Parcel Sortation Systems Market Report

Published Date: 22 January 2026 | Report Code: parcel-sortation-systems

Parcel Sortation Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Parcel Sortation Systems market from 2023 to 2033, focusing on market trends, size, segmentation, and regional insights to guide stakeholders in making informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

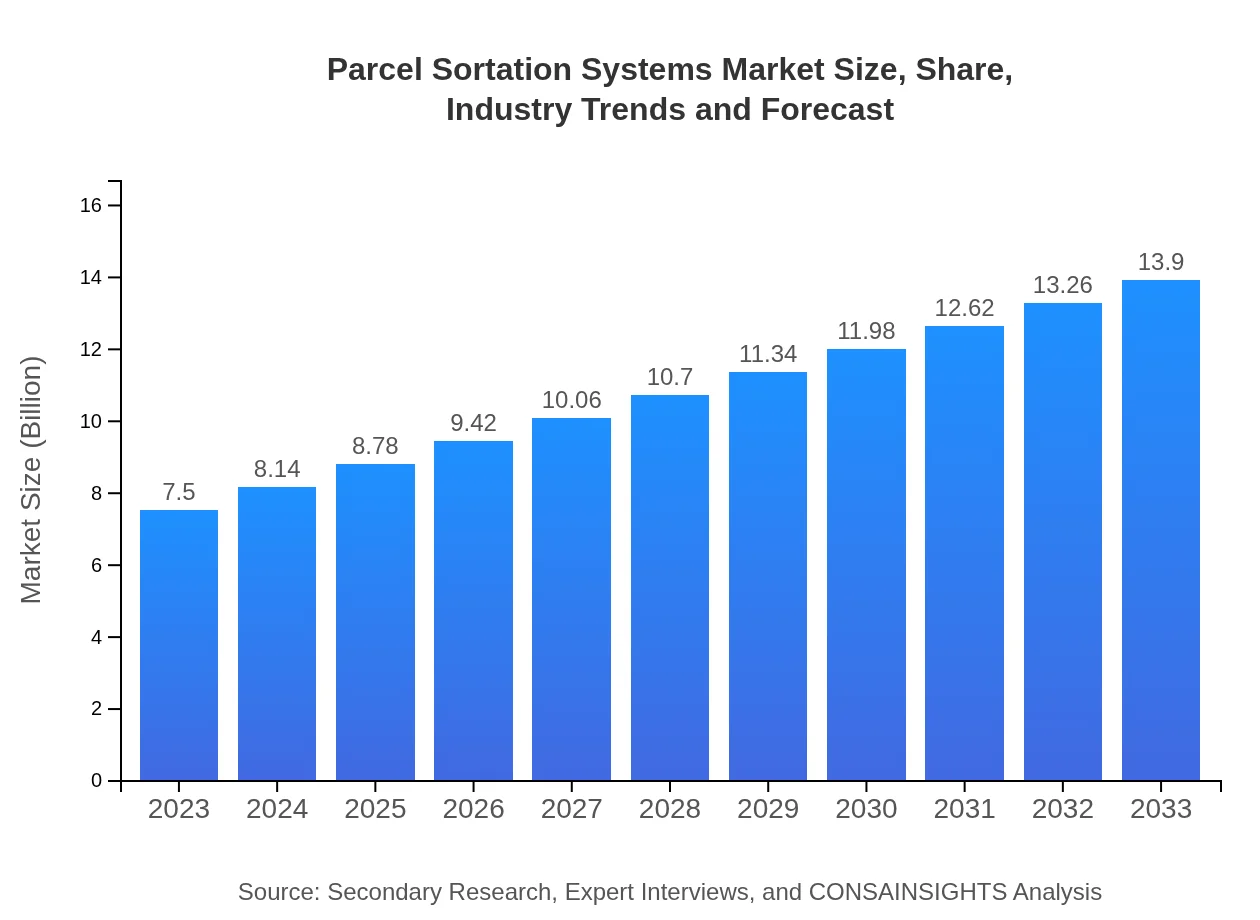

| 2023 Market Size | $7.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $13.90 Billion |

| Top Companies | Siemens , Honeywell , Zebra Technologies, Daifuku Co., Ltd. |

| Last Modified Date | 22 January 2026 |

Parcel Sortation Systems Market Overview

Customize Parcel Sortation Systems Market Report market research report

- ✔ Get in-depth analysis of Parcel Sortation Systems market size, growth, and forecasts.

