Passenger Count System Market Report

Published Date: 31 January 2026 | Report Code: passenger-count-system

Passenger Count System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the global Passenger Count System market, including market size, growth forecasts from 2023 to 2033, and key industry insights. It also covers market segmentation, regional analyses, and trends shaping the future of the industry.

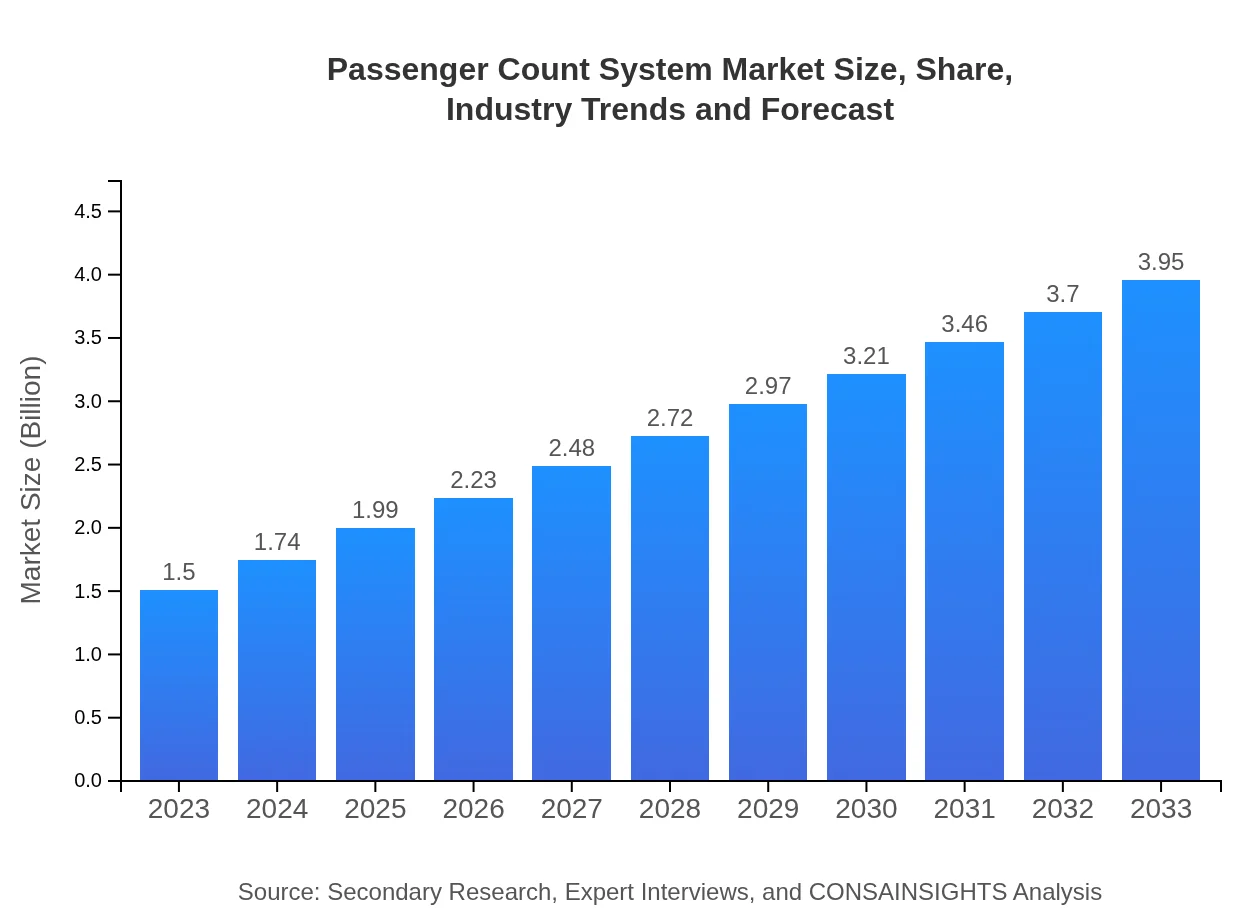

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 9.8% |

| 2033 Market Size | $3.95 Billion |

| Top Companies | Sensory Inc., Rohde & Schwarz, Zebra Technologies, Cubic Corporation |

| Last Modified Date | 31 January 2026 |

Passenger Count System Market Overview

Customize Passenger Count System Market Report market research report

- ✔ Get in-depth analysis of Passenger Count System market size, growth, and forecasts.

