Passive Optical Component Market Report

Published Date: 31 January 2026 | Report Code: passive-optical-component

Passive Optical Component Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Passive Optical Component market, examining current trends, market dynamics, and future projections from 2023 to 2033. It offers valuable insights into market size, growth, and technological advancements shaping the industry.

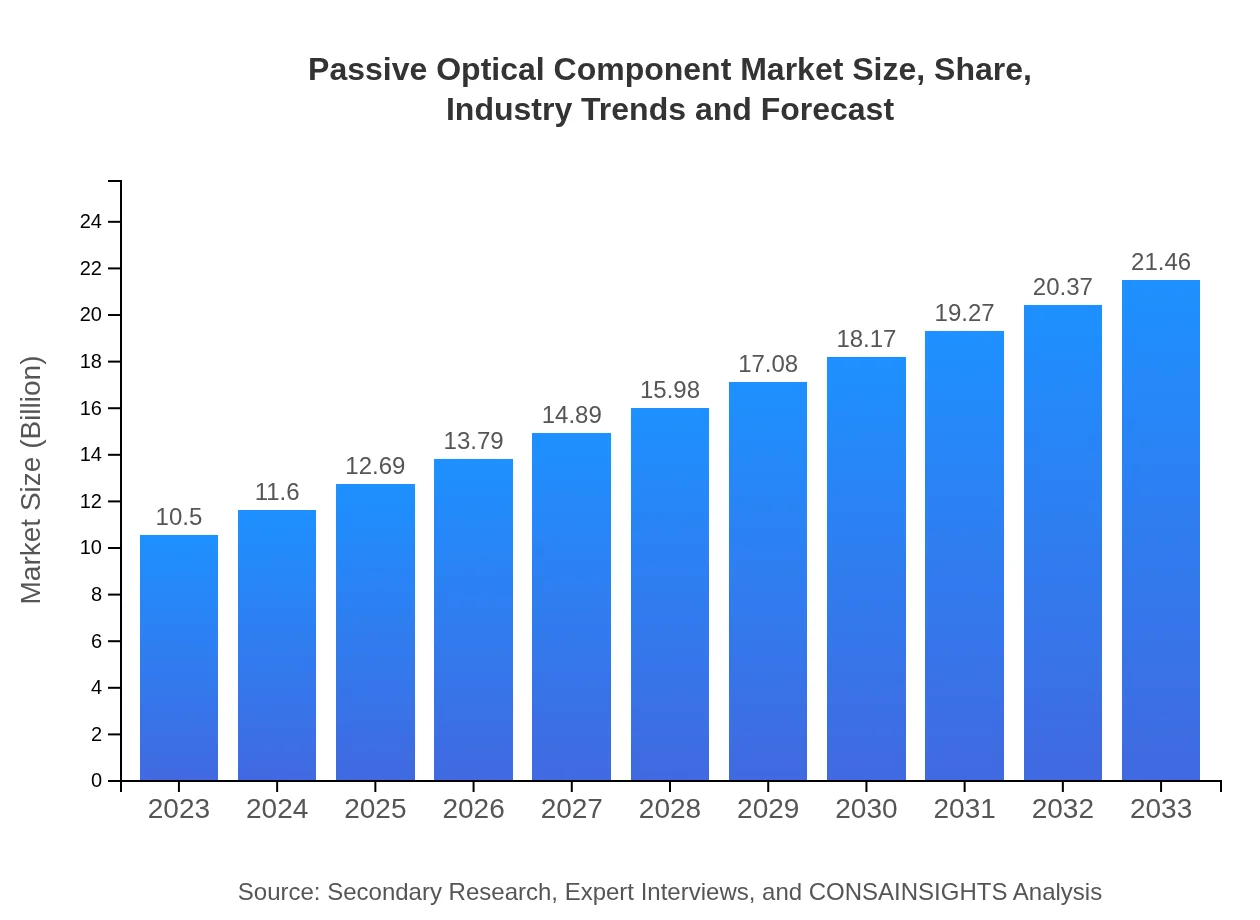

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | Corning Incorporated, Prysmian Group, Finisar Corporation, Broadcom Inc. |

| Last Modified Date | 31 January 2026 |

Passive Optical Component Market Overview

Customize Passive Optical Component Market Report market research report

- ✔ Get in-depth analysis of Passive Optical Component market size, growth, and forecasts.

