Payment Processor Market Report

Published Date: 31 January 2026 | Report Code: payment-processor

Payment Processor Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Payment Processor market, covering trends, segmentation, regional insights, and future forecasts from 2023 to 2033, illustrating the evolution of technology and consumer behavior in payment processing.

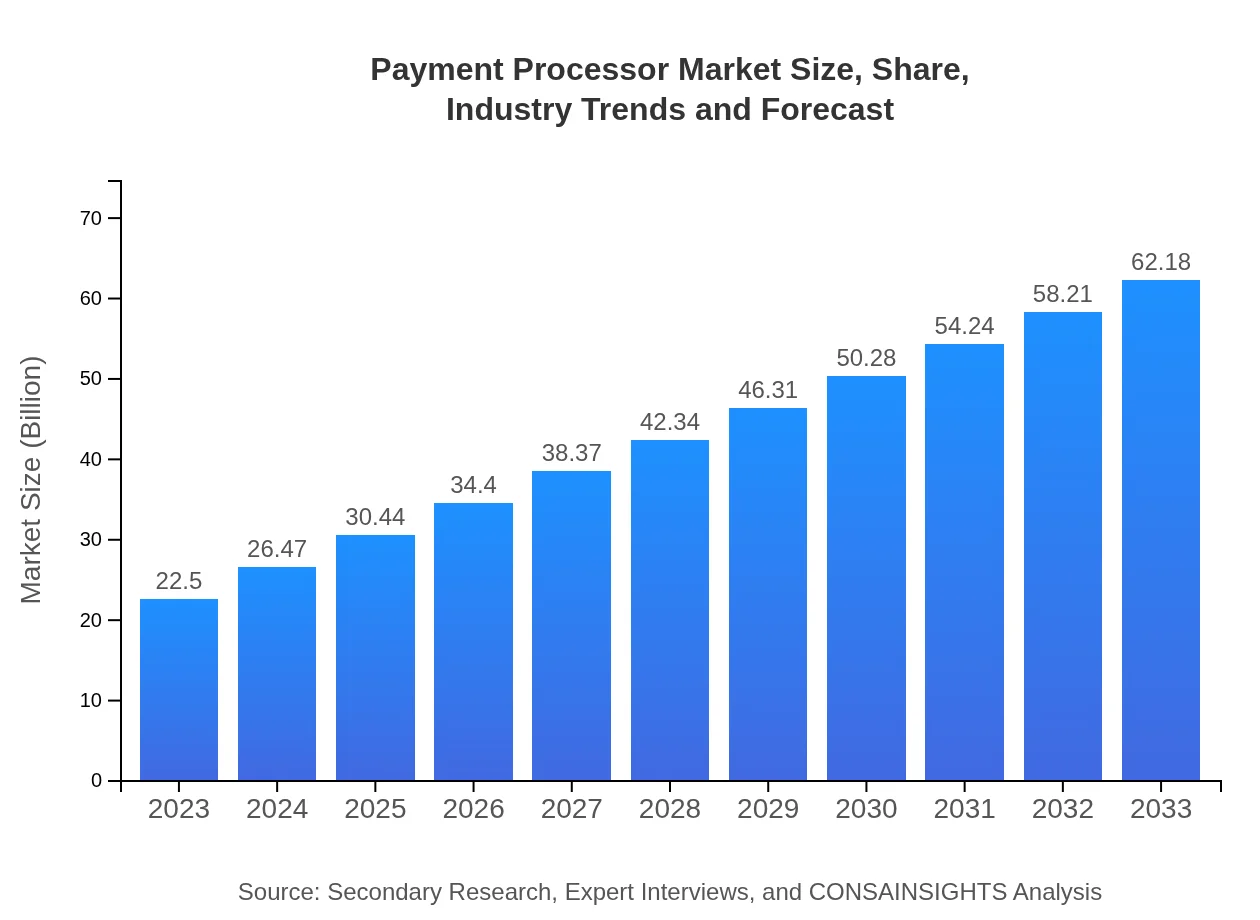

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $22.50 Billion |

| CAGR (2023-2033) | 10.3% |

| 2033 Market Size | $62.18 Billion |

| Top Companies | PayPal Holdings, Inc., Square, Inc., Stripe, Inc., Adyen N.V. |

| Last Modified Date | 31 January 2026 |

Payment Processor Market Overview

Customize Payment Processor Market Report market research report

- ✔ Get in-depth analysis of Payment Processor market size, growth, and forecasts.

