Passenger Car Sensors Market Report

Published Date: 02 February 2026 | Report Code: passenger-car-sensors

Passenger Car Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report analyses the Passenger Car Sensors market from 2023 to 2033, providing insights on market conditions, size, growth rates, and technological innovations influencing the industry. It aims to equip stakeholders with comprehensive data to make informed decisions in this evolving market.

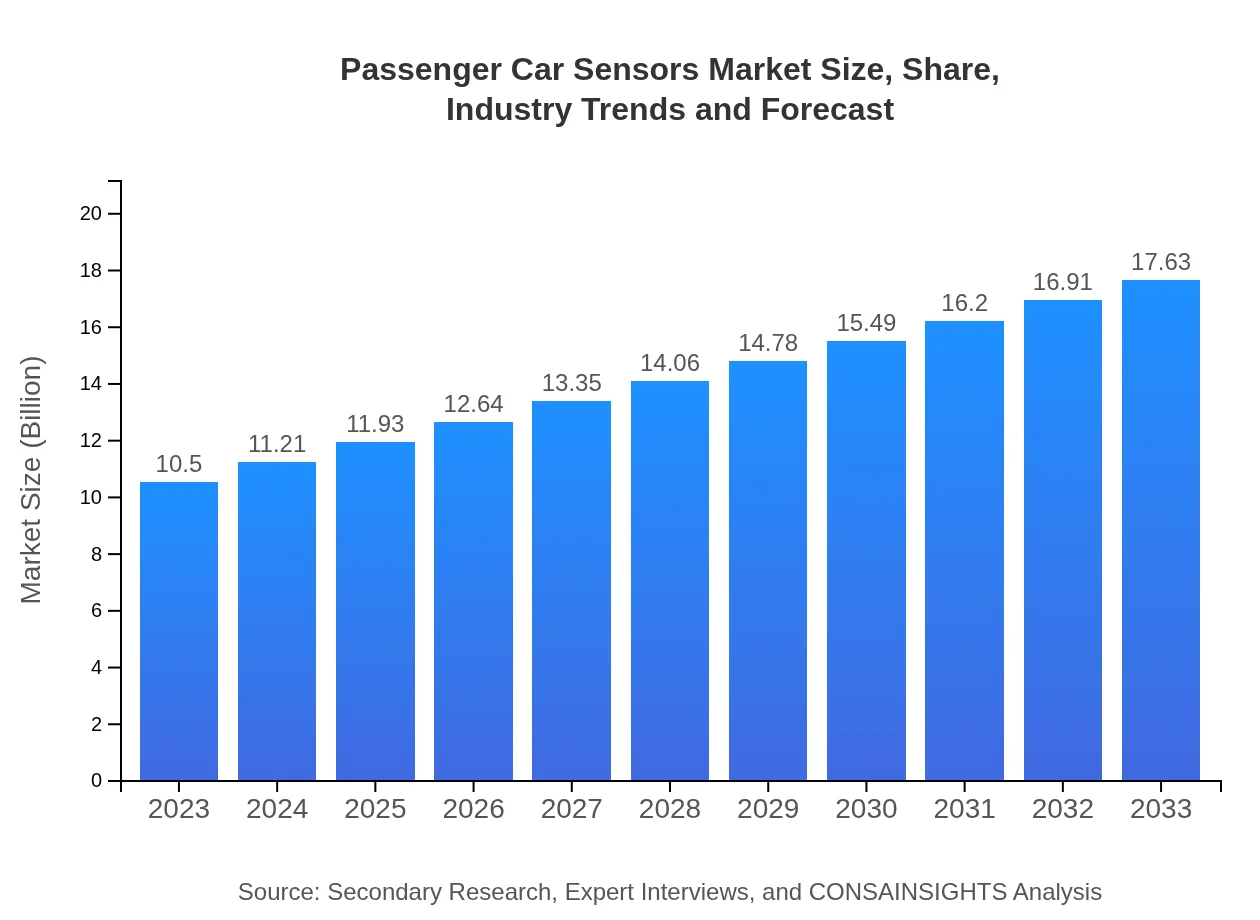

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $17.63 Billion |

| Top Companies | Bosch, Continental AG, Denso Corporation, Sensata Technologies, TE Connectivity |

| Last Modified Date | 02 February 2026 |

Passenger Car Sensors Market Overview

Customize Passenger Car Sensors Market Report market research report

- ✔ Get in-depth analysis of Passenger Car Sensors market size, growth, and forecasts.