- ✔ Understand Passenger Count System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Passenger Count System

What is the Market Size & CAGR of Passenger Count System market in 2023?

Passenger Count System Industry Analysis

Passenger Count System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Passenger Count System Market Analysis Report by Region

Europe Passenger Count System Market Report:

The European market for Passenger Count Systems is expected to grow from $0.38 billion in 2023 to $1.00 billion by 2033. The growing concern for sustainable transport and upcoming regulations on public transport efficiency significantly drive growth in this region. Countries such as Germany, the UK, and France are leading in adopting smart transport solutions.Asia Pacific Passenger Count System Market Report:

In the Asia Pacific region, the Passenger Count System market is anticipated to grow from $0.29 billion in 2023 to $0.77 billion by 2033. The rapid urbanization and increasing investments in transportation infrastructure in countries like China, India, and Japan are significant growth drivers. Additionally, the rising adoption of smart city initiatives is expected to enhance the demand for passenger counting technologies.North America Passenger Count System Market Report:

North America is anticipated to see robust growth, with the market expected to expand from $0.53 billion in 2023 to $1.40 billion by 2033. The United States is at the forefront, with significant investments in public transport systems and an emphasis on data collection for service improvement. The increasing focus on reducing operational costs in transit agencies is further propelling the demand for these systems.South America Passenger Count System Market Report:

The South American market is projected to expand from $0.09 billion in 2023 to $0.24 billion in 2033. Although currently smaller, the market is growing due to increasing government projects aimed at improving public transport and urban mobility solutions. Countries like Brazil and Argentina are focusing on modernizing their transit systems, which will likely boost the adoption of passenger counting systems.Middle East & Africa Passenger Count System Market Report:

The Middle East and Africa market is expected to experience growth from $0.20 billion in 2023 to $0.53 billion by 2033. The burgeoning urban development projects and the drive toward enhancing public transportation systems in countries like the UAE and South Africa are pivotal in increasing the adoption rates of passenger counting technologies.Tell us your focus area and get a customized research report.

