Passive Optical Network Pon Equipment Market Report

Published Date: 31 January 2026 | Report Code: passive-optical-network-pon-equipment

Passive Optical Network Pon Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Passive Optical Network Pon Equipment market, providing in-depth insights, trends, and forecasts from 2023 to 2033. It covers market size, segmentation, regional analysis, and the impact of technological advancements on the industry.

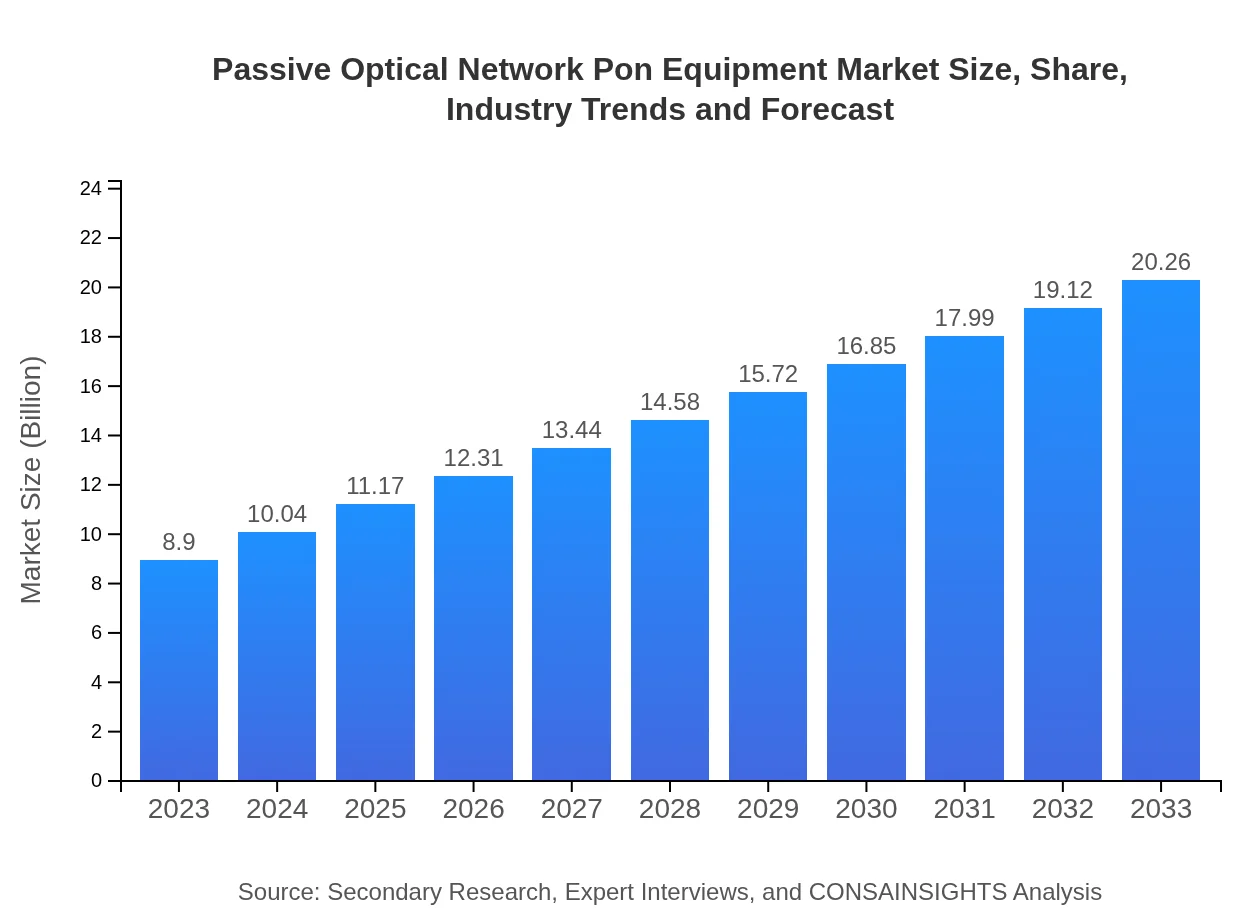

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.90 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $20.26 Billion |

| Top Companies | Huawei Technologies Co., Ltd., Nokia Corporation, Cisco Systems, Inc., ZTE Corporation, ADTRAN, Inc. |

| Last Modified Date | 31 January 2026 |

Passive Optical Network Pon Equipment Market Overview

Customize Passive Optical Network Pon Equipment Market Report market research report

- ✔ Get in-depth analysis of Passive Optical Network Pon Equipment market size, growth, and forecasts.

