Peptides And Heparin Market Report

Published Date: 31 January 2026 | Report Code: peptides-and-heparin

Peptides And Heparin Market Size, Share, Industry Trends and Forecast to 2033

This report provides an insightful analysis of the Peptides and Heparin market from 2023 to 2033, highlighting market dynamics, trends, and forecasts. Detailed insights into market segmentation, regional analysis, and industry leaders are included to guide stakeholders in strategic decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

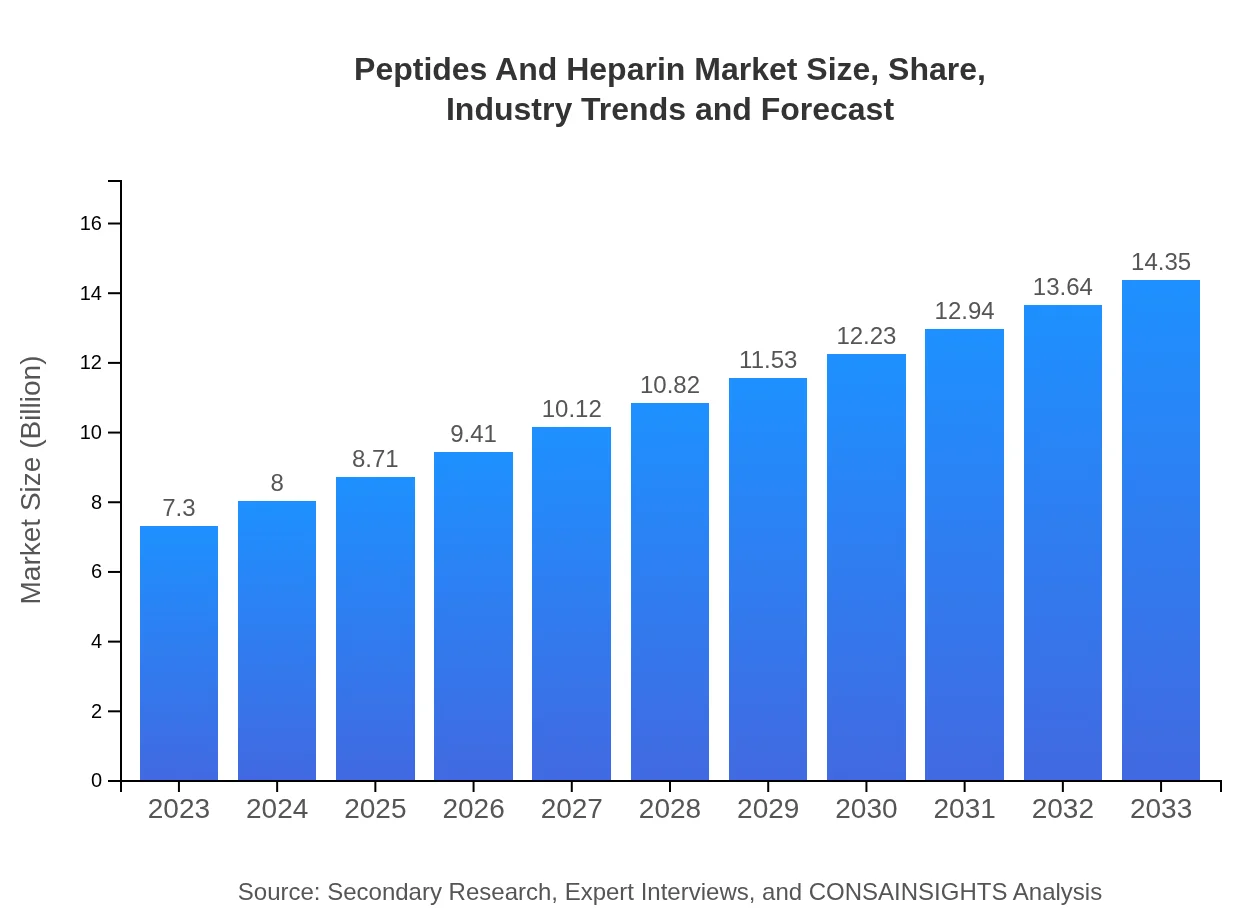

| 2023 Market Size | $7.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $14.35 Billion |

| Top Companies | Novo Nordisk, Sandoz, Bachem, Eli Lilly and Company, Merck KGaA |

| Last Modified Date | 31 January 2026 |

Peptides And Heparin Market Overview

Customize Peptides And Heparin Market Report market research report

- ✔ Get in-depth analysis of Peptides And Heparin market size, growth, and forecasts.