- ✔ Understand Payment Processor's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Payment Processor

What is the Market Size & CAGR of Payment Processor market in 2023?

Payment Processor Industry Analysis

Payment Processor Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Payment Processor Market Analysis Report by Region

Europe Payment Processor Market Report:

The European market is projected to witness robust growth, climbing from $7.94 billion in 2023 to $21.94 billion by 2033. The adoption of innovative payment solutions, coupled with stringent regulations focused on consumer protection and data security, plays a vital role in enhancing market opportunities across the region.Asia Pacific Payment Processor Market Report:

The Asia Pacific region is estimated to reach $10.42 billion by 2033, growing from $3.77 billion in 2023. This growth is fueled by the rapid digitalization of economies, increasing smartphone penetration, and a burgeoning middle class demanding fast and efficient payment solutions. Countries like China and India are at the forefront of adopting digital payments, enhancing the region's overall market dynamics.North America Payment Processor Market Report:

North America is expected to dominate the market, increasing from $7.55 billion in 2023 to $20.86 billion by 2033. The region is characterized by a high level of internet penetration, advanced technological infrastructure, and established consumer trust in digital transactions, which are critical factors supporting this growth.South America Payment Processor Market Report:

In South America, the Payment Processor market is projected to grow from $0.34 billion in 2023 to $0.95 billion by 2033. This region is witnessing rising adoption of digital payments due to government initiatives aimed at increasing financial inclusion and the growing trend towards e-commerce, particularly among younger consumers.Middle East & Africa Payment Processor Market Report:

The Middle East and Africa market is anticipated to expand from $2.90 billion in 2023 to $8.01 billion by 2033, driven by a rise in e-commerce activities and governmental initiatives toward a cashless economy. The growing number of fintech startups is also enhancing competitiveness and innovation in the payment processing landscape.Tell us your focus area and get a customized research report.