- ✔ Understand Passive Optical Component's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Passive Optical Component

What is the Market Size & CAGR of Passive Optical Component market in 2023?

Passive Optical Component Industry Analysis

Passive Optical Component Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Passive Optical Component Market Analysis Report by Region

Europe Passive Optical Component Market Report:

Europe's market size for Passive Optical Components is forecasted to double from $3.82 billion in 2023, reaching $7.82 billion by 2033. Continued investment in next-generation broadband due to regulatory support and consumer demand for high-speed connectivity is driving growth.Asia Pacific Passive Optical Component Market Report:

The Asia Pacific region illustrates substantial growth potential in the Passive Optical Component market, with a market size projected to increase from $1.85 billion in 2023 to $3.79 billion by 2033. The surge in localized manufacturing and the rising demand for high-speed internet are primary drivers, alongside government initiatives to improve telecommunications infrastructure.North America Passive Optical Component Market Report:

North America holds a significant share of the Passive Optical Component market, with an expected increase from $3.39 billion in 2023 to $6.94 billion by 2033. The region benefits from advanced technological infrastructure, high consumer demand for streaming services, and aggressive deployment of fiber-optic networks.South America Passive Optical Component Market Report:

In South America, the Passive Optical Component market is anticipated to grow from $0.86 billion in 2023 to $1.76 billion by 2033. Increased investments in telecommunications infrastructure and rising internet penetration rates are key factors propelling the market forward.Middle East & Africa Passive Optical Component Market Report:

In the Middle East and Africa, the Passive Optical Component market is projected to expand from $0.56 billion in 2023 to $1.15 billion by 2033. Incremental growth is observed due to rising capital expenditure on telecommunications and increasing mobile internet usage.Tell us your focus area and get a customized research report.

