Pancreatic And Biliary Stents Market Report

Published Date: 31 January 2026 | Report Code: pancreatic-and-biliary-stents

Pancreatic And Biliary Stents Market Size, Share, Industry Trends and Forecast to 2033

This market report delves into the Pancreatic And Biliary Stents market, analyzing key trends, segmentation, and forecasts from 2023 to 2033, providing valuable insights for stakeholders looking to navigate this dynamic industry.

| Metric | Value |

|---|---|

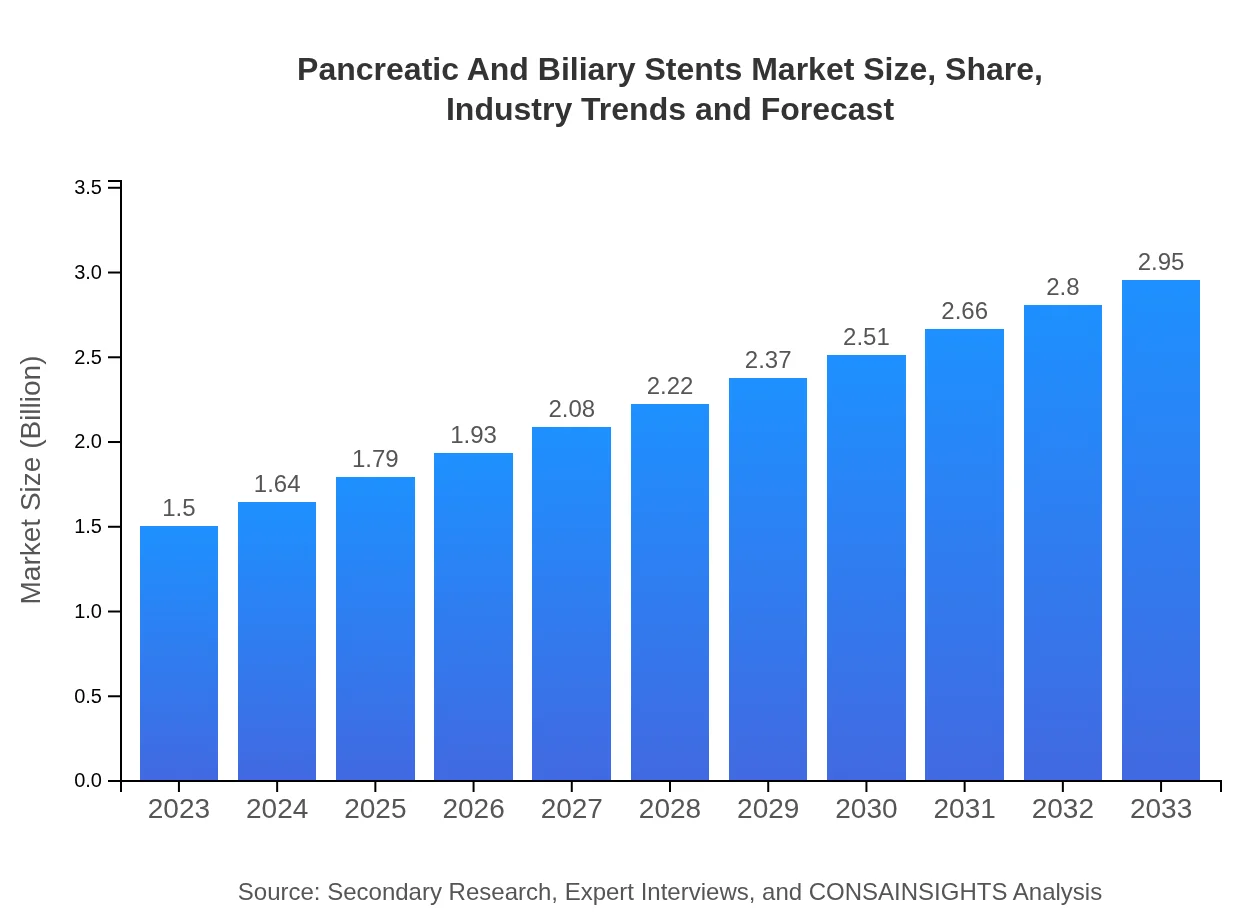

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.95 Billion |

| Top Companies | Boston Scientific, Medtronic , Cordis, Cook Medical |

| Last Modified Date | 31 January 2026 |

Pancreatic And Biliary Stents Market Overview

Customize Pancreatic And Biliary Stents Market Report market research report

- ✔ Get in-depth analysis of Pancreatic And Biliary Stents market size, growth, and forecasts.

