Patient Registry Software Market Report

Published Date: 31 January 2026 | Report Code: patient-registry-software

Patient Registry Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Patient Registry Software market, highlighting market conditions, size, segmentation, technology trends, and regional insights for the forecast period from 2023 to 2033.

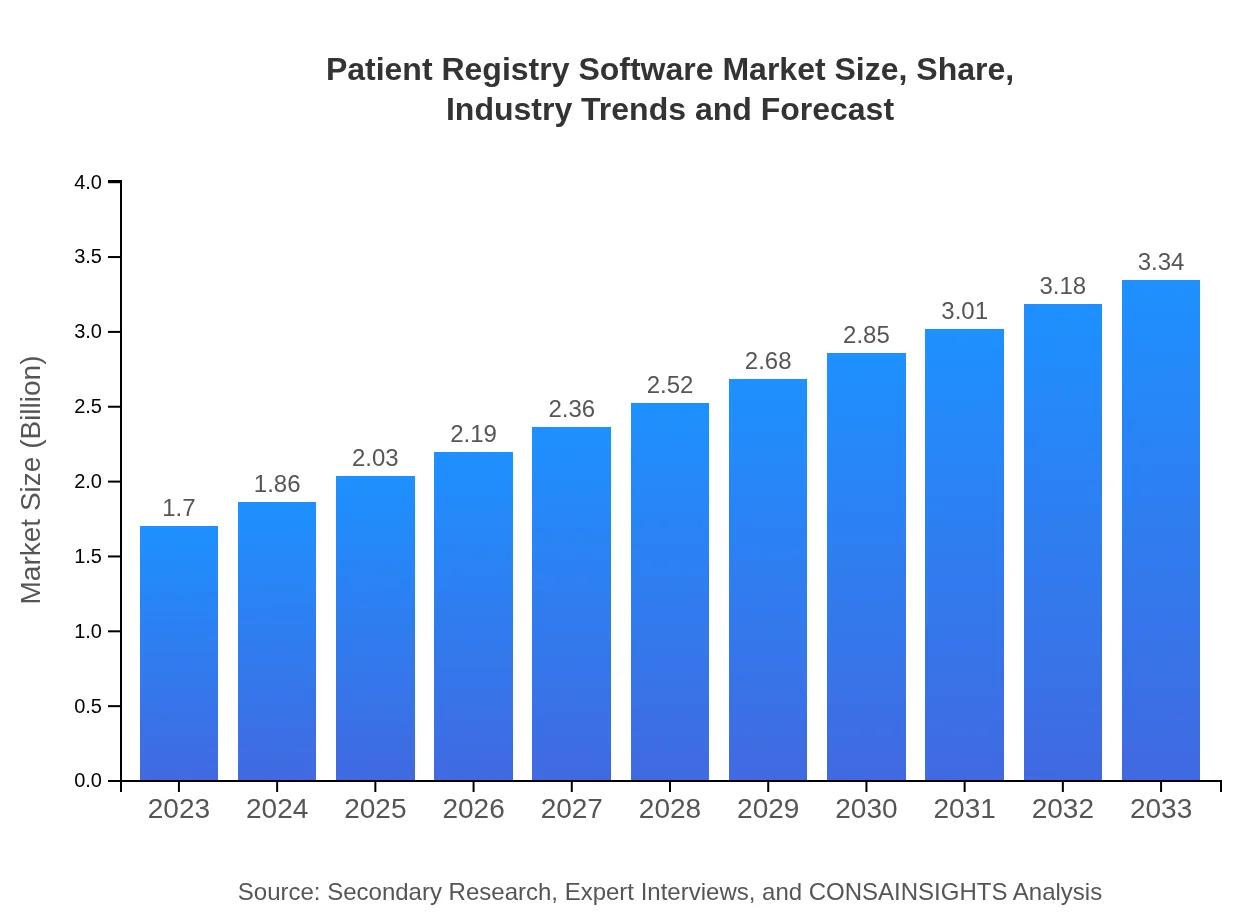

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Optum, McKesson Corporation, Cerner Corporation, Allscripts, Epic Systems |

| Last Modified Date | 31 January 2026 |

Patient Registry Software Market Overview

Customize Patient Registry Software Market Report market research report

- ✔ Get in-depth analysis of Patient Registry Software market size, growth, and forecasts.

