Payment Security Market Report

Published Date: 31 January 2026 | Report Code: payment-security

Payment Security Market Size, Share, Industry Trends and Forecast to 2033

This report covers the Payment Security market from 2023 to 2033, providing insights into market trends, size, segmentation, and regional analysis. It also highlights prominent players and forecasts future developments within the industry.

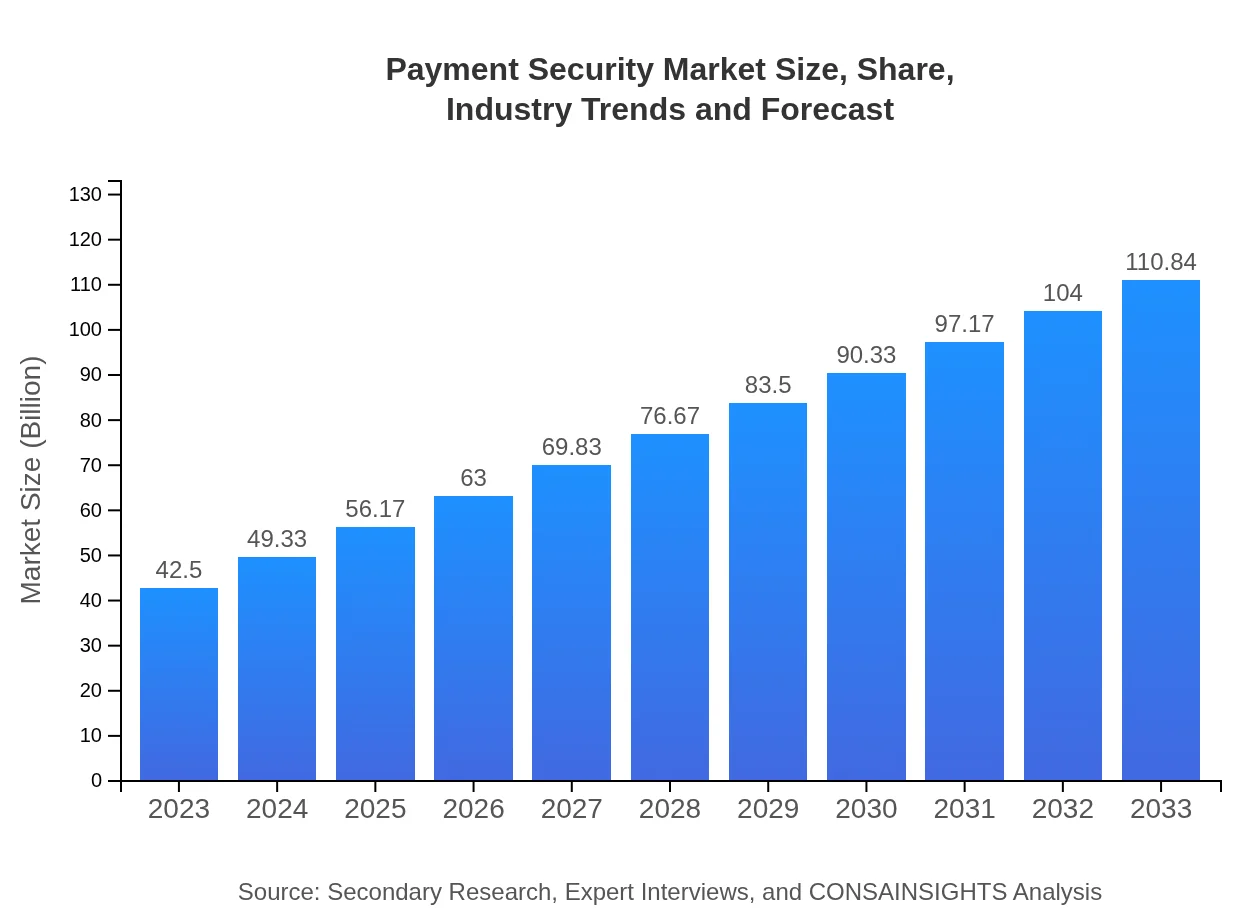

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $42.50 Billion |

| CAGR (2023-2033) | 9.7% |

| 2033 Market Size | $110.84 Billion |

| Top Companies | IBM Security, PayPal, Visa Inc., RSA Security |

| Last Modified Date | 31 January 2026 |

Payment Security Market Overview

Customize Payment Security Market Report market research report

- ✔ Get in-depth analysis of Payment Security market size, growth, and forecasts.

