Pharmaceutical Analytical Testing Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-analytical-testing

Pharmaceutical Analytical Testing Market Size, Share, Industry Trends and Forecast to 2033

This report analyzes the Pharmaceutical Analytical Testing market, detailing market size, CAGR forecasts, industry analyses, regional insights, and trends from 2023 to 2033.

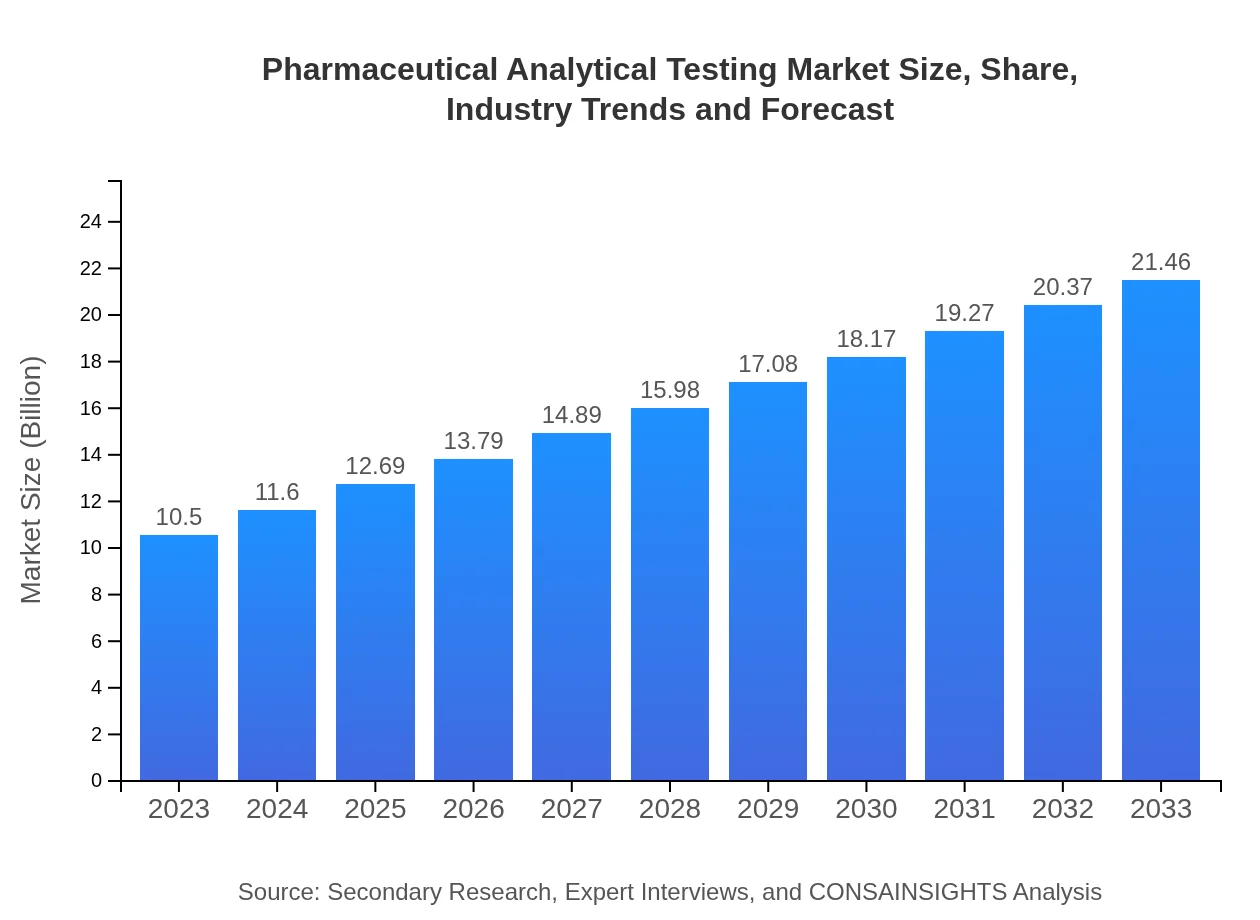

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $21.46 Billion |

| Top Companies | SGS SA, Eurofins Scientific, Covance |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Analytical Testing Market Overview

Customize Pharmaceutical Analytical Testing Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Analytical Testing market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Analytical Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Analytical Testing

What is the Market Size & CAGR of Pharmaceutical Analytical Testing market in 2023?

