Payment Processing Solutions Market Report

Published Date: 31 January 2026 | Report Code: payment-processing-solutions

Payment Processing Solutions Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Payment Processing Solutions market, covering market size, segmentation, regional insights, and trends from 2023 to 2033, along with forecasts for growth and challenges ahead.

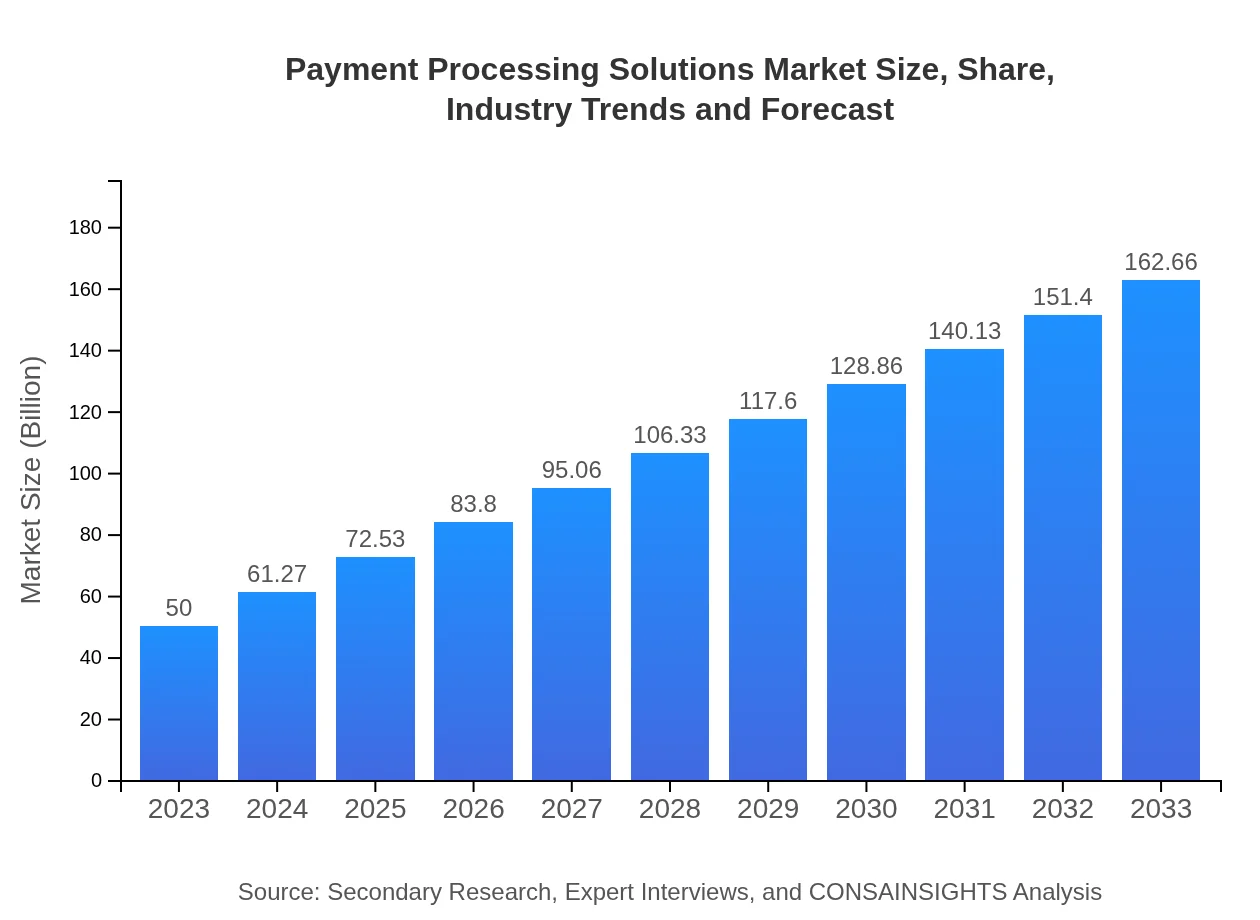

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $162.66 Billion |

| Top Companies | PayPal Holdings Inc., Square, Inc., Stripe, Inc., Adyen N.V., Worldpay, Inc. |

| Last Modified Date | 31 January 2026 |

Payment Processing Solutions Market Overview

Customize Payment Processing Solutions Market Report market research report

- ✔ Get in-depth analysis of Payment Processing Solutions market size, growth, and forecasts.

