Pcr Molecular Diagnostics Market Report

Published Date: 31 January 2026 | Report Code: pcr-molecular-diagnostics

Pcr Molecular Diagnostics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the PCR Molecular Diagnostics market from 2023 to 2033. It covers market size, growth trends, regional insights, technological advancements, and profiles of key market leaders.

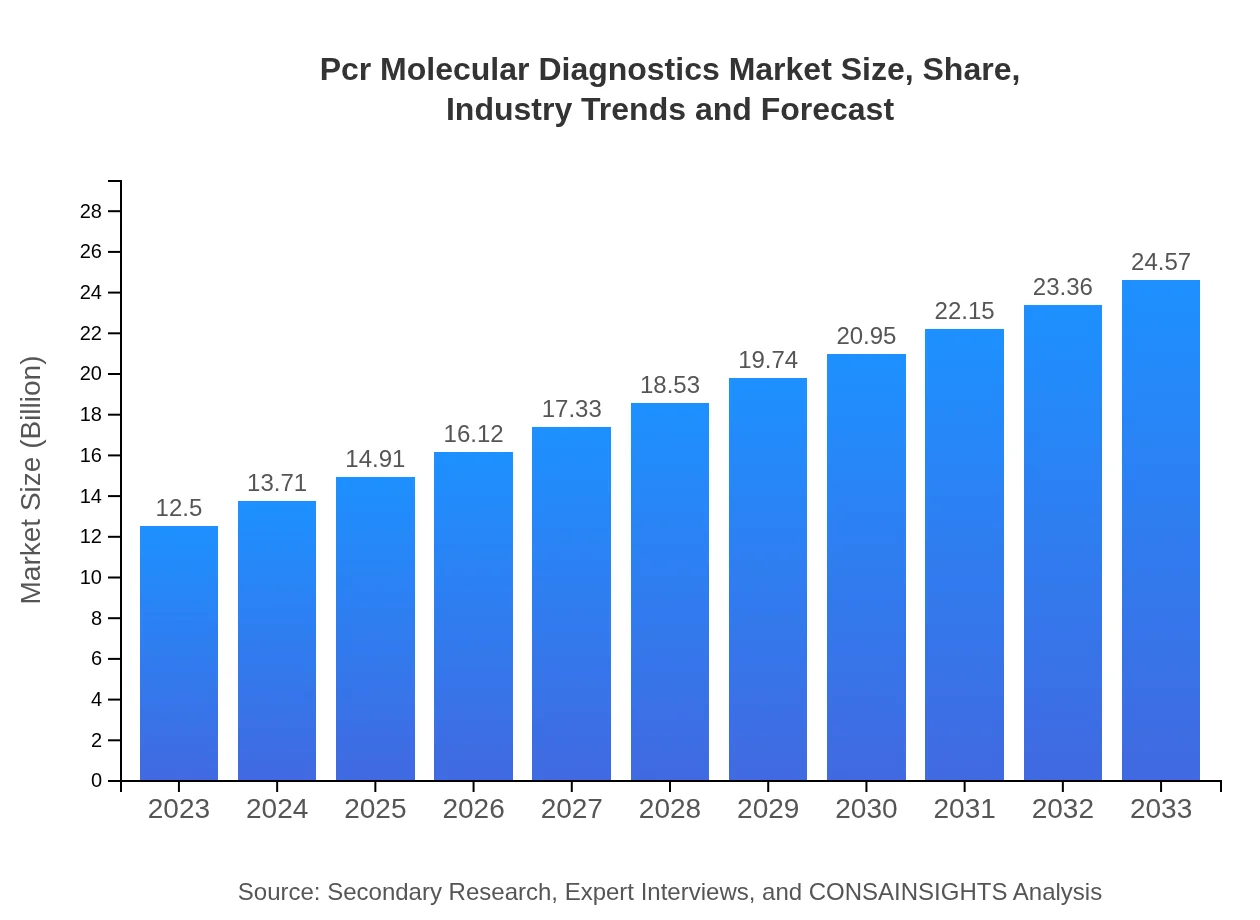

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $24.57 Billion |

| Top Companies | Roche Diagnostics, Thermo Fisher Scientific, Abbott Laboratories, Qiagen N.V., Agilent Technologies, Inc. |

| Last Modified Date | 31 January 2026 |

Pcr Molecular Diagnostics Market Overview

Customize Pcr Molecular Diagnostics Market Report market research report

- ✔ Get in-depth analysis of Pcr Molecular Diagnostics market size, growth, and forecasts.