- ✔ Understand Pancreatic And Biliary Stents's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pancreatic And Biliary Stents

What is the Market Size & CAGR of Pancreatic And Biliary Stents Market in 2023?

Pancreatic And Biliary Stents Industry Analysis

Pancreatic And Biliary Stents Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pancreatic And Biliary Stents Market Analysis Report by Region

Europe Pancreatic And Biliary Stents Market Report:

Europe accounts for a significant share of the global market, with a projected rise from USD 0.50 billion in 2023 to USD 0.98 billion by 2033. Increased R&D activities and favorable regulations contribute to the positive outlook.Asia Pacific Pancreatic And Biliary Stents Market Report:

The Asia Pacific region exhibits significant growth potential due to increasing healthcare investments and rising incidences of biliary diseases. The market is expected to see a notable rise from approximately USD 0.28 billion in 2023 to USD 0.55 billion by 2033.North America Pancreatic And Biliary Stents Market Report:

North America is the largest market, driven by technological advancements and high healthcare expenditures. The market was USD 0.51 billion in 2023 and is expected to rise to USD 0.99 billion by 2033, showcasing robust growth in surgical interventions.South America Pancreatic And Biliary Stents Market Report:

In South America, the market is relatively small but shows signs of growth. The market size was approximate USD 0.01 billion in 2023, projected to grow to USD 0.02 billion by 2033, reflecting gradual improvement in healthcare infrastructure.Middle East & Africa Pancreatic And Biliary Stents Market Report:

The Middle East and Africa is witnessing gradual growth in the Pancreatic and Biliary Stents market, from USD 0.21 billion in 2023 to an estimated USD 0.41 billion by 2033, driven by increasing prevalence of digestive disorders.Tell us your focus area and get a customized research report.

