Pathology Devices Market Report

Published Date: 31 January 2026 | Report Code: pathology-devices

Pathology Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Pathology Devices market from 2023 to 2033, detailing market size, industry trends, segmentation, regional insights, and the competitive landscape, to guide stakeholders in making informed decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

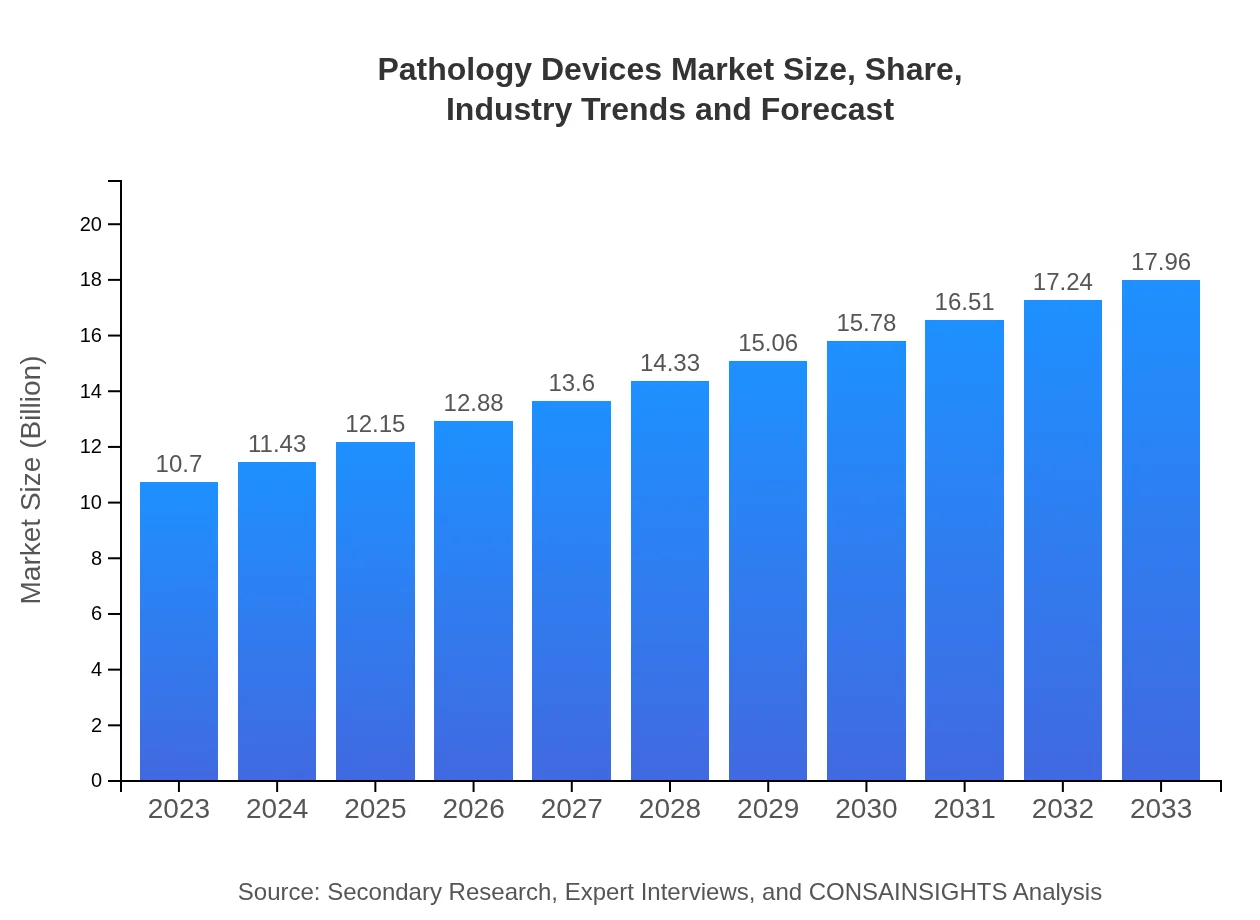

| 2023 Market Size | $10.70 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $17.96 Billion |

| Top Companies | Roche Diagnostics, Thermo Fisher Scientific, Danaher Corporation, Siemens Healthineers |

| Last Modified Date | 31 January 2026 |

Pathology Devices Market Overview

Customize Pathology Devices Market Report market research report

- ✔ Get in-depth analysis of Pathology Devices market size, growth, and forecasts.