- ✔ Understand Pcr Molecular Diagnostics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pcr Molecular Diagnostics

What is the Market Size & CAGR of Pcr Molecular Diagnostics market in 2023?

Pcr Molecular Diagnostics Industry Analysis

Pcr Molecular Diagnostics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pcr Molecular Diagnostics Market Analysis Report by Region

Europe Pcr Molecular Diagnostics Market Report:

The European PCR Molecular Diagnostics market stands at $3.84 billion in 2023, projected to expand to $7.55 billion by 2033. Factors such as regulatory support for innovative diagnostics and increased public health initiatives are driving this growth.Asia Pacific Pcr Molecular Diagnostics Market Report:

In 2023, the Asia Pacific PCR Molecular Diagnostics market is valued at $2.30 billion and is expected to grow to $4.53 billion by 2033. The region is experiencing increasing investments in healthcare infrastructure and rising awareness of molecular diagnostics, driven by a growing population and infectious disease outbreaks.North America Pcr Molecular Diagnostics Market Report:

North America leads with a market size of $4.67 billion in 2023, expected to reach $9.19 billion by 2033. The region boasts a well-established healthcare system, significant R&D investments, and a high prevalence of chronic diseases requiring innovative diagnostic solutions.South America Pcr Molecular Diagnostics Market Report:

The South American market is projected to grow from $0.68 billion in 2023 to $1.34 billion by 2033. The region's growth is supported by rising healthcare expenditure and improvements in laboratory capabilities for molecular diagnostics.Middle East & Africa Pcr Molecular Diagnostics Market Report:

The Middle East and Africa market is valued at $1.00 billion in 2023, with a growth to $1.96 billion by 2033, influenced by ongoing improvements in healthcare access and the need for advanced diagnostics to combat public health challenges.Tell us your focus area and get a customized research report.