Pharmaceutical Analytical Testing Industry Analysis

Pharmaceutical Analytical Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Analytical Testing Market Analysis Report by Region

Europe Pharmaceutical Analytical Testing Market Report:

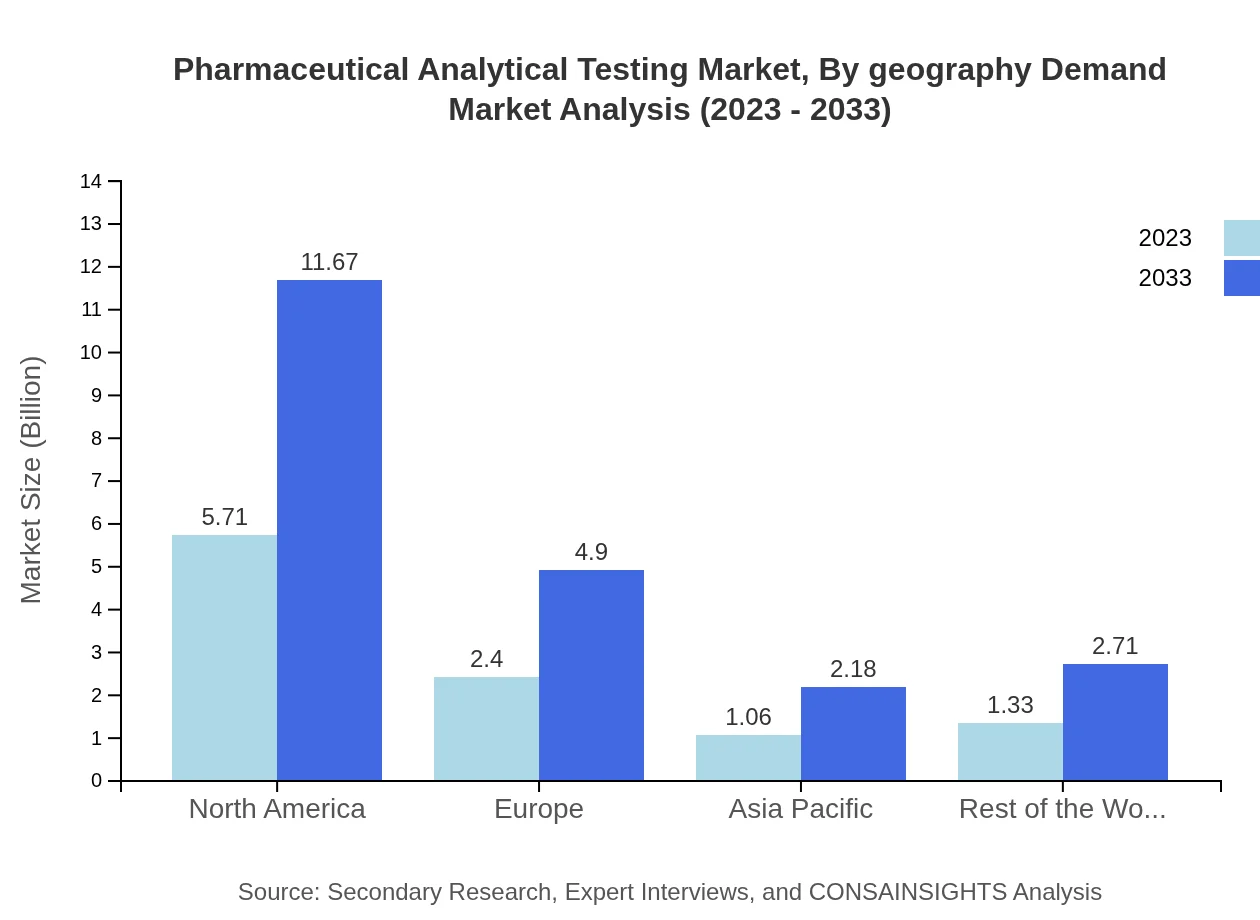

In Europe, the Pharmaceutical Analytical Testing market is expected to see an increase from USD 2.69 billion in 2023 to USD 5.51 billion by 2033. The region is characterized by strict regulatory requirements and a strong emphasis on drug safety and quality. The rise of biopharmaceutical products and advancements in analytical techniques will likely drive further growth in this market segment.Asia Pacific Pharmaceutical Analytical Testing Market Report:

The Asia Pacific region is witnessing substantial growth in the Pharmaceutical Analytical Testing market, with a market size projected to grow from USD 2.08 billion in 2023 to USD 4.25 billion by 2033. This growth is propelled by increasing investments in pharmaceutical research and development and the expansion of generic drug manufacturing. Countries like China and India are emerging as hubs for both production and analytical services due to their large populations and rising healthcare needs.North America Pharmaceutical Analytical Testing Market Report:

North America continues to dominate the Pharmaceutical Analytical Testing market, with anticipated growth from USD 3.82 billion in 2023 to USD 7.80 billion by 2033. The region benefits from a robust pharmaceutical sector, significant R&D expenditure, and stringent regulations mandating comprehensive testing processes. The presence of numerous leading contract laboratories and pharmaceutical companies further strengthens the market.South America Pharmaceutical Analytical Testing Market Report:

In South America, the Pharmaceutical Analytical Testing market is forecasted to grow from USD 0.63 billion in 2023 to USD 1.29 billion by 2033. The growth is primarily driven by the increasing demand for high-quality pharmaceutical products, alongside expanding regulatory frameworks that necessitate rigorous analytical testing to ensure compliance with international standards.Middle East & Africa Pharmaceutical Analytical Testing Market Report:

The Middle East and Africa region is projected to grow from USD 1.28 billion in 2023 to USD 2.62 billion by 2033. The growth in this region is aided by the increasing investments in healthcare infrastructure and pharmaceutical manufacturing. Emerging markets within the region are gradually adopting stringent quality control measures, driving demand for analytical testing services.Tell us your focus area and get a customized research report.

