Pc As A Service Market Report

Published Date: 31 January 2026 | Report Code: pc-as-a-service

Pc As A Service Market Size, Share, Industry Trends and Forecast to 2033

This report covers comprehensive insights into the Pc As A Service market, analyzing trends from 2023 to 2033. It includes market size, segmentation, regional analysis, key players, and future forecasts, providing valuable data for stakeholders in this evolving industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

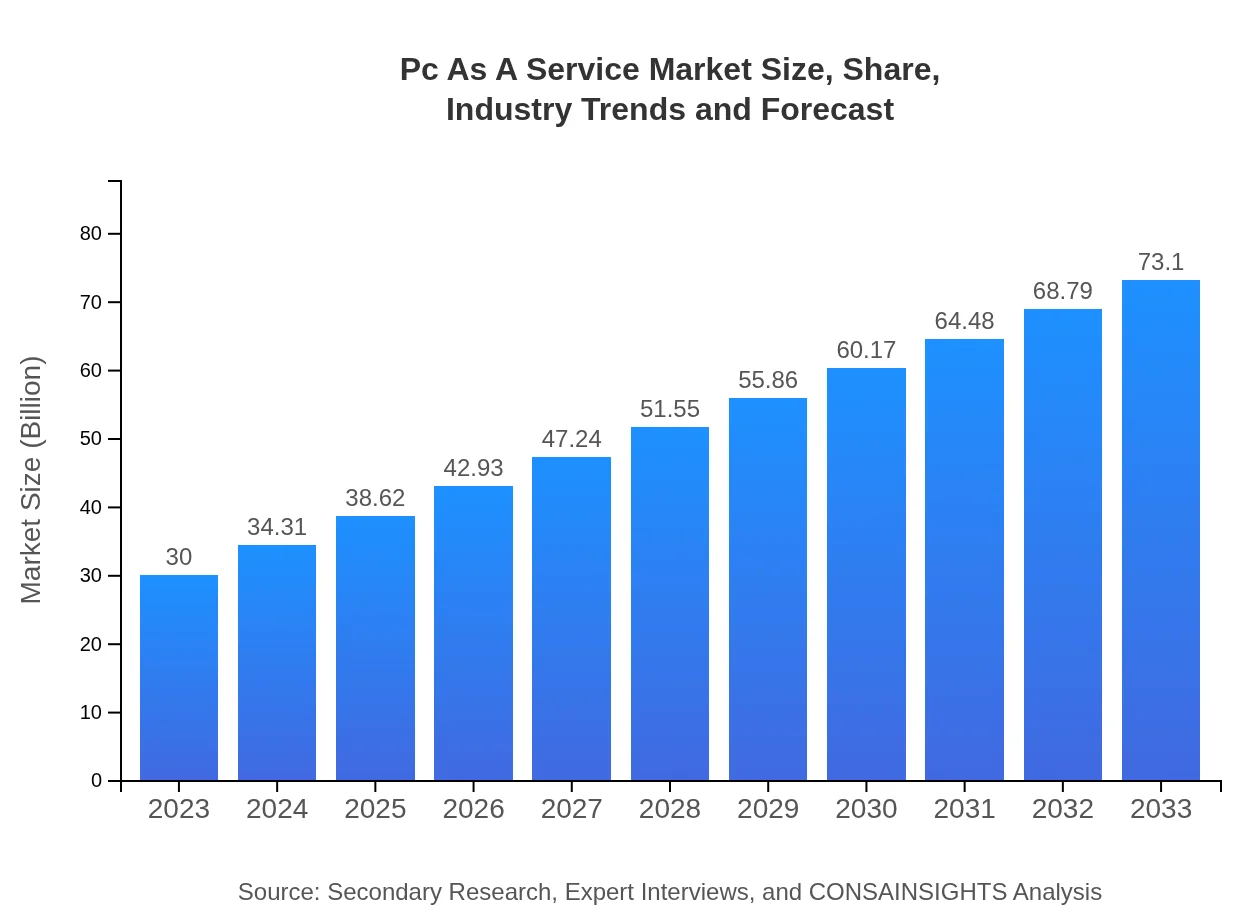

| 2023 Market Size | $30.00 Billion |

| CAGR (2023-2033) | 9% |

| 2033 Market Size | $73.10 Billion |

| Top Companies | Dell Technologies, HP Inc., Microsoft Corporation, Lenovo Group |

| Last Modified Date | 31 January 2026 |

Pc As A Service Market Overview

Customize Pc As A Service Market Report market research report

- ✔ Get in-depth analysis of Pc As A Service market size, growth, and forecasts.