- ✔ Understand Pathology Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pathology Devices

What is the Market Size & CAGR of Pathology Devices market in 2023?

Pathology Devices Industry Analysis

Pathology Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pathology Devices Market Analysis Report by Region

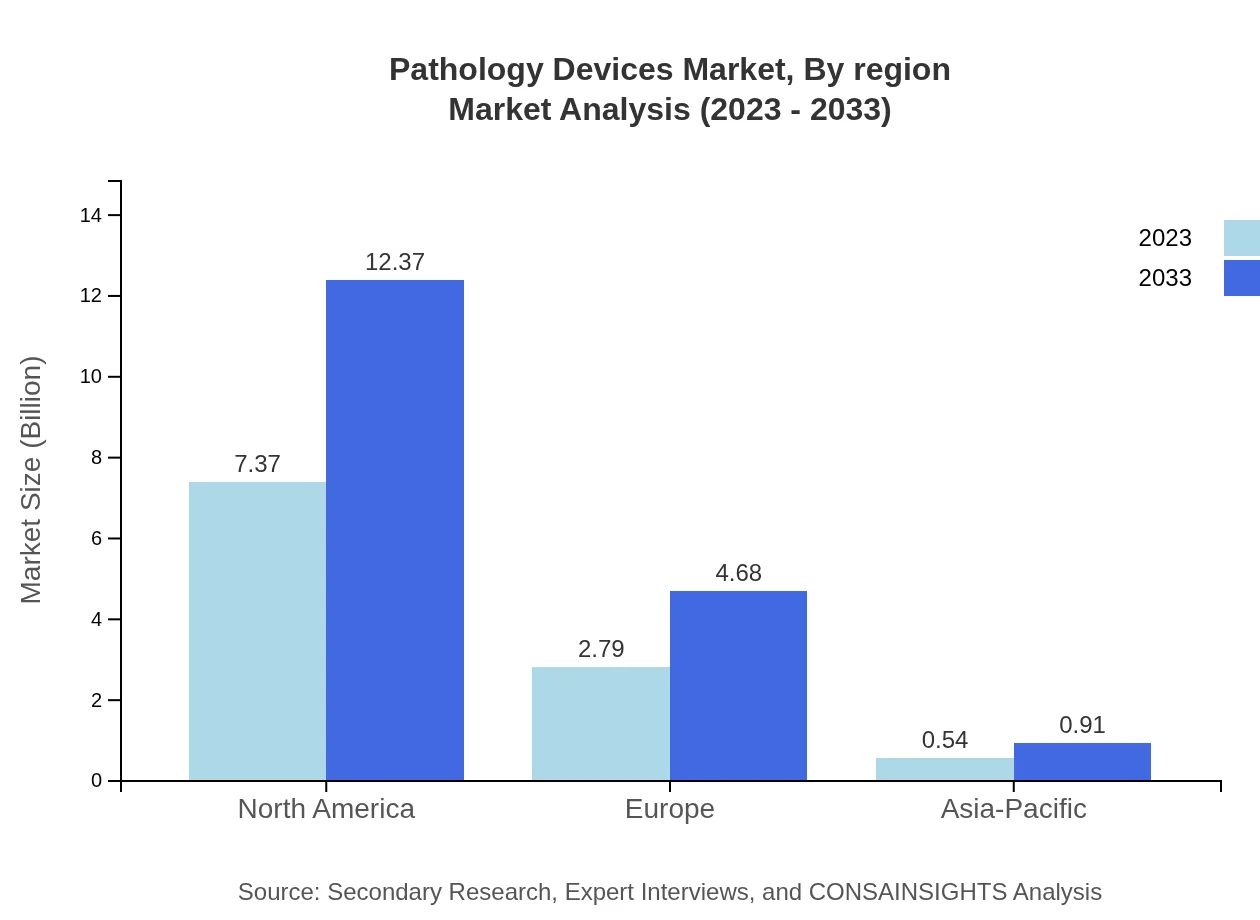

Europe Pathology Devices Market Report:

The European pathology devices market is projected to increase from $2.68 billion in 2023 to $4.50 billion by 2033. Major growth factors include a well-established healthcare system, rising adoption of advanced diagnostic technologies, and increased focus on personalized medicine and precision diagnostics.Asia Pacific Pathology Devices Market Report:

The Asia-Pacific region is anticipated to witness substantial growth, with the market size projected to reach approximately $3.69 billion by 2033 from $2.20 billion in 2023. The region benefits from an expanding population, increased healthcare investment, and rising incidences of diseases requiring pathology services. Innovative healthcare policies and collaborations further bolster market opportunities.North America Pathology Devices Market Report:

North America remains the top contributor to the pathology devices market, with a market size projected to grow from $4.17 billion in 2023 to $7.00 billion by 2033. This growth is fueled by advanced healthcare infrastructure, a high prevalence of chronic diseases, and significant investments in R&D by leading companies in the region.South America Pathology Devices Market Report:

In South America, the pathology devices market is expected to grow from $0.98 billion in 2023 to $1.64 billion by 2033. The growth is driven by enhance healthcare expenditures, government initiatives to improve healthcare facilities, and an increasing demand for fast and accurate diagnostics.Middle East & Africa Pathology Devices Market Report:

In the Middle East and Africa, the market is expected to grow from $0.67 billion in 2023 to $1.12 billion by 2033. The growth is attributed to increasing healthcare investments, a gradual shift towards advanced pathology solutions, and increasing public health initiatives aimed at enhancing disease detection capabilities.Tell us your focus area and get a customized research report.

