Peripheral Intervention Drugeluting Devices Market Report

Published Date: 31 January 2026 | Report Code: peripheral-intervention-drugeluting-devices

Peripheral Intervention Drugeluting Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Peripheral Intervention Drugeluting Devices market from 2023 to 2033. It includes insights on market trends, size, segmentation, regional analysis, and key players to help stakeholders make informed decisions.

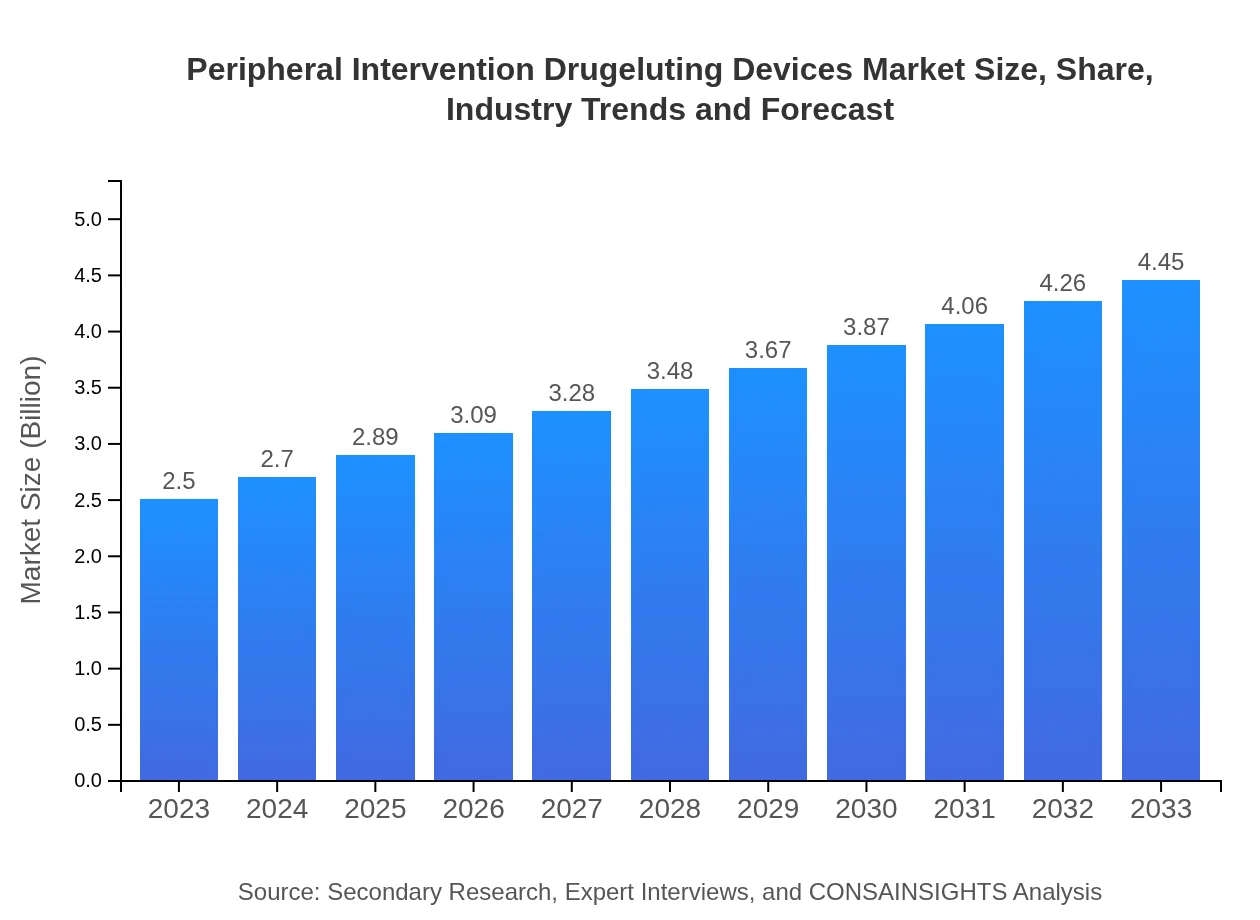

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.8% |

| 2033 Market Size | $4.45 Billion |

| Top Companies | Boston Scientific Corporation, Medtronic PLC, Abbott Laboratories, Terumo Corporation, C.R. Bard, Inc (BD) |

| Last Modified Date | 31 January 2026 |

Peripheral Intervention Drugeluting Devices Market Overview

Customize Peripheral Intervention Drugeluting Devices Market Report market research report

- ✔ Get in-depth analysis of Peripheral Intervention Drugeluting Devices market size, growth, and forecasts.