- ✔ Understand Payment Processing Solutions's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Payment Processing Solutions

What is the Market Size & CAGR of Payment Processing Solutions market in 2023?

Payment Processing Solutions Industry Analysis

Payment Processing Solutions Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Payment Processing Solutions Market Analysis Report by Region

Europe Payment Processing Solutions Market Report:

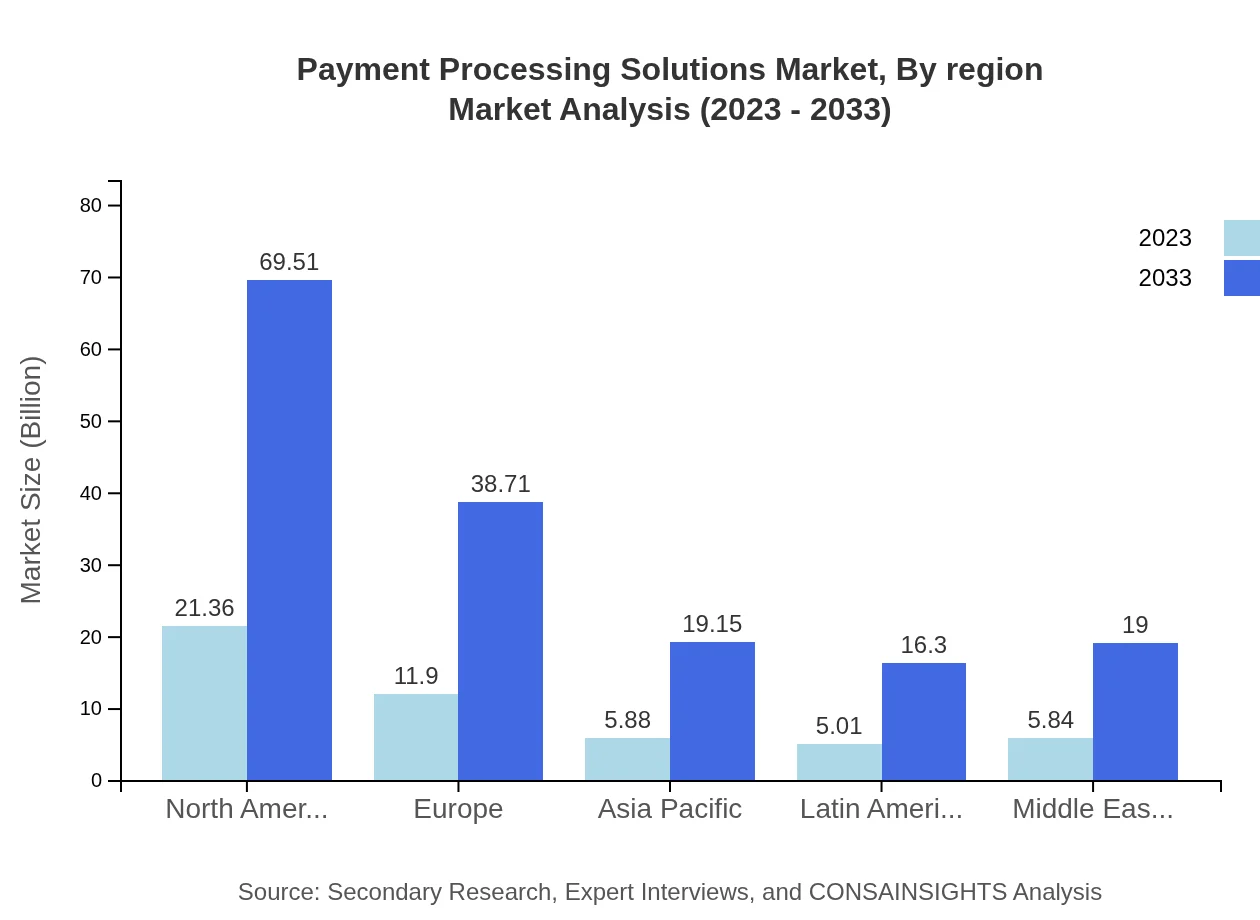

The European market is anticipated to grow substantially from $18.93 billion in 2023 to $61.58 billion by 2033. The region's robust regulatory framework, including GDPR and PSD2, bolsters secure transactions and fosters competition among service providers, significantly impacting growth.Asia Pacific Payment Processing Solutions Market Report:

The Asia Pacific region is witnessing significant growth, moving from $8.11 billion in 2023 to approximately $26.37 billion by 2033, driven by rising smartphone ownership and digital transaction adoption. Countries like China and India are leading the market due to their vast populations and increasing economic activities.North America Payment Processing Solutions Market Report:

North America holds a strong foothold in the Payment Processing Solutions market, with the market size expected to rise from $16.00 billion in 2023 to $52.05 billion by 2033. The U.S. leads in adopting cutting-edge payment technologies, while stringent regulations have enhanced security across transactions.South America Payment Processing Solutions Market Report:

In South America, the Payment Processing Solutions market is projected to grow from $3.85 billion in 2023 to $12.52 billion by 2033. The region is gradually embracing digital payment solutions, with Brazil and Argentina at the forefront of this transition, although challenges such as infrastructure still hinder full market potential.Middle East & Africa Payment Processing Solutions Market Report:

The Middle East and Africa region is expanding from $3.12 billion in 2023 to $10.13 billion by 2033. The rise in mobile payment solutions is rapidly changing the payment landscape, particularly in countries like UAE and South Africa, where digital adoption is accelerating.Tell us your focus area and get a customized research report.

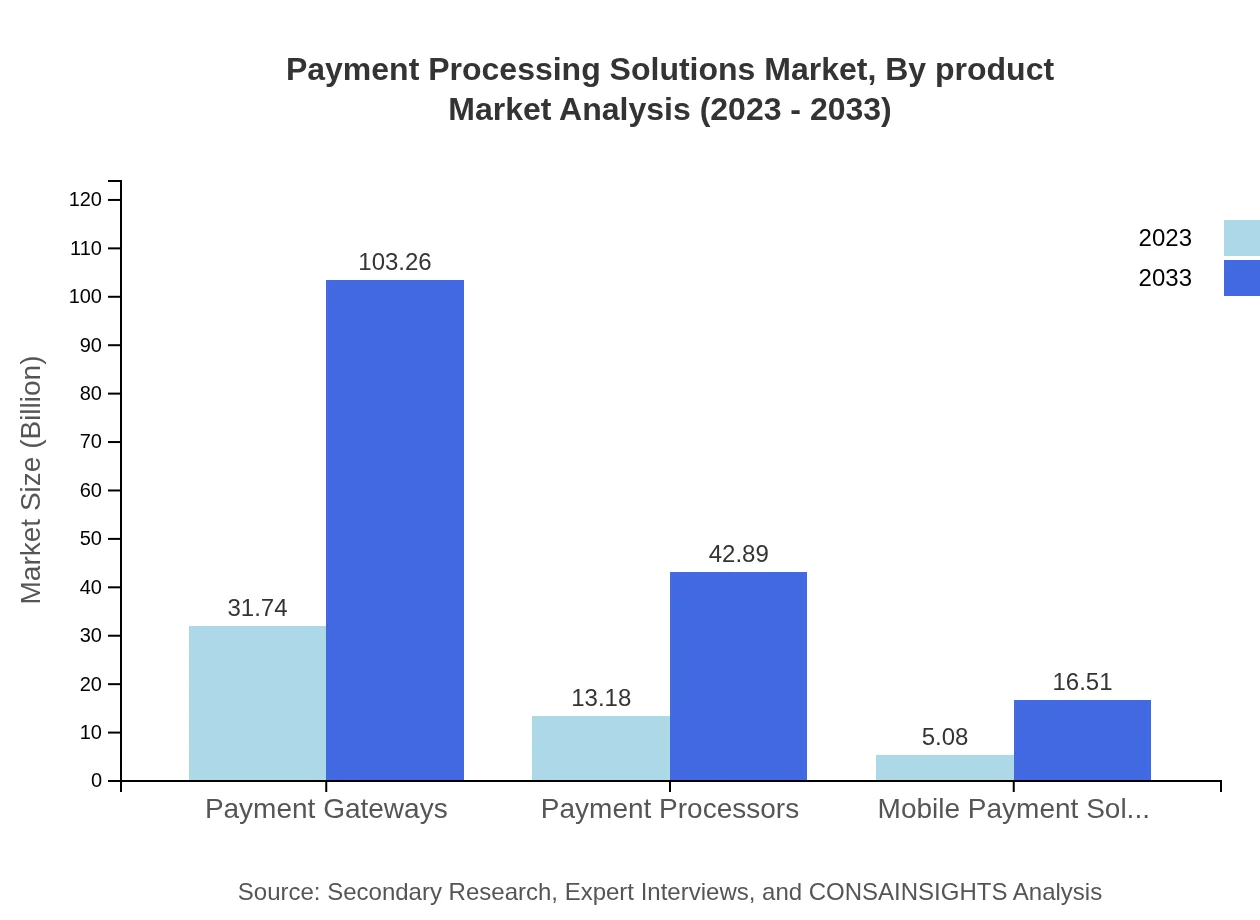

Payment Processing Solutions Market Analysis By Product

The product segmentation in the Payment Processing Solutions market reveals a significant concentration on Payment Gateways, which hold 63.48% of the market share, amounting to $31.74 billion in 2023 and projected to reach $103.26 billion by 2033. Payment Processors account for 26.37% of the market share, with values moving from $13.18 billion in 2023 to $42.89 billion by 2033. Mobile Payment Solutions are increasingly relevant, growing from $5.08 billion to $16.51 billion, indicating a shift in consumer preferences towards mobile transactions.

