Payment As A Service Market Report

Published Date: 31 January 2026 | Report Code: payment-as-a-service

Payment As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Payment As A Service market, covering insights and data forecasts from 2023 to 2033, including current market dynamics, segmentations, and regional performances for a comprehensive understanding of future trends.

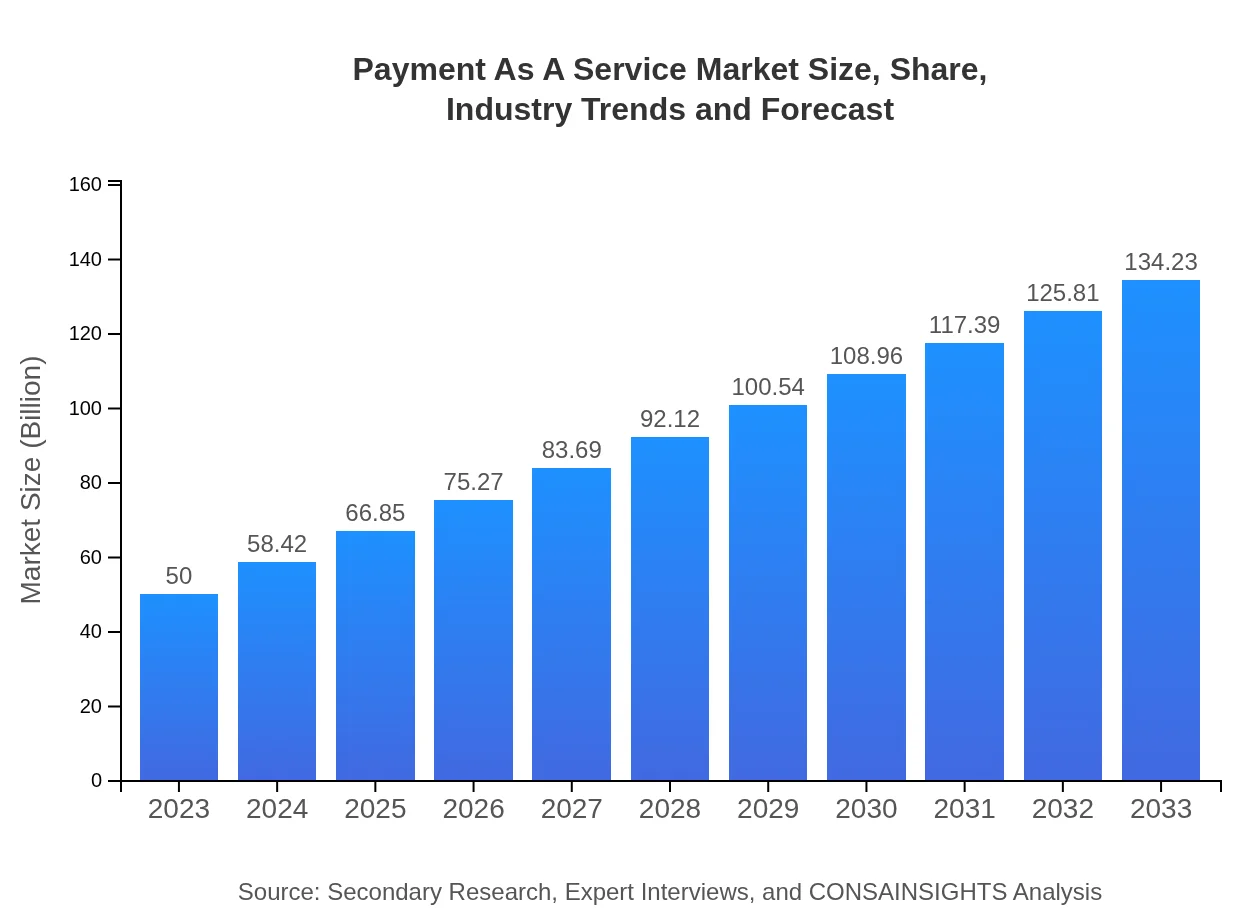

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $134.23 Billion |

| Top Companies | PayPal, Stripe, Square, Adyen, Authorize.Net |

| Last Modified Date | 31 January 2026 |

Payment As A Service Market Overview

Customize Payment As A Service Market Report market research report

- ✔ Get in-depth analysis of Payment As A Service market size, growth, and forecasts.