- ✔ Understand Passive Optical Network Pon Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Passive Optical Network Pon Equipment

What is the Market Size & CAGR of Passive Optical Network Pon Equipment market in 2023?

Passive Optical Network Pon Equipment Industry Analysis

Passive Optical Network Pon Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Passive Optical Network Pon Equipment Market Analysis Report by Region

Europe Passive Optical Network Pon Equipment Market Report:

Europe is witnessing strong growth in the PON equipment market, forecasted to expand from USD 2.58 billion in 2023 to USD 5.88 billion by 2033. Rising demand for high-bandwidth applications and the implementation of 5G technology contribute to this expansion, along with various government incentives promoting broadband access.Asia Pacific Passive Optical Network Pon Equipment Market Report:

The Asia Pacific region holds a significant market share, estimated to be around USD 1.70 billion in 2023 and projected to grow to USD 3.87 billion by 2033. The demand is driven by rapid urbanization and the growing adoption of FTTH technologies in countries like China and India, where telecommunication infrastructure is evolving rapidly.North America Passive Optical Network Pon Equipment Market Report:

North America leads in the PON Equipment market, with an estimated market size of USD 3.28 billion in 2023, anticipated to grow to USD 7.47 billion by 2033. The region's growth is fueled by advancements in technology and significant investments from major telecom operators focused on expanding their fiber optic networks.South America Passive Optical Network Pon Equipment Market Report:

In South America, the Passive Optical Network Pon Equipment market size in 2023 is about USD 0.28 billion, expected to rise to USD 0.63 billion by 2033. The growth in this region is attributed to government initiatives and increased investment in telecommunications infrastructure to enhance internet connectivity.Middle East & Africa Passive Optical Network Pon Equipment Market Report:

The Middle East and Africa region is experiencing growth, with a market size of USD 1.06 billion in 2023, expected to reach USD 2.41 billion by 2033. This growth is particularly driven by urbanization and the need for improved telecommunication infrastructure across various countries in this region.Tell us your focus area and get a customized research report.

