People Counting System Market Report

Published Date: 31 January 2026 | Report Code: people-counting-system

People Counting System Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the People Counting System market, including market size forecasts, segment insights, industry trends, and regional performance for 2023-2033.

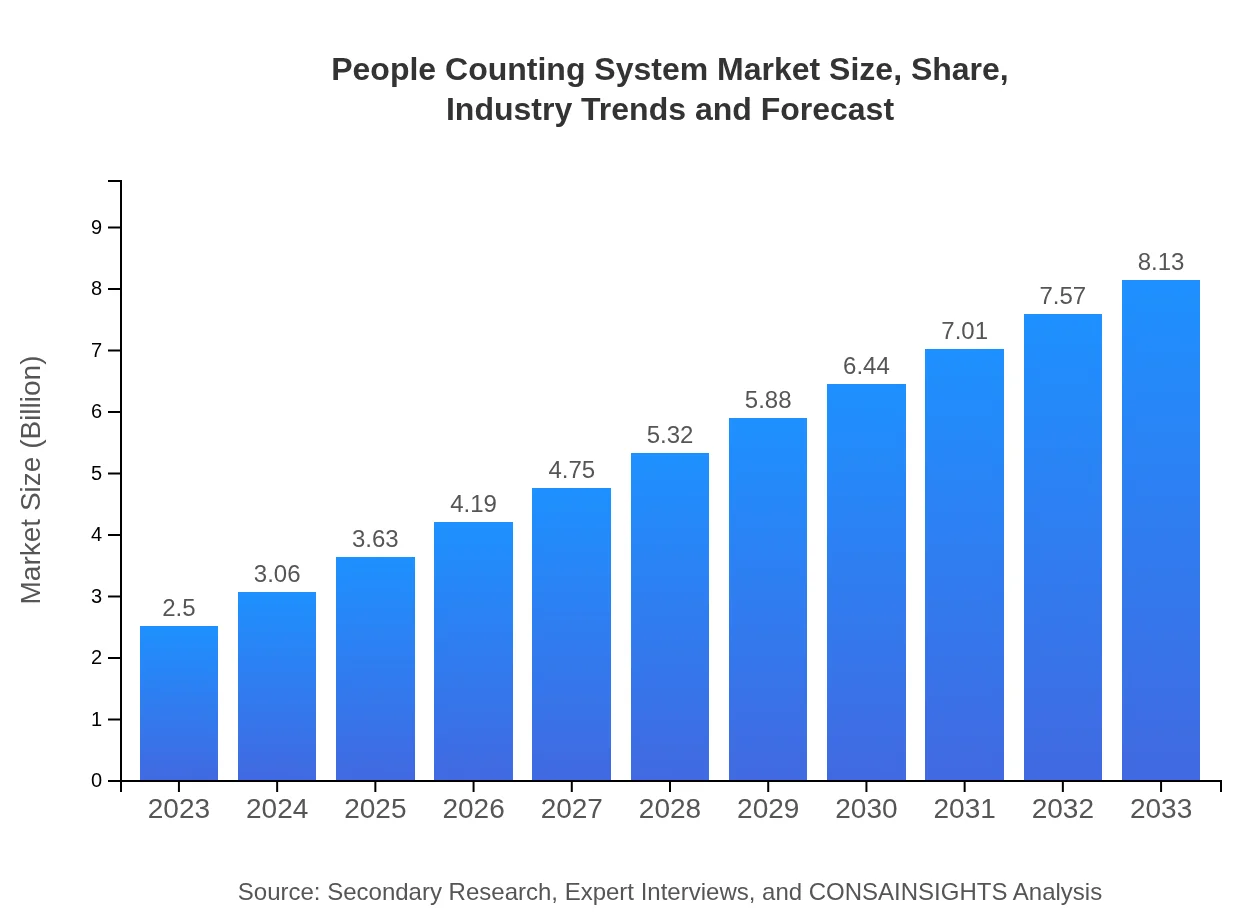

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $8.13 Billion |

| Top Companies | Sensource, RetailNext, V-Count, CountWise |

| Last Modified Date | 31 January 2026 |

People Counting System Market Overview

Customize People Counting System Market Report market research report

- ✔ Get in-depth analysis of People Counting System market size, growth, and forecasts.