- ✔ Understand Payment As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Payment As A Service

What is the Market Size & CAGR of Payment As A Service market in 2023?

Payment As A Service Industry Analysis

Payment As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Payment As A Service Market Analysis Report by Region

Europe Payment As A Service Market Report:

Europe’s Payment As A Service market was valued at $17.21 billion in 2023 and is expected to reach $46.22 billion by 2033. The region comprises a matured payment landscape, with regulatory frameworks like PSD2 encouraging innovation and competition within the market.Asia Pacific Payment As A Service Market Report:

In 2023, the Asia Pacific market stood at $9.39 billion with projections of $25.22 billion by 2033. Rapid economic growth, a burgeoning middle class, and increasing mobile and online payment adoption drive this market. This region is expected to witness substantial technological advancements and investments in digital payment infrastructures.North America Payment As A Service Market Report:

The North American market reached $17.27 billion in 2023 and is expected to grow to $46.38 billion by 2033. High adaptation rates of technology and infrastructure, along with the demand for advanced payment solutions by enterprises, bolster market growth in this region.South America Payment As A Service Market Report:

The South American market was valued at $4.62 billion in 2023, with an anticipated growth to $12.39 billion by 2033. Growing digitalization in the region, coupled with increasing consumer preference for online purchasing, accelerates the growth of Payment As A Service solutions.Middle East & Africa Payment As A Service Market Report:

In 2023, the market for the Middle East and Africa was valued at $1.50 billion, projected to grow to $4.03 billion by 2033. As digital payment systems gain popularity particularly in South Africa and the UAE, investments in fintech solutions are set to enhance the growth of payment services.Tell us your focus area and get a customized research report.