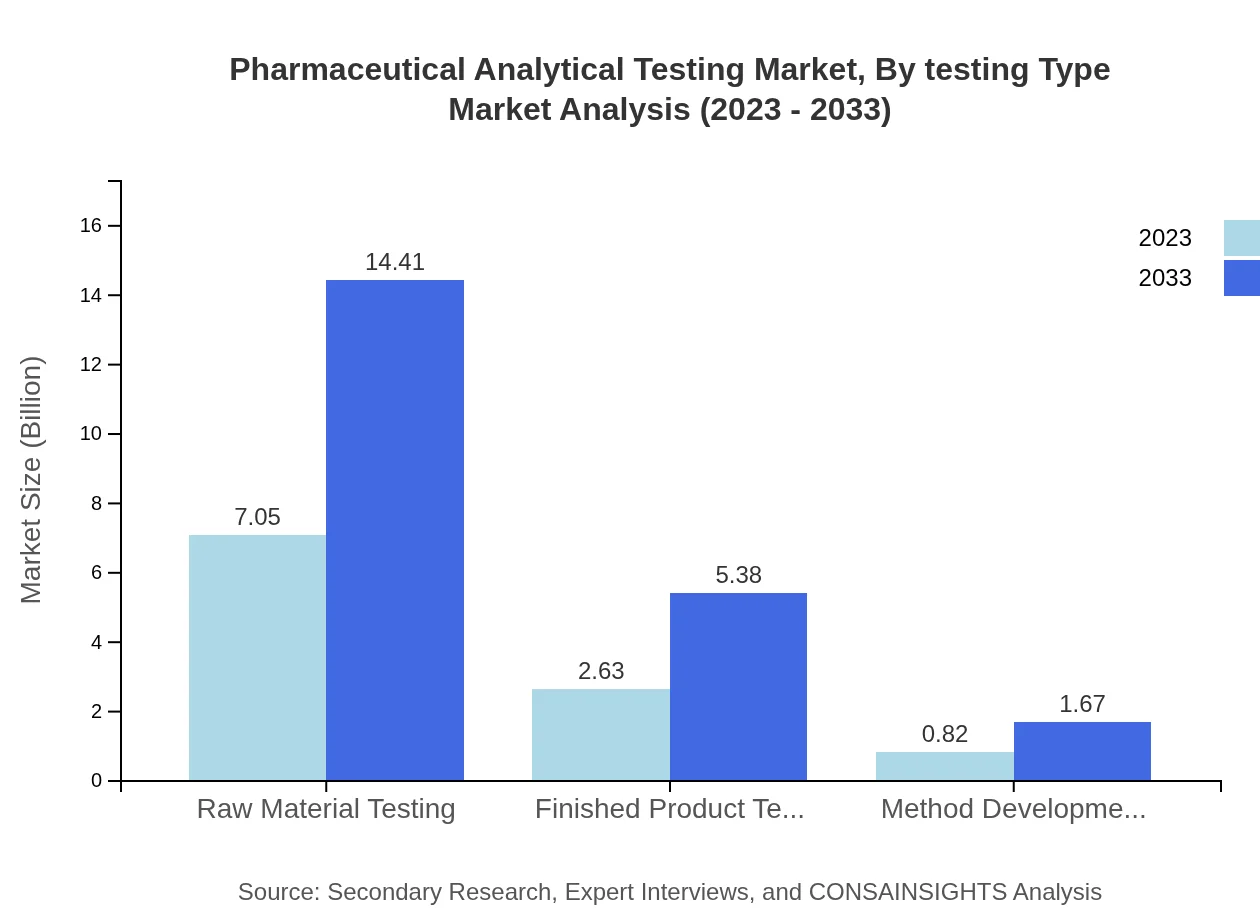

Pharmaceutical Analytical Testing Market Analysis By Testing Type

The market shows a clear bifurcation in testing types with significant contributions from raw material testing, which maintains a sizable share of 67.15% in 2023, growing to similar proportions in 2033. Finished product testing also plays a crucial role, specifically with a market size of USD 2.63 billion in 2023, expanding to USD 5.38 billion by 2033. Method development & validation is also essential, showing a steady growth trend across the forecast period.