- ✔ Understand Payment Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Payment Security

What is the Market Size & CAGR of Payment Security market in 2023?

Payment Security Industry Analysis

Payment Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Payment Security Market Analysis Report by Region

Europe Payment Security Market Report:

In Europe, the market is projected to grow from $10.85 billion in 2023 to $28.31 billion by 2033. European countries are implementing stringent regulations like GDPR, compelling businesses to prioritize data and transaction security. Moreover, the adoption of secure payment methods and advanced technologies is high, reflecting significant investments in the Payment Security sector.Asia Pacific Payment Security Market Report:

As of 2023, the Payment Security market in the Asia Pacific is valued at approximately $9.27 billion and is expected to grow to $24.18 billion by 2033. The region is witnessing an increase in internet penetration and mobile payments, leading to higher demands for payment security solutions. Countries like China and India are at the forefront of adopting innovative payment technologies, contributing significantly to market growth, driven by regulatory mandates and consumer expectations.North America Payment Security Market Report:

North America leads the Payment Security market, with a value of approximately $13.78 billion in 2023, expected to escalate to $35.93 billion by 2033. The region benefits from technological advancements and a strong regulatory framework, ensuring high demand for sophisticated payment security solutions. A focus on minimizing cyber fraud and extensive digital transformation initiatives is driving growth.South America Payment Security Market Report:

In South America, the Payment Security market was valued at $4.15 billion in 2023, and projections suggest it will reach about $10.82 billion by 2033. The growing e-commerce sector and a rising number of payment fraud incidents are compelling businesses in this region to adopt more advanced security solutions. Regulatory developments also push firms to enhance their security measures.Middle East & Africa Payment Security Market Report:

The Middle East and Africa's Payment Security market is valued at $4.45 billion in 2023, anticipated to grow to $11.59 billion by 2033. The region's market is in phase with increasing awareness surrounding cybersecurity threats and a spurt in digital payments. Countries in this region are investing in payment security measures to curb rising fraudulent activities and enhance technological capabilities.Tell us your focus area and get a customized research report.

