Passenger Security Equipment Market Report

Published Date: 31 January 2026 | Report Code: passenger-security-equipment

Passenger Security Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Passenger Security Equipment market, including key insights, trends, and projections from 2023 to 2033. The focus is on market size, segmentation, regional dynamics, and technological advancements that are expected to shape the industry.

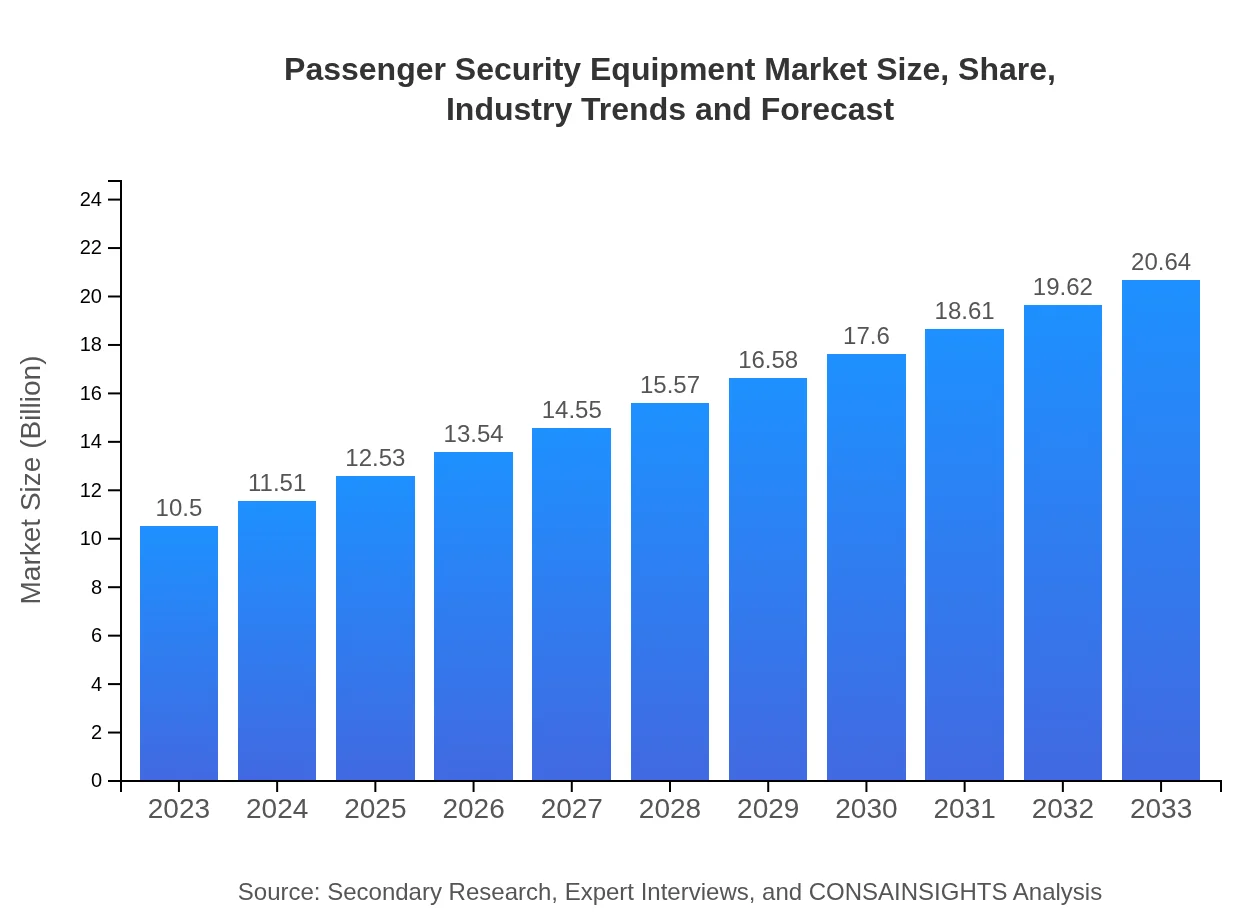

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | Smiths Detection, L3Harris Technologies, Honeywell International Inc., Bosch Security Systems, Atkins |

| Last Modified Date | 31 January 2026 |

Passenger Security Equipment Market Overview

Customize Passenger Security Equipment Market Report market research report

- ✔ Get in-depth analysis of Passenger Security Equipment market size, growth, and forecasts.