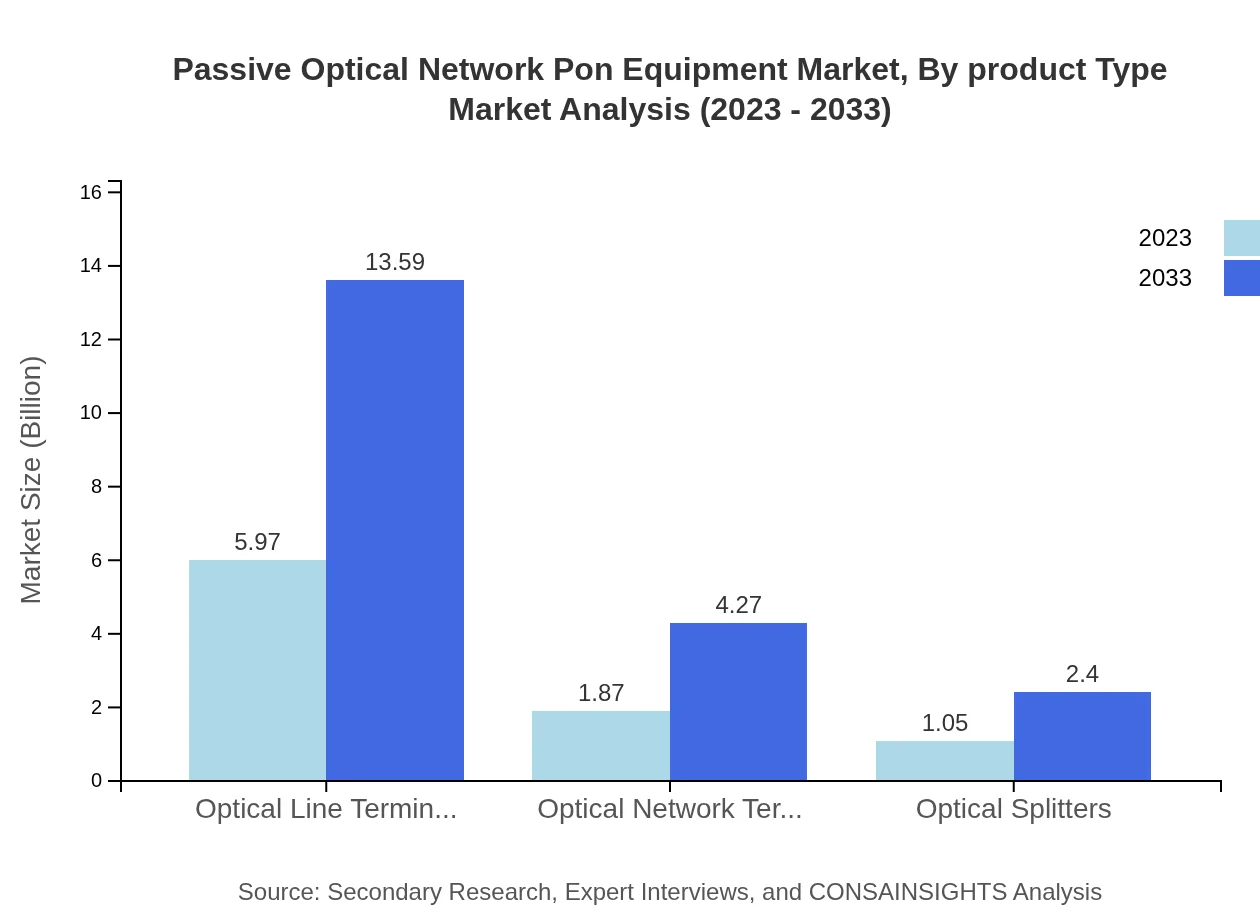

Passive Optical Network Pon Equipment Market Analysis By Product Type

The Passive Optical Network Equipment market, segmented by product type, reveals that Optical Line Terminals (OLT) are leading with a market size of USD 5.97 billion in 2023 and an expected growth to USD 13.59 billion by 2033. Optical Network Terminals (ONT) follow closely, with a projected rise from USD 1.87 billion to USD 4.27 billion during the same period.

