Passenger Service System Market Report

Published Date: 31 January 2026 | Report Code: passenger-service-system

Passenger Service System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Passenger Service System market from 2023 to 2033. It covers market trends, size, segmentation, regional insights, and profiles of leading companies in the industry, offering valuable insights for stakeholders and investors.

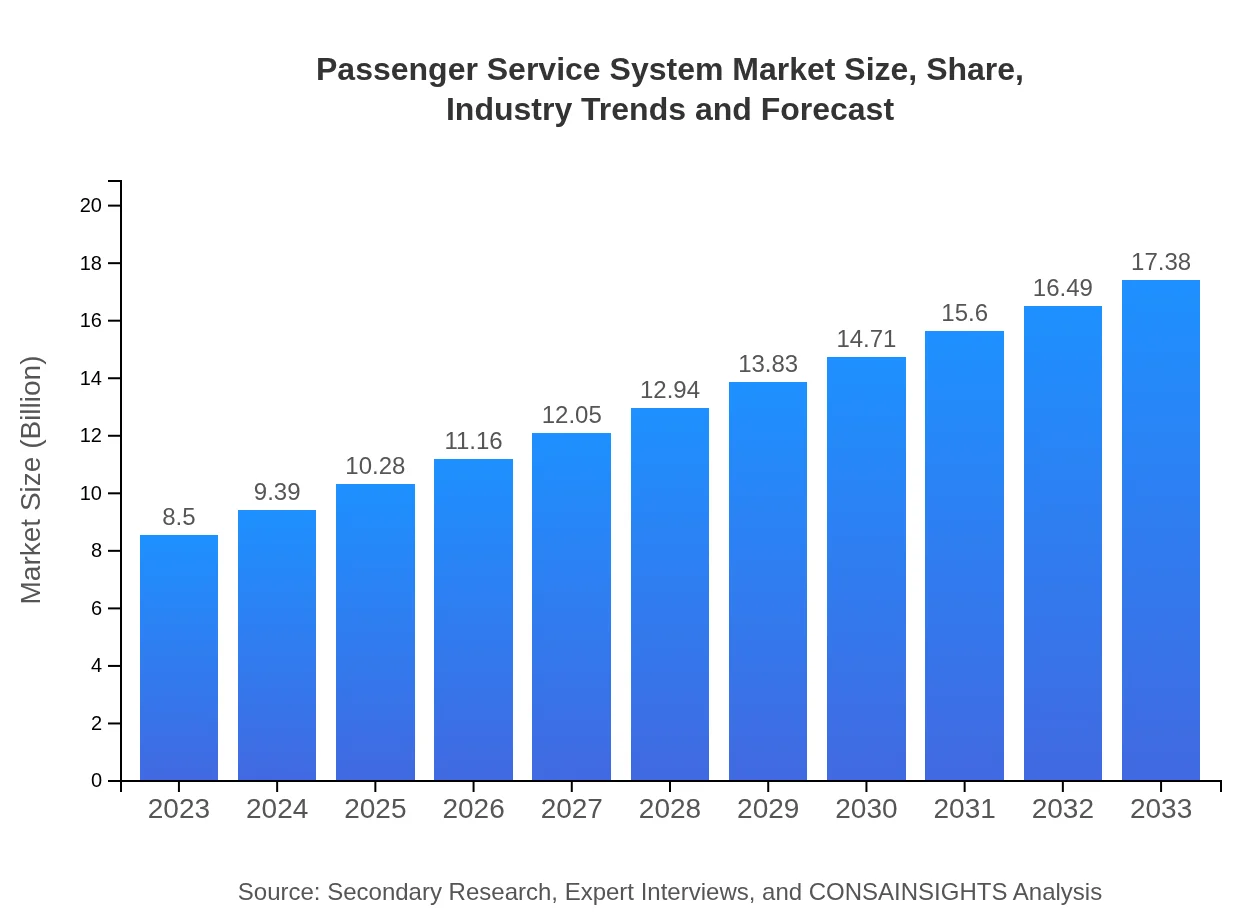

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $17.38 Billion |

| Top Companies | Amadeus IT Group, Sabre Corporation, SITA, Travelport |

| Last Modified Date | 31 January 2026 |

Passenger Service System Market Overview

Customize Passenger Service System Market Report market research report

- ✔ Get in-depth analysis of Passenger Service System market size, growth, and forecasts.

