Pet Oral Care Products Market Report

Published Date: 31 January 2026 | Report Code: pet-oral-care-products

Pet Oral Care Products Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pet Oral Care Products market from 2023 to 2033, including insights into market size, growth trends, segmentation, regional analysis, and key players within the industry.

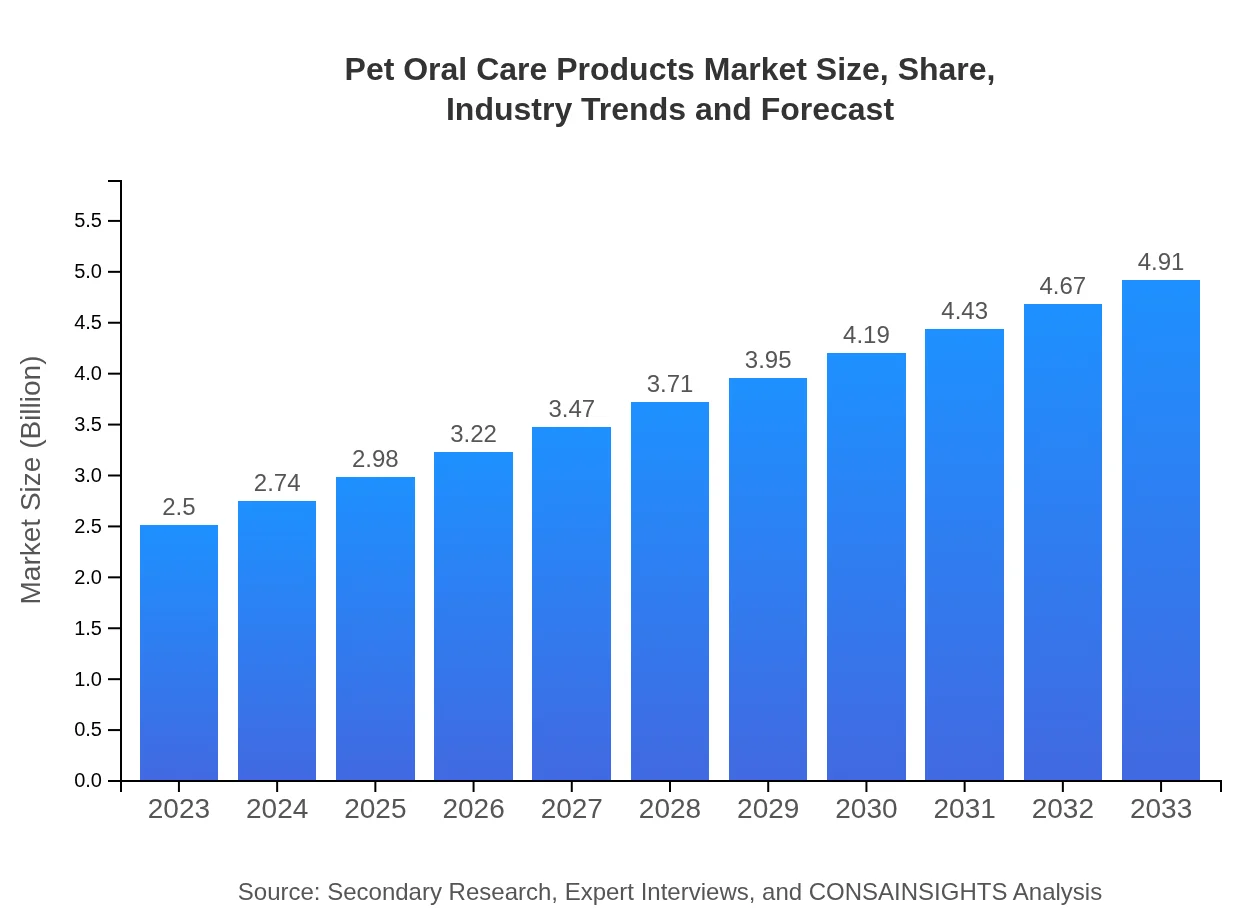

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Hill's Pet Nutrition, PetSmile, Zoetis, Virbac, Bayer Animal Health |

| Last Modified Date | 31 January 2026 |

Pet Oral Care Products Market Overview

Customize Pet Oral Care Products Market Report market research report

- ✔ Get in-depth analysis of Pet Oral Care Products market size, growth, and forecasts.