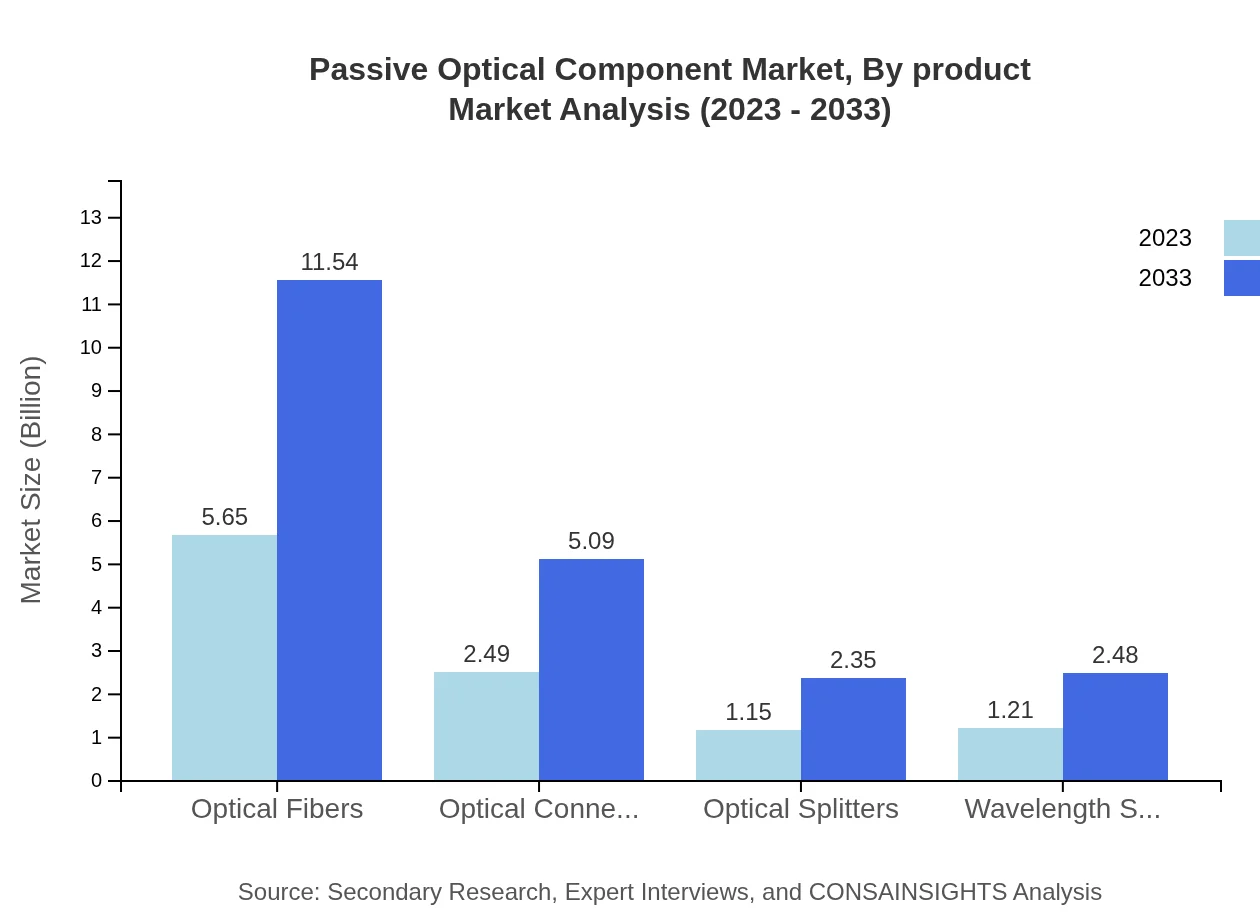

Passive Optical Component Market Analysis By Product

The key product segments in the Passive Optical Components market include Optical Fibers, Optical Connectors, Optical Splitters, and Wavelength Selective Switches. Optical Fibers dominate the market with a size of $5.65 billion in 2023, projected to grow to $11.54 billion by 2033. Optical Connectors follow with a market size of $2.49 billion in 2023, expected to reach $5.09 billion by 2033. Additionally, Optical Splitters and Wavelength Selective Switches are essential, with sizes of $1.15 billion and $1.21 billion in 2023, anticipated to rise to $2.35 billion and $2.48 billion respectively by 2033.