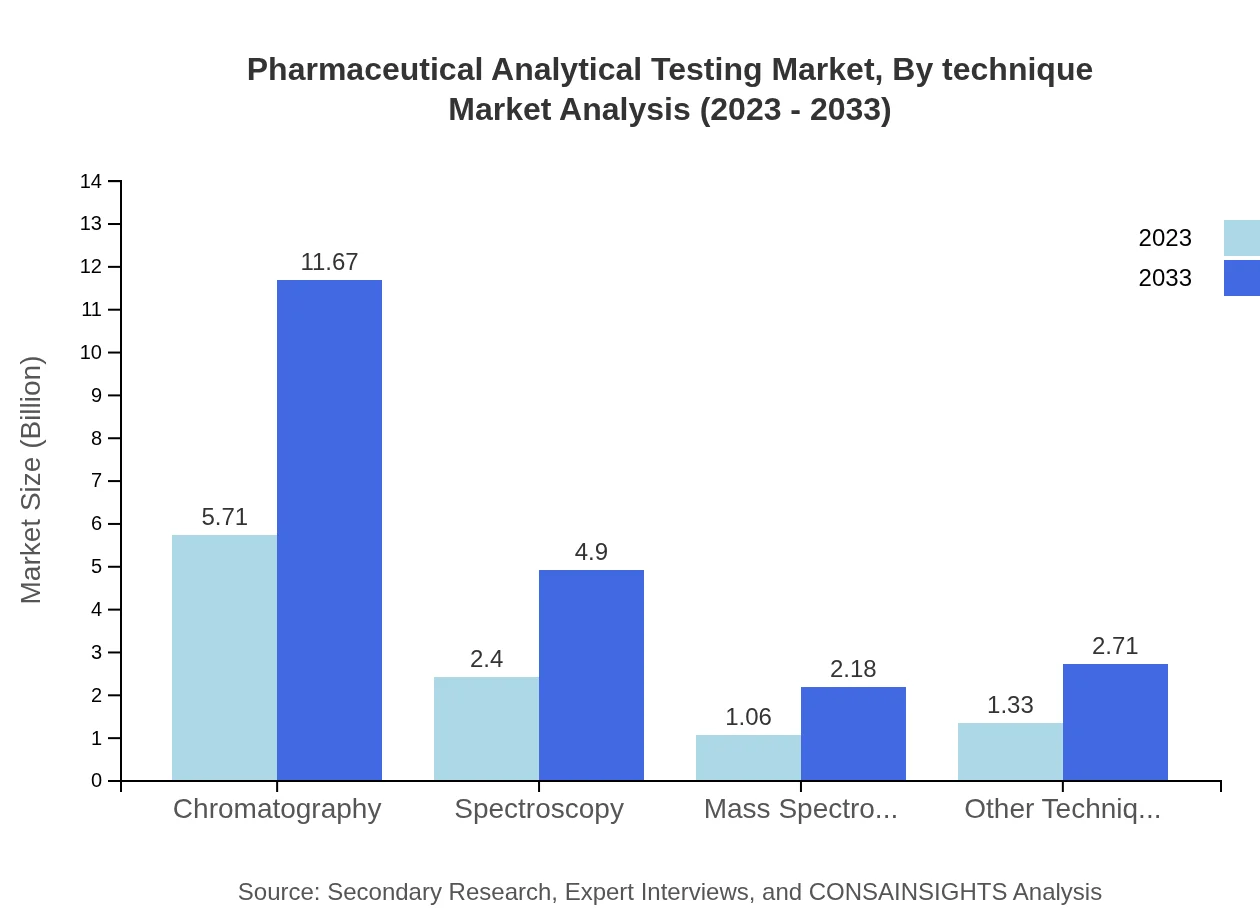

Pharmaceutical Analytical Testing Market Analysis By Technique

The analytical techniques sector is witnessing robust growth, particularly chromatography, leading with a market size of USD 5.71 billion in 2023 and expected to reach USD 11.67 billion by 2033. Spectroscopy and mass spectrometry also maintain significant positions within the market, showing strong growth trends owing to their essential roles in pharmaceutical testing.

