Peptide And Anticoagulant Drugs Market Report

Published Date: 31 January 2026 | Report Code: peptide-and-anticoagulant-drugs

Peptide And Anticoagulant Drugs Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Peptide and Anticoagulant Drugs market, covering market size, growth trends, segmentation, and regional insights from 2023 to 2033.

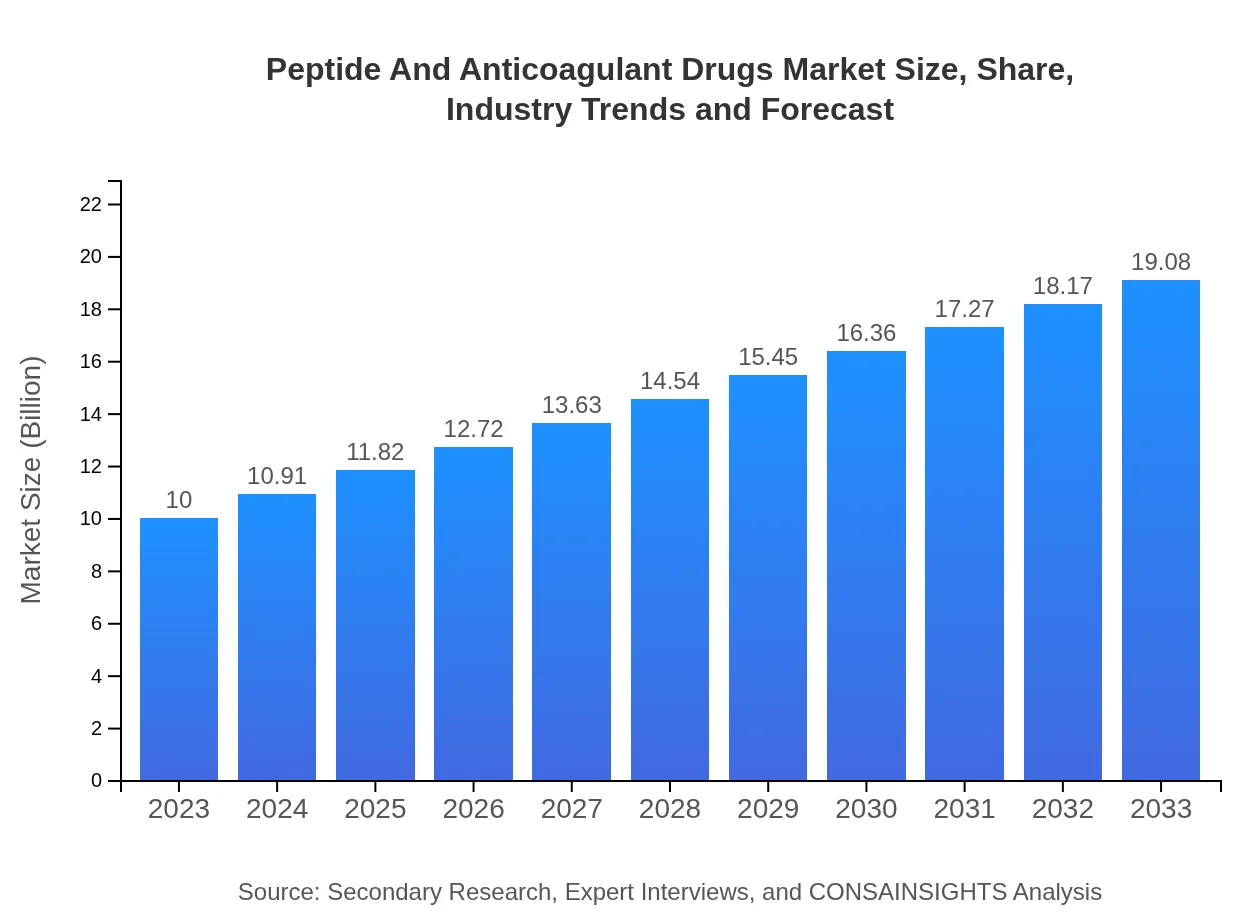

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $19.08 Billion |

| Top Companies | Pfizer Inc., Boehringer Ingelheim, Novartis AG, Sanofi S.A., AstraZeneca |

| Last Modified Date | 31 January 2026 |

Peptide And Anticoagulant Drugs Market Overview

Customize Peptide And Anticoagulant Drugs Market Report market research report

- ✔ Get in-depth analysis of Peptide And Anticoagulant Drugs market size, growth, and forecasts.