- ✔ Understand Passenger Security Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Passenger Security Equipment

What is the Market Size & CAGR of Passenger Security Equipment market in 2023?

Passenger Security Equipment Industry Analysis

Passenger Security Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Passenger Security Equipment Market Analysis Report by Region

Europe Passenger Security Equipment Market Report:

The European market is expected to grow from USD 2.82 billion in 2023 to USD 5.55 billion by 2033, supported by robust public safety policies, increased funding for transport facilities, and the presence of key market players developing innovative solutions aimed at improving passenger security.Asia Pacific Passenger Security Equipment Market Report:

In the Asia Pacific region, the market is anticipated to expand from USD 2.29 billion in 2023 to USD 4.51 billion by 2033, driven by increasing travel frequency and government-led initiatives to enhance public safety. The growth of urban areas and rising passenger transportation infrastructure projects are expected to further propel the demand for advanced security equipment.North America Passenger Security Equipment Market Report:

North America's market for Passenger Security Equipment is projected to rise from USD 3.41 billion in 2023 to USD 6.70 billion by 2033. This significant growth is fueled by stringent safety regulations, high disposable income, and advanced technological adoption among transport operators and service providers.South America Passenger Security Equipment Market Report:

The South American market is projected to grow from USD 0.89 billion in 2023 to USD 1.75 billion by 2033. Although the market is smaller compared to other regions, increasing security investments by governments and private sectors to combat rising crime rates are expected to drive adoption.Middle East & Africa Passenger Security Equipment Market Report:

In the Middle East and Africa, the market size is projected to increase from USD 1.09 billion in 2023 to USD 2.13 billion by 2033. This growth is linked to expanding transportation networks and increasing security threats in the region, prompting investments in reliable security solutions for various transport sectors.Tell us your focus area and get a customized research report.

