Pegylated Proteins Market Report

Published Date: 31 January 2026 | Report Code: pegylated-proteins

Pegylated Proteins Market Size, Share, Industry Trends and Forecast to 2033

This market report provides a comprehensive analysis of the Pegylated Proteins market from 2023 to 2033, focusing on market size, trends, regional insights, and competitive landscape. It offers data-driven insights to support strategic planning and decision-making.

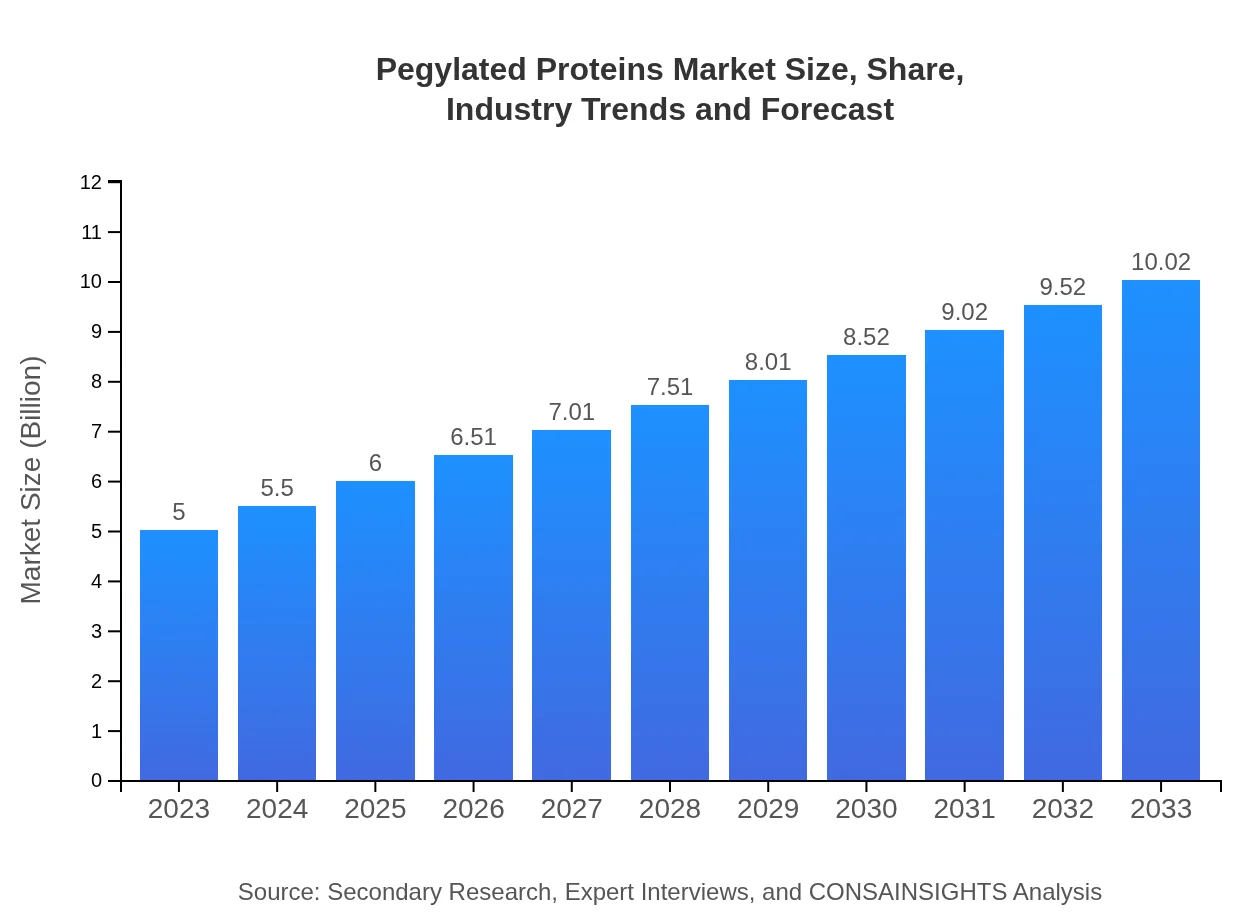

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.00 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $10.02 Billion |

| Top Companies | Amgen Inc., Roche Holding AG, Merck & Co., Inc., Genentech, Inc. |

| Last Modified Date | 31 January 2026 |

Pegylated Proteins Market Overview

Customize Pegylated Proteins Market Report market research report

- ✔ Get in-depth analysis of Pegylated Proteins market size, growth, and forecasts.

