Pay Tv Market Report

Published Date: 31 January 2026 | Report Code: pay-tv

Pay Tv Market Size, Share, Industry Trends and Forecast to 2033

This report covers the comprehensive analysis of the Pay TV market, examining trends, forecasts, and regional insights from 2023 to 2033. It highlights the industry's growth, market size, and competitive landscape to provide valuable insights for stakeholders.

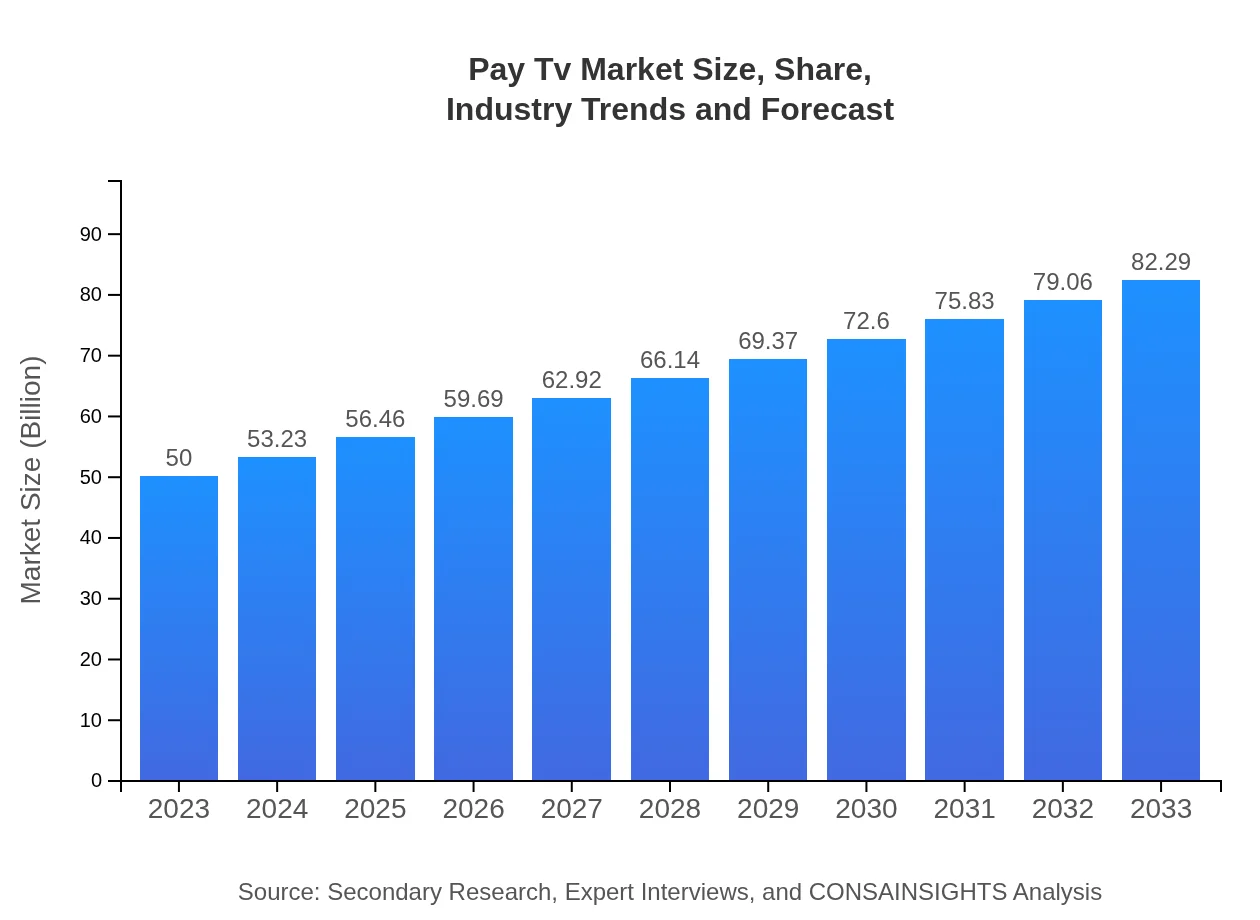

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $82.29 Billion |

| Top Companies | Comcast, Dish Network , AT&T, Netflix, ViacomCBS |

| Last Modified Date | 31 January 2026 |

Pay Tv Market Overview

Customize Pay Tv Market Report market research report

- ✔ Get in-depth analysis of Pay Tv market size, growth, and forecasts.