- ✔ Understand Peptide And Anticoagulant Drugs's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Peptide And Anticoagulant Drugs

What is the Market Size & CAGR of Peptide And Anticoagulant Drugs market in 2023?

Peptide And Anticoagulant Drugs Industry Analysis

Peptide And Anticoagulant Drugs Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Peptide And Anticoagulant Drugs Market Analysis Report by Region

Europe Peptide And Anticoagulant Drugs Market Report:

Europe's Peptide and Anticoagulant Drugs market is forecasted to grow from $3.36 billion in 2023 to $6.40 billion by 2033. This increase is driven by extensive research initiatives, regulatory support for new drug developments, and a focus on innovative treatment solutions.Asia Pacific Peptide And Anticoagulant Drugs Market Report:

In 2023, the Asia Pacific region's Peptide and Anticoagulant Drugs market is valued at $1.76 billion and is projected to grow to $3.35 billion by 2033, reflecting a significant CAGR. This growth can be attributed to an increasing patient population, advancements in healthcare infrastructure, and a rise in the adoption of novel therapeutic solutions.North America Peptide And Anticoagulant Drugs Market Report:

North America holds a valuation of $3.45 billion in 2023 and is expected to reach $6.58 billion by 2033. This region remains a leader in the adoption of new therapies due to its advanced healthcare system, prevalent R&D activities, and high healthcare expenditures.South America Peptide And Anticoagulant Drugs Market Report:

The South American market for Peptide and Anticoagulant Drugs is estimated at $0.27 billion in 2023, with expectations of reaching $0.51 billion by 2033. Growing awareness regarding the treatment of chronic diseases and governmental investments in healthcare are key factors driving market expansion.Middle East & Africa Peptide And Anticoagulant Drugs Market Report:

The Middle East and Africa market is valued at $1.17 billion in 2023, with projections reaching $2.23 billion by 2033. Factors fueling this growth include an increase in healthcare access, rising prevalence of chronic diseases, and a growing focus on improving healthcare systems in emerging economies.Tell us your focus area and get a customized research report.