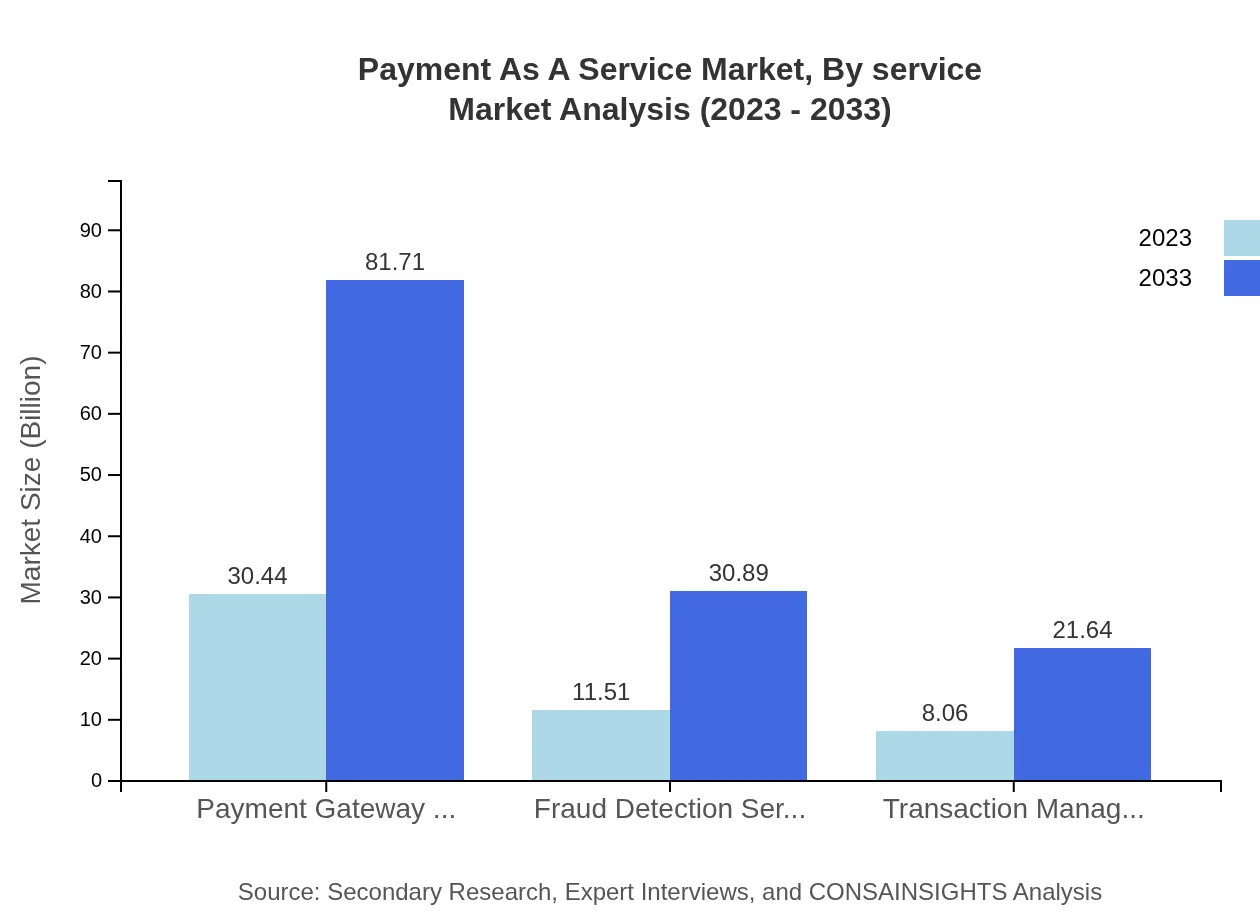

Payment As A Service Market Analysis By Service

The Payment-as-a-Service market demonstrates a significant shift towards payment gateway services characterized by a market size of $30.44 billion in 2023 and an expected growth to $81.71 billion by 2033. Fraud detection services and transaction management services also showcase substantial growth, reflecting businesses’ pressing need for security and management efficiency in transactions.

