Payment Gateway Market Report

Published Date: 31 January 2026 | Report Code: payment-gateway

Payment Gateway Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Payment Gateway market, covering insights on market size, industry trends, technological advancements, and growth forecasts from 2023 to 2033.

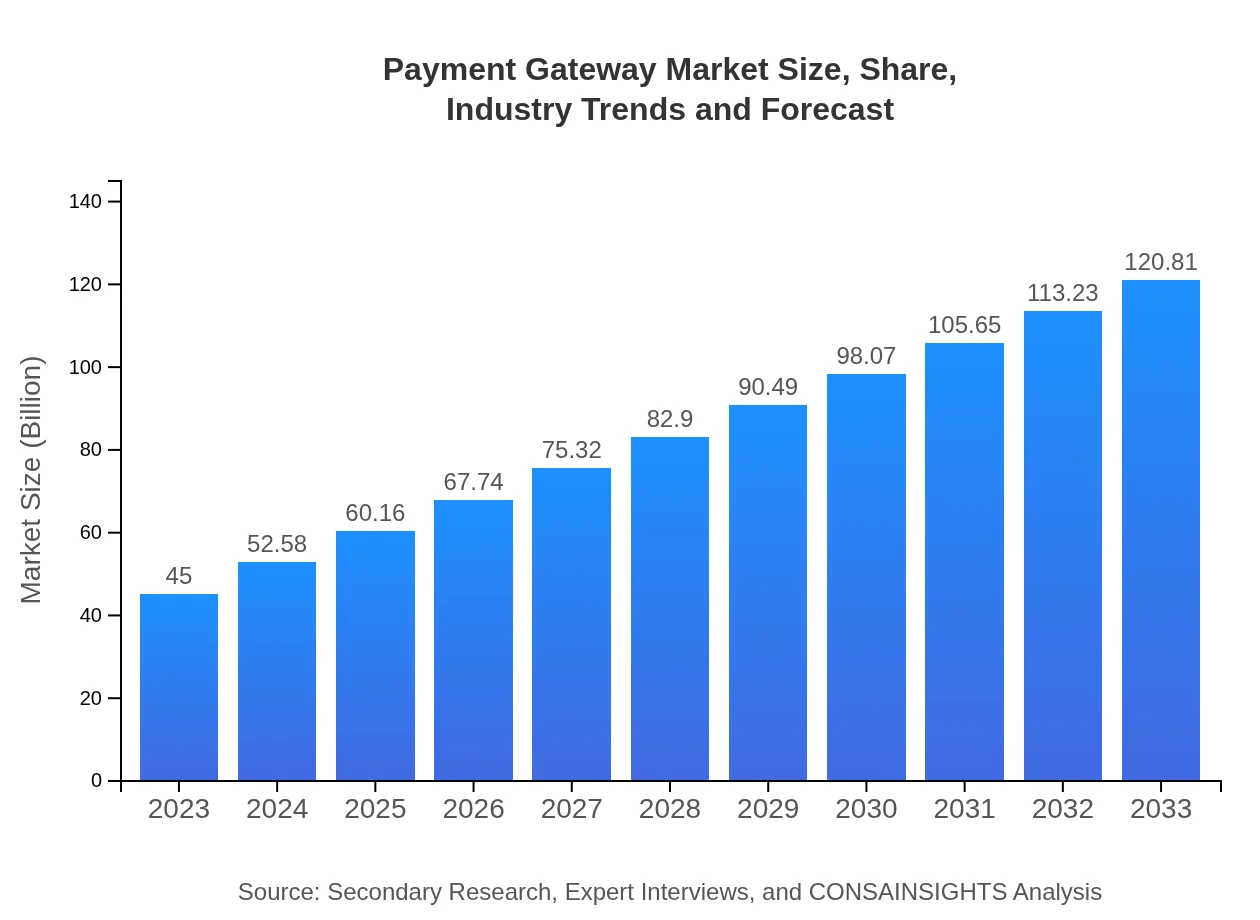

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $120.81 Billion |

| Top Companies | PayPal, Stripe, Square, Authorize.Net, Adyen |

| Last Modified Date | 31 January 2026 |

Payment Gateway Market Overview

Customize Payment Gateway Market Report market research report

- ✔ Get in-depth analysis of Payment Gateway market size, growth, and forecasts.