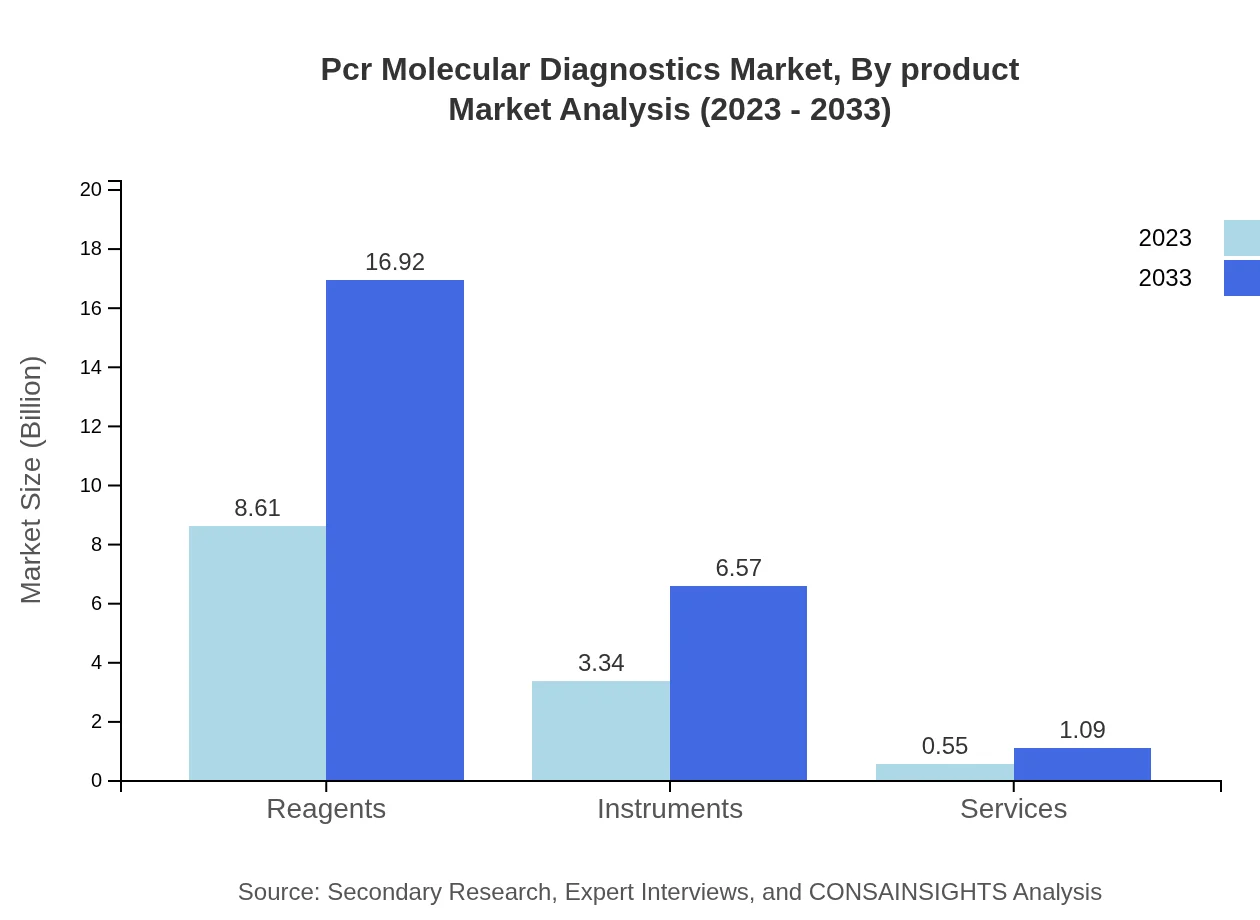

Pcr Molecular Diagnostics Market Analysis By Product

The product segment of the PCR Molecular Diagnostics market includes reagents, instruments, and services. As of 2023, reagents accounted for a market size of $8.61 billion, projected to grow to $16.92 billion by 2033. Instruments contribute significantly with a 2023 market size of $3.34 billion, expected to increase to $6.57 billion. Services, while smaller, also show growth potential, projected from $0.55 billion to $1.09 billion.