- ✔ Understand Passenger Service System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Passenger Service System

What is the Market Size & CAGR of Passenger Service System market in 2023 and 2033?

Passenger Service System Industry Analysis

Passenger Service System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Passenger Service System Market Analysis Report by Region

Europe Passenger Service System Market Report:

The European market is experiencing robust growth, with an increase from $2.18 billion in 2023 to $4.46 billion by 2033. Continued investments in technology and a strong emphasis on customer experience improvements are propelling this growth, along with significant compliance regulations that companies must adhere to.Asia Pacific Passenger Service System Market Report:

The Asia Pacific region is one of the fastest-growing markets for Passenger Service Systems, with a market size of $1.77 billion in 2023, projected to nearly double to approximately $3.62 billion by 2033. Growth is fueled by rising travel demands in countries like China and India, along with increased investments in airport infrastructure and digital service enhancements.North America Passenger Service System Market Report:

North America is a significant market for Passenger Service Systems, with revenues projected to expand from $3.07 billion in 2023 to $6.28 billion by 2033. The high adoption of technology and consumer demand for improved services are key factors enhancing market growth.South America Passenger Service System Market Report:

In South America, the Passenger Service System market is expected to grow from $0.68 billion in 2023 to around $1.38 billion by 2033. This growth is driven by a rising middle class and improving transportation infrastructure, although challenges such as political instability can affect market dynamics.Middle East & Africa Passenger Service System Market Report:

The Middle East and Africa market, currently valued at $0.80 billion in 2023, is expected to grow to $1.64 billion by 2033. The expansion of air travel and government-backed initiatives to improve tourism are critical drivers in this region, despite facing infrastructural challenges.Tell us your focus area and get a customized research report.

