Panel Level Packaging Market Report

Published Date: 31 January 2026 | Report Code: panel-level-packaging

Panel Level Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Panel Level Packaging market, covering key insights from 2023 to 2033, including market size, regional dynamics, industry trends, and forecasts.

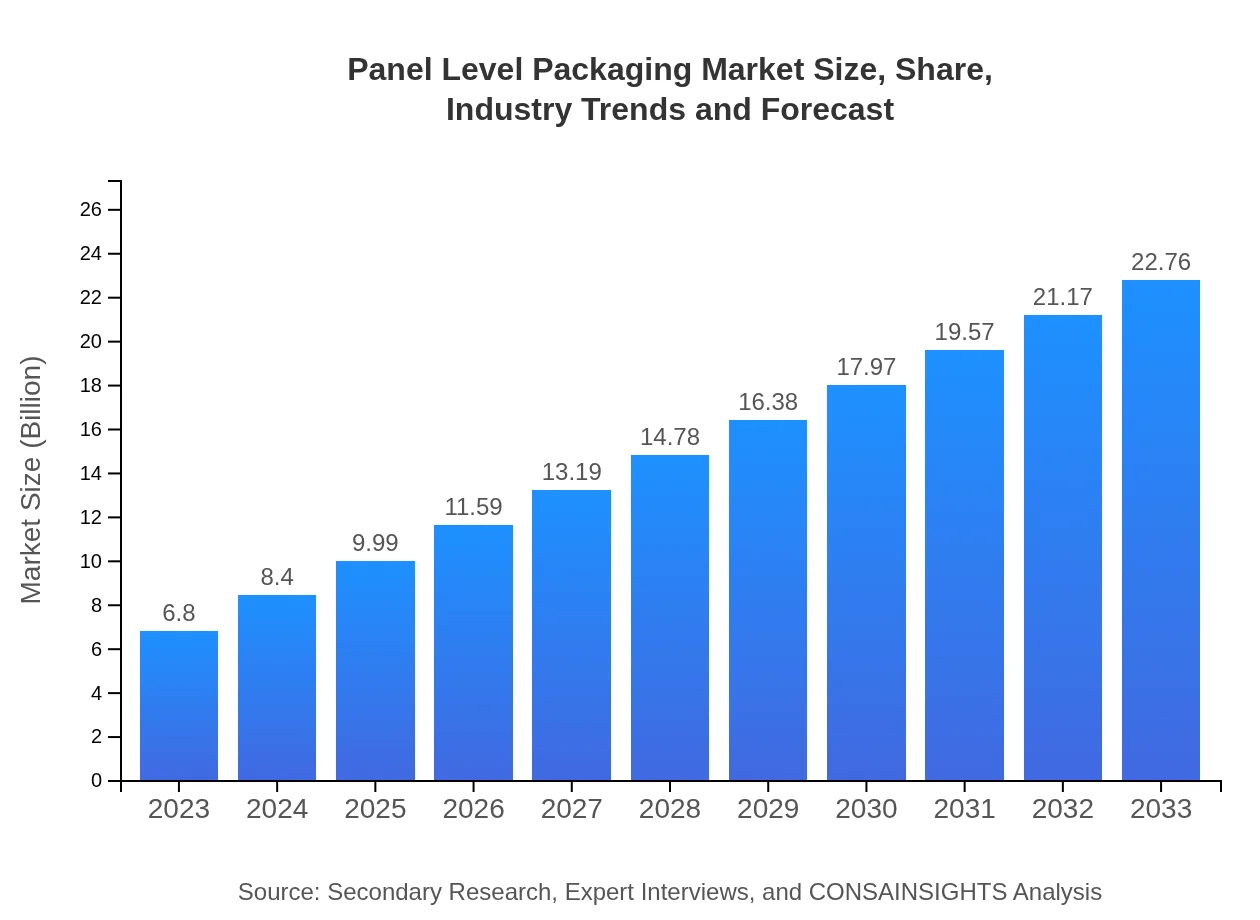

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.80 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $22.76 Billion |

| Top Companies | Amkor Technology, Inc., STATS ChipPAC Pte. Ltd., Mitsubishi Electric Corporation, AT&S Austria Technologie & Systemtechnik AG |

| Last Modified Date | 31 January 2026 |

Panel Level Packaging Market Overview

Customize Panel Level Packaging Market Report market research report

- ✔ Get in-depth analysis of Panel Level Packaging market size, growth, and forecasts.