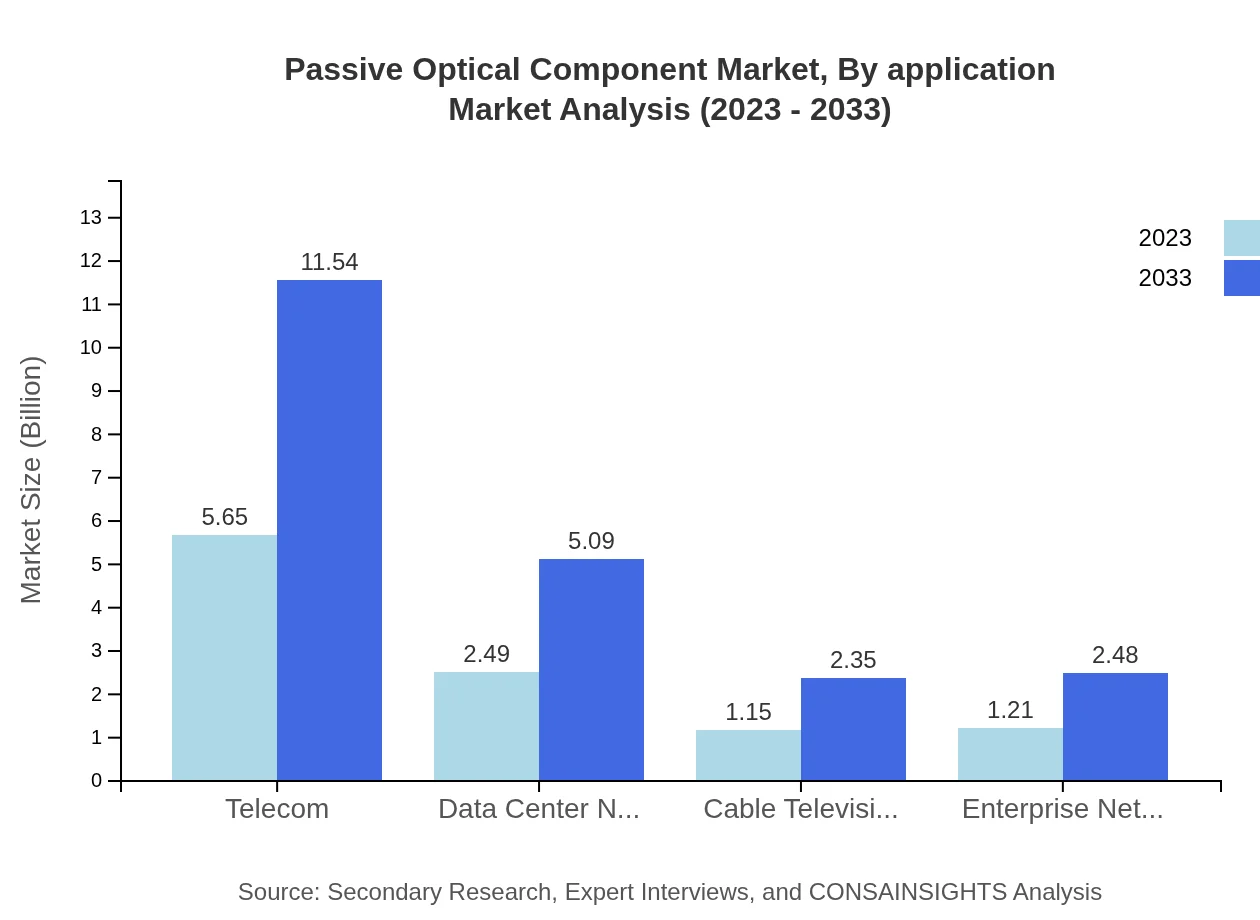

Passive Optical Component Market Analysis By Application

In terms of application, the market is divided into Telecommunications Service Providers, Enterprises, Government and Defense, and Cable Operators. The Telecommunications Service Providers segment holds the largest share, constituting $5.65 billion in 2023 with significant growth expected over the forecast period. Enterprises and Government and Defense sectors also exhibit promising growth, indicating a growing reliance on robust optical solutions.

