Passenger Security Market Report

Published Date: 03 February 2026 | Report Code: passenger-security

Passenger Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Passenger Security market, including insights, trends, and forecasts for the years 2023 to 2033. It covers market size, regional segmentation, and an in-depth look at industry players and emerging technologies.

| Metric | Value |

|---|---|

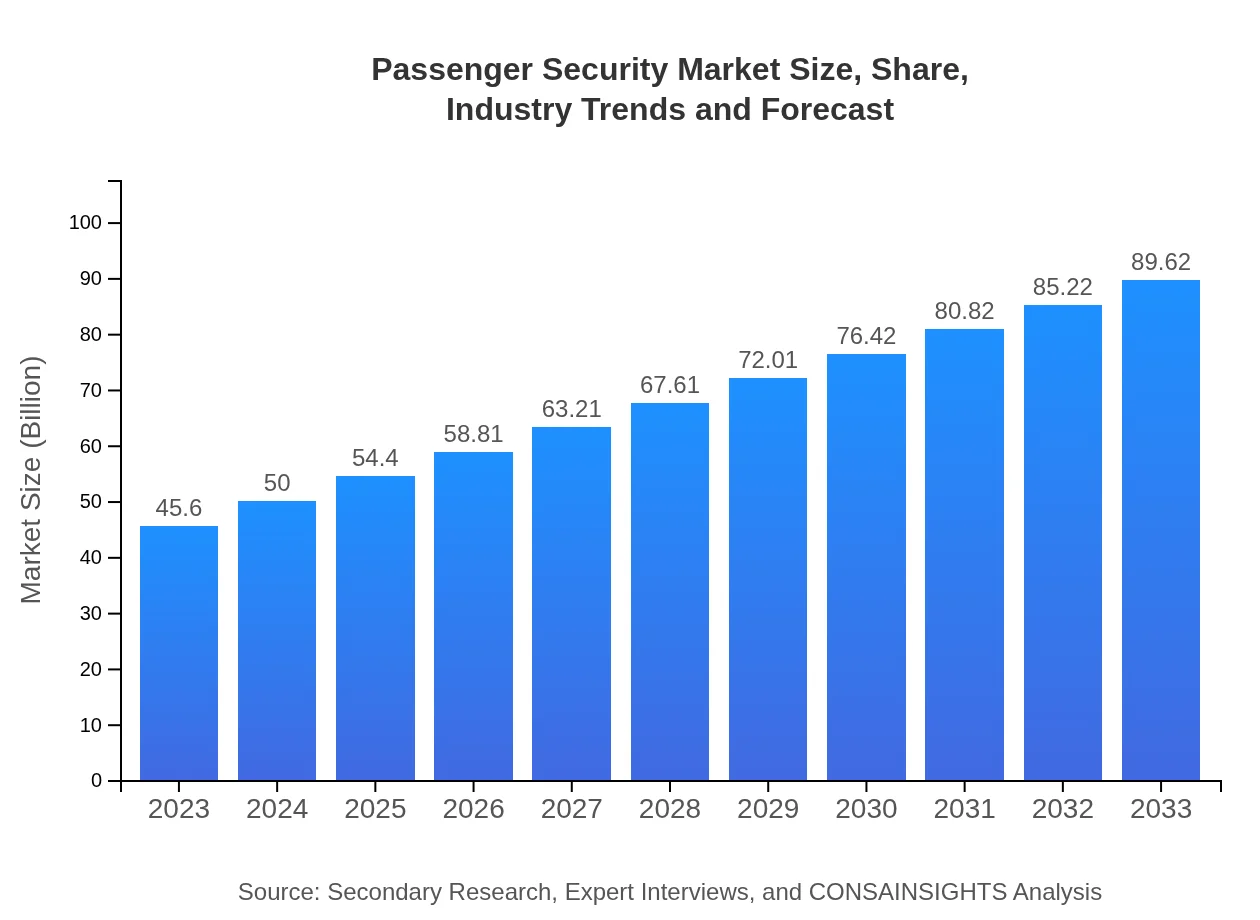

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $89.62 Billion |

| Top Companies | SITA, L3Harris Technologies, Thales, Honeywell |

| Last Modified Date | 03 February 2026 |

Passenger Security Market Overview

Customize Passenger Security Market Report market research report

- ✔ Get in-depth analysis of Passenger Security market size, growth, and forecasts.