- ✔ Understand Pegylated Proteins's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pegylated Proteins

What is the Market Size & CAGR of Pegylated Proteins market in 2023 and 2033?

Pegylated Proteins Industry Analysis

Pegylated Proteins Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pegylated Proteins Market Analysis Report by Region

Europe Pegylated Proteins Market Report:

The European Pegylated Proteins market is forecasted to rise from $1.46 billion in 2023 to $2.92 billion by 2033. Increasing demand for innovative medications and supportive government policies are driving this growth.Asia Pacific Pegylated Proteins Market Report:

In the Asia Pacific region, the Pegylated Proteins market is set to grow from $1 billion in 2023 to $2.01 billion by 2033, driven by increased healthcare expenditure and a burgeoning pharmaceutical sector focused on biopharmaceuticals.North America Pegylated Proteins Market Report:

North America represents the largest market for Pegylated Proteins, growing from $1.76 billion in 2023 to $3.54 billion by 2033, fueled by significant R&D investment, regulatory support, and the presence of key industry players.South America Pegylated Proteins Market Report:

The South American Pegylated Proteins market is expected to double from $0.44 billion in 2023 to $0.88 billion by 2033. The growth is attributed to an increase in disease prevalence and improved access to healthcare facilities.Middle East & Africa Pegylated Proteins Market Report:

The Middle East and Africa region is projected to grow from $0.34 billion in 2023 to $0.68 billion by 2033, as healthcare infrastructure improves and awareness of biopharmaceuticals expands.Tell us your focus area and get a customized research report.