- ✔ Understand Pay Tv's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pay Tv

What is the Market Size & CAGR of the Pay Tv market in 2023?

Pay Tv Industry Analysis

Pay Tv Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pay Tv Market Analysis Report by Region

Europe Pay Tv Market Report:

The European Pay TV market is significant, with a market value of $16.01 billion in 2023, poised to grow to $26.35 billion by 2033. Key factors include a strong focus on content localization and increasing competition from OTT services.Asia Pacific Pay Tv Market Report:

The Asia Pacific region is witnessing robust growth, with the market value projected to rise from $9.75 billion in 2023 to $16.05 billion by 2033. This growth is attributed to rising disposable incomes, increasing urbanization, and heightened demand for diverse content offerings.North America Pay Tv Market Report:

North America remains one of the largest markets for Pay TV, estimated to be valued at $16.70 billion in 2023 and projected to reach $27.48 billion by 2033. This growth is driven by the high penetration of digital services and demand for streaming options alongside traditional cable services.South America Pay Tv Market Report:

In South America, the Pay TV market is anticipated to grow from $1.26 billion in 2023 to $2.07 billion in 2033. The region is gradually shifting towards digital platforms, although challenges such as economic instability and varying consumer preferences persist.Middle East & Africa Pay Tv Market Report:

The Middle East and Africa region is expected to grow from $6.28 billion in 2023 to $10.34 billion by 2033. Key drivers include an increase in satellite TV subscribership and the rise of bundled packages in urban areas.Tell us your focus area and get a customized research report.