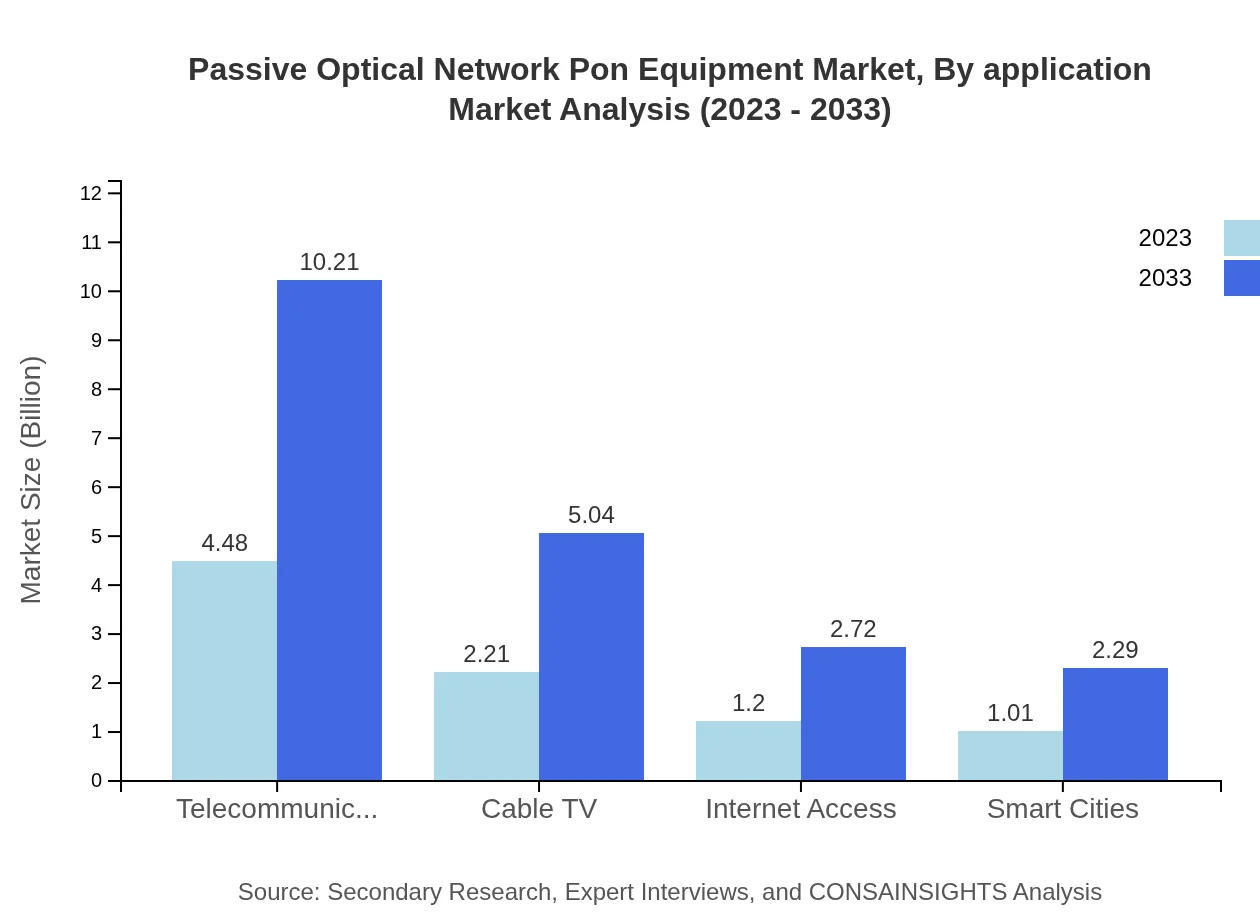

Passive Optical Network Pon Equipment Market Analysis By Application

In terms of application, the telecommunications sector dominates, accounting for USD 4.48 billion in 2023 and expected to grow to USD 10.21 billion by 2033. Additional applications include Internet Access, Cable TV, and Smart Cities, all contributing to the growing demand for high-speed internet and efficient data handling.