- ✔ Understand Patient Registry Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Patient Registry Software

What is the Market Size & CAGR of Patient Registry Software market in 2023?

Patient Registry Software Industry Analysis

Patient Registry Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Patient Registry Software Market Analysis Report by Region

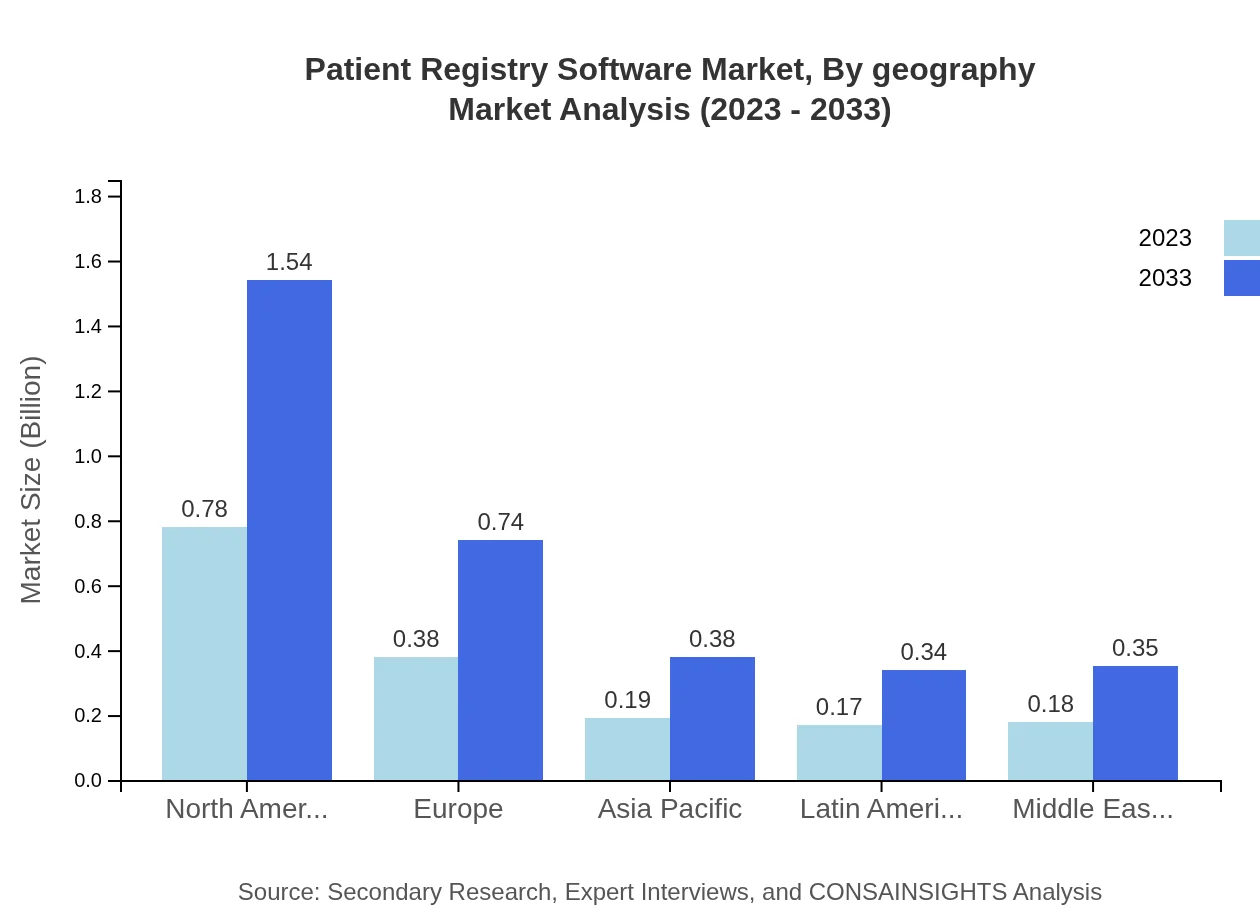

Europe Patient Registry Software Market Report:

The European market is anticipated to grow from $0.54 million in 2023 to $1.06 million by 2033. The push for improved health outcomes and the consolidation of healthcare data under national registries are key drivers in this region.Asia Pacific Patient Registry Software Market Report:

The Asia Pacific region is projected to grow significantly, from a market size of $0.31 million in 2023 to $0.62 million by 2033. The growing healthcare sector, increasing investments in health IT, and demand for improved patient care mainly drive this growth.North America Patient Registry Software Market Report:

North America holds a substantial portion of the market, with a value of $0.61 million in 2023 expected to rise to $1.20 million by 2033. This dominance is fueled by a favorable reimbursement scenario, technological infrastructure, and widespread adoption of health IT.South America Patient Registry Software Market Report:

In South America, the Patient Registry Software market will expand from $0.13 million in 2023 to $0.25 million by 2033. The adoption of digital health solutions and government initiatives to improve healthcare access are crucial factors in this region.Middle East & Africa Patient Registry Software Market Report:

In the Middle East and Africa, the market is expected to grow modestly from $0.10 million in 2023 to $0.20 million by 2033, driven by a gradual shift towards digitalization in healthcare and increasing awareness of data management.Tell us your focus area and get a customized research report.

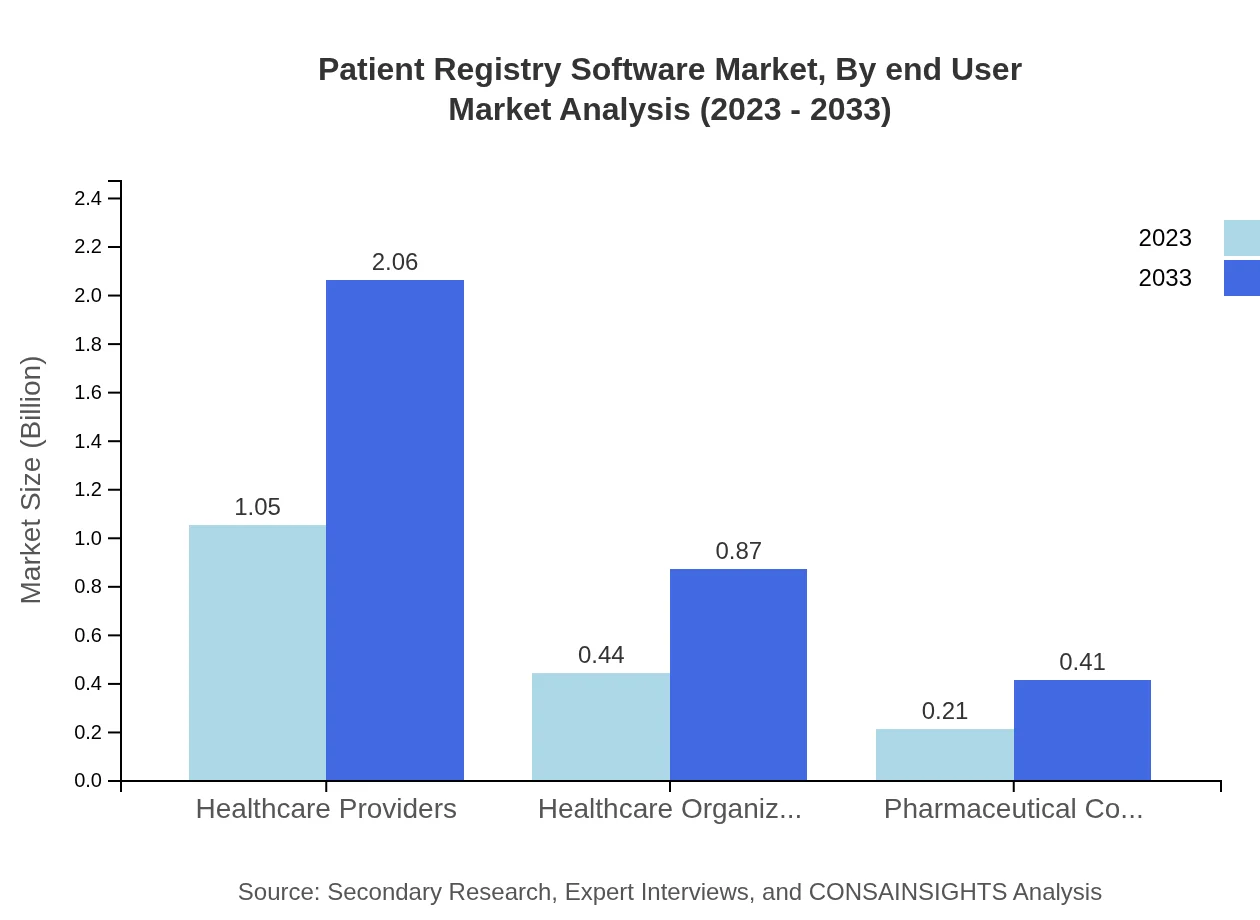

Patient Registry Software Market Analysis By End User

Healthcare providers are the primary end-users, showing a market size of $1.05 billion in 2023 and projected to grow to $2.06 billion by 2033. Healthcare organizations follow at $0.44 billion, expected to double over the same period, while pharmaceutical companies will also see their market size grow from $0.21 billion to $0.41 billion.

