Peripheral Vascular Devices Market Report

Published Date: 31 January 2026 | Report Code: peripheral-vascular-devices

Peripheral Vascular Devices Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Peripheral Vascular Devices market from 2023 to 2033, outlining market dynamics, growth trends, and future forecasts. It covers market size, segmentation, regional insights, technological advancements, and key players driving the industry.

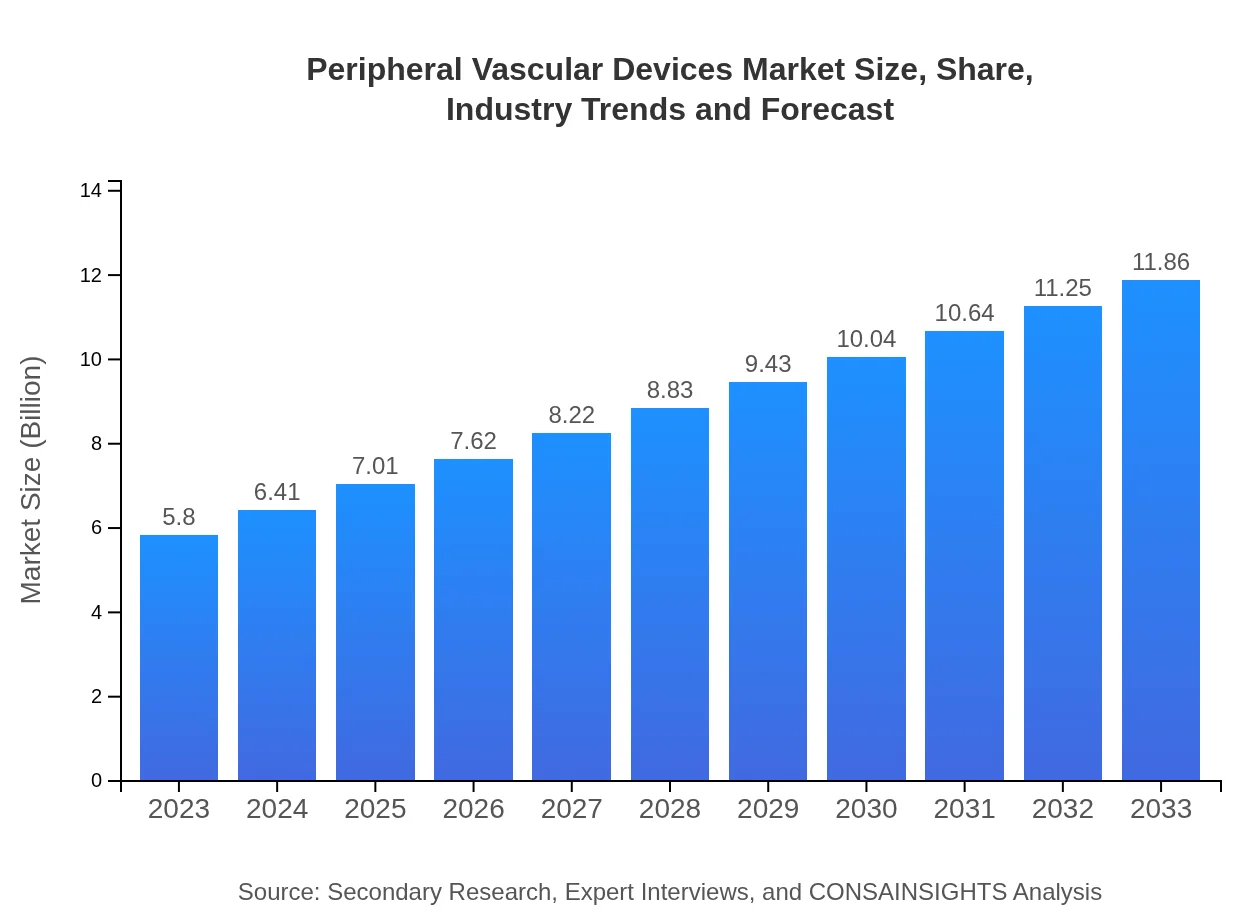

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.86 Billion |

| Top Companies | Medtronic , Boston Scientific, Abbott Laboratories, Siemens Healthineers |

| Last Modified Date | 31 January 2026 |

Peripheral Vascular Devices Market Overview

Customize Peripheral Vascular Devices Market Report market research report

- ✔ Get in-depth analysis of Peripheral Vascular Devices market size, growth, and forecasts.