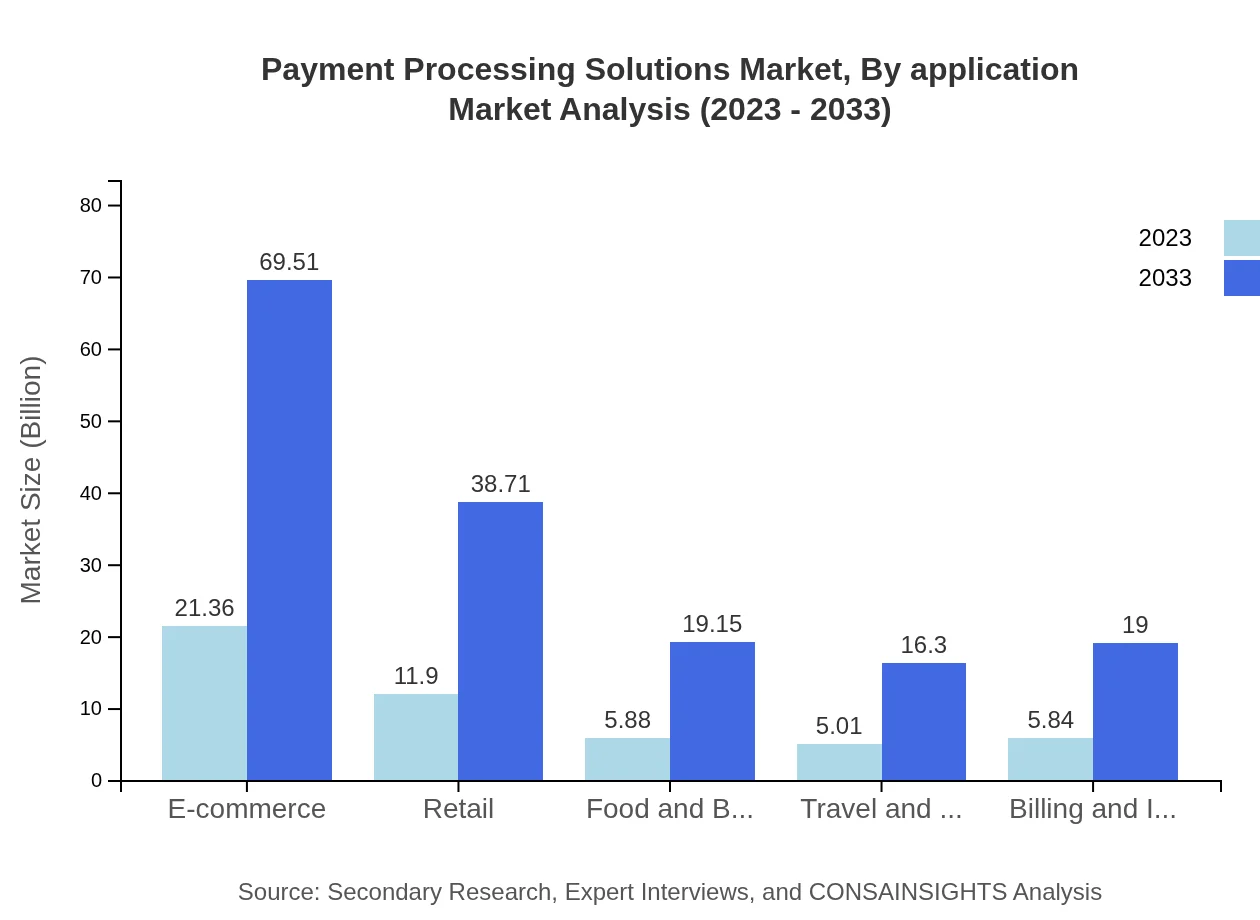

Payment Processing Solutions Market Analysis By Application

The market segmentation by application showcases strong demand in E-commerce, which represents 42.73% of the total market share in 2023, growing from $21.36 billion to $69.51 billion by 2033. Retail applications follow with a significant market presence, while sectors such as Food & Beverage and Travel & Tourism display notable potential growth, particularly through innovative payment solutions that cater to consumer mobility.

