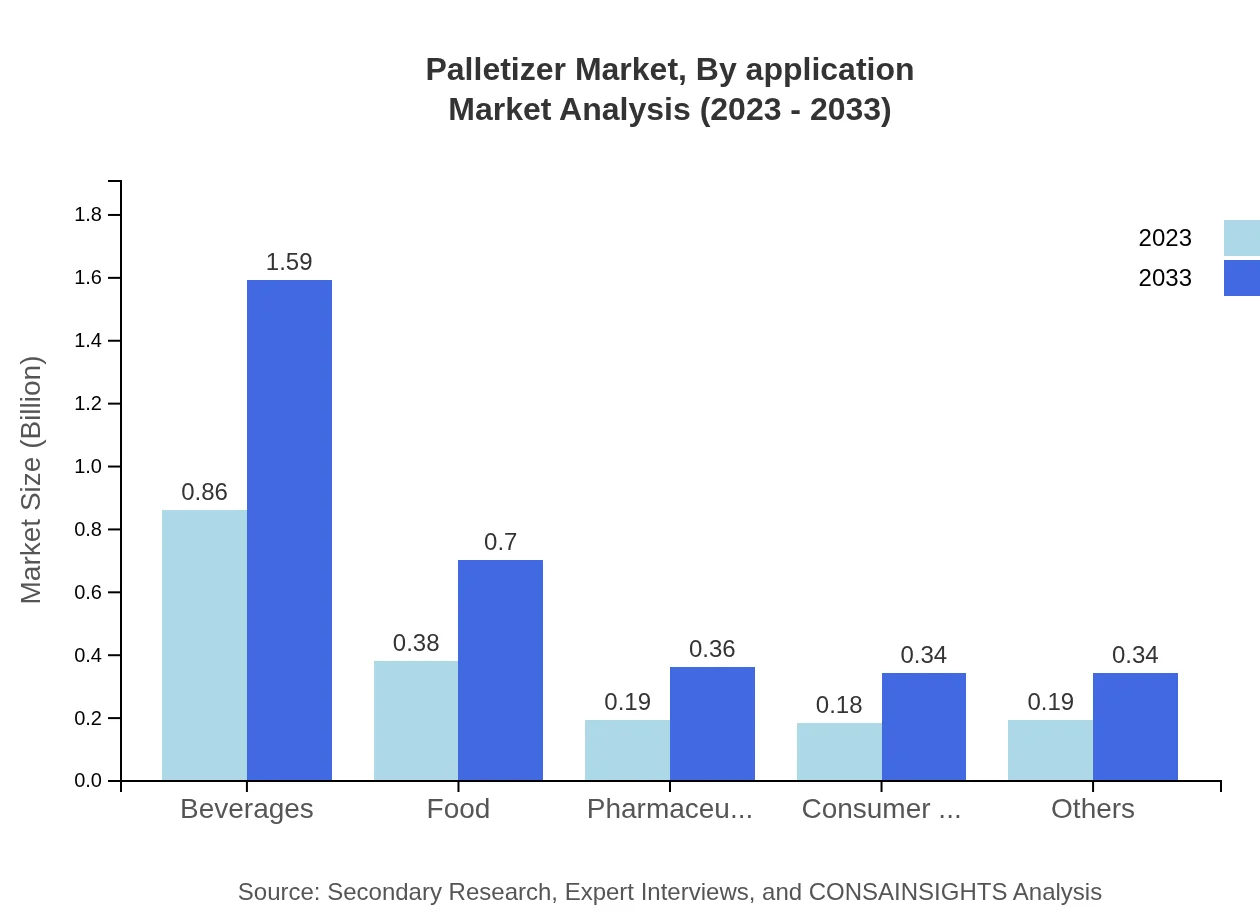

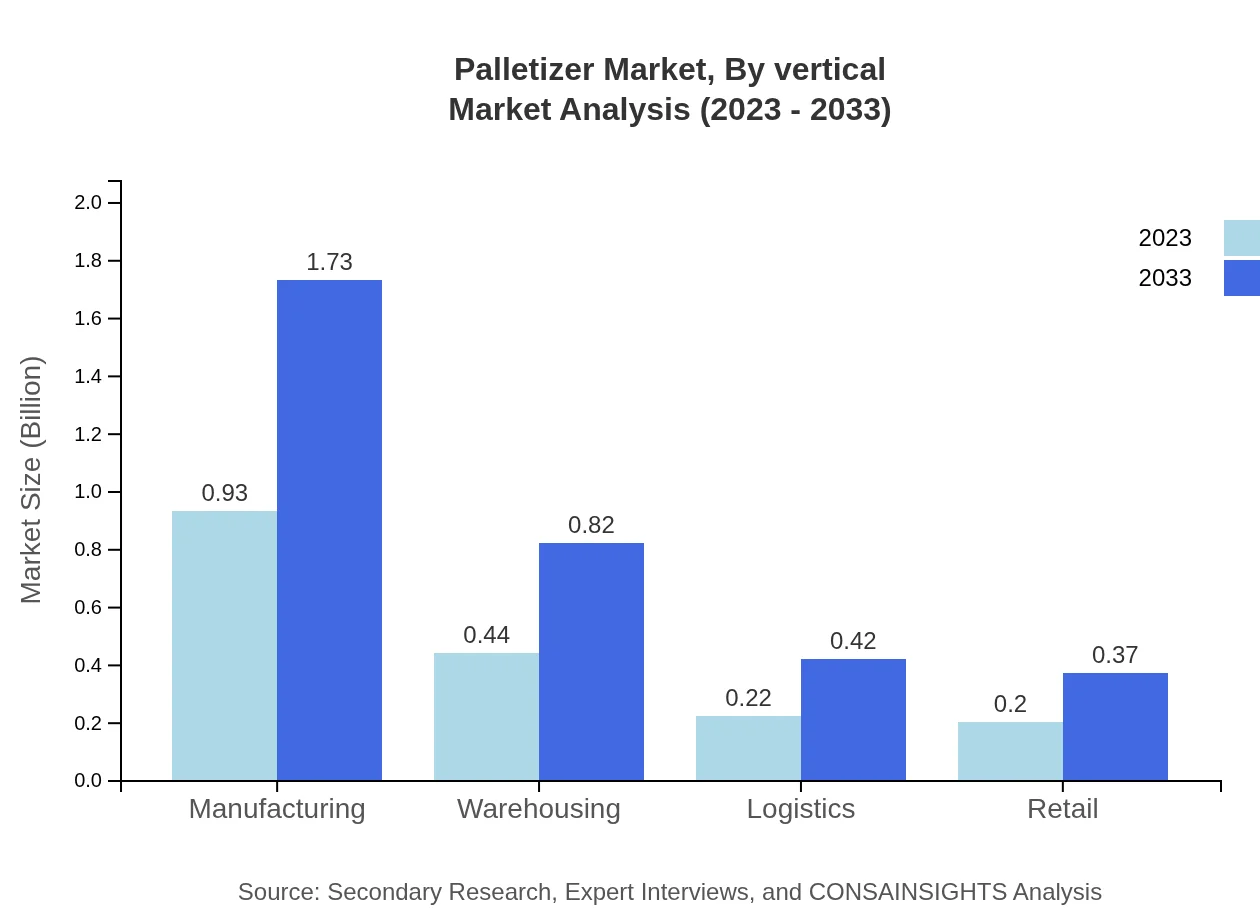

Palletizer Market Analysis By Application

The manufacturing sector dominates with $0.93 billion in 2023 and is expected to reach $1.73 billion by 2033. Warehousing follows closely, increasing from $0.44 billion to $0.82 billion over the same period.