- ✔ Understand Peripheral Vascular Devices's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Peripheral Vascular Devices

What is the Market Size & CAGR of Peripheral Vascular Devices market in 2023?

Peripheral Vascular Devices Industry Analysis

Peripheral Vascular Devices Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Peripheral Vascular Devices Market Analysis Report by Region

Europe Peripheral Vascular Devices Market Report:

The European market is expected to increase from $1.51 billion in 2023 to $3.09 billion by 2033, as aging populations drive demand for medical interventions. Strong regulatory support and investment in healthcare infrastructure further enhance market development.Asia Pacific Peripheral Vascular Devices Market Report:

In the Asia Pacific region, the market is anticipated to grow from $1.21 billion in 2023 to $2.47 billion in 2033, driven by increasing incidences of vascular diseases and enhanced healthcare infrastructure. Countries like India and China are leading this growth due to rising medical tourism and healthcare investment.North America Peripheral Vascular Devices Market Report:

North America holds the largest share of the market, valued at $2.09 billion in 2023 and expected to reach $4.27 billion by 2033. The high prevalence of lifestyle-related diseases and rapid technological advancements contribute to the robust market growth in this region.South America Peripheral Vascular Devices Market Report:

The South American market is projected to expand from $0.30 billion in 2023 to $0.62 billion by 2033. This growth is attributed to the increasing awareness of advanced vascular treatments and the rising burden of chronic diseases across the region.Middle East & Africa Peripheral Vascular Devices Market Report:

The Middle East and Africa market is projected to grow from $0.69 billion in 2023 to $1.41 billion by 2033. Improvements in healthcare facilities, alongside the increasing burden of cardiovascular diseases, are key factors driving this growth.Tell us your focus area and get a customized research report.