- ✔ Understand Pc As A Service's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pc As A Service

What is the Market Size & CAGR of Pc As A Service market in 2023?

Pc As A Service Industry Analysis

Pc As A Service Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pc As A Service Market Analysis Report by Region

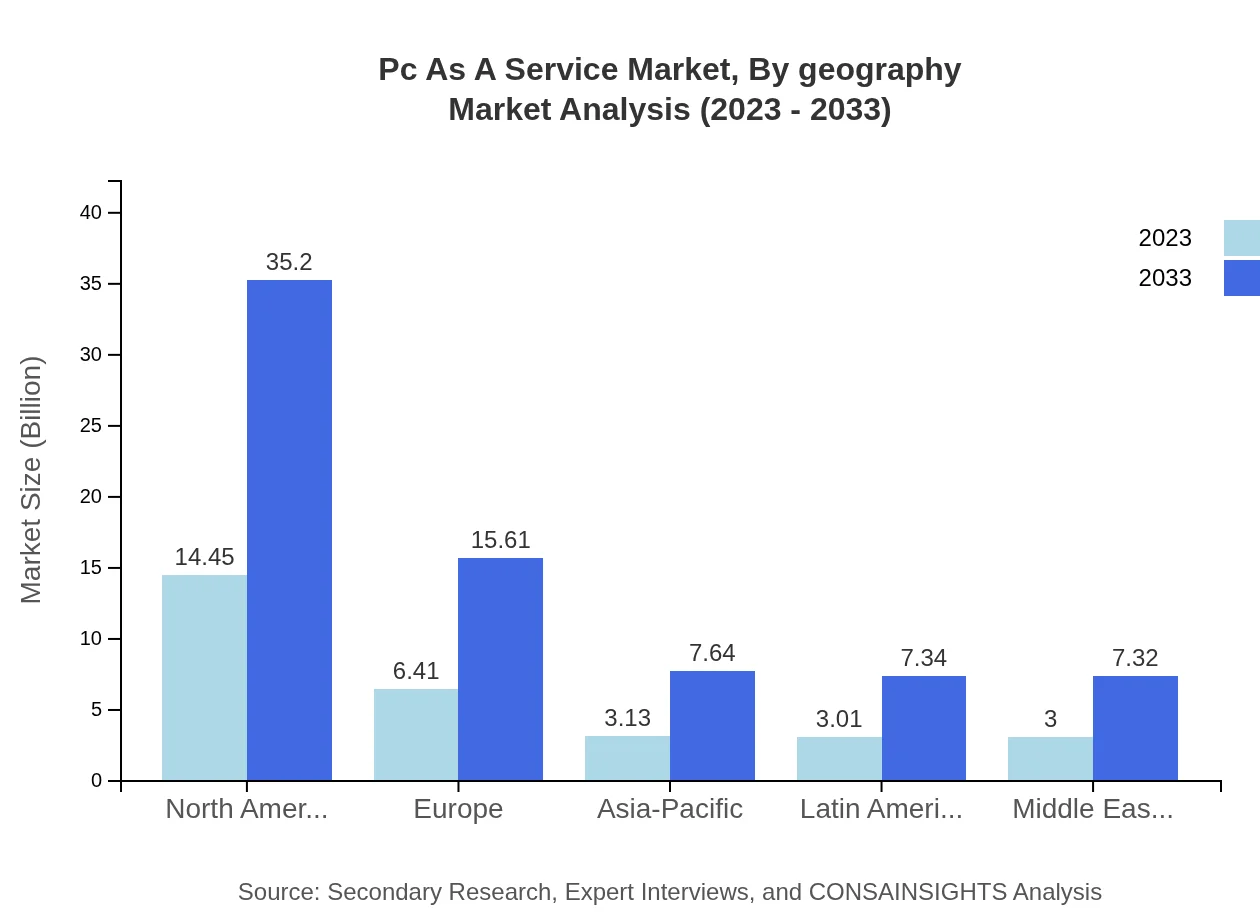

Europe Pc As A Service Market Report:

Europe's market stands at $7.84 billion in 2023 and is expected to grow to $19.09 billion by 2033, fueled by stringent data privacy regulations and a strong trend toward digital transformation.Asia Pacific Pc As A Service Market Report:

In the Asia Pacific region, the Pc As A Service market is valued at $5.91 billion in 2023, expected to grow to $14.40 billion by 2033, due to increased adoption by businesses transitioning to digital ecosystems.North America Pc As A Service Market Report:

North America leads the market with a valuation of $11.37 billion in 2023, expected to rise to $27.71 billion by 2033, largely due to technological advancements and high demand for remote work solutions.South America Pc As A Service Market Report:

The South America market starts at $1.58 billion in 2023, projected to reach $3.85 billion in 2033, driven by the growing IT infrastructure and increasing foreign investments in technology.Middle East & Africa Pc As A Service Market Report:

The market in the Middle East and Africa is initially valued at $3.30 billion in 2023, with projections reaching $8.05 billion by 2033, influenced by investment in cloud technologies and improvements in IT infrastructure.Tell us your focus area and get a customized research report.

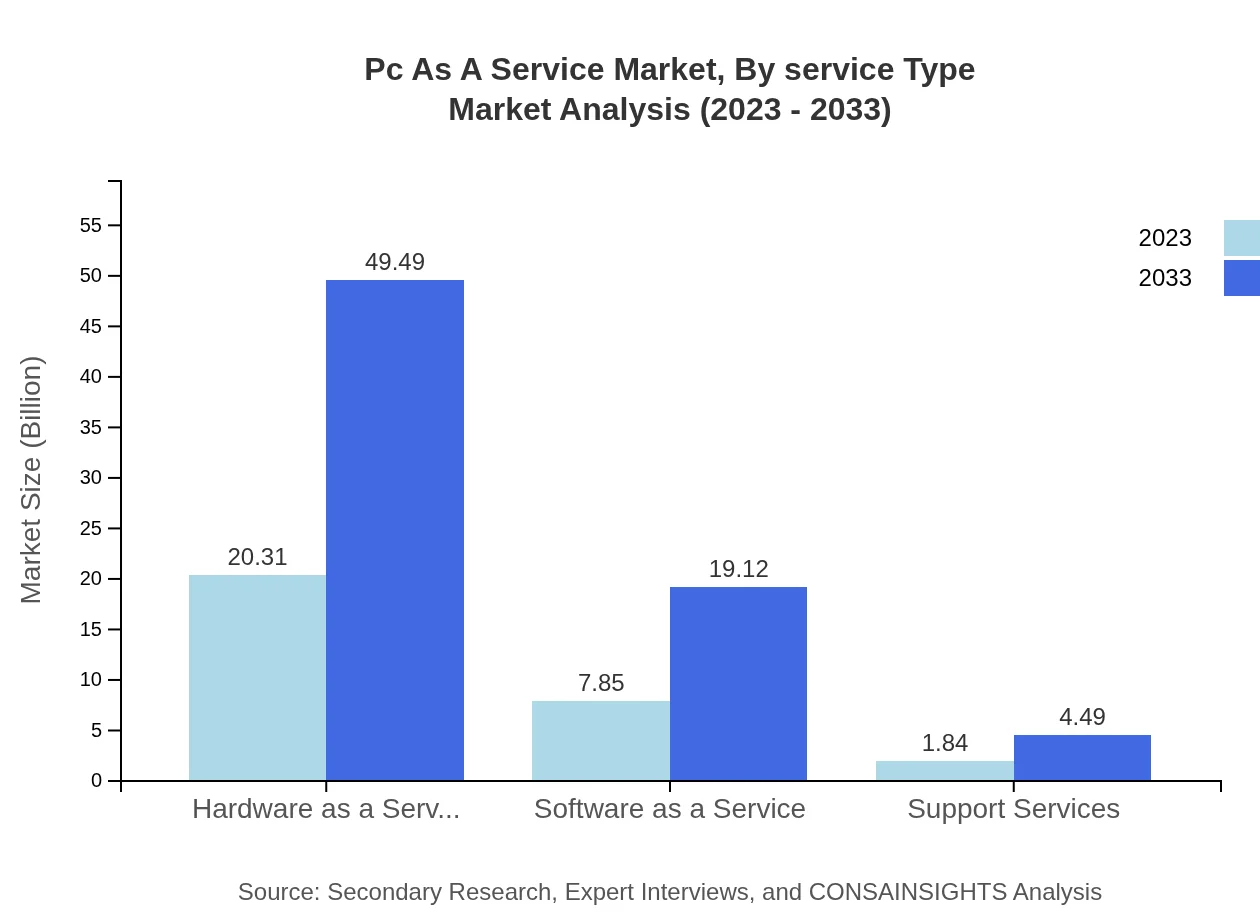

Pc As A Service Market Analysis By Service Type

The PC-as-a-Service market is primarily driven by multiple service types, including Hardware as a Service (HaaS) and Software as a Service (SaaS). As of 2023, HaaS constitutes a significant market share due to its growing acceptance among organizations needing efficient capital allocation. The growth of software solutions within the market also contributes positively, enhancing the overall service experience.