- ✔ Understand Parcel Sortation Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Parcel Sortation Systems

What is the Market Size & CAGR of Parcel Sortation Systems market in 2023?

Parcel Sortation Systems Industry Analysis

Parcel Sortation Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Parcel Sortation Systems Market Analysis Report by Region

Europe Parcel Sortation Systems Market Report:

The European market is expected to grow from $2.27 billion in 2023 to $4.21 billion by 2033, propelled by stringent regulations favoring automation and market maturity. Countries like Germany and the UK are leading the way in adopting advanced sorting solutions.Asia Pacific Parcel Sortation Systems Market Report:

In the Asia Pacific region, the market size is projected to grow from $1.29 billion in 2023 to $2.40 billion by 2033, driven by increasing urbanization and growth in e-commerce. Countries like China and India are at the forefront, embracing automation in logistics to meet consumer demand.North America Parcel Sortation Systems Market Report:

North America is anticipated to maintain a dominant market presence, growing from $2.83 billion in 2023 to $5.25 billion by 2033. The presence of major e-commerce players and high demand for advanced logistical solutions significantly drive this growth.South America Parcel Sortation Systems Market Report:

The South American market is expected to grow from $0.68 billion in 2023 to $1.25 billion in 2033. The logistics sector is evolving, with significant growth in e-commerce, leading to an increasing adoption of advanced sorting technologies as businesses aim to improve operational efficiency.Middle East & Africa Parcel Sortation Systems Market Report:

The Middle East and Africa market is projected to grow from $0.43 billion in 2023 to $0.79 billion by 2033. Growing investments in logistics infrastructure and the rising influence of e-commerce are key factors driving this growth.Tell us your focus area and get a customized research report.