- ✔ Understand People Counting System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in People Counting System

What is the Market Size & CAGR of People Counting System market in 2023?

People Counting System Industry Analysis

People Counting System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

People Counting System Market Analysis Report by Region

Europe People Counting System Market Report:

Europe's market is expected to expand from $0.70 billion in 2023 to $2.28 billion by 2033, supported by infrastructure investments in urban mobility and an increase in retail analytics adoption across Western and Eastern Europe.Asia Pacific People Counting System Market Report:

The Asia Pacific region is projected to grow from $0.53 billion in 2023 to $1.74 billion in 2033, driven by an uptick in infrastructure development and a growing retail sector in emerging markets. Government initiatives supporting smart cities are fueling the adoption of advanced counting systems.North America People Counting System Market Report:

North America is expected to grow significantly from $0.82 billion in 2023 to $2.65 billion in 2033. The region's technological advancements and heightened emphasis on data analytics play a pivotal role in driving market demand.South America People Counting System Market Report:

In South America, the market is projected to increase from $0.12 billion in 2023 to $0.38 billion by 2033, as investments in modern retail and public transportation systems rise. Challenges remain due to fluctuating economic conditions.Middle East & Africa People Counting System Market Report:

The Middle East and Africa region is anticipated to grow from $0.33 billion in 2023 to $1.08 billion in 2033. The expansion is backed by a growing focus on enhancing security and visitor management across shopping malls and public venues.Tell us your focus area and get a customized research report.