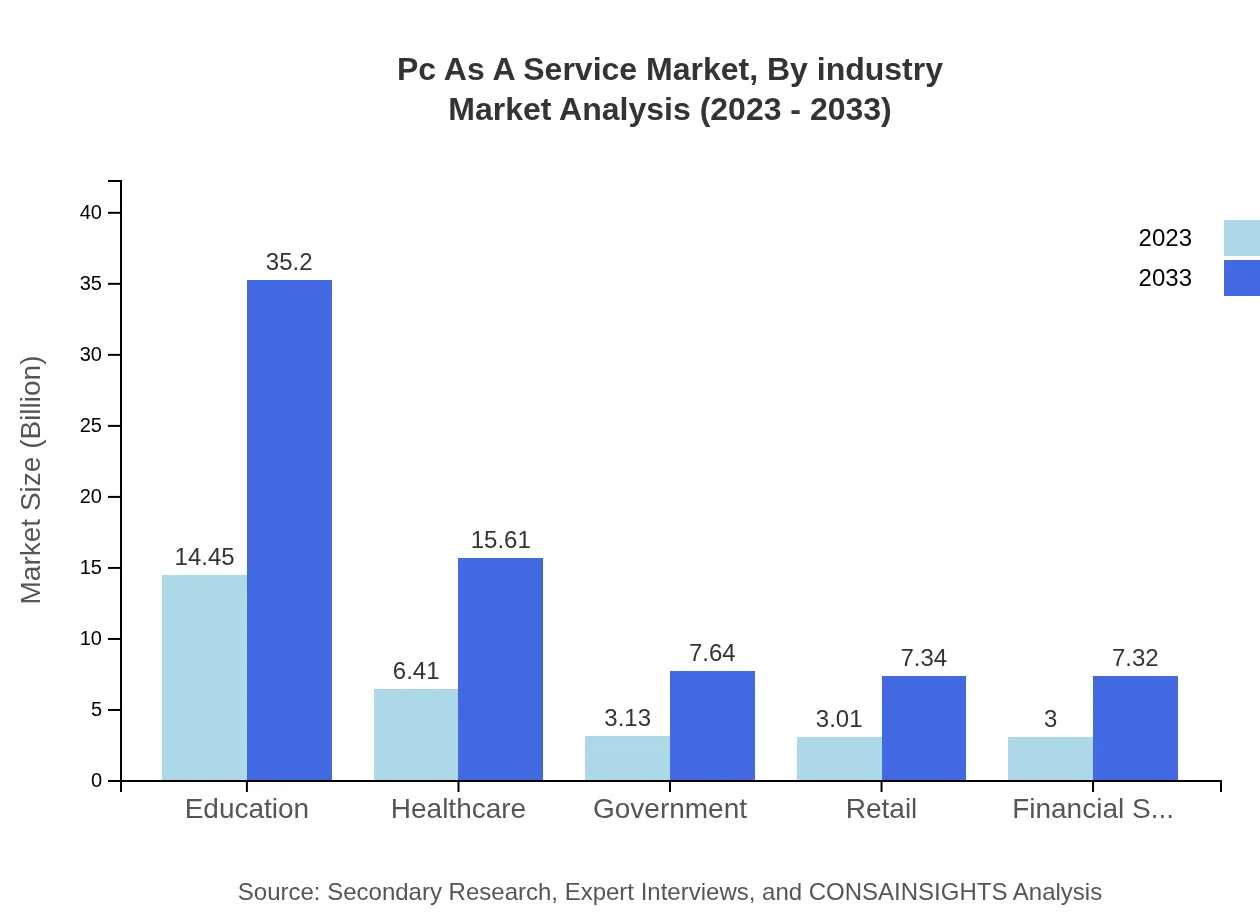

Pc As A Service Market Analysis By Industry

The education sector showcases the largest market size, with an initial value of $14.45 billion expected to grow to $35.20 billion by 2033. Healthcare and government sectors also illustrate noteworthy market segments, driven by expansive technology adoption in management systems and administrative efficiency.