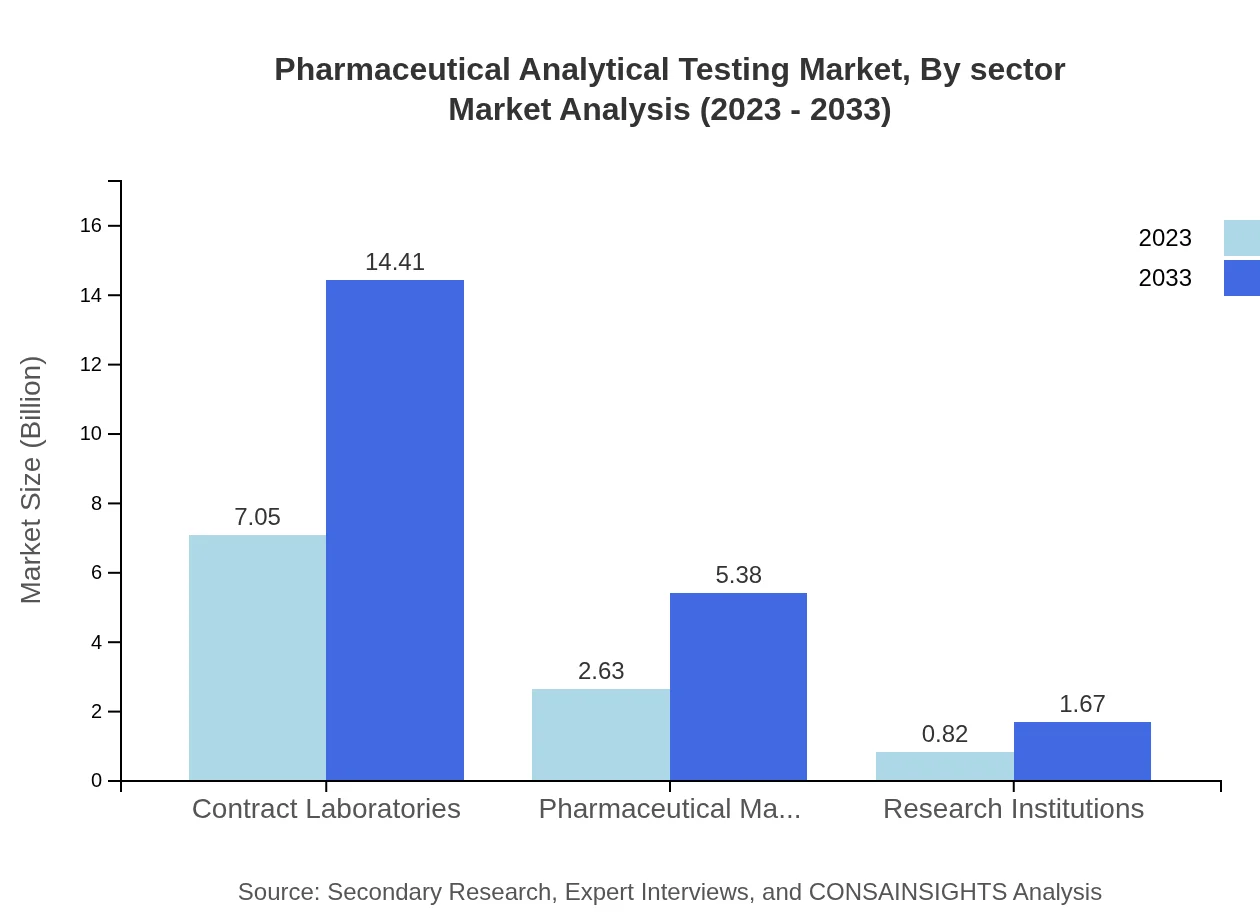

Pharmaceutical Analytical Testing Market Analysis By Sector

The key sectors within the Pharmaceutical Analytical Testing market include contract laboratories and pharmaceutical manufacturers. Contract laboratories dominate the market with a major share of 67.15% and are expected to grow similarly in the forecast period, while pharmaceutical manufacturers account for 25.07% of the market in 2023, reflecting their critical need for compliance and quality assurance.