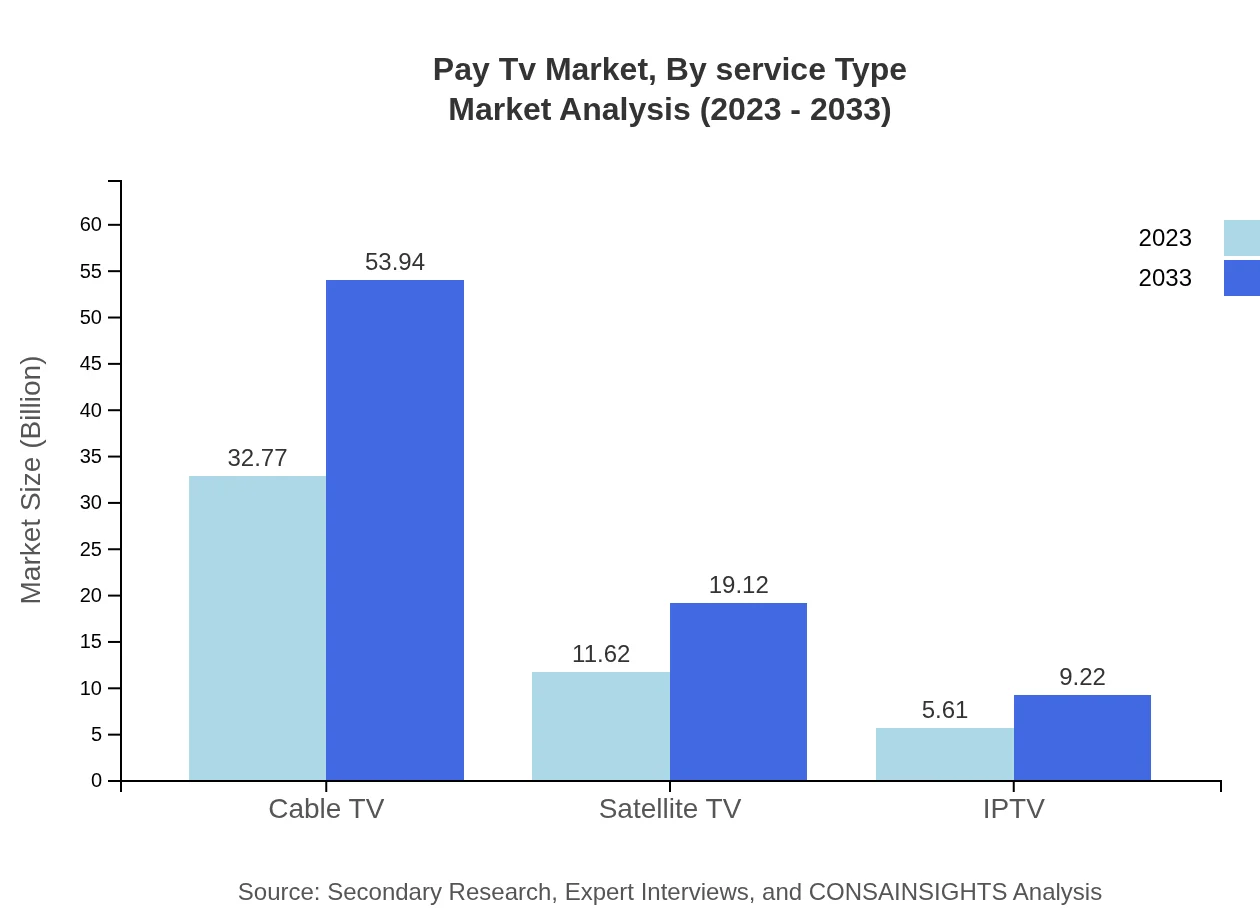

Pay Tv Market Analysis By Service Type

In 2023, the service types within the Pay-TV market highlight Cable TV leading with a market size of $32.77 billion (65.55% market share), followed by Satellite TV at $11.62 billion (23.24%), and IPTV at $5.61 billion (11.21%). By 2033, Cable TV is expected to grow to $53.94 billion, Satellite TV to $19.12 billion, and IPTV to $9.22 billion.