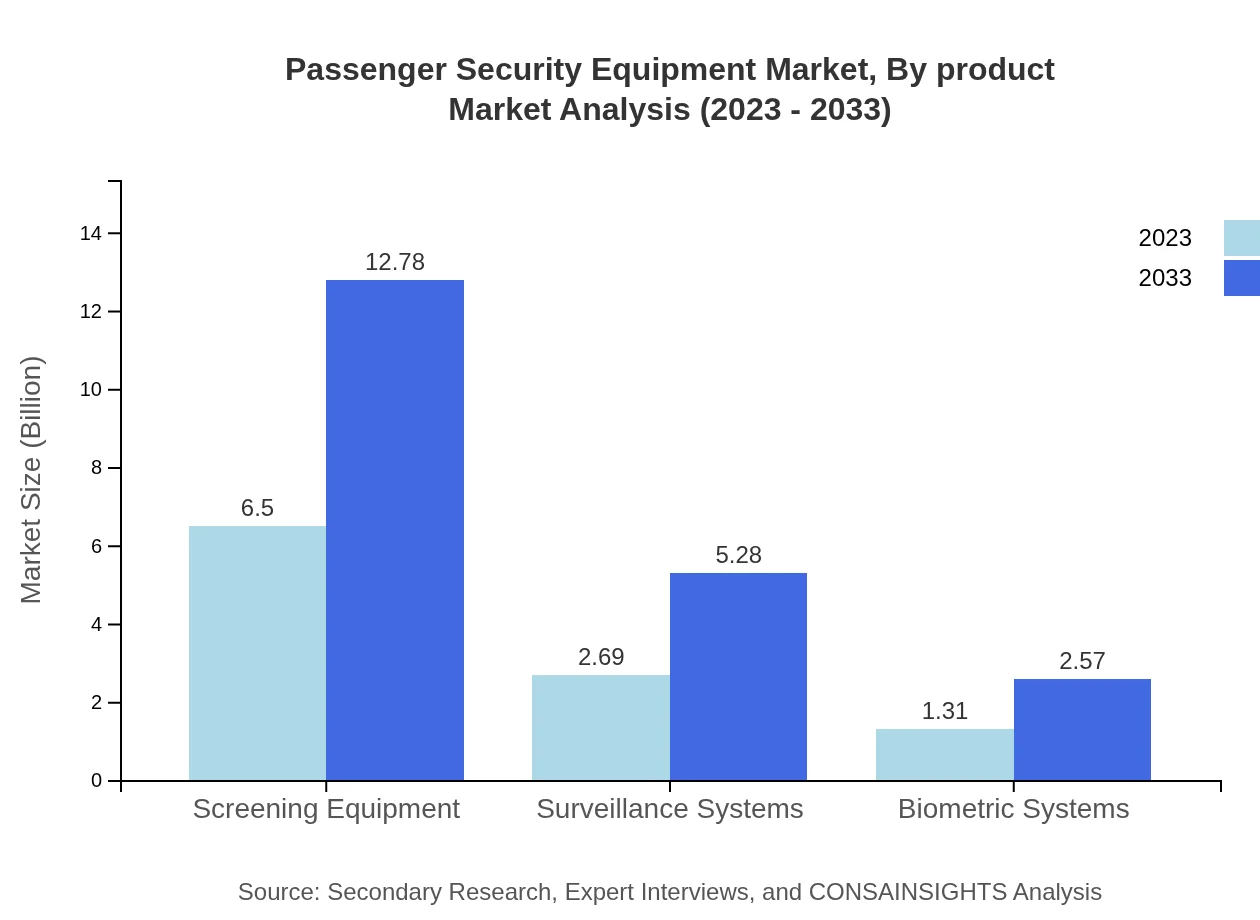

Passenger Security Equipment Market Analysis By Product

The Passenger Security Equipment market is dominated by Screening Equipment, which is projected to grow from USD 6.50 billion in 2023 to USD 12.78 billion by 2033, representing 61.93% market share throughout the forecast. Surveillance Systems follow, expanding from USD 2.69 billion to USD 5.28 billion (25.6% market share). Biometric Systems, though smaller, are proving vital with a growth forecast from USD 1.31 billion to USD 2.57 billion (12.47% market share).