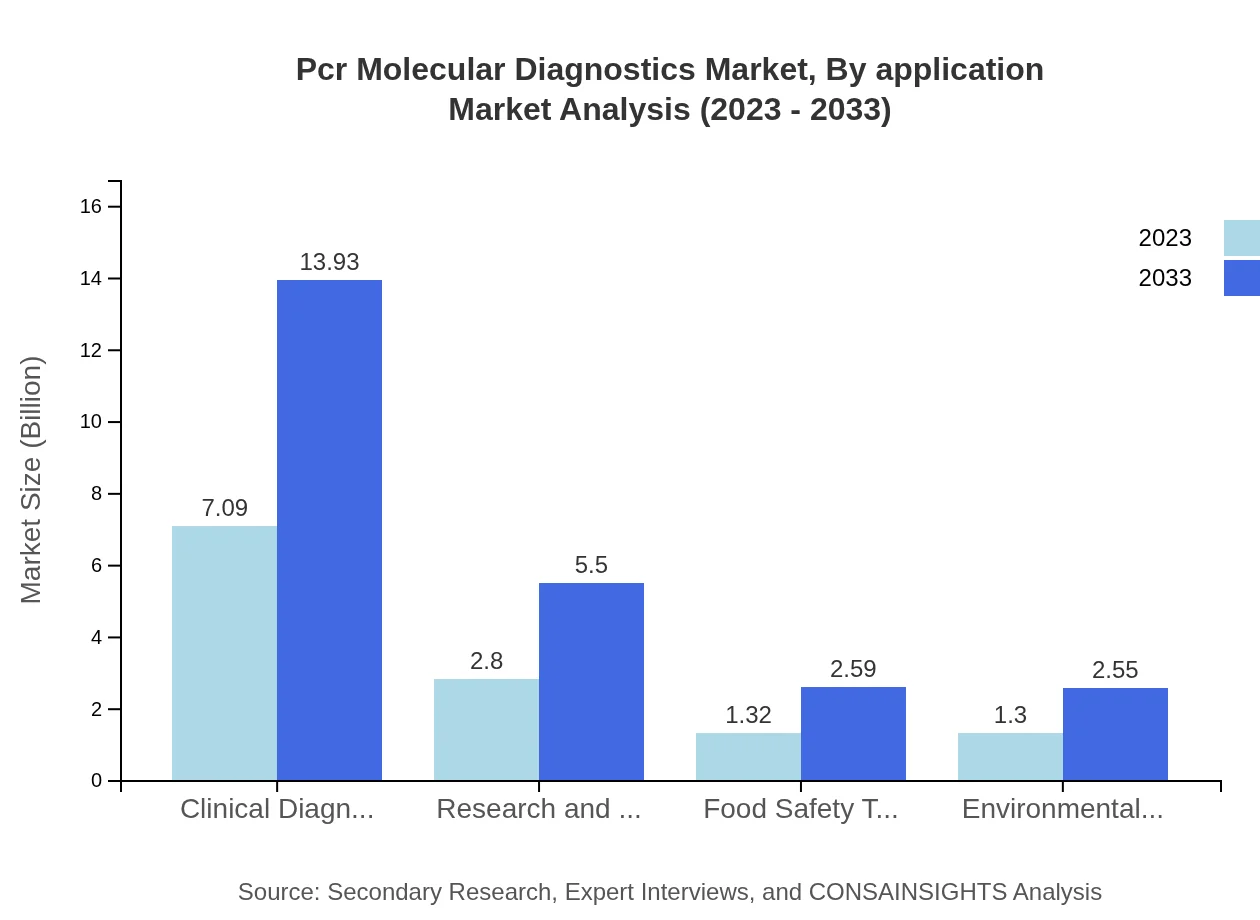

Pcr Molecular Diagnostics Market Analysis By Application

The application segment includes clinical diagnostics, research and development, food safety testing, and more. Clinical diagnostics dominate with a 2023 market size of $7.09 billion, increasing to $13.93 billion by 2033. Research and development also sees significant activity, growing from $2.80 billion to $5.50 billion, reflecting continuous innovation in testing methodologies.