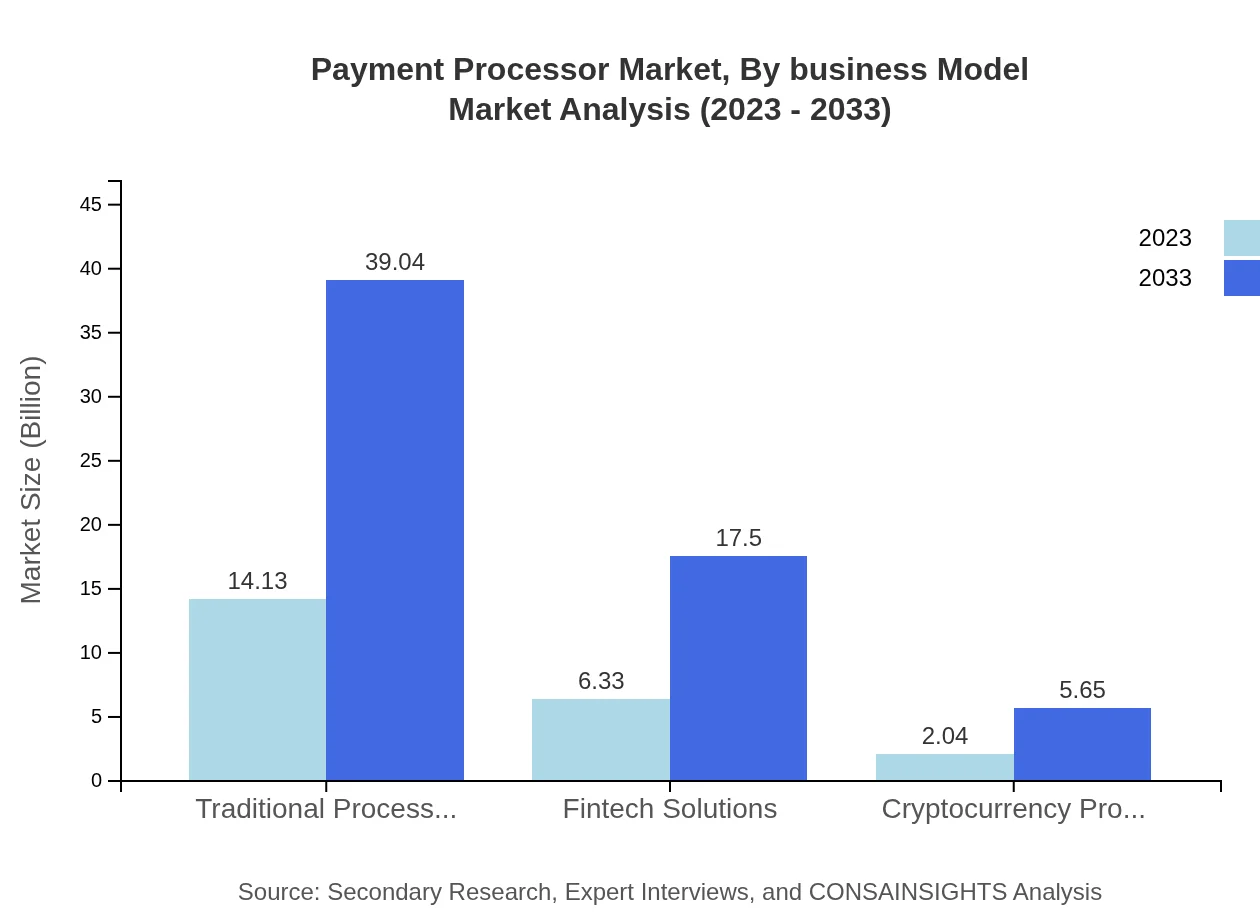

Payment Processor Market Analysis By Transaction Type

The global Payment Processor market is segmented by transaction type, with traditional processors leading the size at $14.13 billion in 2023, projected to reach $39.04 billion by 2033, maintaining a market share of 62.78%. Fintech solutions follow, starting at $6.33 billion and growing to $17.50 billion, making up 28.14% of the market. Cryptocurrency processors contribute approximately $2.04 billion, reflecting a continued interest in alternative currencies. Credit cards and other payment methods such as mobile wallets are also gaining traction, responding to the demand for diverse payment options.

Payment Processor Market Analysis By Business Model

Market segmentation by business model reveals traditional transaction processors still hold a significant share, with fintech companies growing rapidly due to the demand for innovative solutions. These firms are focusing on underbanked demographics while providing added value through analytics and digital finance solutions, thus diversifying the offerings within this segment.