- ✔ Understand Passenger Car Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Passenger Car Sensors

What is the Market Size & CAGR of Passenger Car Sensors market in 2023?

Passenger Car Sensors Industry Analysis

Passenger Car Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Passenger Car Sensors Market Analysis Report by Region

Europe Passenger Car Sensors Market Report:

Europe is projected to see significant growth from $3.41 billion in 2023 to $5.73 billion by 2033. The adoption of stringent emissions regulations and proactive government policies promoting electric vehicles are key factors driving this growth, alongside consumer preference for advanced safety features.Asia Pacific Passenger Car Sensors Market Report:

The Asia Pacific region is projected to grow from a market size of $1.86 billion in 2023 to $3.11 billion by 2033, driven by increasing automotive production and sales in countries like China and India. Additionally, technological advancements and a strong push for adopting electric vehicles further enhance market potential in this region.North America Passenger Car Sensors Market Report:

North America, with a market size of $3.67 billion in 2023, is expected to grow to $6.15 billion by 2033. Dominated by U.S. automotive manufacturers, the region benefits from stringent safety regulations and increasing demand for advanced vehicular technologies, including ADAS.South America Passenger Car Sensors Market Report:

The South American market for Passenger Car Sensors is anticipated to increase from $0.92 billion in 2023 to $1.54 billion in 2033. The growth is supported by rising automotive production and investments in improving vehicle safety standards, primarily in Brazil and Argentina.Middle East & Africa Passenger Car Sensors Market Report:

The Middle East and Africa market is expected to expand from $0.65 billion in 2023 to $1.09 billion by 2033, with a notable rise in vehicle safety regulations and demand for enhanced electrical systems in vehicles, particularly in countries such as South Africa and the UAE.Tell us your focus area and get a customized research report.

