Patient Positioning System Market Report

Published Date: 31 January 2026 | Report Code: patient-positioning-system

Patient Positioning System Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Patient Positioning System market, including insights on market size, growth potential, industry dynamics, and forecasts for 2023 to 2033. Key trends and drivers influencing market performance are also explored.

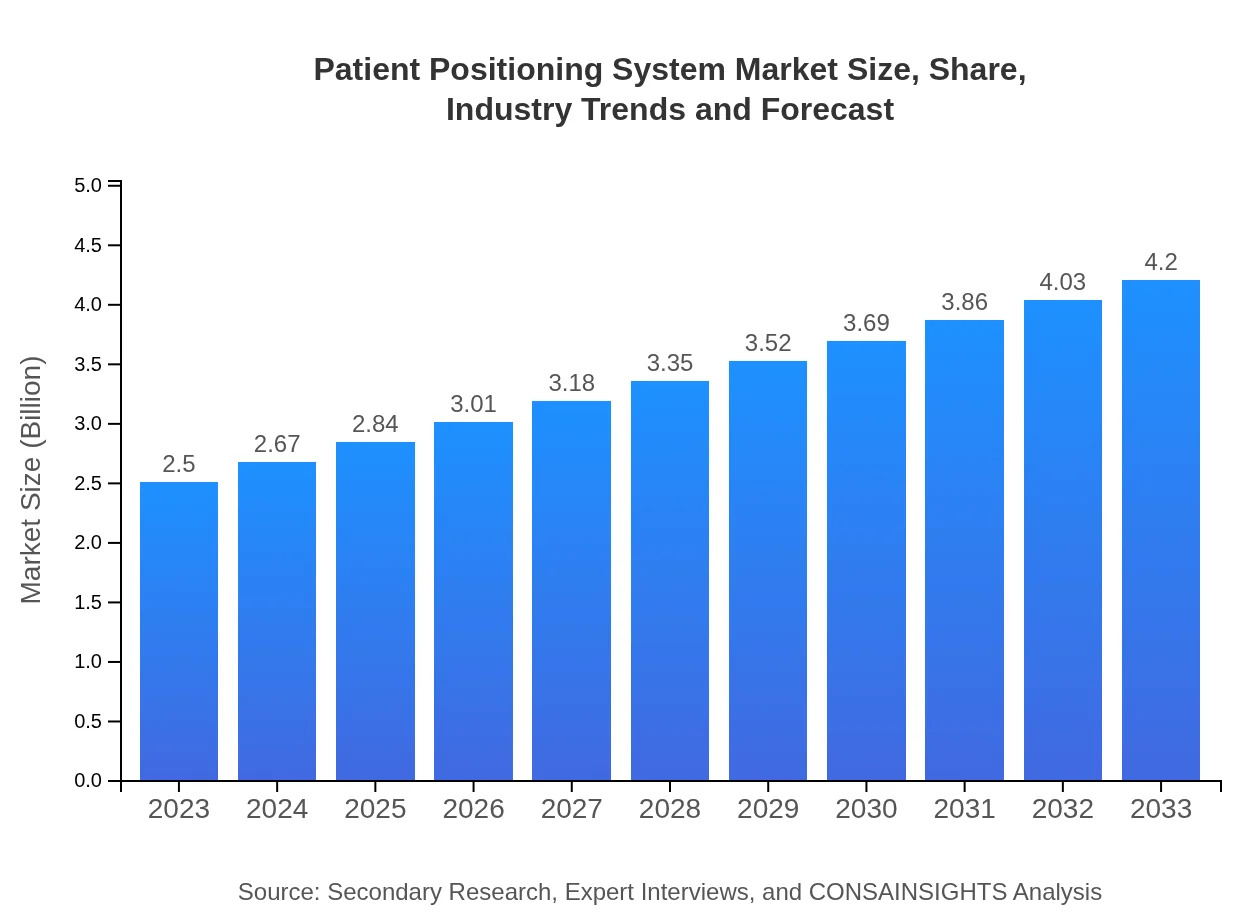

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $4.20 Billion |

| Top Companies | Medtronic , Olympus Corporation, Stryker Corporation, SKYTRON, Hillrom |

| Last Modified Date | 31 January 2026 |

Patient Positioning System Market Overview

Customize Patient Positioning System Market Report market research report

- ✔ Get in-depth analysis of Patient Positioning System market size, growth, and forecasts.