- ✔ Understand Payment Gateway's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Payment Gateway

What is the Market Size & CAGR of the Payment Gateway market in 2023?

Payment Gateway Industry Analysis

Payment Gateway Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Payment Gateway Market Analysis Report by Region

Europe Payment Gateway Market Report:

In Europe, the market is set to increase from $11.12 billion in 2023 to $29.86 billion by 2033, bolstered by regulations like PSD2 that drive competition and innovation in payment processing, alongside a substantial shift towards digital and mobile payment solutions.Asia Pacific Payment Gateway Market Report:

In the Asia Pacific region, the Payment Gateway market is projected to grow from $9.81 billion in 2023 to $26.34 billion by 2033, driven by strong e-commerce growth and increasing smartphone penetration. The region's diverse payment landscape and rapid digital transformation further contribute to the market's expanding footprint.North America Payment Gateway Market Report:

North America is forecasted to rise from $14.84 billion in 2023 to $39.83 billion by 2033, backed by mature e-commerce ecosystems and a high inclination towards secure and convenient online payments. The presence of leading fintech companies also catalyzes market innovations in payment gateways.South America Payment Gateway Market Report:

The South American market is expected to see growth from $3.45 billion in 2023 to $9.25 billion by 2033, as local businesses increasingly adopt digital payment solutions and e-commerce expands throughout the region, supported by government initiatives to boost the digital economy.Middle East & Africa Payment Gateway Market Report:

The Middle East and Africa region is estimated to grow from $5.78 billion in 2023 to $15.52 billion by 2033, facilitated by an increasing reliance on e-commerce and improvements in internet connectivity. Governments are also encouraging digital payments as part of broader economic reform initiatives.Tell us your focus area and get a customized research report.