- ✔ Understand Panel Level Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Panel Level Packaging

What is the Market Size & CAGR of Panel Level Packaging market in 2023?

Panel Level Packaging Industry Analysis

Panel Level Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Panel Level Packaging Market Analysis Report by Region

Europe Panel Level Packaging Market Report:

Europe exhibits a significant increase in market size from $1.80 billion in 2023 to $6.03 billion by 2033. The demand for eco-friendly packaging solutions and superior quality drives growth in the region. Major players are adapting their products in response to stringent regulations and customer preference toward greener options.Asia Pacific Panel Level Packaging Market Report:

In 2023, the Asia Pacific region holds a market size of $1.36 billion, projected to reach $4.55 billion by 2033. The rapid industrialization and technological advancements in countries like China, South Korea, and Japan drive this growth, particularly in the electronics and automotive sectors. Additionally, the expanding consumer base and increasing disposable incomes contribute significantly to the increasing demand for compact electronic devices.North America Panel Level Packaging Market Report:

The North American market stands at $2.21 billion in 2023, with expectations to rise to $7.41 billion by 2033. The region is characterized by technological innovation, particularly in electronics and automotive applications. A strong focus on sustainability and waste reduction in packaging is reinforcing growth in the market.South America Panel Level Packaging Market Report:

South America’s market for Panel Level Packaging is valued at $0.53 billion in 2023, anticipated to grow to $1.77 billion by 2033. Factors such as rising e-commerce and increasing consumer demand for packaged goods are key contributors to market growth. However, challenges including economic instability and supply chain disruptions pose risks for sustained expansion.Middle East & Africa Panel Level Packaging Market Report:

In the Middle East and Africa, the market size of Panel Level Packaging is valued at $0.90 billion in 2023, set to expand to $3.00 billion by 2033. The increasing adoption of advanced technologies and urbanization, coupled with evolving consumer purchasing patterns, support this growth trajectory. However, regional disparities and fluctuating oil prices may present challenges.Tell us your focus area and get a customized research report.

