Pet Food Processing Market Report

Published Date: 31 January 2026 | Report Code: pet-food-processing

Pet Food Processing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pet Food Processing market from 2023 to 2033, including market overview, size, industry analysis, segmentation, regional insights, technology trends, product performance, major players, and future forecasts.

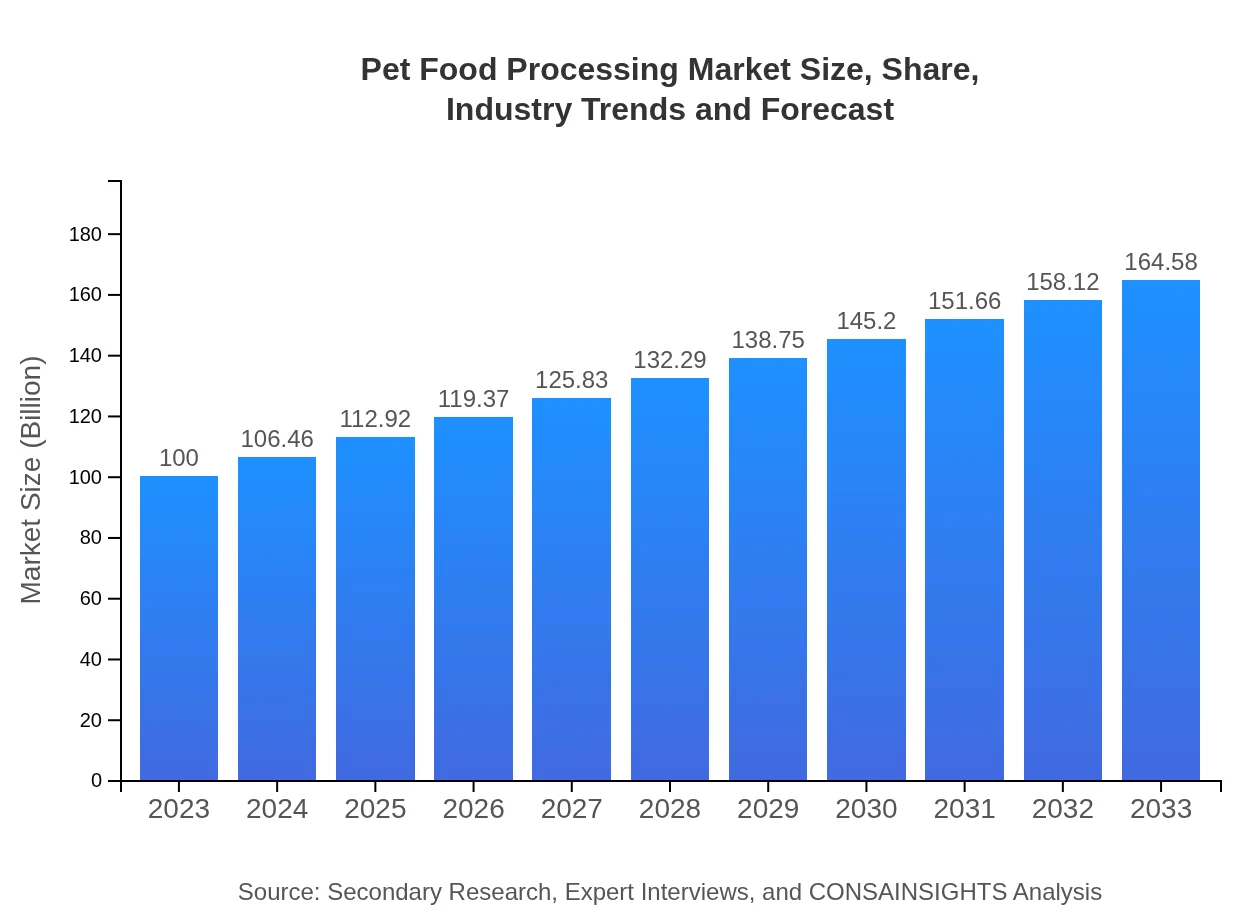

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Nestlé Purina PetCare, Mars Petcare, Hill’s Pet Nutrition, Blue Buffalo, Diamond Pet Foods |

| Last Modified Date | 31 January 2026 |

Pet Food Processing Market Overview

Customize Pet Food Processing Market Report market research report

- ✔ Get in-depth analysis of Pet Food Processing market size, growth, and forecasts.