Palletizer Market Analysis By Driving Factor

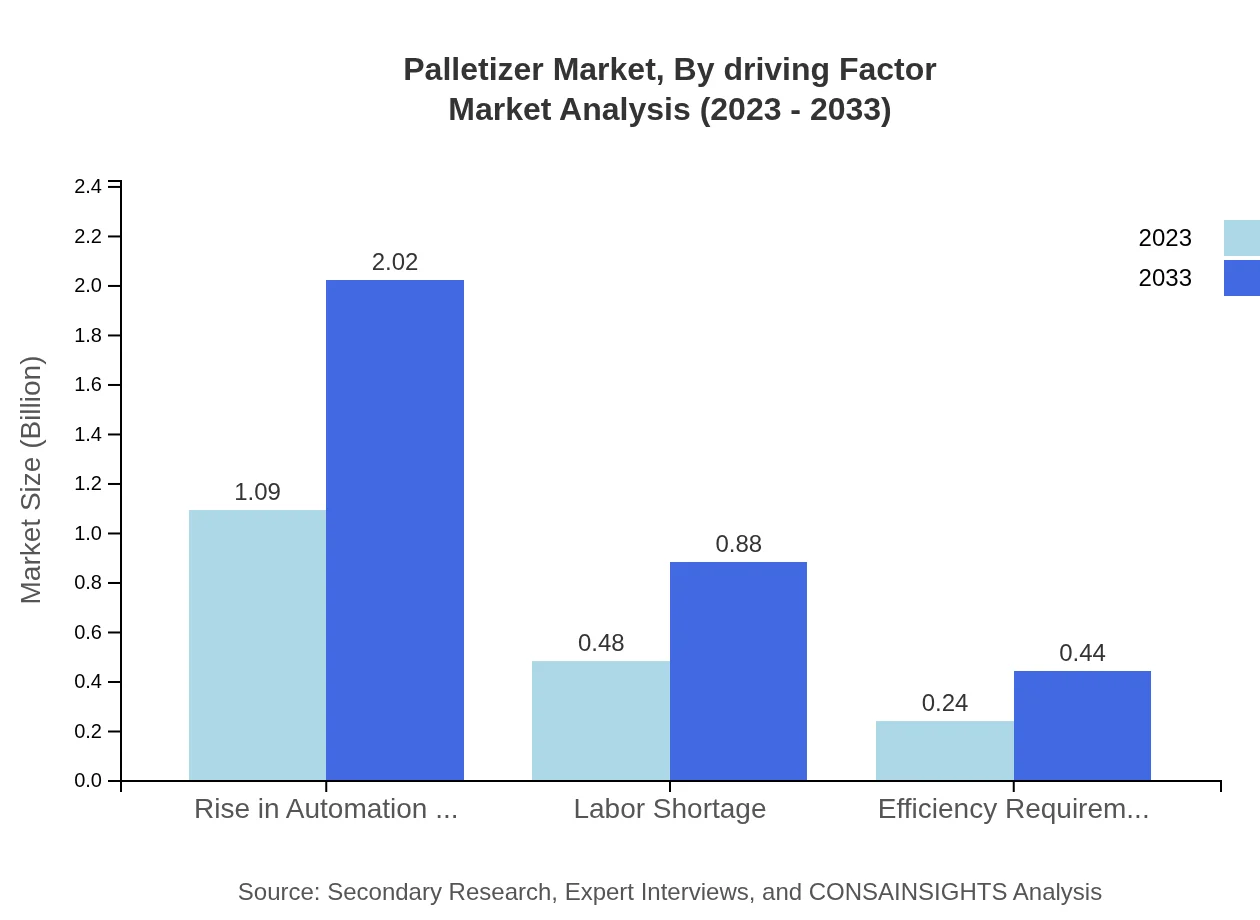

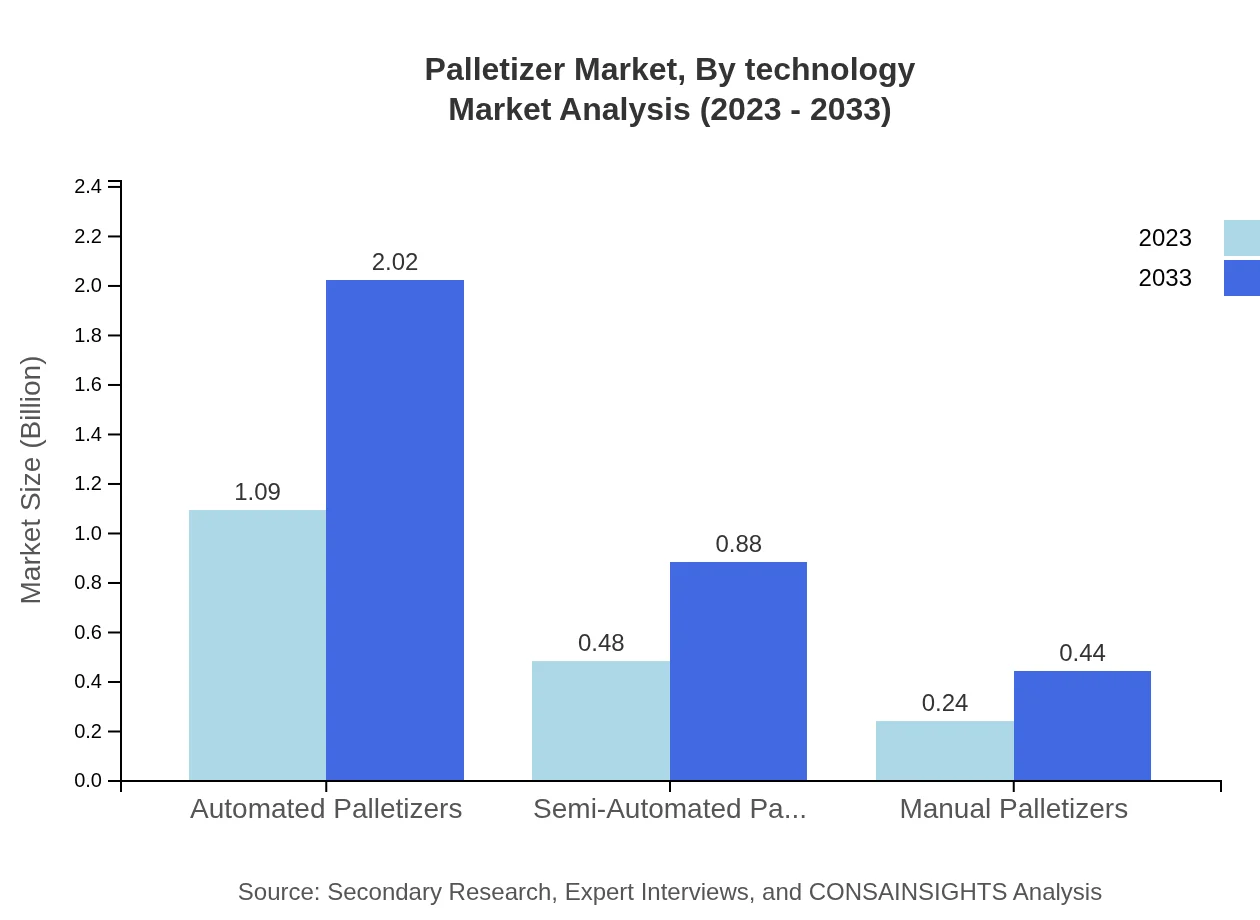

The rise in automation demand is a dominant factor in the market, from $1.09 billion in 2023 to $2.02 billion by 2033. Labor shortages and efficiency requirements are also contributing significantly to market growth.

Palletizer Market Analysis By Vertical

The beverages segment leads with an estimated size of $0.86 billion in 2023, growing to $1.59 billion by 2033. The food and pharmaceuticals segments follow, with respective sizes of $0.38 billion and $0.19 billion.

Palletizer Market Analysis By Technology

Advanced technologies such as these have seen significant interest, particularly automated and semi-automated systems. Automated palletizers account for 60.43% of the market share, growing from $1.09 billion to $2.02 billion by 2033.

Palletizer Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Palletizer Industry

KUKA AG:

A leader in automation solutions, KUKA specializes in robotic arm technology and advanced palletizing systems, contributing significantly to the industry's technological advancement.Schneider Electric:

Known for its expertise in automation and control solutions, Schneider Electric provides innovative palletizing systems, focusing on enhancing operational efficiency and sustainability.Fanuc Corporation:

A top manufacturer of industrial robots, Fanuc offers reliable and high-performing palletizers that cater to various industries, particularly in the automotive and logistics sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of palletizers?

The global palletizer market is projected to reach approximately $1.8 billion in 2023, with a compound annual growth rate (CAGR) of 6.2% anticipated over the next decade. This growth reflects increasing automation and demand for efficient packaging solutions.