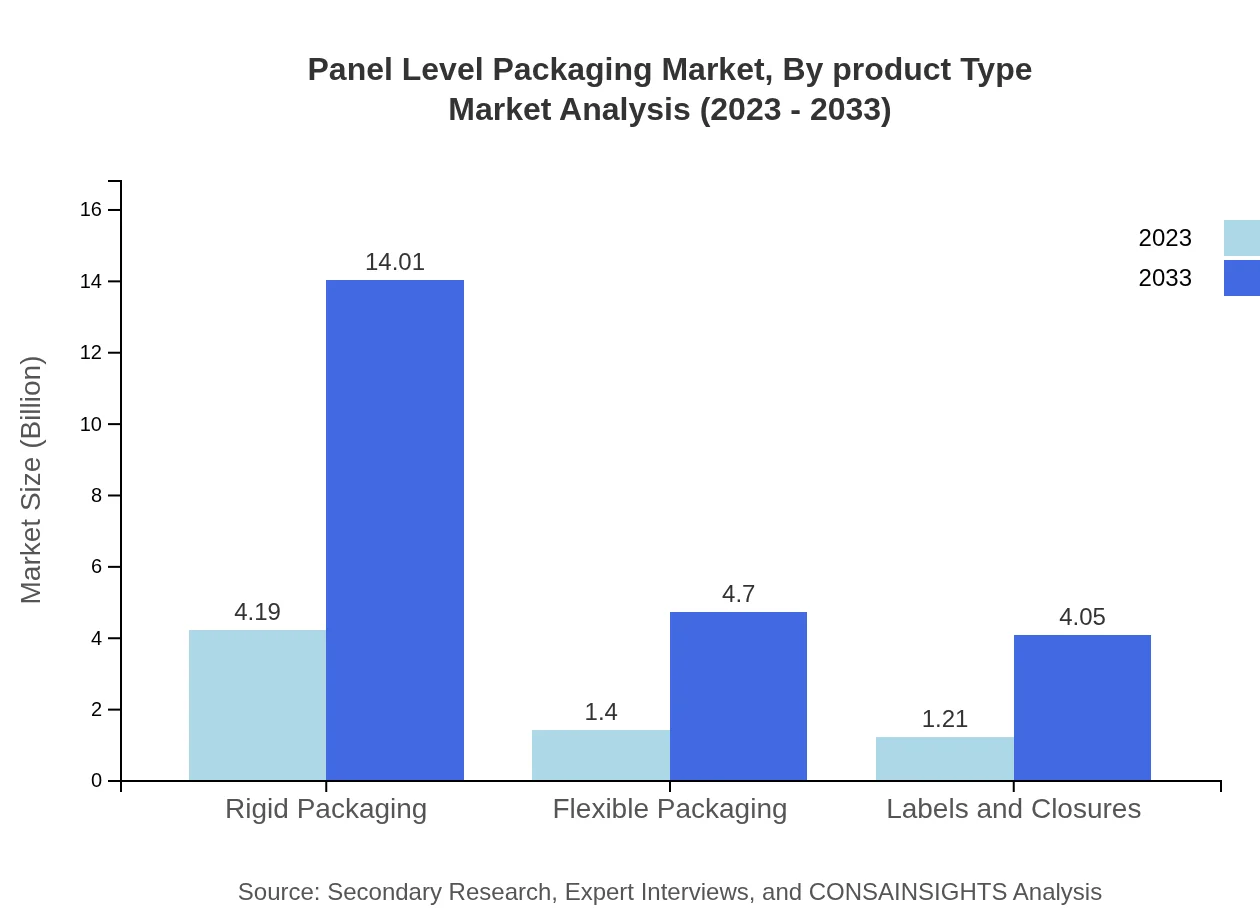

Panel Level Packaging Market Analysis By Product Type

The analysis reveals that the Rigid Packaging segment is dominant with a market share of 61.56%, translating to a size of $4.19 billion in 2023, expected to reach $14.01 billion by 2033. Flexible Packaging and Labels and Closures follow at 20.63% and 17.81% market shares, respectively, indicating diverse consumer preferences across segments.