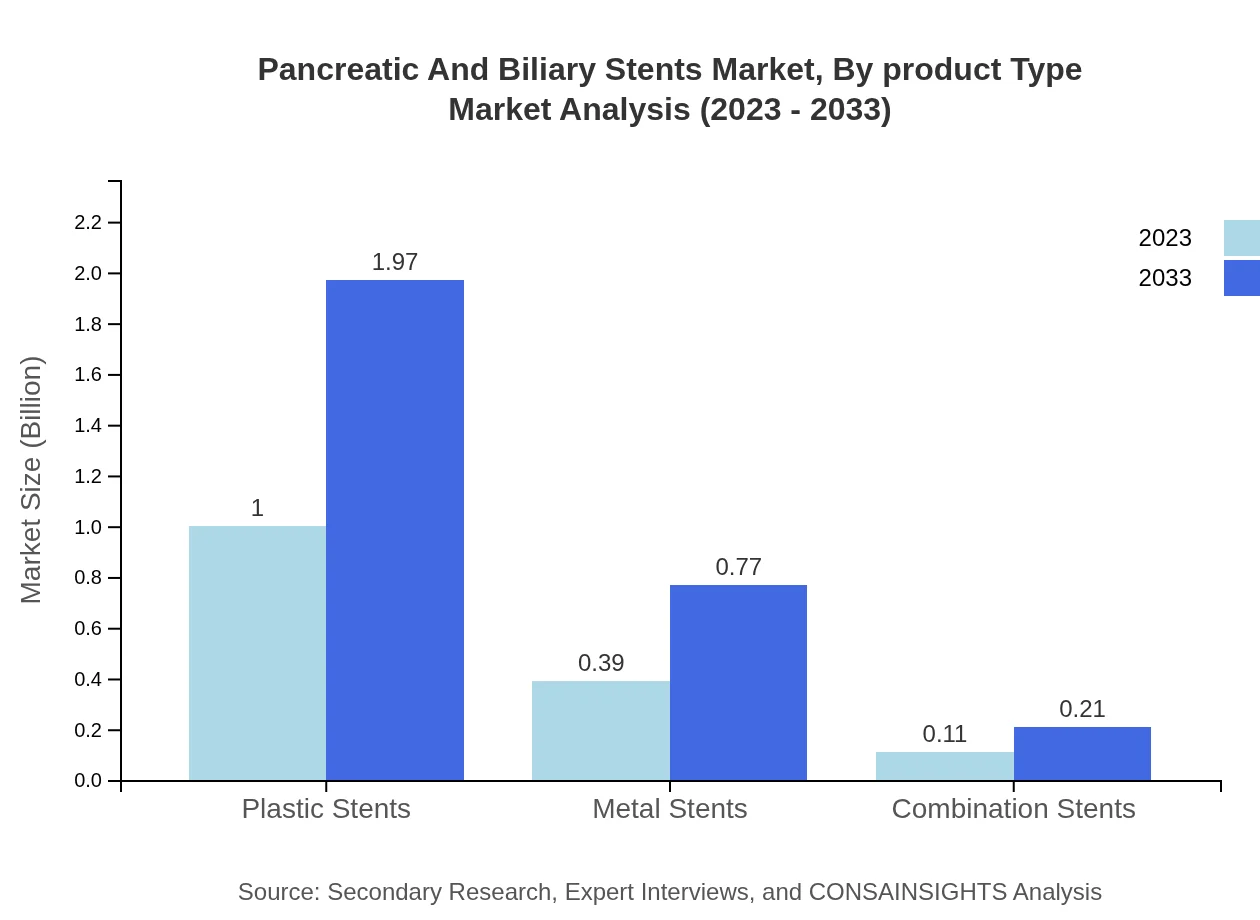

Pancreatic And Biliary Stents Market Analysis By Product Type

The market comprises plastic stents holding a large share of 66.73% in 2023, projected to maintain this share into 2033. Metal stents and combination stents follow, attributing to innovations leading to improved patient outcomes.