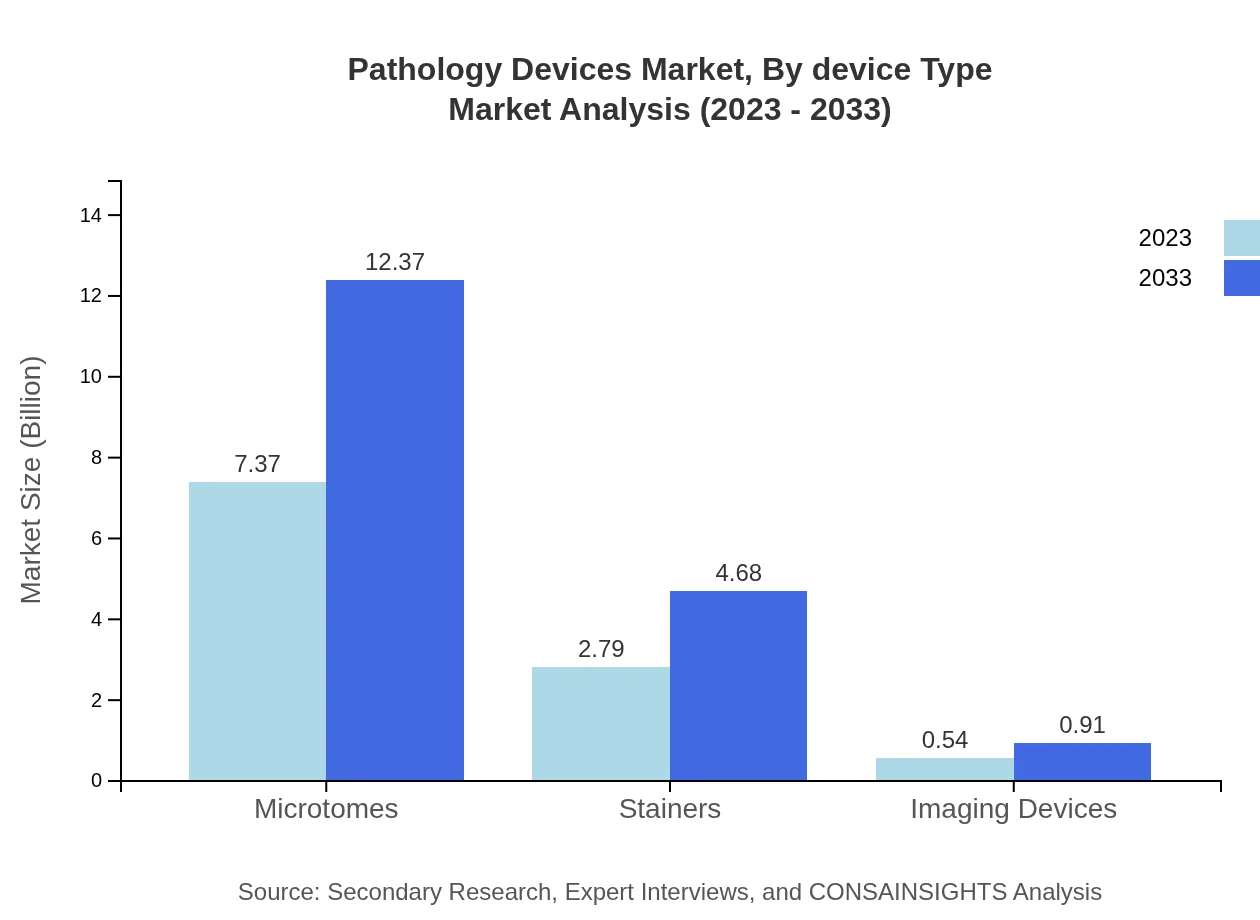

Pathology Devices Market Analysis By Device Type

The market segmentation by device type includes Microtomes, Stainers, and Imaging Devices, which dominate the market due to their crucial role in tissue processing, staining for microscopic examination, and imaging for diagnostics respectively. Microtomes account for significant market share, driven by technological advancements that facilitate precision and efficiency in sectioning tissues.