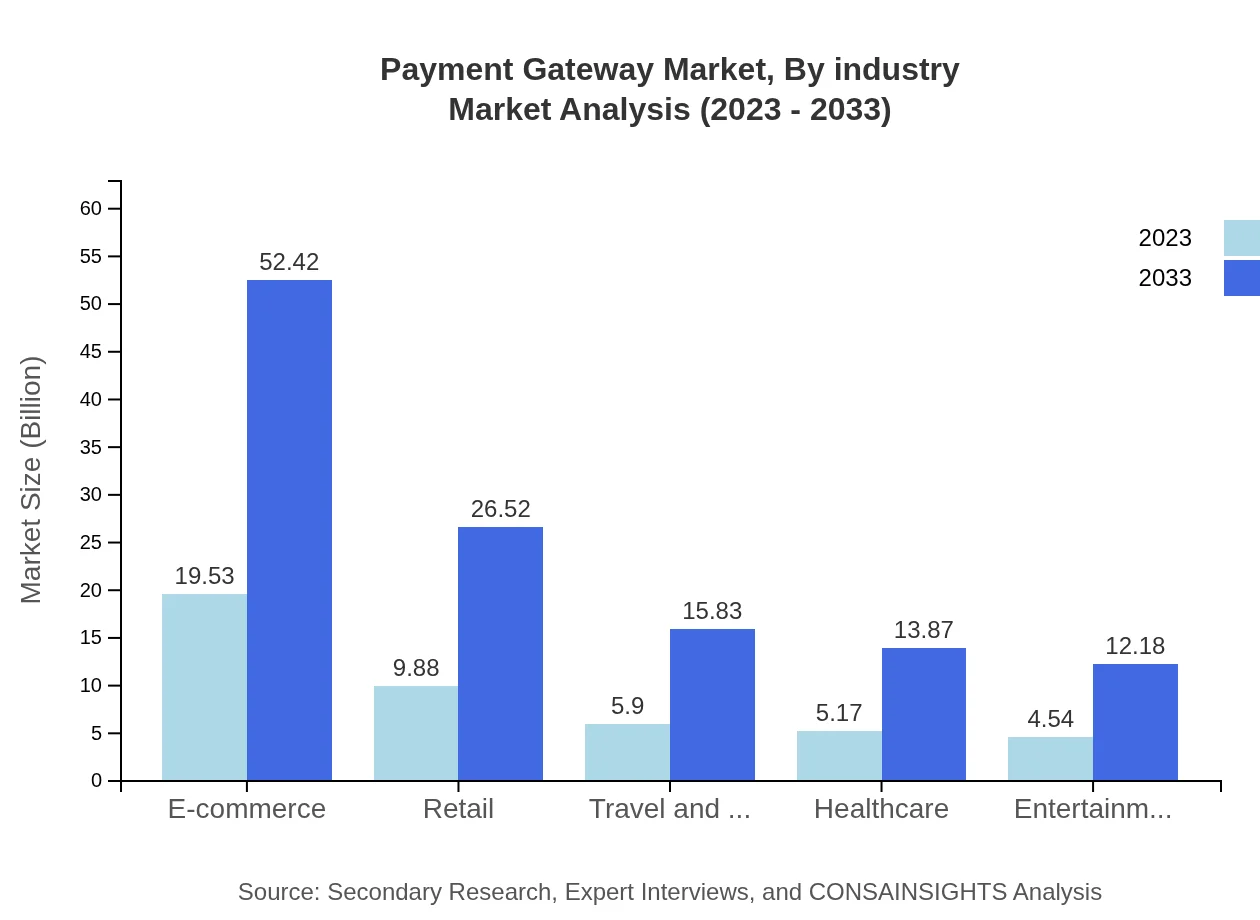

Payment Gateway Market Analysis By Industry

The E-commerce sector leads the market, valued at $19.53 billion in 2023 and expected to grow to $52.42 billion by 2033, holding 43.39% market share. Retail follows with values of $9.88 billion in 2023 and $26.52 billion in 2033, also reflecting a share of 21.95%. Other noteworthy sectors include Travel and Hospitality ($5.90 billion to $15.83 billion, 13.1% share) and Healthcare ($5.17 billion to $13.87 billion, 11.48% share). Entertainment accounts for $4.54 billion in 2023, anticipated to rise to $12.18 billion by 2033.

