Pesticide Intermediate Market Report

Published Date: 31 January 2026 | Report Code: pesticide-intermediate

Pesticide Intermediate Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pesticide Intermediate market, including market size, trends, and regional insights. It covers the market forecast from 2023 to 2033, offering valuable information for stakeholders in the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

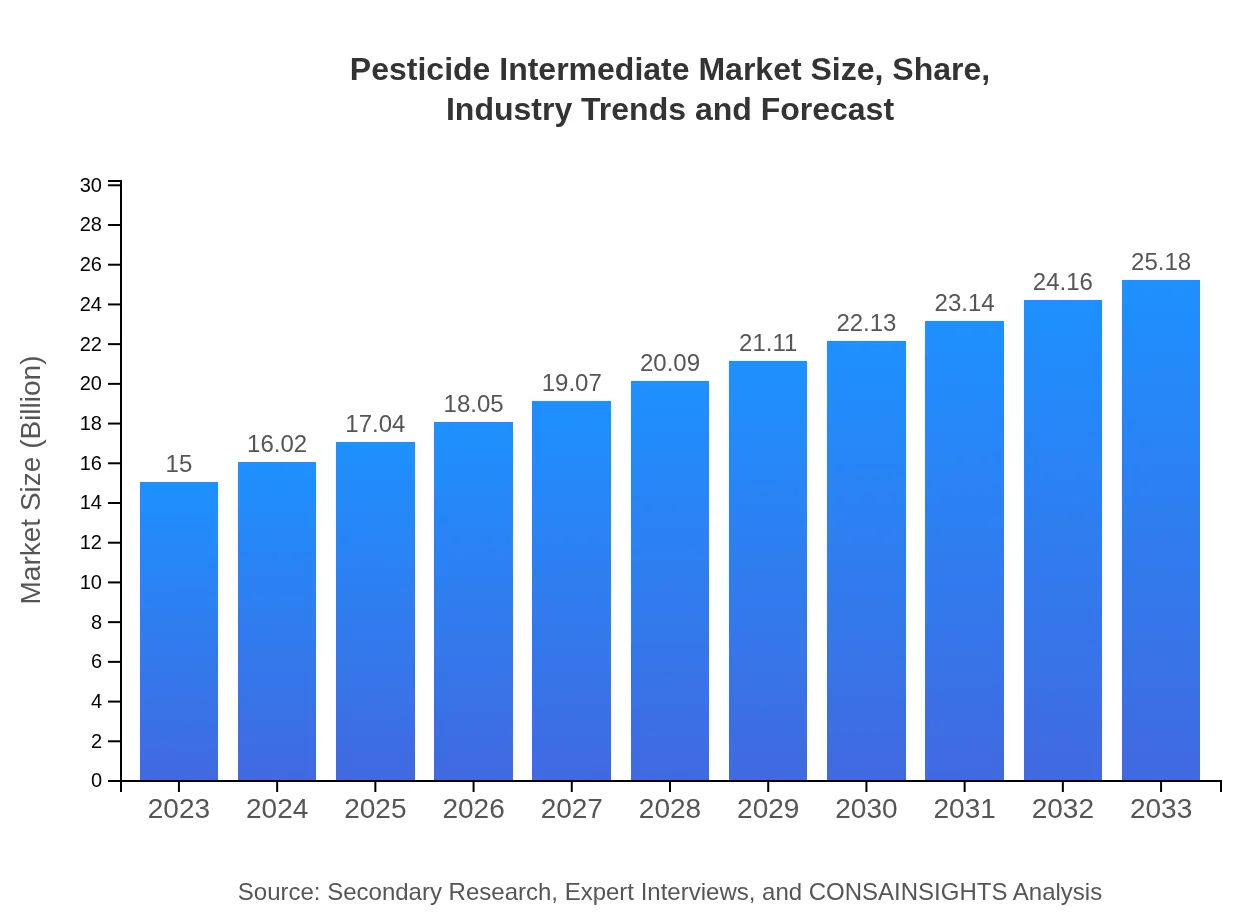

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $25.18 Billion |

| Top Companies | BASF SE, Syngenta AG, FMC Corporation, Dow AgroSciences, Nufarm Limited |

| Last Modified Date | 31 January 2026 |

Pesticide Intermediate Market Overview

Customize Pesticide Intermediate Market Report market research report

- ✔ Get in-depth analysis of Pesticide Intermediate market size, growth, and forecasts.