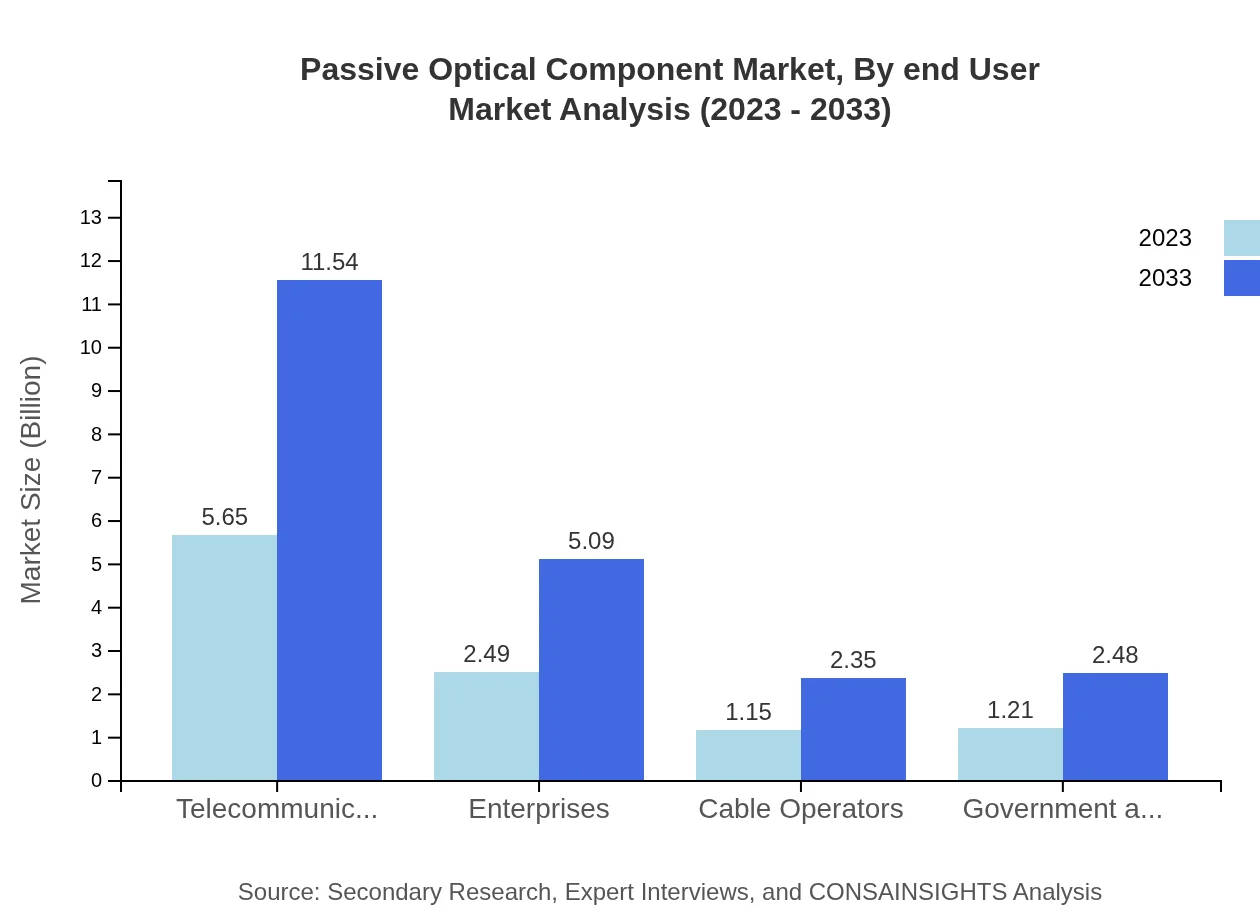

Passive Optical Component Market Analysis By End User

The end-user industry segmentation highlights the importance of applications in Telecom, Data Center Networking, and Cable Television Networks. With an increase from $5.65 billion in 2023 to $11.54 billion by 2033, the Telecom sector remains robust, closely followed by Data Center Networking which anticipates growth from $2.49 billion to $5.09 billion in the same time frame.