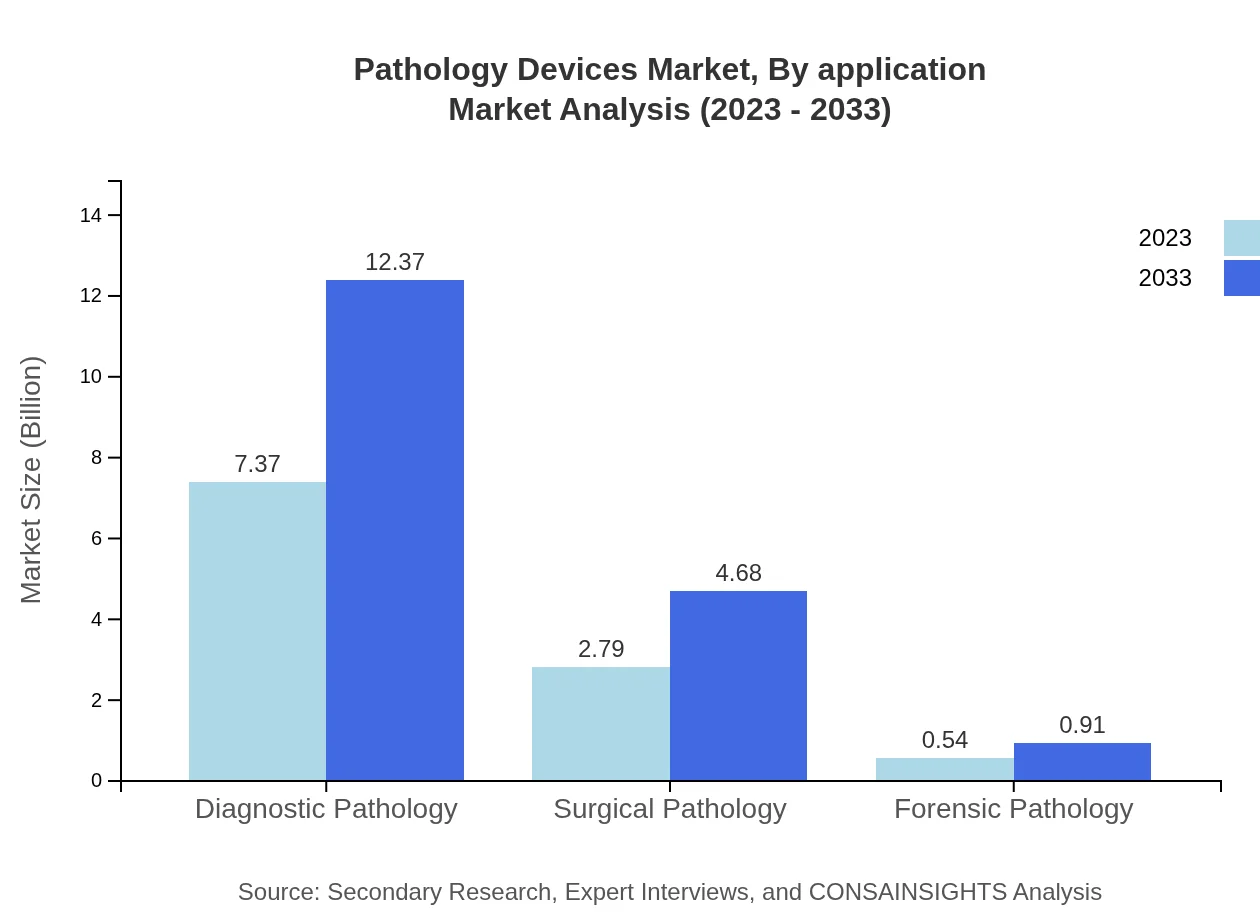

Pathology Devices Market Analysis By Application

The applications of pathology devices are segmented into Diagnostic Pathology, Surgical Pathology, and Forensic Pathology. Diagnostic and surgical pathology represent the largest segments due to the high volume of surgeries and diagnostics performed globally, facilitating high demand for effective and efficient pathology devices.