- ✔ Understand Patient Positioning System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Patient Positioning System

What is the Market Size & CAGR of Patient Positioning System market in 2023?

Patient Positioning System Industry Analysis

Patient Positioning System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Patient Positioning System Market Analysis Report by Region

Europe Patient Positioning System Market Report:

The European market is valued at $0.60 billion in 2023 and is expected to reach $1.01 billion by 2033. The growth in this region is driven by stringent patient safety standards and a growing number of robotic-assisted surgeries.Asia Pacific Patient Positioning System Market Report:

In the Asia Pacific region, the Patient Positioning System market is valued at $0.52 billion in 2023 and is expected to grow to $0.87 billion by 2033. This growth is fueled by increased healthcare spending, improvements in healthcare infrastructure, and rising awareness about advanced surgical technologies in countries like China and India.North America Patient Positioning System Market Report:

North America represents the largest market share, valued at $0.97 billion in 2023 and projected to grow to $1.62 billion by 2033. This region's dominance is due to higher adoption rates of advanced medical technologies and a well-established healthcare system, alongside a substantial number of surgical procedures performed annually.South America Patient Positioning System Market Report:

South America's market value is estimated at $0.14 billion in 2023, projected to reach $0.23 billion by 2033. The growth is driven by a gradual improvement in healthcare access and a rising elderly population that necessitates more surgical interventions.Middle East & Africa Patient Positioning System Market Report:

In the Middle East and Africa, the market is valued at $0.27 billion in 2023, anticipated to grow to $0.46 billion by 2033. The expansion is influenced by improving healthcare infrastructure and investment in medical technology by various governments.Tell us your focus area and get a customized research report.