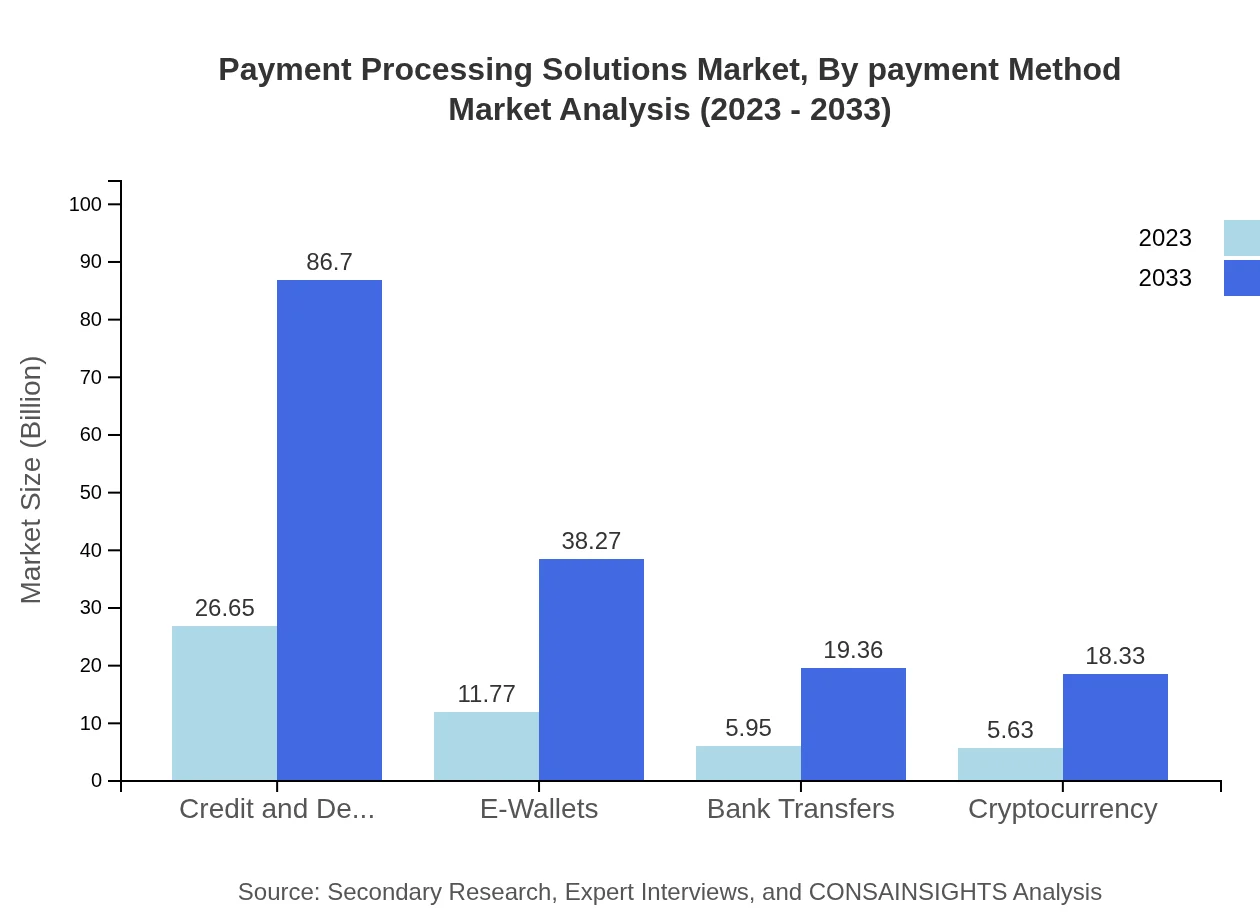

Payment Processing Solutions Market Analysis By Payment Method

Credit and debit cards remain the dominant payment methods, constituting 53.3% of the market share with a size of $26.65 billion in 2023, projected to grow to $86.70 billion by 2033. E-wallets hold a substantial portion at 23.53%, with values increasing from $11.77 billion to $38.27 billion. Other payment methods, including bank transfers and cryptocurrency, are gaining traction as more consumers explore diverse payment channels.

