Pet Insurance Market Report

Published Date: 24 January 2026 | Report Code: pet-insurance

Pet Insurance Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Pet Insurance market, detailing market size, growth trends, and segmentation, along with regional insights and forecasts for the years 2023 to 2033.

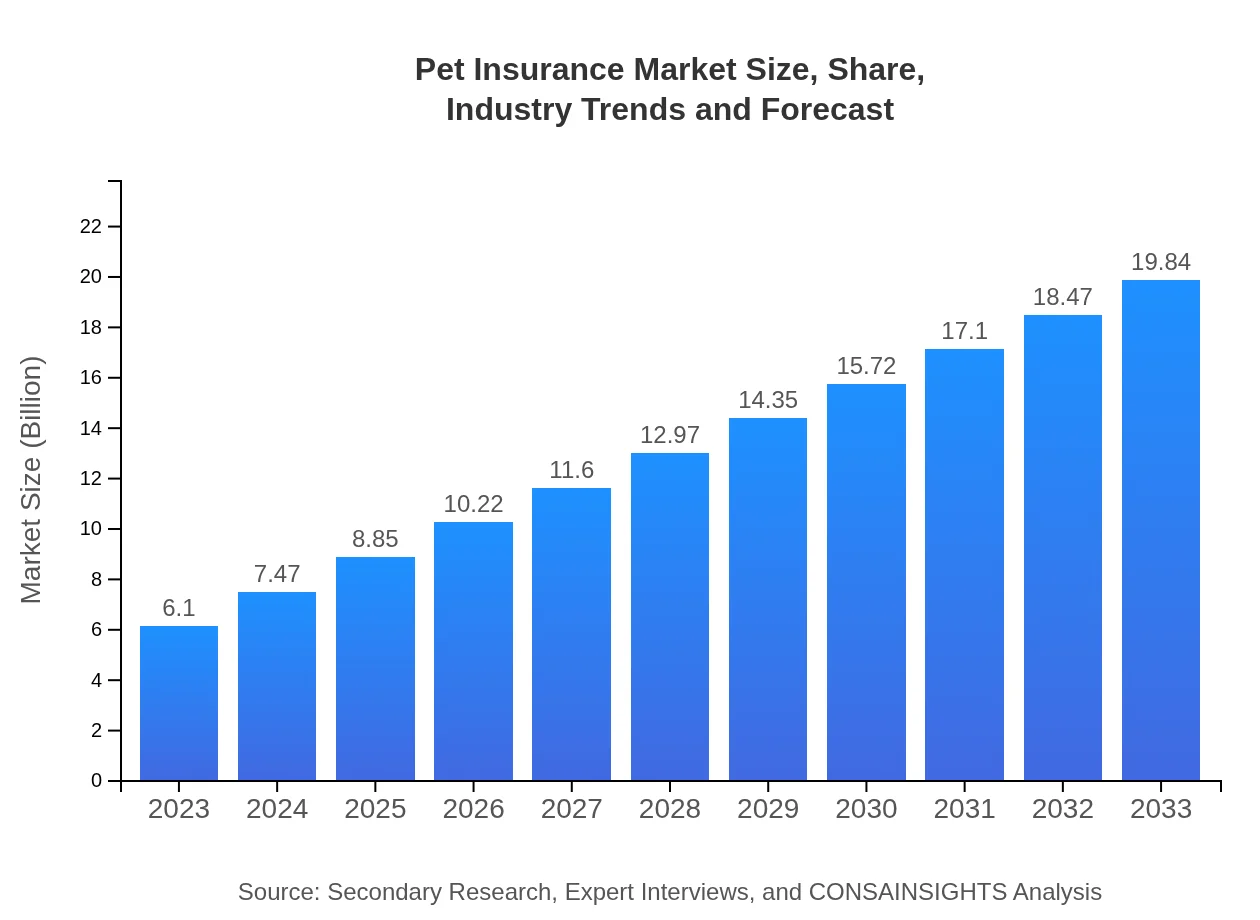

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.10 Billion |

| CAGR (2023-2033) | 12.0% |

| 2033 Market Size | $19.84 Billion |

| Top Companies | Allianz, Trupanion, Pets Best, Nationwide |

| Last Modified Date | 24 January 2026 |

Pet Insurance Market Overview

Customize Pet Insurance Market Report market research report

- ✔ Get in-depth analysis of Pet Insurance market size, growth, and forecasts.