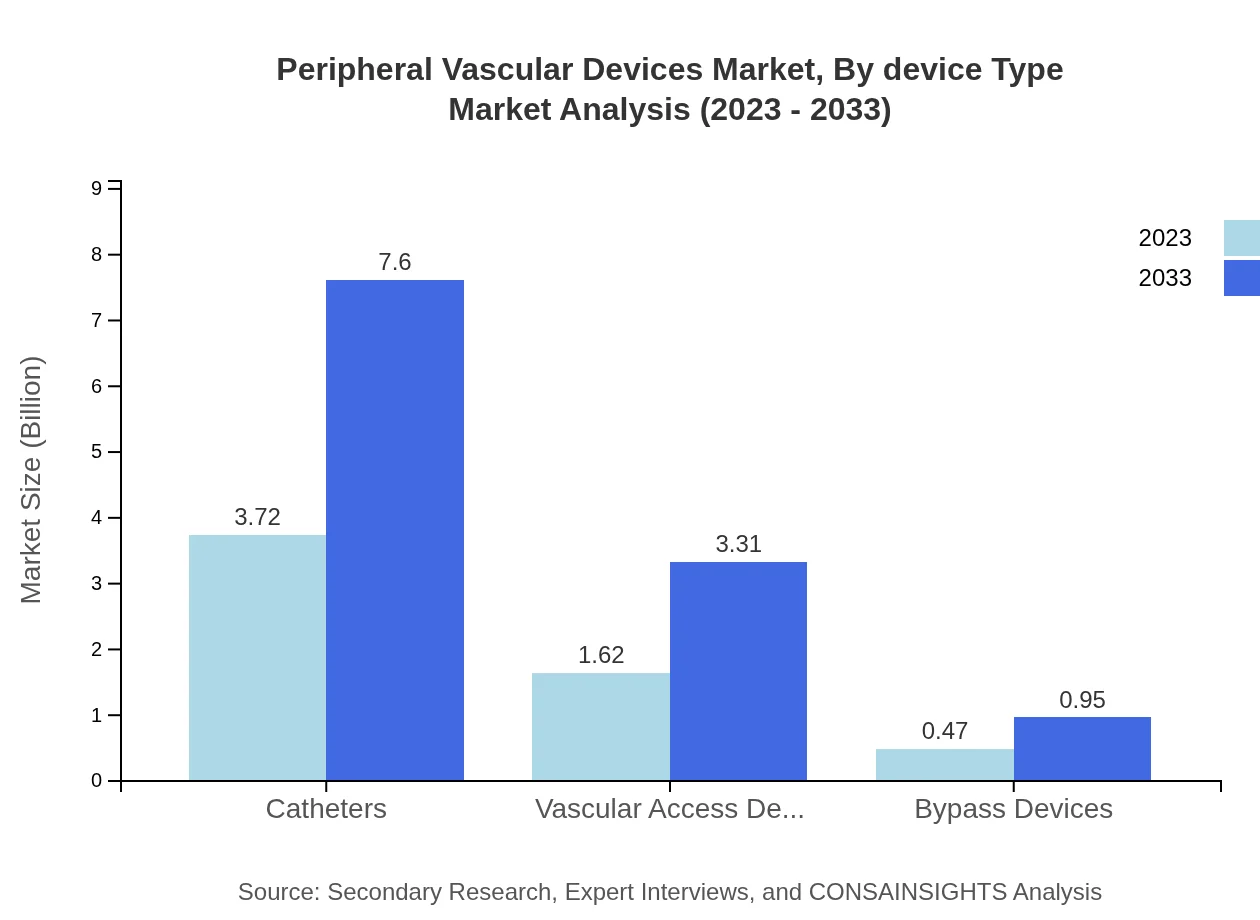

Peripheral Vascular Devices Market Analysis By Device Type

The market is segmented by device type, with key categories including Angioplasty devices, Stenting devices, Thrombectomy devices, Catheters, and Vascular Access Devices. Angioplasty devices dominate the market with a projected growth from $3.72 billion in 2023 to $7.60 billion in 2033, holding a 64.08% share. Stenting devices follow, accounting for a significant 27.9% share, with growth driven by technological innovations in stent design.