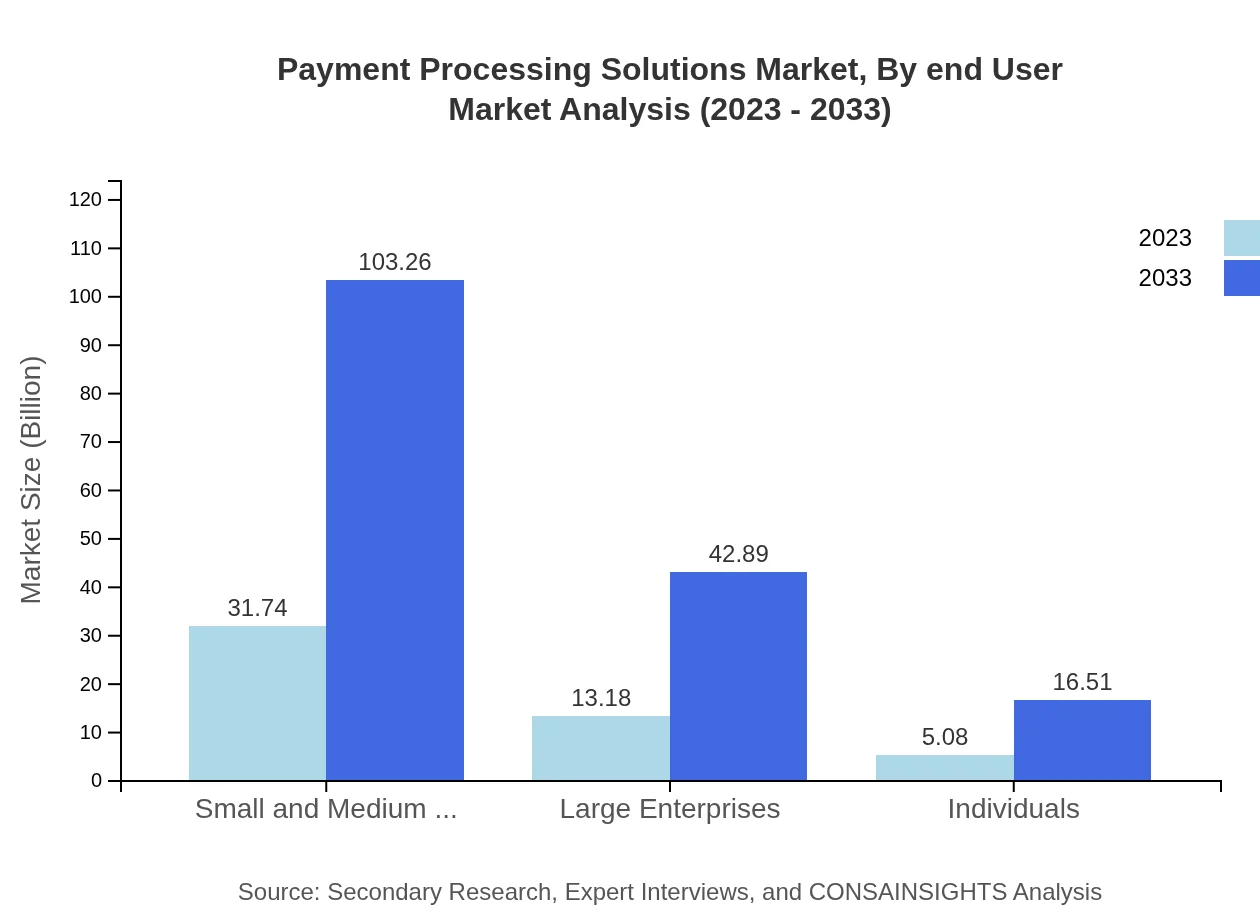

Payment Processing Solutions Market Analysis By End User

The end-user segmentation emphasizes the significant share held by Small and Medium Enterprises (SMEs), accounting for 63.48% of the market, with growth projected from $31.74 billion in 2023 to $103.26 billion by 2033. Large Enterprises, although they hold a smaller portion, represent a crucial market element, moving from $13.18 billion to $42.89 billion within the same period.

Payment Processing Solutions Market Analysis By Region

Regional analysis identifies North America as a principal contributor to the market, holding 42.73% market share at $16.00 billion in 2023. Europe follows closely, demonstrating solid growth driven by regulatory advancements. The Asia Pacific region, while initially smaller, is expected to showcase rapid expansion, reflecting superior increases in market size over the forecast period.

Payment Processing Solutions Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Payment Processing Solutions Industry

PayPal Holdings Inc.:

A leading provider of digital payment solutions, PayPal facilitates transactions among consumers and merchants with a robust platform focused on security and ease of use.Square, Inc.:

Square offers a range of financial services, allowing small businesses to accept card payments, manage their finances, and connect with consumers through innovative solutions.Stripe, Inc.:

Stripe provides payment processing infrastructure for the internet, facilitating online payments for businesses of all sizes with extensive APIs and robust support.Adyen N.V.:

Adyen is a global payment company that allows businesses to accept payments, offering unparalleled support for a variety of payment methods worldwide.Worldpay, Inc.:

Worldpay is a prominent payment processing company that helps businesses manage payments and offers tailored solutions in various industry sectors globally.We're grateful to work with incredible clients.

FAQs

What is the market size of payment Processing Solutions?

The payment processing solutions market is projected to reach approximately $50 billion by 2033, growing at a CAGR of 12% from its current size. This growth is driving increased investments and innovations within the sector, positioning it as a critical financial infrastructure.