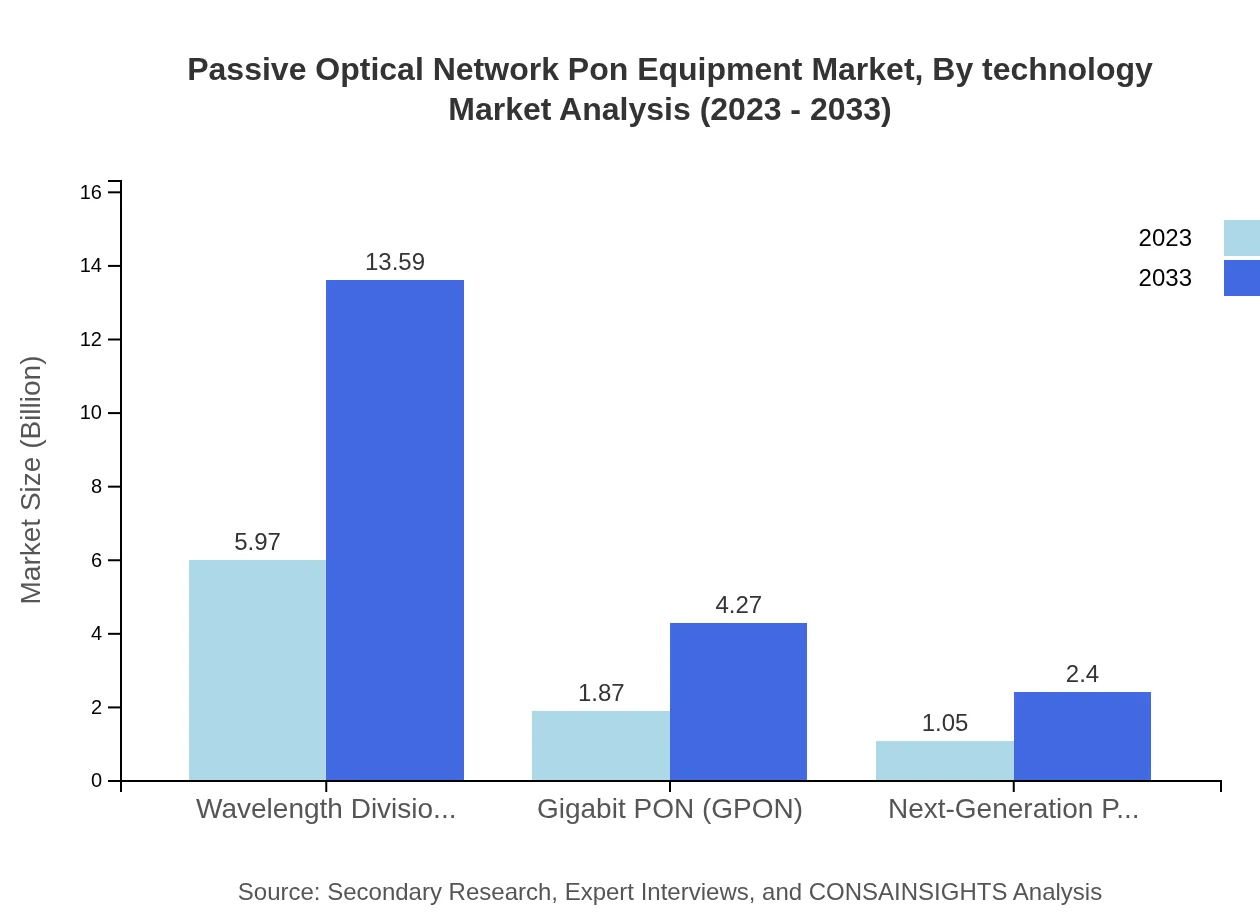

Passive Optical Network Pon Equipment Market Analysis By Technology

Within the technology segment, Wavelength Division Multiplexing PON (WDM-PON) is prominent in the market, with a size of USD 5.97 billion in 2023 and climbing to USD 13.59 billion by 2033. Gigabit PON (GPON) also holds significant market share, reflecting the sector's focus on higher data rates.