- ✔ Understand Passenger Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Passenger Security

What is the Market Size & CAGR of Passenger Security market in 2023 and 2033?

Passenger Security Industry Analysis

Passenger Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Passenger Security Market Analysis Report by Region

Europe Passenger Security Market Report:

In Europe, the Passenger Security market accounted for $13.87 billion in 2023, with prospects of reaching $27.25 billion by 2033. Stringent regulatory frameworks and growing public safety awareness fuel growth in this region.Asia Pacific Passenger Security Market Report:

In the Asia Pacific region, the Passenger Security market was valued at approximately $8.16 billion in 2023, with expectations of growing to around $16.04 billion by 2033. Rapid urbanization, increasing passenger traffic, and investments in smart transportation infrastructure are driving growth in this region.North America Passenger Security Market Report:

The North American market is the largest, with a valuation of $17.00 billion in 2023, anticipated to grow to $33.40 billion by 2033. High security concerns following recent incidents have resulted in increased spending on advanced security technologies across commercial and government sectors.South America Passenger Security Market Report:

South America’s Passenger Security market size stood at $4.01 billion in 2023, projected to reach $7.89 billion by 2033. Enhanced security measures in public transportation and airports driven by rising crime rates contribute to market expansion.Middle East & Africa Passenger Security Market Report:

At $2.56 billion in 2023, the market in the Middle East and Africa is expected to grow to $5.04 billion by 2033. Security threats related to terrorism and crime have compelled governments to enhance security systems across transportation facilities.Tell us your focus area and get a customized research report.