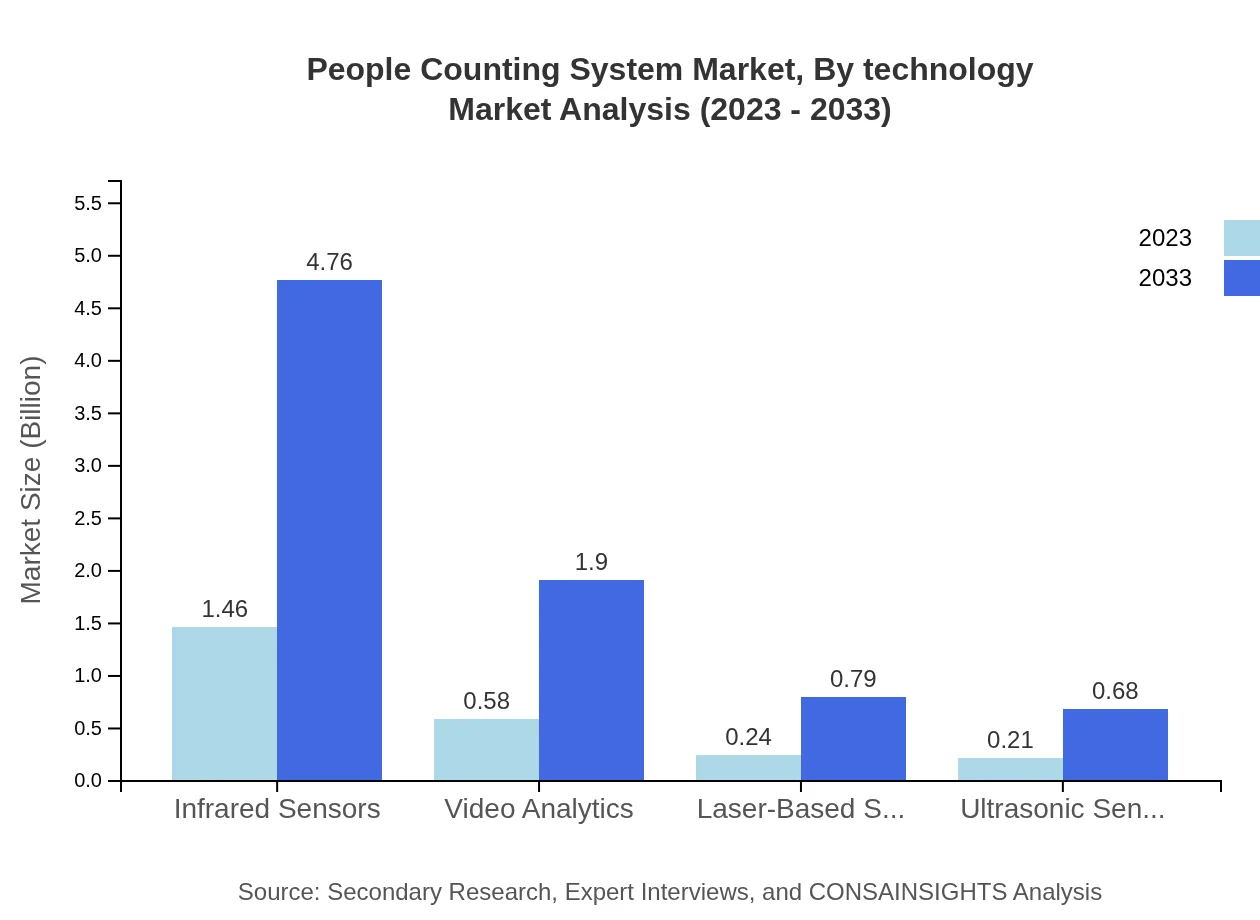

People Counting System Market Analysis By Technology

The People Counting System offers various technologies, including infrared sensors, video analytics, laser-based systems, and ultrasonic sensors. Infrared sensors dominate the market in both size and share, accounting for approximately $1.46 billion (58.5%) in 2023 and projected to reach $4.76 billion by 2033. Video analytics also sees substantial traction, growing from $0.58 billion (23.36%) to $1.90 billion in the same period.