What are the key market players or companies in the palletizer industry?

Key players in the palletizer market include companies like ABB, FANUC, KUKA, and Mitsubishi, among others. These firms are recognized for their innovative solutions in material handling and automation technology, contributing significantly to the industry.

What are the primary factors driving the growth in the palletizer industry?

The growth of the palletizer market is primarily driven by rising automation demand, labor shortages, and the need for improved efficiency in production processes. These factors motivate industries to adopt advanced palletizing solutions to enhance productivity.

Which region is the fastest Growing in the palletizer market?

Asia-Pacific is currently the fastest-growing region in the palletizer market, with an increase from $0.34 billion in 2023 to $0.62 billion by 2033. This growth is fueled by expanding manufacturing and logistics sectors in emerging economies.

Does ConsaInsights provide customized market report data for the palletizer industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the palletizer industry. Clients can request insights based on particular market segments, geographical areas, or unique operational requirements.

What deliverables can I expect from this palletizer market research project?

Deliverables from the palletizer market research project include comprehensive market analysis, segmented data, insights on trends, competitive landscape evaluations, and forecasts showcasing potential market developments over the next decade.

What are the market trends of palletizers?

Current trends in the palletizer market include increasing adoption of robotic palletizers, growth in automated solutions, and a focus on energy efficiency. These trends reflect a shift toward smarter, more efficient packaging systems across industries.