- ✔ Understand Pet Oral Care Products's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pet Oral Care Products

What is the Market Size & CAGR of Pet Oral Care Products market in 2023?

Pet Oral Care Products Industry Analysis

Pet Oral Care Products Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pet Oral Care Products Market Analysis Report by Region

Europe Pet Oral Care Products Market Report:

The European market for Pet Oral Care Products is projected at $0.81 billion in 2023, set to grow to $1.59 billion by 2033. The European Union's regulations on pet care products are encouraging manufacturers to innovate and produce high-quality products, thereby enhancing market growth.Asia Pacific Pet Oral Care Products Market Report:

In 2023, the market in Asia Pacific is valued at $0.47 billion and is projected to reach $0.93 billion by 2033. The rising urban population and increasing awareness about pet care dynamics contribute to this growth. Countries like China and Japan are expected to lead this market growth due to the surge in pet adoption.North America Pet Oral Care Products Market Report:

North America constitutes the largest share of the market, with an estimated size of $0.89 billion in 2023. By 2033, this figure is expected to reach $1.74 billion. The demand here is fueled by heightened awareness of pet dental health and the launch of specialized products catering to diverse pet populations.South America Pet Oral Care Products Market Report:

The South American market for Pet Oral Care Products is estimated at $0.19 billion in 2023, expected to grow to $0.37 billion by 2033. This growth is primarily driven by a rise in disposable income among pet owners and increased spending on pet products.Middle East & Africa Pet Oral Care Products Market Report:

The MEA region is on a slower growth trajectory with a market size of $0.14 billion in 2023, projected to reach $0.28 billion by 2033. However, increasing adoption of pets and awareness about pet oral health are gradually driving growth in this region.Tell us your focus area and get a customized research report.

