Pension Funds Market Report

Published Date: 24 January 2026 | Report Code: pension-funds

Pension Funds Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pension Funds market from 2023 to 2033, covering market size, segmentation, regional insights, and analysis of trends and forecasts. It aims to equip stakeholders with valuable data for strategic planning.

| Metric | Value |

|---|---|

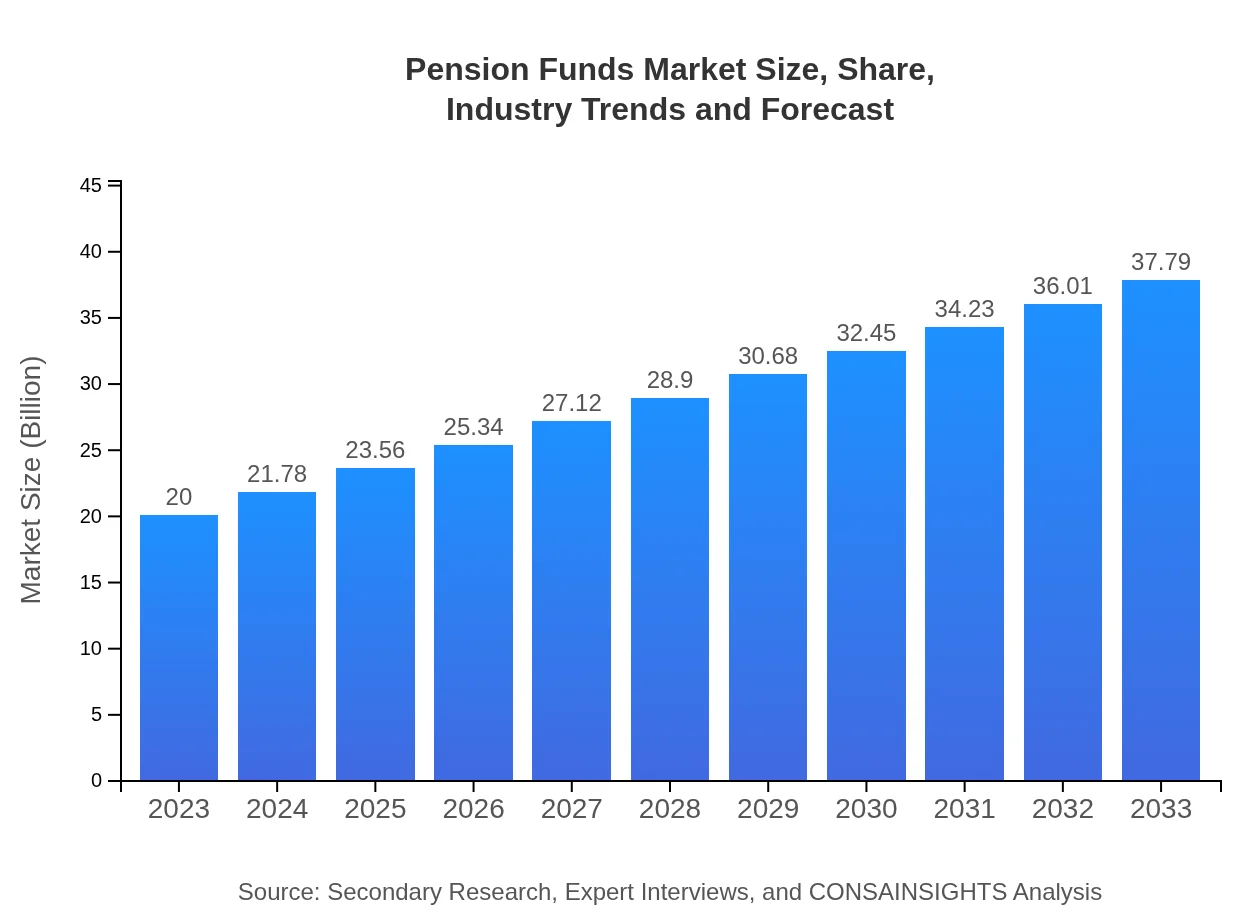

| Study Period | 2023 - 2033 |

| 2023 Market Size | $20.00 Trillion |

| CAGR (2023-2033) | 6.4% |

| 2033 Market Size | $37.79 Trillion |

| Top Companies | BlackRock , Vanguard, Fidelity Investments, State Street Global Advisors |

| Last Modified Date | 24 January 2026 |

Pension Funds Market Overview

Customize Pension Funds Market Report market research report

- ✔ Get in-depth analysis of Pension Funds market size, growth, and forecasts.