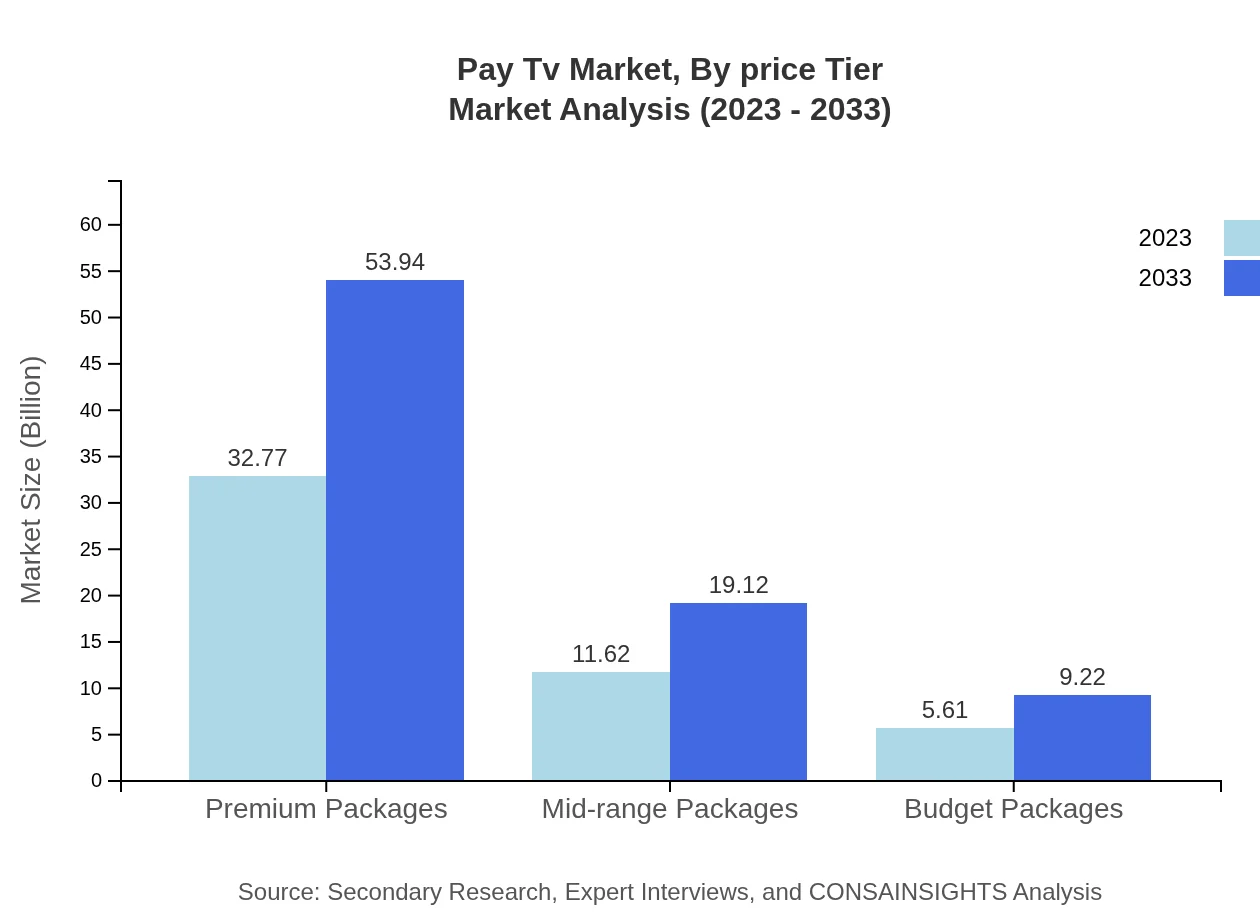

Pay Tv Market Analysis By Price Tier

Premium packages dominate the market with a size of $32.77 billion in 2023, accounting for 65.55% market share. This segment is projected to increase to $53.94 billion by 2033. Mid-range (2023: $11.62 billion, 23.24% share; 2033: $19.12 billion) and Budget packages (2023: $5.61 billion, 11.21% share; 2033: $9.22 billion) are also critical, although with smaller shares.