- ✔ Understand Pesticide Intermediate's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pesticide Intermediate

What is the Market Size & CAGR of Pesticide Intermediate market in 2033?

Pesticide Intermediate Industry Analysis

Pesticide Intermediate Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pesticide Intermediate Market Analysis Report by Region

Europe Pesticide Intermediate Market Report:

In Europe, the market is set to increase from USD 4.82 billion in 2023 to USD 8.08 billion by 2033. The stringent regulatory environment and focus on sustainable agriculture practices are driving innovation and adoption of safer pesticide intermediates.Asia Pacific Pesticide Intermediate Market Report:

The Asia-Pacific region is experiencing robust growth in the Pesticide Intermediate market, expected to expand from USD 2.91 billion in 2023 to USD 4.88 billion by 2033. This growth can be attributed to increasing agricultural productivity and the adoption of advanced farming techniques in countries like China and India.North America Pesticide Intermediate Market Report:

The North American market, valued at USD 4.83 billion in 2023, is projected to reach USD 8.11 billion by 2033. This growth is underpinned by advanced agricultural practices and significant investments in research and development within the agrochemical sector.South America Pesticide Intermediate Market Report:

In South America, the market is anticipated to grow from USD 1.10 billion in 2023 to USD 1.84 billion by 2033. The agriculture-driven economies in Brazil and Argentina are major contributors, with a focus on increasing export-quality crops.Middle East & Africa Pesticide Intermediate Market Report:

The Middle East and Africa region's Pesticide Intermediate market is expected to grow from USD 1.35 billion in 2023 to USD 2.26 billion by 2033. The agricultural sectors in countries such as South Africa and Egypt are expanding, driven by food security initiatives and agricultural financing.Tell us your focus area and get a customized research report.