- ✔ Understand Peripheral Intervention Drugeluting Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Peripheral Intervention Drugeluting Devices

What is the Market Size & CAGR of Peripheral Intervention Drugeluting Devices market in 2023-2033?

Peripheral Intervention Drugeluting Devices Industry Analysis

Peripheral Intervention Drugeluting Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Peripheral Intervention Drugeluting Devices Market Analysis Report by Region

Europe Peripheral Intervention Drugeluting Devices Market Report:

The European market, valued at $0.76 billion in 2023, is expected to grow to $1.35 billion by 2033. Significant growth drivers include an aging population, increasing prevalence of chronic diseases, and the presence of key market players in the region, which are fostering innovation.Asia Pacific Peripheral Intervention Drugeluting Devices Market Report:

In 2023, the Asia Pacific market is valued at $0.45 billion and is expected to grow to $0.80 billion by 2033. Key growth factors include rising healthcare investments, an increasing patient population, and the emergence of local manufacturers. Countries like China and India are key markets, driven by the increasing prevalence of diabetes and cardiovascular diseases.North America Peripheral Intervention Drugeluting Devices Market Report:

North America leads the market, with a valuation of $0.94 billion in 2023, predicted to reach $1.68 billion by 2033. This dominance is attributed to advanced healthcare systems, high disposable incomes, and a prevalence of lifestyle-related diseases. Additionally, regulatory support and technological advancements enhance market growth.South America Peripheral Intervention Drugeluting Devices Market Report:

The South American market is projected to expand from $0.19 billion in 2023 to $0.33 billion in 2033. Factors such as improving healthcare infrastructure, rising awareness about vascular treatments, and growing investments from global key players are fostering this growth.Middle East & Africa Peripheral Intervention Drugeluting Devices Market Report:

The Middle East and Africa market is anticipated to grow from $0.16 billion in 2023 to $0.29 billion by 2033. While currently the smallest market, growth attributes to rising healthcare spending and increasing awareness of advanced treatment options despite facing challenges such as infrastructural limitations.Tell us your focus area and get a customized research report.