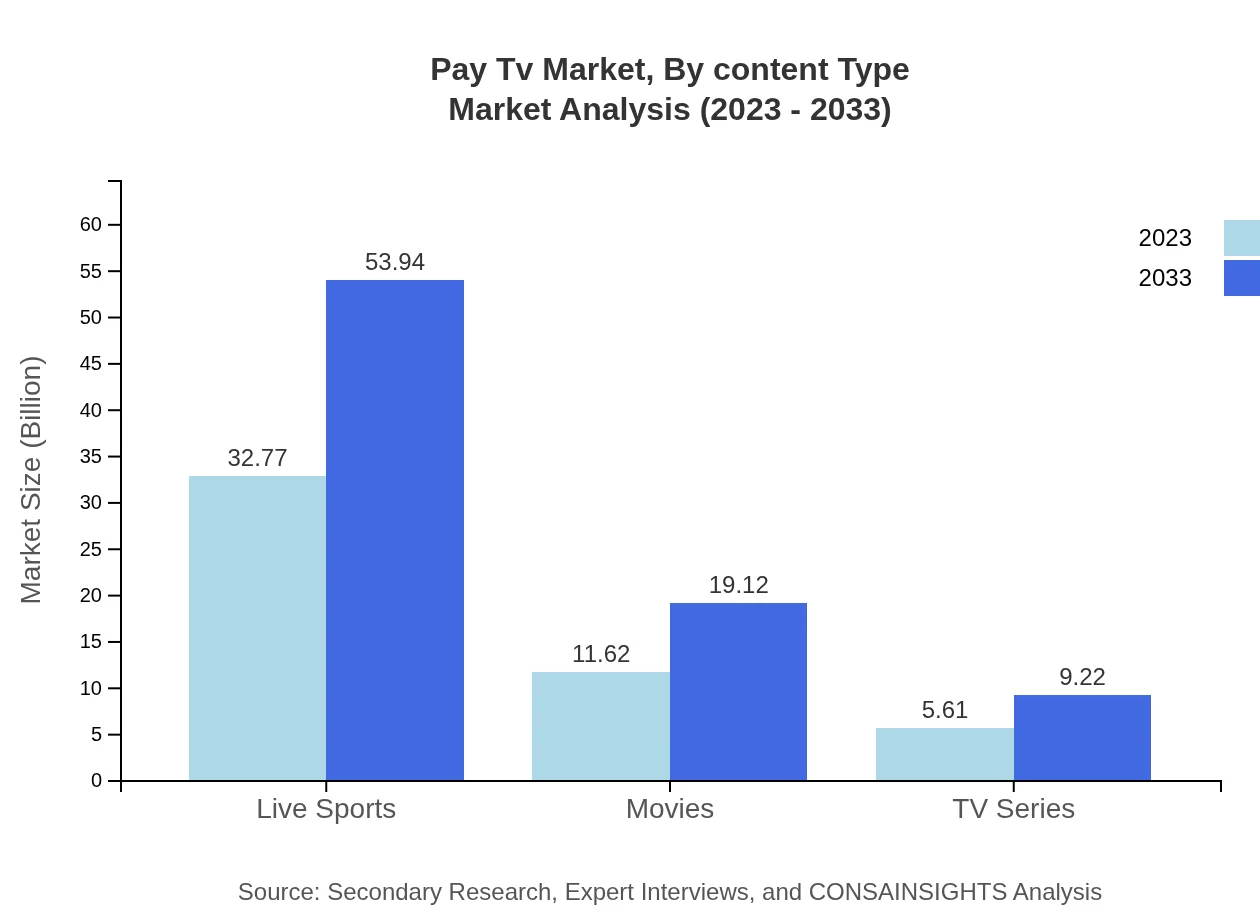

Pay Tv Market Analysis By Content Type

The content type segment emphasizes Live Sports, with a market size of $32.77 billion (65.55% share) in 2023, growing to $53.94 billion in 2033. Movies and TV Series follow at $11.62 billion (23.24%) and $5.61 billion (11.21%), respectively, with consistent growth anticipated in the next decade.