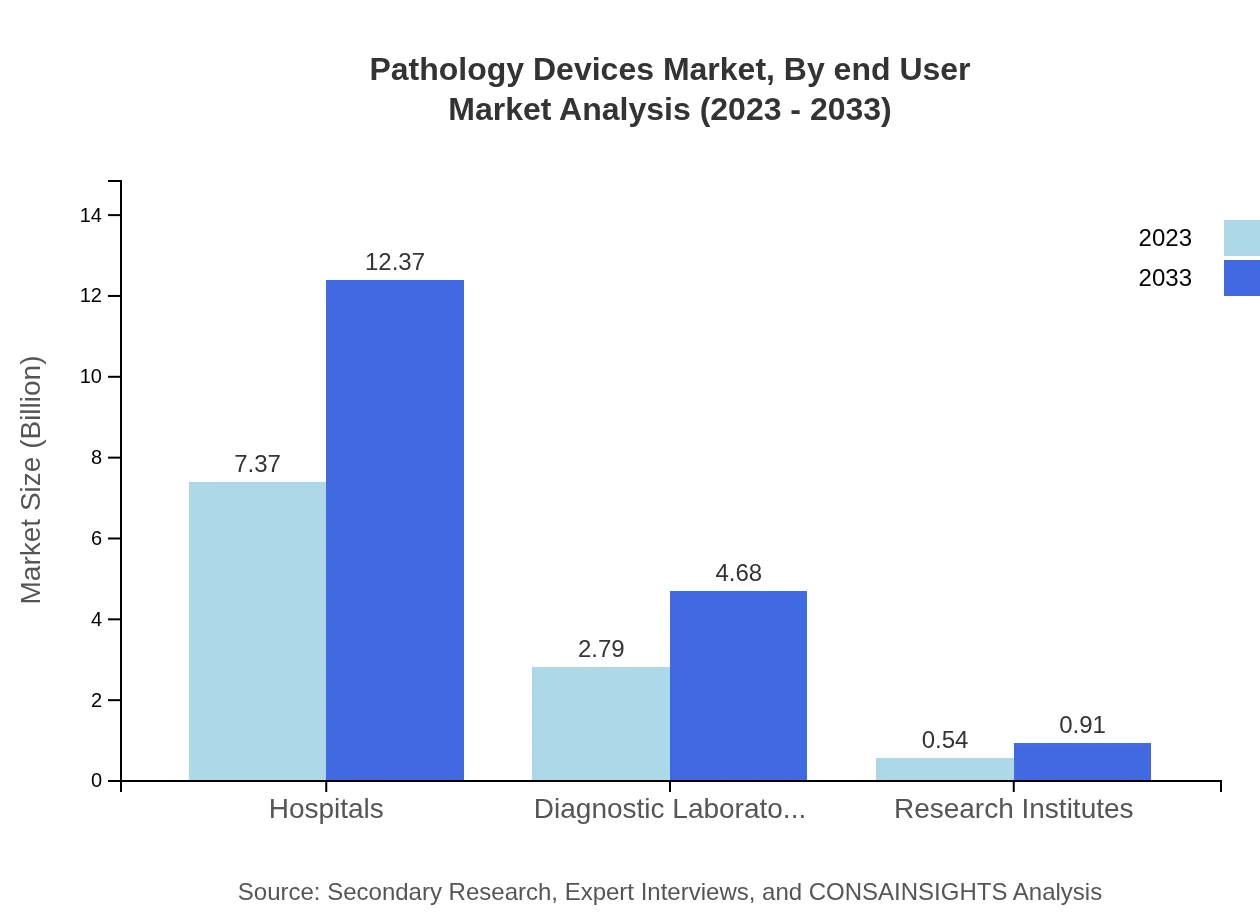

Pathology Devices Market Analysis By End User

End-users of pathology devices primarily include Hospitals, Diagnostic Laboratories, and Research Institutes. Hospitals constitute the dominant market segment, as they require extensive pathology services to handle various diagnostic needs for patients. Diagnostic laboratories also hold a significant share due to increasing public and private laboratory setups.