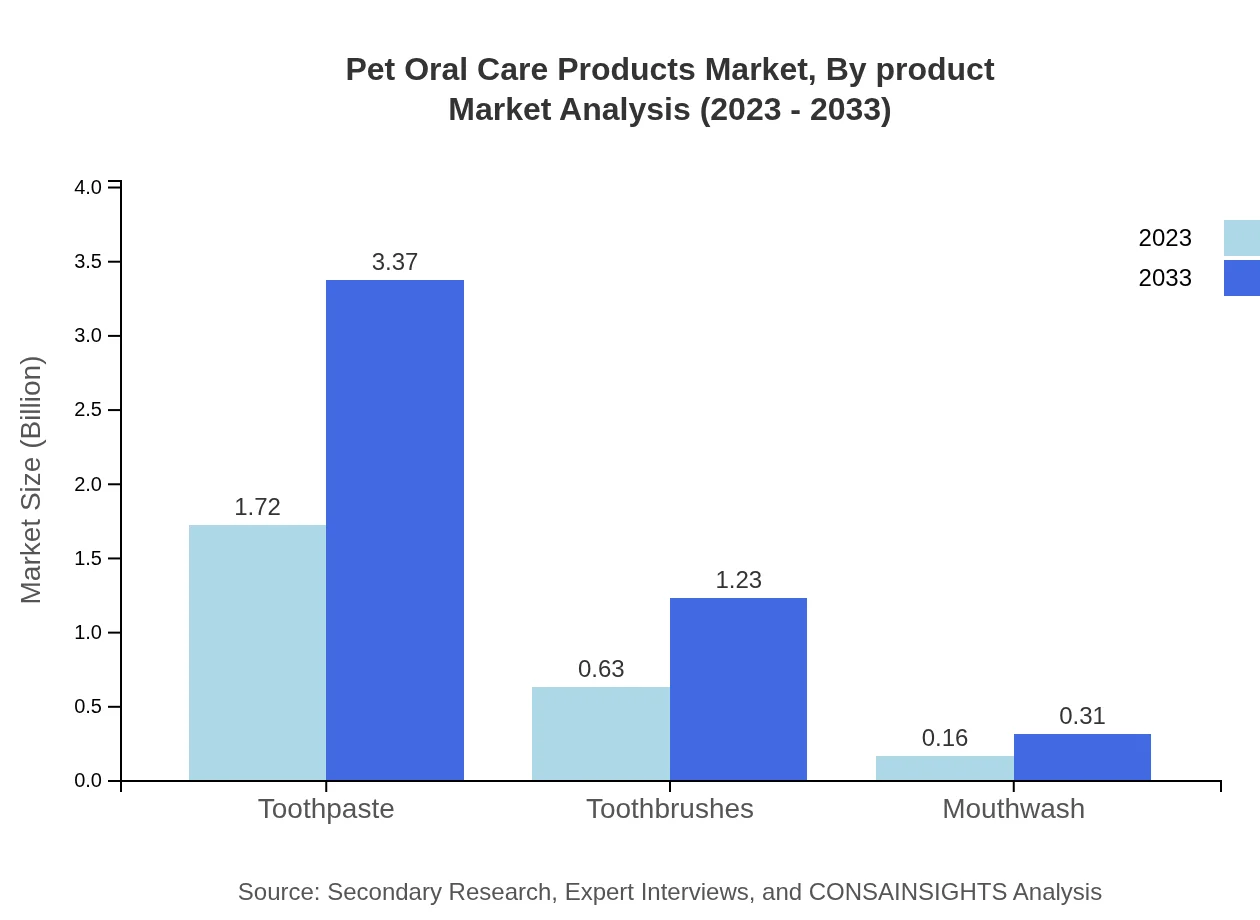

Pet Oral Care Products Market Analysis By Product

The market is segmented by product types such as liquids, solids, toothpaste, toothbrushes, and mouthwash, with liquids dominating the market due to their versatility and ease of use. In 2023, the liquid segment holds a market size of $2.19 billion and is set to reach $4.31 billion by 2033. Solid products like dental chews also contribute significantly with a growing consumer preference for alternative forms.