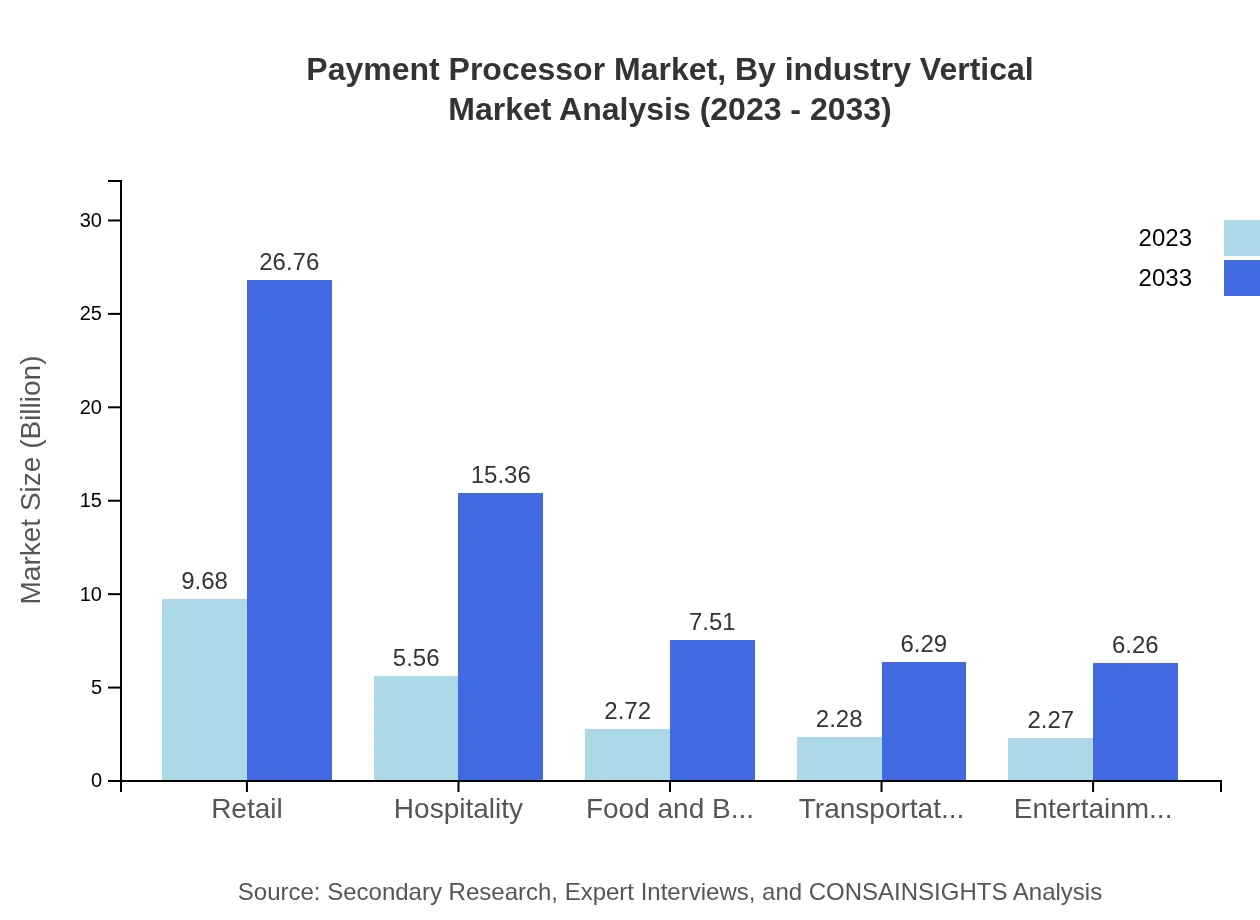

Payment Processor Market Analysis By Industry Vertical

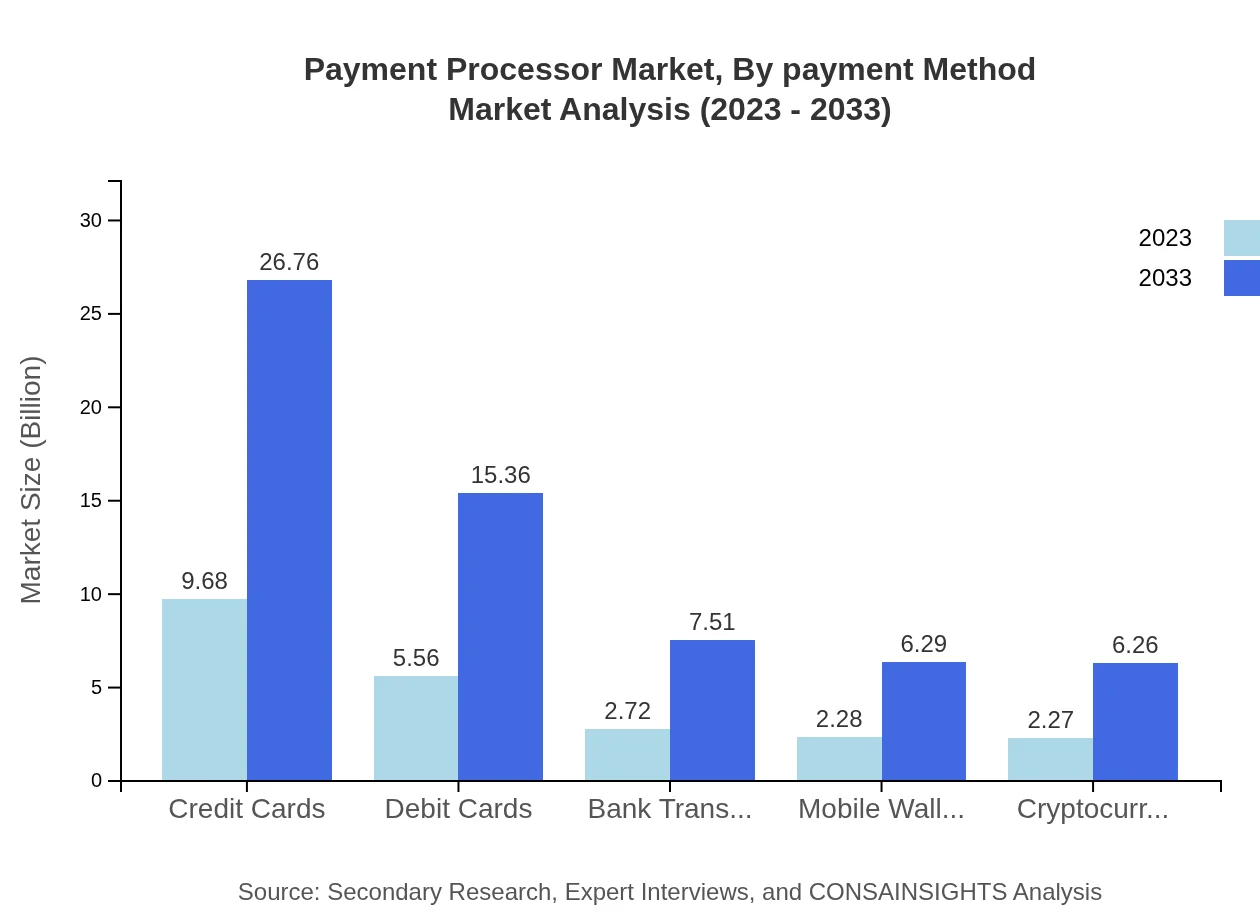

Across various industry verticals, retail dominates the Payment Processor market, projected to grow significantly from $9.68 billion in 2023 to $26.76 billion by 2033. Other notable sectors include hospitality, food and beverage, and transportation, illustrating the widespread reliance on digital payment solutions across diverse fields.