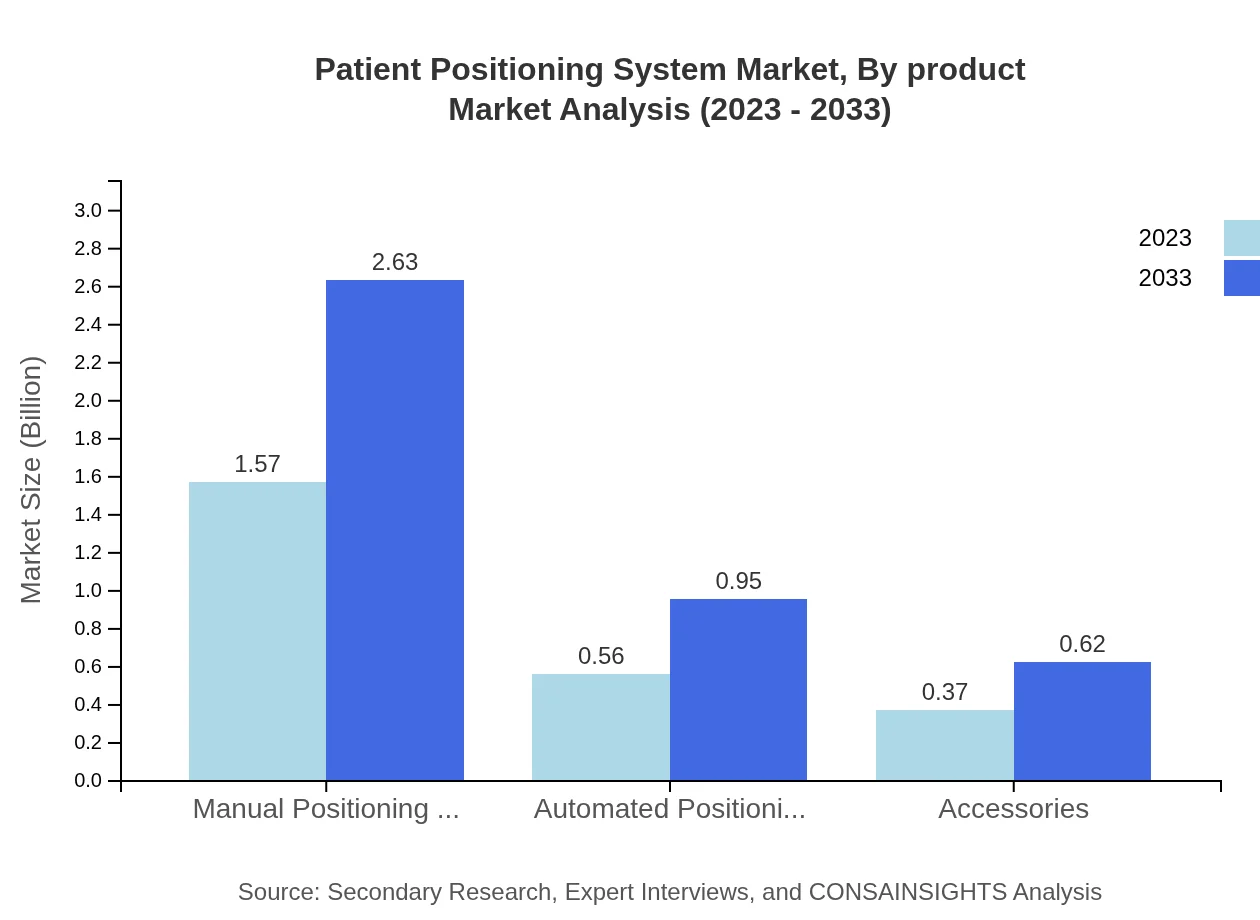

Patient Positioning System Market Analysis By Product

The Patient Positioning System market is significantly influenced by the following product types: - Manual Positioning Systems: Valued at $1.57 billion in 2023, projected to grow to $2.63 billion by 2033, accounting for 62.62% share. - Automated Positioning Systems: Expected to reach $0.95 billion from $0.56 billion, holding a 22.55% market share. - Accessories: This segment will see a growth from $0.37 billion to $0.62 billion, representing a 14.83% market share.