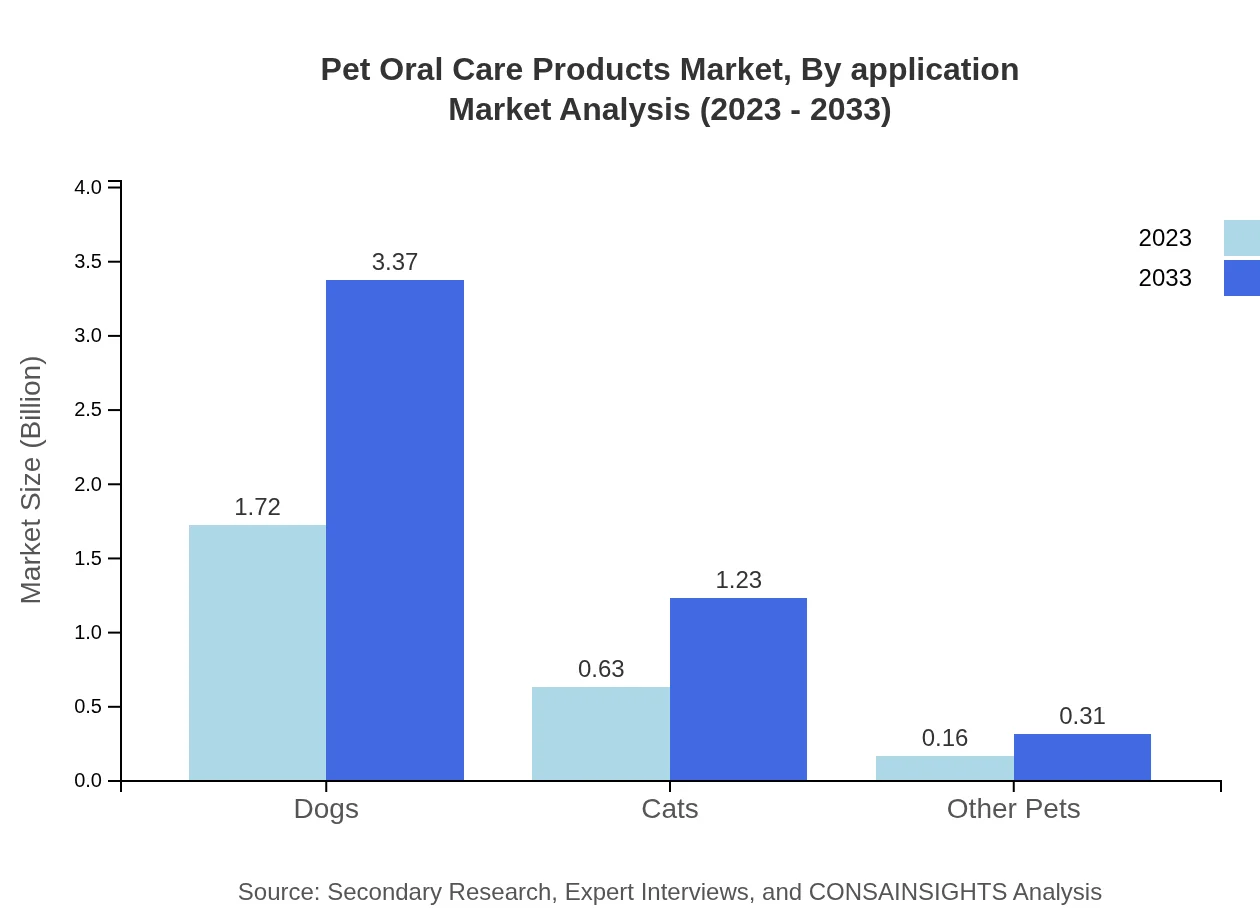

Pet Oral Care Products Market Analysis By Application

The application of these products varies across pet types, with notable differentiation between dogs and cats. The dog segment shows a market size of $1.72 billion in 2023, while the cat segment generates $0.63 billion. This differentiation underlines the need for specialized formulations that cater to specific dental requirements and preferences.