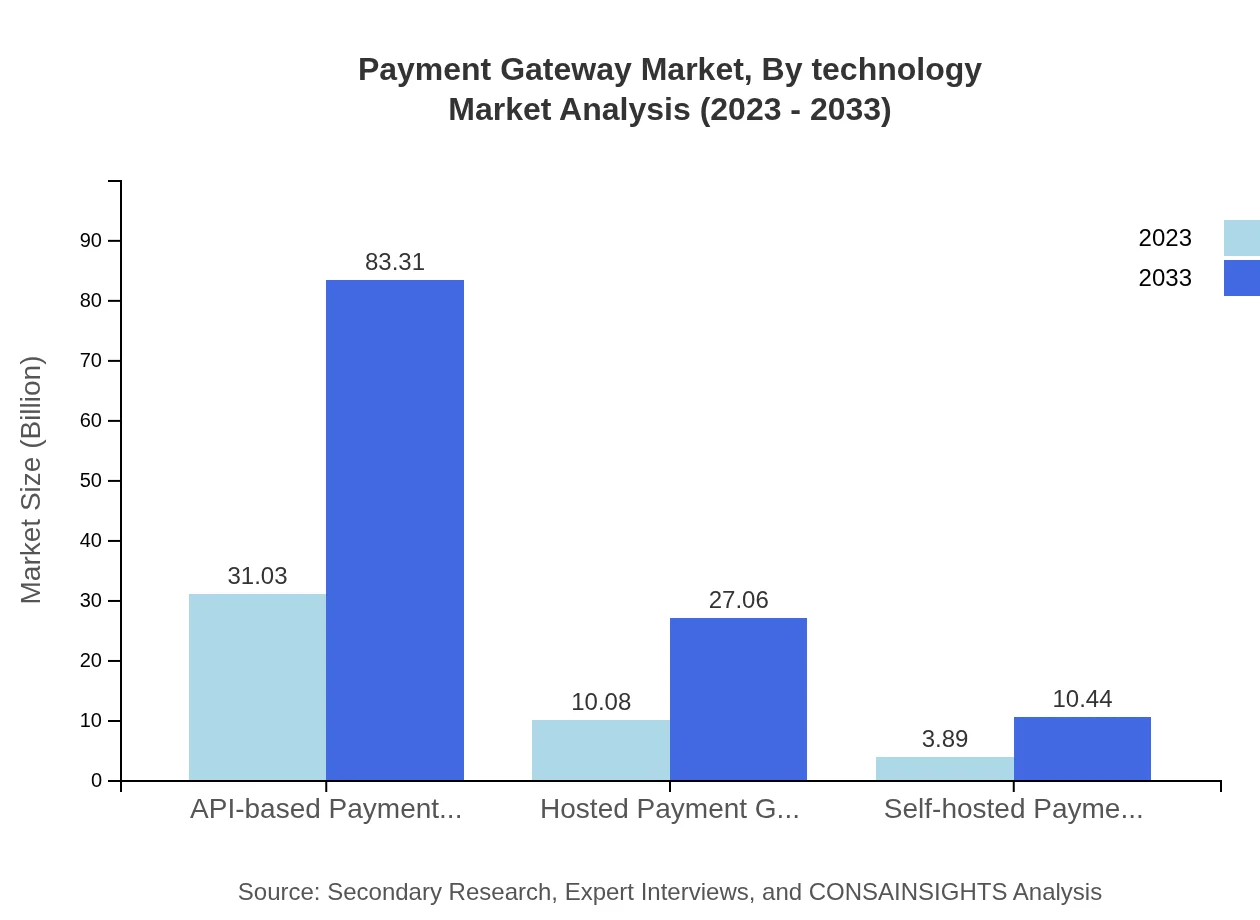

Payment Gateway Market Analysis By Technology

The Payment Gateway market is primarily driven by API-based solutions, accounting for $31.03 billion in 2023 and projected to reach $83.31 billion by 2033, claiming 68.96% market share. Hosted payment gateways show significant promise, expected to grow from $10.08 billion to $27.06 billion, while self-hosted solutions are anticipated to rise from $3.89 billion to $10.44 billion.