- ✔ Understand Peptides And Heparin's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Peptides And Heparin

What is the Market Size & CAGR of Peptides And Heparin market in 2023?

Peptides And Heparin Industry Analysis

Peptides And Heparin Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Peptides And Heparin Market Analysis Report by Region

Europe Peptides And Heparin Market Report:

In Europe, the market is expected to increase from $2.04 billion in 2023 to $4.02 billion by 2033. European countries are advancing towards personalized medicine, driving the demand for peptides and heparin products, particularly in the therapeutic and cosmetic sectors.Asia Pacific Peptides And Heparin Market Report:

The Asia Pacific region is expected to display substantial growth, with the market projected to reach $3.02 billion by 2033, up from $1.54 billion in 2023. Key drivers include rising healthcare investments and an increasing prevalence of chronic diseases, coupled with technological advancements in peptide synthesis.North America Peptides And Heparin Market Report:

North America remains the largest regional market, forecasted to grow from $2.47 billion in 2023 to $4.86 billion by 2033. The robust healthcare infrastructure, extensive R&D activities, and high acceptance of advanced therapies contribute to its market prominence.South America Peptides And Heparin Market Report:

The South American market, although comparatively smaller, is poised for growth, anticipated to expand from $0.63 billion in 2023 to $1.24 billion by 2033. The rise can be attributed to increased awareness of peptide therapies and growing collaborations among research institutions and pharmaceutical companies.Middle East & Africa Peptides And Heparin Market Report:

The Middle East and Africa market is projected to grow from $0.62 billion in 2023 to $1.21 billion by 2033. Factors such as increased healthcare spending, governmental health initiatives, and growing access to advanced medical technologies contribute to this growth.Tell us your focus area and get a customized research report.