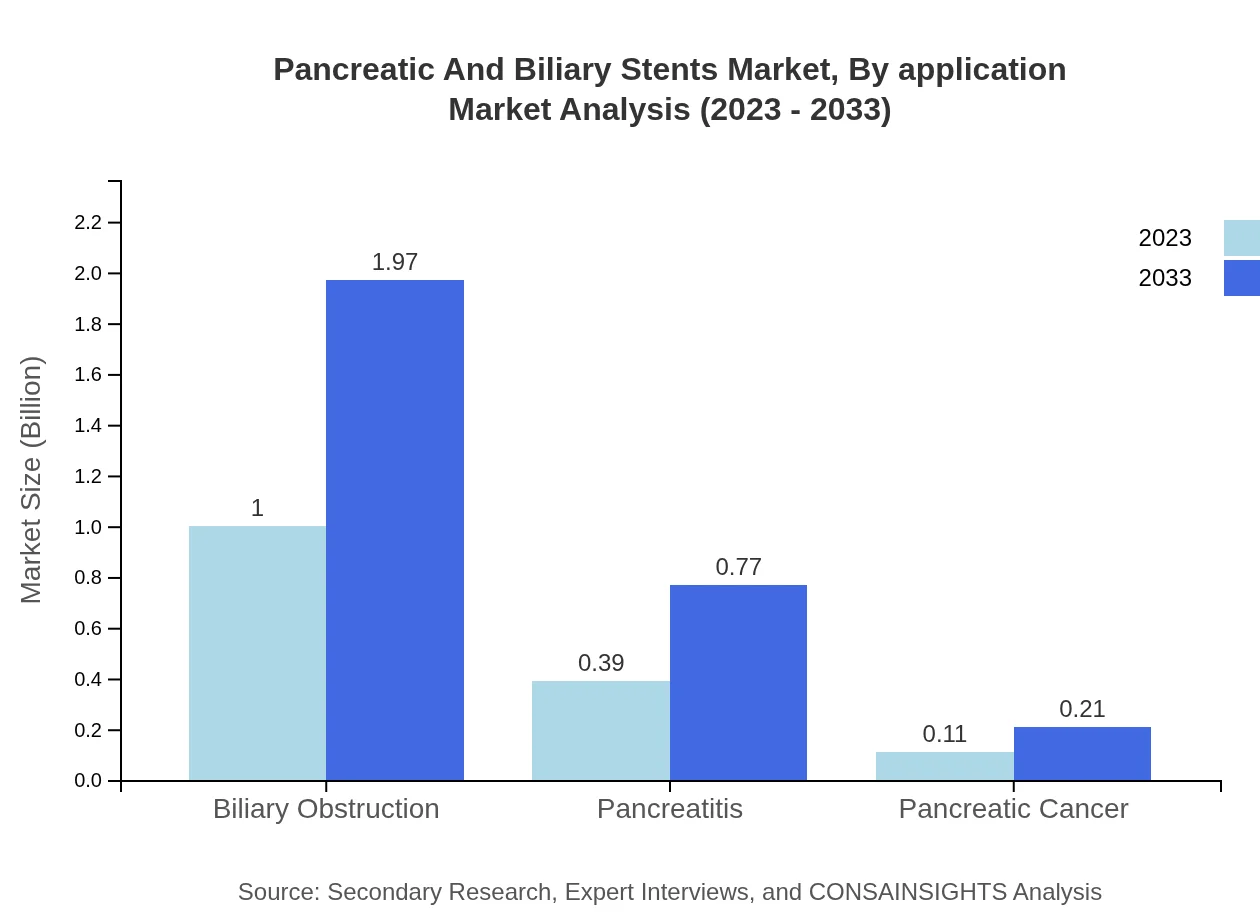

Pancreatic And Biliary Stents Market Analysis By Application

In terms of applications, the biliary obstruction segment dominates the market, holding a substantial share due to growing pancreatitis and pancreatic cancer cases. The segment’s size is projected to grow from USD 1 billion in 2023 to USD 1.97 billion by 2033.