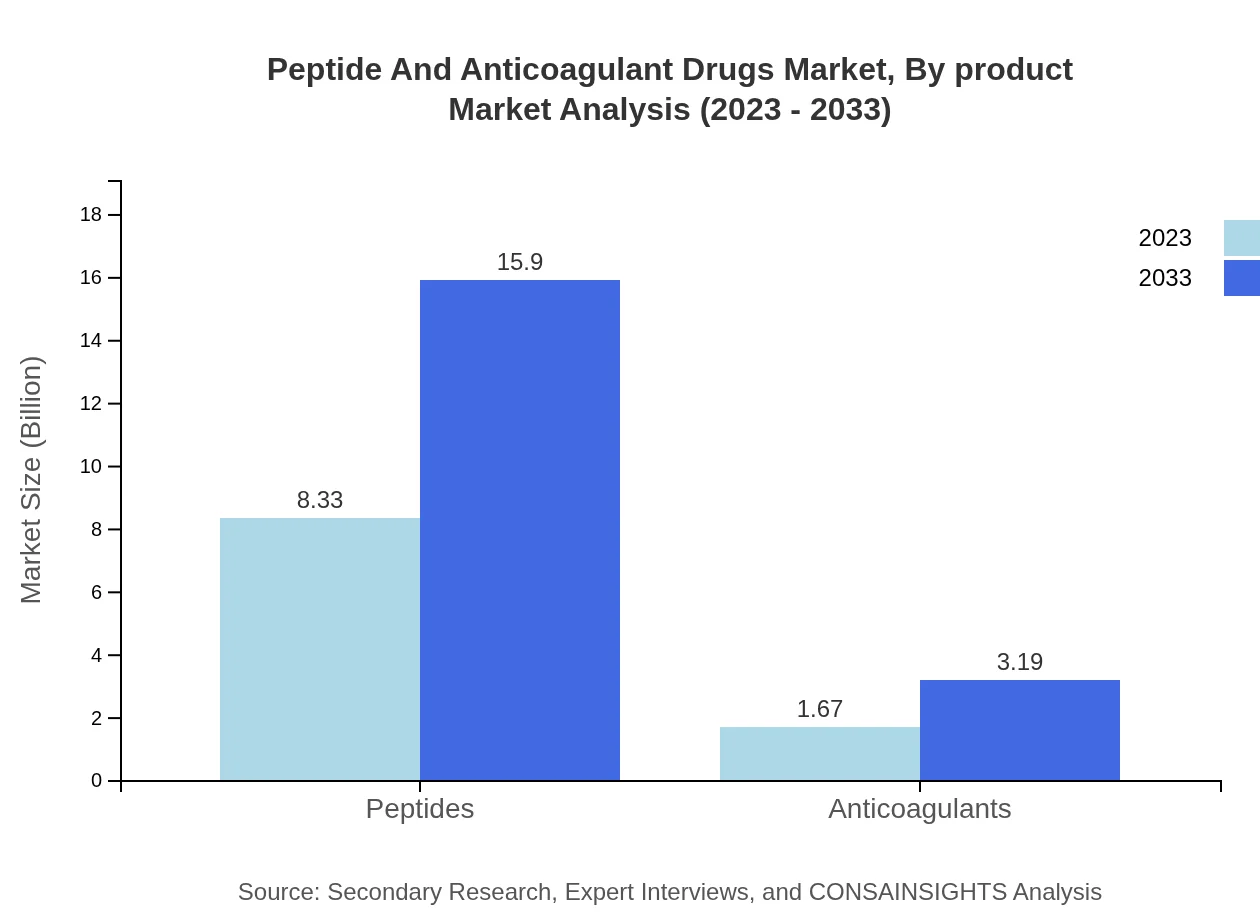

Peptide And Anticoagulant Drugs Market Analysis By Product

The market for Peptides is expected to grow from $8.33 billion in 2023 to $15.90 billion by 2033, accounting for 83.3% of the market share. In contrast, Anticoagulants will see an increase from $1.67 billion to $3.19 billion, maintaining a significant presence at 16.7% market share.