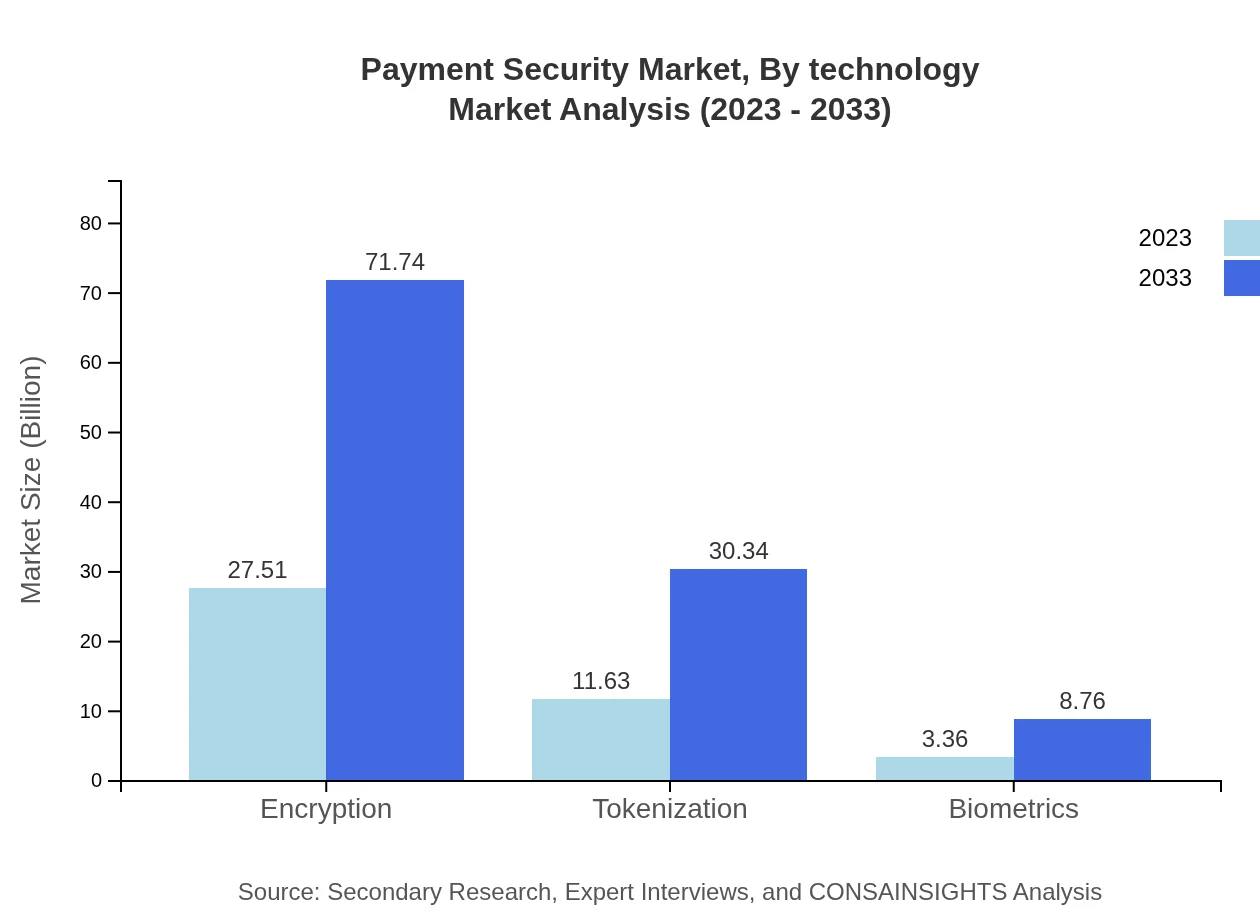

Payment Security Market Analysis By Technology

The Payment Security market by technology is dominated by encryption solutions, projected to rise from $27.51 billion in 2023 to $71.74 billion in 2033. Tokenization also plays a significant role, growing from $11.63 billion to $30.34 billion during the same period. Biometric solutions represent a smaller portion but are gaining traction due to increasing security demands.