- ✔ Understand Pension Funds's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pension Funds

What is the Market Size & CAGR of Pension Funds market in 2023?

Pension Funds Industry Analysis

Pension Funds Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pension Funds Market Analysis Report by Region

Europe Pension Funds Market Report:

Europe's pension funds market will grow from $4.80 trillion in 2023 to $9.08 trillion by 2033, driven by regulatory frameworks encouraging retirement savings and a growing trend towards self-directed investment options to increase individual portfolios.Asia Pacific Pension Funds Market Report:

The Asia Pacific region entails a rapidly growing pension funds market, projected to increase from $4.35 trillion in 2023 to $8.22 trillion by 2033. Economic growth, coupled with advancing aging populations, is propelling this growth. Digital innovations in fund management also significantly enhance participation.North America Pension Funds Market Report:

North America leads with a pension funds market size of approximately $7.33 trillion in 2023, likely to grow to $13.84 trillion by 2033. The high prevalence of defined contribution plans and increasing participation in employer-sponsored retirement plans fuel this growth.South America Pension Funds Market Report:

In South America, the pension funds market is anticipated to grow from $1.58 trillion to $2.99 trillion from 2023 to 2033. Factors contributing to this expansion include increased awareness about retirement savings and government reforms aimed at improving pension fund systems.Middle East & Africa Pension Funds Market Report:

The market in the Middle East and Africa is on the rise, with a value expected to expand from $1.94 trillion in 2023 to $3.66 trillion by 2033. The region's efforts toward economic diversification and financial inclusion are pivotal in developing a sustainable pension sector.Tell us your focus area and get a customized research report.