- ✔ Understand Pet Insurance's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pet Insurance

What is the Market Size & CAGR of Pet Insurance Market in 2023?

Pet Insurance Industry Analysis

Pet Insurance Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pet Insurance Market Analysis Report by Region

Europe Pet Insurance Market Report:

The European market size in 2023 is USD 1.60 billion, with expectations to escalate to USD 5.21 billion by 2033. Increased expenditure on pet health and a rise in the number of veterinarians are significant drivers in this market.Asia Pacific Pet Insurance Market Report:

In the Asia Pacific region, the Pet Insurance market was valued at USD 1.16 billion in 2023 and is anticipated to grow to USD 3.78 billion by 2033. Increasing pet ownership and rising awareness of pet health insurance are driving this growth.North America Pet Insurance Market Report:

North America currently holds a significant portion of the market, valued at USD 1.98 billion in 2023, with projections to reach USD 6.45 billion by 2033. The high levels of pet ownership and awareness of insurance options are driving factors for growth in this region.South America Pet Insurance Market Report:

The South American Pet Insurance market is expected to expand from USD 0.52 billion in 2023 to USD 1.70 billion by 2033. Growing disposable incomes and the increasing humanization of pets are key factors in this market's growth.Middle East & Africa Pet Insurance Market Report:

In the Middle East and Africa, the Pet Insurance market is projected to grow from USD 0.83 billion in 2023 to USD 2.70 billion by 2033. This growth is attributed to increasing pet ownership and emerging awareness around pet health issues.Tell us your focus area and get a customized research report.