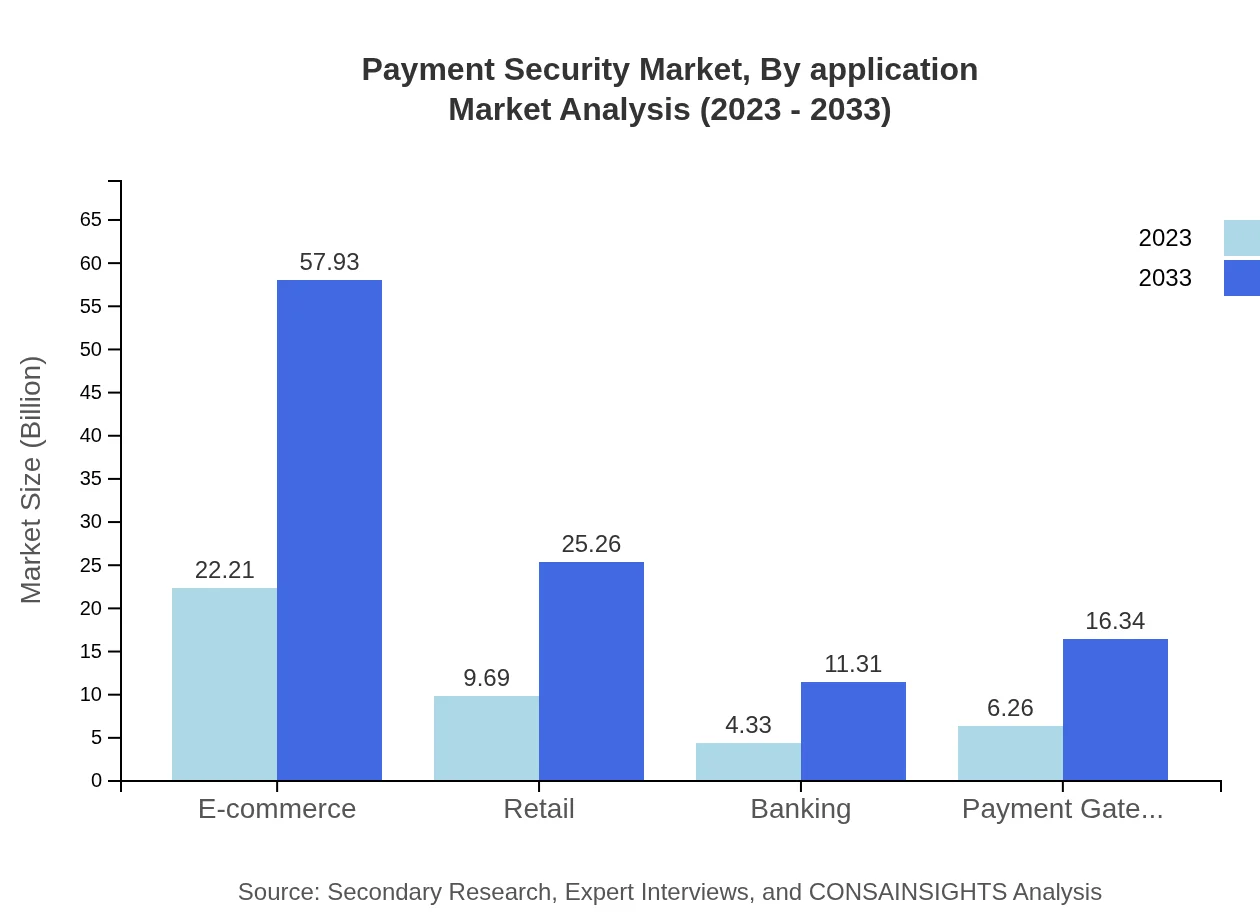

Payment Security Market Analysis By Application

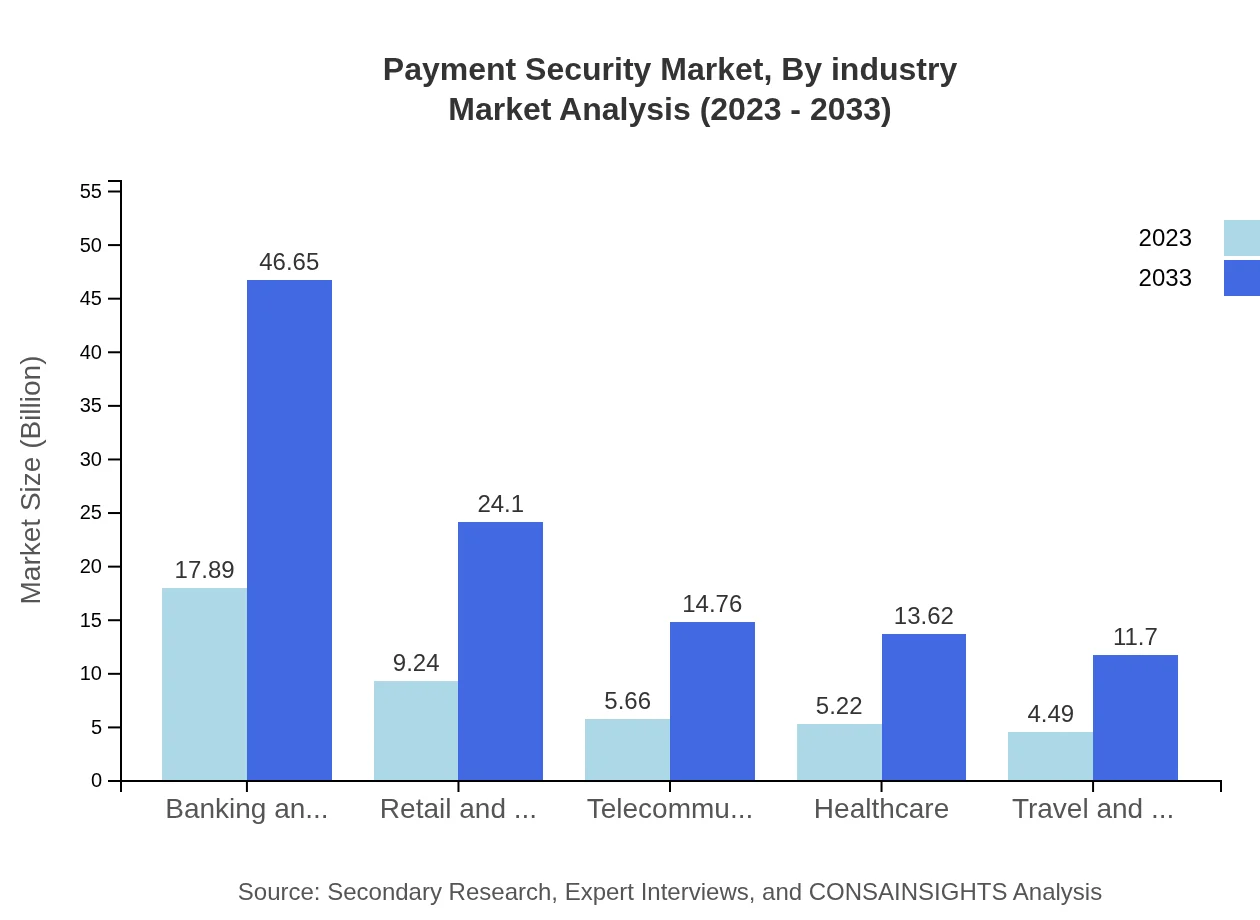

In the applications segment, Banking and Financial Services command a large share, expected to grow from $17.89 billion to $46.65 billion by 2033. Retail and E-commerce applications also show significant growth, moving to $24.10 billion. Telecommunications and Healthcare are special sectors increasingly investing in security measures.