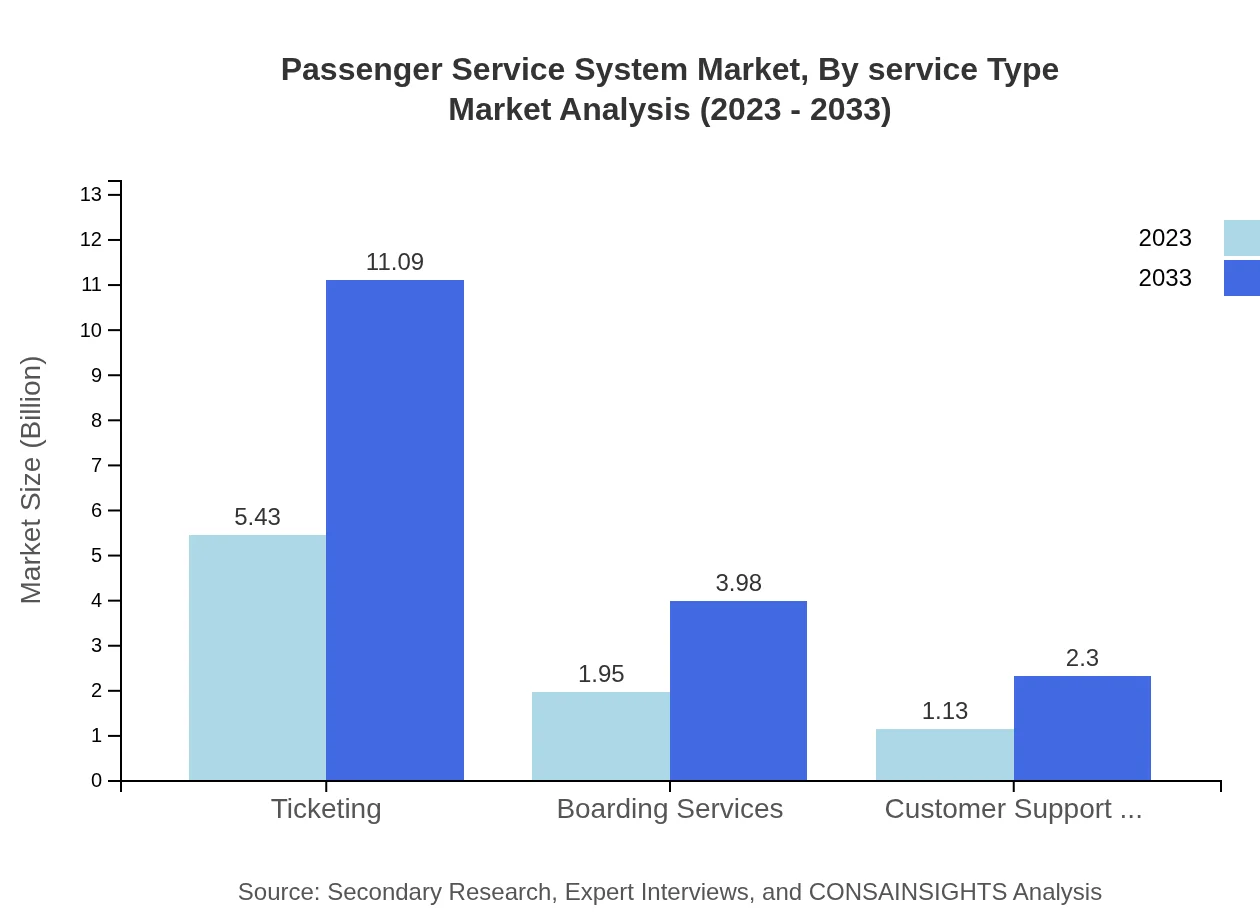

Passenger Service System Market Analysis By Service Type

The Passenger Service System market by service type is significantly influenced by airlines, accounting for approximately 58.51% of the market in 2023 and projected to maintain this share to 2033. Ticketing services dominate with a market size of $5.43 billion in 2023 and expected growth to $11.09 billion by 2033. Railways and travel agencies follow, showcasing diverse opportunities for market penetration based on service focus.