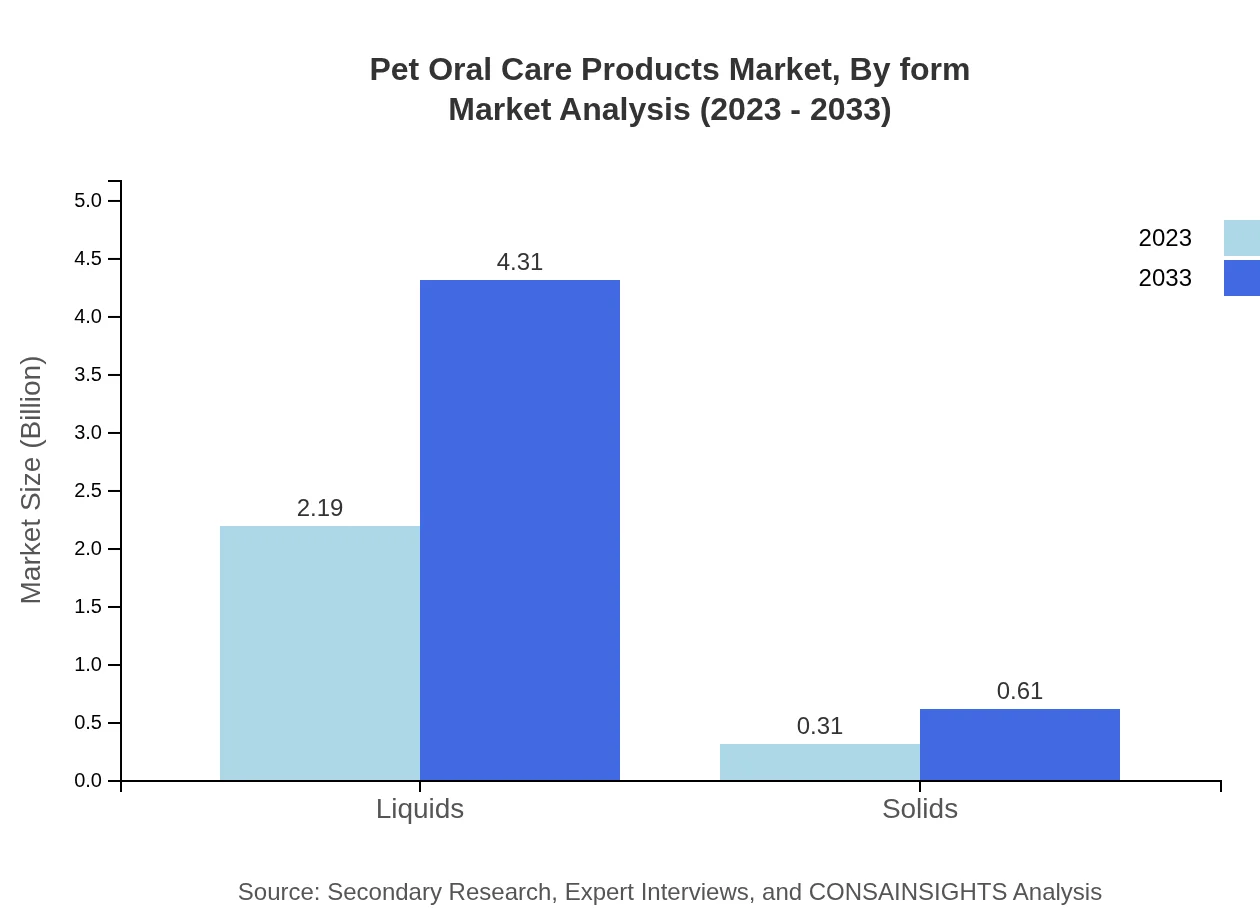

Pet Oral Care Products Market Analysis By Form

The products are also categorized by form, with liquids leading the market share significantly. In 2023, liquids constitute 87.67% of the market share, while solids hold 12.33%. This stronghold indicates consumer trust in liquid formulations for effective dental care.