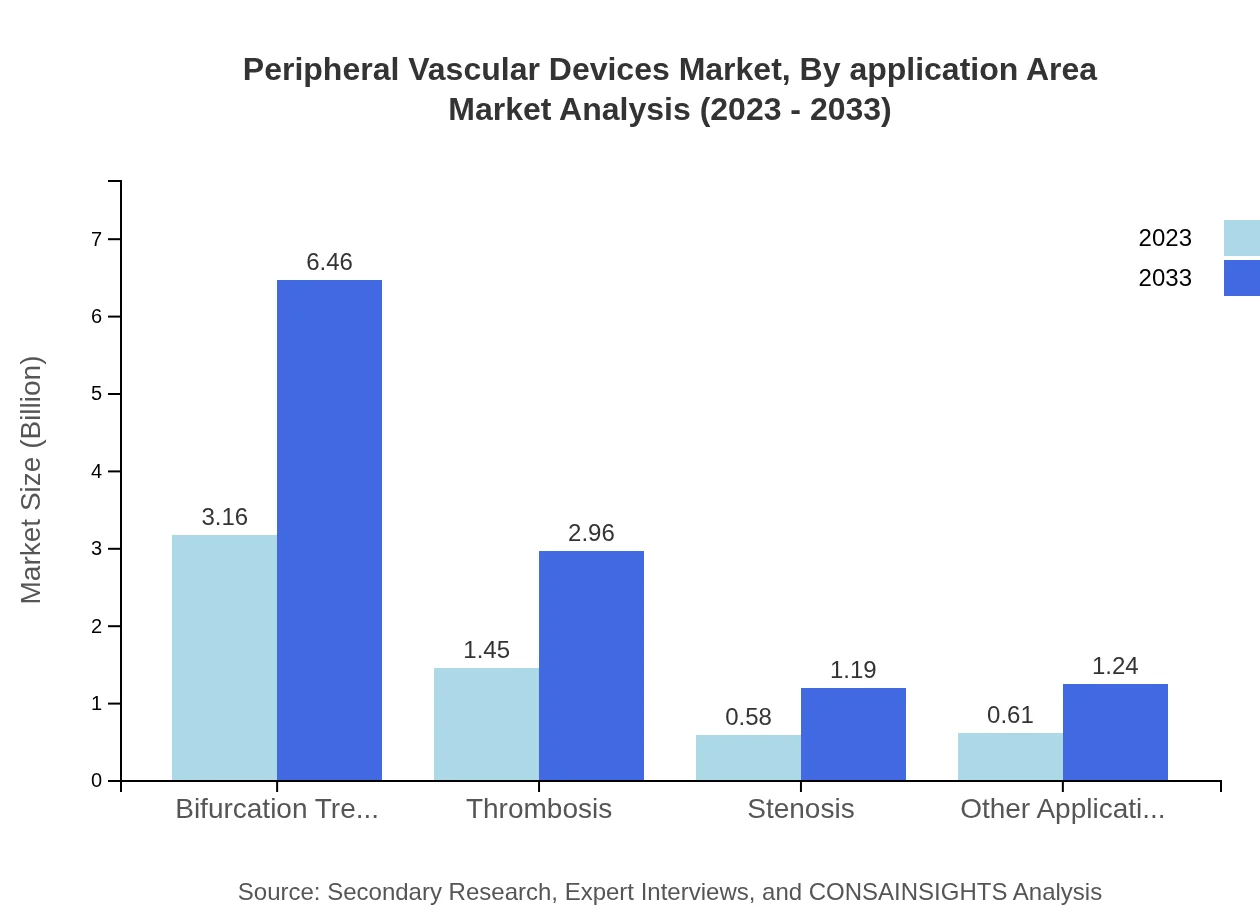

Peripheral Vascular Devices Market Analysis By Application Area

The application area segmentation includes Bifurcation Treatment, Thrombosis, Stenosis, and Other Applications. Bifurcation Treatment holds a leading position with a size of $3.16 billion in 2023, expected to reach $6.46 billion by 2033. This segment's share stands at 54.48%, highlighting the critical nature of these interventions.