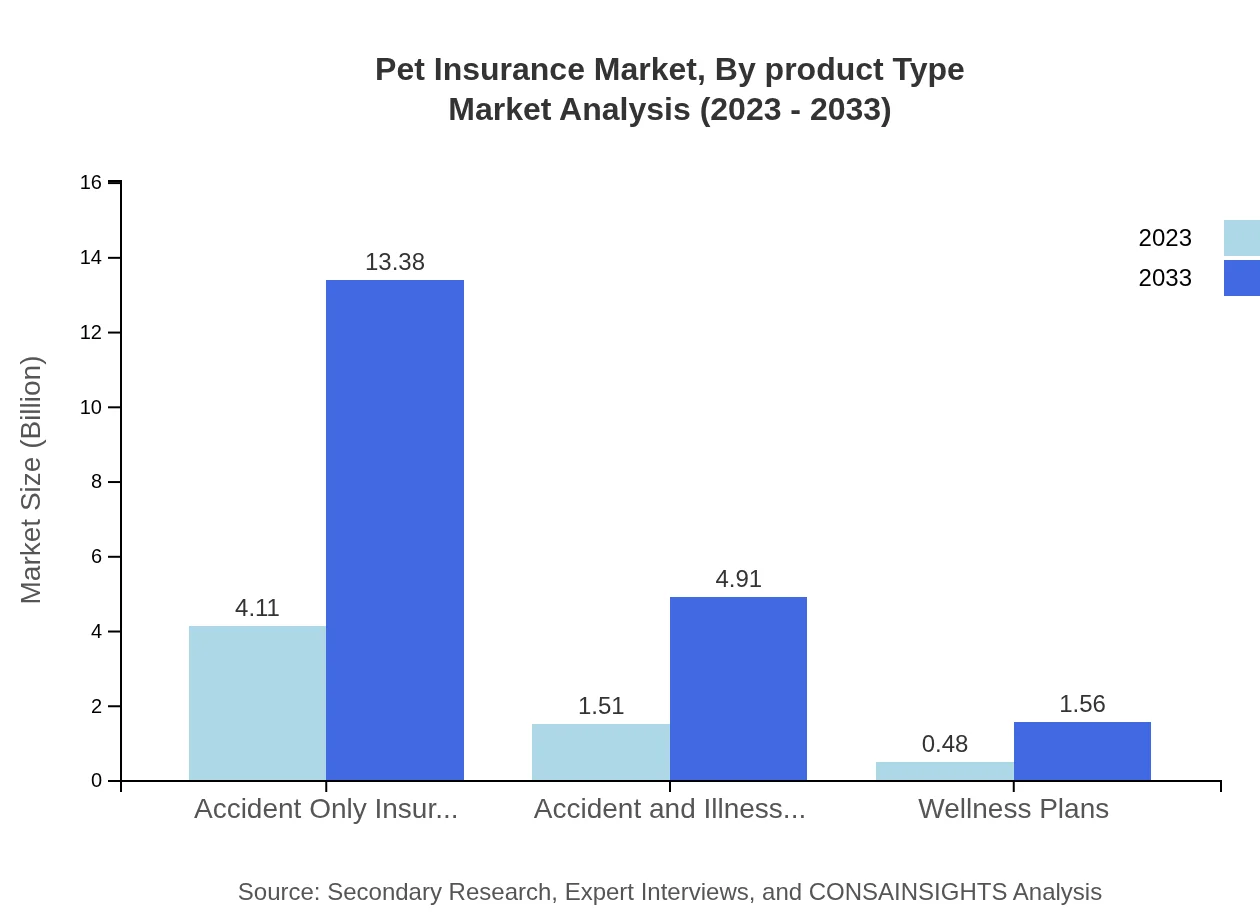

Pet Insurance Market Analysis By Product Type

The Pet Insurance market is segmented by product types, including Accident Only Insurance, Accident and Illness Insurance, and Wellness Plans. Each product type demonstrates significant growth prospects, with Accident Only Insurance making up a considerable market share due to affordability. Comprehensive policies, despite higher costs, are preferred for their extensive coverage.