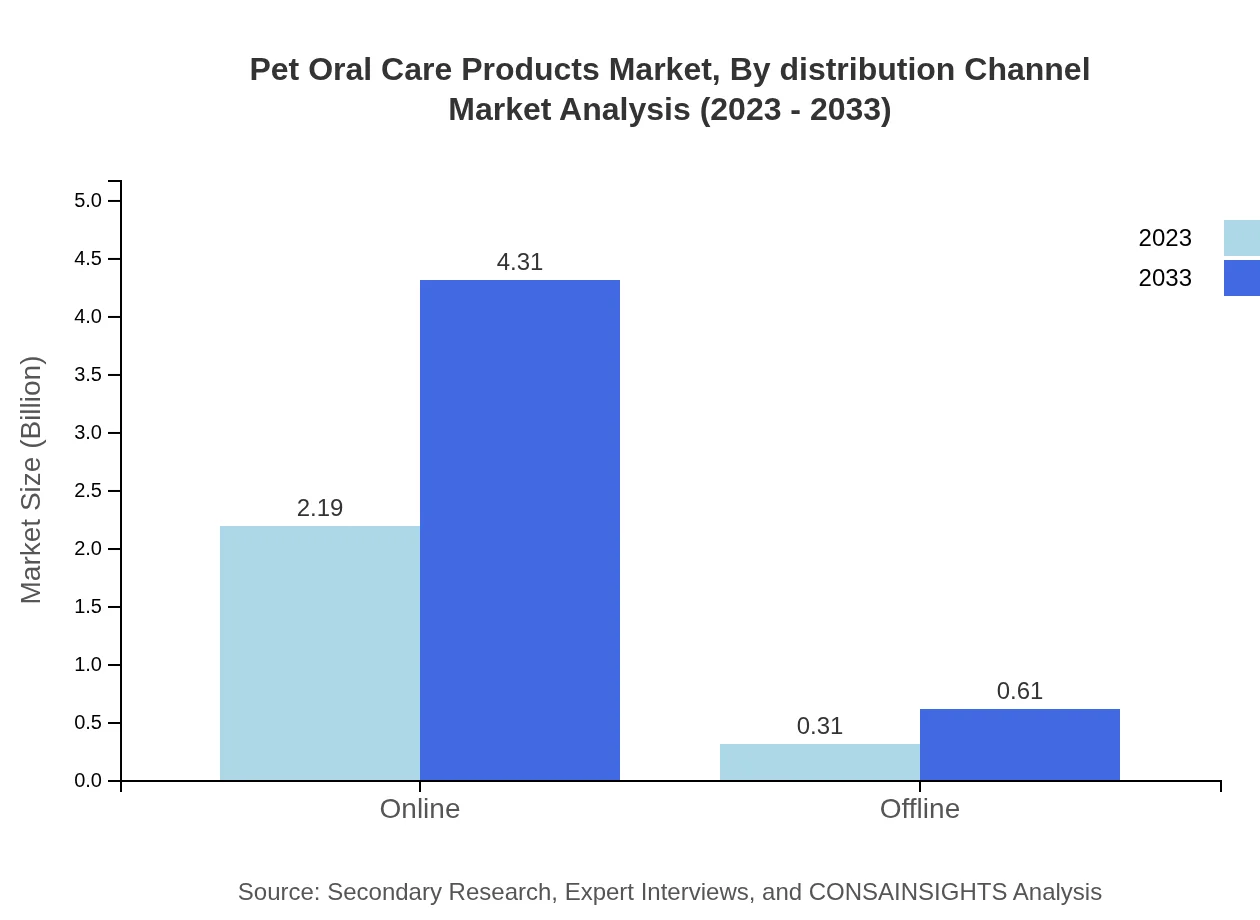

Pet Oral Care Products Market Analysis By Distribution Channel

The distribution channels include online and offline methods, with online sales reflective of the modern retail landscape where 87.67% of the market share was attributed to online channels in 2023. This shift emphasizes the growing trend of e-commerce in the pet care market.