- ✔ Understand Pet Food Processing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pet Food Processing

What is the Market Size & CAGR of Pet Food Processing market in 2023?

Pet Food Processing Industry Analysis

Pet Food Processing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pet Food Processing Market Analysis Report by Region

Europe Pet Food Processing Market Report:

Europe's market for Pet Food Processing is estimated to grow from $31.23 billion in 2023 to $51.40 billion by 2033, with strong growth propelled by increasing awareness of pet health and nutrition amongst pet owners.Asia Pacific Pet Food Processing Market Report:

In the Asia Pacific region, the Pet Food Processing market is projected to grow from $19.01 billion in 2023 to $31.29 billion by 2033, fueled by increasing pet population and changing dietary habits of pet owners.North America Pet Food Processing Market Report:

North America, being one of the largest markets, is estimated to jump from $34.57 billion in 2023 to $56.89 billion by 2033, driven by high pet ownership rates and a robust demand for premium and organic pet food products.South America Pet Food Processing Market Report:

The South American market is also on an upward trend, anticipated to rise from $7.59 billion in 2023 to $12.49 billion in 2033, supported by a growing middle-class consumer base that invests more in pet health and nutrition.Middle East & Africa Pet Food Processing Market Report:

The Middle East and Africa market is projected to expand from $7.60 billion in 2023 to $12.51 billion by 2033, driven by rising urbanization and changes in consumer lifestyle, leading to increased demand for pet ownership.Tell us your focus area and get a customized research report.