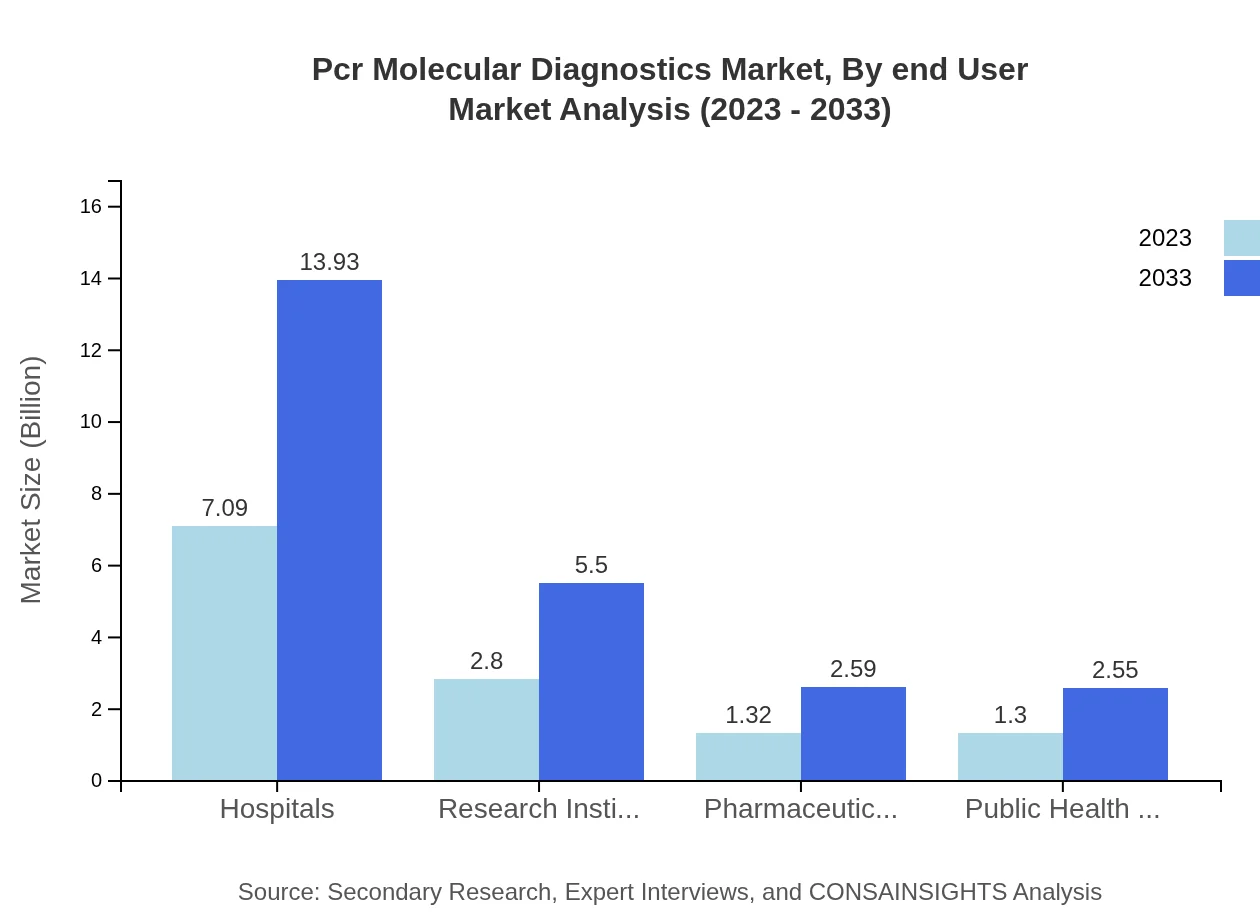

Pcr Molecular Diagnostics Market Analysis By End User

The end-user segment comprises hospitals, research institutions, pharmaceutical companies, public health organizations, and others. Hospitals lead with a market size of $7.09 billion in 2023, set to reach $13.93 billion. Research institutions follow with $2.80 billion to $5.50 billion, demonstrating their vital role in advancing diagnostics.