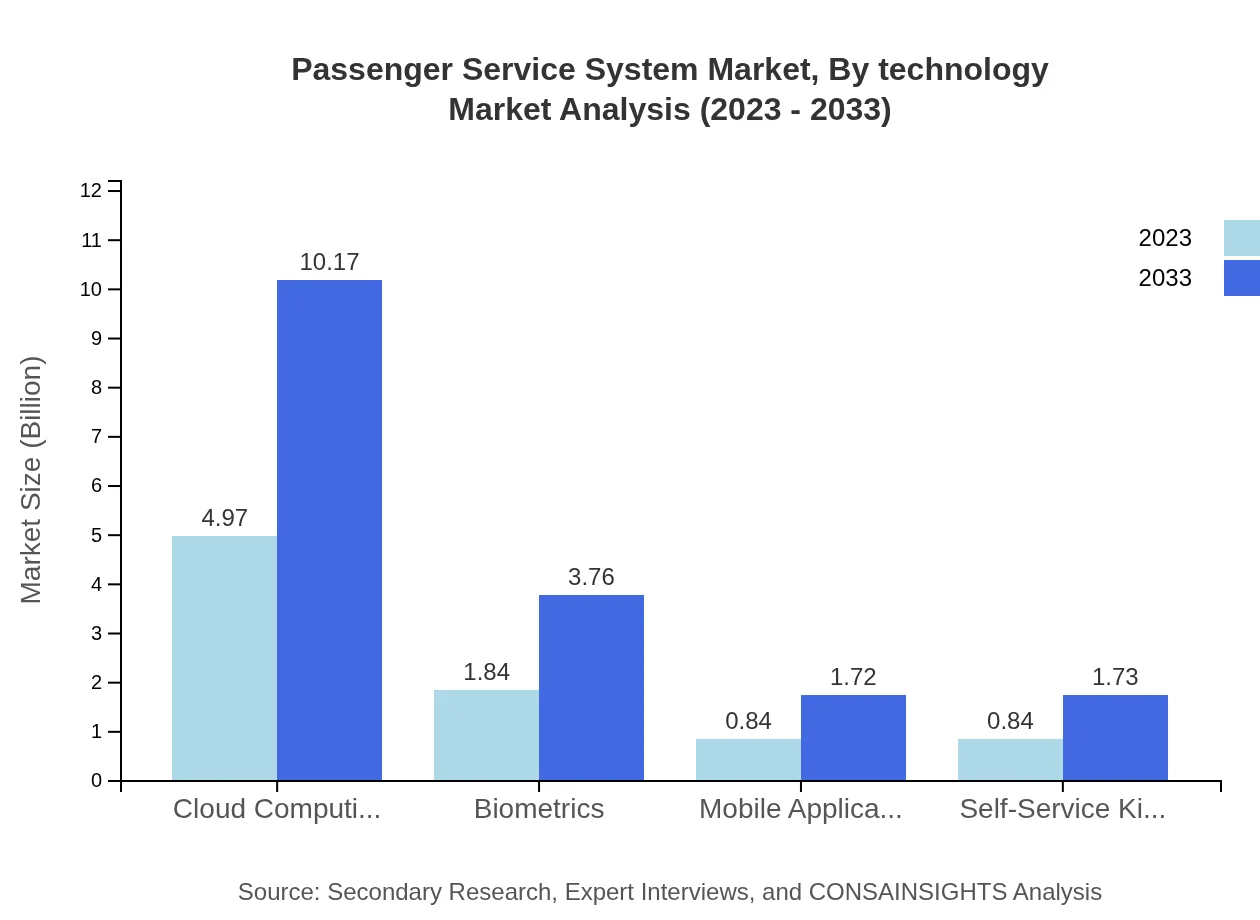

Passenger Service System Market Analysis By Technology

The technological segment showcases the rise of cloud computing solutions, dominating the market with a size of $4.97 billion in 2023, and expanding to $10.17 billion by 2033. Additionally, advancements in biometrics and mobile applications are reshaping the market, highlighting the significance of innovation in enhancing operational efficiency and customer engagement.