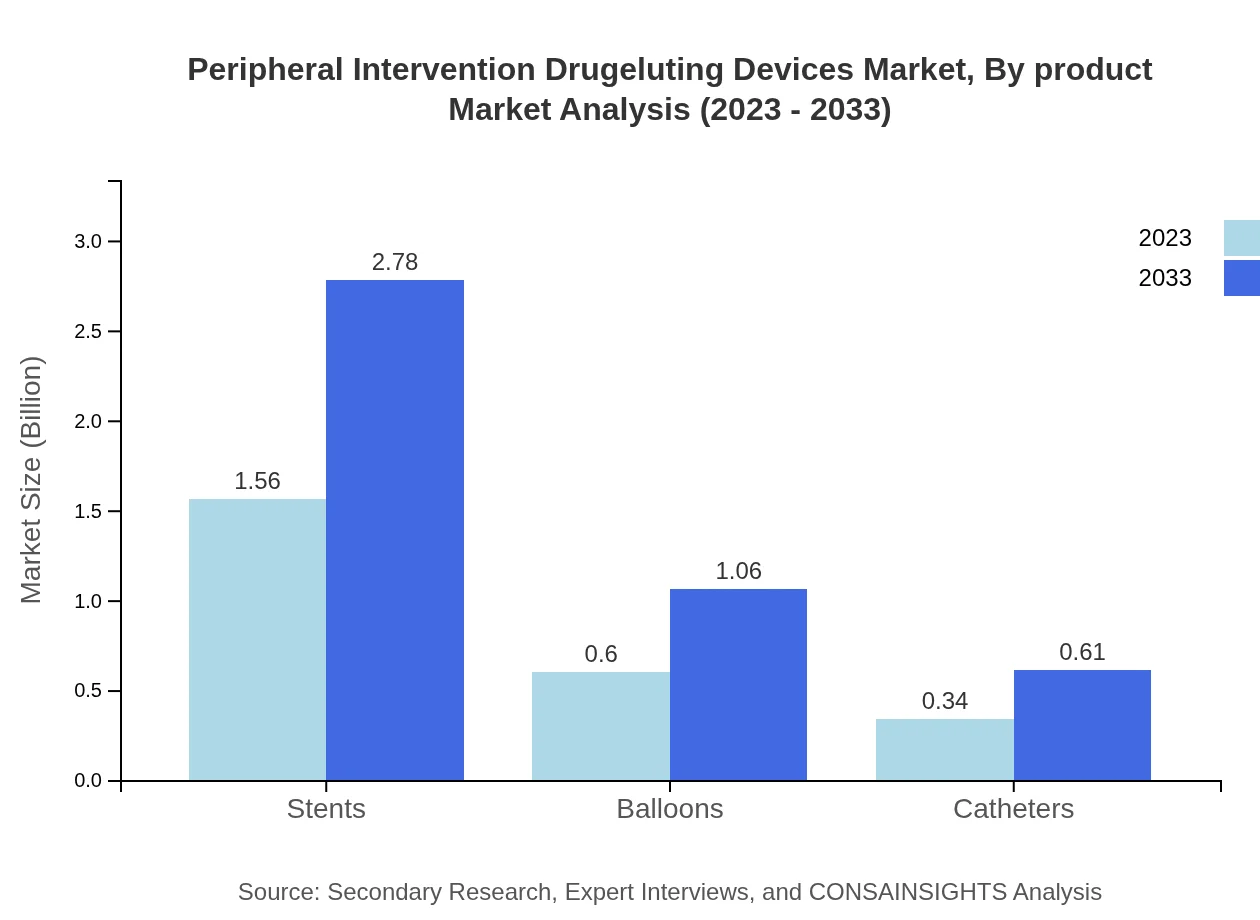

Peripheral Intervention Drugeluting Devices Market Analysis By Product

The product segment of the Peripheral Intervention Drug-Eluting Devices includes Stents, Balloons, and Catheters. The Stents category holds a dominant market share generating $1.56 billion in 2023 and anticipated to rise to $2.78 billion by 2033, accounting for 62.4% market share throughout the forecast period. Balloons, generating $0.60 billion in 2023 to reach $1.06 billion by 2033, represent 23.82% share, while Catheters generate $0.34 billion growing to $0.61 billion, holding 13.78% share.