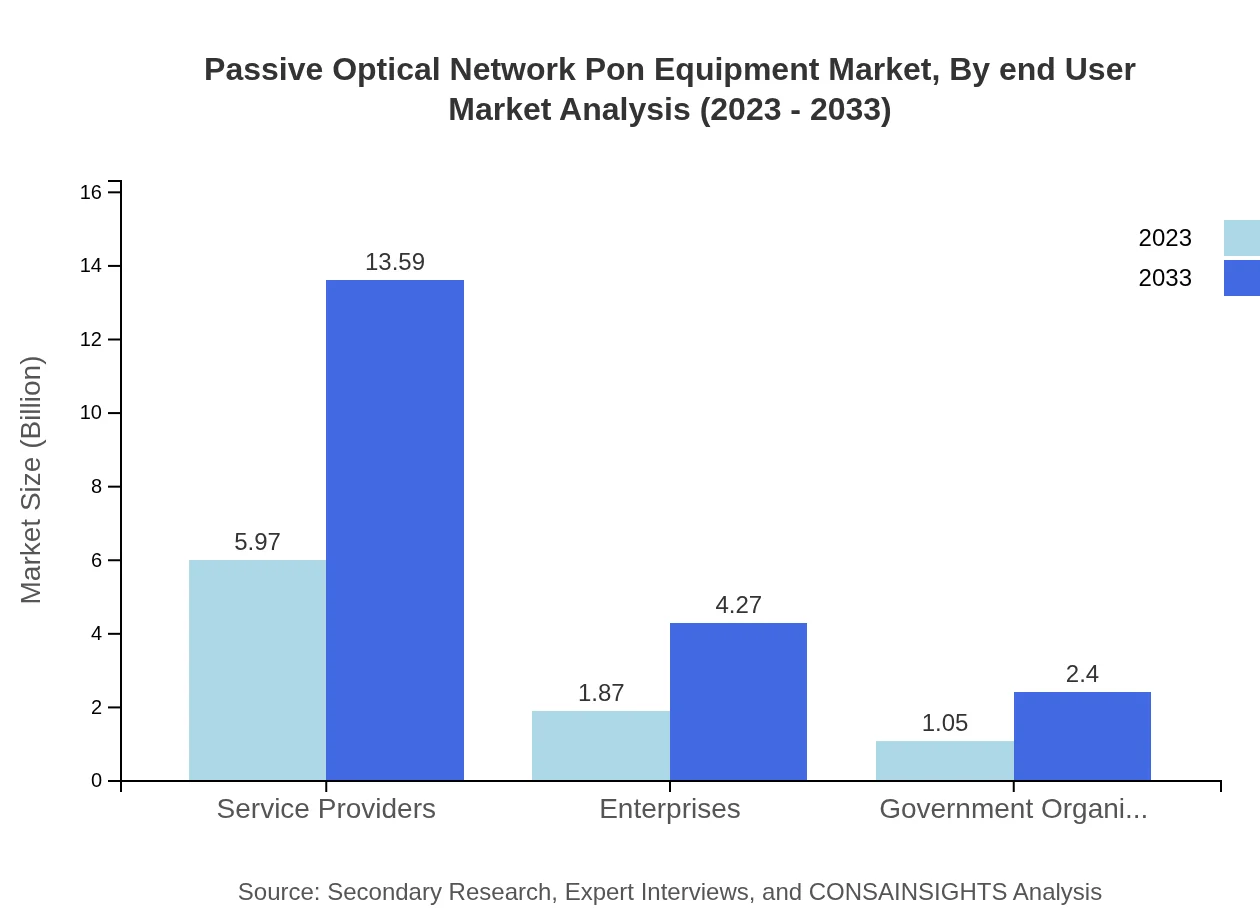

Passive Optical Network Pon Equipment Market Analysis By End User

In terms of end-users, service providers dominate the market with a size of USD 5.97 billion in 2023 projected to expand to USD 13.59 billion by 2033. Meanwhile, enterprises and government organizations also contribute to market growth but to a lesser degree.