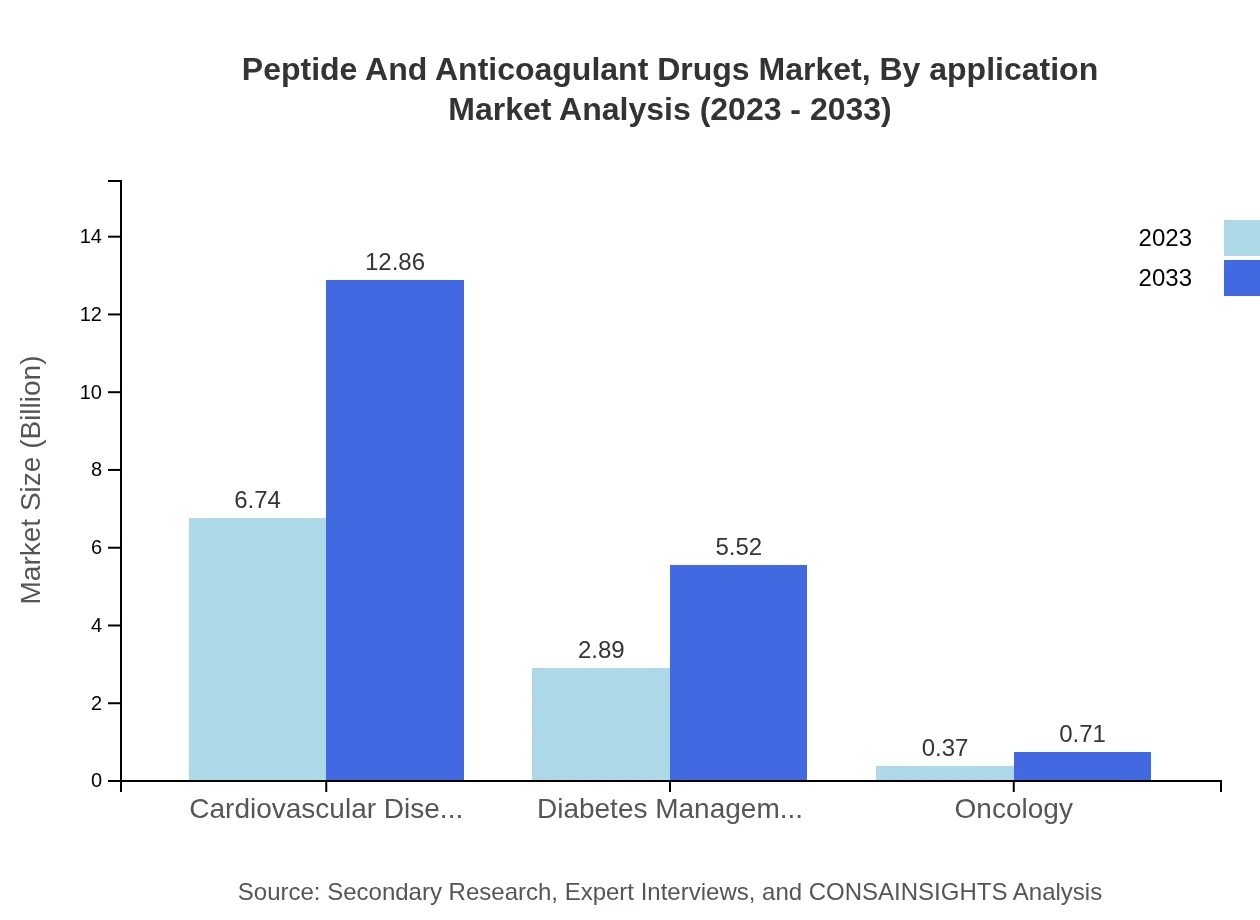

Peptide And Anticoagulant Drugs Market Analysis By Application

In applications, the segment related to Cardiovascular Diseases is projected to grow from $6.74 billion in 2023 to $12.86 billion by 2033, holding 67.37% of market share. The Diabetes Management segment will expand from $2.89 billion to $5.52 billion, representing 28.92%, while Oncology remains a smaller segment, with a projected increase from $0.37 billion to $0.71 billion, making up 3.71%.