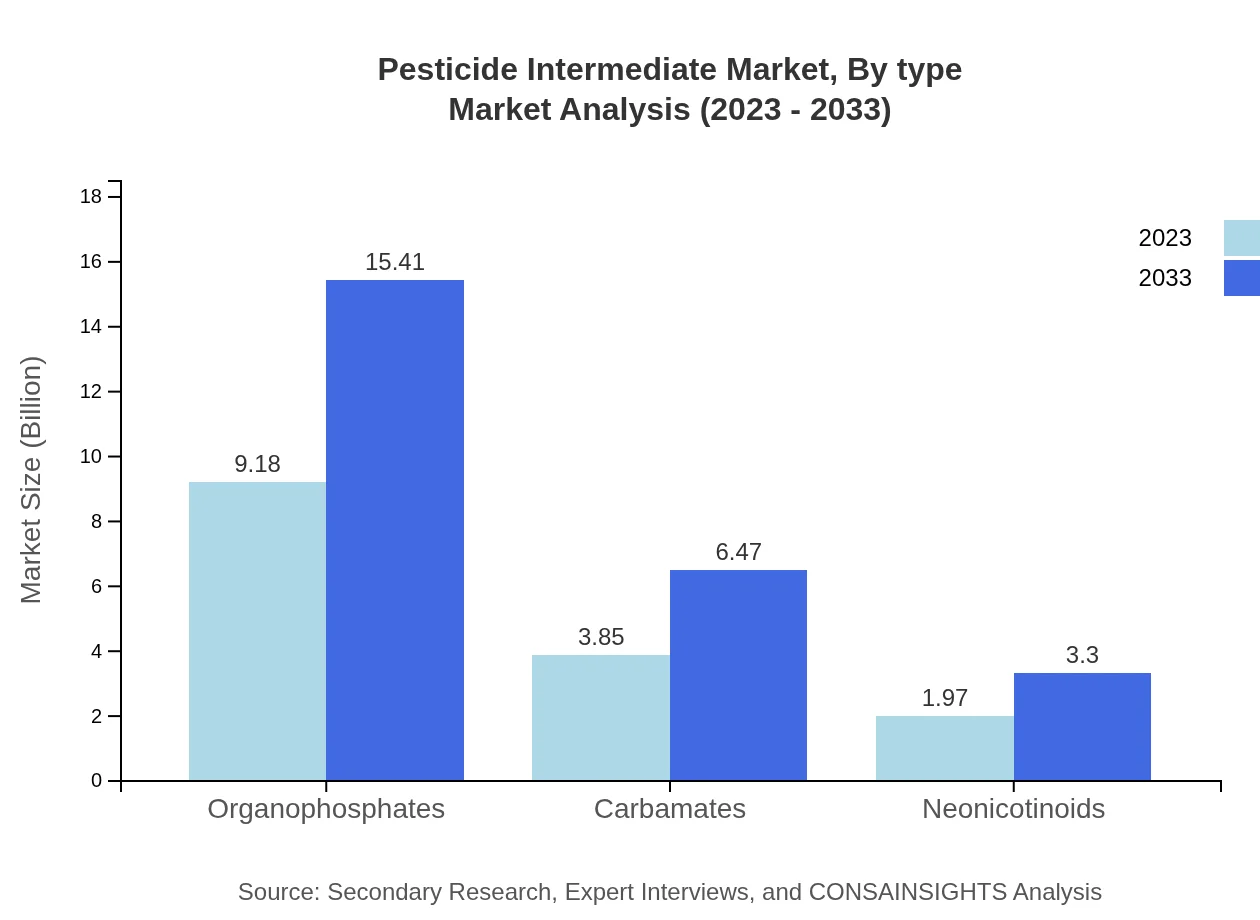

Pesticide Intermediate Market Analysis By Type

The market is dominated by organophosphates, which are expected to grow from USD 9.18 billion in 2023 to USD 15.41 billion by 2033. Carbamates and neonicotinoids follow, with respective sizes increasing from USD 3.85 billion to USD 6.47 billion and USD 1.97 billion to USD 3.30 billion during the same period.