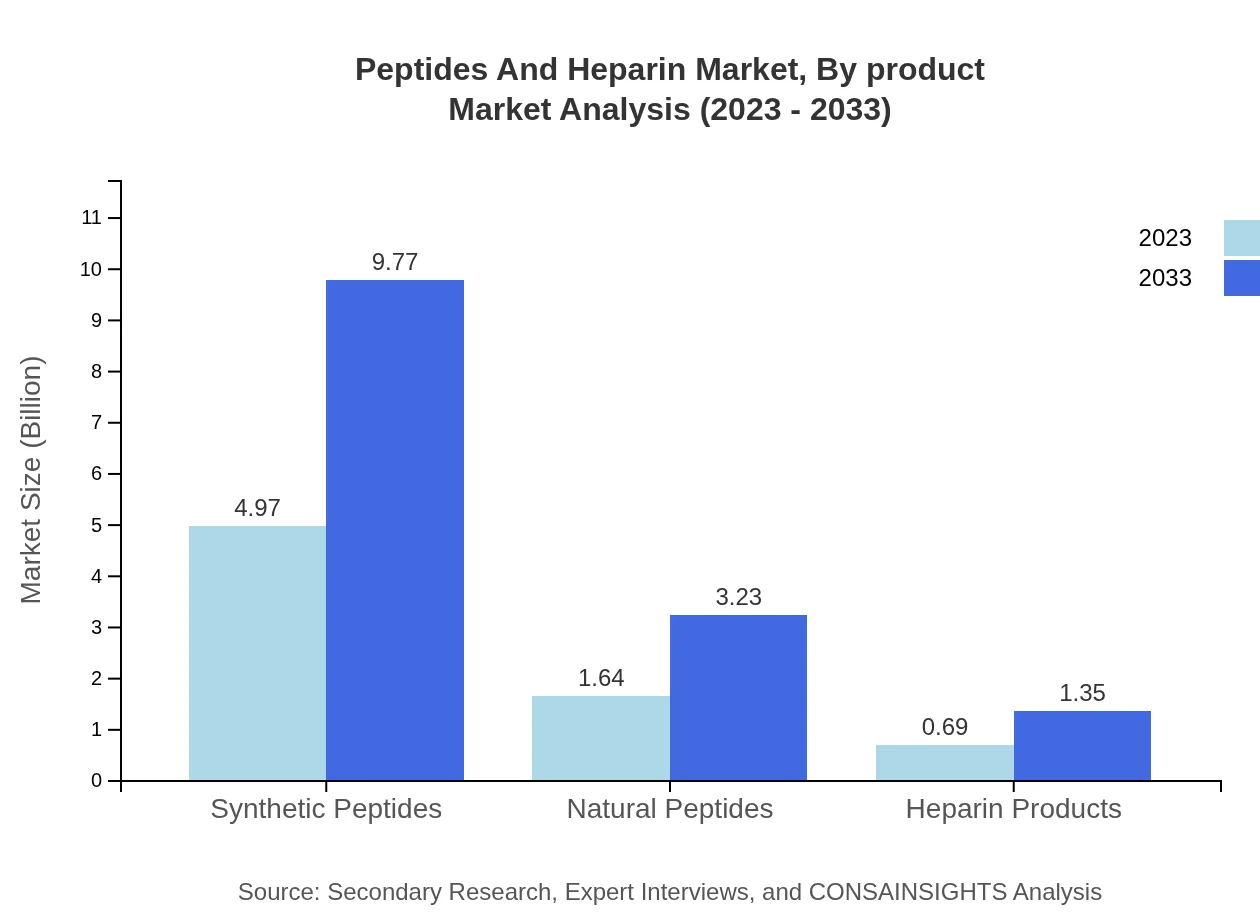

Peptides And Heparin Market Analysis By Product

The Peptides and Heparin market segmentation by product type reveals notable insights. Synthetic peptides are estimated to dominate the market, scaling from $4.97 billion in 2023 to $9.77 billion in 2033, maintaining a 68.11% market share. Natural peptides and heparin products also contributed significantly to the market, with natural peptides growing from $1.64 billion to $3.23 billion, representing a 22.48% market share and heparin products scaling from $0.69 billion to $1.35 billion, with a 9.41% market share.