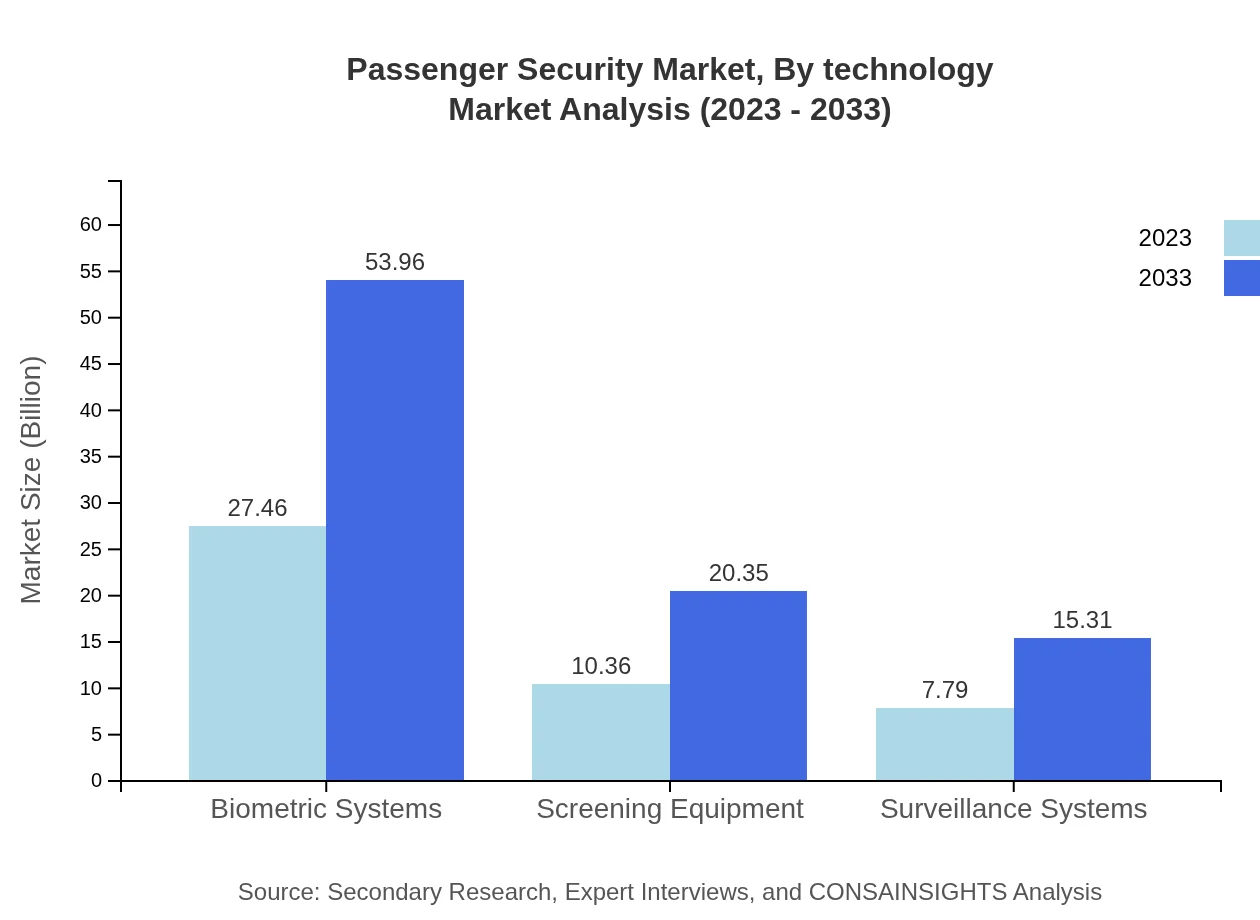

Passenger Security Market Analysis By Technology

The Passenger Security market is heavily reliant on technology segments such as Biometric Systems, Screening Equipment, and Surveillance Systems. For instance, Biometric Systems generated a size of $27.46 billion in 2023, expected to double by 2033, owing to their effectiveness in identity verification. Screening Equipment and Surveillance Systems accounted for market sizes of $10.36 billion and $7.79 billion respectively in 2023, reflecting their critical roles in passenger security operations.