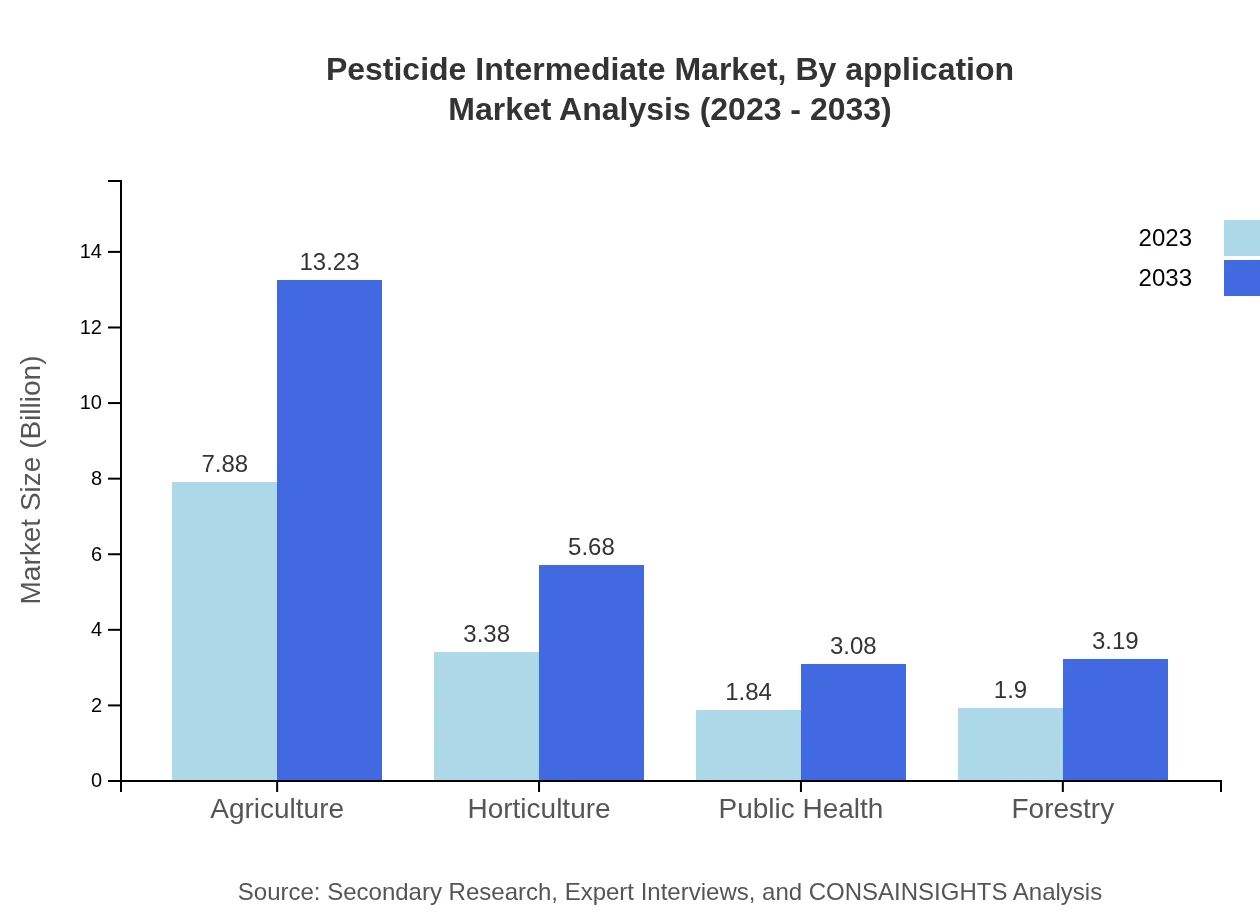

Pesticide Intermediate Market Analysis By Application

Agriculture dominates the application sector, with the market expected to rise from USD 7.88 billion in 2023 to USD 13.23 billion by 2033. Horticulture and public health applications also play a significant role, reflecting the diversity in usage across various sectors.