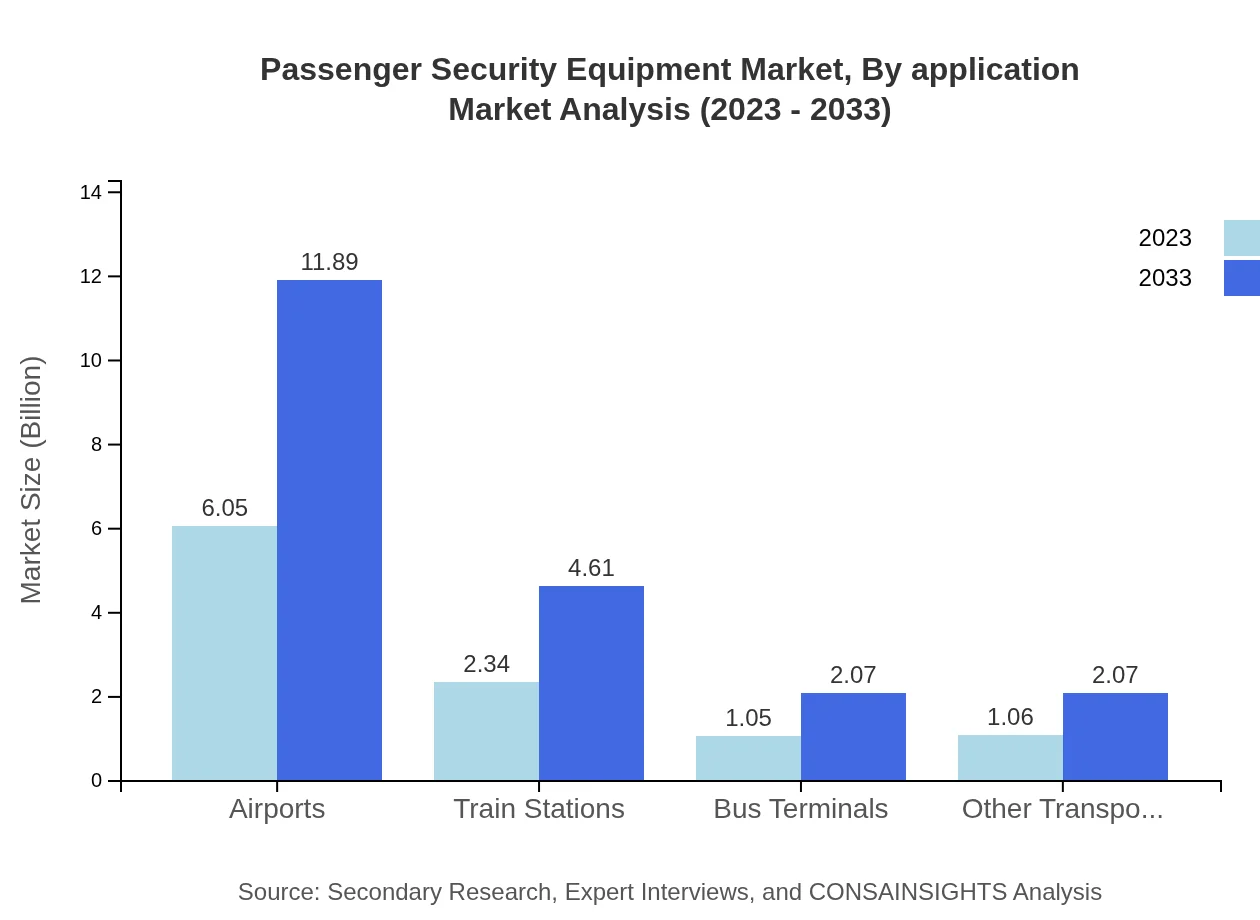

Passenger Security Equipment Market Analysis By Application

Commercial applications dominate the Passenger Security Equipment market, with Airports leading at USD 6.05 billion in 2023. Projected growth to USD 11.89 billion by 2033 ensures a market share of 57.62%. Train Stations and Bus Terminals respectively contribute with USD 2.34 billion and USD 1.05 billion in 2023. Both are set to witness notable growth as urban transport systems expand.