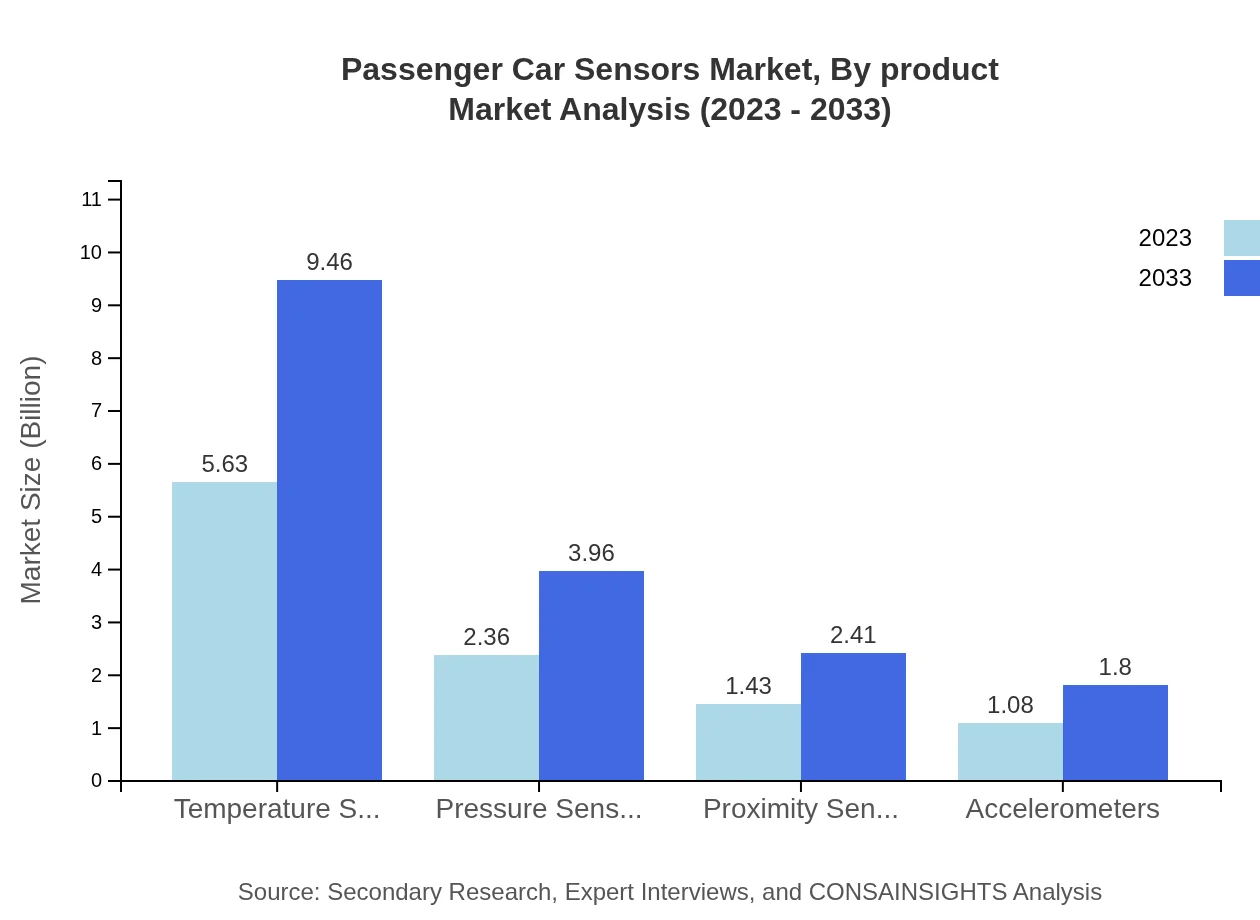

Passenger Car Sensors Market Analysis By Product

Temperature Sensors dominate the market with a projected size of $5.63 billion in 2023, increasing to $9.46 billion by 2033, holding a 53.66% market share. This segment's growth is driven by increasing demand for both HVAC and engine control functionalities. Pressure Sensors follow with a size of $2.36 billion in 2023, expected to reach $3.96 billion by 2033, with a 22.44% share, crucial for safety systems. Proximity Sensors, with a size of $1.43 billion in 2023, will expand to $2.41 billion in 2033, securing a share of 13.66%, vital for parking assistance technologies. Meanwhile, Accelerometers and other sensors yield significant contributions, each expanding substantially over the forecast period.