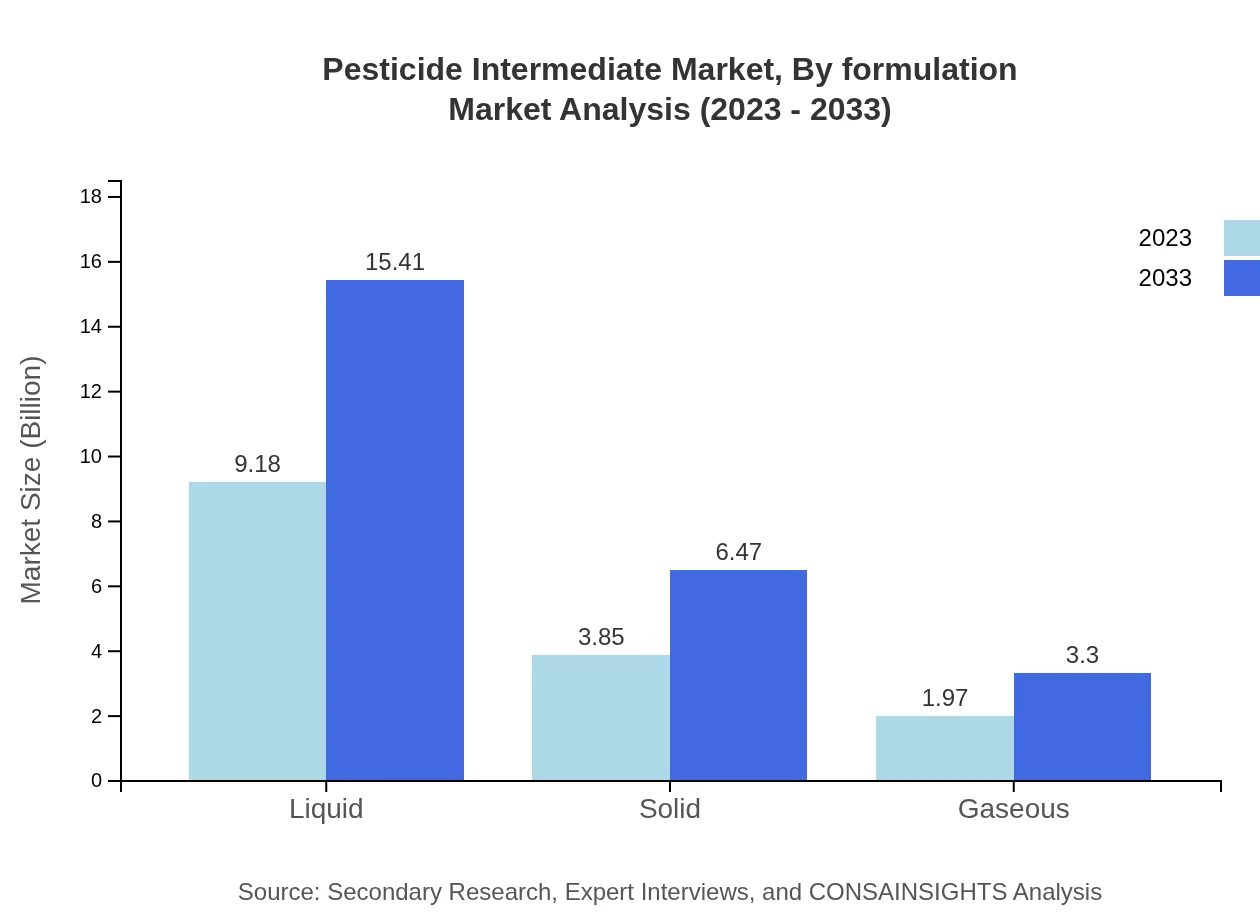

Pesticide Intermediate Market Analysis By Formulation

Liquid formulations take the lead, expected to grow from USD 9.18 billion in 2023 to USD 15.41 billion by 2033. Solid and gaseous forms also contribute, although they represent smaller segments within the overall market.