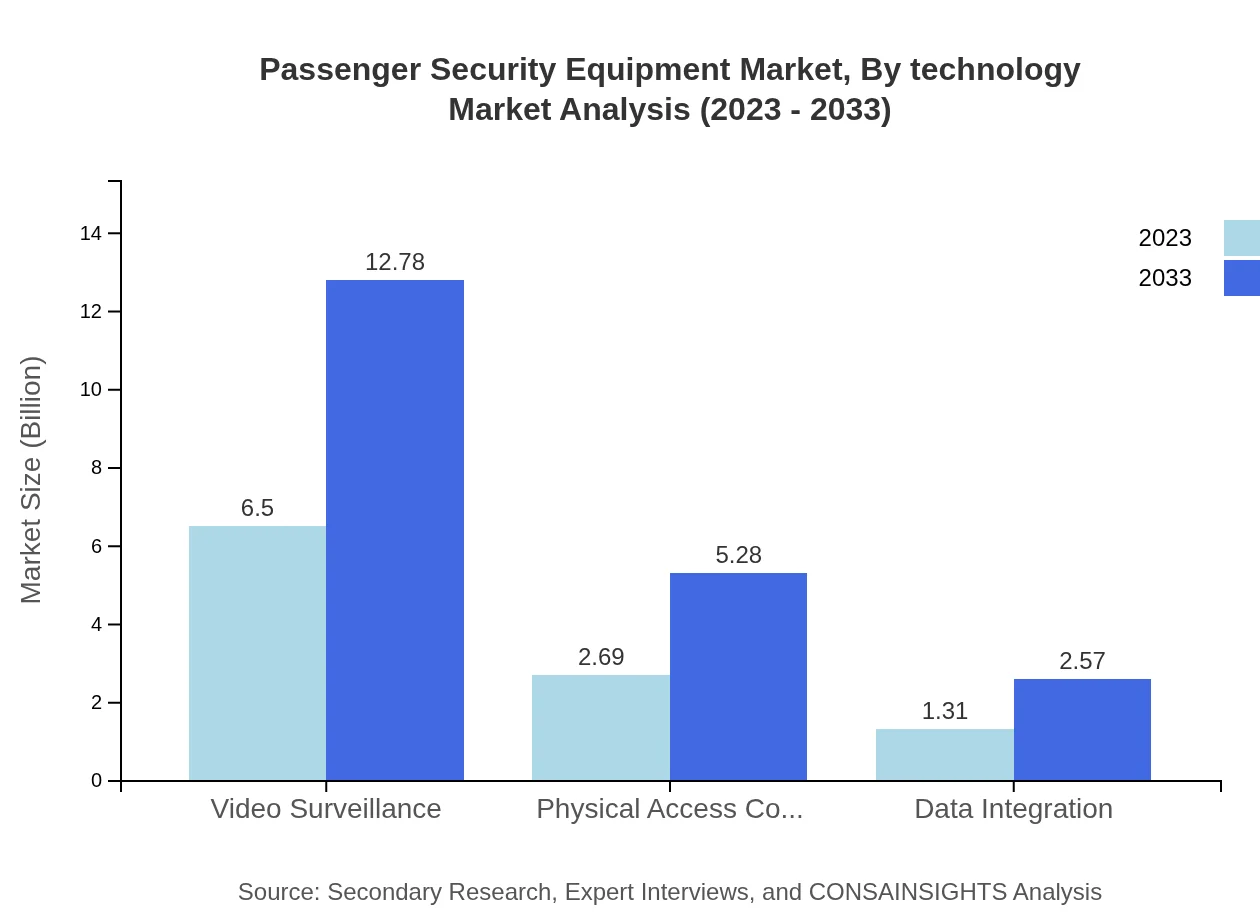

Passenger Security Equipment Market Analysis By Technology

Technological advancements in AI and machine learning shape the Passenger Security Equipment landscape. Video Surveillance maintains dominance, expanding from USD 6.50 billion to USD 12.78 billion (61.93% market share). Physical Access Control Systems are also significant, growing from USD 2.69 billion to USD 5.28 billion, maintaining a sizable share, highlighting the shift towards highly integrated technological security solutions.