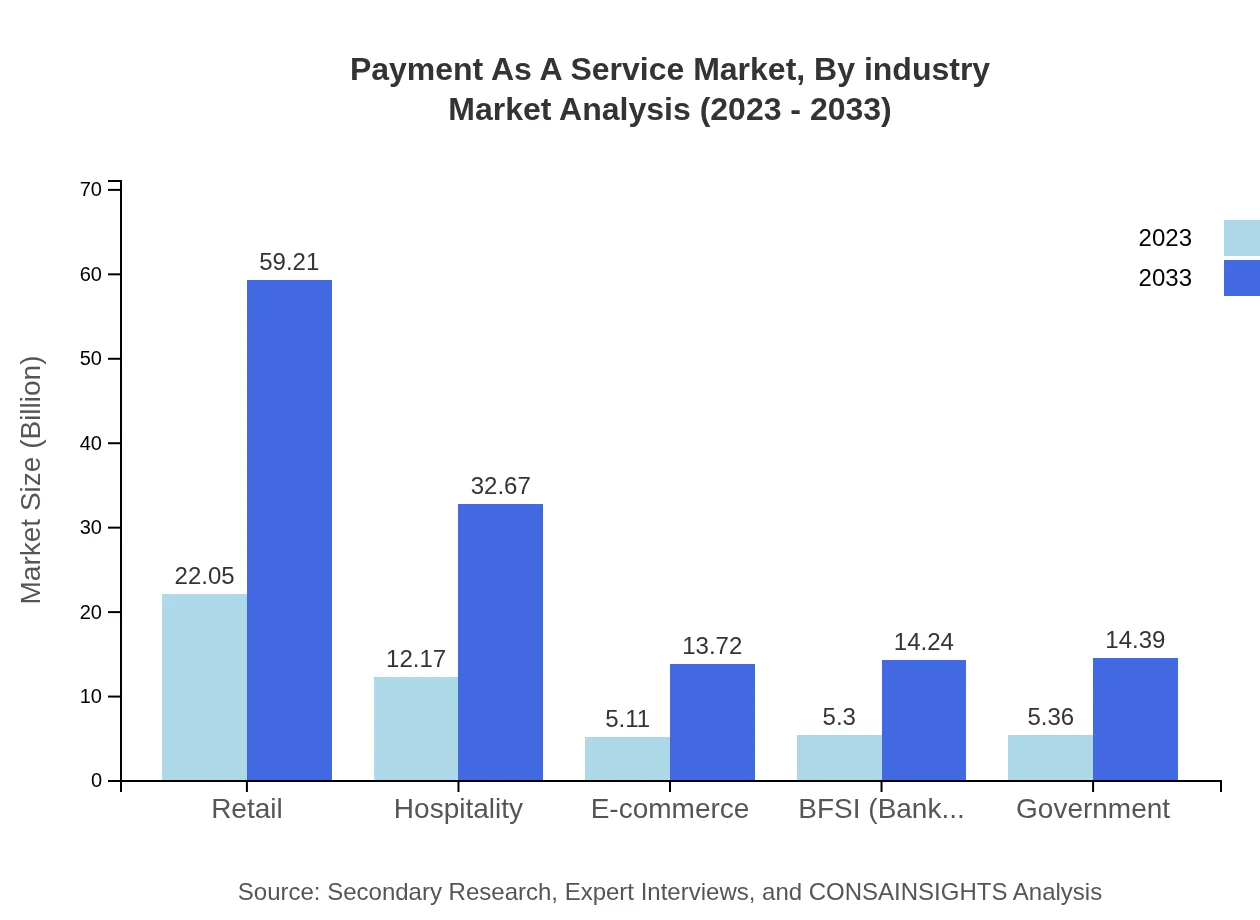

Payment As A Service Market Analysis By Industry

Segmented by industry, retail leads the market with a valuation of $22.05 billion in 2023, expanding to $59.21 billion by 2033. The hospitality and e-commerce sectors also show promising growth alongside BFSI and government industries, emphasizing the increasing reliance on payment technologies in various fields.