Passenger Security Market Analysis By Application

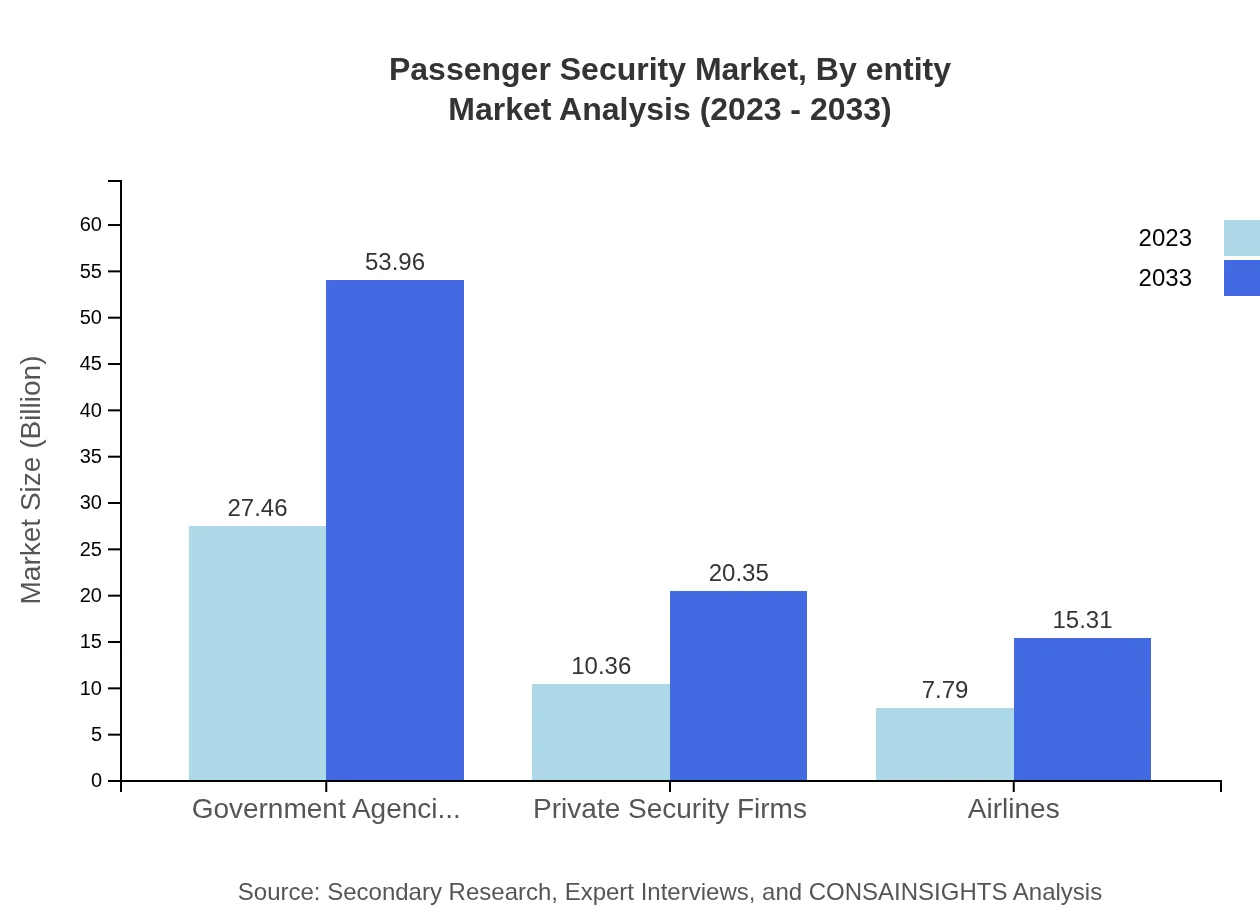

Applications in the Passenger Security market include Government Agencies, Private Security Firms, and Airlines. Government Agencies hold the largest market share with a size of $27.46 billion in 2023, indicating the high demand for security measures across public sectors. Private Security Firms at $10.36 billion and Airlines at $7.79 billion also significantly contribute, particularly in enhancing security protocols to assure passenger safety.