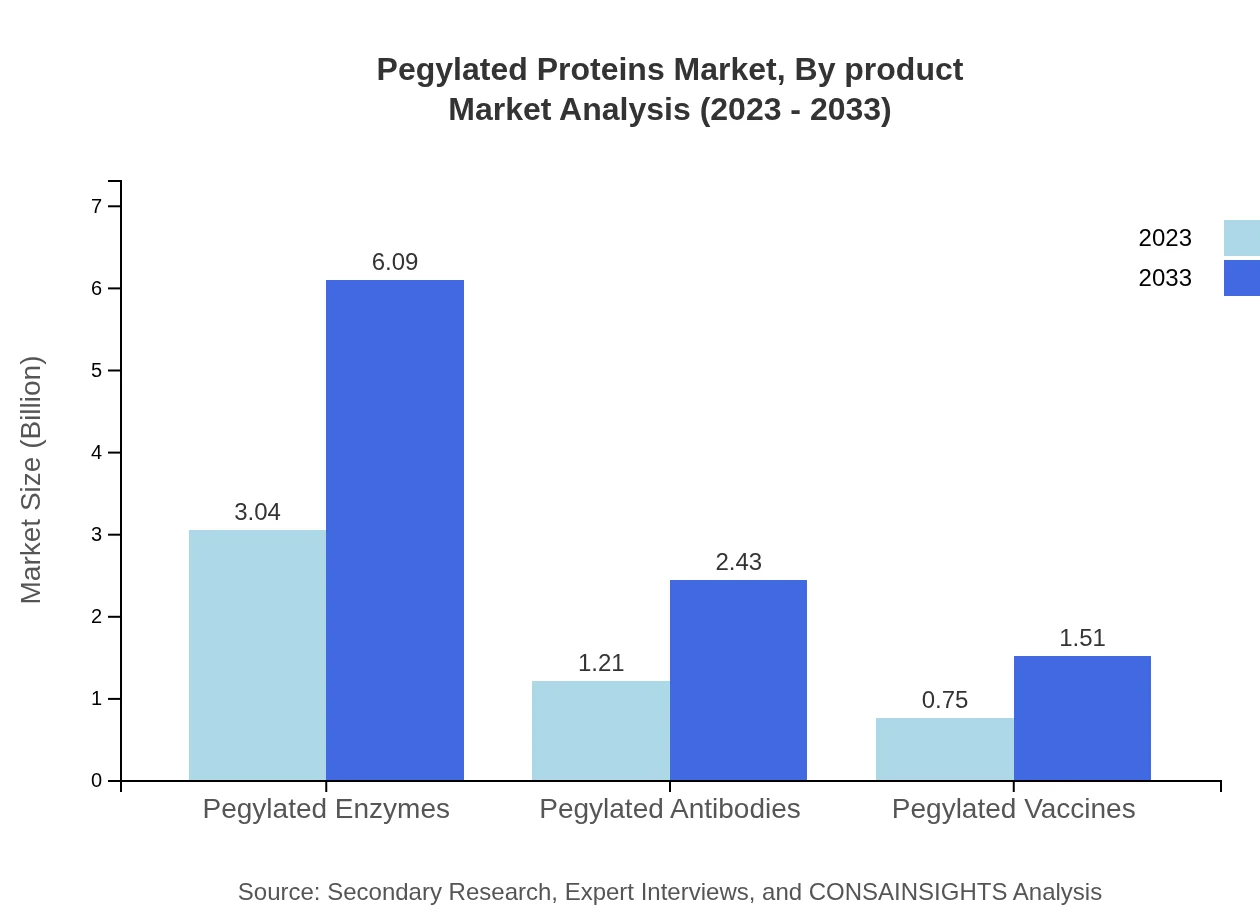

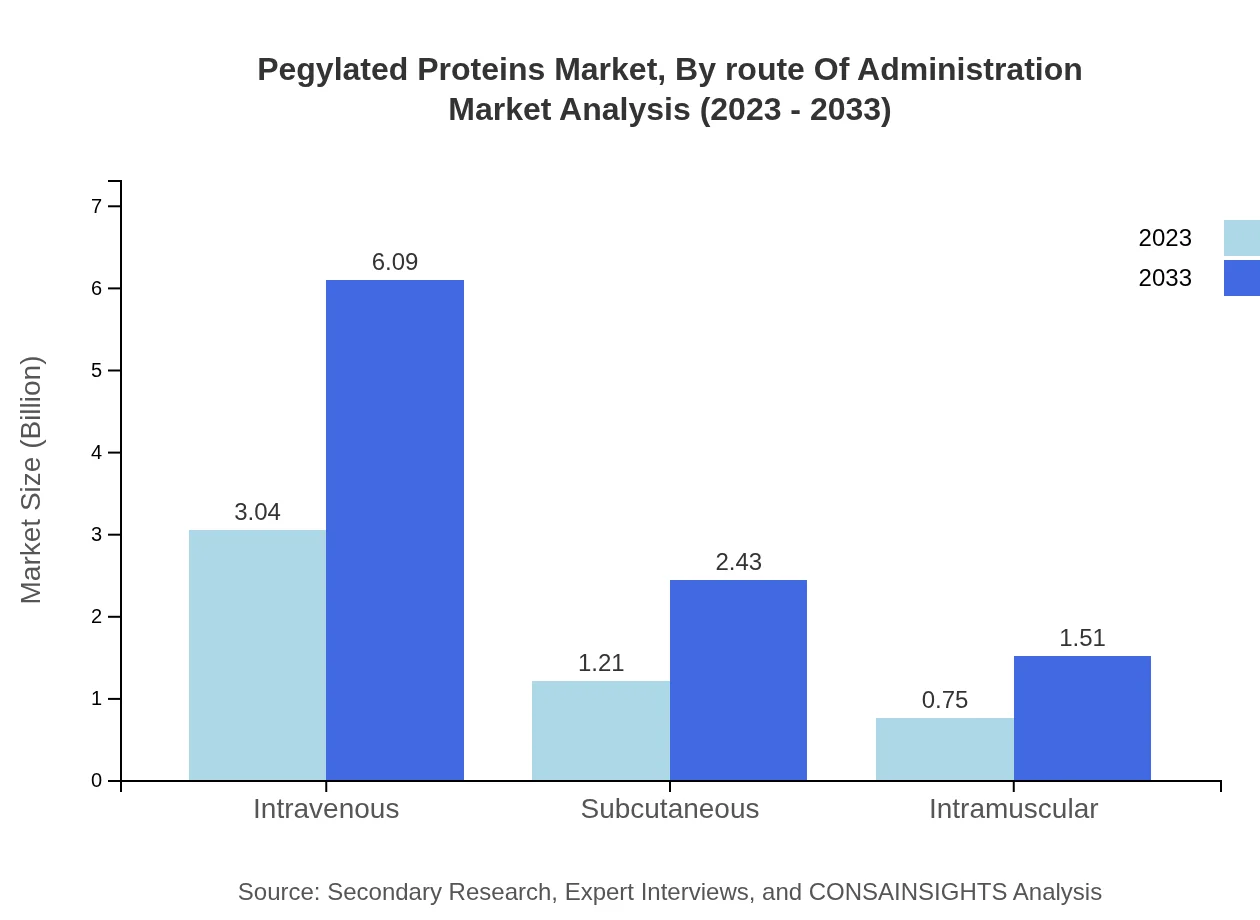

Pegylated Proteins Market Analysis By Product

In 2023, Pegylated Enzymes hold a significant market size of $3.04 billion and are expected to reach $6.09 billion by 2033. Pegylated Antibodies account for $1.21 billion, projected to grow to $2.43 billion. Pegylated Vaccines currently at $0.75 billion, are set to reach $1.51 billion by 2033, demonstrating the expanding role of pegylated products in healthcare.