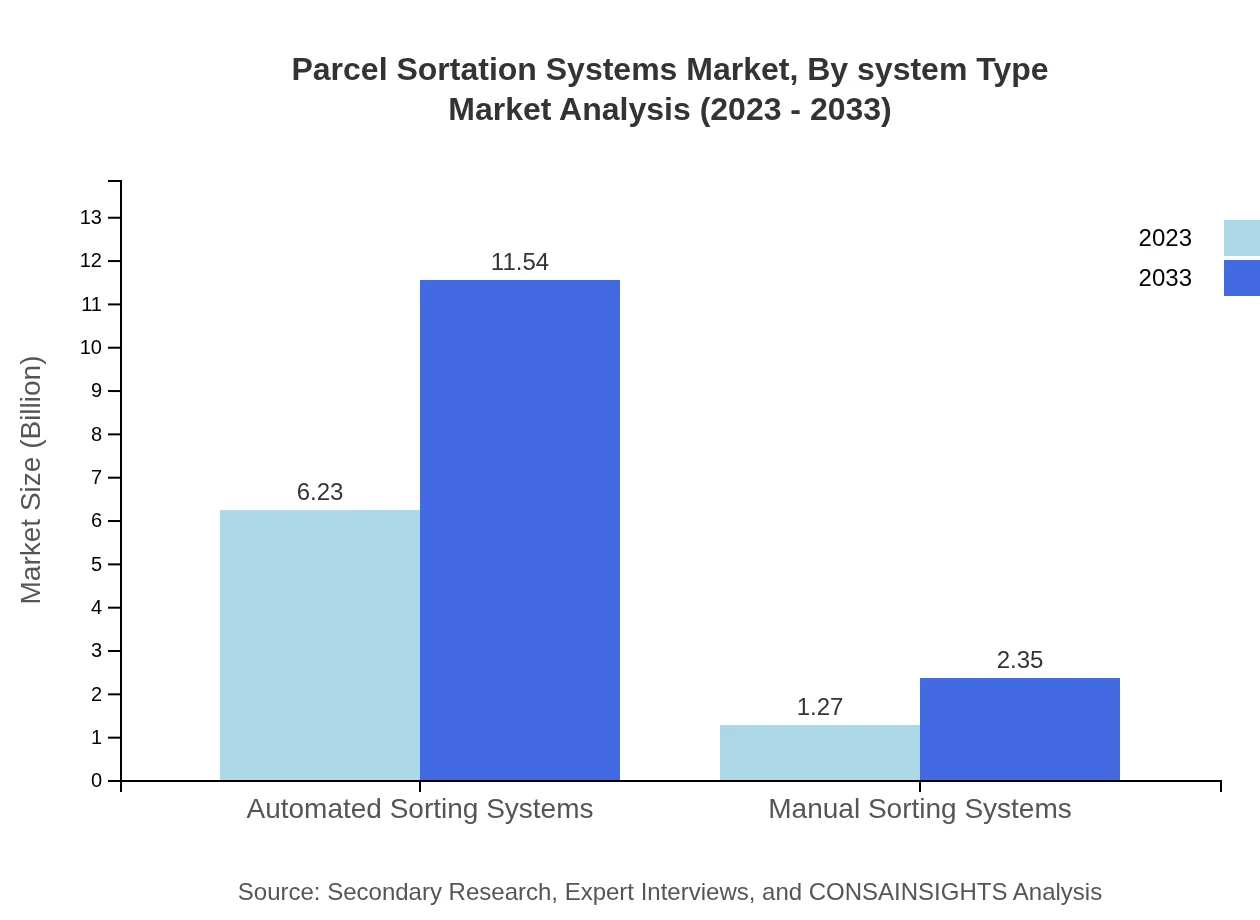

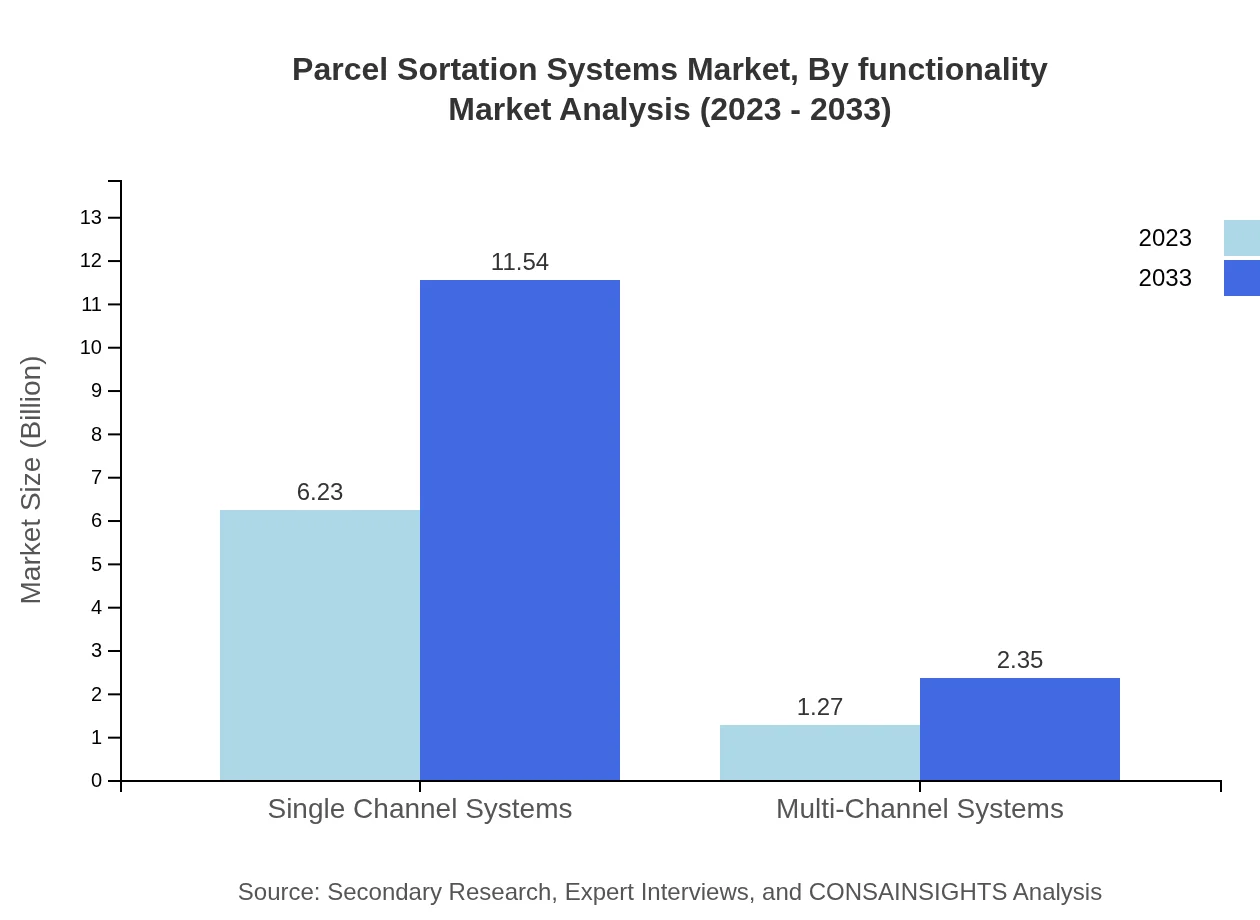

Parcel Sortation Systems Market Analysis By System Type

The market can be segmented into Automated Sorting Systems, which are anticipated to dominate the market with sizes estimated at $6.23 billion in 2023, increasing to $11.54 billion by 2033, and Manual Sorting Systems, ranging from $1.27 billion in 2023 to $2.35 billion in 2033. Automated solutions bring efficiency and accuracy, critical in high-demand environments like e-commerce.