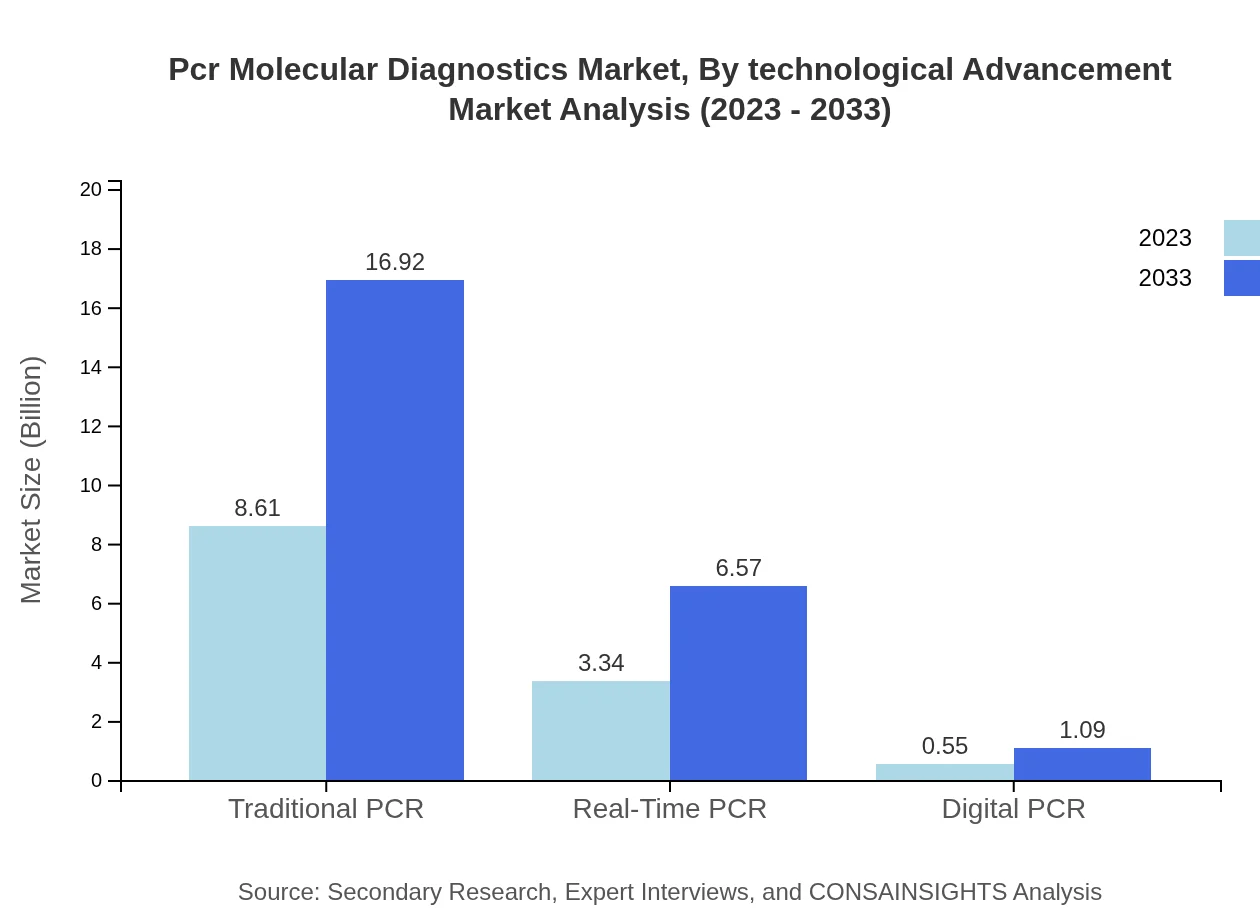

Pcr Molecular Diagnostics Market Analysis By Technological Advancement

Technological advancements in PCR, including traditional, real-time, and digital PCR, are pivotal. Traditional PCR holds market dominance with a 68.85% share, followed by real-time PCR at 26.73%. Digital PCR, while smaller, reflects innovative progress, showing potential for growth in precise and sensitive applications.

Pcr Molecular Diagnostics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in PCR Molecular Diagnostics Industry

Roche Diagnostics:

Roche Diagnostics is a global leader in diagnostics and focuses on precision medicine, offering a wide range of molecular diagnostic solutions and innovative technologies.Thermo Fisher Scientific:

Thermo Fisher Scientific specializes in biotechnology and molecular diagnostics, providing advanced tools and reagents that aid in disease diagnosis and management.Abbott Laboratories:

Abbott Laboratories develops and produces a wide array of diagnostics solutions, including molecular diagnostics technologies that support healthcare providers.Qiagen N.V.:

Qiagen is prominent in both sample preparation and molecular diagnostics, enhancing diagnostic workflows with its innovative products.Agilent Technologies, Inc.:

Agilent Technologies focuses on providing advanced analytical solutions, including PCR-based diagnostics, emphasizing accuracy and reliability.We're grateful to work with incredible clients.

FAQs

What is the market size of PCR molecular diagnostics?

The PCR molecular diagnostics market was valued at $12.5 billion in 2023, with a projected compound annual growth rate (CAGR) of 6.8% up to 2033, indicating robust growth driven by increased adoption in clinical settings.

What are the key market players or companies in the PCR molecular diagnostics industry?

Key players in the PCR molecular diagnostics industry include major biotechnology firms and diagnostic companies that lead in manufacturing reagents, instruments, and providing diagnostic services, thus driving competition and innovation.

What are the primary factors driving the growth in the PCR molecular diagnostics industry?

The growth of the PCR molecular diagnostics industry is primarily driven by increasing demand for accurate and rapid diagnostic tests, advancements in specific PCR technologies, and rising healthcare expenditures globally.

Which region is the fastest Growing in the PCR molecular diagnostics?

The fastest-growing region in the PCR molecular diagnostics market is North America, with a market size projected to grow from $4.67 billion in 2023 to $9.19 billion by 2033, reflecting increasing healthcare investments and technology enhancements.

Does ConsaInsights provide customized market report data for the PCR molecular diagnostics industry?

Yes, ConsaInsights offers customized market report data tailored to the PCR molecular diagnostics industry, enabling stakeholders to access specific insights relevant to their strategic planning and market positioning.

What deliverables can I expect from this PCR molecular diagnostics market research project?

Deliverables from the PCR molecular diagnostics market research include comprehensive reports on market analysis, trends, competitive landscape, regional insights, and forecasts for different segments over the defined period.

What are the market trends of PCR molecular diagnostics?

Current market trends in PCR molecular diagnostics include increased reliance on real-time PCR technologies, integration of digital PCR, and an expanding application base in personalized medicine and pathogen detection.