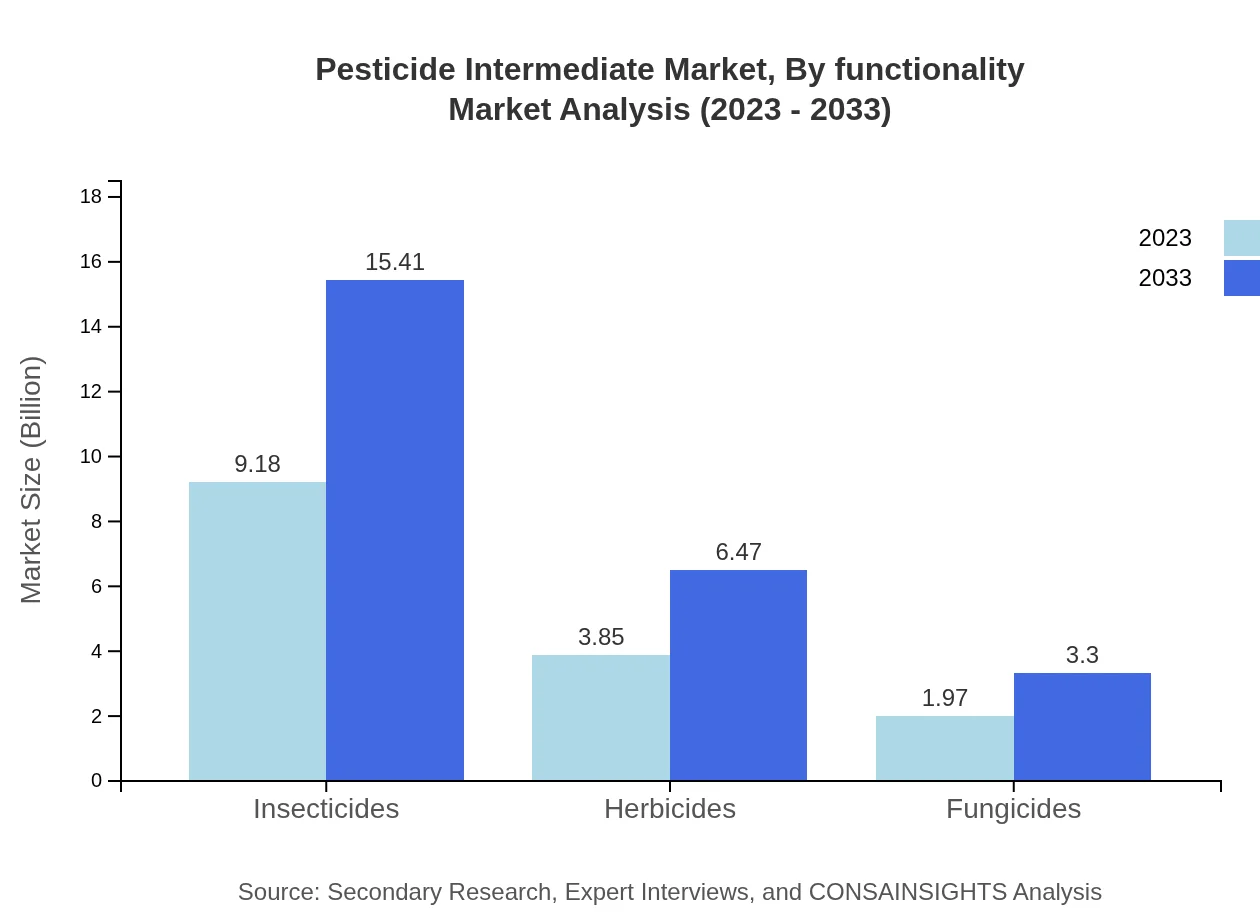

Pesticide Intermediate Market Analysis By Functionality

The functionality segment highlights the crucial role of insecticides, which account for a major market share, projected to grow significantly. Focusing on the need for effective pest control in agriculture signifies the growing importance of functional pesticide intermediates.