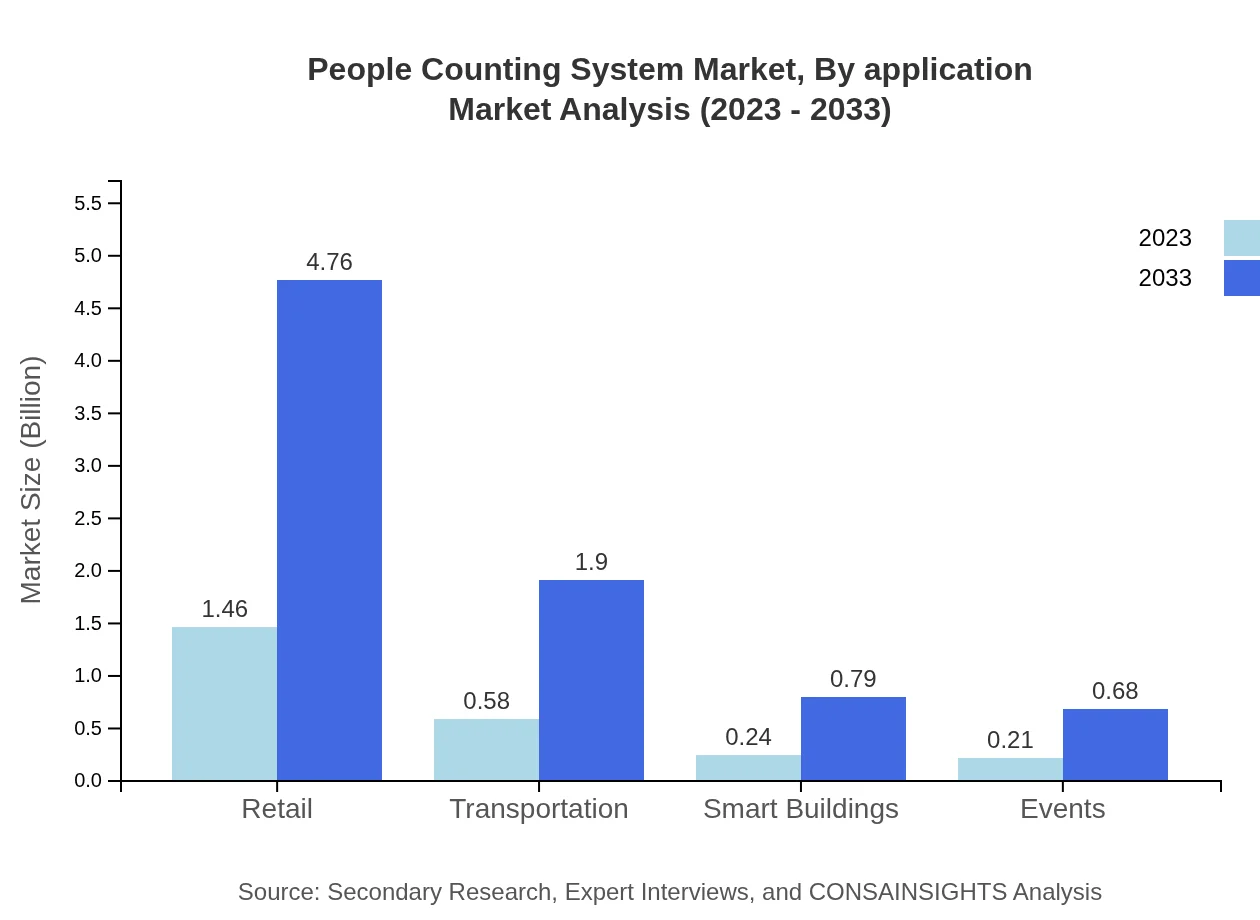

People Counting System Market Analysis By Application

Applications of People Counting Systems span urban planning, healthcare, education, event hosting, and retail. Urban Planning represents a key segment, projected to grow from $1.46 billion in 2023 to $4.76 billion by 2033. In the retail sector, the market is projected to grow to $4.76 billion by 2033, driven by enhanced customer experience strategies.