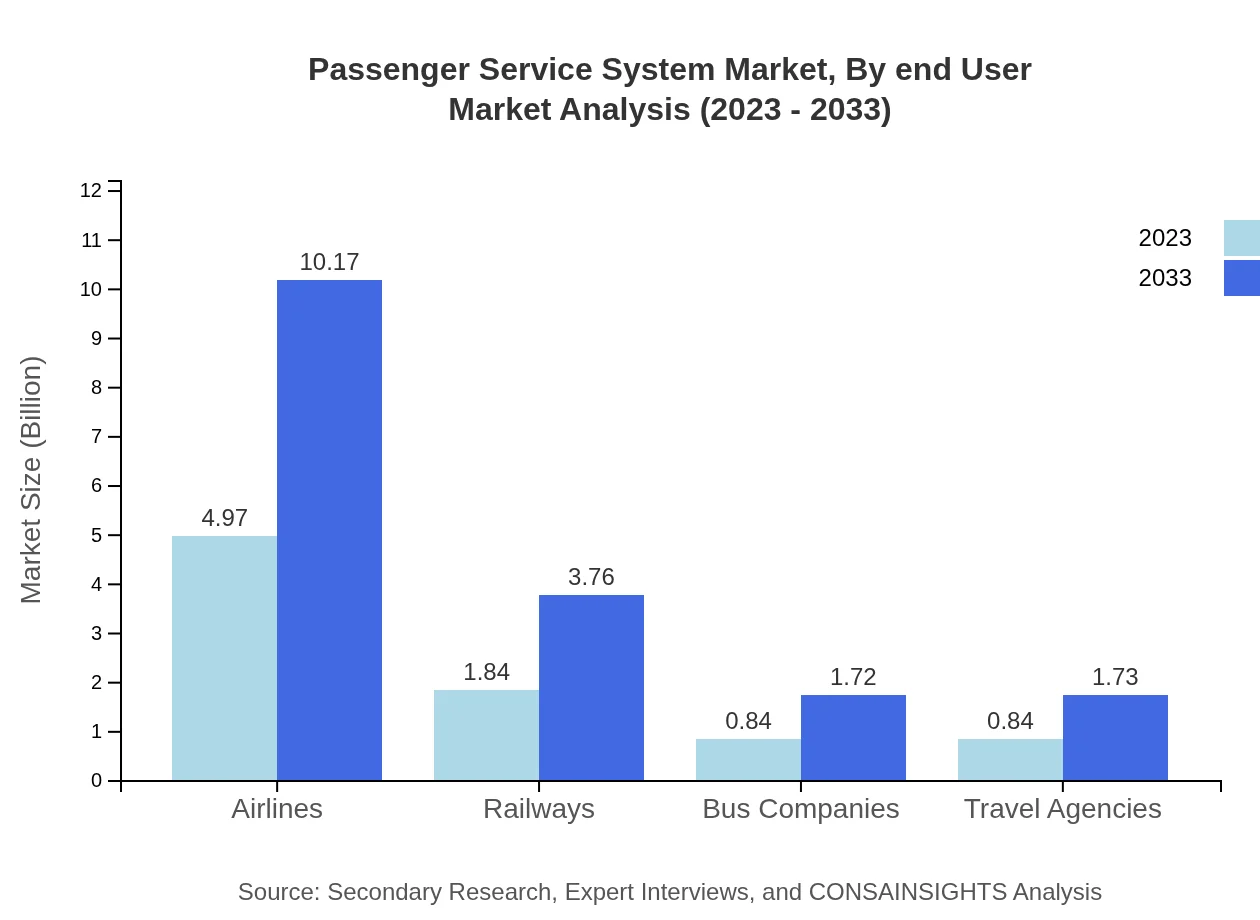

Passenger Service System Market Analysis By End User

Airlines lead the end-user segment with a market size of $4.97 billion in 2023 and expected to reach $10.17 billion by 2033. Railways are also significant, highlighting the diverse application of Passenger Service Systems across different transportation modes.