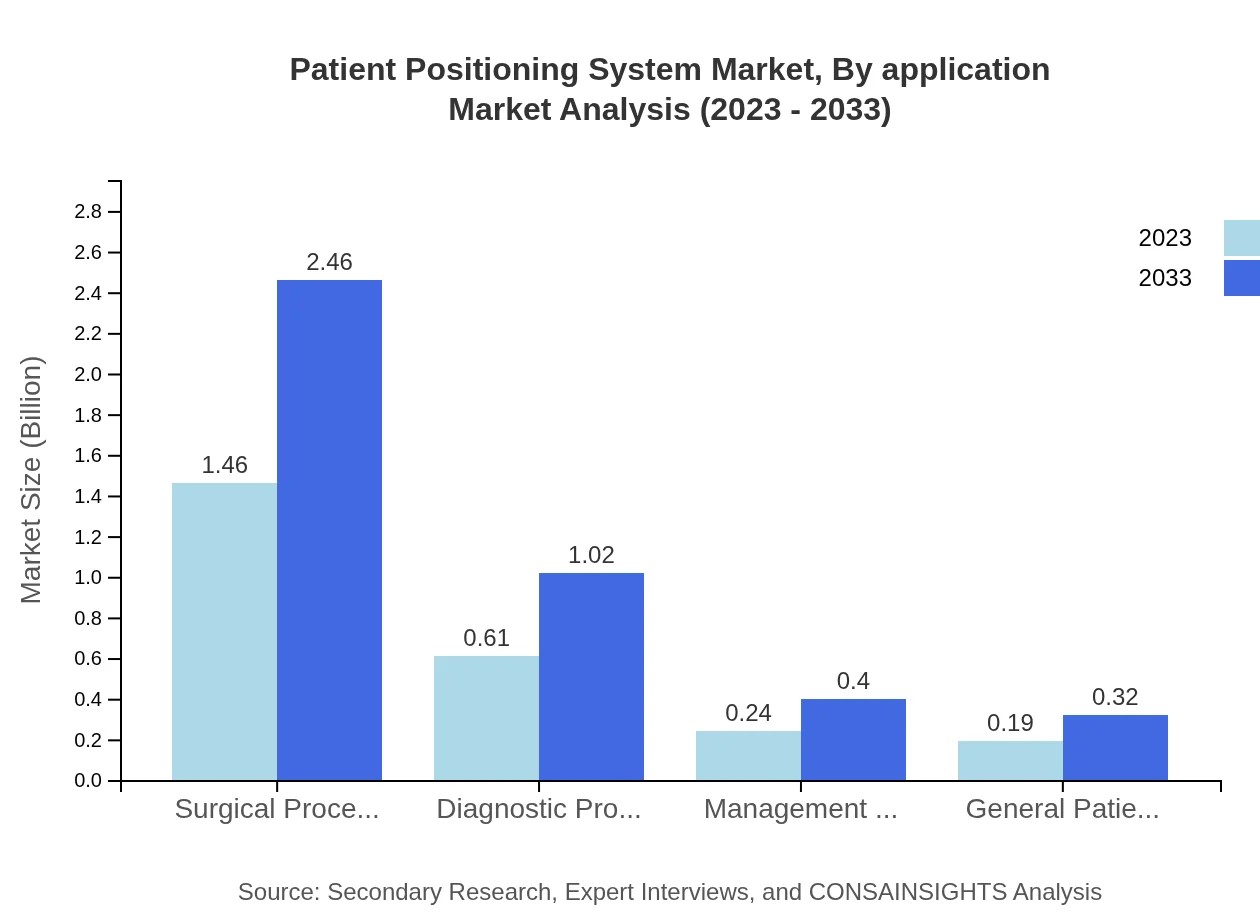

Patient Positioning System Market Analysis By Application

Applications in the Patient Positioning System market include: - Surgical Procedures: $1.46 billion in 2023, growing to $2.46 billion (58.59% share). - Diagnostic Procedures: Expected to grow from $0.61 billion to $1.02 billion (24.21% share). - Management of Chronic Conditions: Incrementing from $0.24 billion to $0.40 billion (9.52% share). - General Patient Care: Growing from $0.19 billion to $0.32 billion (7.68% share).