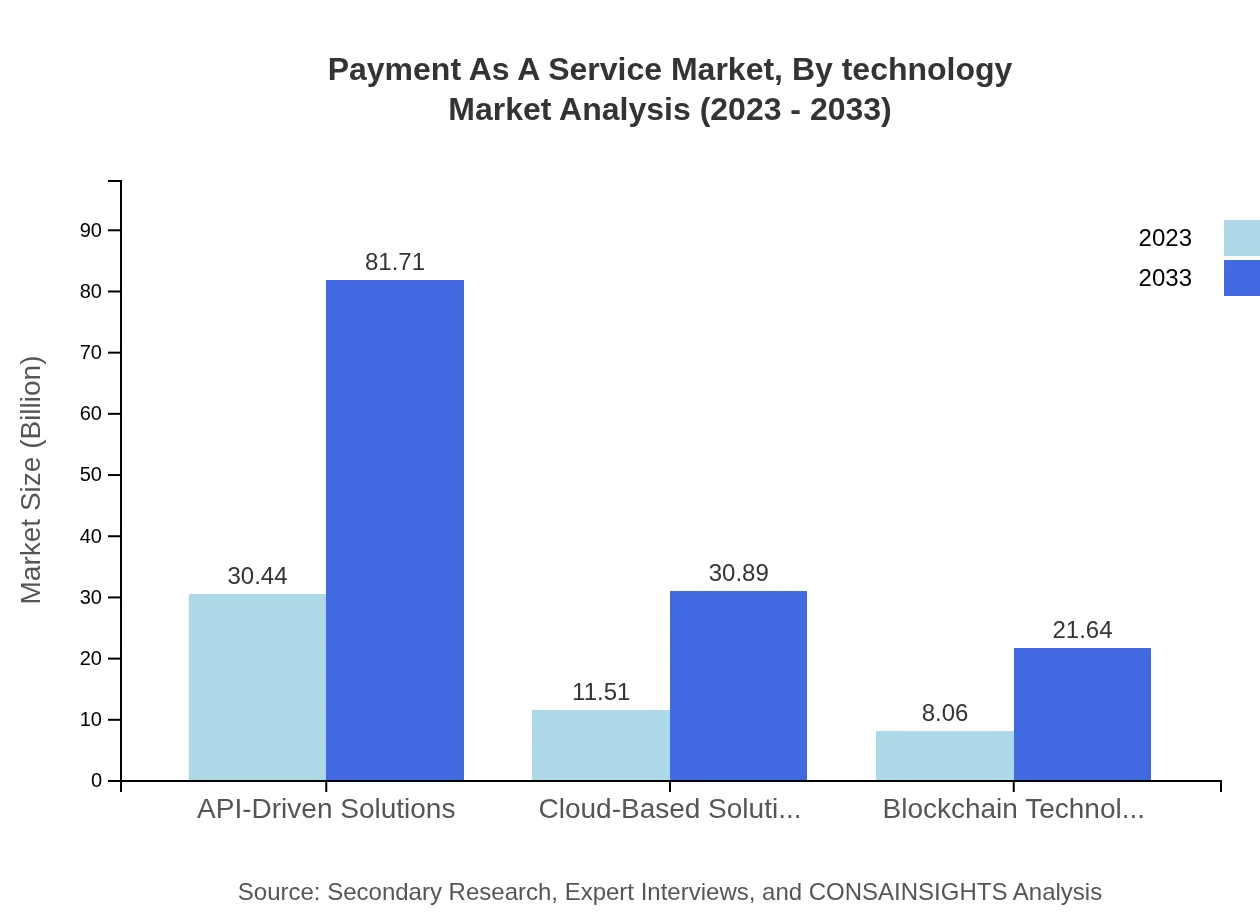

Payment As A Service Market Analysis By Technology

Innovations in technology are crucial for the Payment-as-a-Service market, with API-driven solutions anticipated to dominate with a market size of $30.44 billion in 2023, soaring to $81.71 billion by 2033. Cloud-based and blockchain technology solutions are also notable, reflecting a shift towards scalable operations and enhanced security measures.