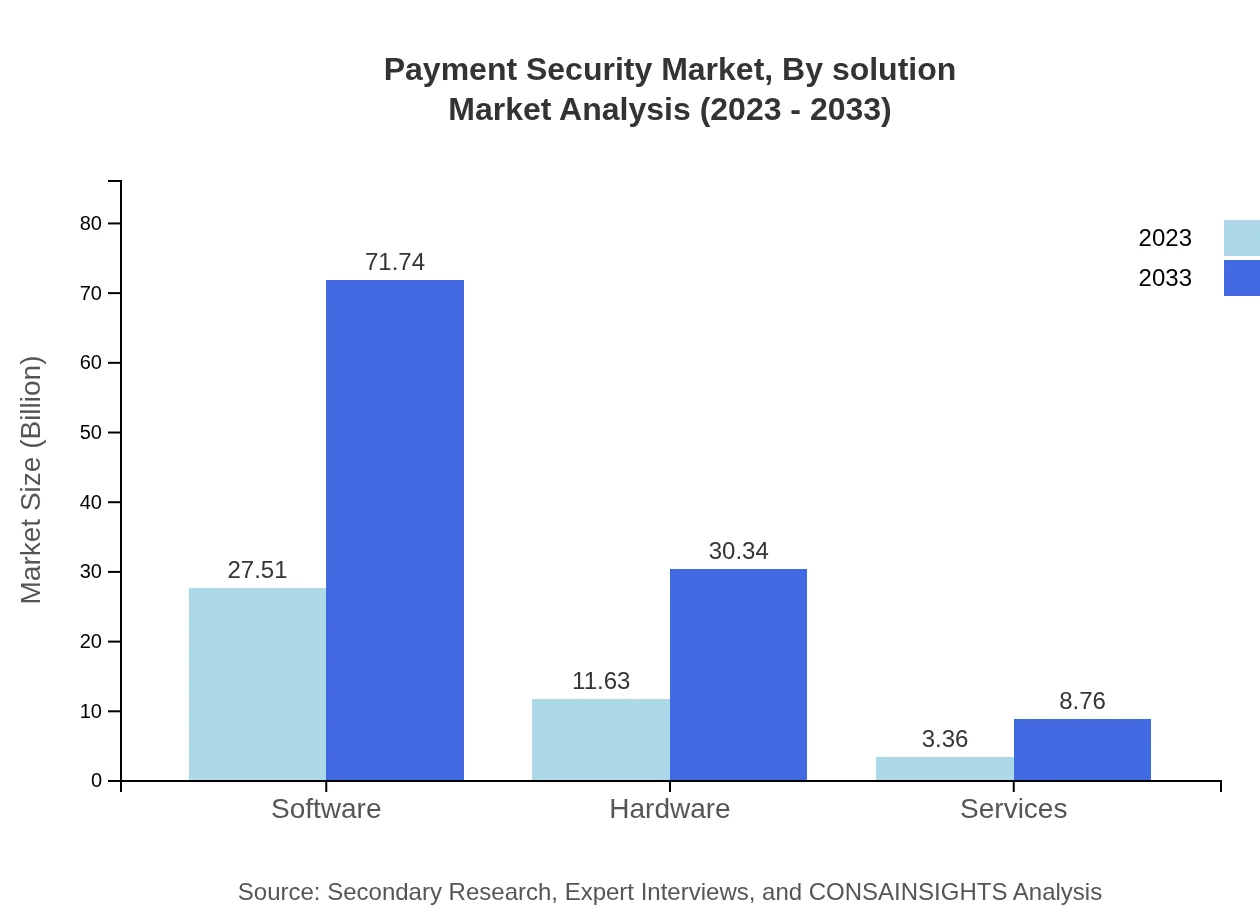

Payment Security Market Analysis By Solution

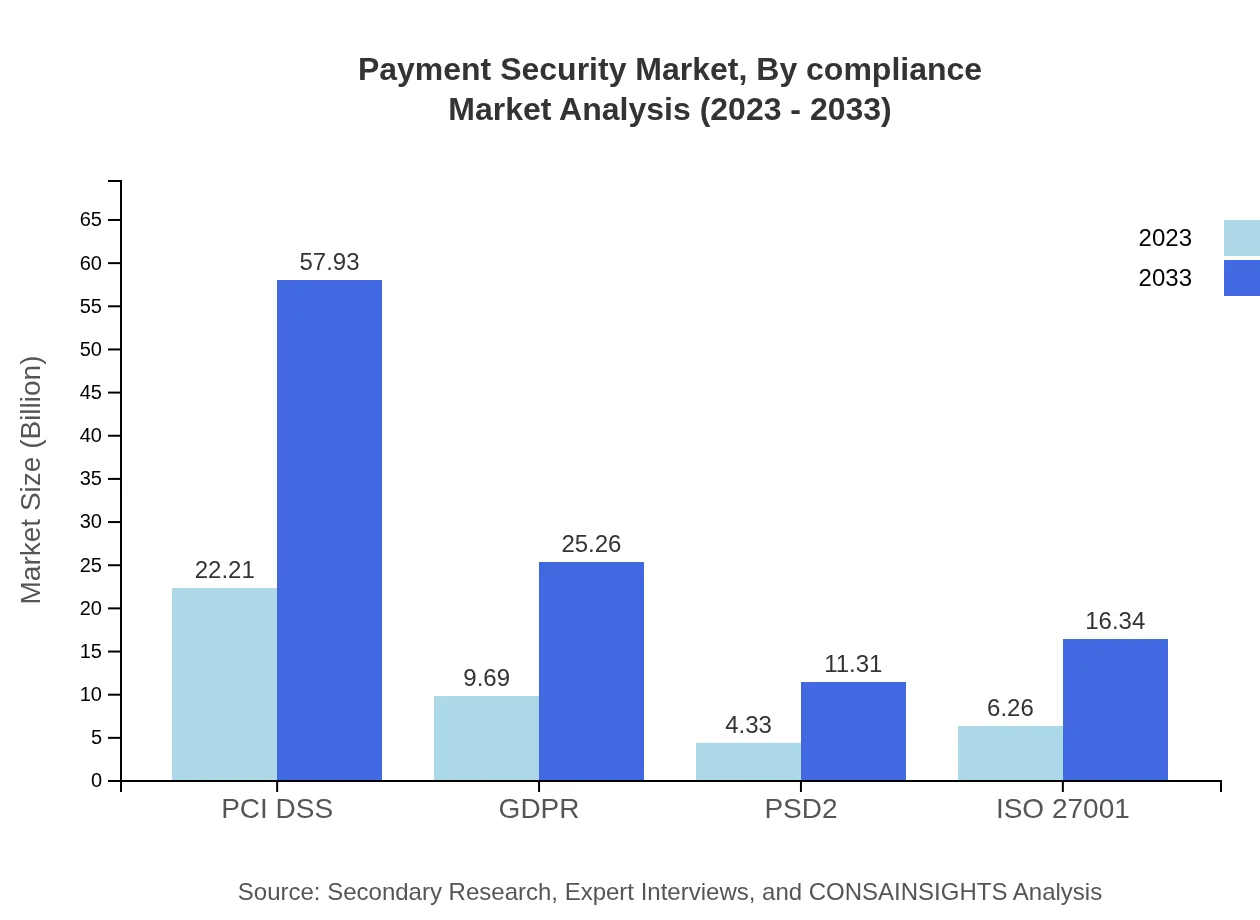

The solutions sector focuses on various compliance standards including PCI DSS, which will rise from $22.21 billion in 2023 to $57.93 billion by 2033. GDPR will also see substantial growth, reflecting the increasing compliance pressure across industries. Other standards like PSD2 and ISO 27001 are also driving market dynamics.

Payment Security Market Analysis By Industry

Industries utilizing Payment Security solutions range widely, from retail to finance, each contributing significantly. Retail alone will grow from $9.69 billion to $25.26 billion, while Banking is also expanding its security framework, growing from $4.33 billion to $11.31 billion.

Payment Security Market Analysis By Compliance

The focus on compliance standards ensures that businesses meet minimum security requirements. PCI DSS remains a pivotal standard in the industry, while newly developed regulations continue to push compliance-related growth across sectors.

Payment Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Payment Security Industry

IBM Security:

A leader in cybersecurity and data protection, IBM Security provides comprehensive payment security solutions, focusing on encryption and advanced threat intelligence.PayPal:

As a prominent online payment processor, PayPal is heavily invested in safeguarding transactions through encryption technologies and consumer trust initiatives.Visa Inc.:

Visa is a major player in payment security, implementing various security measures including tokenization and biometrics to protect card transactions.RSA Security:

RSA Security specializes in digital risk management, helping organizations implement security solutions that protect consumer payment data and ensure compliance.We're grateful to work with incredible clients.

FAQs

What is the market size of payment Security?