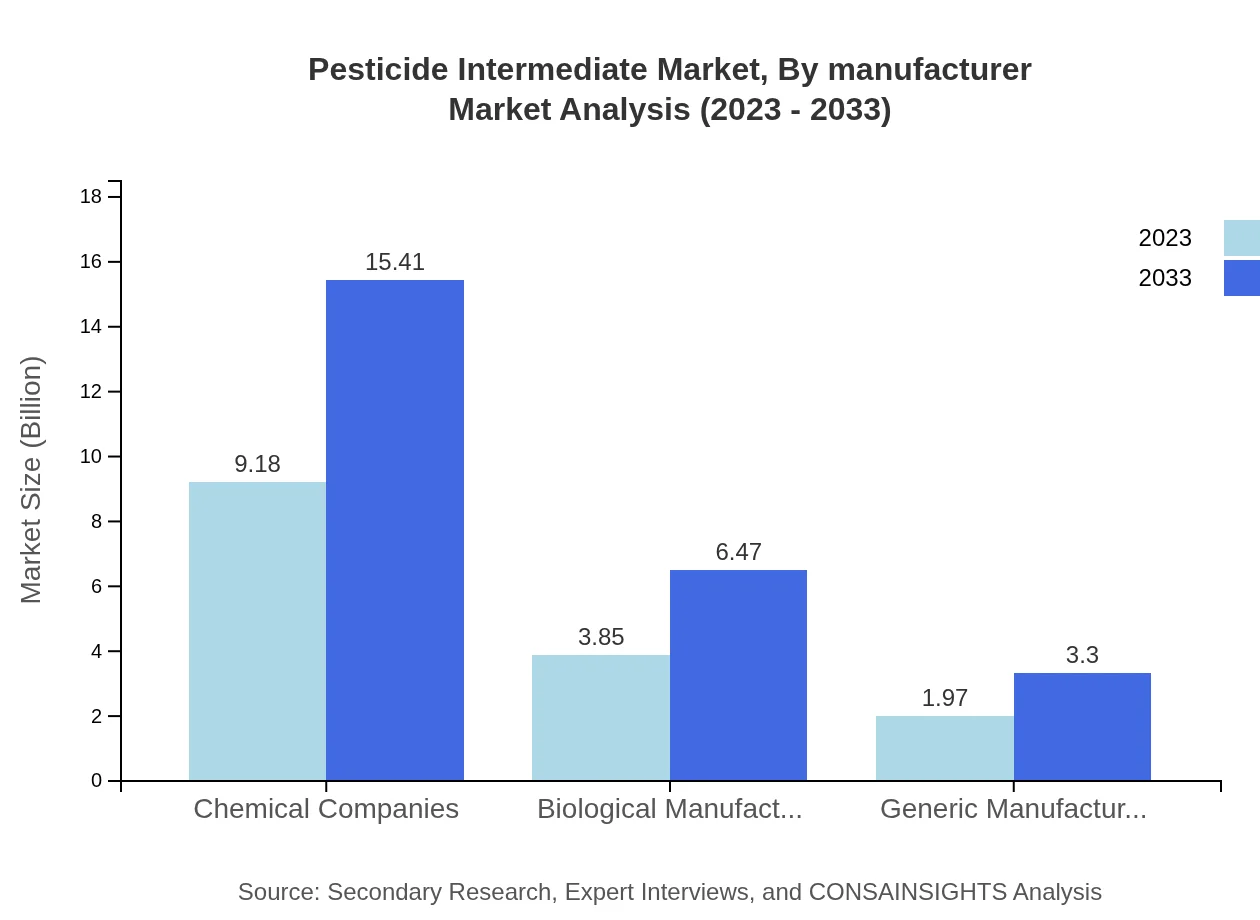

Pesticide Intermediate Market Analysis By Manufacturer

The market includes various manufacturers, such as chemical companies, biological manufacturers, and generic manufacturers, each contributing distinctly towards the overall supply chain and market dynamics.

Pesticide Intermediate Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pesticide Intermediate Industry

BASF SE:

A leading global chemical company, BASF provides innovative solutions and products in the agricultural sector, including a range of pesticide intermediates.Syngenta AG:

Syngenta specializes in crop protection products and has a strong portfolio of pesticide intermediates, with a focus on research and development in agrochemicals.FMC Corporation:

FMC offers a broad spectrum of agricultural products, including insecticides and herbicides prepared using pesticide intermediates.Dow AgroSciences:

Part of the Dow Chemical Company, Dow AgroSciences plays a key role in developing advanced pesticide intermediates that enhance global agricultural productivity.Nufarm Limited:

Nufarm produces a variety of crop protection products, leveraging pesticide intermediates in its formulations to address the needs of farmers.We're grateful to work with incredible clients.

FAQs

What is the market size of pesticide Intermediate?

The pesticide intermediate market is currently estimated at $15 billion in 2023, with a projected growth rate of 5.2% CAGR. By 2033, this market is expected to expand considerably, reflecting the increasing demand for agricultural products.

What are the key market players or companies in this pesticide Intermediate industry?

Key players in the pesticide-intermediate industry include major chemical companies and biological manufacturers. With competitive dynamics shaping the landscape, these companies focus on innovation, regulatory compliance, and sustainability to maintain market leadership.

What are the primary factors driving the growth in the pesticide Intermediate industry?

Factors driving growth include rising agricultural demand, increasing pest resistance, and technological advancements in pesticide formulation. Additionally, heightened awareness of food security and sustainability initiatives further fuel the industry's expansion.

Which region is the fastest Growing in the pesticide Intermediate?

The Asia Pacific region is anticipated to be the fastest-growing market segment from 2023 to 2033, with a market size increasing from $2.91 billion to $4.88 billion, reflecting significant agricultural growth and rising population demands.

Does ConsaInsights provide customized market report data for the pesticide Intermediate industry?

Yes, ConsaInsights offers customized market reports tailored to client specifications. Companies can choose specific data segments, trends, and forecasts to suit their strategic planning and market analysis needs.

What deliverables can I expect from this pesticide Intermediate market research project?

Deliverables include comprehensive market analysis reports, segmented data insights, growth forecasts, competitive landscape evaluation, and regional market assessments, helping stakeholders make informed decisions in the pesticide-intermediate sector.

What are the market trends of pesticide Intermediate?

Current trends include increasing adoption of integrated pest management, growing organic farming practices, and innovations in biotechnology. The market is shifting towards greener alternatives, with significant research investment in sustainable pesticide development.