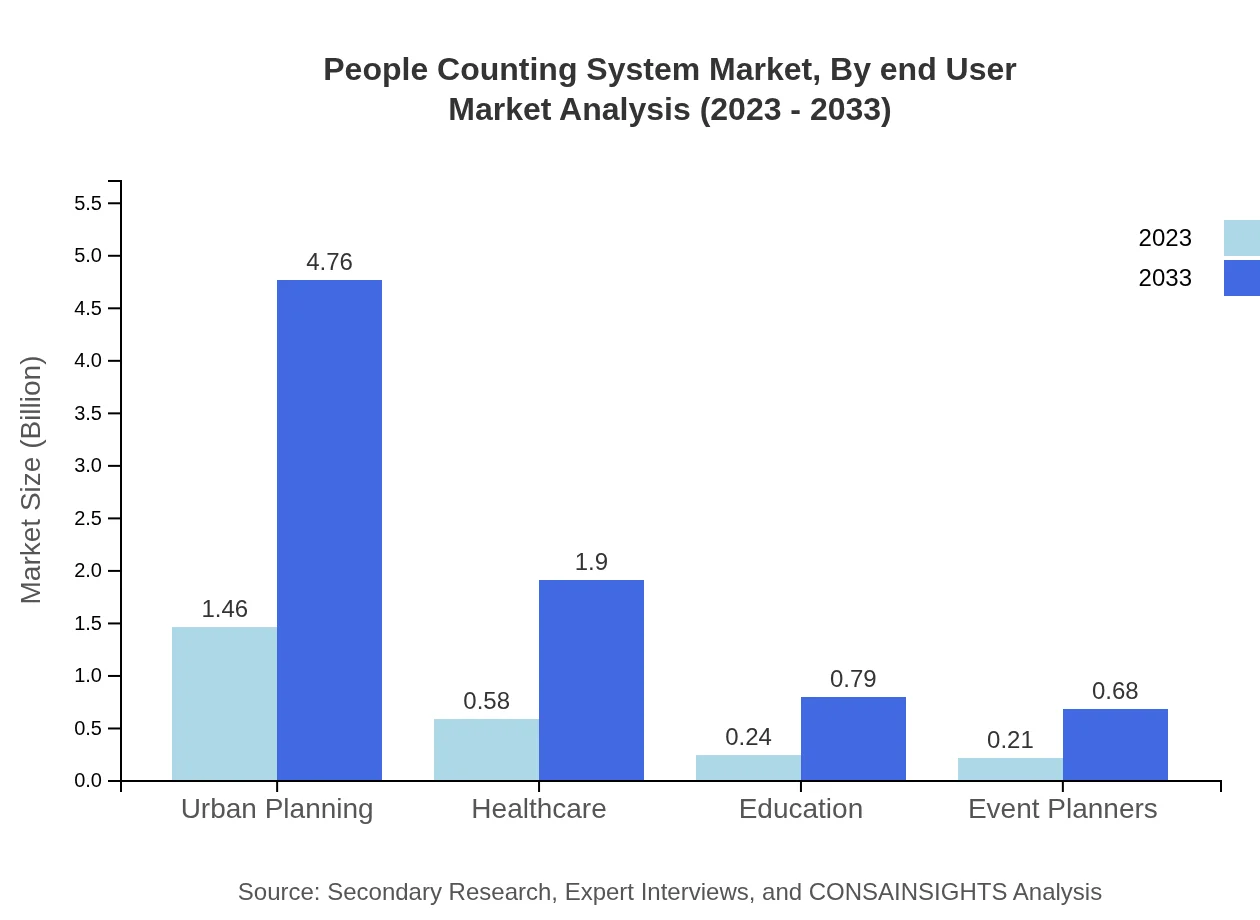

People Counting System Market Analysis By End User

End-users of People Counting Systems include retail, transportation, and hospitality industries. Retail remains the most significant end-user, with a substantial share, capturing around 58.5% of the market in 2023. The transportation sector is also notable, projected to grow significantly as public transit systems seek operational efficiencies and better crowd management.