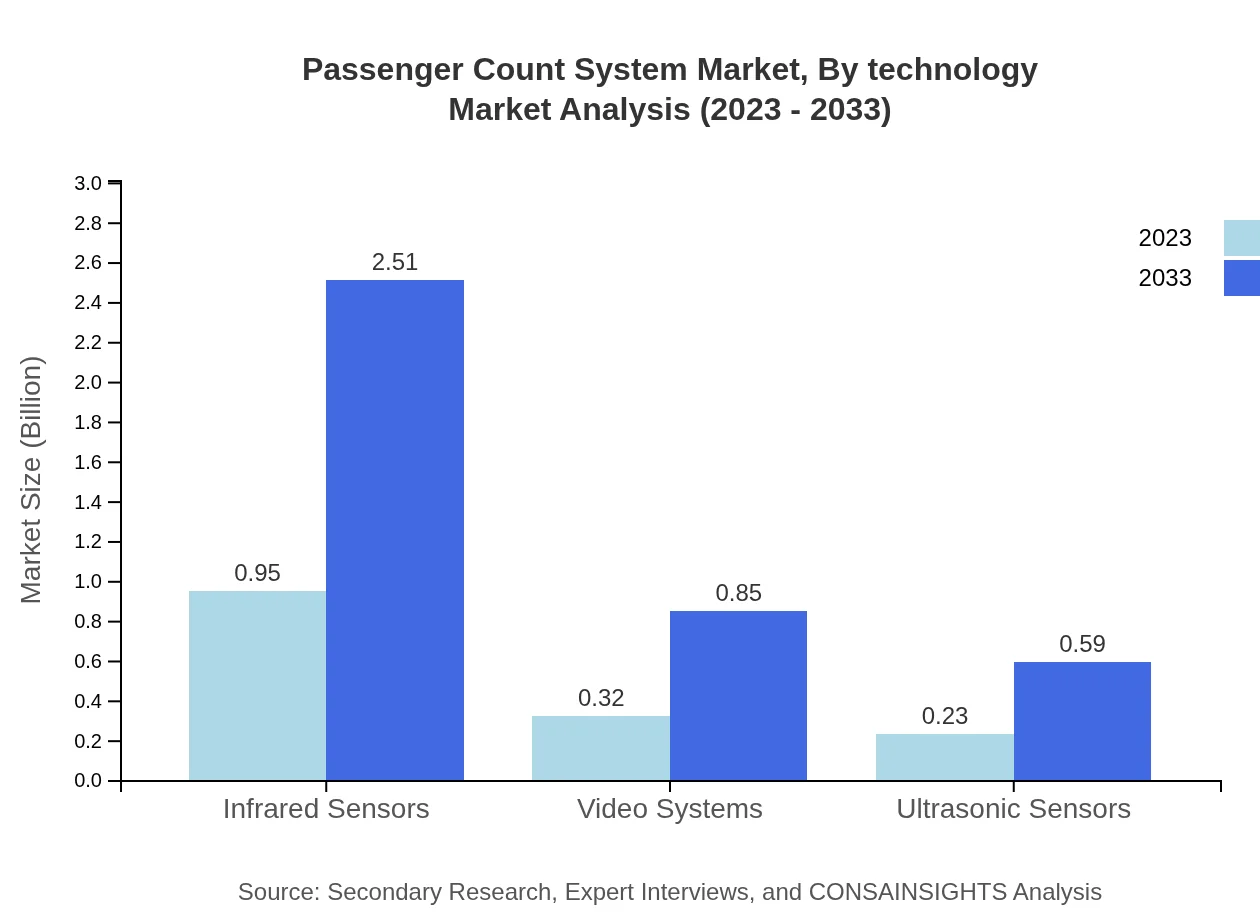

Passenger Count System Market Analysis By Technology

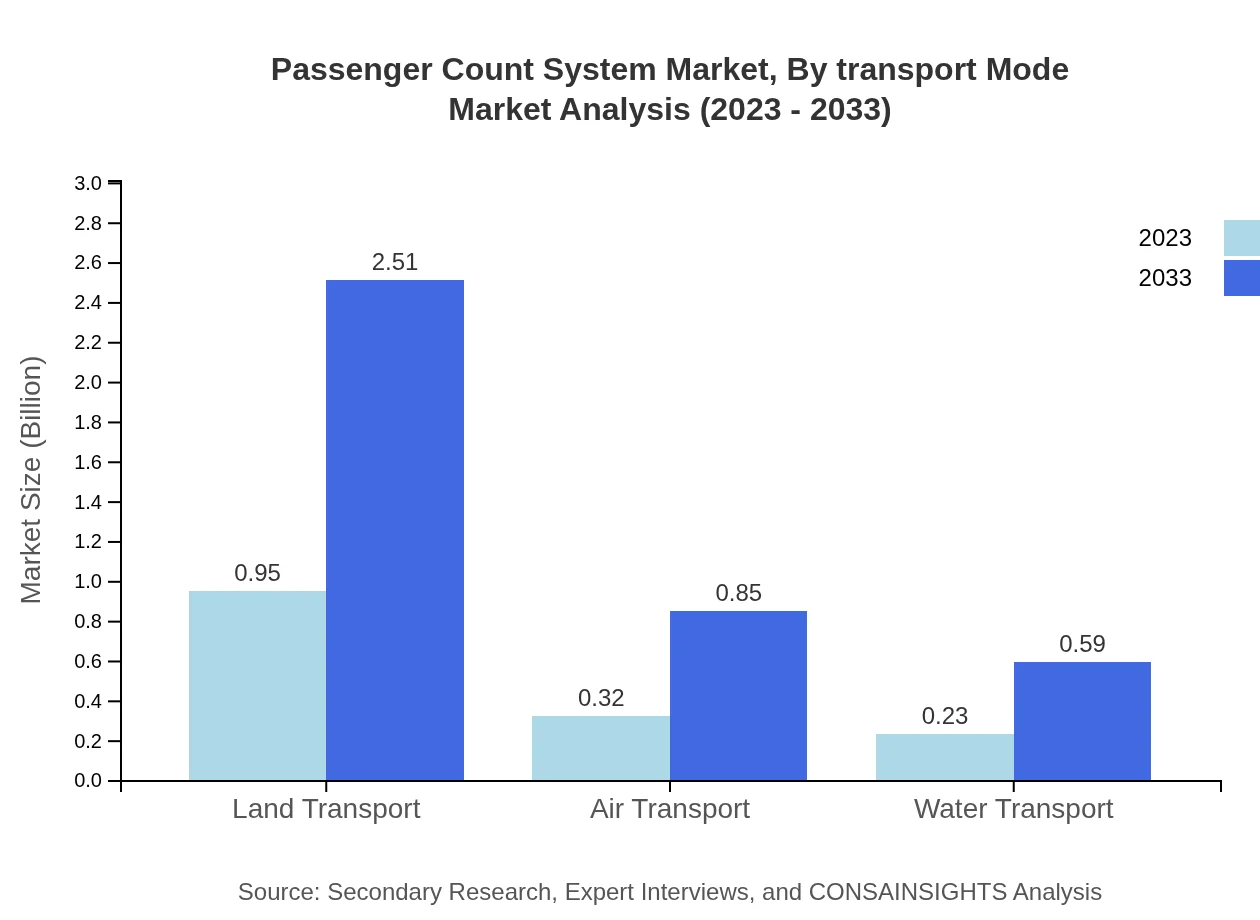

The Passenger Count System market by technology is segmented into hardware, software, and services. The hardware segment, including infrared and video systems, is expected to capture a significant market share, projected to grow from $0.95 billion in 2023 to $2.51 billion by 2033. Software and services also contribute substantially, with respective market sizes of $0.32 billion and $0.23 billion in 2023, growing to $0.85 billion and $0.59 billion by 2033.