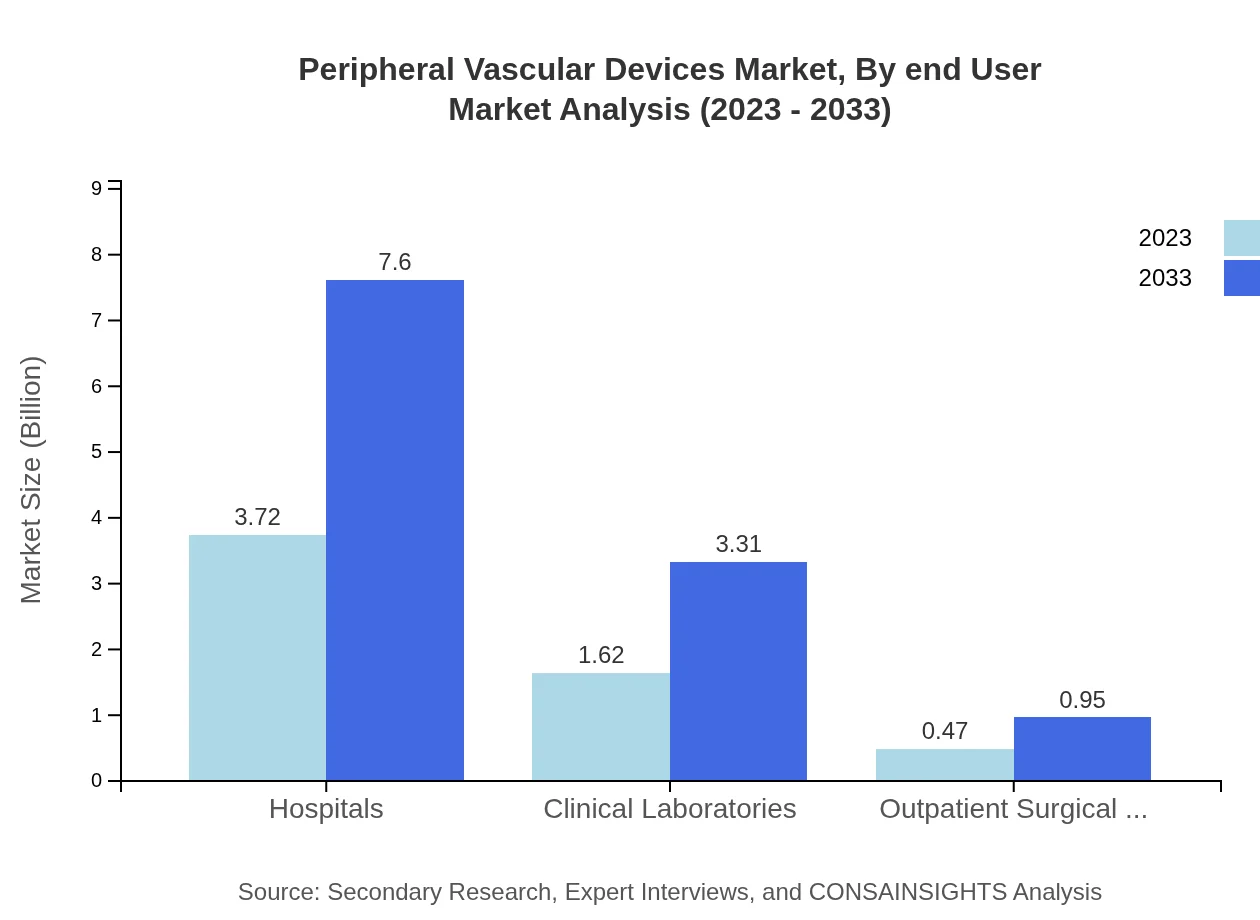

Peripheral Vascular Devices Market Analysis By End User

End-user segments include Hospitals, Clinical Laboratories, and Outpatient Surgical Centers. Hospitals dominate the market, growing from $3.72 billion in 2023 to $7.60 billion in 2033, representing 64.08% of the total market share. This trend reflects the central role hospitals play in vascular procedures.