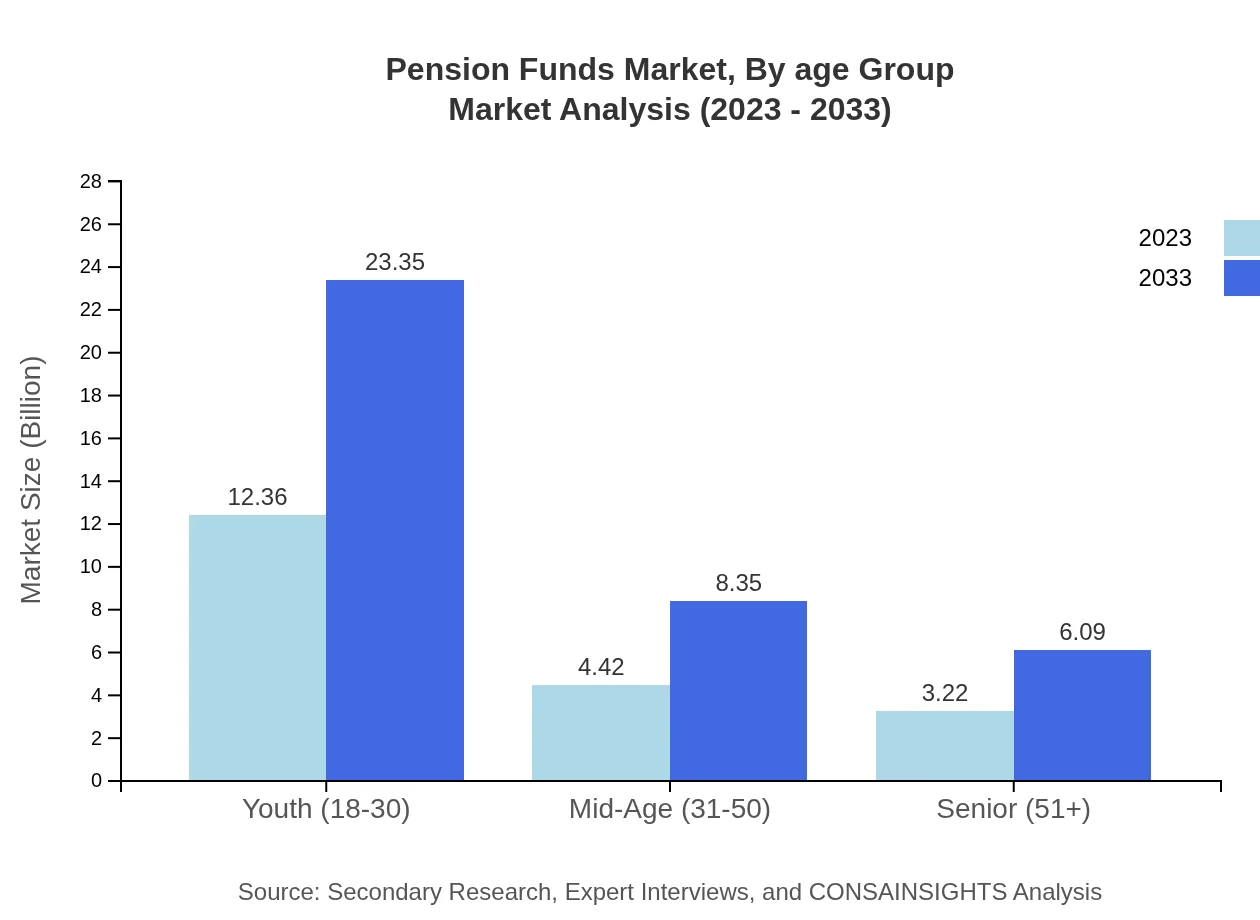

Pension Funds Market Analysis By Age Group

The age groups segment displays a clear stratification in participant interest: the youth segment (18-30) holds a sizable market share, representing $12.36 trillion in 2023, expected to double due to millennial awareness, while mid-age (31-50) and seniors (51+) account for $4.42 trillion and $3.22 trillion respectively. Such shifts illustrate how demographic transitions influence asset allocation strategies.