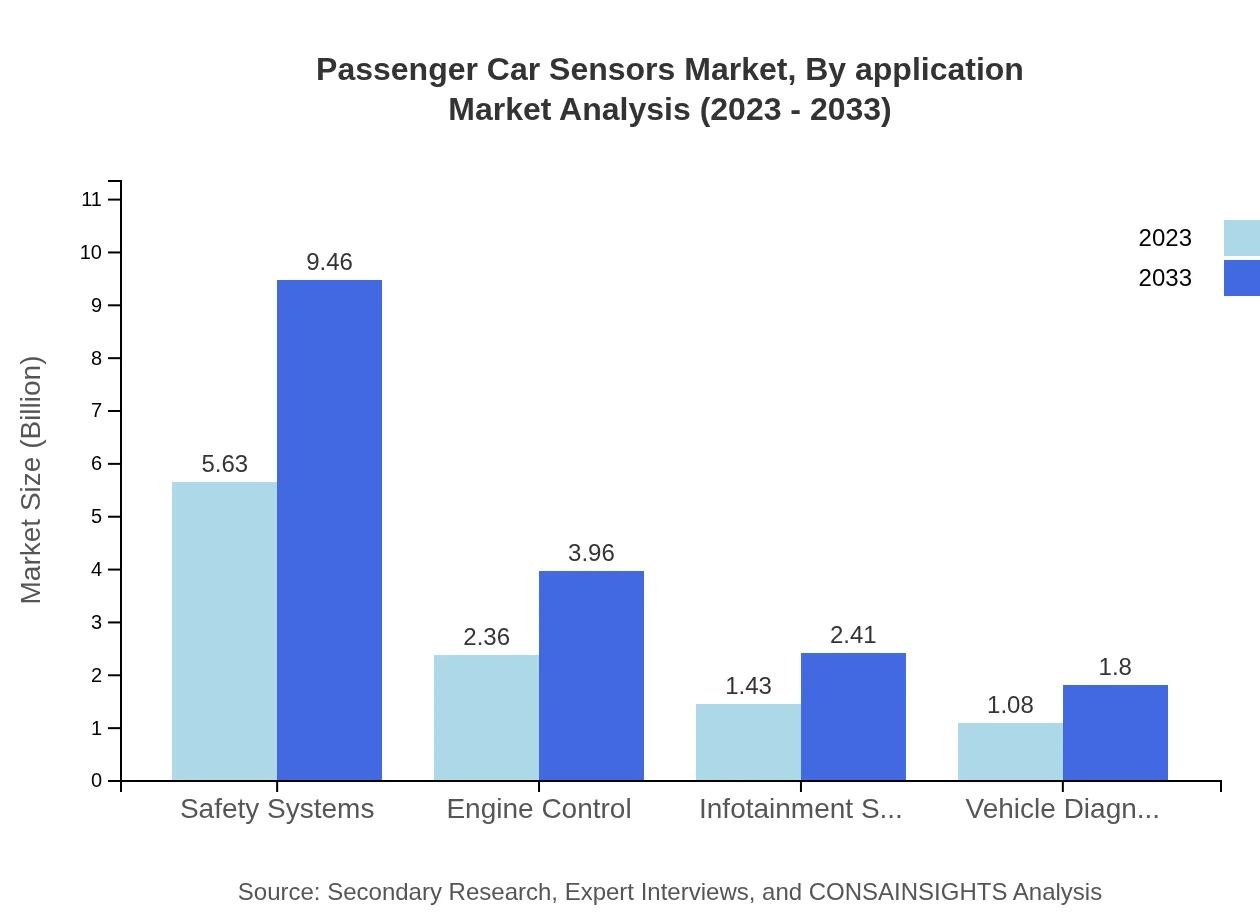

Passenger Car Sensors Market Analysis By Application

Safety Systems, compassing a range of sensor applications, will grow from $5.63 billion in 2023 to $9.46 billion by 2033, maintaining a market share of 53.66%. Engine Control systems are also critical, expanding from $2.36 billion to $3.96 billion, with 22.44% market share. Infotainment systems and vehicle diagnostics show robust growth with market sizes of $1.43 billion and $1.08 billion respectively in 2023, projected to rise towards $2.41 billion and $1.80 billion respectively in 2033.