The payment security market is projected to reach approximately $42.5 billion by 2033, growing from $18.6 billion in 2023, representing a robust CAGR of 9.7% over the decade.

What are the key market players or companies in this payment Security industry?

Key players in the payment security industry include major technology firms and financial institutions specializing in secure payment solutions, compliance services, and cybersecurity technology, contributing to a competitive marketplace.

What are the primary factors driving the growth in the payment Security industry?

Growth in the payment security industry is largely driven by increasing online transactions, growing cyber threats, stringent regulatory requirements, and rising demand for advanced security solutions across sectors.

Which region is the fastest Growing in the payment Security?

The North America region is the fastest-growing market for payment security solutions, with a projected market growth from $13.78 billion in 2023 to $35.93 billion by 2033, indicating a significant escalation in digital transactions.

Does ConsaInsights provide customized market report data for the payment Security industry?

Yes, ConsaInsights offers customized market report data tailored to your specific needs within the payment security industry, enabling businesses to make informed decisions based on precise market insights.

What deliverables can I expect from this payment Security market research project?

Expect comprehensive deliverables including market analysis reports, insights on emerging trends, competitor benchmarking, and tailored strategy recommendations focused on specific segments in payment security.

What are the market trends of payment Security?

Current trends in payment security include increasing adoption of advanced encryption, biometric authentication, and AI-driven fraud detection, alongside growing regulatory compliance measures, making the sector more resilient against cyber threats.