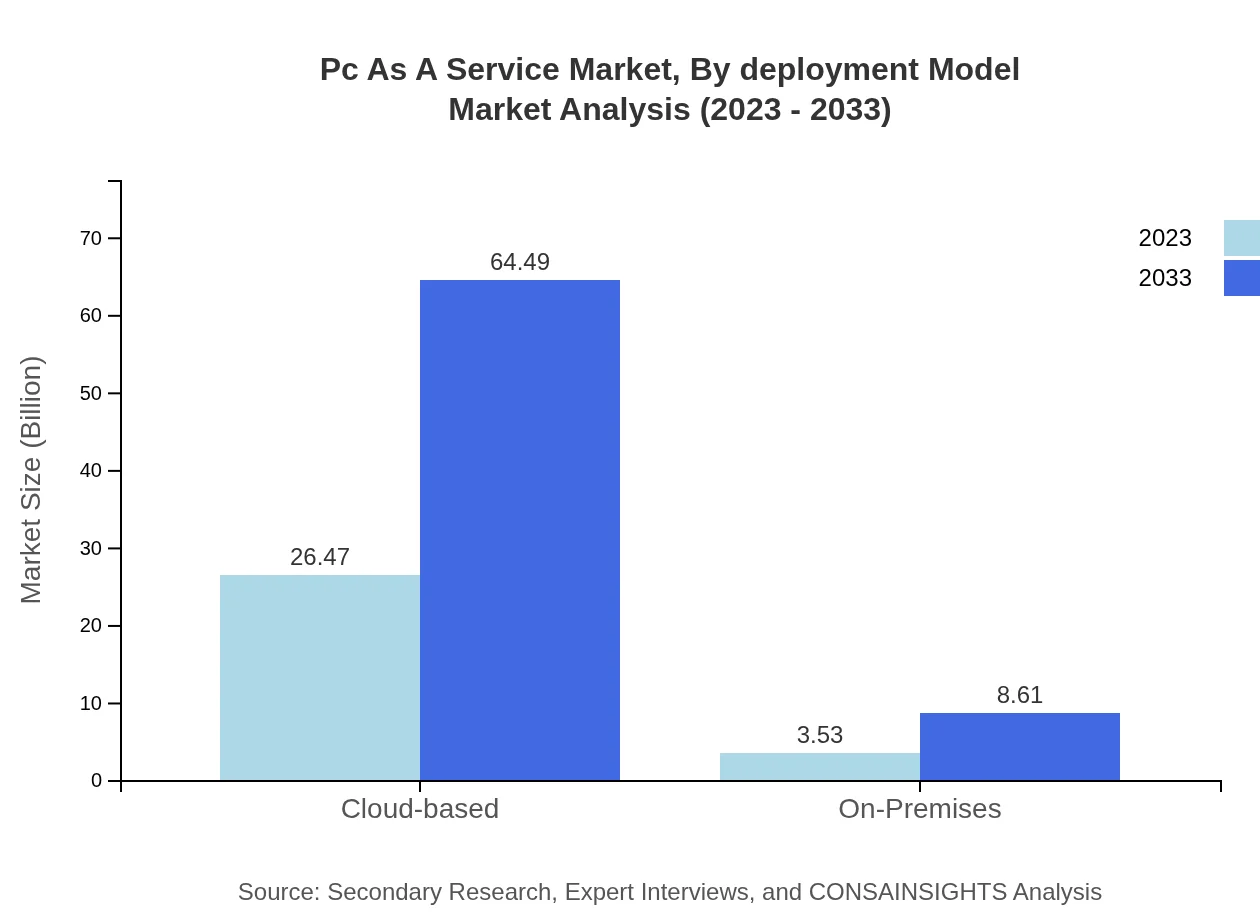

Pc As A Service Market Analysis By Deployment Model

The market is divided into Cloud-based and On-Premises deployment models. Cloud-based solutions dominate, accounting for 88.22% of the market share in 2023, emphasizing the advantages of scalability and flexibility in resource management.