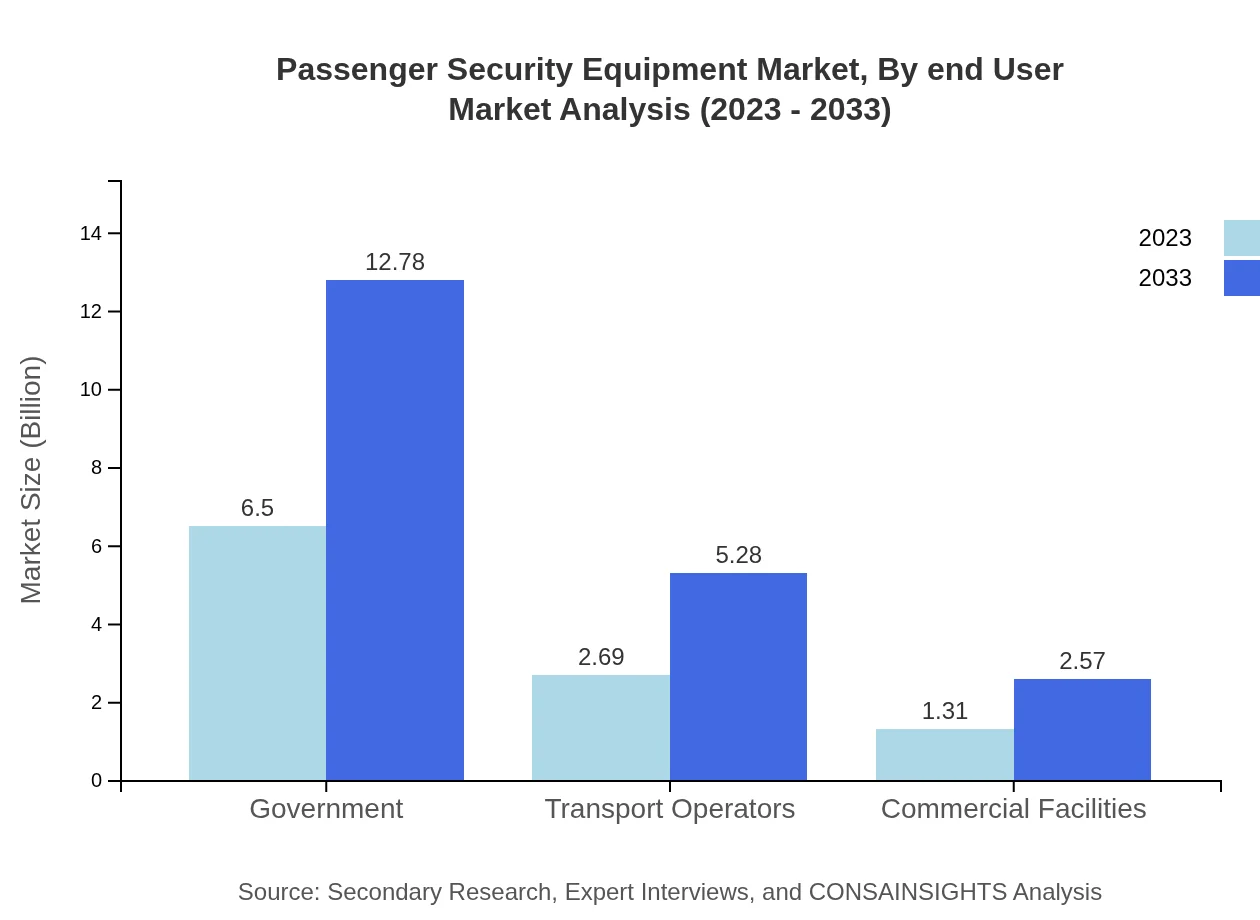

Passenger Security Equipment Market Analysis By End User

Governments remain the primary end-users of Passenger Security Equipment, with expenditures projected to sustain a 61.93% share as spending rises from USD 6.50 billion to USD 12.78 billion by 2033. Transportation operators, including train and bus systems, contribute significantly, expected to see growth from USD 2.69 billion to USD 5.28 billion as public transport facilities modernize and enhance safety measures.

Passenger Security Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Passenger Security Equipment Industry

Smiths Detection:

A leading provider of threat detection and security solutions, Smiths Detection specializes in providing advanced screening technologies to enhance safety across transport hubs.L3Harris Technologies:

Known for its innovations in security, L3Harris offers a range of Passenger Security Equipment, focusing on integrated systems for transport operators.Honeywell International Inc.:

Honeywell provides cutting-edge technologies for security, including video surveillance and access control, catering to a diverse clientele in the transportation sector.Bosch Security Systems:

Bosch offers an extensive portfolio of security solutions including surveillance systems and integrated access control technologies tailored for public transport.Atkins:

Atkins specializes in engineering and design services, working closely with governments and transport operators to enhance security surveillance systems.We're grateful to work with incredible clients.

FAQs

What is the market size of passenger Security Equipment?

The global passenger security equipment market is valued at $10.5 billion in 2023, with an expected CAGR of 6.8% through 2033. As security concerns grow, investment in advanced technology for passenger safety is anticipated to drive market expansion.

What are the key market players or companies in this passenger Security Equipment industry?

Key players in the passenger security equipment market include major companies such as L3 Technologies, Smiths Detection, and Security Detection Systems. These firms dominate with innovative security solutions and equipment, capturing significant market shares across various regions.

What are the primary factors driving the growth in the passenger Security Equipment industry?

The growth of the passenger security equipment industry is driven by increasing global travel, heightened security concerns, regulatory investments in safety, technological advancements in security systems, and the need for enhanced airport and transport facility security measures.

Which region is the fastest Growing in the passenger security equipment?

The fastest-growing region in the passenger security equipment market is the Asia Pacific, projected to grow from $2.29 billion in 2023 to $4.51 billion by 2033. Rapid urbanization and increasing passenger volumes in this region significantly contribute to market growth.

Does ConsaInsights provide customized market report data for the passenger Security Equipment industry?

Yes, ConsaInsights provides customized market report data tailored to specific requirements in the passenger security equipment sector. Clients can request focused insights based on regional studies, technological advancements, and market segmentation.

What deliverables can I expect from this passenger Security Equipment market research project?

Expected deliverables include comprehensive market analysis reports, detailed segment insights, regional studies, competitive landscape evaluations, and trend forecasting for the passenger security equipment market, tailored to your strategic business needs.

What are the market trends of passenger Security Equipment?

Current trends in the passenger security equipment market include integration of AI and machine learning in surveillance, advancements in biometric systems, increasing demand for real-time data access in security measures, and a focus on seamless passenger experience without compromising safety.