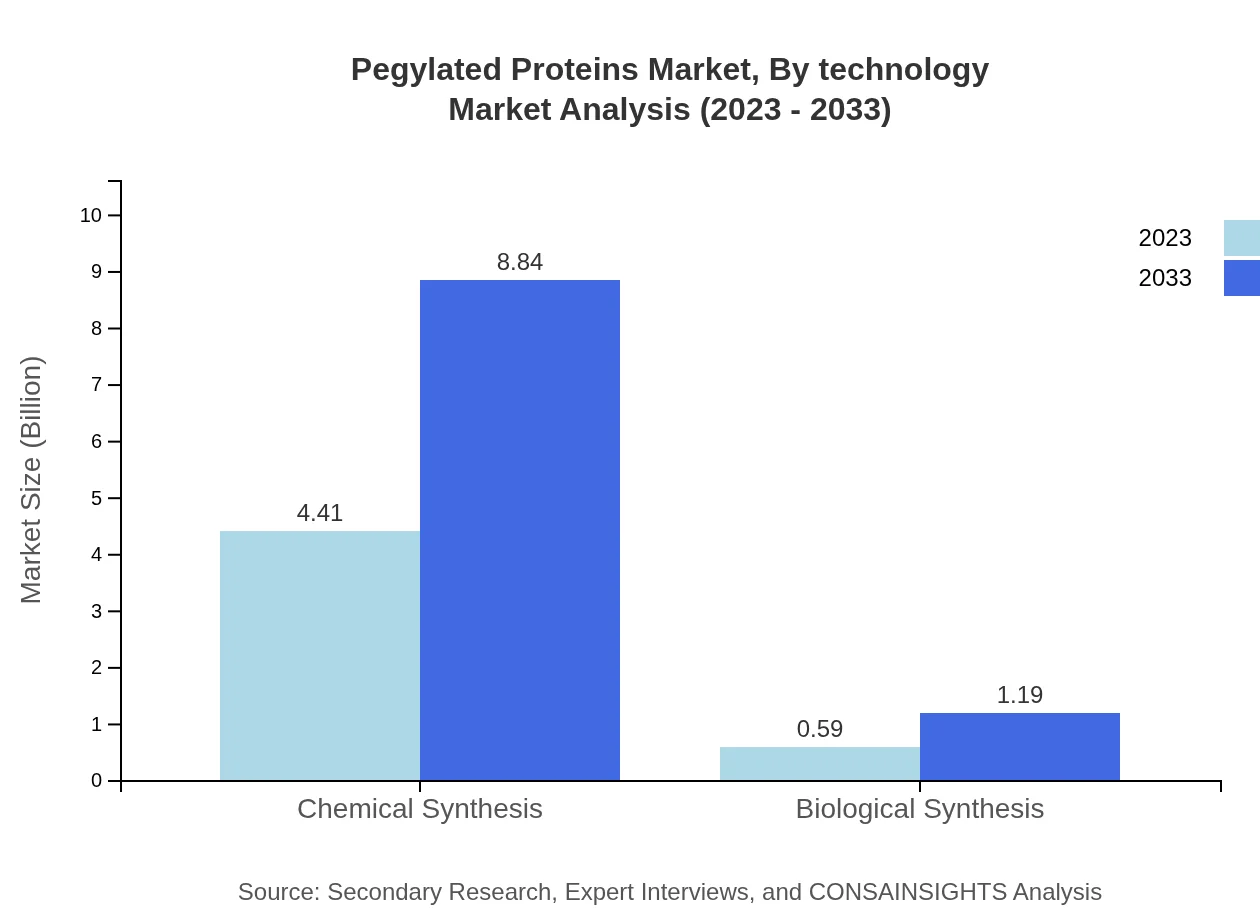

Pegylated Proteins Market Analysis By Technology

The market is also segmented based on technology, primarily focusing on Chemical Synthesis and Biological Synthesis, which currently dominate the industry. Chemical Synthesis accounted for $4.41 billion in 2023 and is projected to reach $8.84 billion in 2033, holding an 88.16% market share, while Biological Synthesis is expected to rise from $0.59 billion to $1.19 billion.