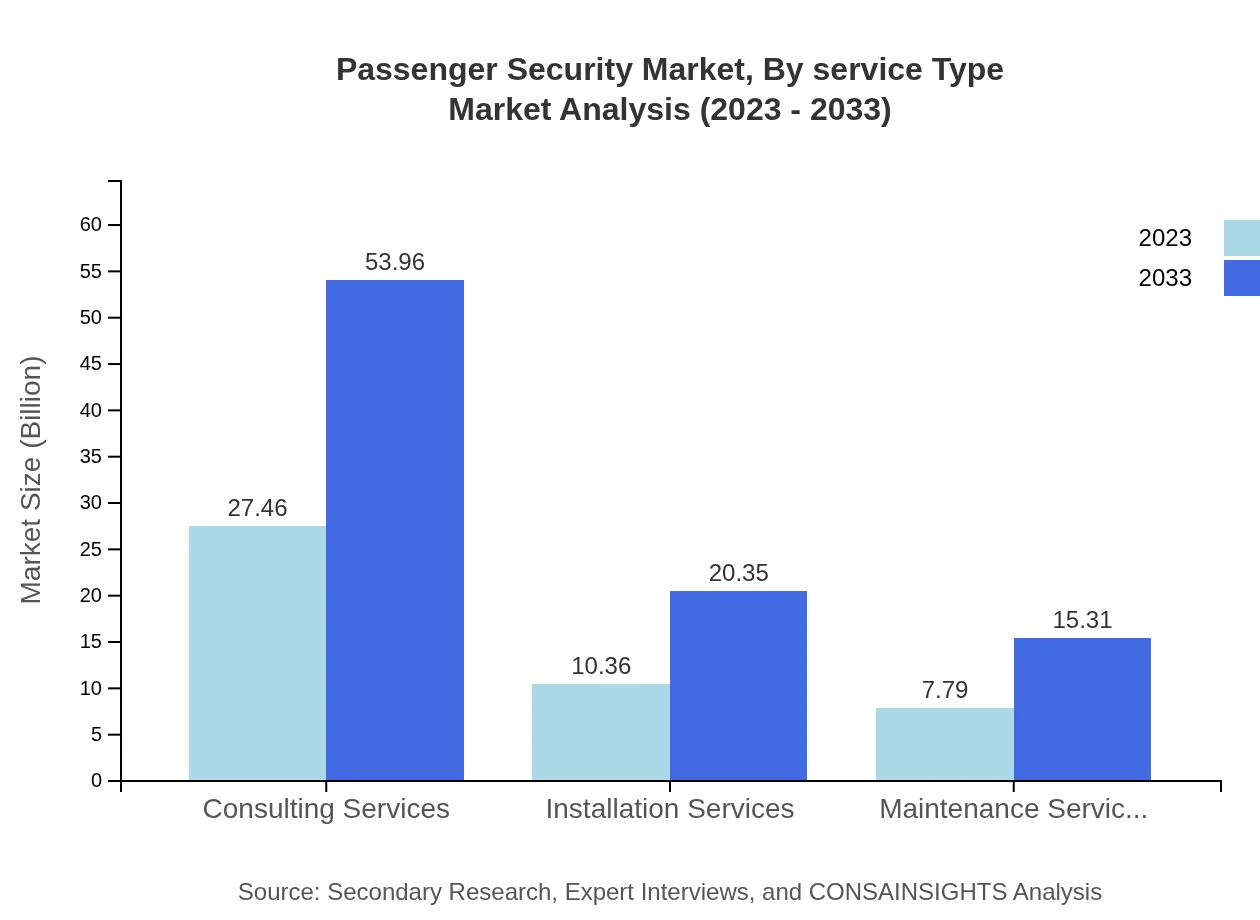

Passenger Security Market Analysis By Service Type

Service types in this market encompass Consulting Services, Installation Services, and Maintenance Services. Consulting Services represent a major segment with $27.46 billion in size at present, reflecting the need for expert guidance in security system deployment. Installation Services contribute $10.36 billion while Maintenance Services, peaking at $7.79 billion, demonstrate the ongoing demand for system upkeep.