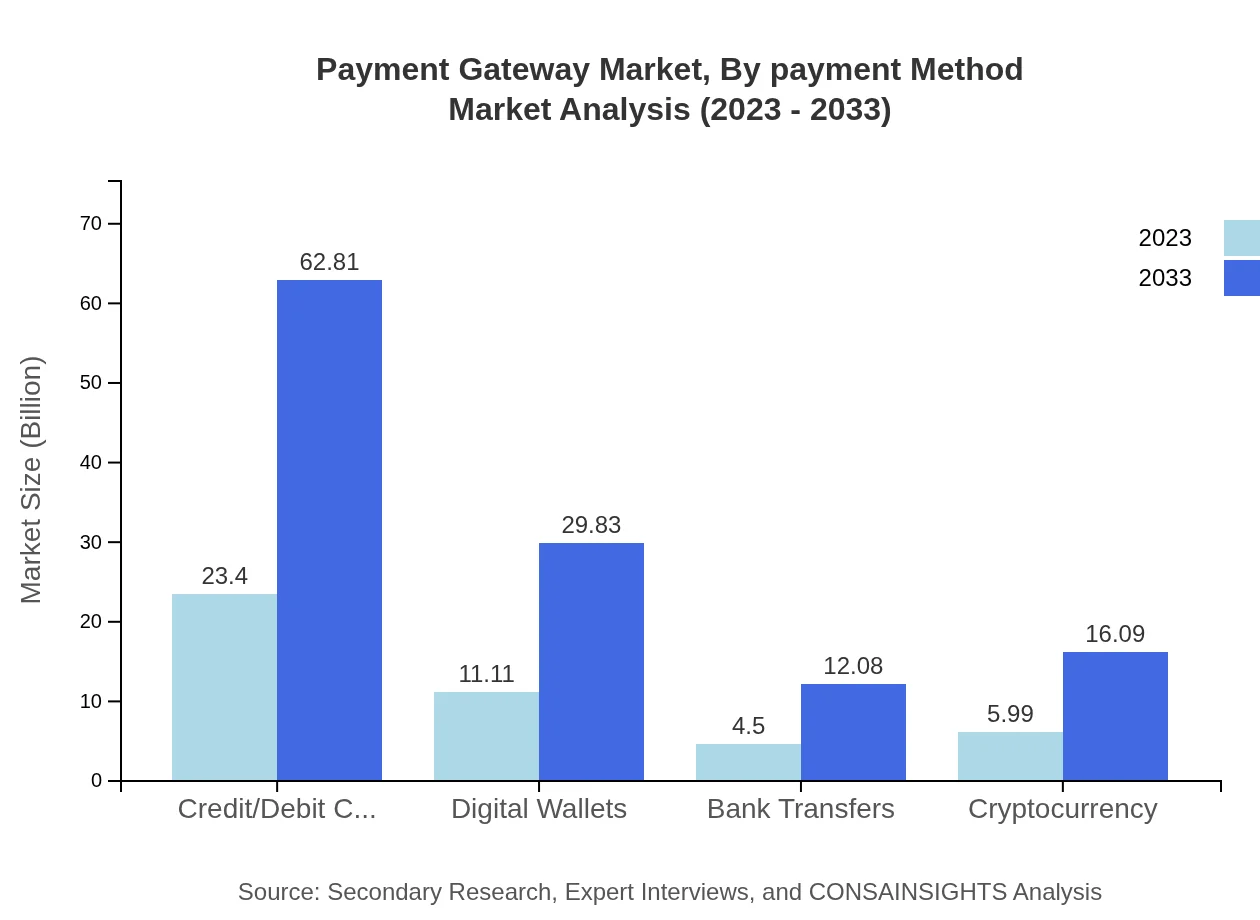

Payment Gateway Market Analysis By Payment Method

Dominating the Payment Method landscape, Credit/Debit Cards are leading with a significant market value of $23.40 billion in 2023, growing to $62.81 billion by 2033 with a 51.99% share. Digital Wallets follow, increasing from $11.11 billion to $29.83 billion. Additionally, Bank Transfers and Cryptocurrencies show promising growth, with respective projections of $4.50 billion to $12.08 billion and $5.99 billion to $16.09 billion.