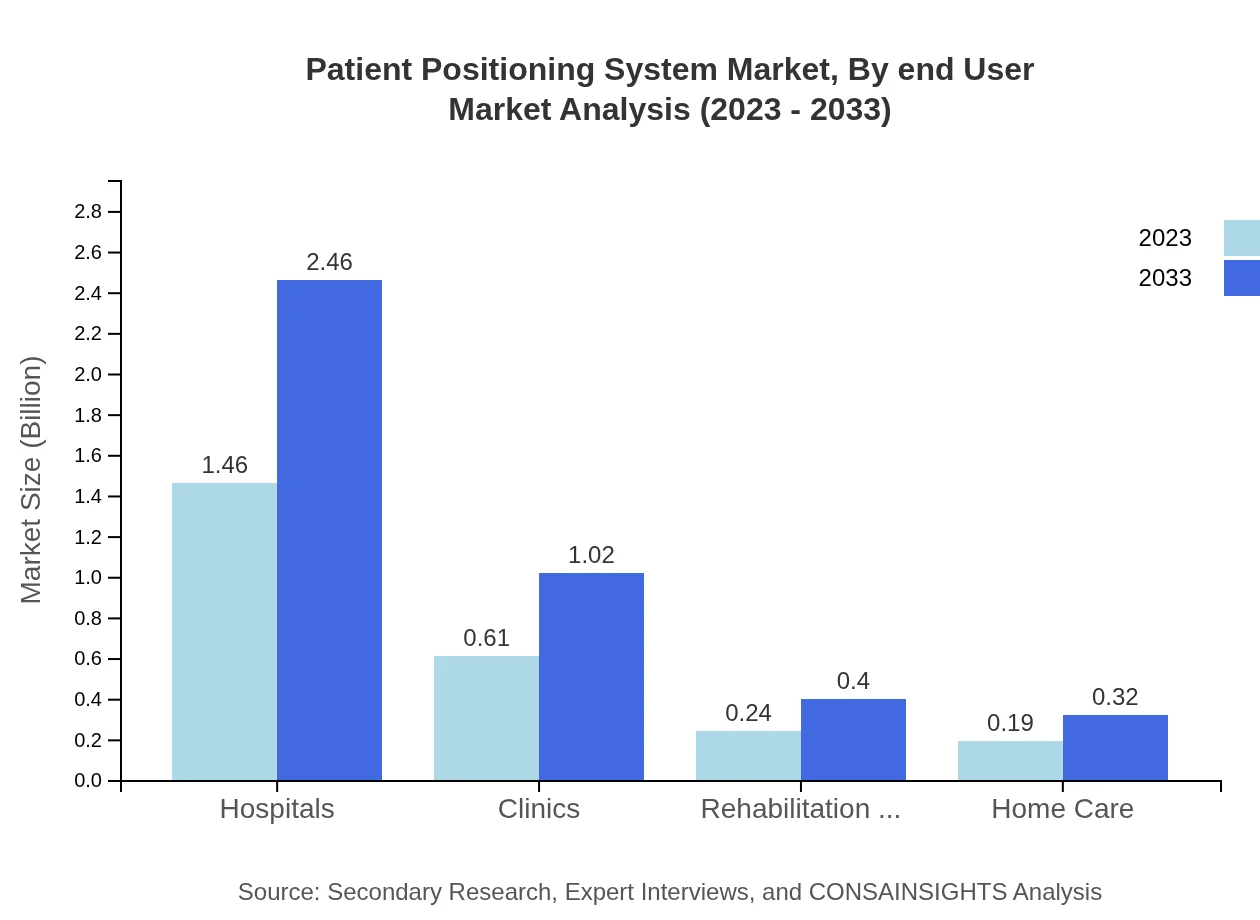

Patient Positioning System Market Analysis By End User

End-user segments include: - Hospitals: The leading market segment valued at $1.46 billion in 2023, forecasted to reach $2.46 billion by 2033, with a 58.59% share. - Clinics: Set to grow from $0.61 billion to $1.02 billion, holding a 24.21% market share. - Rehabilitation Centers: Incrementing from $0.24 billion to $0.40 billion, maintaining a 9.52% share. - Home Care: Anticipated to rise from $0.19 billion to $0.32 billion (7.68% share).