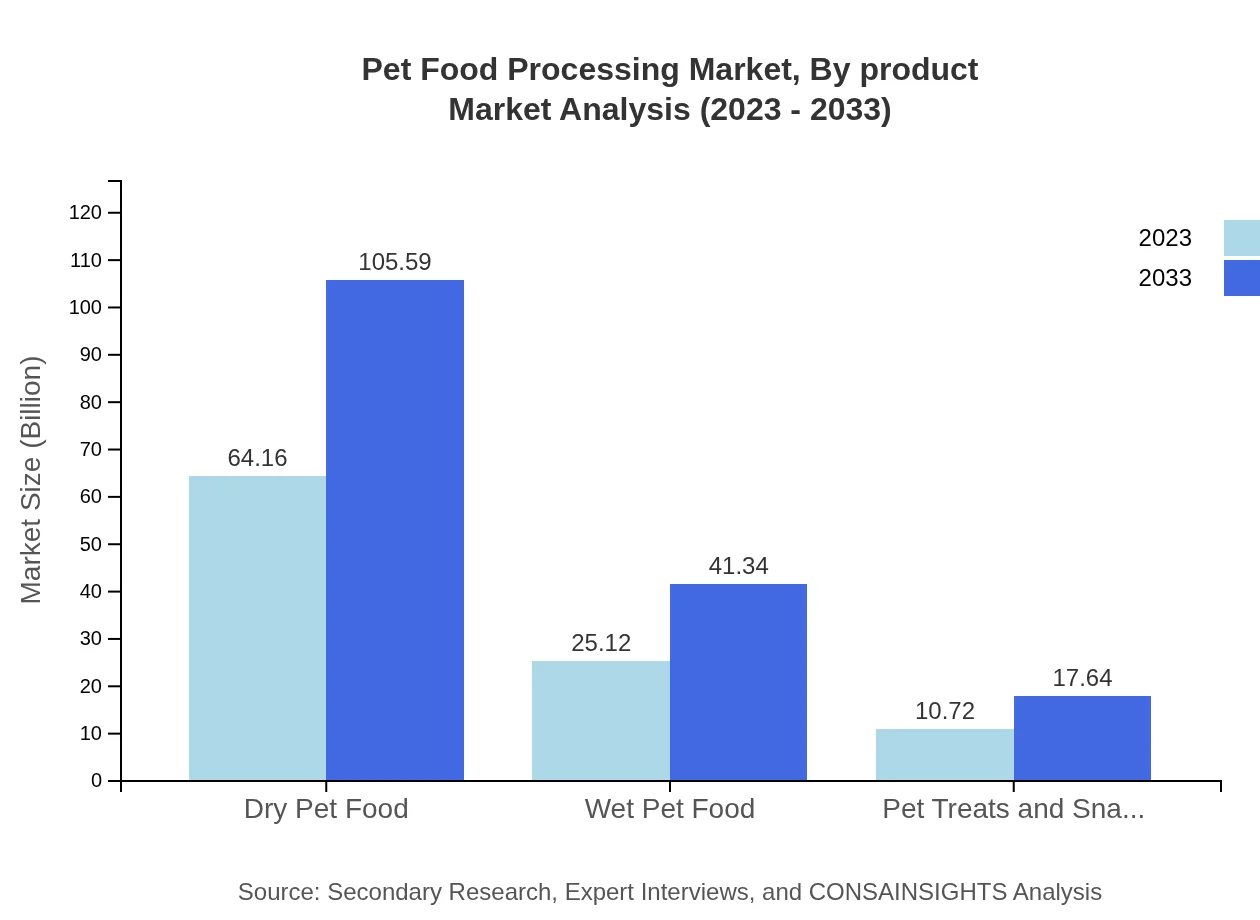

Pet Food Processing Market Analysis By Product

The Pet Food Processing market by product reveals substantial market share for Dry Pet Food, projected to grow from $64.16 billion in 2023 to $105.59 billion by 2033. Wet Pet Food, while smaller, is also expected to rise, from $25.12 billion to $41.34 billion, reflecting a shift towards moisture-rich diets, whereas Pet Treats and Snacks will see an increase from $10.72 billion to $17.64 billion, indicating a growing trend for snacks and treats.