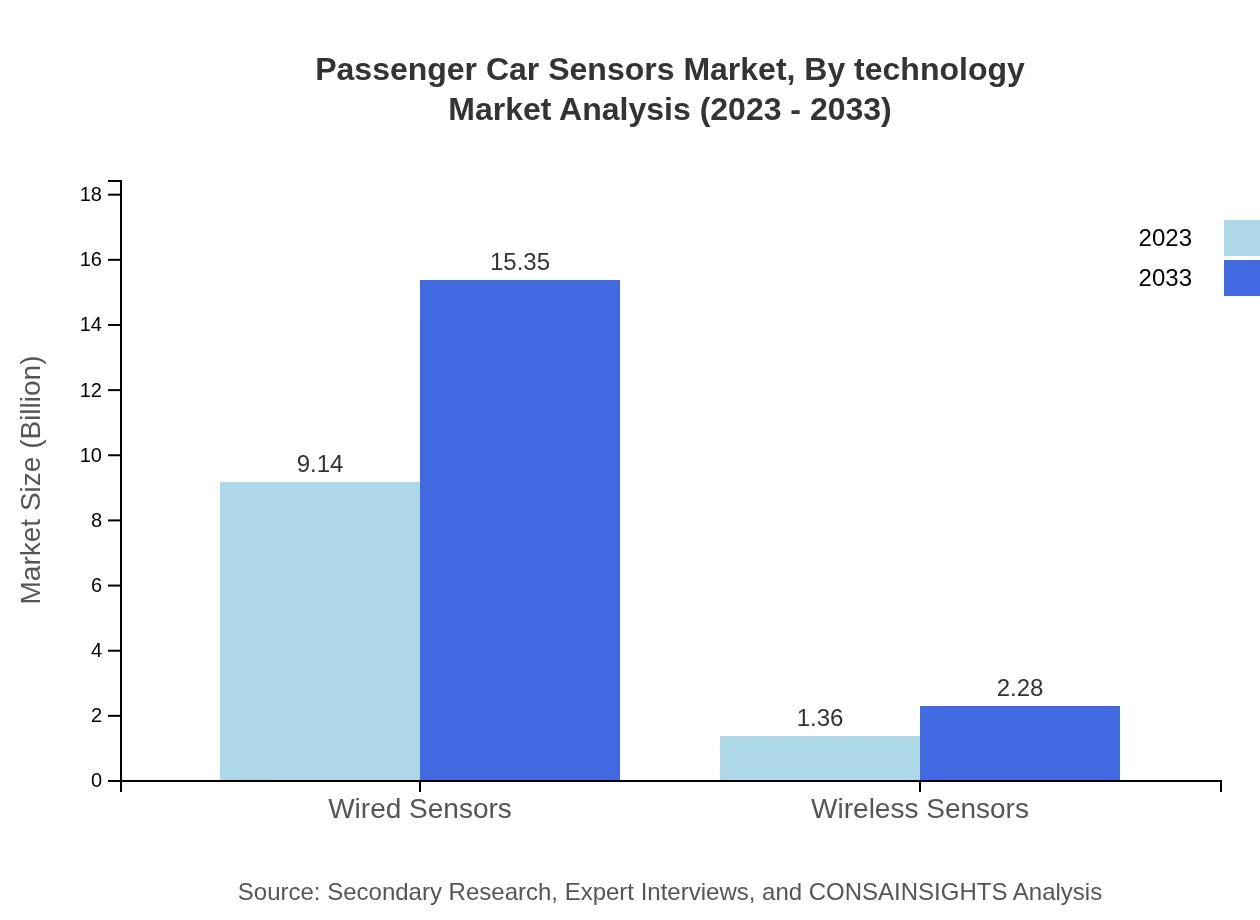

Passenger Car Sensors Market Analysis By Technology

Wired Sensors will dominate the Passenger Car Sensors market, growing from $9.14 billion in 2023 to $15.35 billion by 2033, accounting for 87.09% market share. In contrast, Wireless Sensors, although holding a smaller market share of 12.91% in 2023, will grow from $1.36 billion to $2.28 billion, gaining importance particularly in connected vehicle technologies.