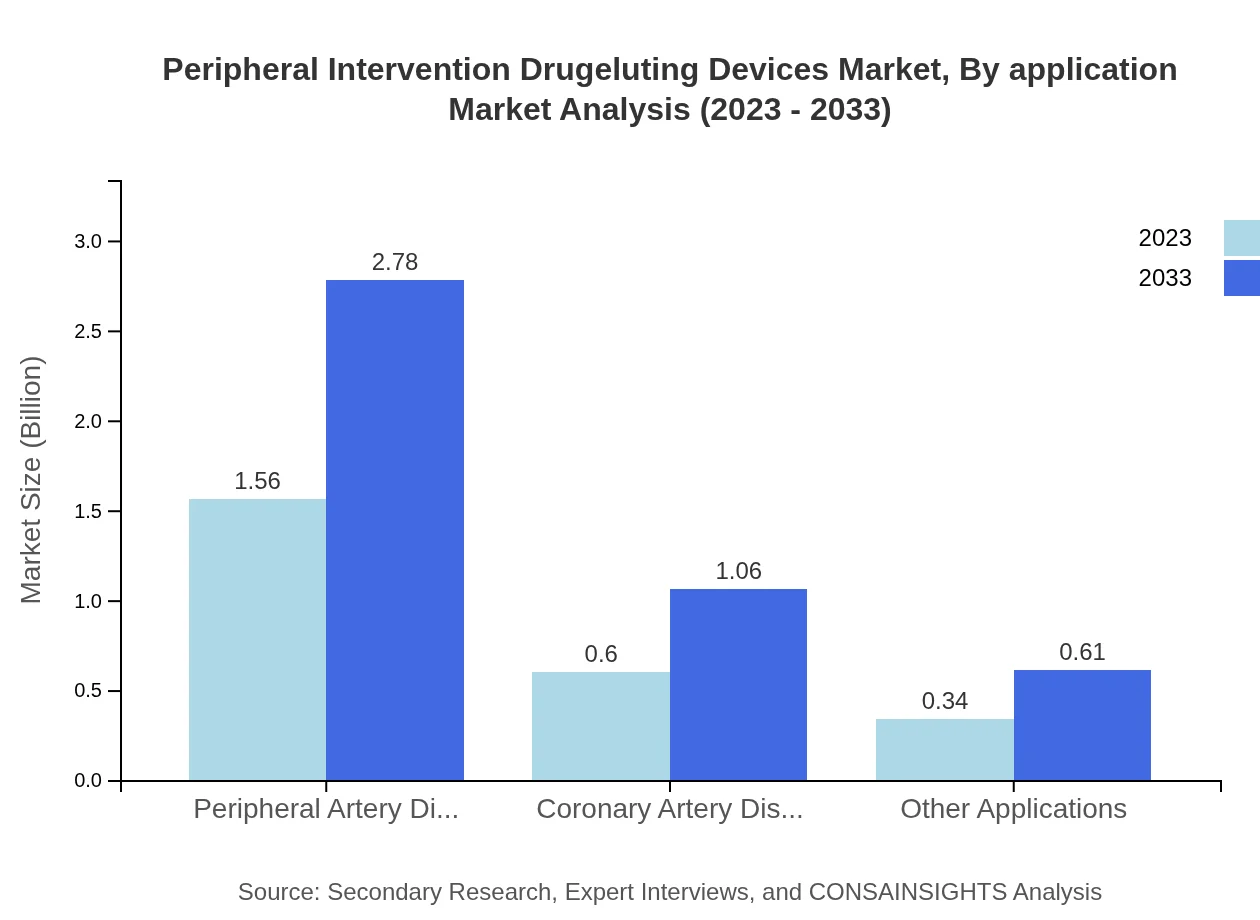

Peripheral Intervention Drugeluting Devices Market Analysis By Application

In application segmentation, Peripheral Artery Disease (PAD) dominates, generating $1.56 billion in 2023 and expected to grow to $2.78 billion by 2033, maintaining a share of 62.4%. Coronary Artery Disease (CAD) holds $0.60 billion in 2023, expected to escalate to $1.06 billion by 2033, representing 23.82% share. Other Applications account for $0.34 billion, projected to grow to $0.61 billion, holding a share of 13.78%.