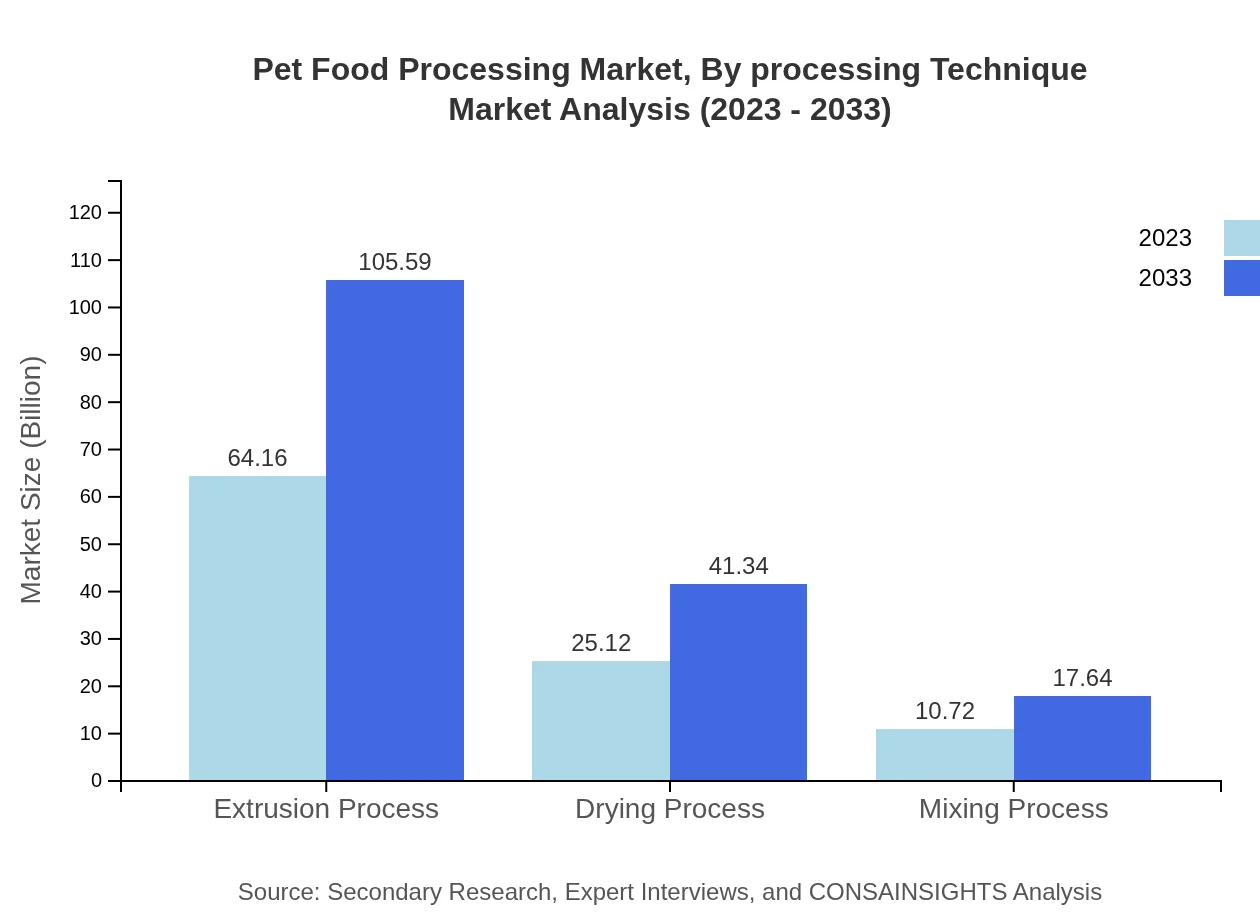

Pet Food Processing Market Analysis By Processing Technique

The market also segments by processing technique, where Extrusion dominates the landscape from $64.16 billion to $105.59 billion due to its efficiency in producing dry food. Traditional methods like Drying ($25.12 billion to $41.34 billion) and Mixing ($10.72 billion to $17.64 billion) will continue to be prominent as manufacturers seek consistency and quality in production.