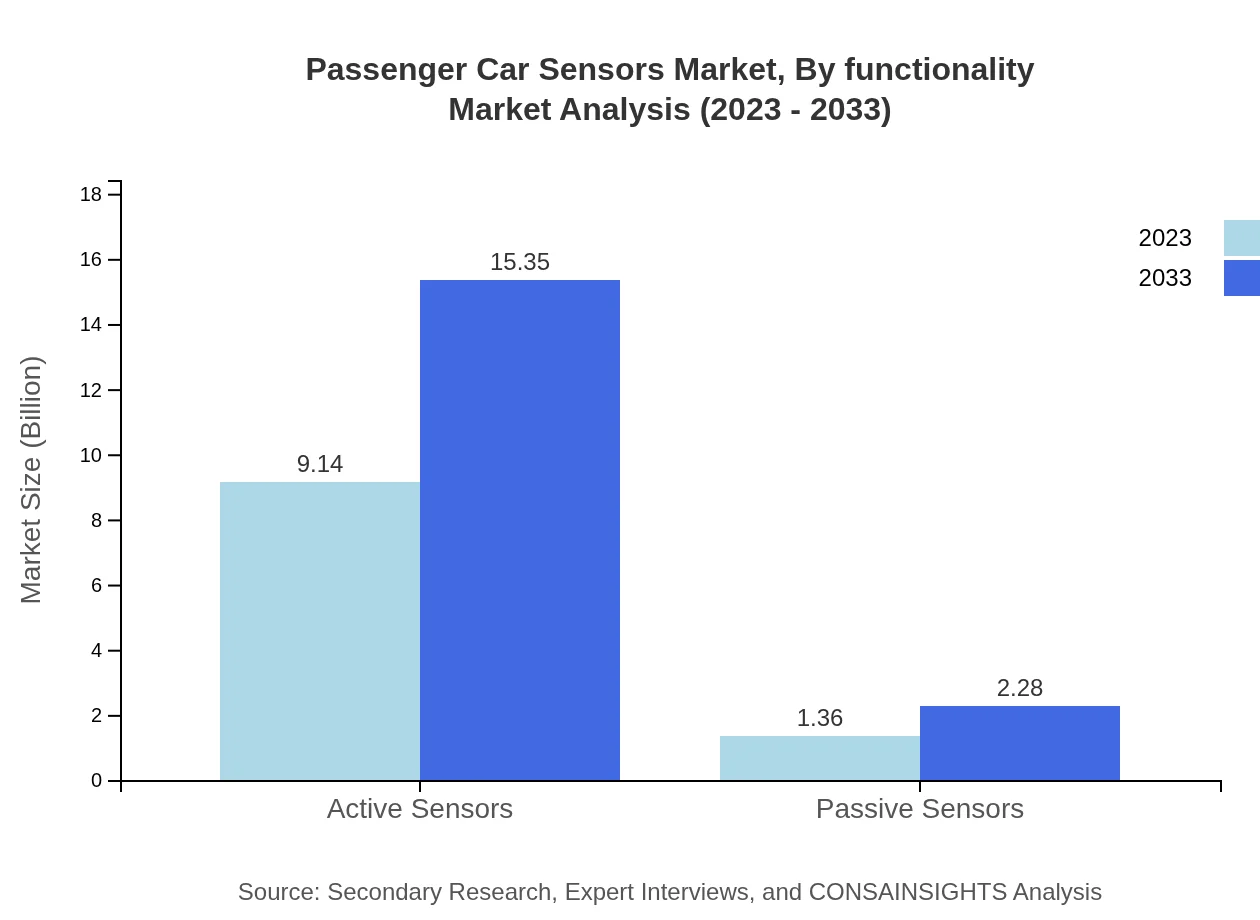

Passenger Car Sensors Market Analysis By Functionality

Active Sensors lead the market with a significant size of $9.14 billion in 2023, projected to grow to $15.35 billion by 2033, holding an 87.09% market share. Conversely, Passive Sensors will also grow steadily from $1.36 billion to $2.28 billion, capturing a 12.91% share as consumer focus on enhanced functionalities increases.