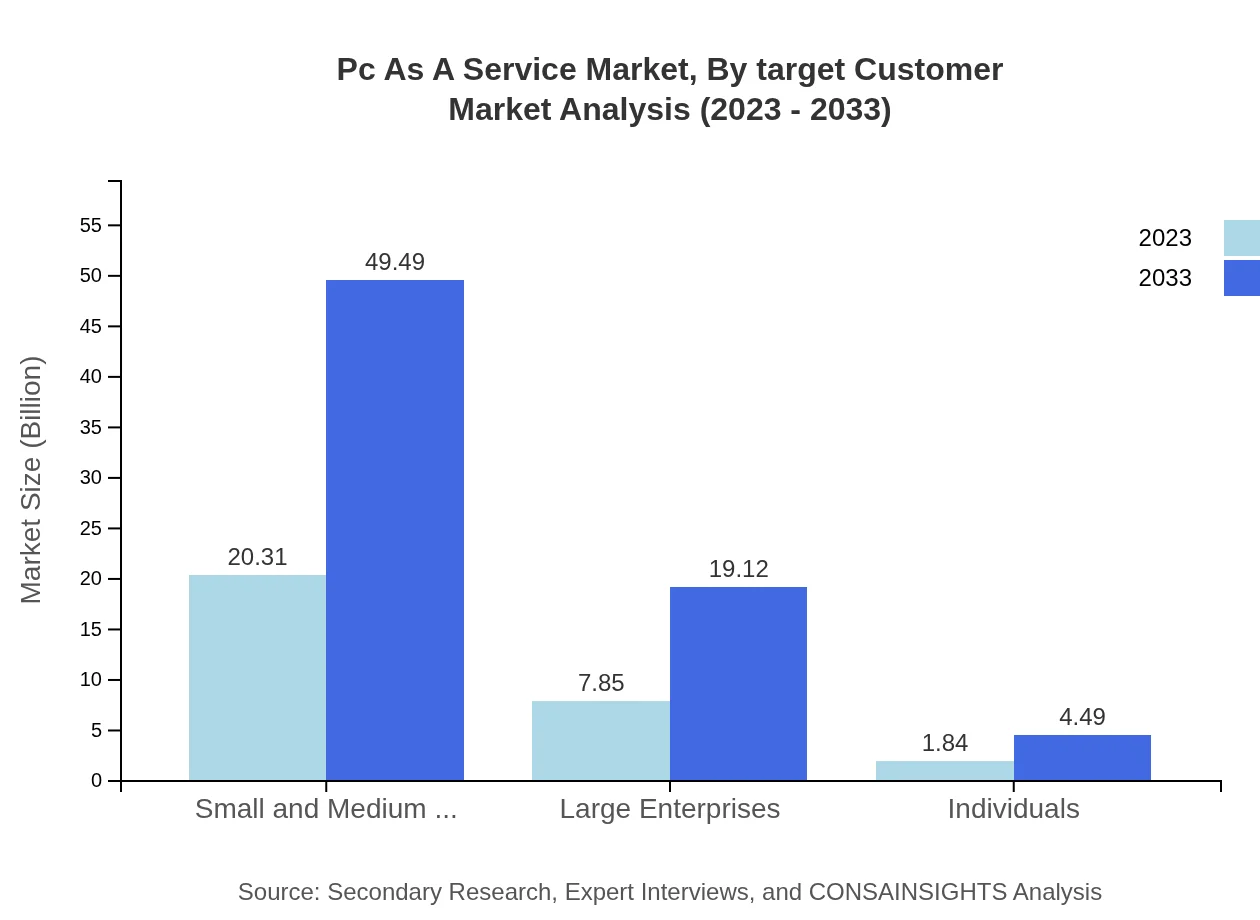

Pc As A Service Market Analysis By Target Customer

SMBs represent a major target customer segment, with a market size of $20.31 billion in 2023, growing to $49.49 billion by 2033. This segment leverages PCaaS for cost-effectiveness and optimizing their operational capabilities without hefty upfront costs.

Pc As A Service Market Analysis By Geography

Regionally, North America leads with significant investments in PCaaS solutions. Rapid digitalization in Europe complements its growing market, while the Asia-Pacific region's increasing adaptation to technology drives equal momentum.

Pc As A Service Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pc As A Service Industry

Dell Technologies:

Dell Technologies is a pioneer in the PC-as-a-Service market, offering comprehensive solutions that blend hardware and software offerings to support business needs.HP Inc.:

HP Inc. provides tailored PCaaS solutions that enhance productivity and streamline IT management for enterprises of all sizes, focusing on customer experience.Microsoft Corporation:

Microsoft offers integrated PCaaS solutions through its cloud services, promoting seamless access and collaborative tools that are essential for modern workforces.Lenovo Group:

Lenovo's PCaaS approach combines innovation in hardware with robust service support, catering to enterprises embarking on digital transformation journeys.We're grateful to work with incredible clients.

FAQs

What is the market size of PC as a Service?

The global PC as a Service market is valued at approximately $30 billion in 2023, with projections indicating a growth to $74.77 billion by 2033, realizing a compound annual growth rate (CAGR) of 9% over the decade.