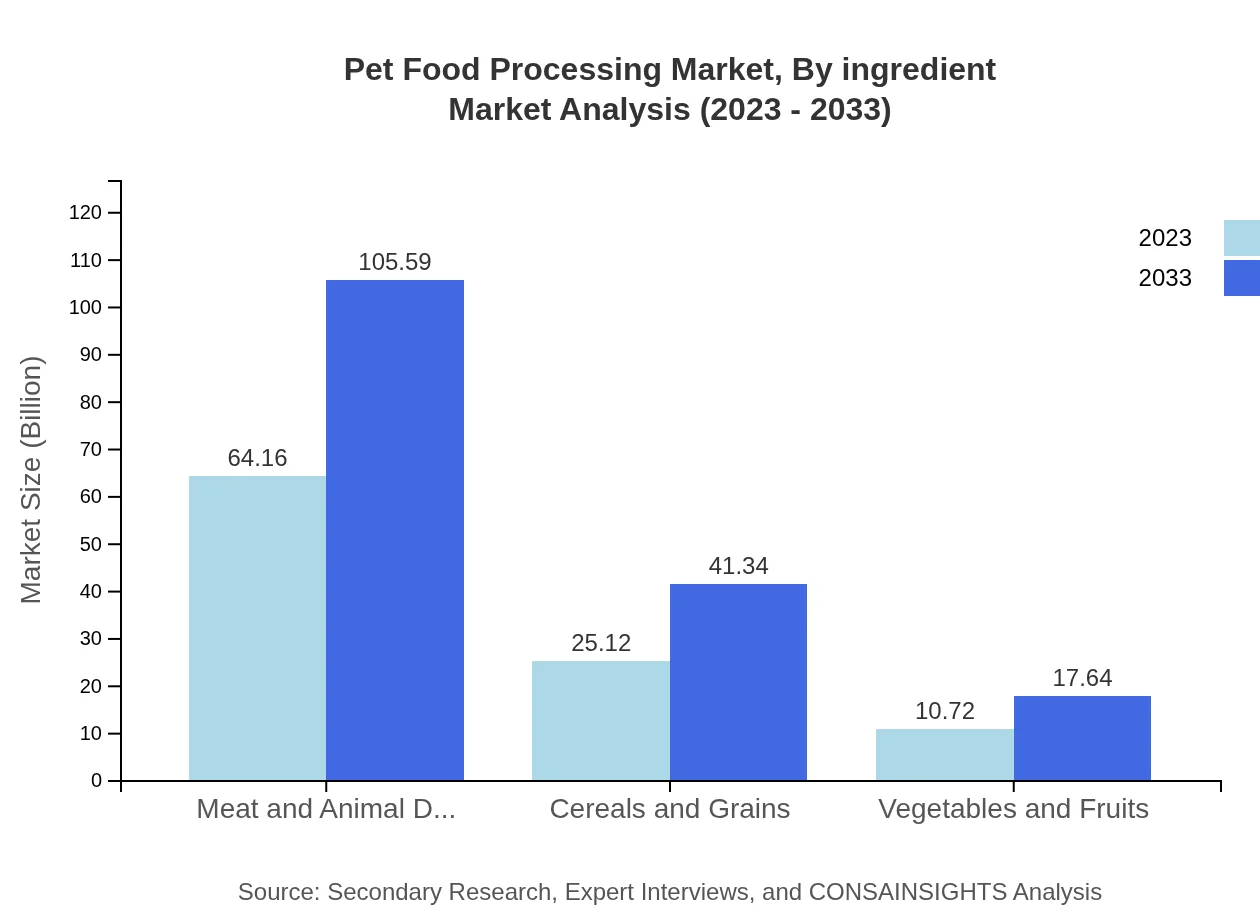

Pet Food Processing Market Analysis By Ingredient

In terms of ingredients, Meat and Animal Derivatives remain the leading segment, growing from $64.16 billion in 2023 to $105.59 billion in 2033. Cereals and Grains, essential for their energy provisions, are expected to grow from $25.12 billion to $41.34 billion. Additionally, Vegetables and Fruits ingredients will see progress from $10.72 billion to $17.64 billion, highlighting the consumer shift towards holistic pet nutrition.