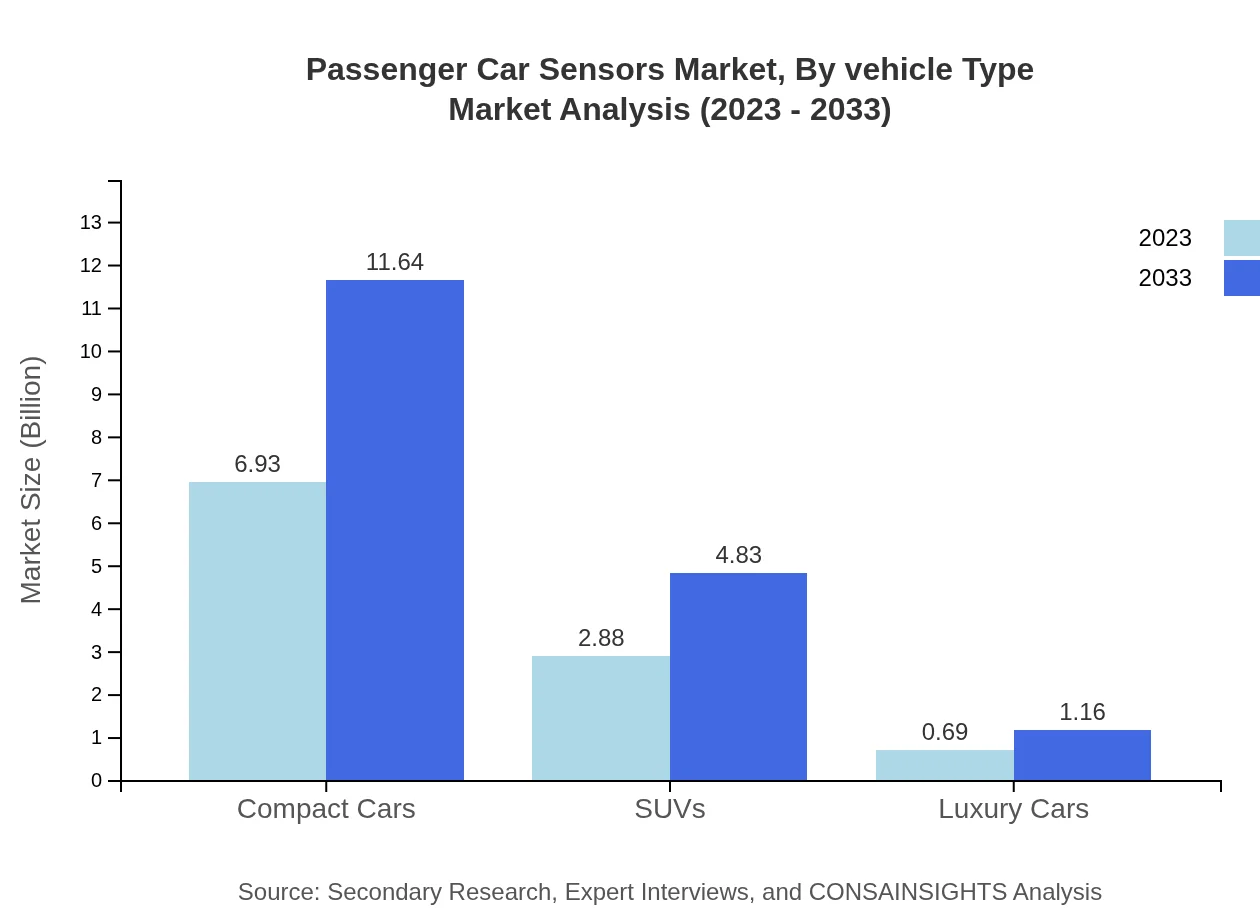

Passenger Car Sensors Market Analysis By Vehicle Type

Compact Cars represent the largest segment of the market in 2023 with a size of $6.93 billion, growing to $11.64 billion by 2033, comprising 66.04% of the market. SUVs are anticipated to expand from $2.88 billion to $4.83 billion, holding 27.4% of the market, while Luxury Cars, currently at $0.69 billion, will grow to $1.16 billion by 2033, showcasing a 6.56% market share, driven by rising disposable incomes and consumer preference.

Passenger Car Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Passenger Car Sensors Industry

Bosch:

A leading supplier of automotive components, Bosch provides a wide range of Passenger Car Sensors known for enhancing vehicle safety and performance.Continental AG:

Continental is renowned for manufacturing innovative sensor technologies that improve vehicle functionality, focusing on automotive electronics and electronics for safety applications.Denso Corporation:

Denso is known for its high-quality automotive components and has a substantial share in the Passenger Car Sensors market, focusing on improving environmental performance.Sensata Technologies:

Sensata specializes in sensing and controlling technologies, contributing significantly to the Passenger Car Sensors market through advanced solutions.TE Connectivity:

TE Connectivity provides various advanced connectivity and sensor solutions crucial for enhancing vehicle safety and performance.We're grateful to work with incredible clients.

FAQs

What is the market size of passenger Car Sensors?

The passenger car sensors market is projected to reach approximately $10.5 billion by 2033, growing at a CAGR of 5.2% from its current value. This growth reflects increasing automotive advancements and consumer safety awareness.

What are the key market players or companies in this passenger Car Sensors industry?

Key players in the passenger car sensors market include established automotive suppliers and technology companies. These corporations are focusing on innovation and strategic partnerships to enhance their sensor technologies and market share.

What are the primary factors driving the growth in the passenger Car Sensors industry?

The growth of the passenger car sensors industry is mainly driven by rising demand for safety features, advancements in automotive technology, and the increasing adoption of electric vehicles, leading to enhanced sensor applications.

Which region is the fastest Growing in the passenger Car Sensors?

The fastest-growing region for passenger car sensors is North America, with the market projected to grow from $3.67 billion in 2023 to $6.15 billion by 2033. Europe is also significant, expanding from $3.41 billion to $5.73 billion.

Does ConsaInsights provide customized market report data for the passenger Car Sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the passenger car sensors industry. This allows businesses to gain insights based on their unique market segments and geographic interests.

What deliverables can I expect from this passenger Car Sensors market research project?

Deliverables from the passenger car sensors market research project include detailed market analysis reports, competitive landscape assessments, and segment-wise breakdowns with comprehensive data that helps in informed decision-making.

What are the market trends of passenger Car Sensors?

Current trends in the passenger car sensors market include the integration of IoT technologies, increased use of active sensors for smart systems, and a shift towards wireless sensor technologies, reflecting the demand for modern automotive functionalities.