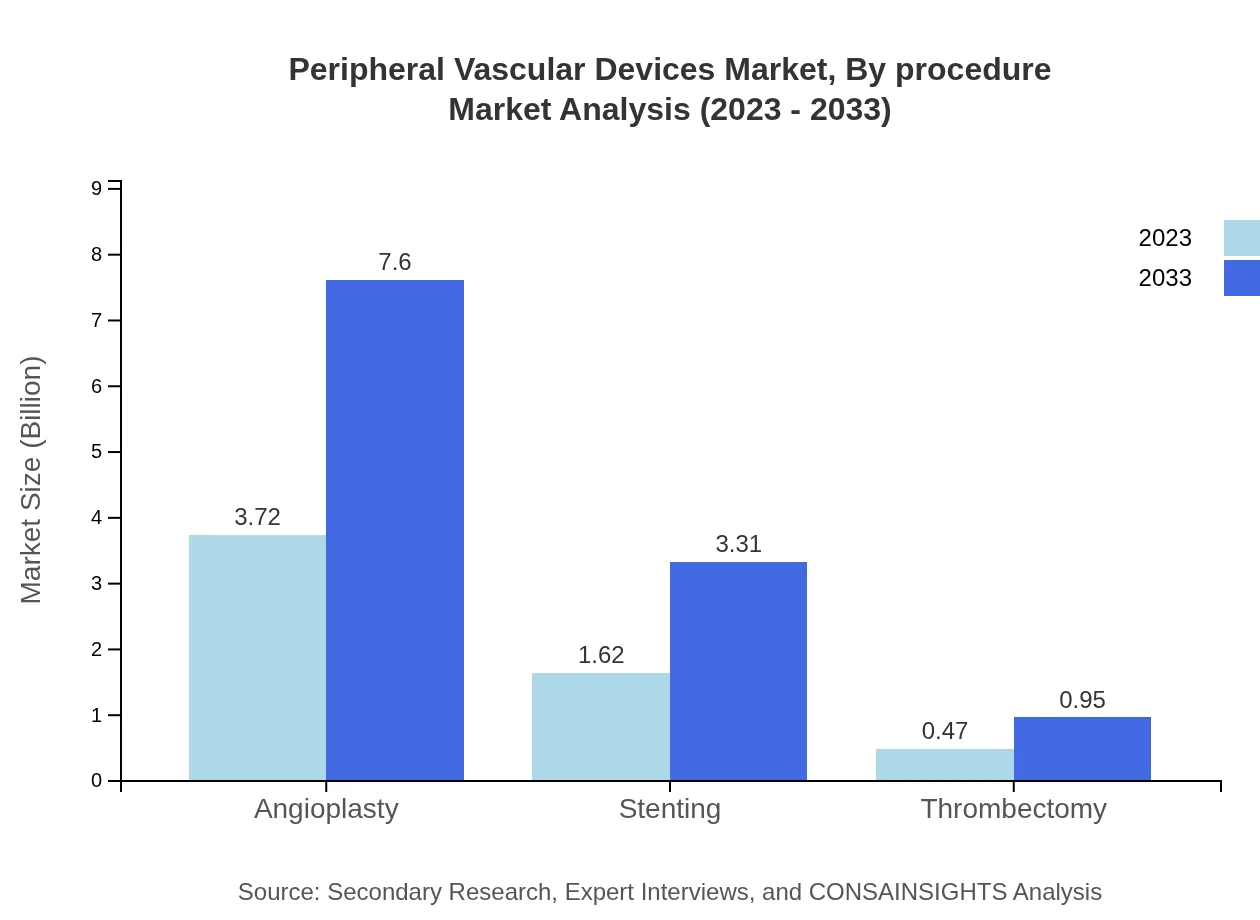

Peripheral Vascular Devices Market Analysis By Procedure

The procedure-based segmentation includes Angioplasty, Stenting, and Thrombectomy procedures. Angioplasties lead the market, reflecting advancements in catheter and balloon technologies that enhance treatment efficiency.