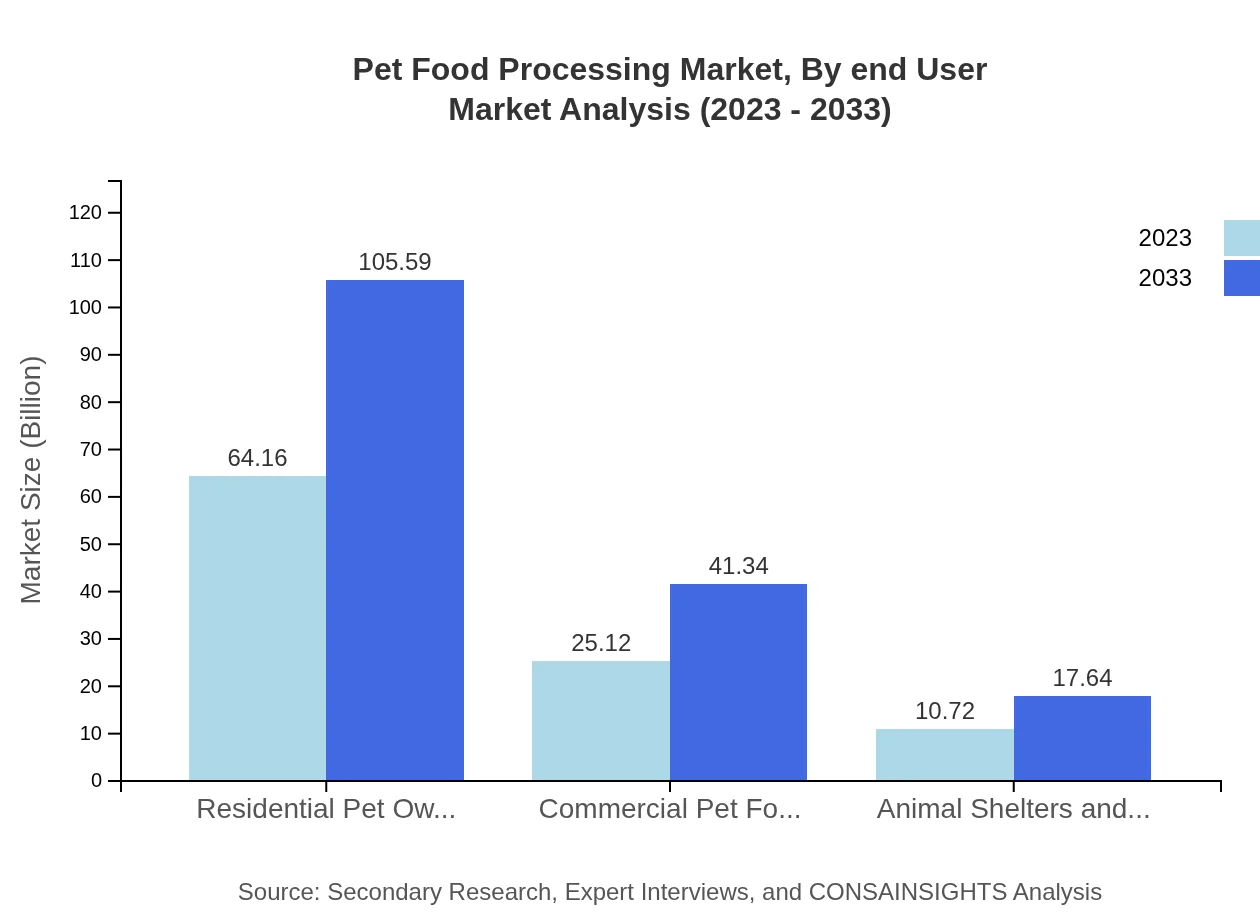

Pet Food Processing Market Analysis By End User

Residential Pet Owners constitute the largest share, showing a growth trajectory from $64.16 billion in 2023 to $105.59 billion by 2033. Commercial Pet Food Brands will also display noticeable growth from $25.12 billion to $41.34 billion, while Animal Shelters and Rescues expand from $10.72 billion to $17.64 billion, emphasizing the growing support for pet welfare organizations.