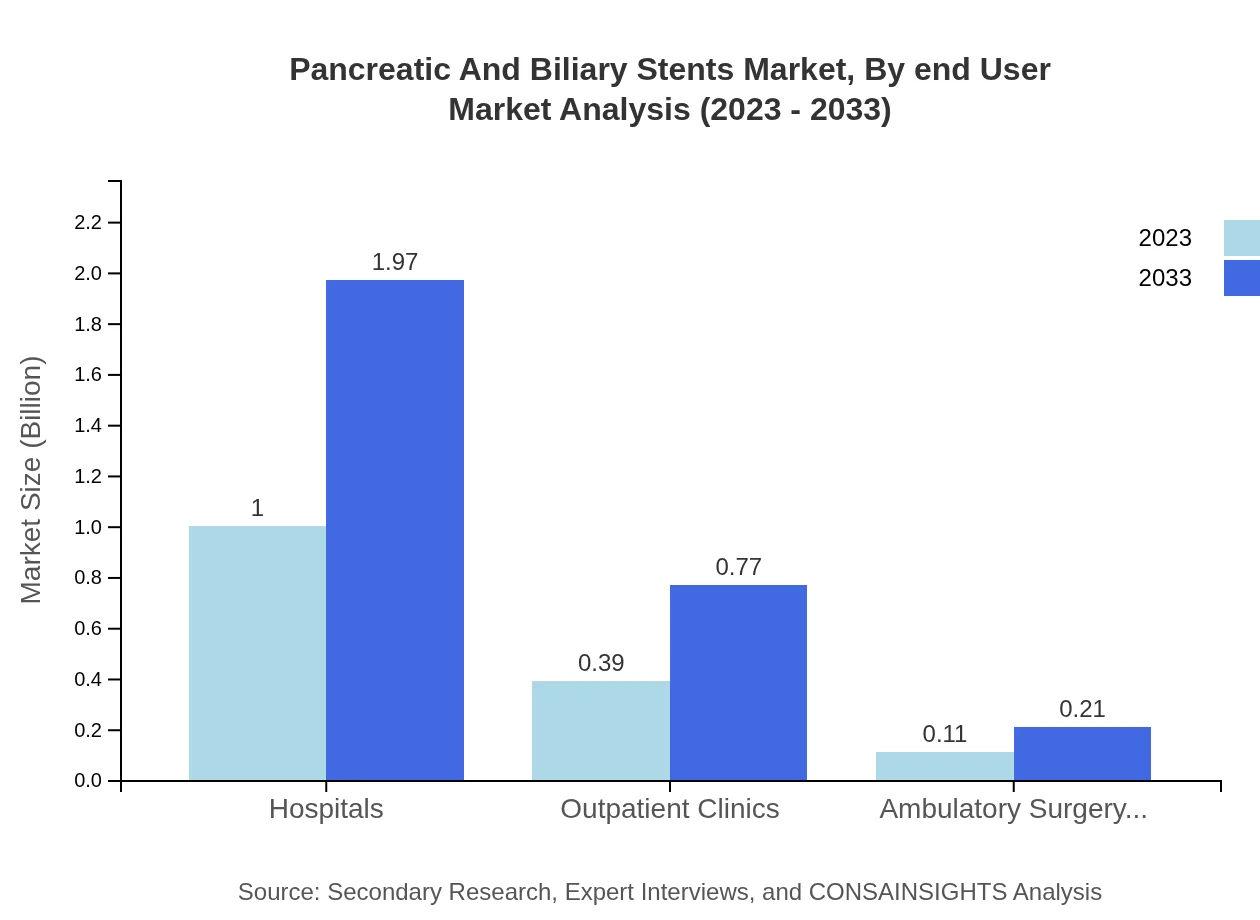

Pancreatic And Biliary Stents Market Analysis By End User

Hospitals are the largest end-user of Pancreatic and Biliary Stents, accounting for 66.73% market share in 2023. The increasing number of outpatient clinics and surgeries has also contributed to segment growth.