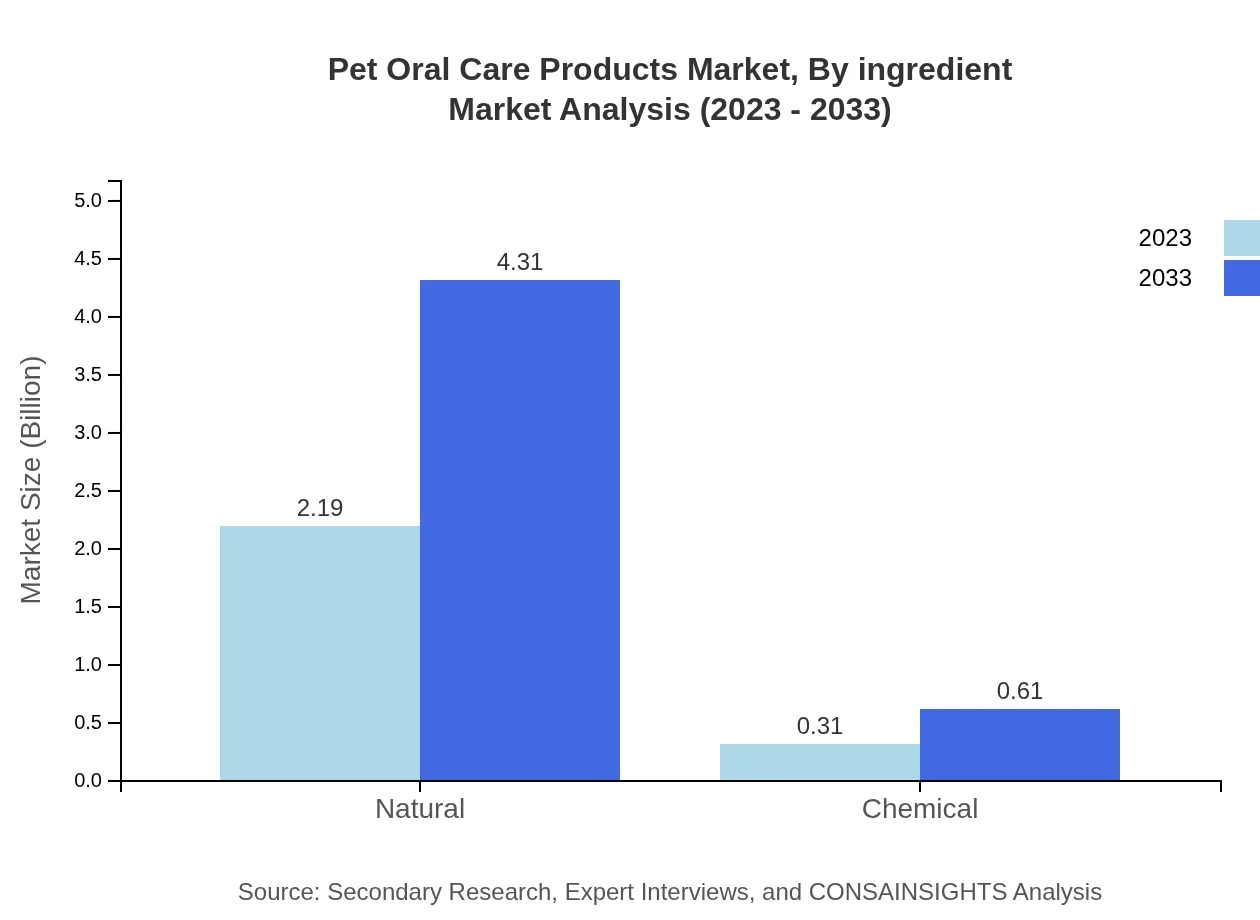

Pet Oral Care Products Market Analysis By Ingredient

In terms of ingredients, the market segments into natural and chemical components. The natural products market represents a substantial share at 87.67% in 2023 as consumers increasingly prioritize organic option for their pets.

Pet Oral Care Products Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pet Oral Care Products Industry

Hill's Pet Nutrition:

Hill's is well-known for its science-based pet food and oral care solutions, focusing on nutritional aspects of pet health.PetSmile:

PetSmile provides veterinarian-approved products aimed at improving oral care and enhancing the overall health of pets.Zoetis:

A global animal health company, Zoetis offers a comprehensive range of solutions for the oral care sector.Virbac:

Virbac focuses on health products for pets including those that improve dental hygiene.Bayer Animal Health:

Bayer offers a wide range of pet care products including dental health solutions tailored for different pet segments.We're grateful to work with incredible clients.

FAQs

What is the market size of pet Oral Care Products?

The global pet oral care products market is valued at approximately $2.5 billion in 2023, with a compound annual growth rate (CAGR) of 6.8%. By 2033, the market is projected to grow significantly, reflecting the increasing awareness of pet dental hygiene.

What are the key market players or companies in this pet Oral Care Products industry?

The pet oral care products industry features key players including PetIQ, PetSmile, TropiClean, and Vet's Best. These companies are renowned for their innovative products and commitment to enhancing pet health, establishing strong market presences globally.

What are the primary factors driving the growth in the pet Oral Care Products industry?

The growth of the pet oral care products market is driven by rising pet ownership globally, increased awareness of pet health, and greater emphasis on preventive healthcare. Additionally, the expansion of e-commerce channels has made products more accessible to consumers.

Which region is the fastest Growing in the pet Oral Care Products market?

The fastest-growing region in the pet oral care products market is North America, projected to grow from $0.89 billion in 2023 to $1.74 billion by 2033. Europe and Asia Pacific also show robust growth, underscoring global health trends in pets.

Does ConsaInsights provide customized market report data for the pet Oral Care Products industry?

Yes, ConsaInsights offers customized market reports tailored to the specific needs of clients in the pet oral care products sector. These reports provide detailed insights into market trends, competitive landscape, and consumer preferences.

What deliverables can I expect from this pet Oral Care Products market research project?

From this market research project, you can expect detailed reports covering market size, growth forecasts, segment analysis, and regional trends. Additionally, competitive analysis and consumer insights will provide a comprehensive understanding of the market.

What are the market trends of pet Oral Care Products?

Current trends in the pet oral care products market include a shift towards natural ingredients and sustainable packaging. Moreover, the online sales segment is leading, with liquids dominating the market share due to consumer preference for easy-to-use products.