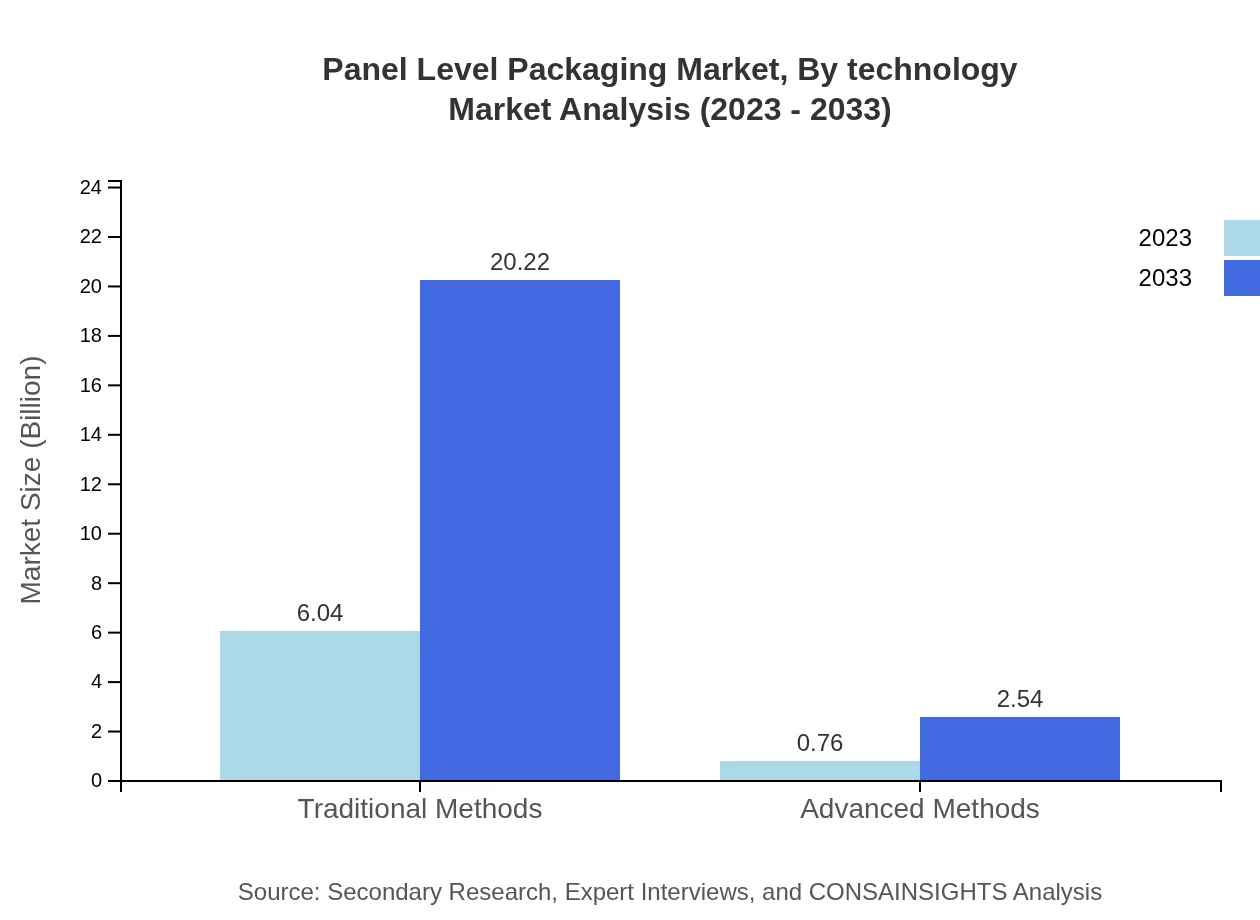

Panel Level Packaging Market Analysis By Technology

Advanced Methods hold a growing share, accounting for 11.17% of the market in 2023 with projections of $2.54 billion by 2033. Traditional Methods dominate with 88.83%, signaling existing preferences but also highlighting areas for innovation and growth as manufacturers explore better technologies.