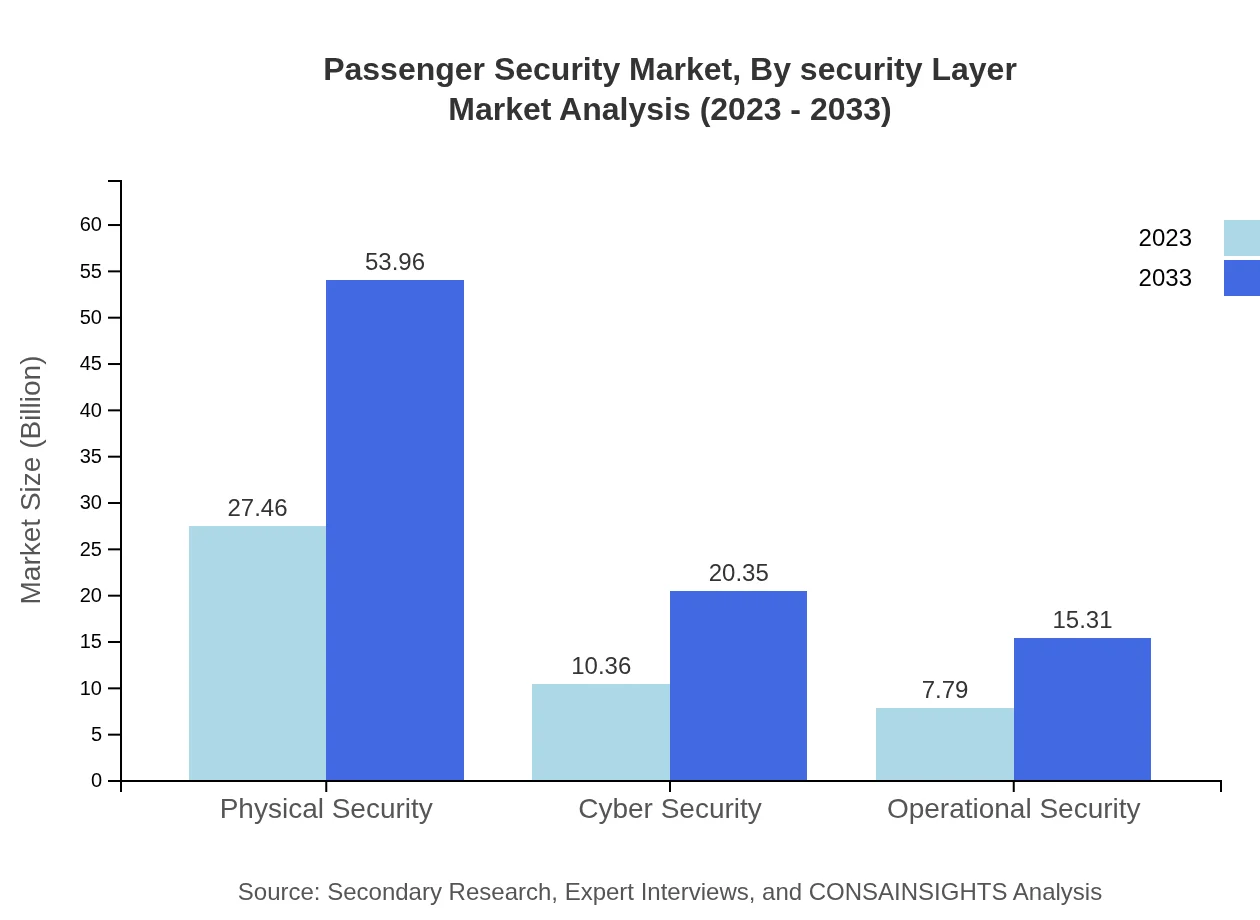

Passenger Security Market Analysis By Security Layer

The market is divided into Physical Security, Cyber Security, and Operational Security layers. Physical Security dominates the market, with a $27.46 billion valuation, showcasing the fundamental role of physical measures in securing passenger transport. Concurrently, Cyber Security represents a growing concern with a market size of $10.36 billion, underscoring the importance of safeguarding sensitive passenger data from digital threats.