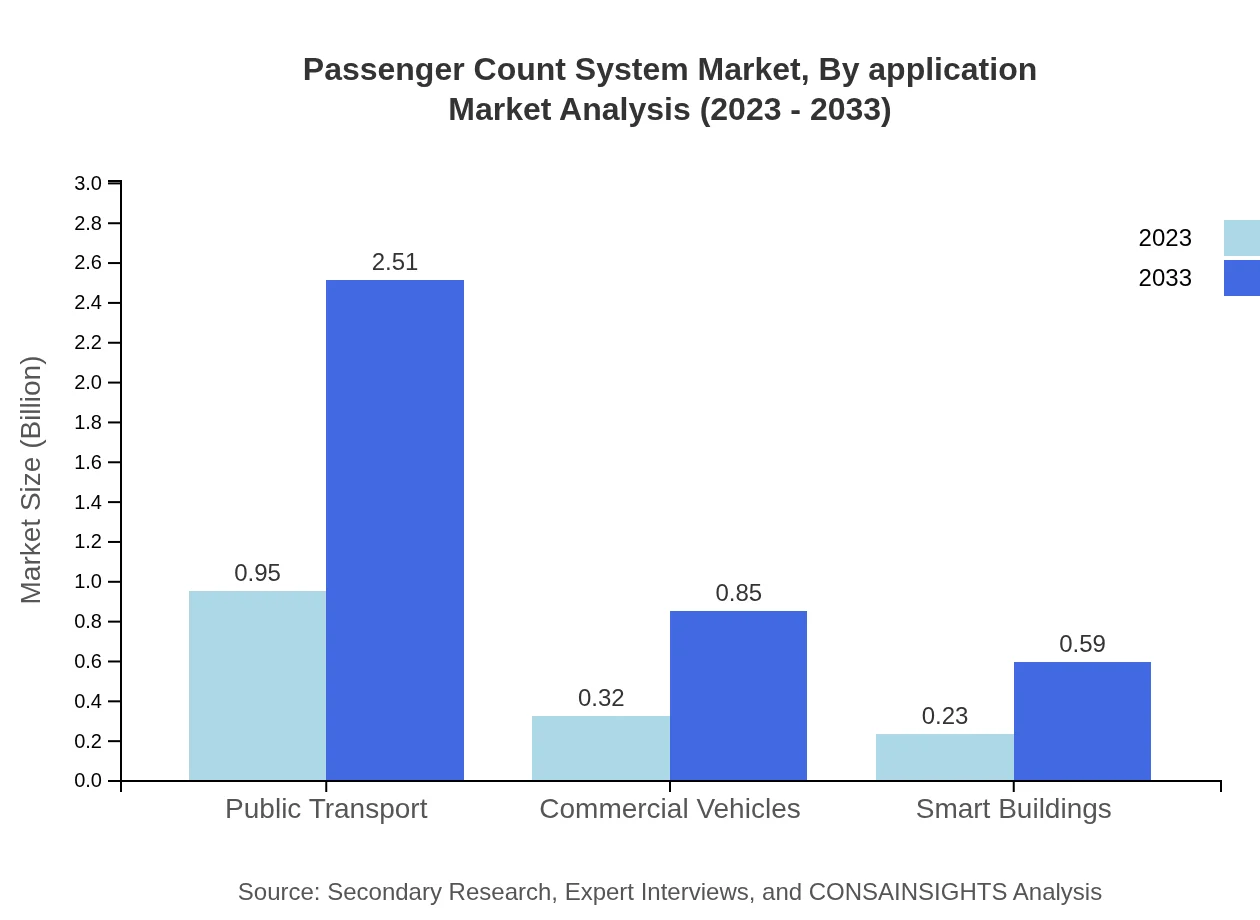

Passenger Count System Market Analysis By Application

Applications of Passenger Count Systems span across various sectors, including public transport, commercial vehicles, smart buildings, land transport, air transport, and water transport. The public transport segment is the largest, accounting for 63.45% market share in 2023, with similar expectations for 2033, attributing its growth to the increased focus on enhancing public transport efficiency.