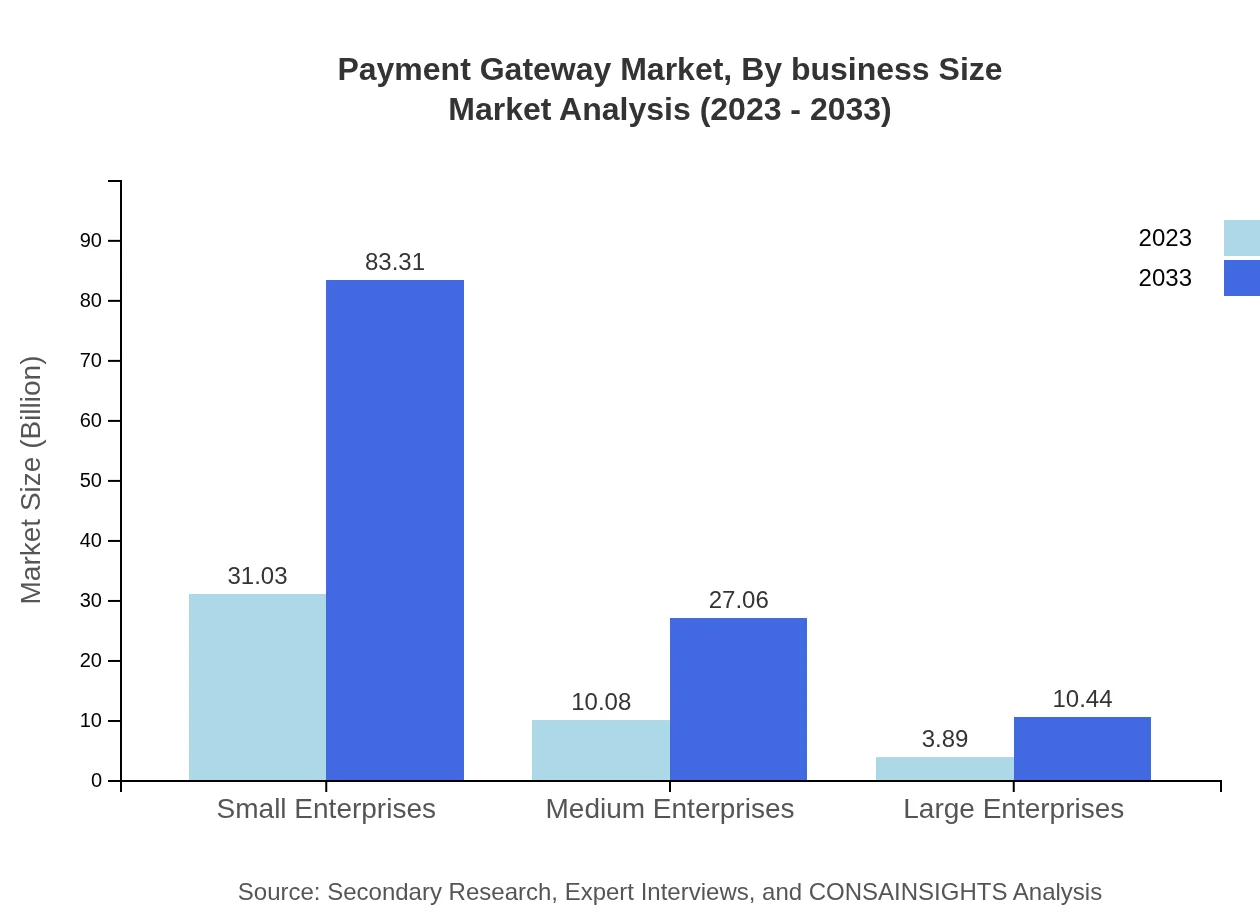

Payment Gateway Market Analysis By Business Size

The landscape shows Small Enterprises leading with $31.03 billion in 2023, expected to climb to $83.31 billion. Medium Enterprises will see growth from $10.08 billion to $27.06 billion, while Large Enterprises are set to grow from $3.89 billion to $10.44 billion.

Payment Gateway Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Payment Gateway Industry

PayPal:

A leading global payment platform that provides a secure and efficient way for businesses and consumers to make payments online.Stripe:

An innovative payment processing company that allows individuals and businesses to make and receive payments over the internet.Square:

A company that provides a suite of payment and point-of-sale solutions for businesses of all sizes, focusing on small and medium enterprises.Authorize.Net:

One of the oldest payment gateway solutions, focusing on providing reliable online payment processing.Adyen:

A comprehensive payment solution offering a multi-channel approach to payment processing for businesses globally.We're grateful to work with incredible clients.

FAQs

What is the market size of payment Gateway?

The global payment gateway market size is projected to reach approximately $45 billion by 2033, growing at a compound annual growth rate (CAGR) of 10% from its current size, reflecting robust demand and technological advancements.

What are the key market players or companies in this payment Gateway industry?

Key market players in the payment gateway industry include large financial technology firms and companies specializing in digital payments, but specific names are not disclosed within the current report.

What are the primary factors driving the growth in the payment gateway industry?

The growth of the payment gateway market is primarily driven by the increase in e-commerce activities, rising smartphone penetration, and the growing preference for digital payment methods across various industries.

Which region is the fastest Growing in the payment gateway?

The fastest-growing region in the payment gateway market is North America, projected to expand from $14.84 billion in 2023 to $39.83 billion in 2033, significantly contributing to regional growth.

Does ConsaInsights provide customized market report data for the payment gateway industry?

Yes, ConsaInsights offers customized market report data tailored to client needs in the payment gateway industry, ensuring insights are relevant to specific business goals and challenges.

What deliverables can I expect from this payment gateway market research project?

Deliverables from the payment gateway market research project include comprehensive market analysis, segmented regional data, growth forecasts, competitive landscape assessments, and tailored insights based on client specifications.

What are the market trends of payment gateway?

Current trends in the payment gateway market include the rise of digital wallets, API-based solutions, and a focus on enhancing security measures to improve user experience and combat fraud.