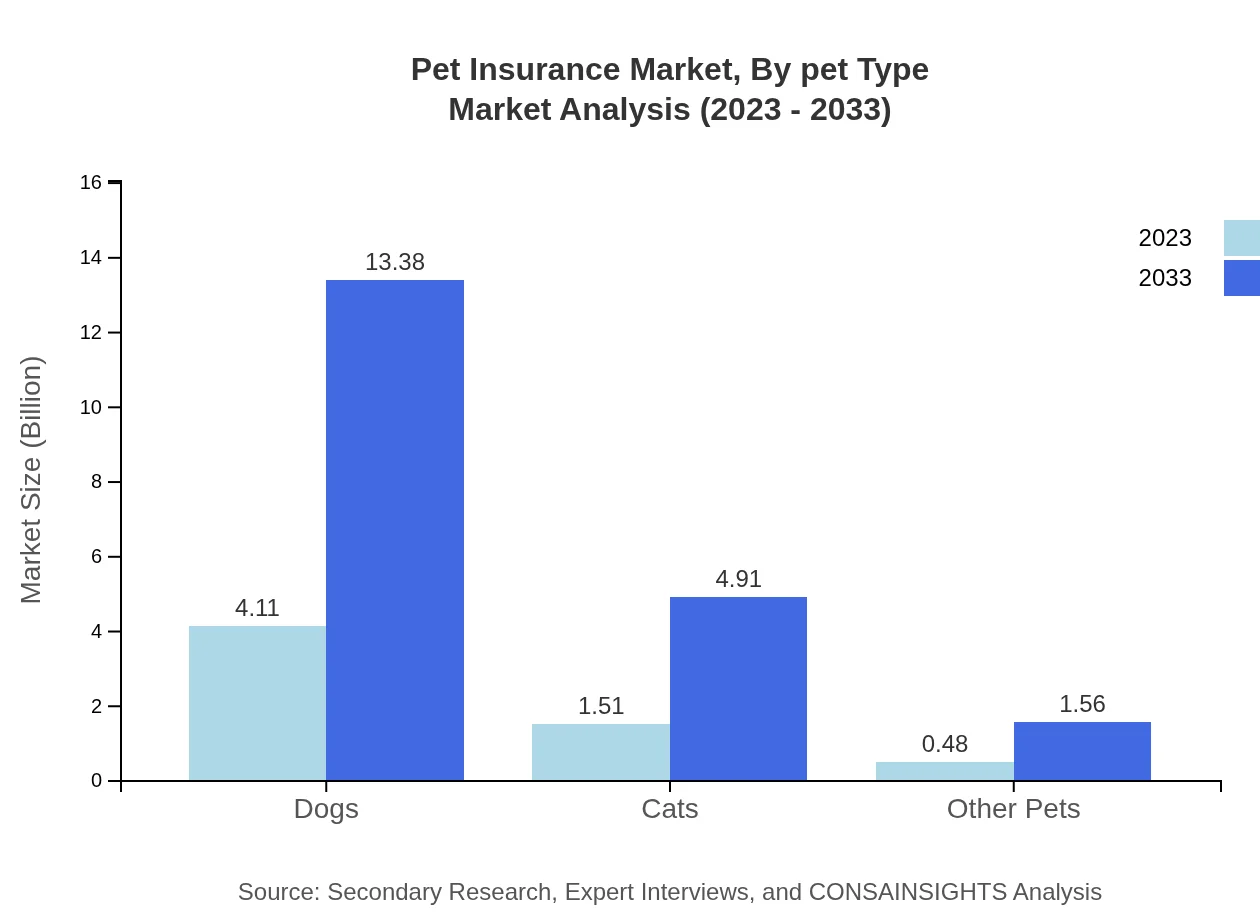

Pet Insurance Market Analysis By Pet Type

The segmentation of the Pet Insurance market by pet type includes Dogs, Cats, and Other Pets, with Dogs comprising the largest share at 67.4% in 2023. The increasing ownership of cats and other pets is notably contributing to the market’s growth and indicates a need for diversified insurance products.