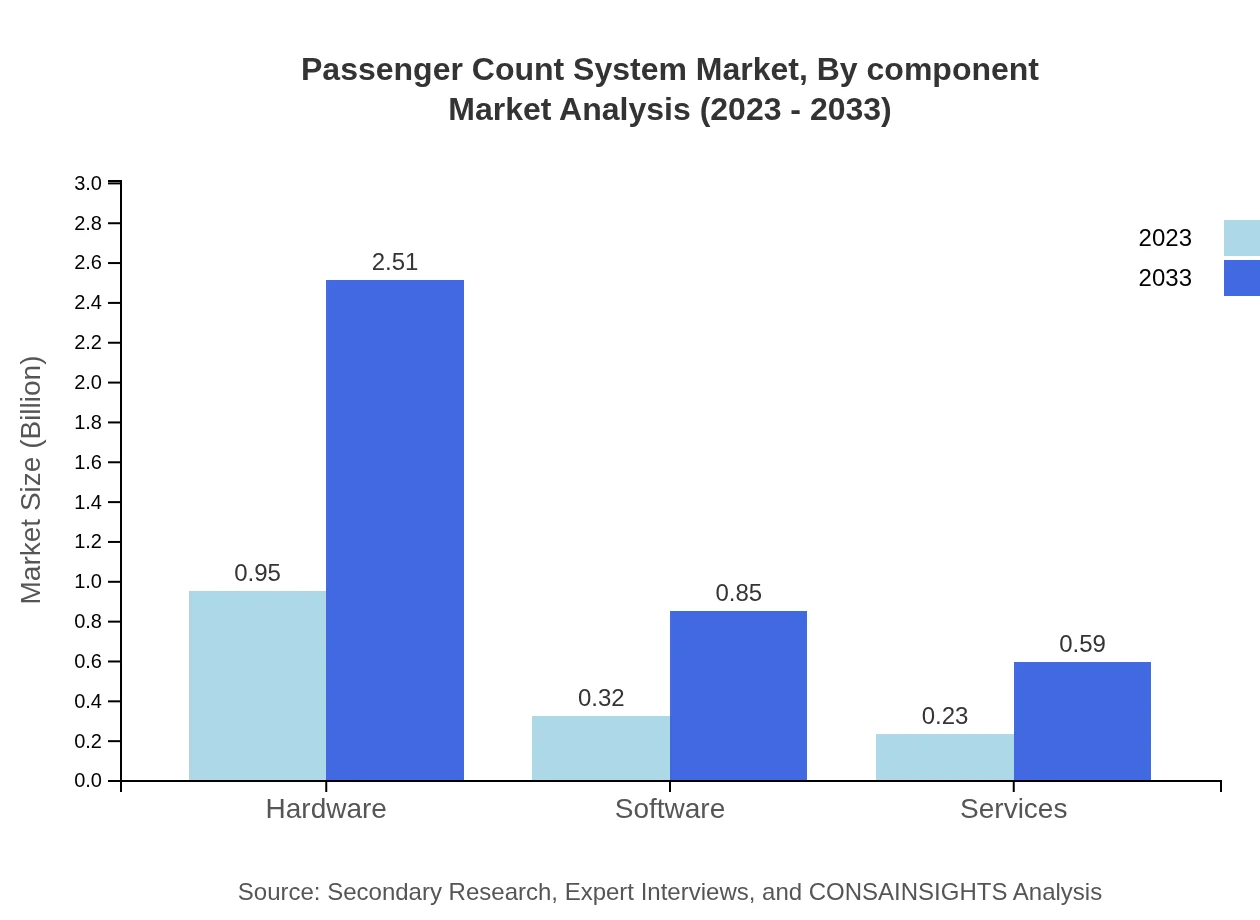

Passenger Count System Market Analysis By Component

By component, the market is increasingly gravitating towards hardware due to its functionality and reliability, expected to maintain a share of 63.45% from 2023 to 2033. Software solutions are gaining traction, projected to hold 21.54% share in the same period as organizations focus more on data analytics.

Passenger Count System Market Analysis By Transport Mode

Passenger Count Systems are employed across various transport modes including land, air, and water. The land transport mode holds the largest share (63.45% in 2023), driven by increasing passenger numbers and the need for precise data capture in public transportation networks.

Passenger Count System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Passenger Count System Industry

Sensory Inc.:

Sensory Inc. offers innovative passenger counting solutions that utilize advanced infrared and video systems to provide reliable real-time data for transport agencies.Rohde & Schwarz:

Rohde & Schwarz is a leading technology company providing precise counting solutions that integrate seamlessly with existing transport infrastructure to enhance operational efficiency.Zebra Technologies:

Zebra Technologies designs software and hardware solutions aimed at optimizing passenger flow in various transport networks, making it a key player in the industry.Cubic Corporation:

Cubic Corporation specializes in technology solutions for transportation systems, offering various passenger counting systems that assist with real-time analytics and operational enhancements.We're grateful to work with incredible clients.

FAQs

What is the market size of passenger Count System?

The passenger count system market is projected to reach approximately $1.5 billion by 2033, with a CAGR of 9.8% from 2023 to 2033. This significant growth reflects rising demand for efficient transport management systems globally.

What are the key market players or companies in this passenger Count System industry?

The passenger count system industry features key players like XYZ Corp, ABC Technologies, and DEF Solutions. These companies lead the market with innovative technologies and strategic partnerships to enhance system performance and drive growth.

What are the primary factors driving the growth in the passenger Count System industry?

Key growth factors include increasing urbanization, a focus on enhancing public transport efficiencies, and advancements in sensor technologies. Furthermore, growing demand for real-time data analytics drives innovation and system adoption across various sectors.

Which region is the fastest Growing in the passenger Count System?

The Asia-Pacific region is expected to be the fastest-growing market, projected to expand from $0.29 billion in 2023 to $0.77 billion by 2033. This growth is fueled by increasing investments in public transportation and smart city initiatives.

Does ConsaInsights provide customized market report data for the passenger Count System industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the passenger-count-system industry. We ensure clients receive insights that meet their unique requirements and business objectives for strategic decision-making.

What deliverables can I expect from this passenger Count System market research project?

Deliverables from our passenger-count-system market research include detailed market analysis, trend forecasting, competitive landscape assessments, and segment-specific insights, equipping clients with the necessary data to make informed business decisions.

What are the market trends of passenger Count System?

Current market trends include increased adoption of AI technology, integration of IoT for real-time analytics, and a shift towards contactless solutions. These trends reflect a growing emphasis on improving operational efficiency and passenger experience.