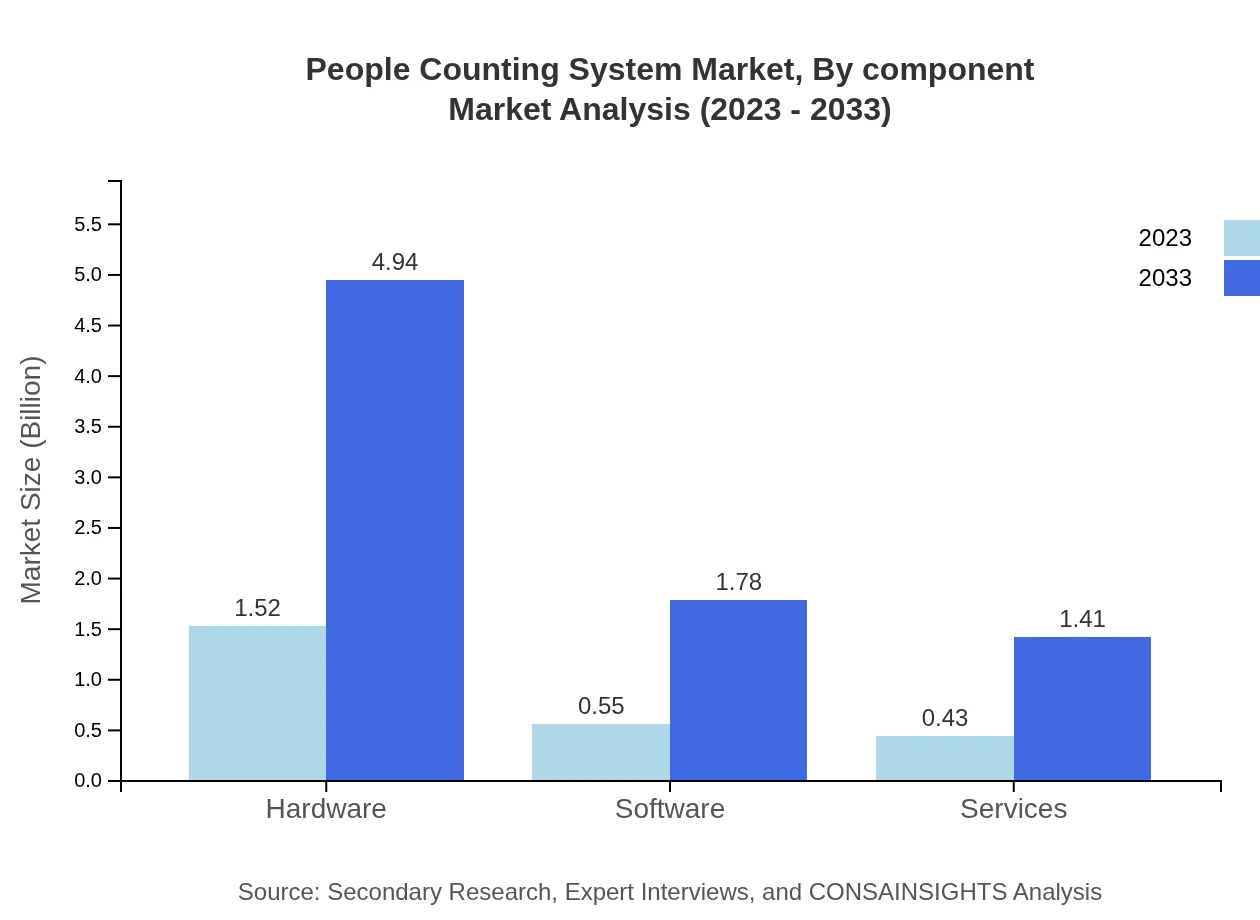

People Counting System Market Analysis By Component

The market can be classified into hardware, software, and services. Hardware leads the segment with a 60.76% market share in 2023, growing from $1.52 billion to $4.94 billion by 2033, driven by continual technological advancement. Software solutions and services are growing rapidly, propelled by increased demand for integrated people counting and management solutions.

People Counting System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in People Counting System Industry

Sensource:

Sensource is known for its advanced analytics solutions, offering high accuracy and customizable people counting systems to various sectors, primarily retail and transportation.RetailNext:

RetailNext specializes in retail analytics technology, providing insights for store performance through sophisticated people counting solutions, enhancing the customer experience.V-Count:

V-Count develops sophisticated people counting systems leveraging AI and analytics, serving a diverse global customer base across retail, transportation, and public sectors.CountWise:

CountWise provides state-of-the-art people counting technologies, focusing on retail and event management sectors with an emphasis on customer experience enhancements.We're grateful to work with incredible clients.

FAQs

What is the market size of People Counting Systems?

The global People Counting System market is valued at approximately $2.5 billion in 2023 and is projected to grow at a CAGR of 12%, reaching around $8.05 billion by 2033, driven by increased demand in various sectors.

What are the key market players or companies in the People Counting Systems industry?

Key players in the People Counting Systems market include notable companies like Axis Communications, Sensormatic Solutions, and RetailNext. These companies are significant for their technological advancements and comprehensive solutions for various industries.

What are the primary factors driving the growth in the People Counting Systems industry?

The growth of the People Counting Systems industry is primarily driven by the increasing demand for retail traffic analytics, smart building implementations, and the need for enhanced safety and efficiency in public spaces, boosting the adoption of these systems.

Which region is the fastest Growing in the People Counting Systems market?

The Asia Pacific region is the fastest-growing market for People Counting Systems, with market growth from $0.53 billion in 2023 to $1.74 billion by 2033. This surge is fueled by rapid urbanization and technological advancements.

Does ConsaInsights provide customized market report data for the People Counting Systems industry?

Yes, ConsaInsights offers tailored market report data for the People Counting Systems industry. Customized reports can address specific needs such as regional insights, market trends, and detailed analysis focused on particular segments.

What deliverables can I expect from this People Counting Systems market research project?

Deliverables from the People Counting Systems market research project typically include comprehensive market analysis, forecasts, segment insights, competitive landscape reviews, and tailored recommendations based on current trends and future growth opportunities.

What are the market trends of People Counting Systems?

Current market trends for People Counting Systems include increasing integration of AI and advanced analytics for improved operational efficiency, heightened demand in smart buildings and retail sectors, and a growing focus on data-driven decision-making, enhancing user experience.