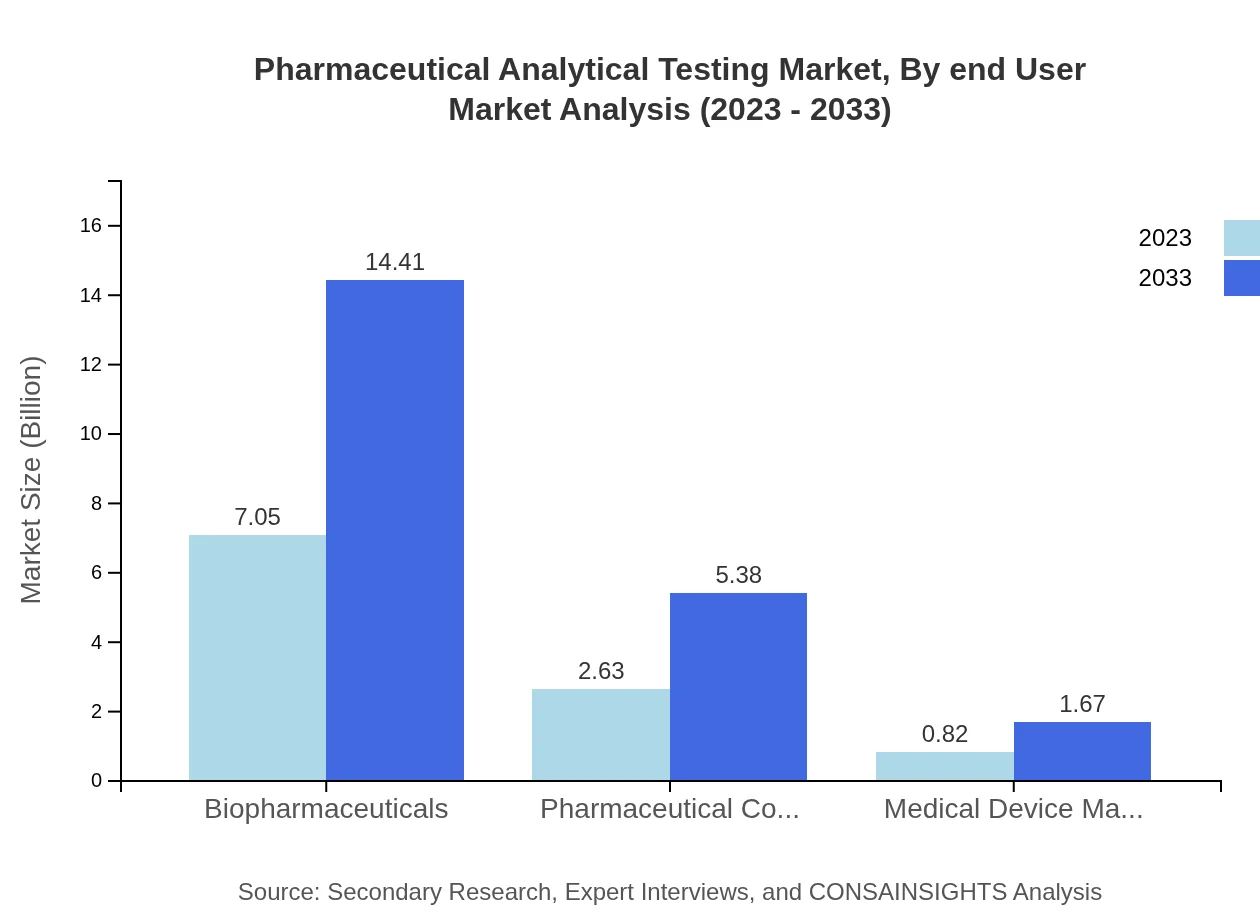

Pharmaceutical Analytical Testing Market Analysis By End User

The end users of these testing services range from pharmaceutical companies, requiring extensive analytical testing for quality assurance, to biotechnology firms focusing on innovation and safety. The growth is driven by the increasing number of drug approvals and the rising complexity of treatments, particularly in the biopharmaceutical sector.

Pharmaceutical Analytical Testing Market Analysis By Geography Demand

From a geographical demand perspective, North America holds the largest market share, at approximately 54.39% in 2023, with Europe and Asia Pacific contributing significantly. The growing reliance on analytical services for compliance in these regions is a key driver, alongside the increasing pace of drug development processes.

Pharmaceutical Analytical Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Analytical Testing Industry

SGS SA:

SGS is a global leader in inspection, verification, testing, and certification, significantly contributing to the pharmaceutical analytical testing landscape with its extensive network and comprehensive service offerings.Eurofins Scientific:

Eurofins is a prominent player specializing in analytical testing services across pharmaceuticals, biopharmaceuticals, and food industries, known for its innovation and high-quality testing methodologies.Covance:

Covance provides comprehensive drug development services, including analytical testing solutions that facilitate the assessment of pharmaceutical products from development through to commercialization.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical Analytical Testing?

The pharmaceutical analytical testing market is valued at approximately $10.5 billion in 2023, with a projected growth at a CAGR of 7.2%, enhancing its market size significantly by 2033.

What are the key market players or companies in this pharmaceutical Analytical Testing industry?

Key players in the pharmaceutical analytical testing industry include major contract laboratories and pharmaceutical manufacturers who dominate the market by providing crucial testing services.

What are the primary factors driving the growth in the pharmaceutical Analytical Testing industry?

Growth in the pharmaceutical analytical testing market is driven by increasing demand for quality assurance in drug development, rising pharmaceutical R&D investments, and stringent regulatory requirements.

Which region is the fastest Growing in the pharmaceutical Analytical Testing?

The fastest-growing region in pharmaceutical analytical testing is North America, projected to expand from $3.82 billion in 2023 to $7.80 billion by 2033, driven by robust pharmaceutical innovation.

Does ConsaInsights provide customized market report data for the pharmaceutical Analytical Testing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the pharmaceutical analytical testing industry, ensuring relevant insights and detailed analysis.

What deliverables can I expect from this pharmaceutical Analytical Testing market research project?

Expect comprehensive deliverables that include market size analysis, competitive landscape, regional breakdowns, and in-depth segmentation insights in the pharmaceutical analytical testing project.

What are the market trends of pharmaceutical Analytical Testing?

Current market trends include increased outsourcing of analytical testing to contract laboratories, advancements in analytical techniques, and the growing importance of compliance with regulatory standards.