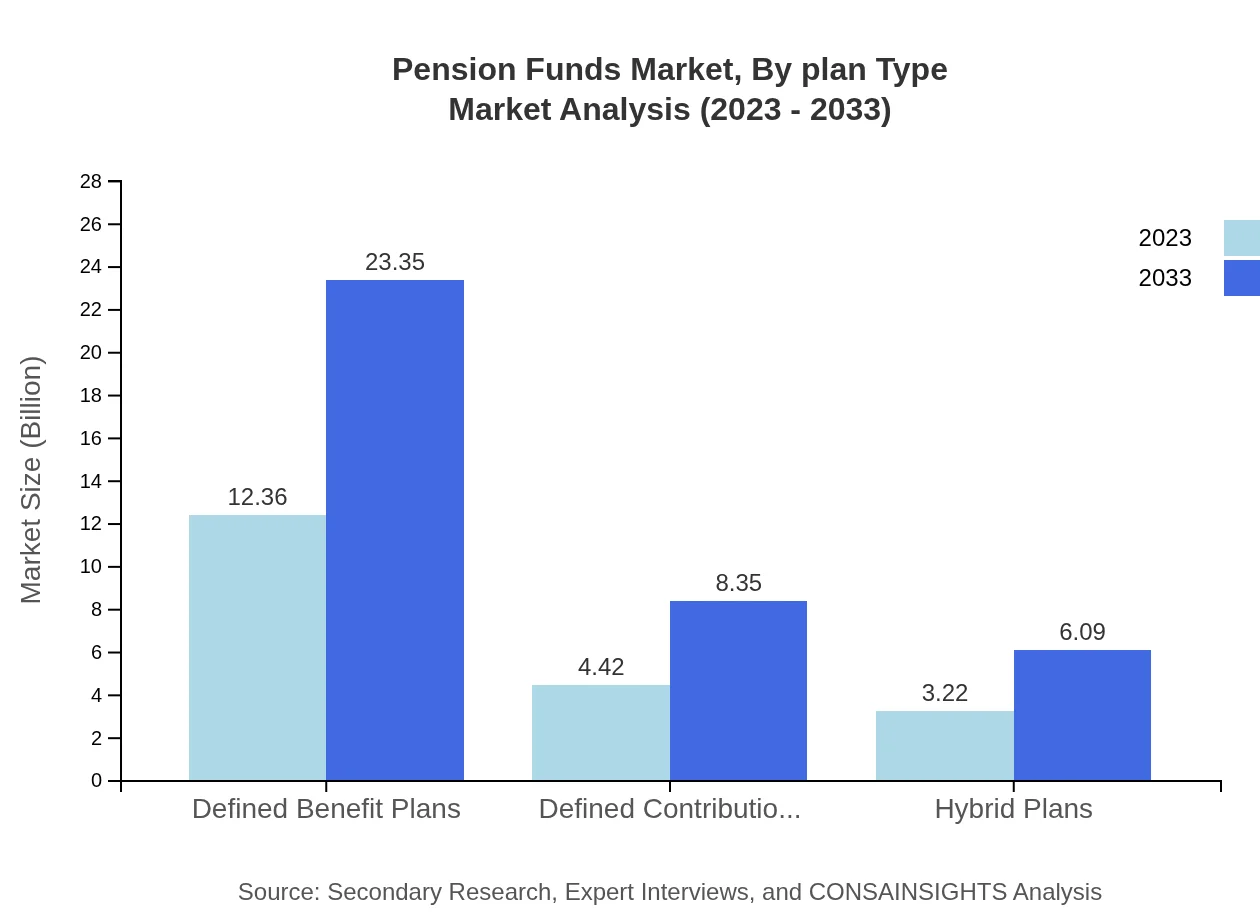

Pension Funds Market Analysis By Plan Type

Defined Benefit Plans dominate the pension funds market, accounting for $12.36 trillion in 2023, with incremental growth expected. Defined Contribution Plans and Hybrid Plans follow, while growing awareness about individual retirement necessitates varied approaches in plan development. Collectively, the segmentation allows stakeholders to gauge shifts in contribution patterns.