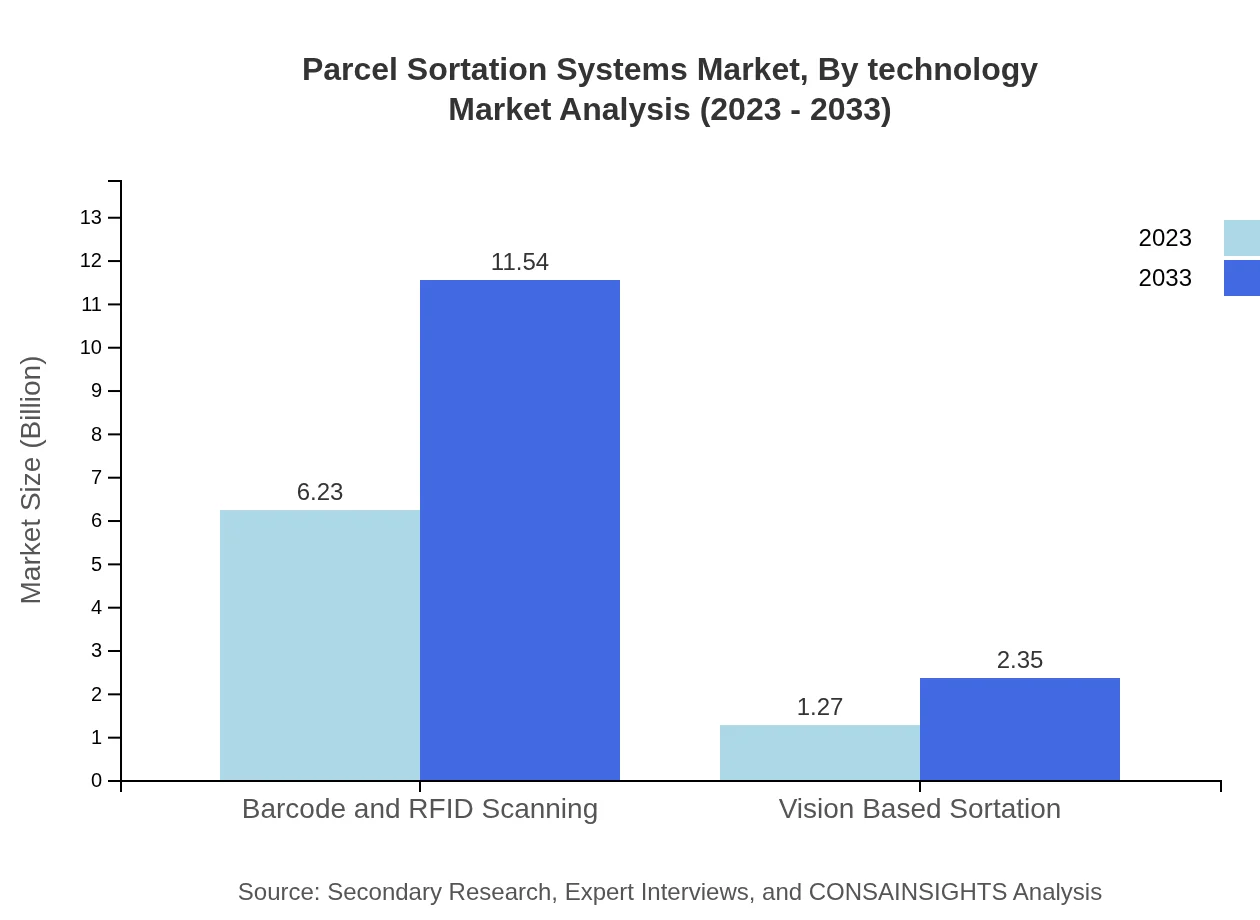

Parcel Sortation Systems Market Analysis By Technology

Technological advancements include Barcode and RFID Scanning, projected to grow from $6.23 billion in 2023 to $11.54 billion by 2033, and Vision Based Sortation, increasing from $1.27 billion to $2.35 billion in the same timeframe. The integration of AI and machine vision systems are reshaping the sorting process, promoting innovation.