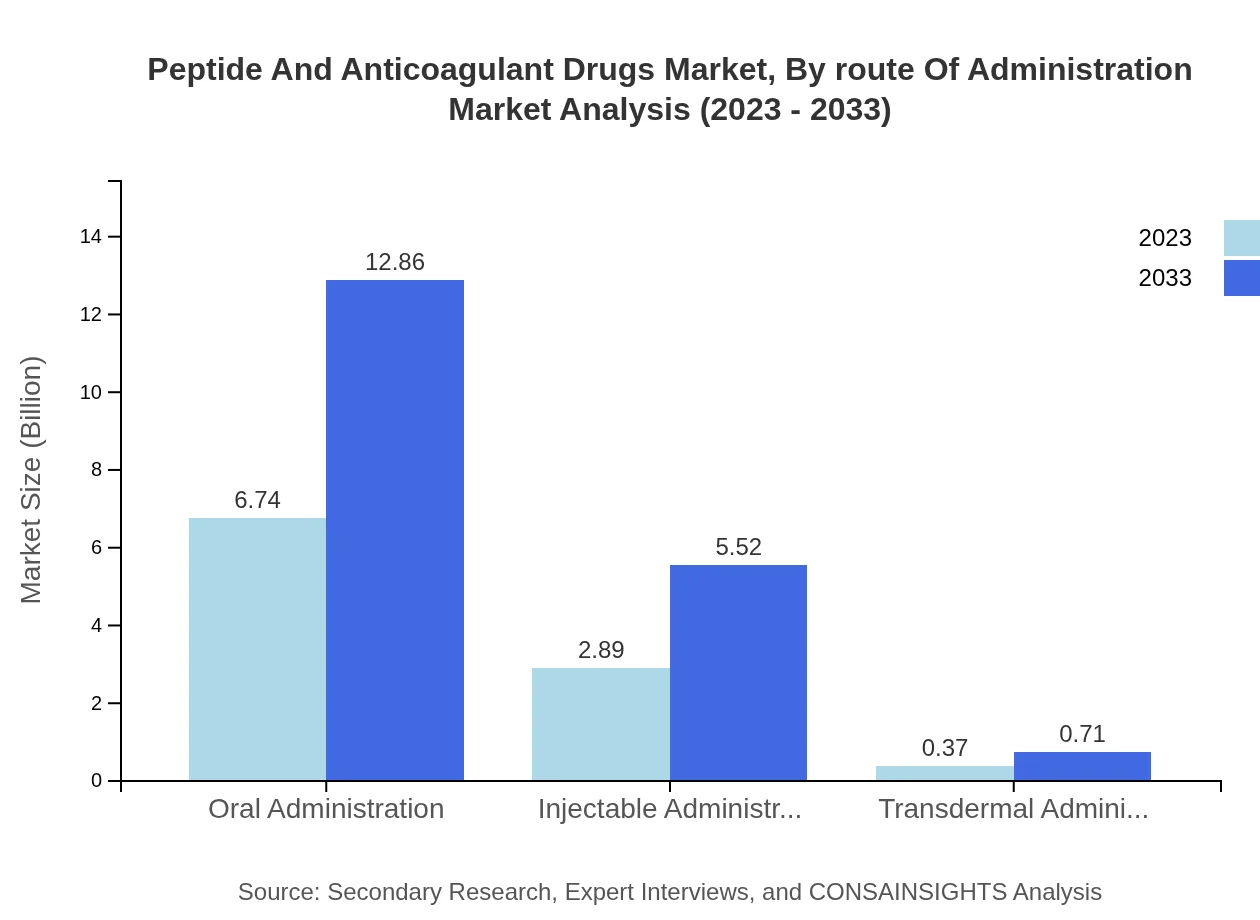

Peptide And Anticoagulant Drugs Market Analysis By Route Of Administration

Oral administration accounts for a substantial portion of the market, anticipated to grow from $6.74 billion in 2023 to $12.86 billion by 2033, representing 67.37% of the market. Injectable administration is also significant, projected to rise from $2.89 billion to $5.52 billion, corresponding to 28.92% of the market, with transdermal administration remaining relatively minor, forecasted at $0.37 billion to $0.71 billion (3.71%).