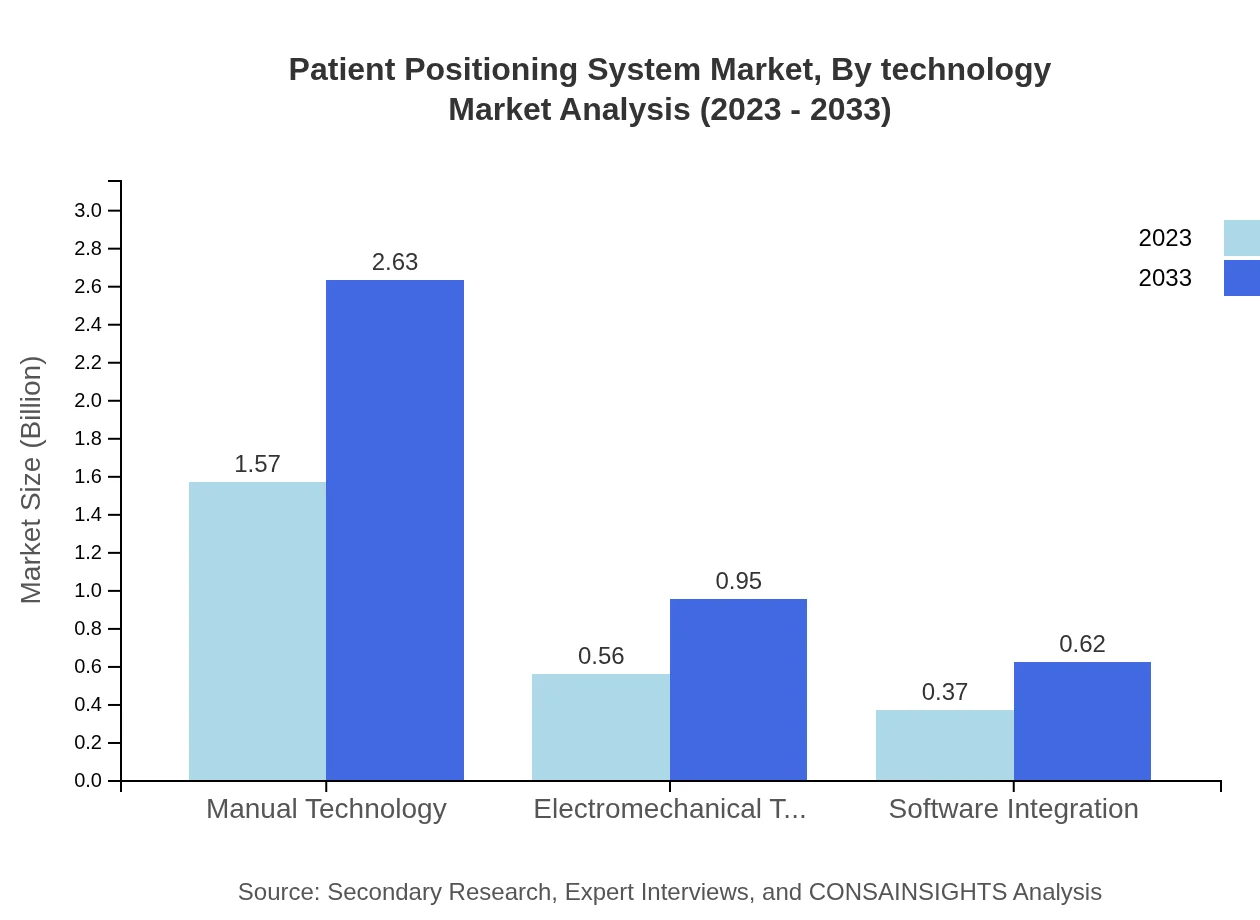

Patient Positioning System Market Analysis By Technology

Technological segments include: - Manual Technology: Valued at $1.57 billion, growing to $2.63 billion (62.62% share). - Electromechanical Technology: Expected to grow from $0.56 billion to $0.95 billion (22.55% share). - Software Integration: Forecasted to enhance from $0.37 billion to $0.62 billion (14.83% share).