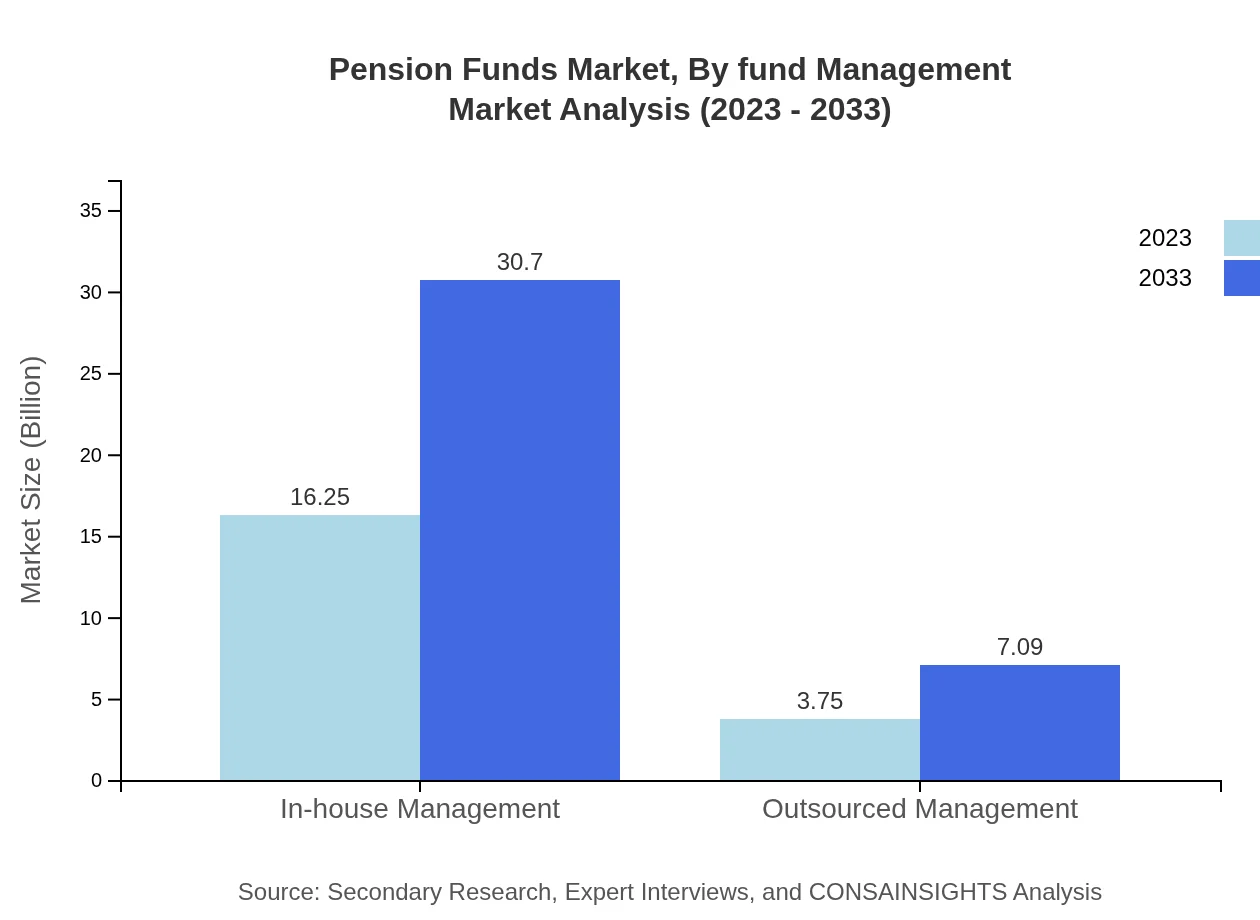

Pension Funds Market Analysis By Fund Management

The management of pension funds is increasingly seen through two lenses: In-house Management, representing $16.25 trillion in 2023, preserves control over fund strategies; outsourced management, while smaller at $3.75 trillion, continues to grow due to operational efficiency demands and the quest for specialized expertise.