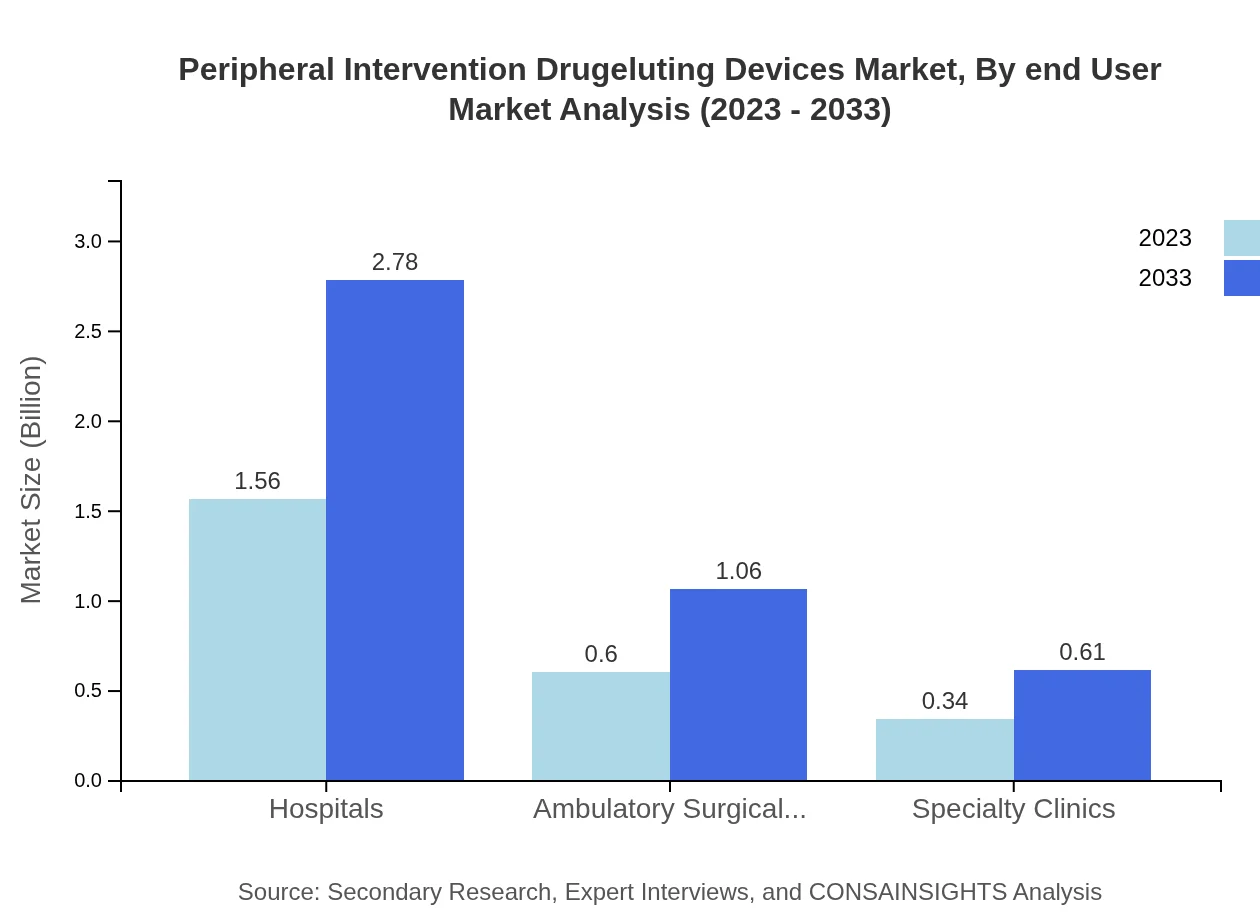

Peripheral Intervention Drugeluting Devices Market Analysis By End User

Key end-users include Hospitals, Ambulatory Surgical Centers (ASCs), and Specialty Clinics. Hospitals generate $1.56 billion in 2023, expected to increase to $2.78 billion by 2033, with a consistent market share of 62.4%. ASCs, valued at $0.60 billion in 2023, are also anticipated to grow to $1.06 billion by 2033, sustaining a share of 23.82%. Specialty Clinics hold $0.34 billion in 2023, likely to advance to $0.61 billion by 2033, consistently accounting for a share of 13.78%.