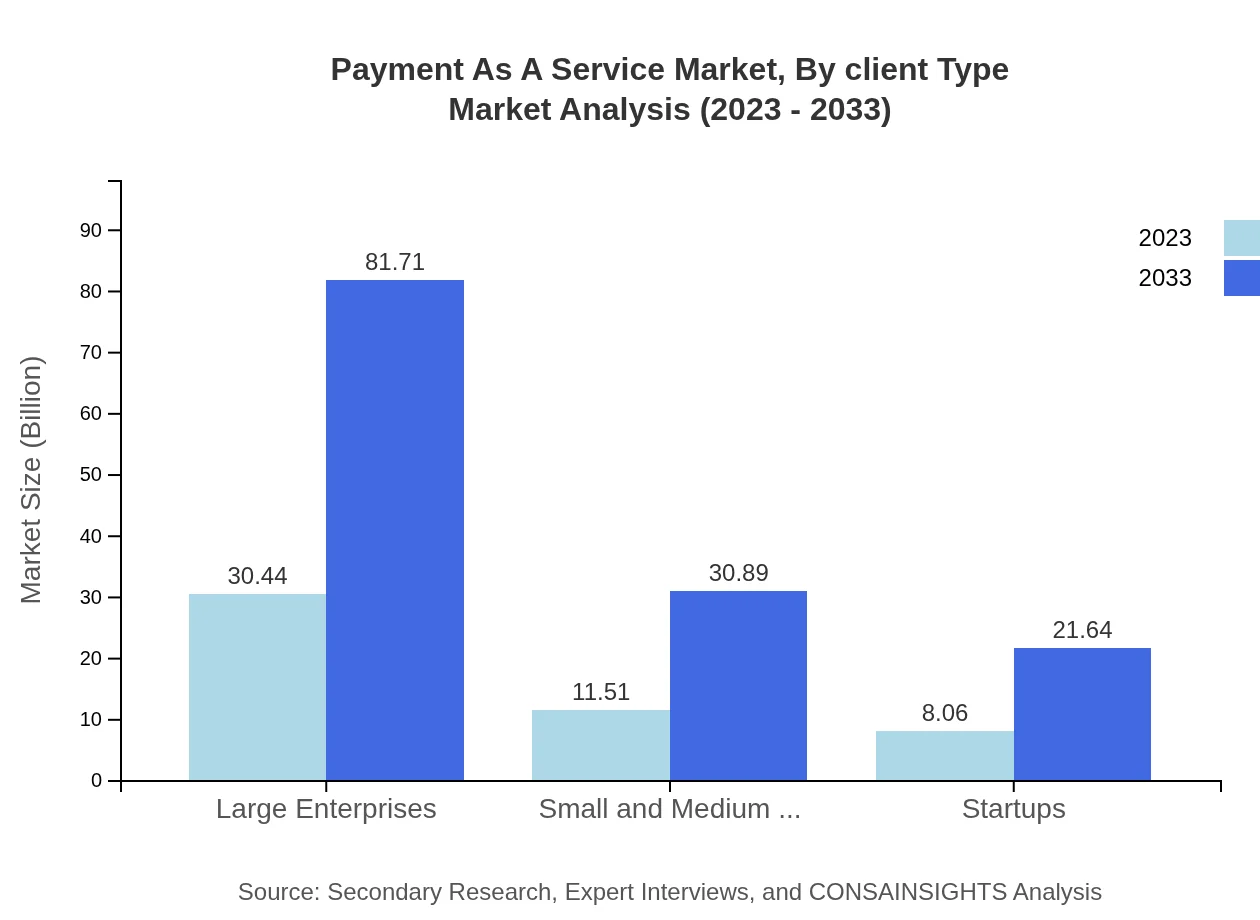

Payment As A Service Market Analysis By Client Type

Large enterprises currently dominate the client type segment, valued at $30.44 billion in 2023 and anticipated to grow to $81.71 billion by 2033. SMBs and startups also present substantial market segments, indicating a widespread adoption of Payment-As-A-Service solutions across various organizational sizes.