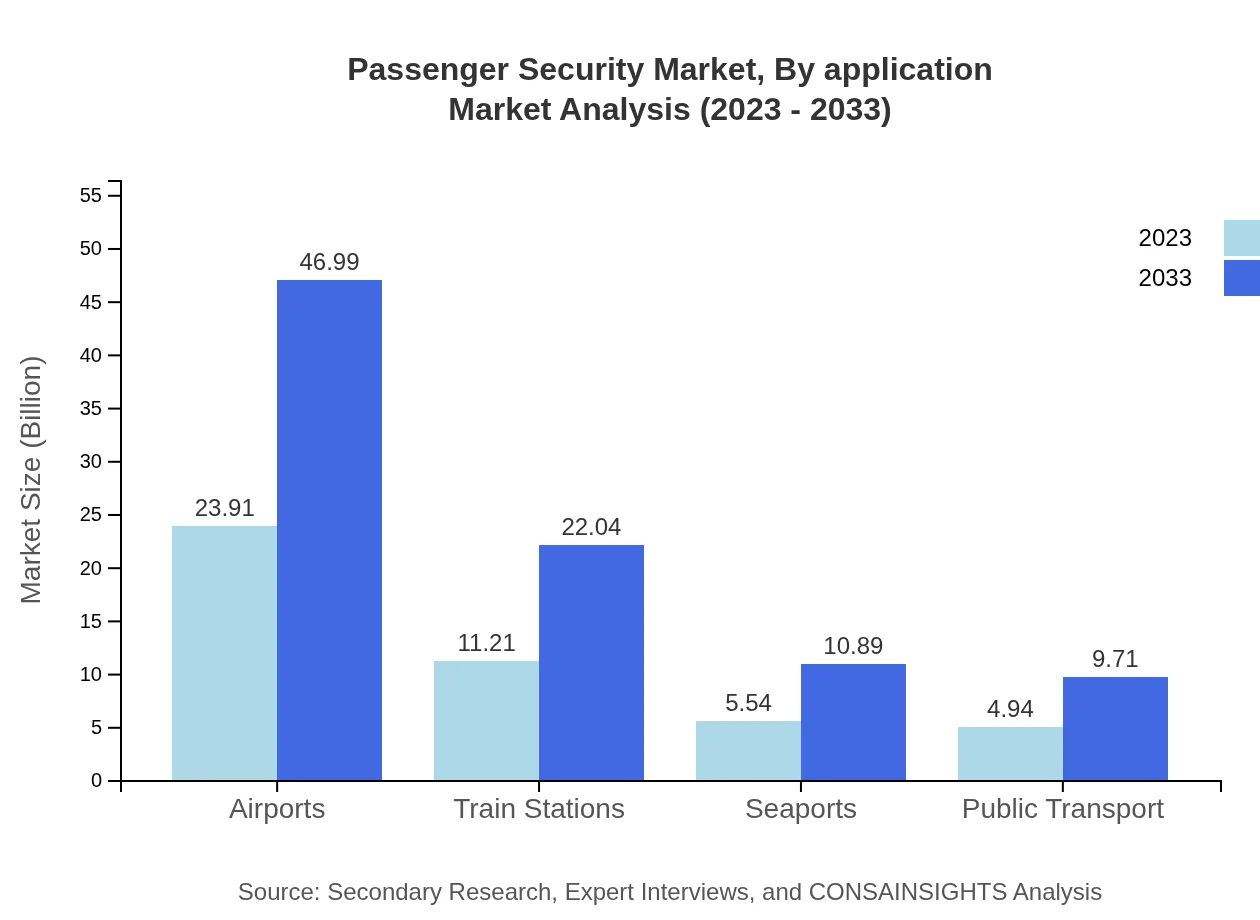

Passenger Security Market Analysis By Entity

The Passenger Security sector incorporates various entities such as Airports, Train Stations, and Seaports. Airports currently lead with an estimated $23.91 billion in size, reflecting the high volume of travelers and associated security measures. Train Stations at $11.21 billion and Seaports at $5.54 billion similarly illustrate the widespread need for effective security solutions across transportation hubs.

Passenger Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Passenger Security Industry

SITA:

SITA is a leading IT provider for the aviation industry, offering advanced passenger tracking and biometric identification solutions that enhance airport security and streamline operations.L3Harris Technologies:

L3Harris is a global player in security and surveillance solutions, known for its cutting-edge screening technologies and integrated security offerings across various transportation sectors.Thales:

Thales is recognized for its comprehensive security solutions, including biometric identification and threat detection systems, making it a key player in global passenger security markets.Honeywell :

Honeywell offers a range of innovative security technologies and services, focusing on the integration of physical and cyber security measures across transportation security systems.We're grateful to work with incredible clients.

FAQs

What is the market size of passenger security?

The passenger security market is projected to reach approximately $45.6 billion by 2033, growing at a CAGR of 6.8%. This growth is driven by increasing security concerns and investments in advanced technologies within transportation networks.

What are the key market players or companies in the passenger security industry?

Key players in the passenger security industry include government agencies, private security firms, and aviation companies. These entities play crucial roles in implementing security measures, technological advancements, and compliance with international security standards.

What are the primary factors driving the growth in the passenger security industry?

The growth in the passenger security market is primarily driven by heightened security threats, technological innovation, and regulatory compliance. Increasing incidents of terrorism and criminal activities necessitate advanced security measures in public and transportation sectors.

Which region is the fastest Growing in the passenger security?

The North America region is the fastest-growing market for passenger security, with projections showing growth from $17.00 billion in 2023 to $33.40 billion by 2033. This growth is fueled by significant investments in security technologies and infrastructure.

Does ConsaInsights provide customized market report data for the passenger security industry?

Yes, ConsaInsights offers customized market report data tailored to your specific needs within the passenger security industry. We provide detailed insights reflecting unique market conditions, trends, and forecasts to support strategic decision-making.

What deliverables can I expect from this passenger security market research project?

From the passenger security market research project, you can expect comprehensive reports detailing market size, growth forecasts, segment analysis, competitive landscape, and key trends. Data visualizations and actionable insights will be included to aid in strategic planning.

What are the market trends of passenger security?

Current market trends in passenger security include the increased adoption of biometric systems, advanced screening equipment, and AI-driven surveillance technologies. Emphasis on integrating physical and cyber security measures is also prevalent as threats evolve.