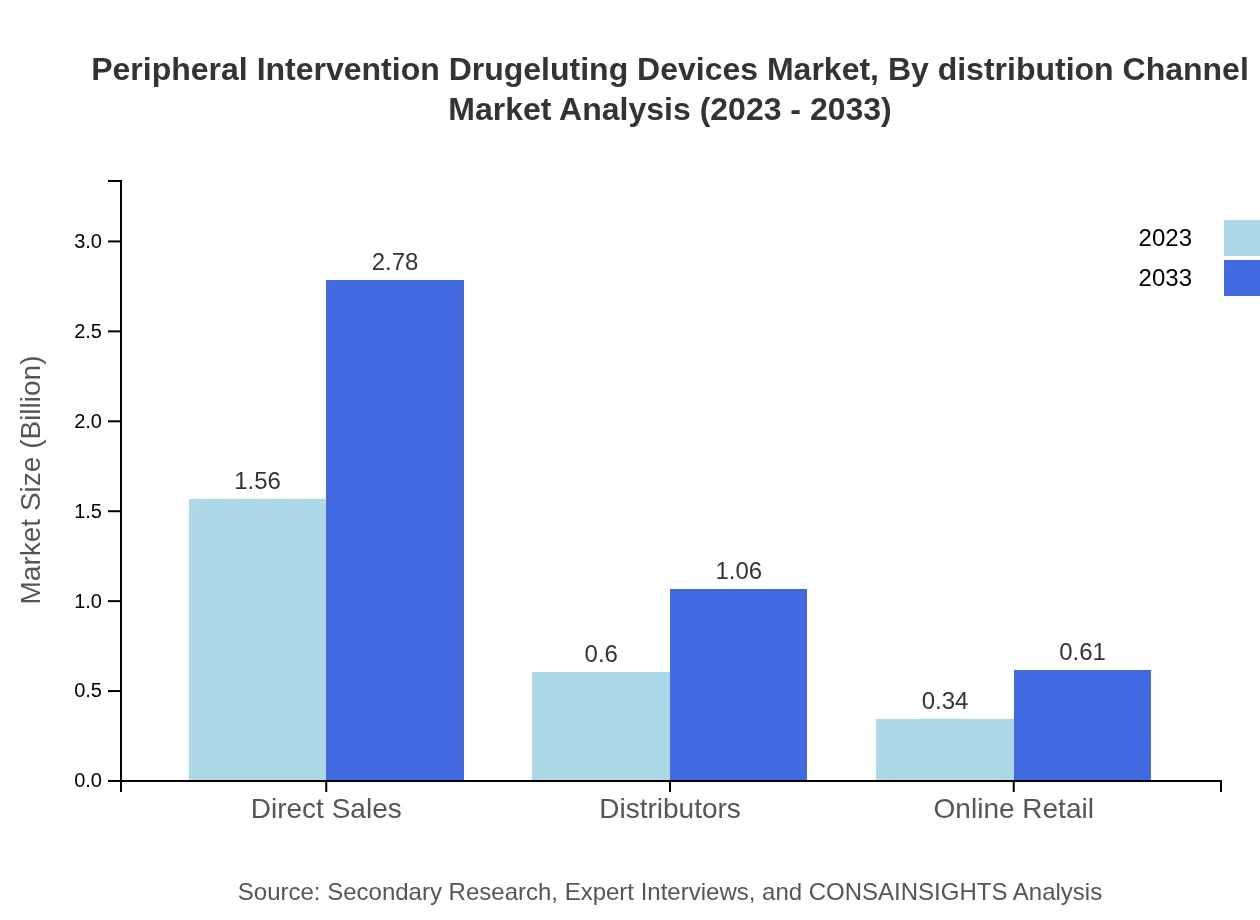

Peripheral Intervention Drugeluting Devices Market Analysis By Distribution Channel

Distribution channels for the market include Direct Sales, Distributors, and Online Retail. Direct Sales dominate the distribution channel with $1.56 billion in 2023, anticipated to grow to $2.78 billion by 2033, holding a 62.4% market share. Distributors account for $0.60 billion in the year 2023, projected to reach $1.06 billion by 2033, representing a share of 23.82%. Online Retail exhibits growth from $0.34 billion to $0.61 billion, maintaining a 13.78% share.