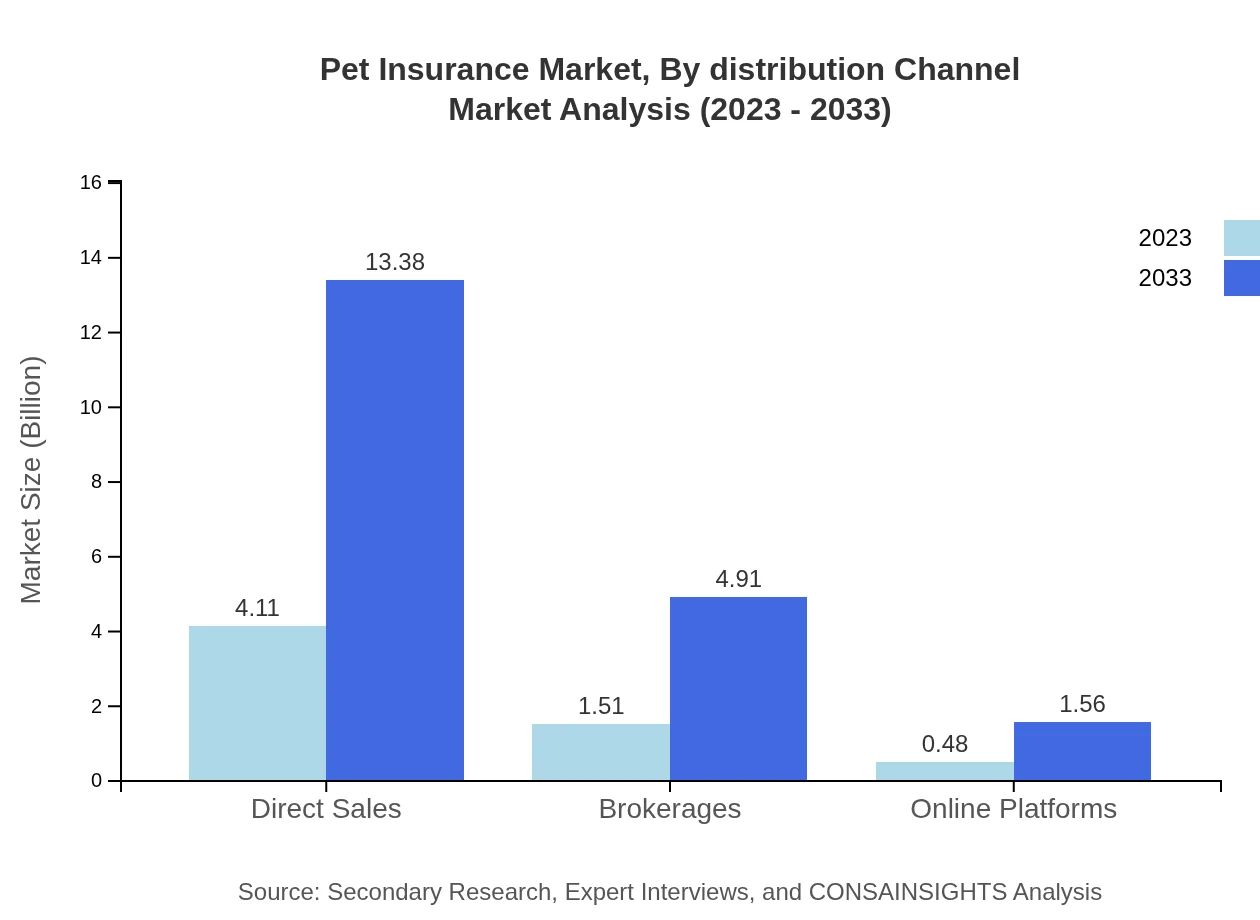

Pet Insurance Market Analysis By Distribution Channel

Distribution channels in the Pet Insurance market include Direct Sales, Brokerages, and Online Platforms. Direct Sales represents the largest share at 67.4%, thanks to simplified purchasing processes and direct interactions between insurers and pet owners.