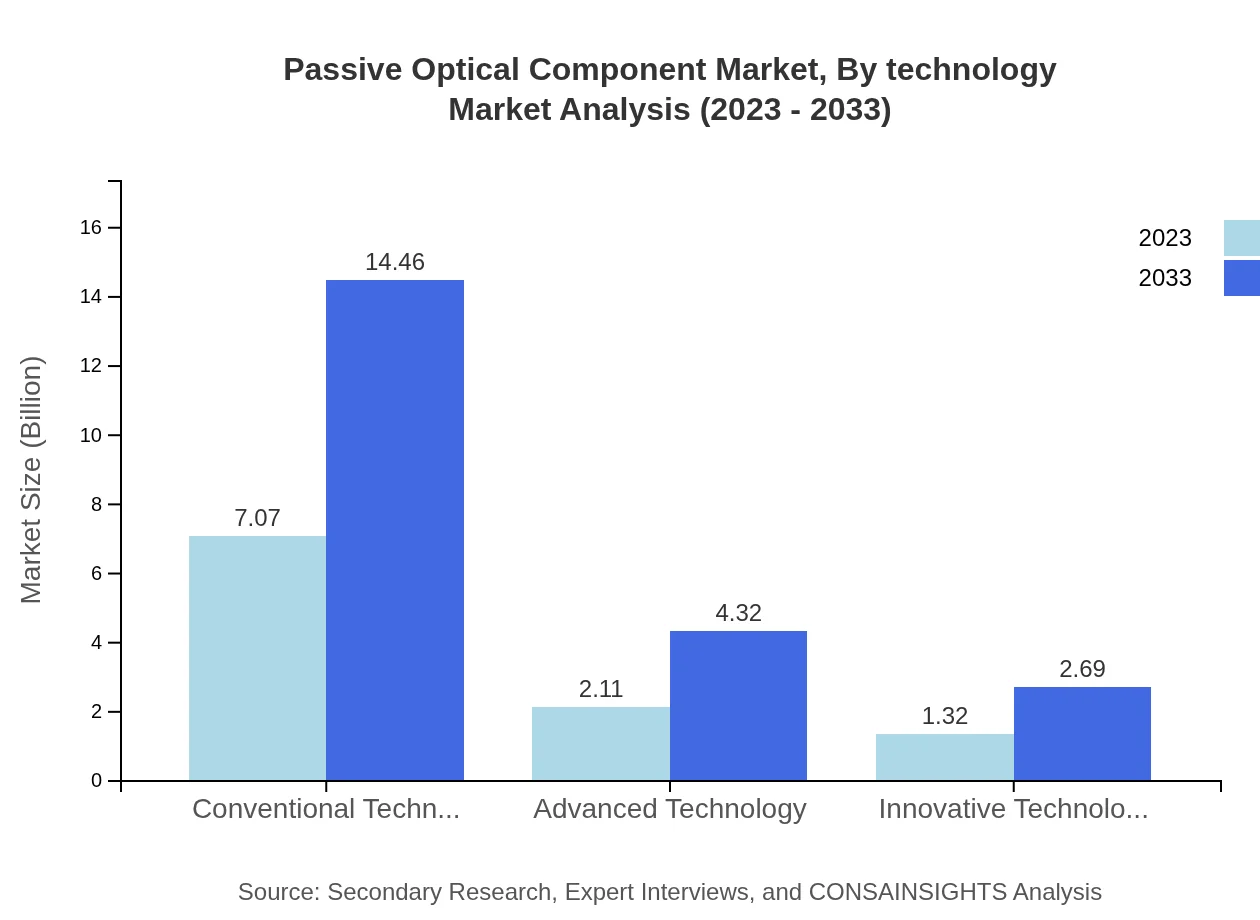

Passive Optical Component Market Analysis By Technology

The market is also segmented based on technology into Conventional, Advanced, and Innovative technologies. Conventional technology leads the market with a size of $7.07 billion in 2023, which will rise to $14.46 billion by 2033, maintaining a significant share across various applications.