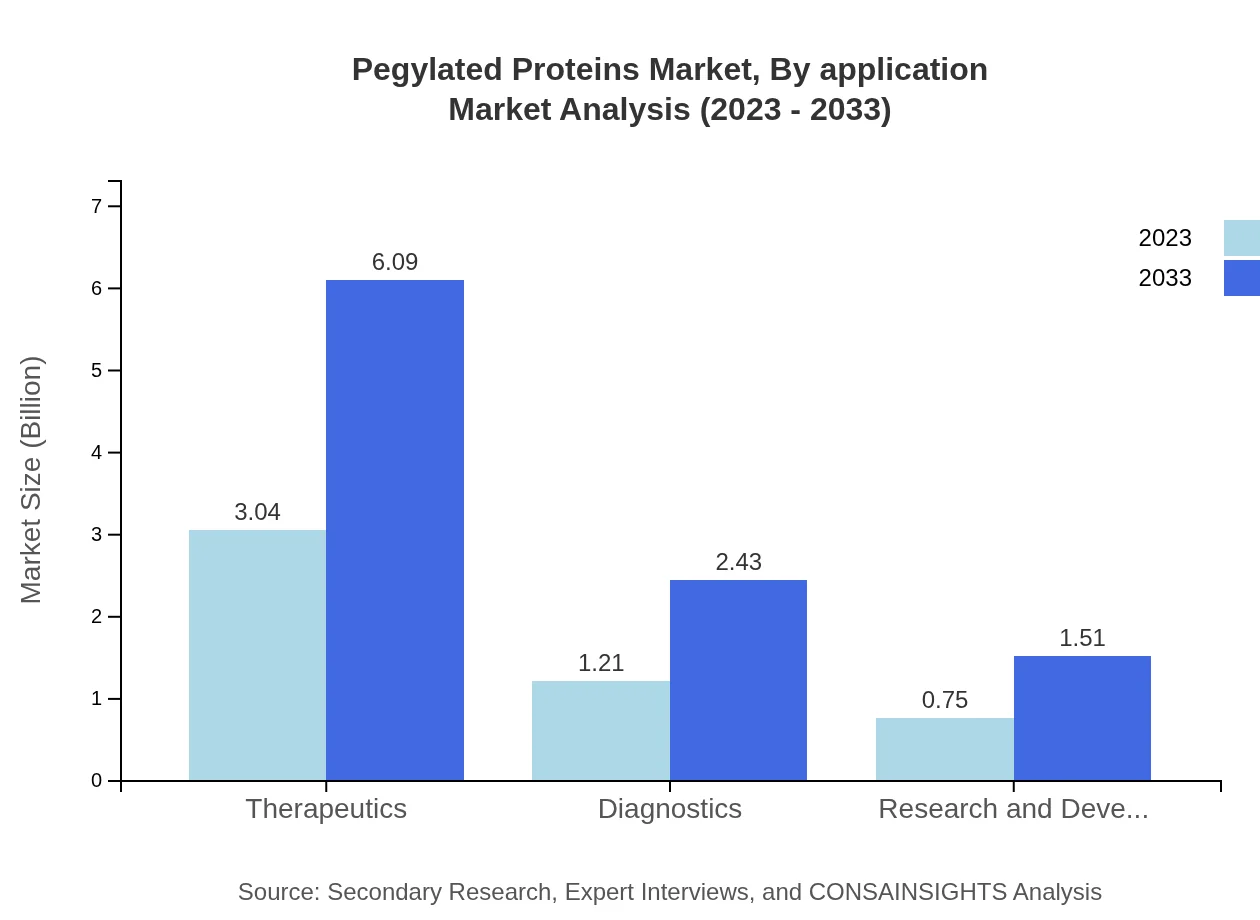

Pegylated Proteins Market Analysis By Application

Applications categorized under Therapeutics, Diagnostics, and Research and Development indicate significant potential. Therapeutics hold the largest share, with $3.04 billion in 2023 and projected growth to $6.09 billion by 2033, complemented by diagnostic applications growing from $1.21 billion to $2.43 billion.