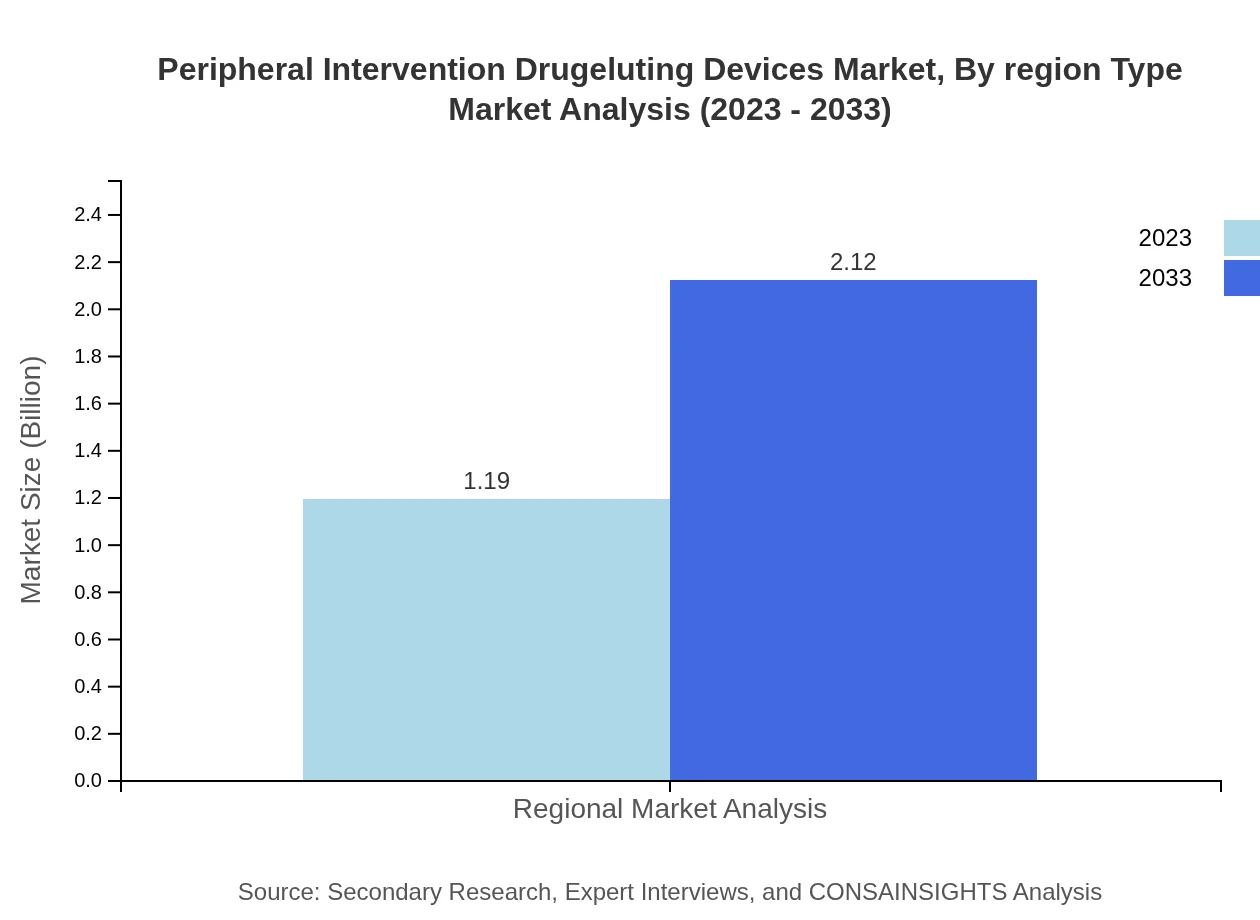

Peripheral Intervention Drugeluting Devices Market Analysis By Region Type

The market demonstrates various regional dynamics, with North America leading in revenue followed by Europe, Asia Pacific, South America, and the Middle East & Africa in terms of size and growth potential.

Peripheral Intervention Drugeluting Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Peripheral Intervention Drugeluting Devices Industry

Boston Scientific Corporation:

A leading player in the cardiology and peripheral interventions market, known for its innovative solutions and commitment to R&D.Medtronic PLC:

Renowned for its advanced medical technologies and comprehensive portfolio in cardiac and vascular solutions, focusing on minimally invasive treatments.Abbott Laboratories:

Specializes in the development of innovative medical devices, including drug-eluting stents, and is a major player in the global cardiovascular market.Terumo Corporation:

Focuses on providing effective and high-quality products for the healthcare profession, with strategic advancements in drug delivery systems.C.R. Bard, Inc (BD):

A significant competitor in the vascular market, emphasizing innovations and expanding its presence through acquisitions and partnerships.We're grateful to work with incredible clients.

FAQs

What is the market size of Peripheral Intervention Drug Eluting Devices?

The Peripheral Intervention Drug Eluting Devices market is valued at approximately $2.5 billion in 2023. It is projected to grow at a CAGR of 5.8%, reaching significant growth by 2033.

What are the key market players or companies in the Peripheral Intervention Drug Eluting Devices industry?

Key players in the Peripheral Intervention Drug Eluting Devices industry include major companies such as Medtronic, Boston Scientific, and Abbott Laboratories, among others, renowned for their innovative technologies and extensive market presence.

What are the primary factors driving the growth in the Peripheral Intervention Drug Eluting Devices industry?

The growth in the Peripheral Intervention Drug Eluting Devices industry is driven by factors such as rising incidences of cardiovascular diseases, advancements in medical technology, and increasing geriatric population contributing to a higher demand for effective medical interventions.

Which region is the fastest Growing in the Peripheral Intervention Drug Eluting Devices market?

North America is currently the fastest-growing region in the Peripheral Intervention Drug Eluting Devices market, projected to rise from $0.94 billion in 2023 to approximately $1.68 billion by 2033, reflecting robust market dynamics.

Does ConsInsights provide customized market report data for the Peripheral Intervention Drug Eluting Devices industry?

Yes, ConsInsights offers customized market report data tailored to the specific needs of clients in the Peripheral Intervention Drug Eluting Devices industry, ensuring relevant and actionable insights for business strategies.

What deliverables can I expect from this Peripheral Intervention Drug Eluting Devices market research project?

The deliverables from the Peripheral Intervention Drug Eluting Devices market research project include comprehensive reports, market analysis, segmentation data, and actionable insights tailored to meet client requirements and support strategic decision-making.

What are the market trends of Peripheral Intervention Drug Eluting Devices?

Current market trends in the Peripheral Intervention Drug Eluting Devices sector include increased adoption of minimally invasive procedures, a shift towards personalized medicine, and rising investments in research and development to enhance device efficacy and patient outcomes.