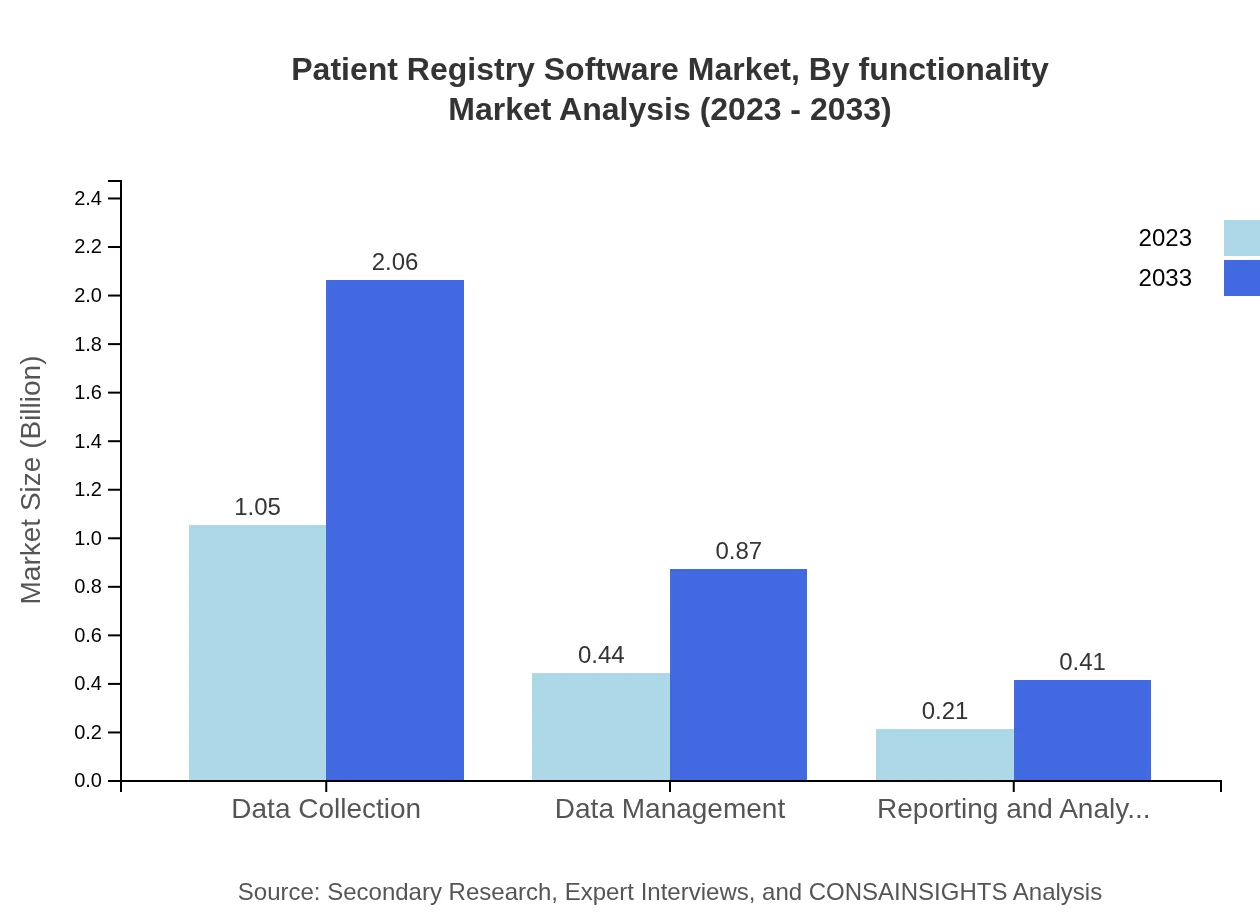

Patient Registry Software Market Analysis By Functionality

The functionality segment is dominated by data collection, representing $1.05 billion in 2023 and is expected to reach $2.06 billion by 2033, maintaining a 61.67% market share, closely followed by data management and reporting and analytics.