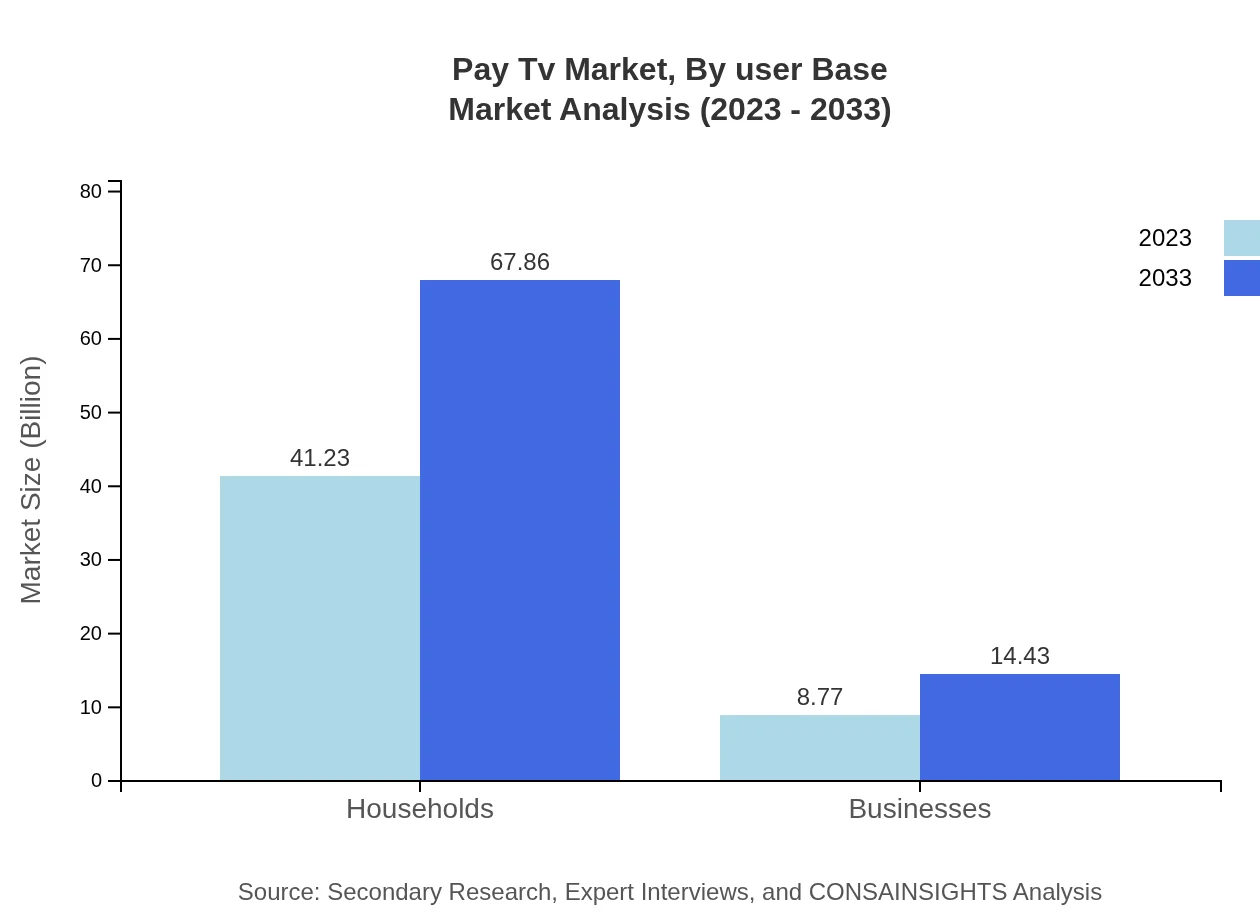

Pay Tv Market Analysis By User Base

The user base segment indicates households leading the market with a size of $41.23 billion (82.47% share) in 2023, expected to reach $67.86 billion by 2033. Businesses constitute a smaller portion at $8.77 billion (17.53% share) but are growing steadily towards $14.43 billion.