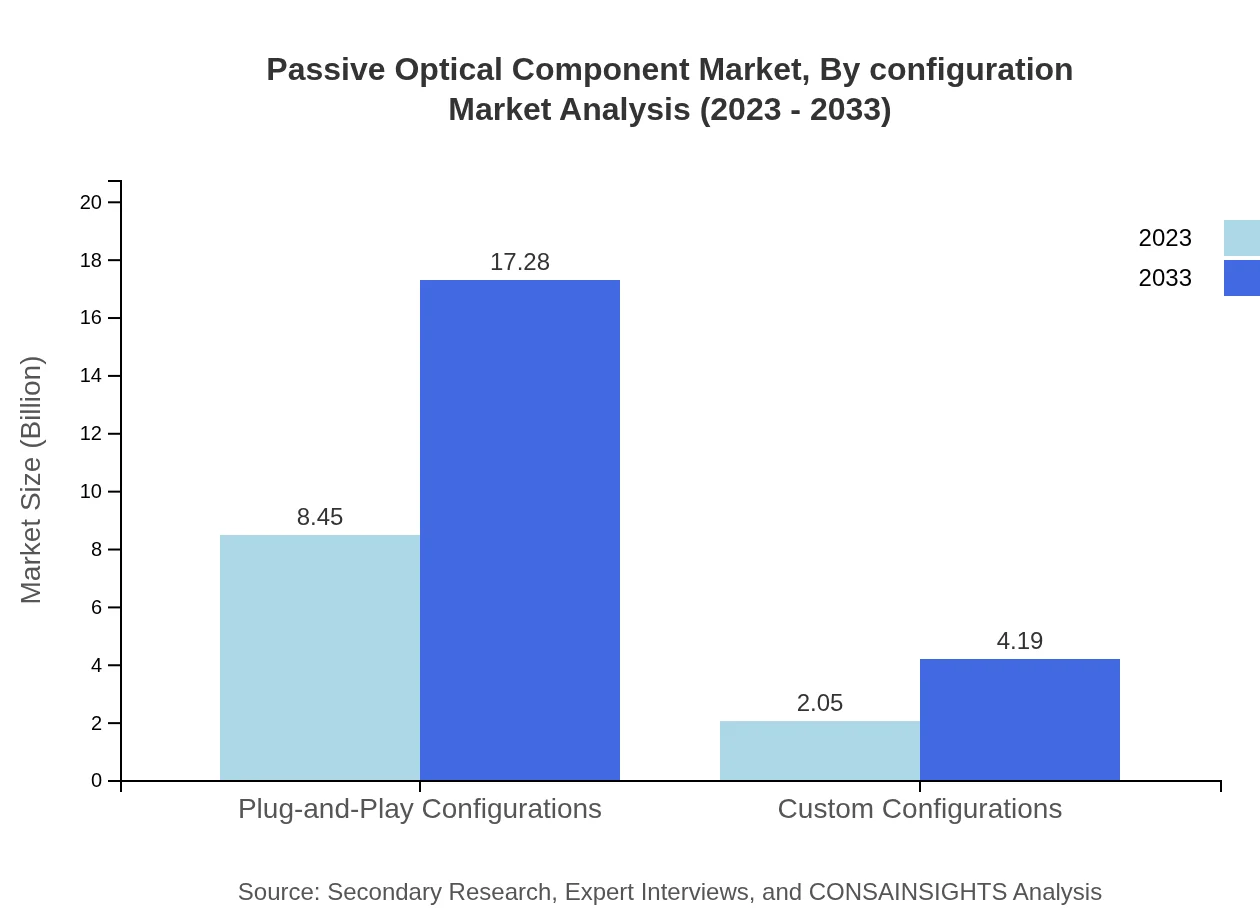

Passive Optical Component Market Analysis By Configuration

In terms of configurations, Plug-and-Play and Custom Configurations illustrate substantial market dynamics. Plug-and-Play configurations currently dominate the market size at $8.45 billion in 2023, set to reach $17.28 billion by 2033. Custom configurations are also growing, expected to develop from $2.05 billion to $4.19 billion during the same timeframe.

Passive Optical Component Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Passive Optical Component Industry

Corning Incorporated:

Corning is a pioneer in optical fiber technology, providing innovative solutions that support high-speed communication networks globally.Prysmian Group:

Prysmian Group specializes in the manufacturing of cables and fiber optics, recognized for their commitment to sustainable technological advancements.Finisar Corporation:

Finisar is a leading provider of optical communication components and subsystems essential for data networks.Broadcom Inc.:

Broadcom provides a diverse range of semiconductor and software solutions, crucial for optical components in telecommunications.We're grateful to work with incredible clients.

FAQs

What is the market size of passive optical components?

The passive optical component market is valued at approximately $10.5 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 7.2%, expected to reach significant growth by 2033.

What are the key market players or companies in the passive optical components industry?

Key players in the passive optical components industry include major companies like Corning Incorporated, Broadcom Inc., and Nokia, which drive innovation and market share, contributing to the advanced development of optical technologies.

What are the primary factors driving the growth in the passive optical components industry?

The growth in the passive optical components industry is largely driven by the increasing demand for high-speed internet, advancements in fiber optic technology, and the adoption of 5G networks, facilitating efficient data transmission.

Which region is the fastest Growing in the passive optical components market?

The Asia-Pacific region is the fastest-growing in the passive optical components market, with expected growth from $1.85 billion in 2023 to $3.79 billion by 2033, attributed to increasing telecommunications investments.

Does ConsaInsights provide customized market report data for the passive optical component industry?

Yes, ConsaInsights offers customized market report data for the passive optical component industry, catering to specific client requirements and providing tailored insights into market trends and forecasts.

What deliverables can I expect from this passive optical component market research project?

Deliverables from the passive optical component market research project typically include comprehensive reports, detailed market analysis, segmentation data, and actionable insights to support strategic decision-making.

What are the market trends of passive optical components?

Key trends in the passive optical components market include the rising adoption of plug-and-play configurations, emphasis on green technologies, and growing investment in data centers, shaping the future of optical networking solutions.