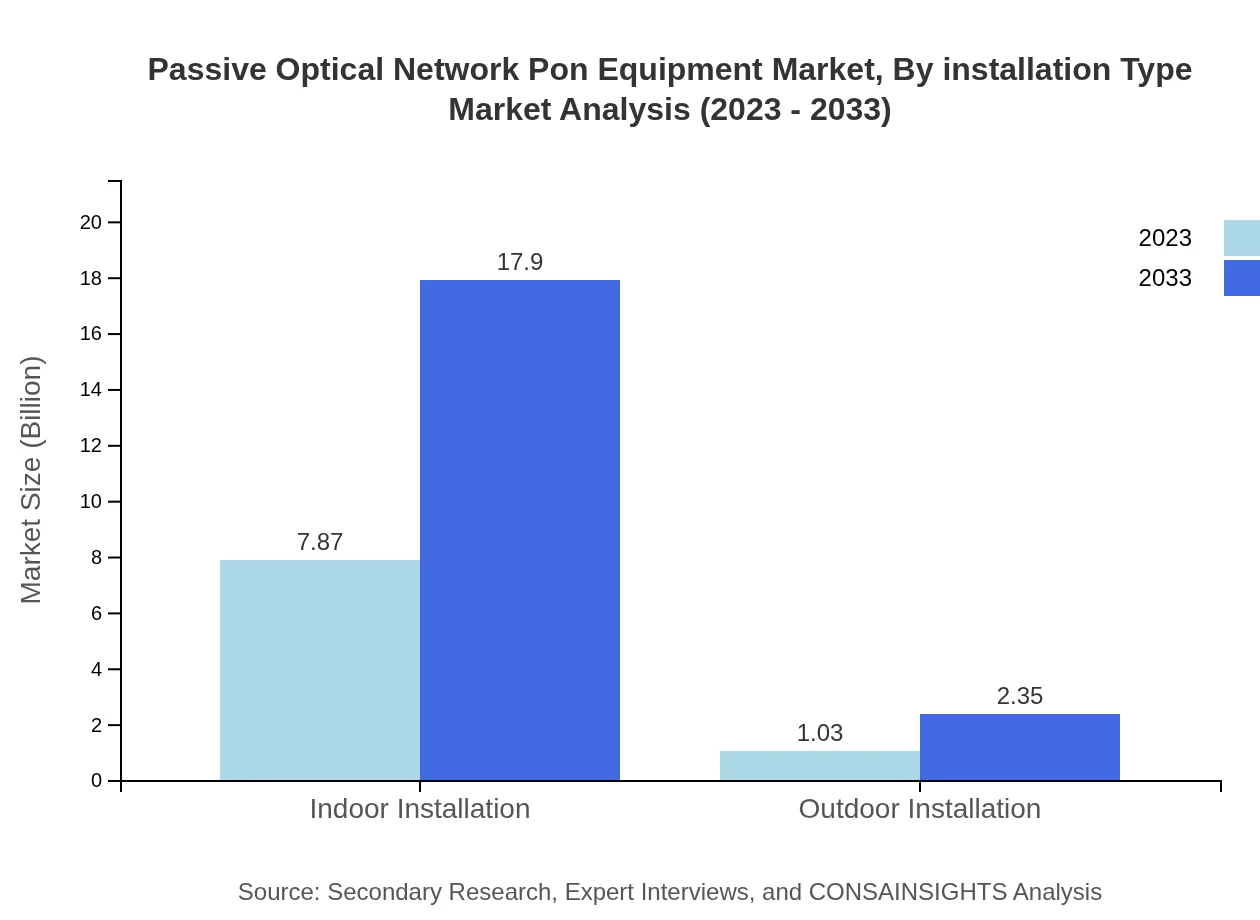

Passive Optical Network Pon Equipment Market Analysis By Installation Type

The market by installation type indicates that indoor installations are leading with USD 7.87 billion in 2023 and are expected to grow to USD 17.90 billion by 2033. Outdoor installations also show growth, albeit at a smaller scale, reaching USD 2.35 billion in the same period.

Passive Optical Network Pon Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Passive Optical Network Pon Equipment Industry

Huawei Technologies Co., Ltd.:

Huawei is a global leader in ICT and telecommunications equipment, known for its innovative PON solutions and extensive portfolio that supports high-speed internet services.Nokia Corporation:

Nokia specializes in advanced network infrastructure and telecommunications equipment, driving developments in optical networking technologies, including PON systems for service providers.Cisco Systems, Inc.:

Cisco is a prominent player in networking technology and solutions, providing a range of PON equipment configured for efficient Internet access and data services.ZTE Corporation:

ZTE delivers comprehensive telecommunications equipment and solutions, specializing in next-generation PON systems and optical networks.ADTRAN, Inc.:

ADTRAN focuses on broadband access solutions and is recognized for its innovative PON technology that enhances network performance and efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of Passive Optical Network (PON) equipment?

The global Passive Optical Network (PON) equipment market is projected to reach approximately $8.9 billion by 2033, growing at a CAGR of 8.3%. This significant growth reflects the rising demand for high-speed internet connectivity and advanced telecommunication infrastructure.

What are the key market players or companies in the Passive Optical Network (PON) equipment industry?

Key players in the Passive Optical Network (PON) equipment industry include major telecommunications companies, technology firms, and equipment manufacturers. They collaborate to advance optical network technologies, providing robust solutions for service providers and enterprises.

What are the primary factors driving the growth in the Passive Optical Network (PON) industry?

The growth in the Passive Optical Network (PON) industry is driven by increasing internet traffic, evolving consumer demands for high bandwidth, and significant investments in telecommunication infrastructure by both public and private sectors.

Which region is the fastest Growing in the Passive Optical Network (PON) market?

The fastest-growing region in the Passive Optical Network (PON) market is North America, with expectations of growth from $3.28 billion in 2023 to $7.47 billion by 2033. This growth is fueled by technological advancements and increased internet usage.

Does ConsaInsights provide customized market report data for the Passive Optical Network (PON) industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the Passive Optical Network (PON) industry. Clients can request detailed analyses based on specific criteria to better align with their strategic goals.

What deliverables can I expect from this Passive Optical Network (PON) market research project?

Expect comprehensive deliverables including analyzed data on market trends, growth forecasts, competitive landscape, segmentation insights, and strategic recommendations tailored to the Passive Optical Network (PON) market.

What are the market trends of Passive Optical Network (PON)?

Market trends in Passive Optical Networks (PON) include the rising adoption of Gigabit PON and Wavelength Division Multiplexing technology, increased demand from service providers, and the growing focus on smart cities and IoT applications.