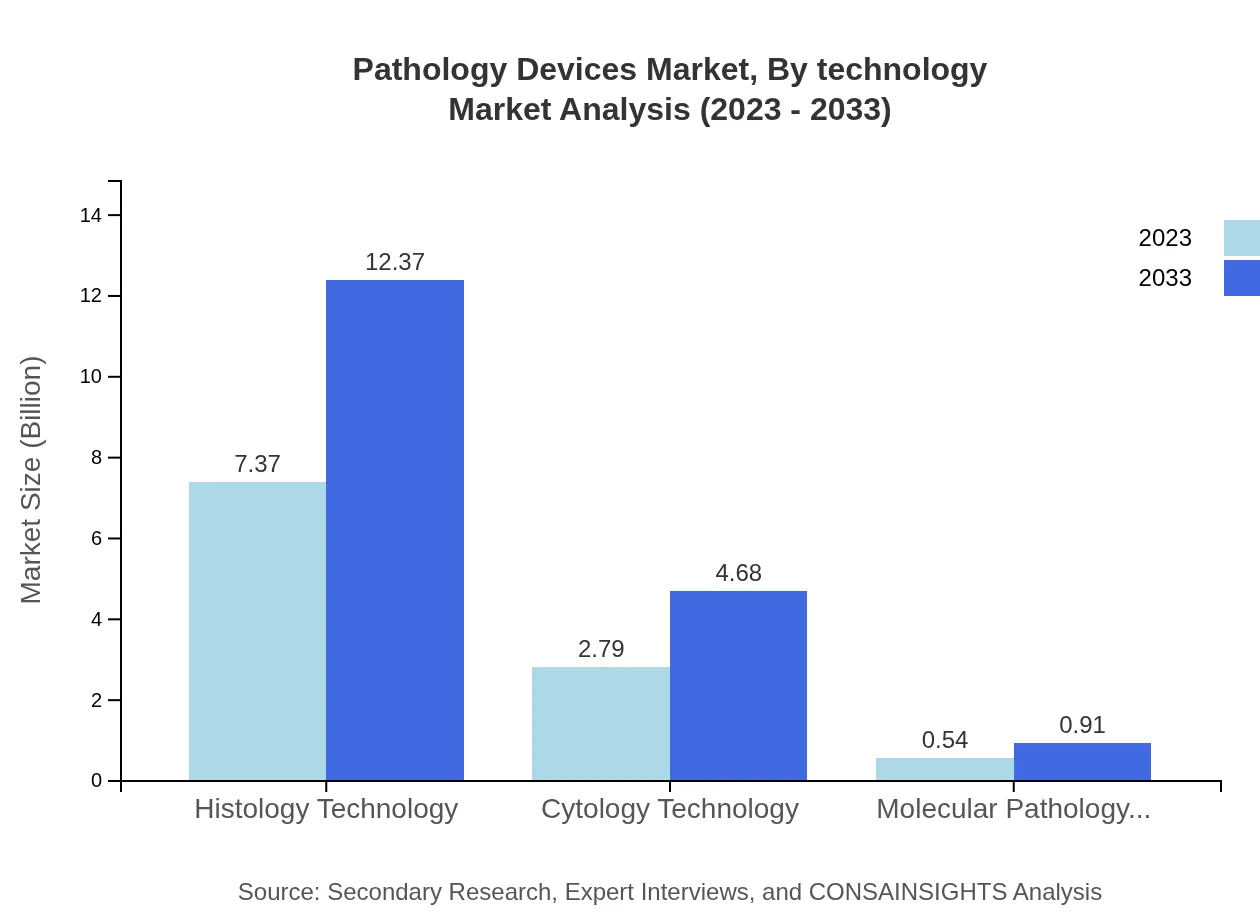

Pathology Devices Market Analysis By Technology

The market analysis based on technology highlights the growing role of digital pathology and AI in revolutionizing diagnostics. These technologies are enhancing efficiency in analysis and providing real-time data for decision-making among pathologists.

Pathology Devices Market Analysis By Region

Regionally, the North American market leads, followed by Europe and Asia-Pacific. Growth in each region is supported by diverse factors, including technological innovation, healthcare reforms, and established infrastructures that promote pathological testing and studies.

Pathology Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pathology Devices Industry

Roche Diagnostics:

A leader in the diagnostics sector, Roche offers a wide range of pathology devices focusing on innovative technologies that enhance diagnostics and personalized medicine applications.Thermo Fisher Scientific:

Known for its comprehensive portfolio of laboratory instruments and reagents, Thermo Fisher focuses heavily on delivering cutting-edge pathology solutions that facilitate rapid and accurate diagnoses.Danaher Corporation:

Danaher is a leading manufacturer of diagnostic tools and technologies in the pathology sector, contributing significantly to the advancement of medical diagnostics through its innovative products.Siemens Healthineers:

Siemens provides a robust range of pathology devices and diagnostic solutions that leverage digital transformation in diagnostics, emphasizing integration and automation.We're grateful to work with incredible clients.

FAQs

What is the market size of pathology Devices?

The pathology devices market is valued at approximately $10.7 billion in 2023, projected to grow at a CAGR of 5.2% through 2033. This growth indicates robust demand and advancements in pathology technologies.

What are the key market players or companies in the pathology Devices industry?

Key players in the pathology devices market include leading companies such as Siemens Healthineers, Roche, Thermo Fisher Scientific, and Leica Biosystems. These companies invest heavily in R&D, enhancing their technological capabilities.

What are the primary factors driving the growth in the pathology devices industry?

Growth in the pathology devices industry is driven by an increase in chronic diseases, advancements in diagnostic technologies, and a growing emphasis on personalized medicine. Additionally, rising investments in healthcare technology fuel market expansion.

Which region is the fastest Growing in the pathology Devices market?

The North American region is the fastest-growing in the pathology devices market, expected to grow from $4.17 billion in 2023 to $7.00 billion by 2033, reflecting increased healthcare spending and technological innovation.

Does ConsaInsights provide customized market report data for the pathology Devices industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the pathology devices industry, enabling them to make informed business decisions based on comprehensive market insights.

What deliverables can I expect from this pathology Devices market research project?

The deliverables for this market research project typically include a detailed report outlining market size, trends, competitive landscape, and regional analysis, alongside actionable recommendations tailored to business needs.

What are the market trends of pathology Devices?

The pathology devices market is witnessing trends such as the integration of AI in diagnostics, rising demand for automation, and increasing focus on precision medicine. This aligns with global healthcare trends emphasizing efficiency and accuracy.