Peptides And Heparin Market Analysis By Application

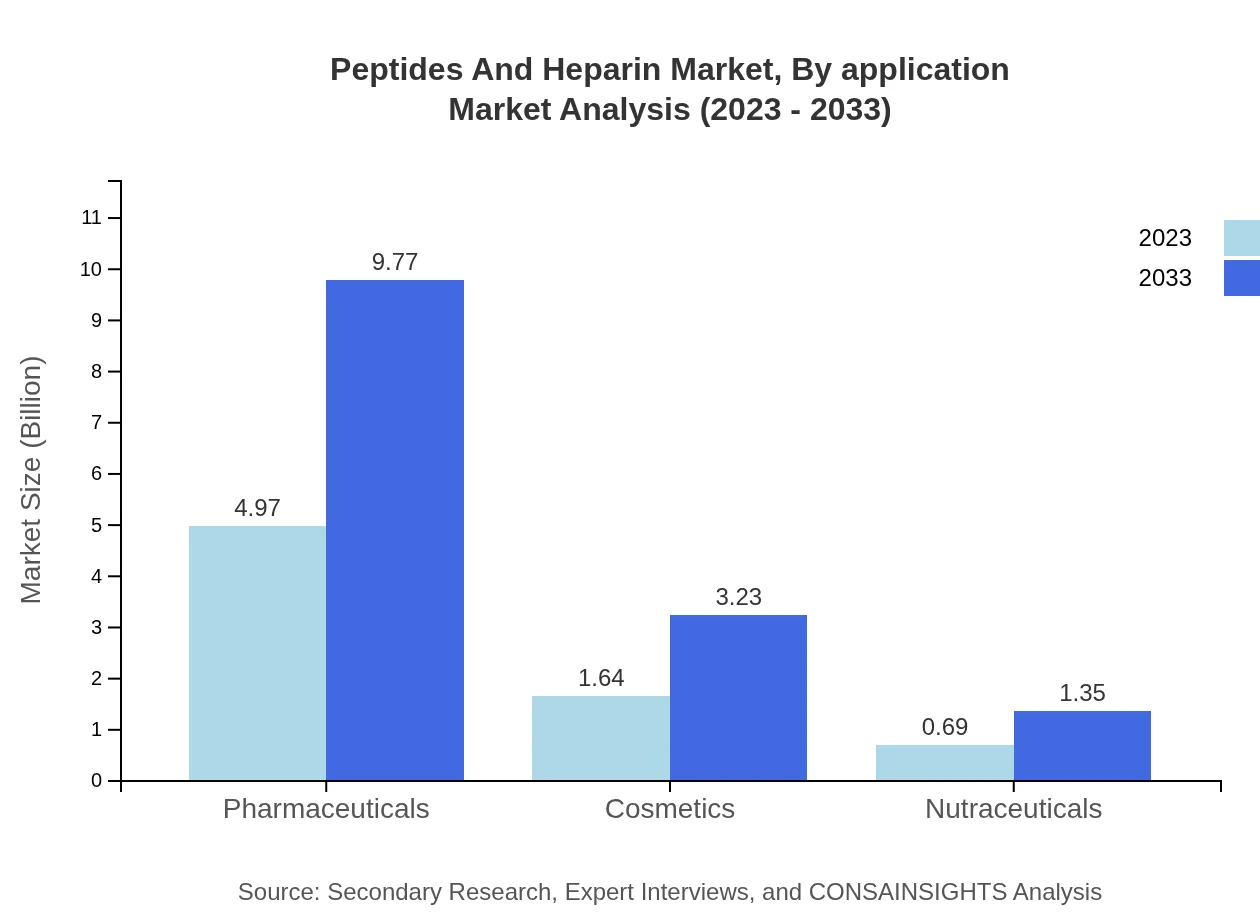

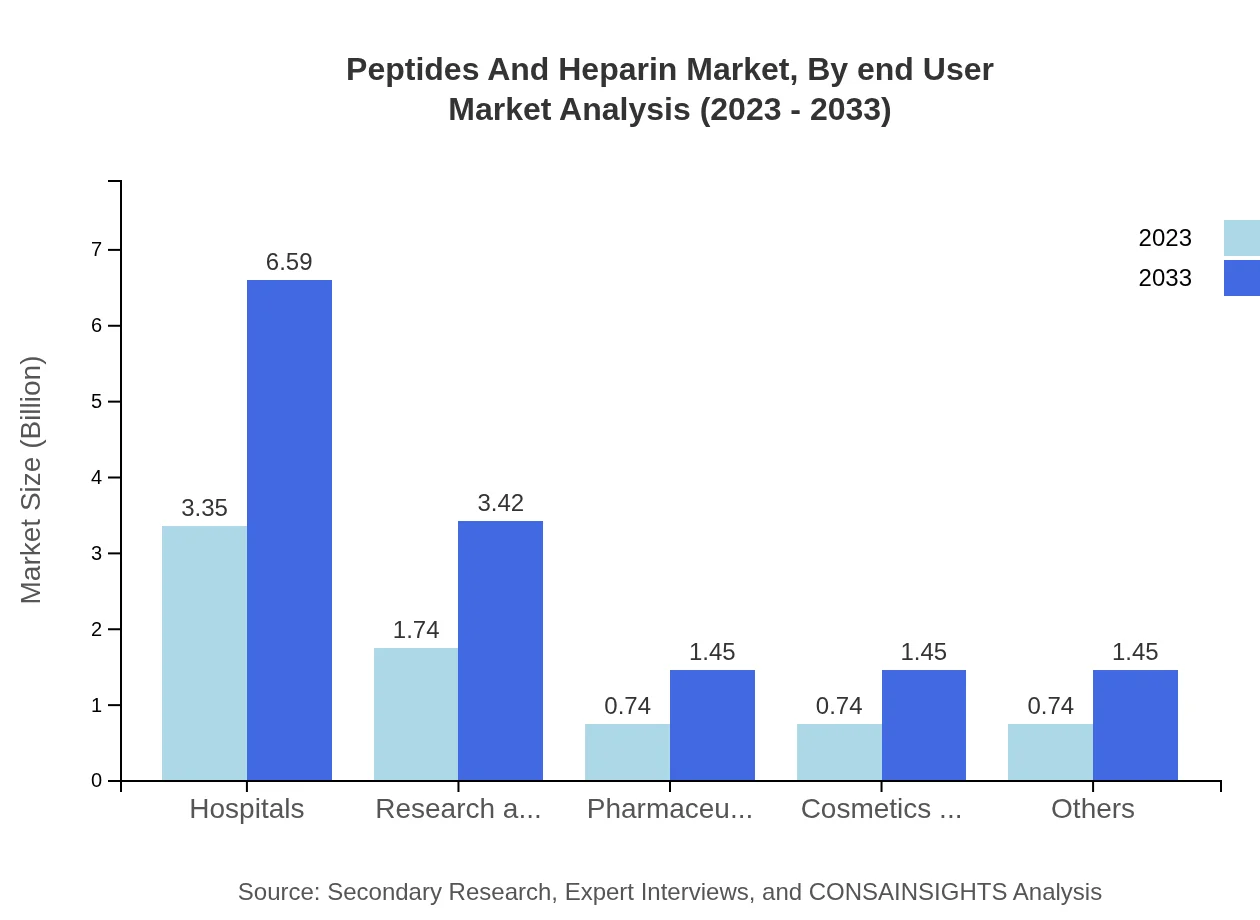

By application, the largest market share is held by hospitals, increasing from $3.35 billion in 2023 to $6.59 billion in 2033, representing 45.9% of the total market. Research and academia are significant contributors, growing from $1.74 billion to $3.42 billion, while pharmaceutical companies and cosmetics manufacturers reflect similar growth patterns, attributed to increasing demand for innovative therapies and cosmetic applications of peptides.