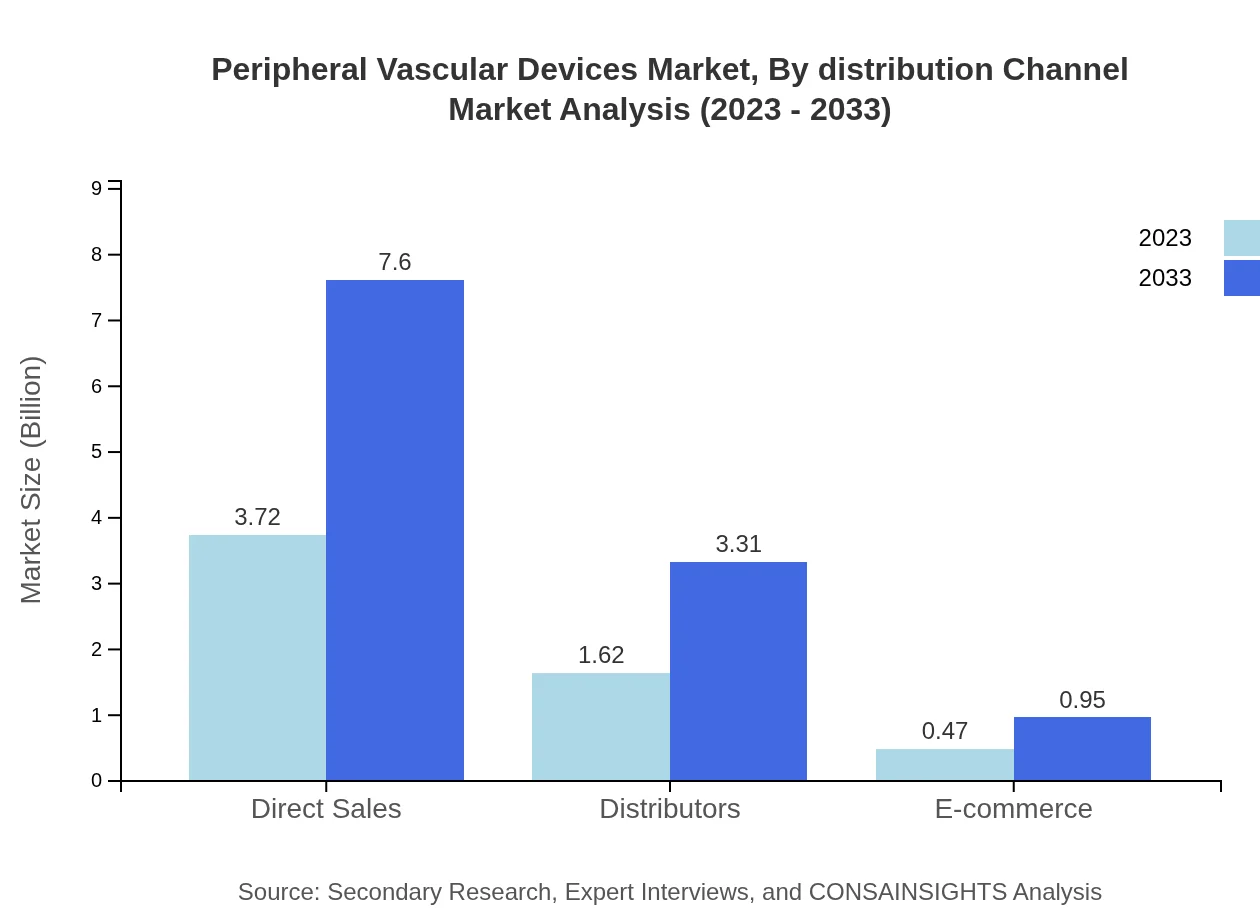

Peripheral Vascular Devices Market Analysis By Distribution Channel

Distribution channels consist of Direct Sales, Distributors, and E-commerce. Direct Sales account for the largest share, expected to maintain a 64.08% market share, supporting manufacturers' direct engagement with healthcare providers.

Peripheral Vascular Devices Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Peripheral Vascular Devices Industry

Medtronic :

A leading global healthcare solutions company offering a comprehensive range of vascular device technologies, driving innovation in minimally invasive treatments.Boston Scientific:

Renowned for its advanced peripheral vascular therapies, Boston Scientific is focused on providing quality devices that enhance patient care.Abbott Laboratories:

Abbott provides innovative vascular solutions and holds a strong market position through its product offerings in both coronary and peripheral domains.Siemens Healthineers:

Siemens specializes in diagnostic imaging and therapeutic devices, enriching the peripheral vascular landscape with cutting-edge technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of peripheral Vascular Devices?

The global market size for peripheral vascular devices is approximately $5.8 billion, with an expected compound annual growth rate (CAGR) of 7.2% from 2023 to 2033. This growth reflects rising healthcare needs and innovative medical technology advancements.

What are the key market players or companies in this peripheral Vascular Devices industry?

Key players in the peripheral vascular devices market include Medtronic, Boston Scientific, Abbott Laboratories, and Cook Medical. These companies are integral due to their innovation, comprehensive product lines, and expansive market reach in vascular treatments.

What are the primary factors driving the growth in the peripheral Vascular Devices industry?

Growth in the peripheral vascular devices industry is driven by increasing prevalence of vascular diseases, aging populations, and advancements in technology that enhance treatment options. Furthermore, rising healthcare expenditures are also a significant factor contributing to market expansion.

Which region is the fastest Growing in the peripheral Vascular Devices?

The fastest-growing region for peripheral vascular devices is projected to be North America, which is expected to grow from $2.09 billion in 2023 to $4.27 billion by 2033. This growth is fueled by advanced healthcare infrastructure and increased patient awareness.

Does ConsaInsights provide customized market report data for the peripheral Vascular Devices industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs within the peripheral vascular devices industry. This service allows businesses to gain insights related to niche segments, competitive analysis, and trend forecasting.

What deliverables can I expect from this peripheral Vascular Devices market research project?

Expect comprehensive deliverables including detailed market analysis, segment insights, competitive landscape, and forecasts. Additionally, customized recommendations and strategic guidance tailored to your specific interests in the peripheral vascular devices market can be included.

What are the market trends of peripheral Vascular Devices?

Current market trends in peripheral vascular devices include a shift towards minimally invasive procedures, increased demand for stenting and angioplasty devices, and advancements in digital health technologies that improve patient outcomes. Focus on patient-centric care continues to influence developments.