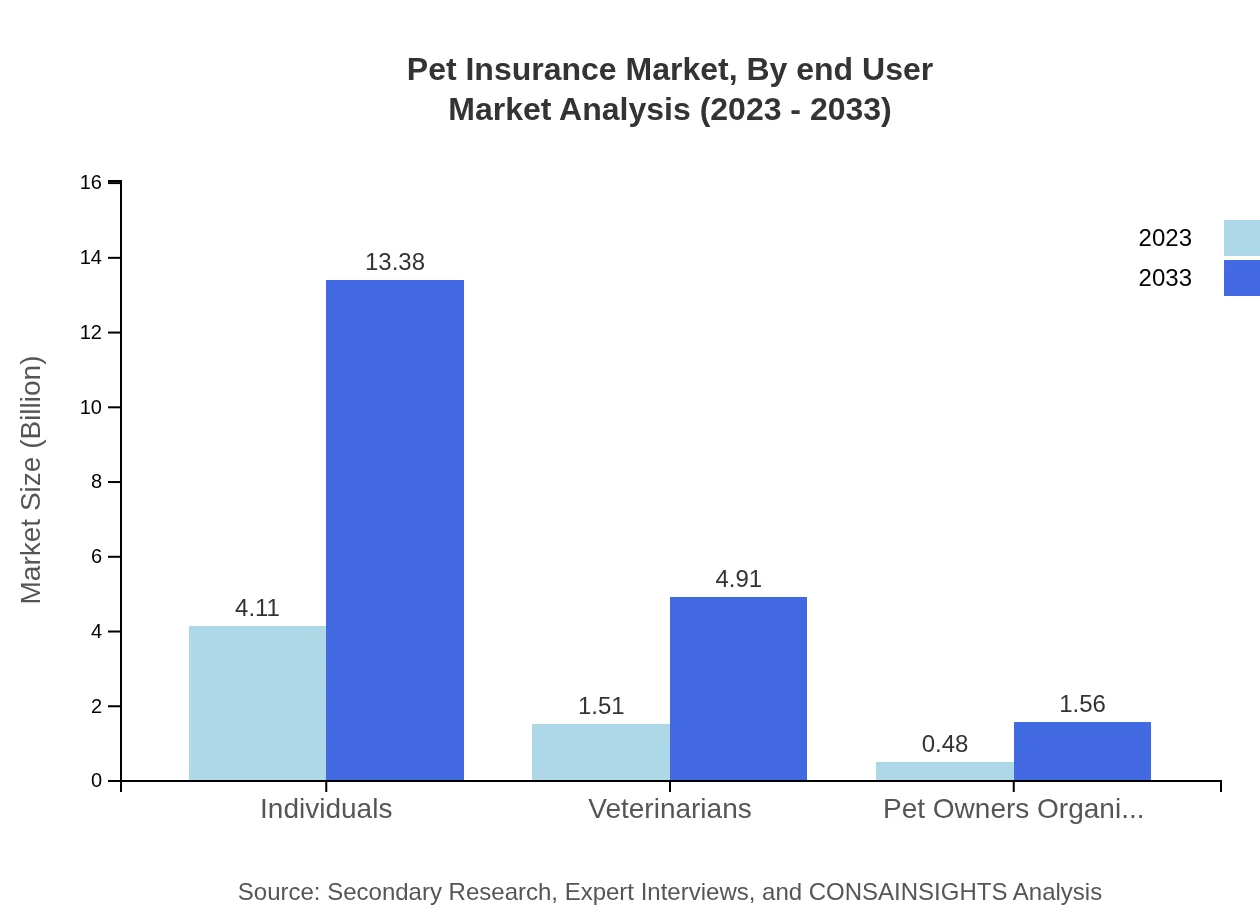

Pet Insurance Market Analysis By End User

The end-user segmentation involves individuals, veterinarians, and pet owner organizations. Individuals take the largest share, accounting for 67.4% in 2023, emphasizing the direct consumer approach of pet insurance products, tailored to meet personal pet care needs.