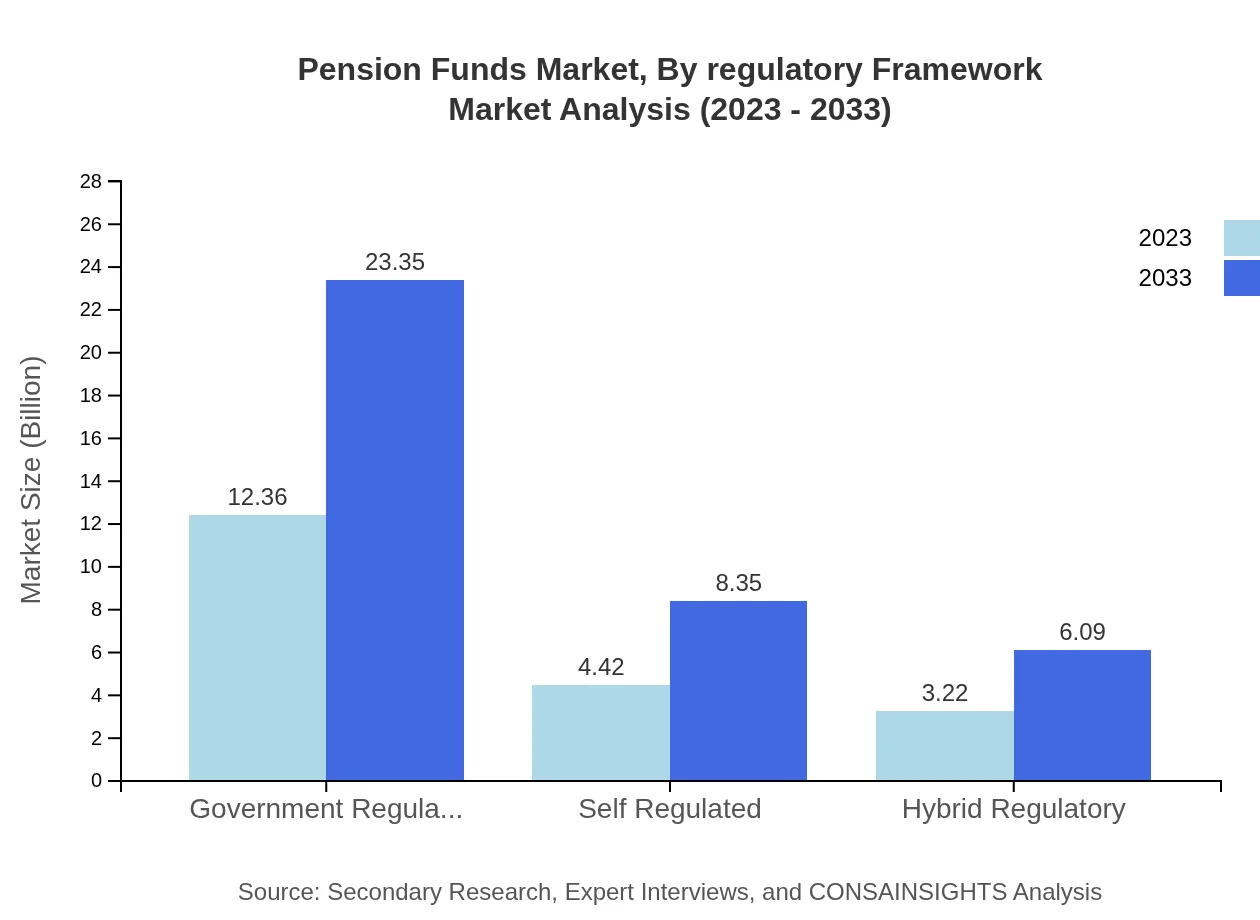

Pension Funds Market Analysis By Regulatory Framework

With regulatory frameworks evolving, the market is segmented into Government Regulated and Self Regulated categories. The Government Regulated funds, valued at $12.36 trillion in 2023, ensure compliance with standards, while Self Regulated funds offer flexibility, catering to innovative investment strategies.