Peptides And Heparin Market Analysis By Formulation

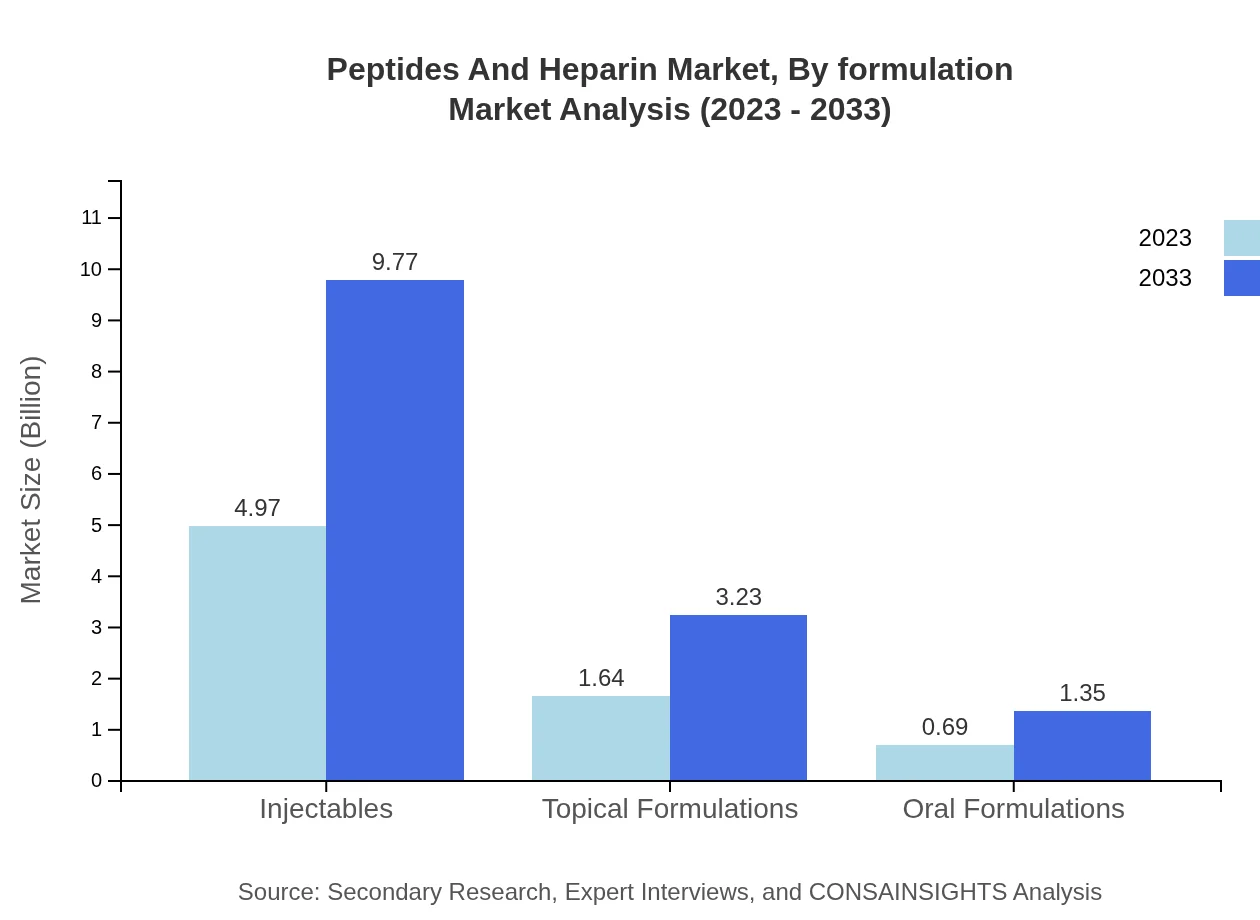

The formulation analysis shows that injectables will continue to dominate, with growth from $4.97 billion in 2023 to $9.77 billion in 2033, maintaining a 68.11% market share. Topical formulations and oral formats are also growing fast, with projected increases from $1.64 billion to $3.23 billion, and $0.69 billion to $1.35 billion, respectively, driven by their application in chronic conditions and cosmetic formulations.

Peptides And Heparin Market Analysis By End User

The end-user analysis reveals that pharmaceuticals take the largest market share, expanding from $4.97 billion in 2023 to $9.77 billion in 2033, while cosmetics, nutraceuticals, and other sectors maintain substantial shares, reflecting the broad applicability of peptide products across industries.

Peptides And Heparin Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Peptides And Heparin Industry

Novo Nordisk:

A leading global healthcare company, Novo Nordisk focuses on discovering and developing innovative biologics including peptides and heparins for chronic diseases.Sandoz:

Sandoz, a division of Novartis, develops and delivers high-quality generic and biosimilar medicines, including a range of peptide and heparin products.Bachem:

Specialized in peptide manufacturing and research, Bachem provides valuable services from peptide synthesis to drug development, enhancing the therapeutic potential of peptides.Eli Lilly and Company:

Eli Lilly specializes in peptide-based drugs, continuously investing in R&D for innovative therapeutic solutions for various ailments.Merck KGaA:

An innovation-driven company, Merck KGaA actively develops peptide products and clients across pharmaceutical and life science research sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of peptides And Heparin?

The peptides and heparin market is valued at $7.3 billion in 2023, with a projected Compound Annual Growth Rate (CAGR) of 6.8%, indicating robust growth and increasing demand across various sectors over the next decade.

What are the key market players or companies in this peptides And Heparin industry?

Key players include companies specializing in peptide synthesis, pharmaceuticals, and heparin products. Leading firms focus on innovative therapeutic solutions, contributing substantially to the market dynamics through research and development of new peptide applications.

What are the primary factors driving the growth in the peptides And Heparin industry?

Growth drivers include increasing prevalence of chronic diseases, advancements in peptide synthesis technologies, and rising applications in therapeutics and cosmetics. Moreover, the expanding research initiatives in biotechnology are significantly enhancing market expansion.

Which region is the fastest Growing in the peptides And Heparin market?

The Asia Pacific region is the fastest-growing, with market estimates of $1.54 billion in 2023 projected to reach $3.02 billion by 2033, reflecting a surge in demand driven by growing healthcare infrastructure and research capabilities.

Does ConsaInsights provide customized market report data for the peptides And Heparin industry?

Yes, ConsaInsights caters to specific business needs by offering customized market reports, allowing clients to access tailored insights and analysis regarding the peptides and heparin market segments and trends.

What deliverables can I expect from this peptides And Heparin market research project?

Deliverables include in-depth market analysis, growth forecasts, regional insights, competitive landscape assessments, and comprehensive reports detailing market segments aimed at stakeholders in the peptides and heparin industry.

What are the market trends of peptides And Heparin?

Current trends include the rising demand for synthetic peptides, with an expected growth from $4.97 billion in 2023 to $9.77 billion by 2033. Moreover, there is a notable shift towards innovative formulations for therapeutic and cosmetic applications.