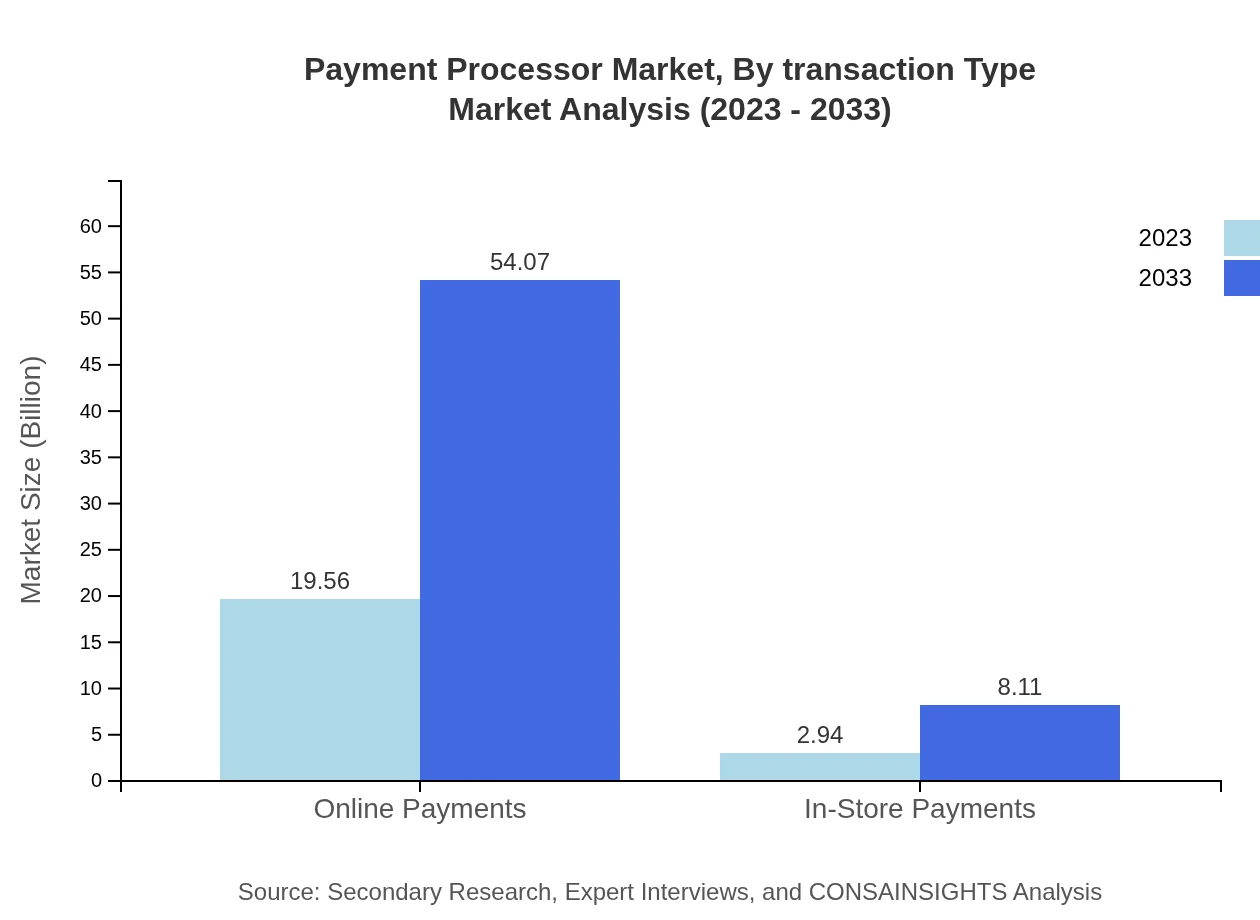

Payment Processor Market Analysis By Payment Method

Payment method distribution showcases online payments leading the market at $19.56 billion in 2023, expected to surge to $54.07 billion by 2033. Other methods such as debit and credit card transactions are also prevalent, highlighting the importance of providing versatile payment solutions to accommodate consumer preferences.

Payment Processor Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Payment Processor Industry

PayPal Holdings, Inc.:

A leading payment processing platform enabling digital transactions worldwide, PayPal is known for its user-friendly interface and robust security measures, catering primarily to e-commerce businesses.Square, Inc.:

Square provides payment processing solutions that empower businesses of all sizes to accept payments and manage transactions easily. Their innovative approach, especially in mobile payments, positions them as a key player in the industry.Stripe, Inc.:

Stripe is a premier online payment processor that offers advanced payment infrastructure for internet businesses, focusing on technical ease of integration and a global payment platform.Adyen N.V.:

Adyen operates as a global payment company, providing a seamless payment experience for online and in-store transactions, serving notable clients across various sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of payment Processor?

The payment processor market is estimated to reach a market size of $22.5 billion in 2023, with a robust CAGR of 10.3%, projecting significant growth leading up to 2033.

What are the key market players or companies in this payment Processor industry?

Key players in the payment processor industry include major financial technology firms and banks which develop payment processing solutions, along with emerging blockchain-based companies providing cryptocurrency transaction services.

What are the primary factors driving the growth in the payment processor industry?

The growth of the payment processor market is driven by increased digital transactions, the rise of e-commerce, and the shift towards mobile payments, coupled with advancements in security technologies.

Which region is the fastest Growing in the payment processor market?

The fastest-growing region in the payment processor market is Asia Pacific, projected to grow from $3.77 billion in 2023 to $10.42 billion by 2033, indicating substantial market potential.

Does ConsaInsights provide customized market report data for the payment processor industry?

Yes, ConsaInsights offers customized market report data for the payment processor industry, providing tailored insights that meet specific business needs and strategic goals.

What deliverables can I expect from this payment processor market research project?

Expect detailed reports containing market size, growth forecasts, competitive analysis, regional insights, and segment data to guide your strategic decisions in the payment processor market.

What are the market trends of payment processor?

Current market trends in the payment processor industry include increasing adoption of fintech solutions, a rise in mobile and online payment methods, and a growing focus on enhancing transaction security.