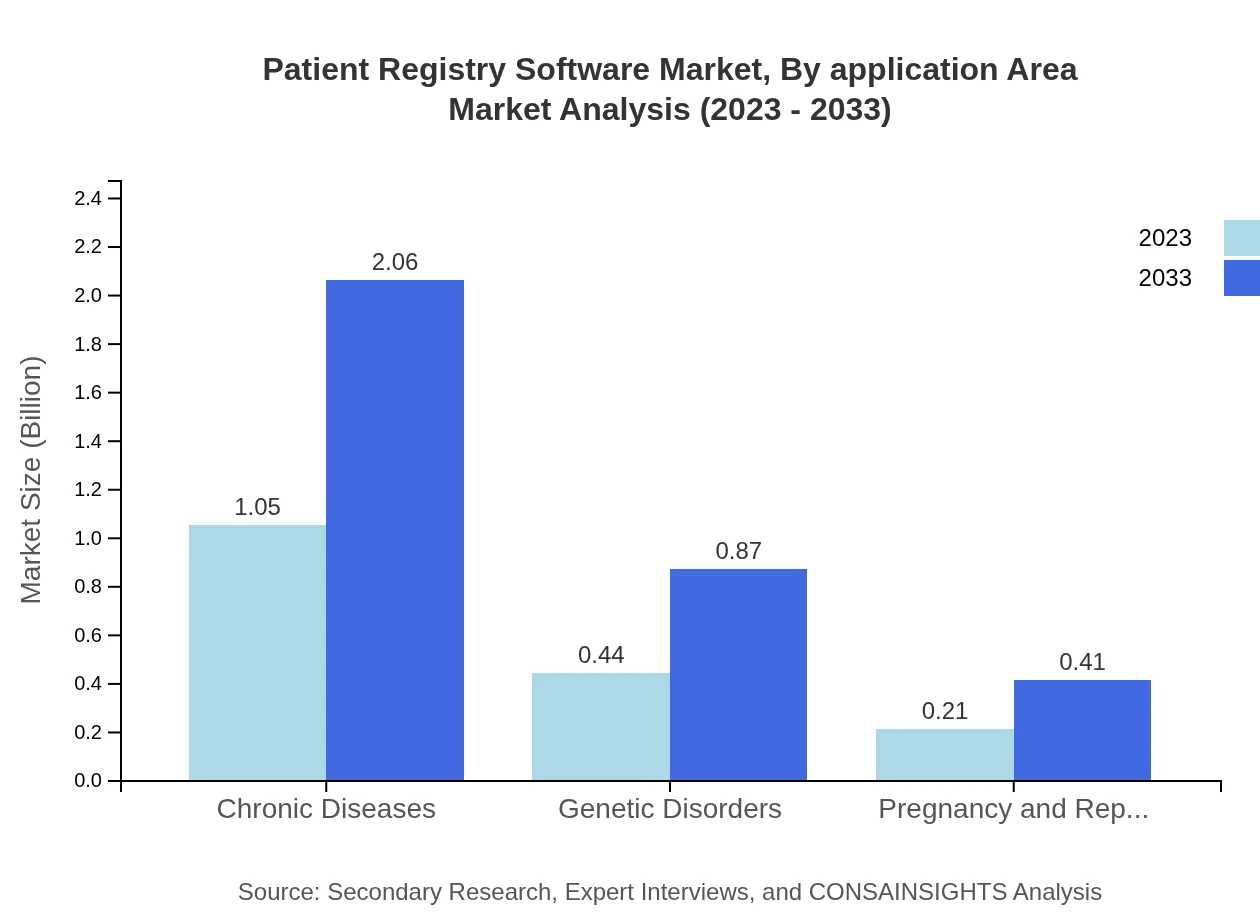

Patient Registry Software Market Analysis By Application Area

Chronic diseases are the most significant application area, with a market value of $1.05 billion in 2023, increasing to $2.06 billion by 2033. This emphasizes the importance of effective tracking and management of chronic conditions.