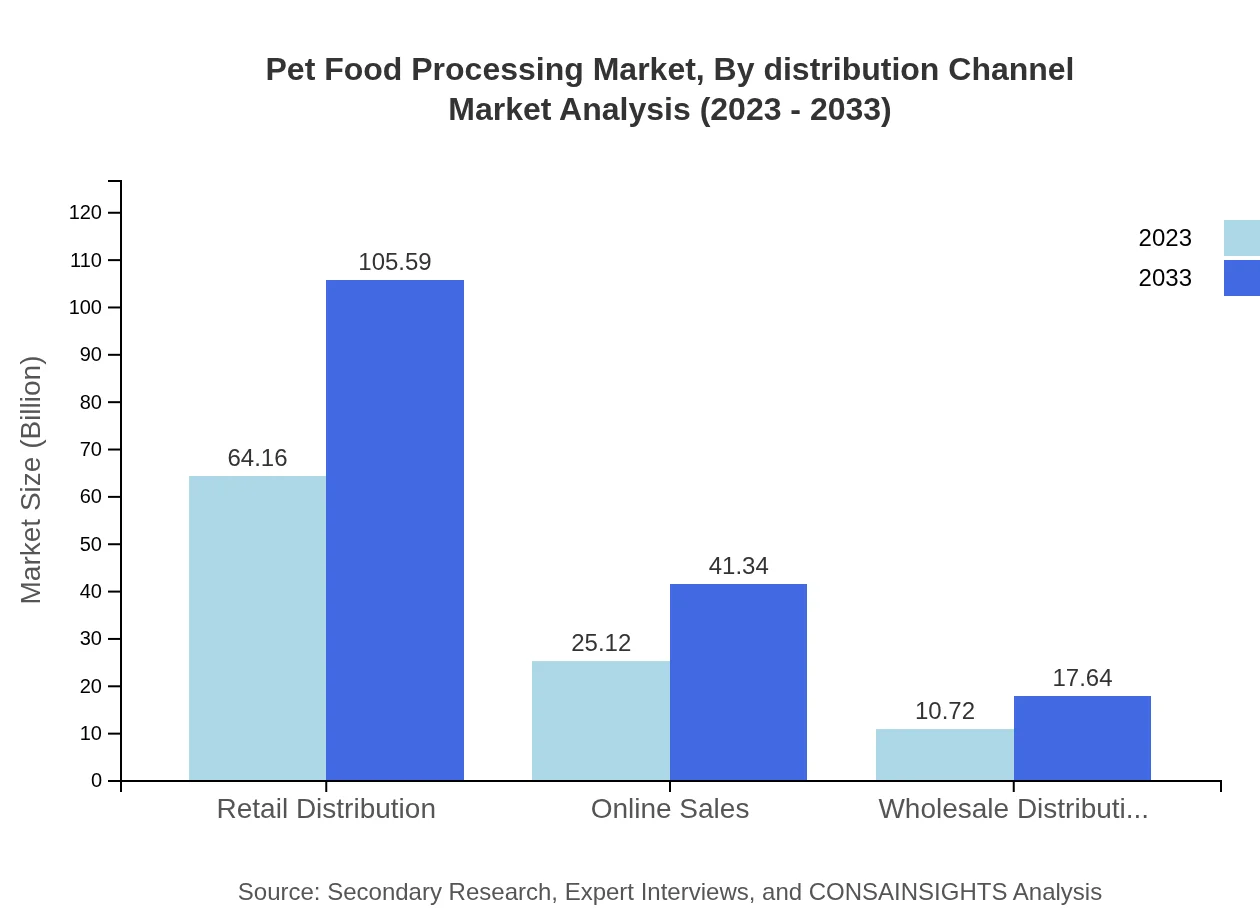

Pet Food Processing Market Analysis By Distribution Channel

The distribution channel reveals a dominant Retail Distribution segment ranging from $64.16 billion to $105.59 billion, bolstered by pet specialty stores. Online Sales are experiencing rapid growth from $25.12 billion to $41.34 billion as e-commerce becomes increasingly prevalent in the pet food sector, while Wholesale Distribution will grow from $10.72 billion to $17.64 billion, underscoring the importance of strategic partnerships in supply chains.

Pet Food Processing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pet Food Processing Industry

Nestlé Purina PetCare:

A subsidiary of Nestlé, it is a leading global manufacturer of pet food, offering a range of premium brands and products tailored for various pet dietary needs.Mars Petcare:

A giant in the pet food sector, Mars Petcare produces highly recognized brands focusing on the health and nutrition of pets, operating in multiple global markets.Hill’s Pet Nutrition:

Specialized in nutritional pet food products, Hill's is known for its science-backed formulations aimed at improving pet health and wellness.Blue Buffalo:

Promoting all-natural ingredients, Blue Buffalo has carved a niche in the health-conscious pet food segment, appealing to discerning pet owners.Diamond Pet Foods:

A prominent player emphasizing high-quality, complete and balanced nutrition for pets with a focus on ingredient transparency and quality.We're grateful to work with incredible clients.

FAQs

What is the market size of pet Food Processing?

The global pet-food processing market is projected to grow from $100 million in 2023 to a expected range of growth influenced by a CAGR of 5% through 2033.

What are the key market players or companies in this pet Food Processing industry?

Key players in the pet-food processing industry include major pet food brands, manufacturers specializing in pet food technology, and suppliers of raw materials essential for production.

What are the primary factors driving the growth in the pet Food Processing industry?

Growth drivers in the pet-food processing industry include rising pet ownership rates, increased spending on premium pet foods, and a growing focus on nutrition and health benefits for pets.

Which region is the fastest Growing in the pet Food Processing?

Asia Pacific is the fastest-growing region in the pet-food processing industry, with market growth anticipated to rise from $19.01 million in 2023 to $31.29 million by 2033, reflecting growing pet ownership and demand.

Does ConsaInsights provide customized market report data for the pet Food Processing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the pet-food processing industry, allowing for detailed insights and analysis.

What deliverables can I expect from this pet Food Processing market research project?

Deliverables typically include comprehensive market analysis reports, trend insights, competitive landscape evaluations, and growth forecasts tailored to the pet-food processing industry.

What are the market trends of pet Food Processing?

Market trends in pet-food processing include an increasing preference for natural and organic ingredients, the rise of e-commerce in pet food sales, and innovations in processing technologies such as extrusion.