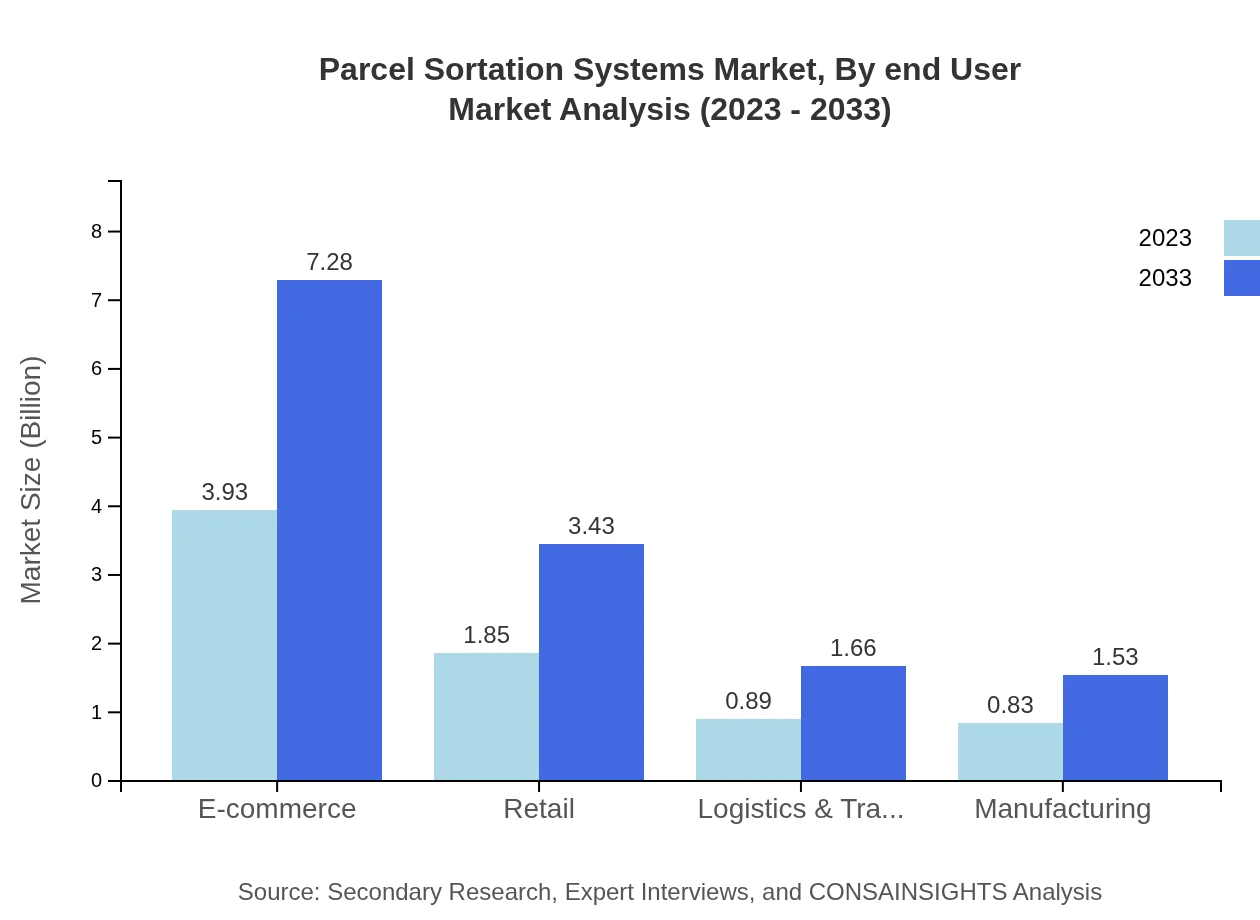

Parcel Sortation Systems Market Analysis By End User

Key end-user segments include E-commerce, with sizes expanding from $3.93 billion in 2023 to $7.28 billion by 2033, and Retail, with growth from $1.85 billion to $3.43 billion. The demand in these sectors emphasizes the critical role of sorting systems in enhancing delivery efficiency.