What are the key market players or companies in the PC as a Service industry?

Key players in the PC as a Service market include leading IT service providers like HP, Dell, Lenovo, and Fujitsu. These companies are leveraging their expertise in hardware and cloud computing to deliver enhanced service solutions.

What are the primary factors driving the growth in the PC as a Service industry?

Key factors contributing to the growth of the PC as a Service industry include the increasing demand for flexible IT solutions, cost efficiency, the rise of remote work, and growing adoption of cloud technologies by businesses.

Which region is the fastest Growing in the PC as a Service?

The fastest-growing region in the PC as a Service market is North America, with market size projected to grow from $11.37 billion in 2023 to $27.71 billion by 2033, driven by technology advancements and strong enterprise adoption.

Does ConsaInsights provide customized market report data for the PC as a Service industry?

Yes, ConsaInsights offers customized market report data tailored specifically for the PC as a Service industry, allowing businesses to obtain insights that meet their unique needs and strategic objectives.

What deliverables can I expect from this PC as a Service market research project?

From the PC as a Service market research project, you can expect comprehensive reports including market size analysis, regional data, segmented insights, competitive landscape, and future growth forecasts.

What are the market trends of PC as a Service?

Current trends in the PC as a Service market include the shift towards cloud-based solutions, the growing emphasis on cybersecurity, integration of Artificial Intelligence, and increasing adoption among educational and healthcare sectors.