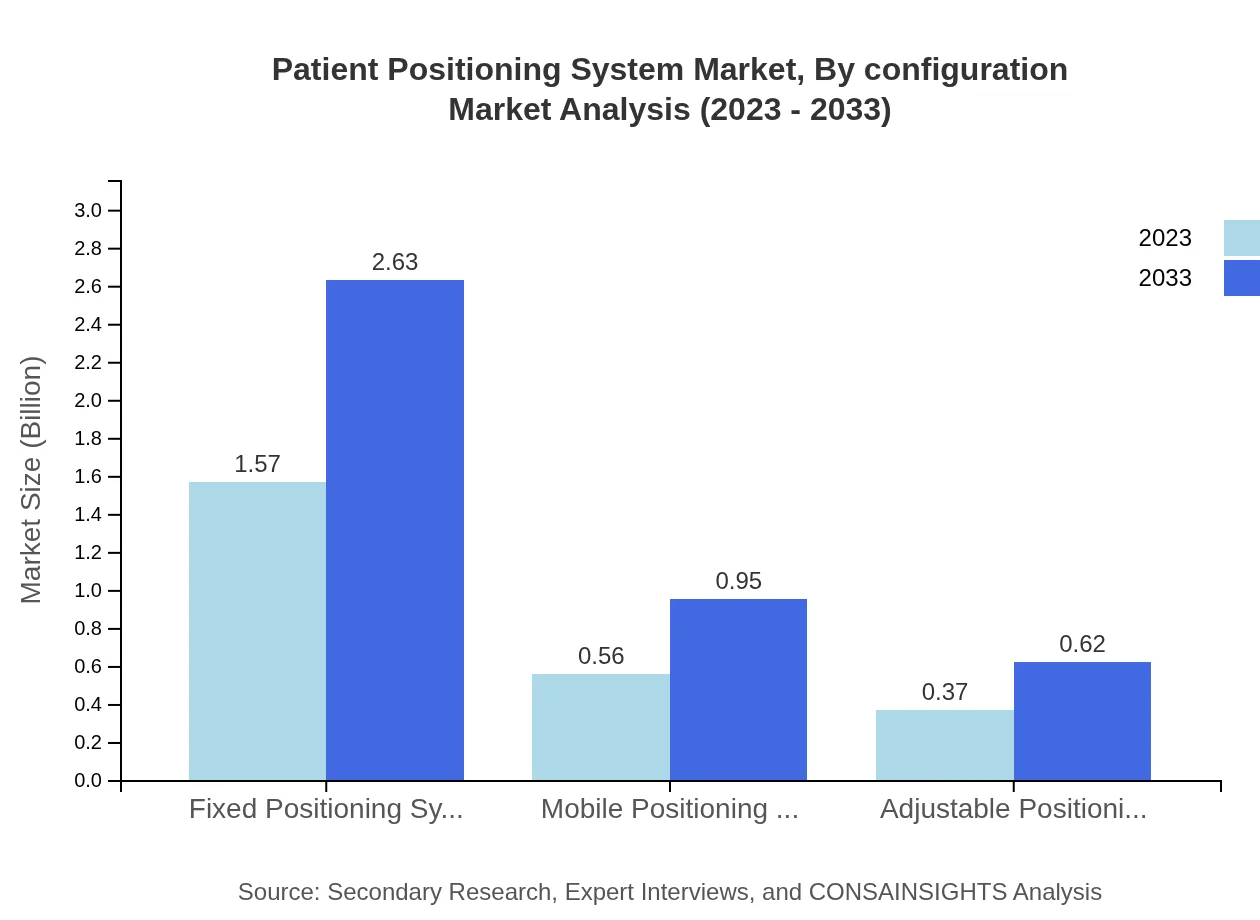

Patient Positioning System Market Analysis By Configuration

Configuration segments of the Patient Positioning System include: - Fixed Positioning Systems: Valued at $1.57 billion in 2023, anticipated to rise to $2.63 billion (62.62% share). - Mobile Positioning Systems: Expected growth from $0.56 billion to $0.95 billion (22.55% share). - Adjustable Positioning Systems: Set to increase from $0.37 billion to $0.62 billion (14.83% share).

Patient Positioning System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Patient Positioning System Industry

Medtronic :

A leading global healthcare solutions company that develops technologies, services, and solutions for hospitals and healthcare professionals.Olympus Corporation:

Renowned for its innovative imaging and surgical devices, Olympus is at the forefront of surgical positioning systems.Stryker Corporation:

Focuses on innovative medical devices, including surgical equipment and patient care, contributing significantly to the positioning system market.SKYTRON:

Specializes in surgical and procedural equipment, offering a range of positioning systems designed for various clinical environments.Hillrom:

A global medical technology company providing equipment and systems that enhance patient outcomes, including positioning devices.We're grateful to work with incredible clients.

FAQs

What is the market size of Patient Positioning System?

The Patient Positioning System market is estimated to be valued at $2.5 billion in 2023, with a compound annual growth rate (CAGR) of 5.2%. This growth reflects increasing demand for patient safety and comfort.

What are the key market players or companies in this Patient Positioning System industry?

Key players in the Patient Positioning System market include Medtronic, Hill-Rom Holdings, Inc., and Stryker Corporation. These companies lead with innovative solutions designed to enhance patient care and operational efficiency.

What are the primary factors driving the growth in the Patient Positioning System industry?

Driving factors include advancements in healthcare technology, increasing patient population, and a growing emphasis on safety and comfort during medical procedures, which fuels demand for effective positioning systems.

Which region is the fastest Growing in the Patient Positioning System?

North America is the fastest-growing region in the Patient Positioning System market, projected to expand from $0.97 billion in 2023 to $1.62 billion by 2033, driven by technological advancements and rising healthcare expenditures.

Does ConsaInsights provide customized market report data for the Patient Positioning System industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the Patient Positioning System industry, enabling targeted insights and strategic planning.

What deliverables can I expect from this Patient Positioning System market research project?

Expect comprehensive reports that include market size, growth forecasts, competitive analysis, segmentation insights, and regional trends tailored to the Patient Positioning System sector.

What are the market trends of Patient Positioning System?

Market trends indicate a shift towards automation in positioning systems, increased focus on ergonomics, and the integration of smart technology to enhance patient safety and operational efficiency.