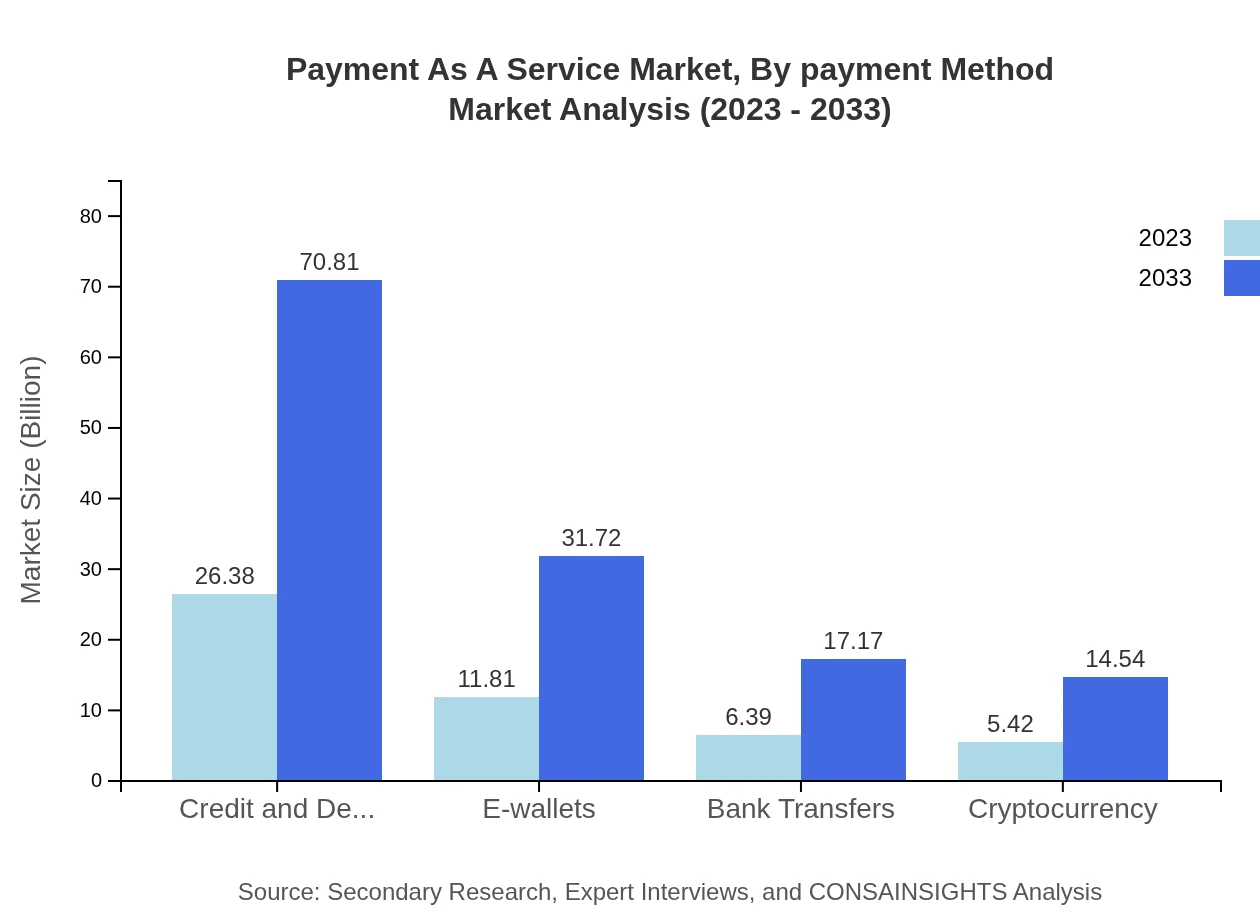

Payment As A Service Market Analysis By Payment Method

Credit and debit cards lead the payment method segment with a market size of $26.38 billion in 2023, with expectations to reach $70.81 billion by 2033. E-wallets and bank transfers also contribute significantly to the market structure, emphasizing the diverse payment options fueling consumer engagement.

Payment As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Payment As A Service Industry

PayPal:

A leading player in digital payments, PayPal enables businesses and consumers worldwide to make secure online payments.Stripe:

Stripe provides tools for online commerce, facilitating transactions for businesses globally with an emphasis on scalability and innovation.Square:

Square specializes in payment processing solutions for merchants, offering hardware and software for point-of-sale services.Adyen:

Adyen connects merchants directly to their customers, offering a unified payment platform that streamlines transactions across various methods.Authorize.Net:

Authorize.Net offers payment gateway services designed for smaller merchants, providing simple and secure payment solutions for online businesses.We're grateful to work with incredible clients.

FAQs

What is the market size of Payment As A Service?

The market size of Payment As A Service in 2023 is valued at approximately $50 billion, with a projected growth at a CAGR of 10% from 2023 to 2033, indicating robust demand and expansion opportunities in the industry.

What are the key market players or companies in this Payment As A Service industry?

Key players in the Payment As A Service industry include major fintech companies and payment solution providers. Their innovative solutions and partnerships drive market competitiveness, fostering growth through enhanced customer experiences and efficient transaction management.

What are the primary factors driving the growth in the Payment As A Service industry?

The growth in the Payment As A Service industry is driven by increasing digital transactions, demand for seamless payment solutions, regulatory changes, and technological advancements such as API-driven solutions and blockchain technology, enabling faster processing and enhanced security.

Which region is the fastest Growing in the Payment As A Service?

The fastest-growing region in the Payment As A Service market is Europe, expected to grow from $17.21 billion in 2023 to $46.22 billion by 2033. North America and Asia Pacific also show significant growth, reflecting rising digital payment adoption.

Does ConsaInsights provide customized market report data for the Payment As A Service industry?

Yes, ConsaInsights provides customized market report data tailored to the specific needs of clients in the Payment As A Service industry, offering insights into size, trends, regional performance, and competitive analysis to support strategic business decisions.

What deliverables can I expect from this Payment As A Service market research project?

From the Payment As A Service market research project, you can expect comprehensive deliverables that include detailed market analysis reports, growth forecasts, competitive landscape assessments, segmentation data, and actionable insights for planning and strategy development.

What are the market trends of Payment As A Service?

Current market trends in Payment As A Service include the rise of contactless payments, integration of AI in fraud detection, increasing popularity of e-wallets, and the adoption of cloud-based solutions, driving operational efficiencies and enhancing customer engagement.