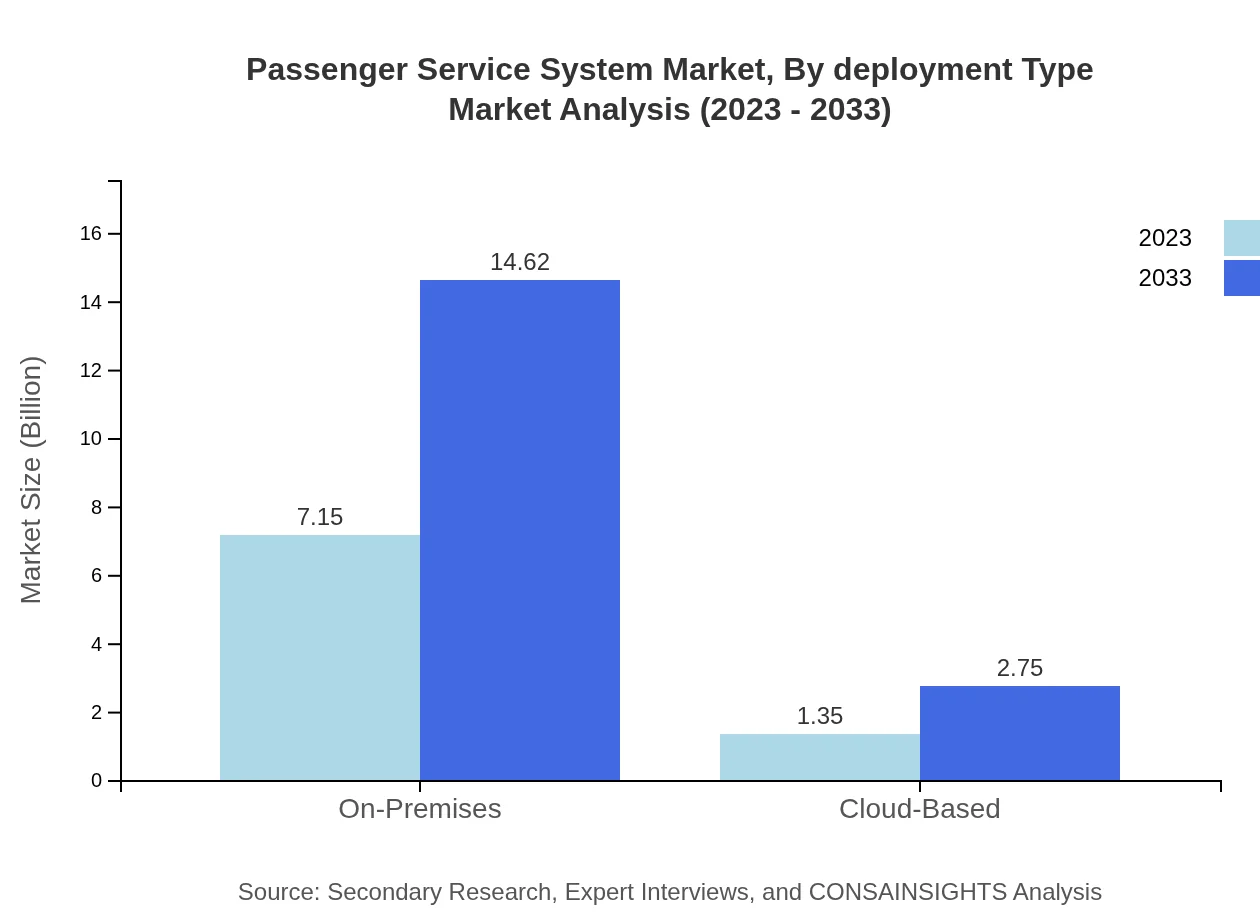

Passenger Service System Market Analysis By Deployment Type

The market is dominated by on-premises solutions that offer robust control and security, capturing 84.16% of the market in 2023 with growth anticipated in the cloud-based segment as businesses shift towards more scalable solutions.