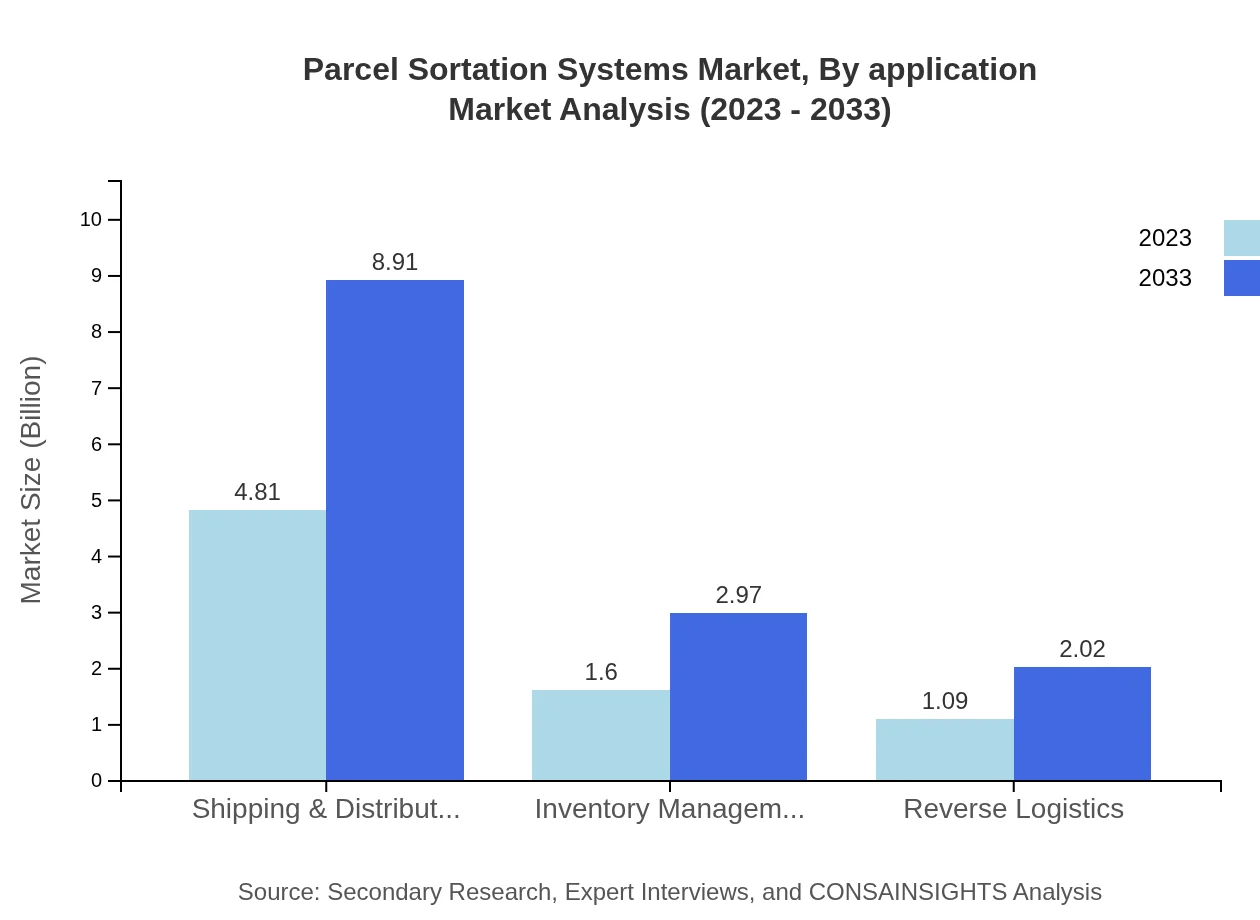

Parcel Sortation Systems Market Analysis By Functionality

Functional segments encompass Shipping and Distribution, which holds the largest share at 64.09%, and Inventory Management, projected to expand from $1.60 billion to $2.97 billion by 2033. Efficient sorting functionalities are essential for effective supply chain management.

Parcel Sortation Systems Market Analysis By Application

Applications in various sectors demonstrate significant growth, with Reverse Logistics expected to rise from $1.09 billion in 2023 to $2.02 billion by 2033. The flexibility of sorting systems to support diverse logistics needs positions them as vital tools in modern supply chains.

Parcel Sortation Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Parcel Sortation Systems Industry

Siemens :

Siemens is known for its innovative automation solutions, contributing significant advancements in parcel sortation technology.Honeywell :

Honeywell offers a variety of sorting systems that enhance efficiency in logistical operations through state-of-the-art technology.Zebra Technologies:

Zebra Technologies specializes in barcode and RFID technologies that are critical to parcel sortation and tracking.Daifuku Co., Ltd.:

As a leader in material handling systems, Daifuku provides comprehensive solutions focused on automation and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of Parcel Sortation Systems?

The Parcel Sortation Systems market is valued at approximately $7.5 billion in 2023, with a projected growth rate (CAGR) of 6.2% expected by 2033.

What are the key market players or companies in this Parcel Sortation Systems industry?

Key players in the Parcel Sortation Systems industry include major companies like Siemens, Honeywell, and Dematic, alongside innovative startups specializing in automation and robotics for logistics.

What are the primary factors driving the growth in the Parcel Sortation Systems industry?

Growth in the Parcel Sortation Systems industry is propelled by the rise of e-commerce, demand for automation in warehousing, and increasing efficiency needs in logistics to handle high parcel volumes and shipping speed.

Which region is the fastest Growing in the Parcel Sortation Systems?

North America is the fastest-growing region, with the market expected to grow from $2.83 billion in 2023 to $5.25 billion by 2033, driven by technological advancements and increased e-commerce activities.

Does ConsaInsights provide customized market report data for the Parcel Sortation Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Parcel Sortation Systems industry, accommodating various segments and regional focus.

What deliverables can I expect from this Parcel Sortation Systems market research project?

Deliverables typically include comprehensive market analysis, trend reports, competitor insights, regional breakdowns, and detailed projections, providing actionable intelligence for strategic planning.

What are the market trends of Parcel Sortation Systems?

Current market trends indicate significant adoption of automated sorting technologies, a strong emphasis on integrating AI and robotics, and a shift towards sustainability in logistics practices.