Pension Funds Market Analysis By Investment Type

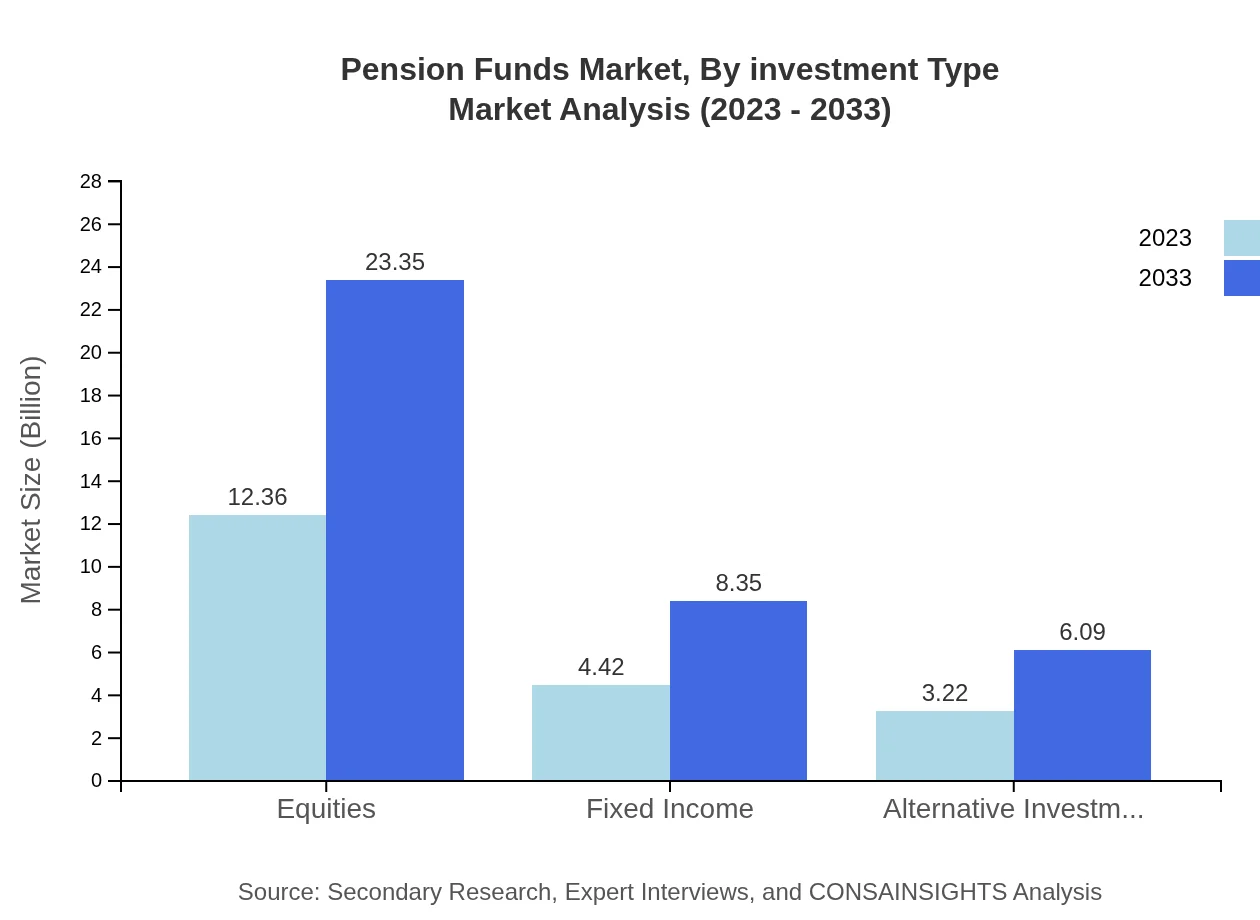

Investment type plays a critical role, with Equities representing $12.36 trillion in 2023, while Fixed Income and Alternative Investments follow, reflecting investor trends and capabilities in pursuing higher returns. The drive for balanced portfolios continues to reshape how pension funds allocate capital.

Pension Funds Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pension Funds Industry

BlackRock :

A leading global investment management corporation, BlackRock focuses on risk management and asset allocation, managing tens of trillions in assets across its pension funds.Vanguard:

Known for its low-cost index funds, Vanguard exemplifies effective pension fund management, continuously innovating to meet client needs for retirement savings.Fidelity Investments:

With a broad range of investment products, Fidelity is a major player in the Pension Funds market, providing solutions for defined benefit and defined contribution plans.State Street Global Advisors:

State Street is recognized for its expertise in institutional investing and is heavily involved in managing pension assets, aligning investment strategies with clients' long-term goals.We're grateful to work with incredible clients.

FAQs

What is the market size of pension funds?

The global pension funds market is valued at approximately $20 trillion in 2023, with a projected CAGR of 6.4% from 2023 to 2033, indicating substantial growth opportunities in this sector over the next decade.

What are the key market players or companies in the pension funds industry?

Key players in the pension funds industry include large financial institutions, asset management firms, and insurance companies, which manage significant assets and influence market trends with their investment strategies and offerings.

What are the primary factors driving the growth in the pension funds industry?

Growth in the pension funds industry is primarily driven by increasing life expectancy, greater financial literacy among individuals, rising levels of disposable income, and a shift towards defined contribution plans that offer portability and flexibility.

Which region is the fastest Growing in the pension funds market?

The fastest-growing region in the pension funds market is Asia Pacific, expected to increase from $4.35 trillion in 2023 to $8.22 trillion in 2033, reflecting the region's expanding middle class and increasing demand for retirement savings options.

Does ConsaInsights provide customized market report data for the pension funds industry?

Yes, ConsaInsights offers tailored market research reports for the pension funds industry that can be customized to meet specific client needs, ensuring relevant insights and data are provided for strategic decision-making.

What deliverables can I expect from this pension funds market research project?

Deliverables from the pension funds market research project typically include detailed reports with market size data, growth forecasts, competitive analysis, regional insights, and segment breakdowns to support informed investment strategies.

What are the market trends of pension funds?

Current market trends in pension funds include a shift toward investment diversification, emphasis on sustainable and responsible investing, increasing use of technology for fund management, and growing interest in alternative investment options for enhanced returns.