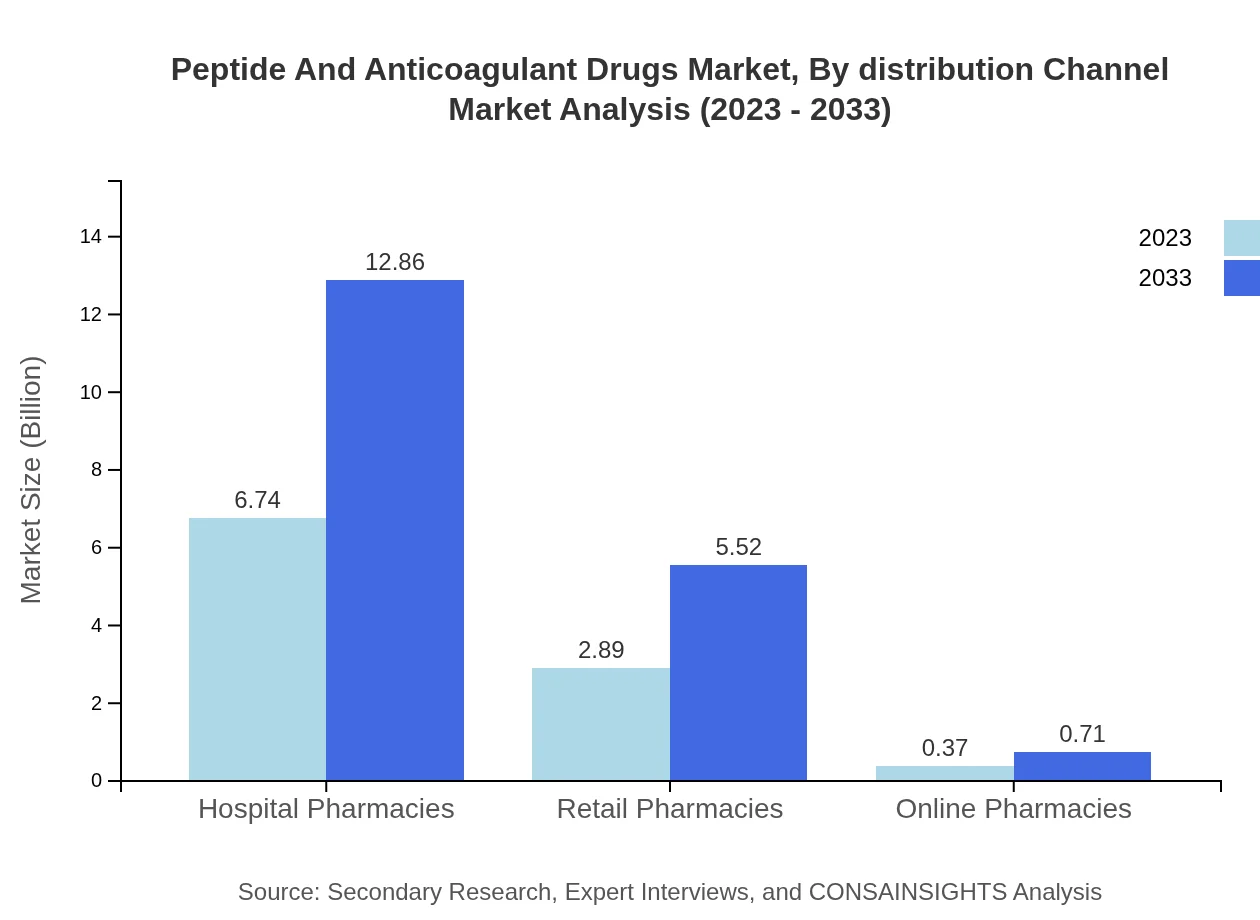

Peptide And Anticoagulant Drugs Market Analysis By Distribution Channel

Hospital pharmacies hold a dominant market share, projected to grow from $6.74 billion in 2023 to $12.86 billion by 2033, maintaining a 67.37% share. Retail pharmacies are similarly significant, with expected growth from $2.89 billion to $5.52 billion (28.92%). Online pharmacies, while smaller, are projected to expand from $0.37 billion to $0.71 billion, growing their contribution to the overall market.

Peptide And Anticoagulant Drugs Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Peptide And Anticoagulant Drugs Industry

Pfizer Inc.:

A leading global biopharmaceutical company, Pfizer specializes in medicines and vaccines, harnessing innovative science to improve health outcomes.Boehringer Ingelheim:

Boehringer Ingelheim is committed to researching and developing innovative therapies that enhance the treatment of diseases, particularly in the anticoagulant segment.Novartis AG:

Novartis is a prominent player that invests heavily in research and development to provide innovative drug options in various therapeutic areas, including the Peptide market.Sanofi S.A.:

Sanofi focuses on developing solutions in diabetes management and cardiovascular treatments, with a strong presence in peptide and anticoagulant drugs.AstraZeneca:

AstraZeneca is a biopharmaceutical company that prioritizes the innovation of drug types, especially in the fields of oncology and cardiovascular diseases.We're grateful to work with incredible clients.

FAQs

What is the market size of Peptide and Anticoagulant Drugs?

The global market size for peptide and anticoagulant drugs is estimated to be approximately $10 billion in 2023, projecting a Compound Annual Growth Rate (CAGR) of 6.5% to reach significant growth by 2033.

What are the key market players or companies in the Peptide and Anticoagulant Drugs industry?

Key players in the peptide and anticoagulant drugs market include major pharmaceutical companies specializing in innovative drug development and production, with notable contributions from firms like Pfizer, Novartis, and Sanofi shaping the landscape of this industry.

What are the primary factors driving the growth in the Peptide and Anticoagulant Drugs industry?

Growth in the peptide and anticoagulant drugs industry is driven by the rising prevalence of cardiovascular diseases, advancements in gene therapy, increased research funding, and a growing demand for personalized medicine, leading to innovative drug solutions.

Which region is the fastest Growing in the Peptide and Anticoagulant Drugs market?

The Asia-Pacific region is identified as the fastest-growing segment in the peptide and anticoagulant drugs market, with market size projected to expand from $1.76 billion in 2023 to $3.35 billion by 2033, reflecting significant growth opportunities.

Does ConsaInsights provide customized market report data for the Peptide and Anticoagulant Drugs industry?

Yes, ConsaInsights offers customized market report data tailored to the unique needs of clients within the peptide and anticoagulant drugs industry, allowing for a focused analysis of specific market segments.

What deliverables can I expect from this Peptide and Anticoagulant Drugs market research project?

Expected deliverables from the peptide and anticoagulant drugs market research project include comprehensive market analysis reports, trend assessments, competitive landscape evaluations, and detailed segment insights with actionable recommendations.

What are the market trends of Peptide and Anticoagulant Drugs?

Current trends in the peptide and anticoagulant drugs market encompass growing investments in biopharmaceuticals, increased use of peptides in drug delivery systems, and the rise of novel anticoagulation therapies to address unmet medical needs.