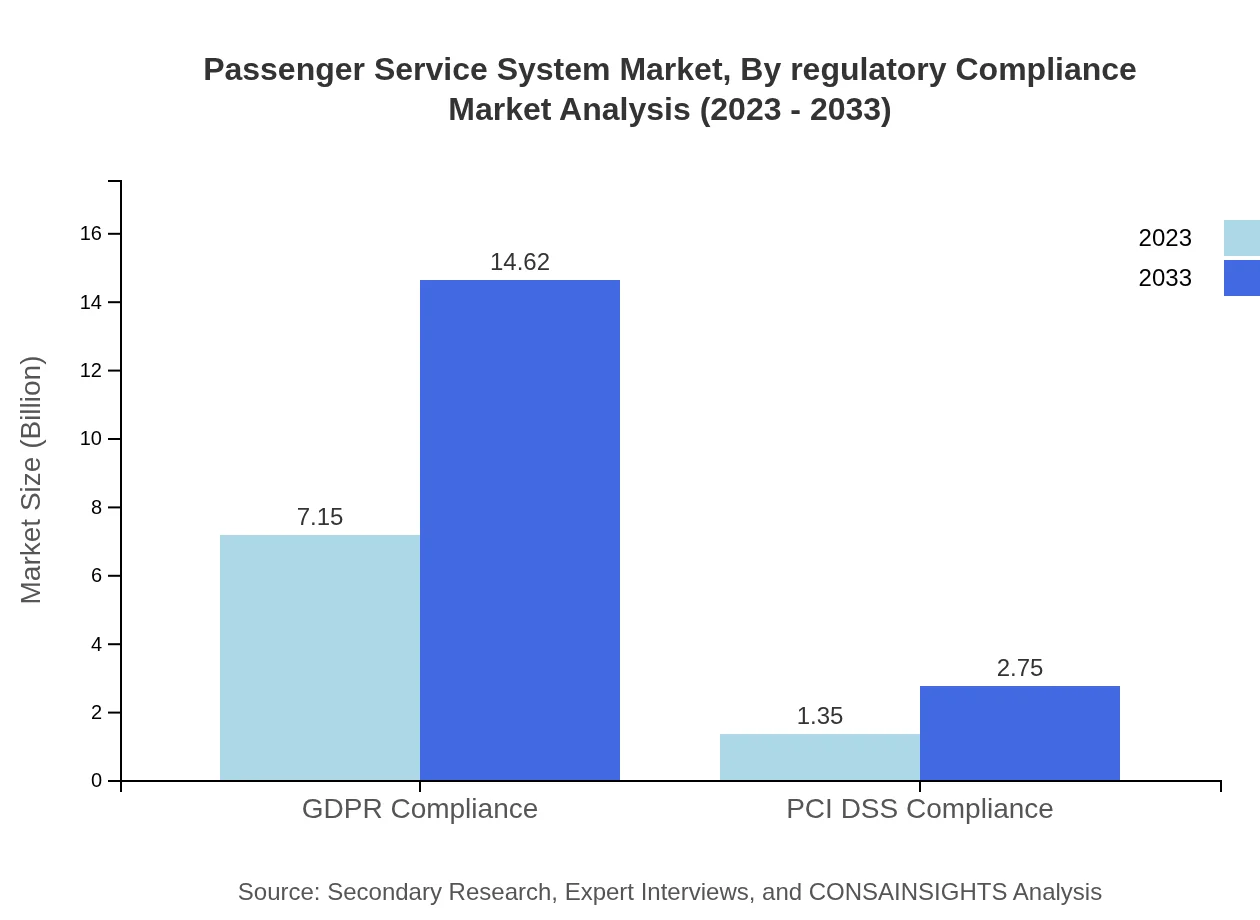

Passenger Service System Market Analysis By Regulatory Compliance

Regulatory compliance is a critical aspect of the Passenger Service System industry, with GDPR compliance presiding due to stringent data protection laws, followed closely by PCI DSS compliance, reflecting the industry's need to ensure secure transactions and data privacy.

Passenger Service System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Passenger Service System Industry

Amadeus IT Group:

A leading provider of technology solutions for the global travel industry, Amadeus offers various systems that enhance operational efficiency and customer experiences.Sabre Corporation:

Specializing in software and technology solutions, Sabre serves airlines, hotels, and travel agencies, providing tools for better customer interaction and data management.SITA:

An air transport IT specialist, SITA delivers passenger services solutions that improve travel processes and support secure and efficient travel experiences.Travelport:

A travel commerce platform that connects buyers and suppliers, Travelport offers technology solutions to enhance the travel journey from booking to completion.We're grateful to work with incredible clients.

FAQs

What is the market size of passenger Service System?

The global Passenger Service System market is projected to reach $8.5 billion by 2033, growing at a CAGR of 7.2% from the current value. This significant growth illustrates a robust demand for advanced services in the passenger transport sector.

What are the key market players or companies in this passenger Service System industry?

Key players in the Passenger Service System market include major airlines, technology vendors, and system integrators. These companies are focusing on innovations like cloud computing and biometrics to enhance customer experiences and operational efficiency.

What are the primary factors driving the growth in the passenger Service System industry?

Growth drivers include the increasing demand for efficient travel options, advancements in technology such as mobile applications, and the rise in global travel tourism. Enhanced passenger experience services are becoming essential for competitiveness in the market.

Which region is the fastest Growing in the passenger Service System?

The Asia-Pacific region is the fastest-growing area in the Passenger Service System market, expected to expand from $1.77 billion in 2023 to $3.62 billion by 2033. Growing travel demand and investments fuel this rapid growth.

Does ConsaInsights provide customized market report data for the passenger Service System industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Passenger Service System industry. Clients can request unique insights focusing on key segments, regional performance, and future trends.

What deliverables can I expect from this passenger Service System market research project?

Deliverables include comprehensive reports detailing market size, growth projections, competitive analysis, regional insights, and strategic recommendations. Clients will receive detailed segmentation reports and trend analyses.

What are the market trends of passenger Service System?

Market trends in the Passenger Service System industry include a shift towards cloud-based solutions, increasing integration of AI for customer service, and the adoption of biometrics for enhanced security and convenience in travel processes.