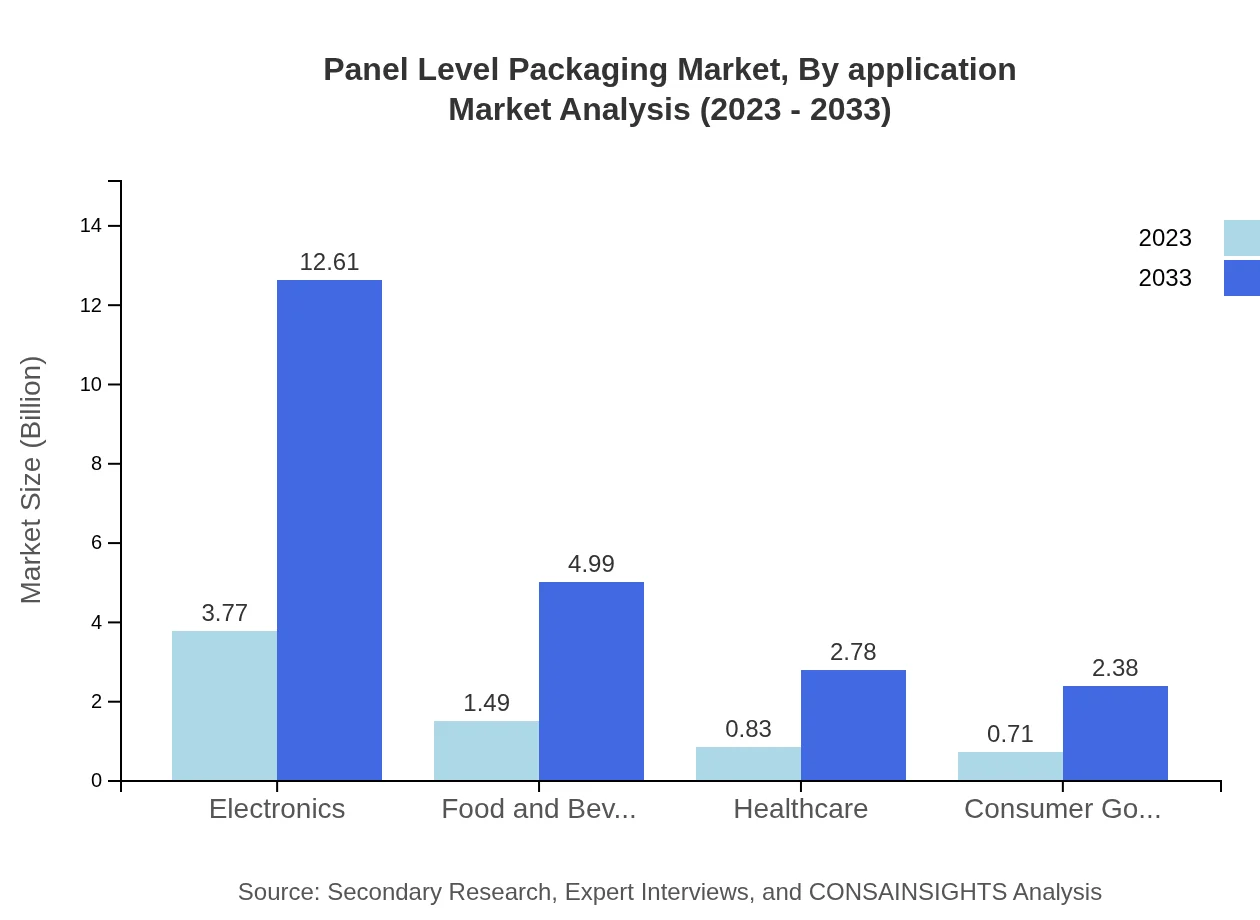

Panel Level Packaging Market Analysis By Application

In terms of applications, Electronics represent the largest segment with a market share of 55.39% in 2023, growing from $3.77 billion to $12.61 billion by 2033. The Food and Beverage segment follows with 21.94%, demonstrating solid consumer demand, while Healthcare captures 12.20%, indicating a stable yet growing requirement for advanced packaging solutions.