Pay Tv Market Analysis By Distribution Channel

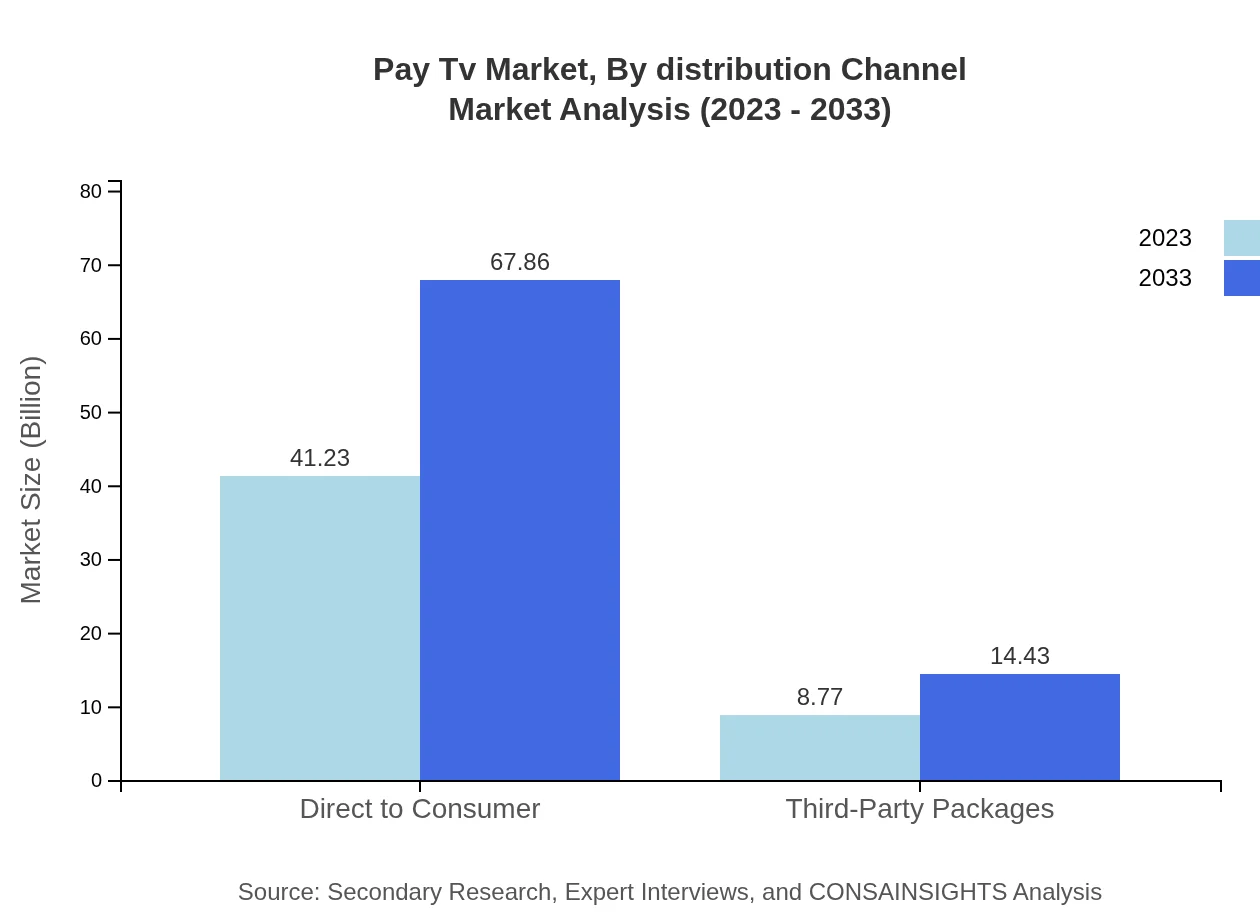

Direct to Consumer channels account for $41.23 billion (82.47%) in 2023, expanding to $67.86 billion by 2033. Third-Party packages are projected to rise from $8.77 billion (17.53%) to $14.43 billion over the same period, reflecting a gradual shift in consumer buying behavior.

Pay Tv Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pay Tv Industry

Comcast:

Comcast is a leader in digital media and technology, operating in the Pay TV sector through its Xfinity brand, providing cable, internet, and telephone services.Dish Network :

As one of the major satellite TV providers in the U.S., Dish Network offers high-definition and 4K programming, enhancing the viewing experience with advanced technology.AT&T:

AT&T, through its DirectTV service, is a major player in the Pay TV landscape, offering satellite TV and broadband services with diverse entertainment packages.Netflix:

Though primarily a streaming service, Netflix has impacted traditional Pay TV significantly, driving content innovations and subscriber shifts due to its original productions.ViacomCBS:

A diversified multinational mass media conglomerate, ViacomCBS contributes to the Pay TV sector through its extensive broadcasting networks and production studios.We're grateful to work with incredible clients.

FAQs

What is the market size of pay Tv?

The global Pay-TV market size was valued at approximately $50 billion in 2023, with an expected Compound Annual Growth Rate (CAGR) of 5% through 2033. By 2033, the market is projected to grow significantly due to ongoing digital transformations.

What are the key market players or companies in this pay Tv industry?

Key market players in the Pay-TV industry include major telecommunications companies, cable networks, and streaming platforms. These entities compete on technology, content offerings, and customer service to capture a larger market share in this sector.

What are the primary factors driving the growth in the pay Tv industry?

Growth in the Pay-TV industry is primarily driven by increasing demand for quality content, technological advancements, and the integration of IPTV services. Enhanced consumer experiences, such as personalized viewing options, also contribute to market expansion.

Which region is the fastest Growing in the pay Tv?

The fastest-growing region in the Pay-TV market is expected to be Europe, with market size growing from $16.01 billion in 2023 to $26.35 billion by 2033. Similar growth is also anticipated in North America and Asia Pacific, driven by technological advancements.

Does ConsaInsights provide customized market report data for the pay Tv industry?

Yes, ConsaInsights offers customized market report data tailored to specific requirements within the Pay-TV industry. This enables clients to obtain insights that align closely with their business needs and strategic goals.

What deliverables can I expect from this pay Tv market research project?

From the Pay-TV market research project, you can expect detailed reports including market analysis, competitive landscape, trend identification, regional insights, and consumer behavior assessments to support strategic decision-making.

What are the market trends of pay Tv?

Key market trends in Pay-TV include the rise of on-demand services, a shift towards bundled offers, and expanded access to premium content. Additionally, the emergence of personalized viewing experiences is significantly shaping consumer preferences.