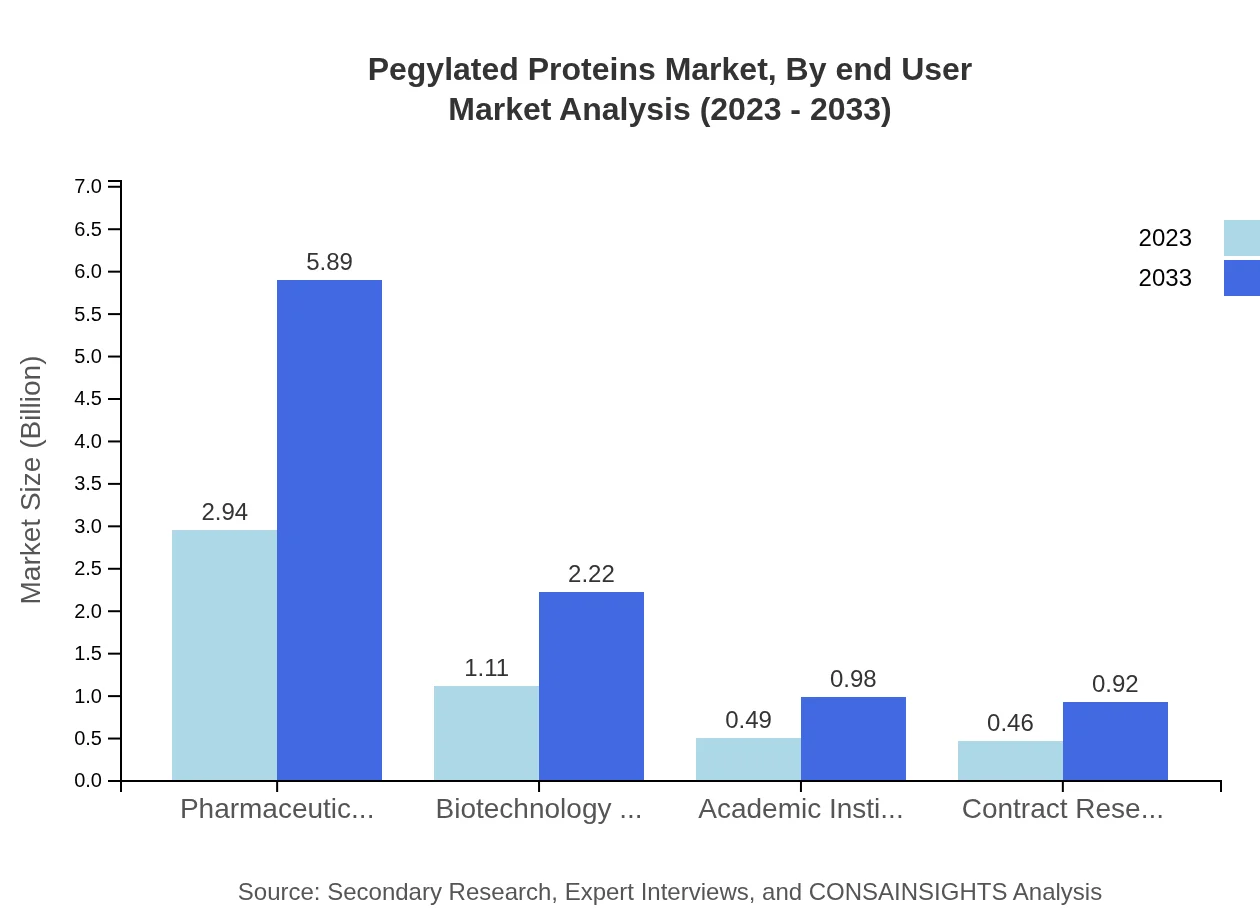

Pegylated Proteins Market Analysis By End User

End-users in the Pegylated Proteins market include Pharmaceutical Companies ($2.94 billion in 2023), Biotechnology Firms ($1.11 billion), Academic Institutions ($0.49 billion), and Contract Research Organizations ($0.46 billion). The demand from pharmaceutical companies is predicted to maintain dominance over the forecast period.

Pegylated Proteins Market Analysis By Route Of Administration

The route of administration is also pivotal, with Intravenous methods leading in market size ($3.04 billion in 2023) and expected to reach $6.09 billion by 2033. Subcutaneous and Intramuscular routes follow with considerable market shares.

Pegylated Proteins Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pegylated Proteins Industry

Amgen Inc.:

Amgen is one of the leading biotechnology companies focusing on developing innovative human therapeutics. They have a strong portfolio of pegylated drugs that enhance the efficacy and reduce the side effects of existing therapies.Roche Holding AG:

Roche is renowned for its significant contributions to diagnostics and therapeutics, including pegylated proteins that address major health issues like cancer.Merck & Co., Inc.:

Merck focuses on a range of therapeutic sectors, including the development of pegylated formulations that improve drug performance and adhere to regulatory standards.Genentech, Inc.:

A member of the Roche Group, Genentech is prominent for its pioneering work in biotechnology, translating research innovations into pegylated drugs that enhance treatment protocols.We're grateful to work with incredible clients.

FAQs

What is the market size of pegylated proteins?

The pegylated proteins market is valued at approximately $5 billion in 2023 and is projected to grow at a CAGR of 7%, reaching significant market size by 2033.

What are the key market players or companies in the pegylated proteins industry?

Key players in the pegylated proteins market include pharmaceutical companies that dominate the market share, such as major biotech firms, along with academic institutions and contract research organizations contributing to advancements in research and development.

What are the primary factors driving the growth in the pegylated proteins industry?

The growth drivers for the pegylated proteins market include advancements in drug delivery systems, increasing incidence of chronic diseases, expanding biotech industries, along with rising investment in research and development by pharmaceutical firms.

Which region is the fastest Growing in the pegylated proteins market?

North America is the fastest-growing region in the pegylated proteins market, expected to expand from $1.76 billion in 2023 to about $3.54 billion by 2033, driven by high healthcare expenditure and innovation.

Does ConsaInsights provide customized market report data for the pegylated proteins industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of clients in the pegylated proteins industry, ensuring comprehensive insights and strategic information.

What deliverables can I expect from this pegylated proteins market research project?

Deliverables from the pegylated proteins market research project will include in-depth market analysis, sector segmentation data, competitive landscape overview, and projections for market growth over the next decade.

What are the market trends of pegylated proteins?

Current trends in the pegylated proteins market include increasing adoption of pegylated therapies in biopharmaceuticals, a rise in personalized medicine, and advancements in synthesis techniques for enhancive therapeutic efficacy.