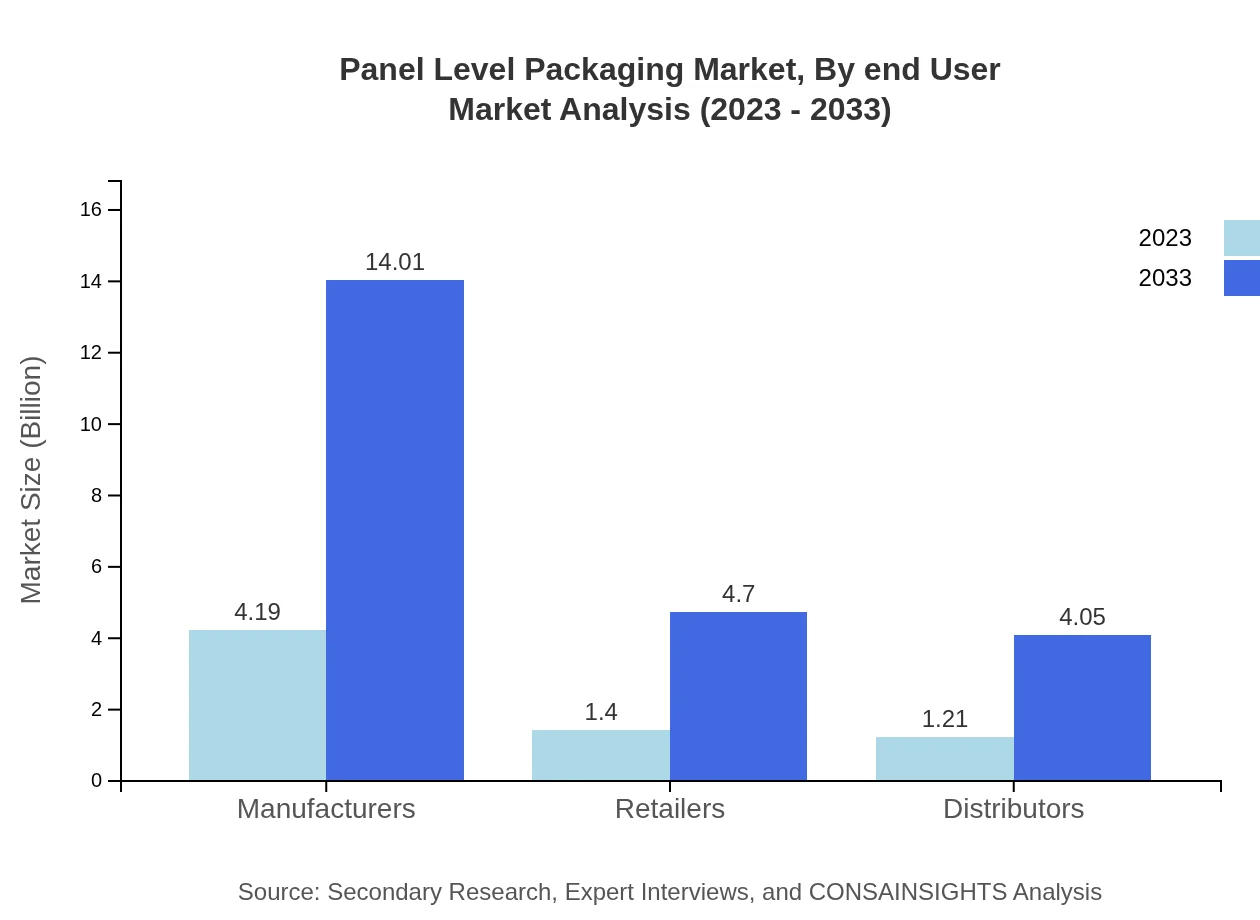

Panel Level Packaging Market Analysis By End User

While manufacturers dominate the end-user landscape with a share of 61.56%, retailers and distributors also play critical roles, representing 20.63% and 17.81% respectively. This landscape indicates a healthy mix of stakeholders committed to enhancing packaging solutions.

Panel Level Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Panel Level Packaging Industry

Amkor Technology, Inc.:

Amkor is a leading provider of semiconductor packaging and test services. The company's emphasis on advanced packaging technologies supports its strong position in the market.STATS ChipPAC Pte. Ltd.:

STATS ChipPAC specializes in advanced semiconductor packaging solutions, leveraging innovative technologies to enhance product performance in various applications.Mitsubishi Electric Corporation:

Mitsubishi Electric delivers sophisticated packaging solutions with a focus on sustainability, addressing growing consumer demand for eco-friendly products.AT&S Austria Technologie & Systemtechnik AG:

AT&S is recognized for its high-end Advanced Package technologies, catering to the automotive and high-frequency applications with a commitment to quality and innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of panel Level Packaging?

The panel-level packaging market is projected to reach a size of approximately $6.8 billion by 2033, exhibiting a robust CAGR of 12.3% from current levels, driven by advancements in packaging technologies.

What are the key market players or companies in this panel Level Packaging industry?

Key players in the panel-level packaging industry include major manufacturers and suppliers of packaging solutions who focus on innovation and sustainability, ensuring they meet evolving market demands and consumer preferences.

What are the primary factors driving the growth in the panel Level Packaging industry?

Growth in the panel-level packaging industry is fueled by rising demand for efficient and sustainable packaging solutions, technological advancements, and increased usage in sectors such as electronics and food and beverage.

Which region is the fastest Growing in the panel Level Packaging?

The fastest-growing region in the panel-level packaging market is Europe, expected to expand from $1.80 billion in 2023 to $6.03 billion by 2033, showcasing the highest growth potential among all regions.

Does ConsaInsights provide customized market report data for the panel Level Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the panel-level packaging industry, ensuring clients receive insights relevant to their operational landscape and market objectives.

What deliverables can I expect from this panel Level Packaging market research project?

Deliverables from the panel-level packaging market research project include comprehensive reports, trend analysis, regional insights, market forecasts, and segmentation data, all key for informed business decisions.

What are the market trends of panel Level Packaging?

Current market trends in panel-level packaging include a shift towards eco-friendly materials, increased automation in packaging processes, and the expansion of applications in various sectors such as electronics and healthcare.