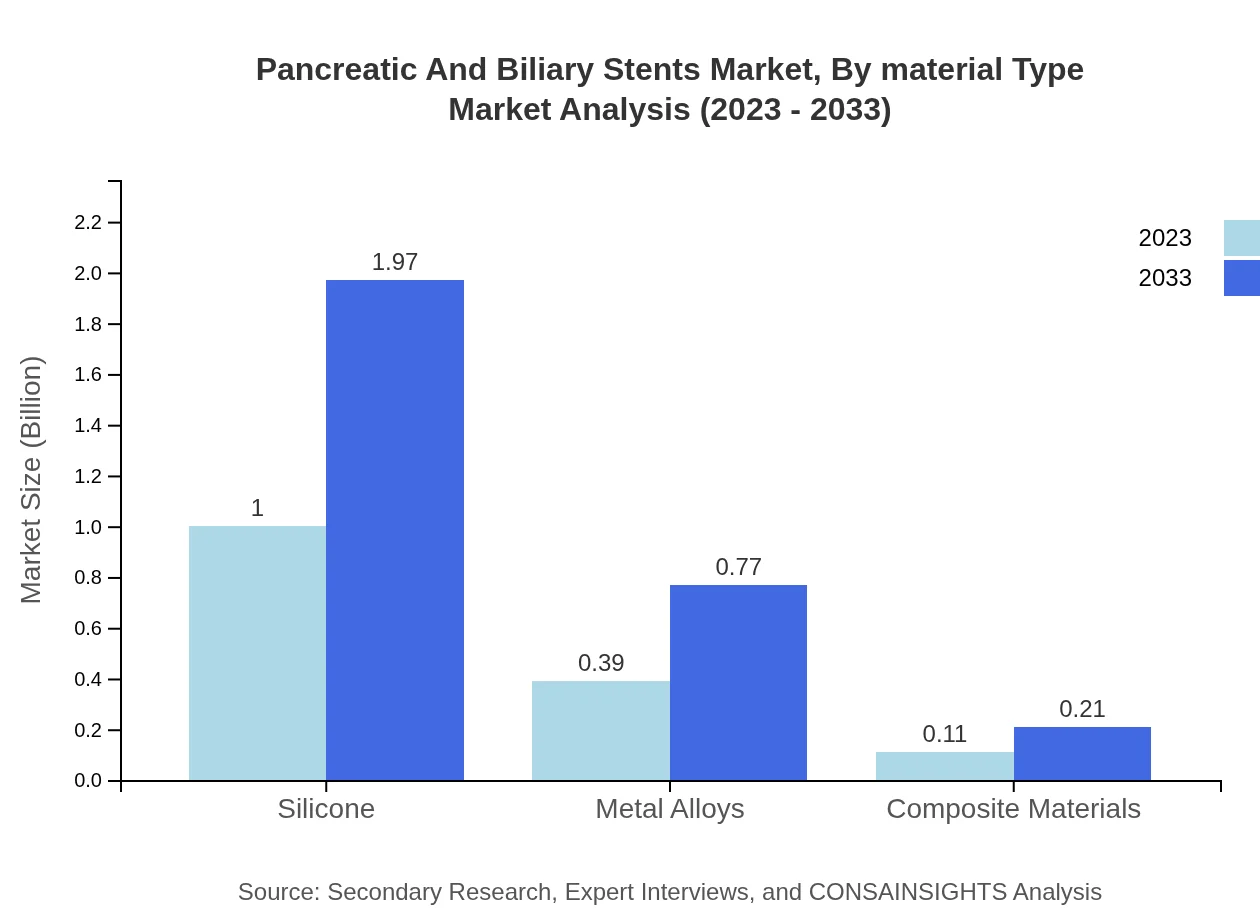

Pancreatic And Biliary Stents Market Analysis By Material Type

Silicone and plastic stents form the majority share of the market with a share of 66.73%, attributed to their versatility and effectiveness in numerous applications. Metal alloys and composite materials present opportunities for niche applications within the market.

Pancreatic And Biliary Stents Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pancreatic And Biliary Stents Industry

Boston Scientific:

A leader in the medical device industry, Boston Scientific is known for its innovation in endoscopy products, significantly contributing to the development of advanced stents.Medtronic :

Medtronic specializes in a wide range of medical devices and therapies, with a strong focus on developing cutting-edge Pancreatic and Biliary stent solutions.Cordis:

Part of the Cardinal Health family, Cordis provides high-quality cardiovascular and endovascular solutions, including Pancreatic and Biliary stents.Cook Medical:

Known for providing innovative medical devices, Cook Medical is a significant player in the stent market with a focus on gastroenterology.We're grateful to work with incredible clients.

FAQs

What is the market size of pancreatic and biliary stents?

The global pancreatic and biliary stents market is valued at approximately $1.5 billion in 2023, with a projected CAGR of 6.8%. This growth indicates a significant expansion anticipated over the decade leading to 2033.

What are the key market players or companies in this pancreatic and biliary stents industry?

The pancreatic and biliary stents market comprises various companies including Boston Scientific, Medtronic, and Cook Medical. These players dominate thanks to their innovative technologies and comprehensive product ranges.

What are the primary factors driving the growth in the pancreatic and biliary stents industry?

Key drivers include the rising incidence of pancreatic disorders, technological advancements in stent design, and increasing awareness of effective treatment options. Additionally, the aging population contributes significantly to market growth.

Which region is the fastest Growing in the pancreatic and biliary stents?

The Asia Pacific region is emerging as the fastest-growing market for pancreatic and biliary stents. It is expected to grow from $0.28 billion in 2023 to $0.55 billion by 2033, indicating robust development.

Does ConsaInsights provide customized market report data for the pancreatic and biliary stents industry?

Yes, ConsaInsights offers tailored market report data to meet specific client needs in the pancreatic and biliary stents industry, allowing for customized insights and analysis.

What deliverables can I expect from this pancreatic and biliary stents market research project?

Expect comprehensive market analysis reports, competitive landscape reviews, segment-wise breakdowns, and forecasts. Detailed insights into trends and growth opportunities will also be included in the deliverables.

What are the market trends of pancreatic and biliary stents?

Current trends include a shift towards minimally invasive techniques, increasing adoption of biodegradable stents, and advancements in materials used for stent manufacturing, such as silicone and various metal alloys.