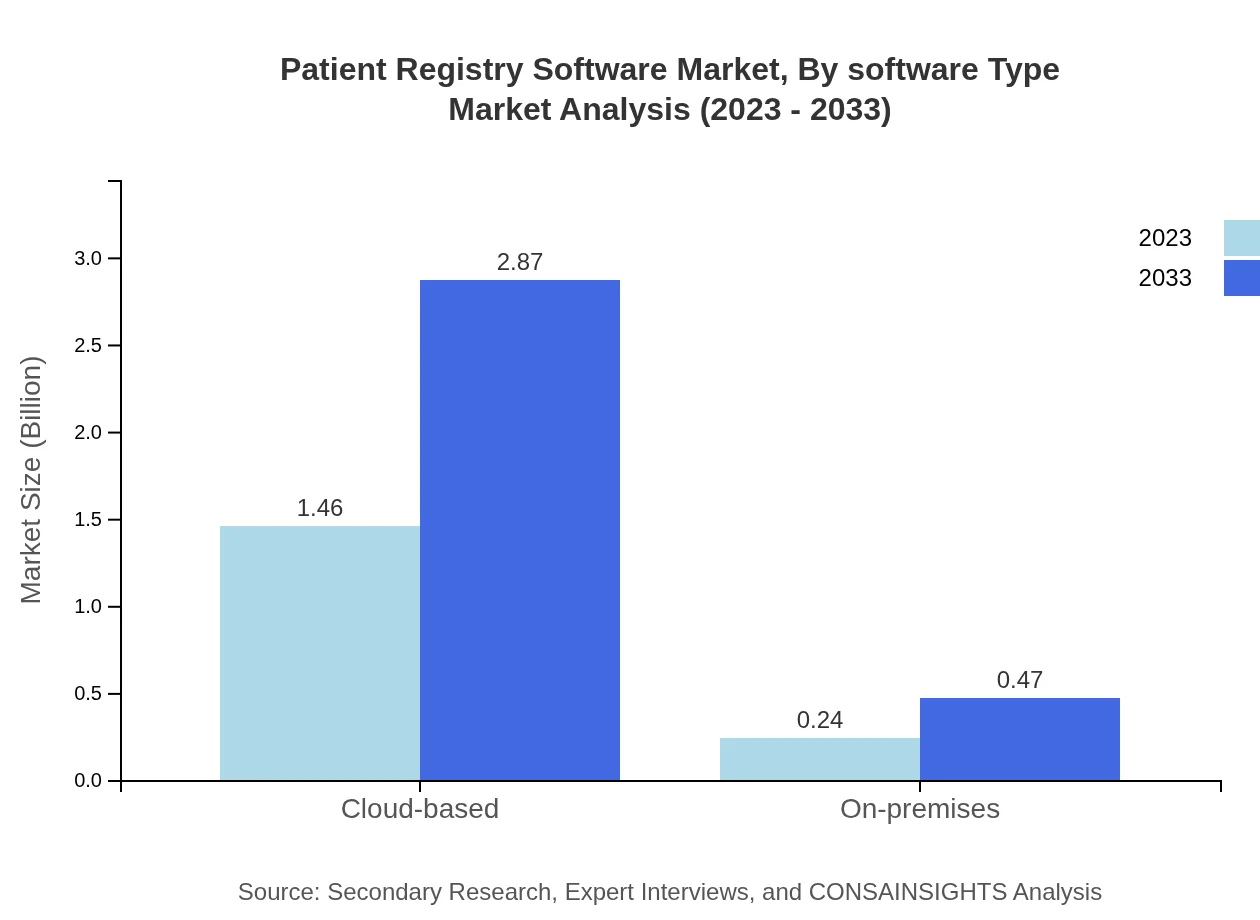

Patient Registry Software Market Analysis By Software Type

Cloud-based solutions dominate the software type segment, accounted for $1.46 billion in 2023 and expected to more than double by 2033, favored for their flexibility and lower operational costs compared to on-premises solutions.

Patient Registry Software Market Analysis By Geography

Geographically, North America leads the market due to technological advancements and integration in its healthcare systems, while Europe and Asia Pacific follow, showcasing robust growth potential in adopting registries for improved healthcare outcomes.

Patient Registry Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Patient Registry Software Industry

Optum:

A leading health services company that provides a comprehensive suite of services, including advanced data analytics and registry solutions.McKesson Corporation:

One of the largest pharmaceutical distribution companies in the US, offering innovative health IT solutions including patient registry software.Cerner Corporation:

A key player in health care technology, Cerner offers a wide range of registry solutions aimed at improving healthcare delivery.Allscripts:

Provides integrated healthcare solutions that improve clinical and financial performance including robust patient registry software.Epic Systems:

Known for its electronic health record software, Epic also offers comprehensive registry solutions as part of its health IT portfolio.We're grateful to work with incredible clients.

FAQs

What is the market size of patient Registry Software?

The patient registry software market is projected to grow from $1.7 billion in 2023 to an estimated value by 2033, with a compound annual growth rate (CAGR) of 6.8%. This growth reflects increasing investments in healthcare IT and digital solutions.

What are the key market players or companies in this patient Registry Software industry?

Key players in the patient registry software industry include major firms specializing in healthcare technology and data management solutions, advancing innovations and expanding their market presence to cater to a growing demand for patient management systems.

What are the primary factors driving the growth in the patient Registry Software industry?

The growth in the patient registry software sector is driven by factors such as the rising prevalence of chronic diseases, increasing focus on patient-centric care, advancements in healthcare IT, and government incentives for adopting electronic health records.

Which region is the fastest Growing in the patient Registry Software?

North America is the fastest-growing region in the patient registry software market, expected to grow from $0.61 billion in 2023 to $1.20 billion by 2033, fueled by strong investments in healthcare technology infrastructure.

Does ConsaInsights provide customized market report data for the patient Registry Software industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements in the patient registry software industry, catering to businesses looking for precise insights and actionable data to enhance their strategic decisions.

What deliverables can I expect from this patient Registry Software market research project?

From the patient registry software market research project, you can expect comprehensive reports detailing market size, growth forecasts, competitive analysis, trend assessments, and actionable insights tailored to support your business strategies.

What are the market trends of patient Registry Software?

Market trends in patient registry software include a shift towards cloud-based solutions, increasing integration with electronic health records, higher demand for analytics capabilities, and a growing emphasis on patient engagement and personalized healthcare solutions.