What are the key market players or companies in the payment Processing Solutions industry?

Key players include PayPal, Square, Stripe, Adyen, and Worldpay. These companies are recognized for their extensive range of services in payment gateways, mobile transactions, and integration solutions, which cater to businesses of all sizes globally.

What are the primary factors driving the growth in the payment Processing Solutions industry?

Factors driving growth include the surge in e-commerce activities, the rise in digital payment adoption, increased demand for convenient payment methods, and growth in regulatory support aimed at enhancing payment security and efficiency in transactions.

Which region is the fastest Growing in the payment Processing Solutions market?

The payment processing solutions market is fastest-growing in the North America region, projected to increase from $16.00 billion in 2023 to $52.05 billion by 2033, reflecting a significant market expansion in digital payment methods in this area.

Does ConsaInsights provide customized market report data for the payment Processing Solutions industry?

Yes, ConsaInsights offers customized market report data specific to the payment-processing solutions industry, allowing clients to obtain tailored insights that meet their unique market research requirements, including specific regional and segment data.

What deliverables can I expect from this payment Processing Solutions market research project?

Deliverables include comprehensive market analysis, segmentation data, regional insights, competitive landscape assessments, and actionable recommendations, providing a clear overview of opportunities and challenges within the payment processing solutions market.

What are the market trends of payment Processing Solutions?

Market trends include a strong shift towards mobile and contactless payments, enhancements in fraud detection technologies, increased use of artificial intelligence for payment processing efficiency, and a growing emphasis on seamless customer experiences in transaction processes.