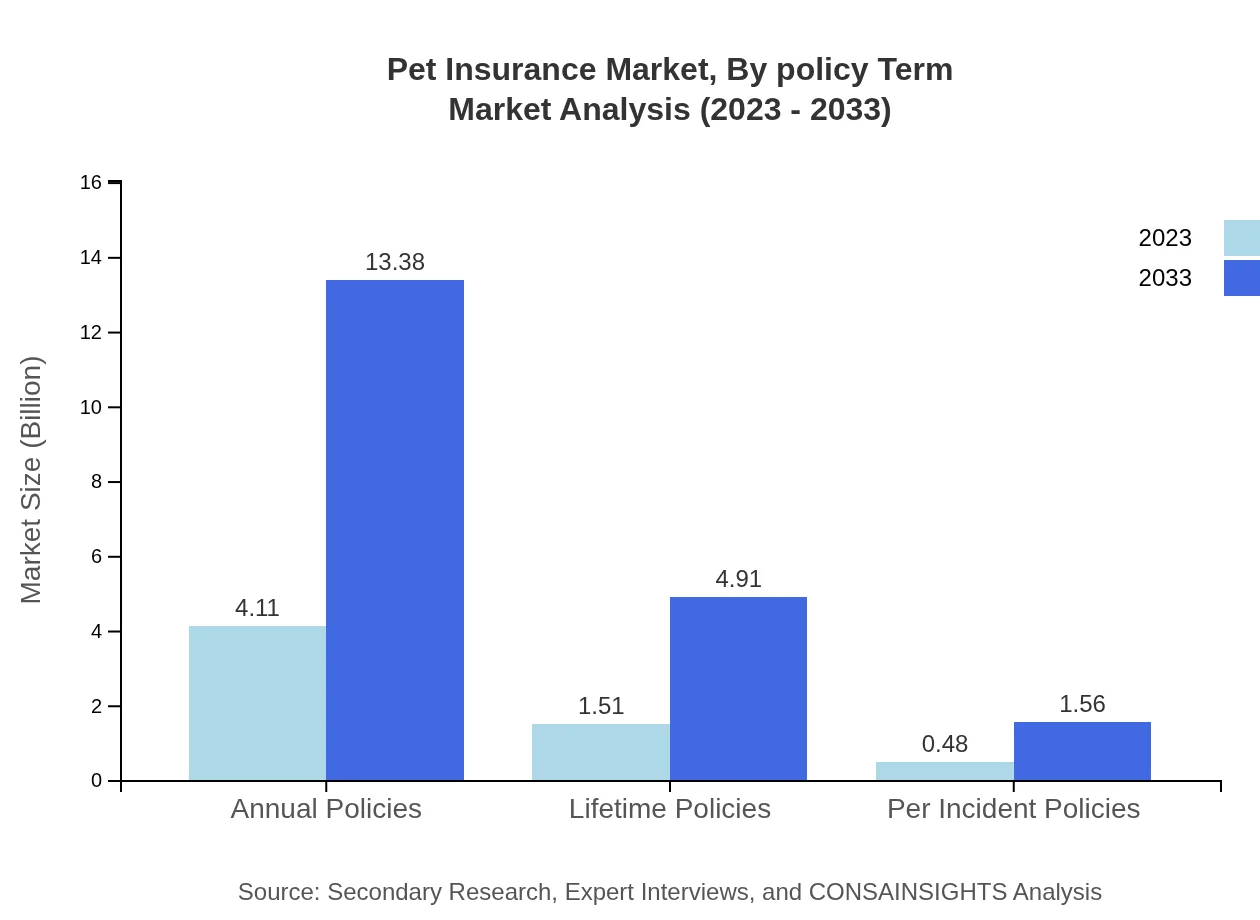

Pet Insurance Market Analysis By Policy Term

Policy terms can be categorized into Annual Policies, Lifetime Policies, and Per Incident Policies. Annual Policies dominate with 67.4% of the market share, providing flexibility to policyholders, though Lifetime Policies are gaining traction due to comprehensive long-term coverage.

Pet Insurance Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pet Insurance Industry

Allianz:

A leader in the global pet insurance market, Allianz provides comprehensive wellness and illness coverage tailored for pets, enhancing protection solutions for pet owners.Trupanion:

Trupanion is known for its unique business model offering lifetime pet health insurance. They emphasize customer satisfaction and claim transparency as key tenets of their service.Pets Best:

Pets Best specializes in affordable pet insurance solutions with a wide range of plans to meet the needs of both pet owners and veterinarians.Nationwide:

Nationwide is a significant player in the pet insurance space, offering both standard and customizable coverage options, positioning themselves as a versatile choice for pet owners.We're grateful to work with incredible clients.

FAQs

What is the market size of pet insurance?

The global pet insurance market is currently valued at approximately $6.1 billion and is projected to grow at a CAGR of 12.0% over the next decade, highlighting the increasing adoption of pet health coverage among pet owners.

What are the key market players or companies in this pet insurance industry?

Key players in the pet insurance market include major companies such as Petplan, Trupanion, and Nationwide. These companies are innovating their offerings to address the growing demands of pet owners for comprehensive insurance coverage.

What are the primary factors driving the growth in the pet insurance industry?

The growth in the pet insurance industry is primarily driven by increasing pet ownership, rising veterinary costs, and consumer awareness regarding pet health. Technological advancements in policy offerings and telemedicine are also significant contributors.

Which region is the fastest Growing in the pet insurance market?

Among regions, North America is experiencing rapid growth in the pet insurance market, projected to grow from $1.98 billion in 2023 to $6.45 billion by 2033, fueled by a high rate of pet ownership and healthcare awareness.

Does Consainsights provide customized market report data for the pet insurance industry?

Yes, Consainsights offers customized market report data for the pet insurance industry. Clients can request tailored analysis to meet their specific needs, ensuring relevant insights for informed decision-making.

What deliverables can I expect from this pet insurance market research project?

Clients can expect comprehensive market research deliverables, including in-depth analysis reports, market forecasts, competitive landscape assessments, and customer segmentation data, helping to inform strategic planning and investment.

What are the market trends of pet insurance?

Current trends in the pet insurance market include an increasing shift towards online policy purchases, the rise of wellness plans, and the growing popularity of annual policies, reflecting the evolving preferences of pet owners.