Pharmaceutical Analytical Testing Outsourcing Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-analytical-testing-outsourcing

Pharmaceutical Analytical Testing Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pharmaceutical Analytical Testing Outsourcing market, including insights on size, growth forecasts, and industry dynamics from 2023 to 2033.

| Metric | Value |

|---|---|

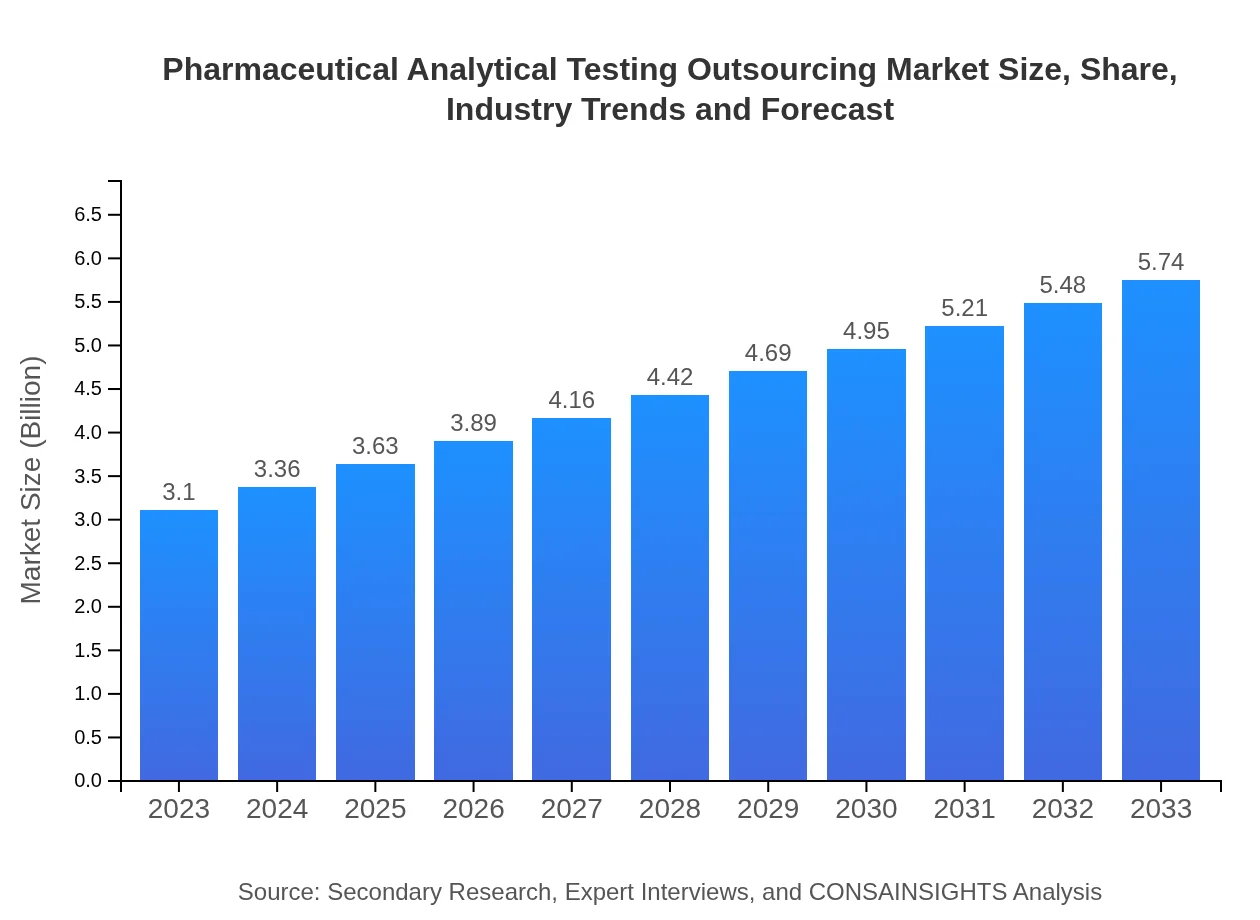

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.10 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $5.74 Billion |

| Top Companies | Covance, Charles River Laboratories, SGS Life Sciences, Eurofins Scientific |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Analytical Testing Outsourcing Market Overview

Customize Pharmaceutical Analytical Testing Outsourcing Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Analytical Testing Outsourcing market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Analytical Testing Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Analytical Testing Outsourcing

What is the Market Size & CAGR of Pharmaceutical Analytical Testing Outsourcing market in 2023?

Pharmaceutical Analytical Testing Outsourcing Industry Analysis

Pharmaceutical Analytical Testing Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Analytical Testing Outsourcing Market Analysis Report by Region

Europe Pharmaceutical Analytical Testing Outsourcing Market Report:

The European market is expected to rise from $1.00 billion in 2023 to $1.85 billion by 2033. Stringent regulatory requirements and demand for high-quality testing facilities are key drivers of this growth.Asia Pacific Pharmaceutical Analytical Testing Outsourcing Market Report:

In the Asia Pacific region, the Pharmaceutical Analytical Testing Outsourcing market is projected to grow from $0.63 billion in 2023 to $1.16 billion by 2033, driven by increasing pharmaceutical R&D investments and growing access to advanced analytical technology.North America Pharmaceutical Analytical Testing Outsourcing Market Report:

North America is anticipated to maintain a leading position, growing from $1.00 billion in 2023 to approximately $1.86 billion by 2033 due to the presence of major pharmaceutical companies and a well-established outsourcing ecosystem.South America Pharmaceutical Analytical Testing Outsourcing Market Report:

For South America, the market will expand from $0.18 billion in 2023 to $0.34 billion in 2033. The growth is fueled by increasing government support for healthcare investments and the rising number of clinical trials in emerging markets.Middle East & Africa Pharmaceutical Analytical Testing Outsourcing Market Report:

In the Middle East and Africa, the market is set to grow from $0.29 billion in 2023 to $0.54 billion by 2033, supported by increasing investments in healthcare and the expansion of pharmaceutical manufacturing capabilities.Tell us your focus area and get a customized research report.

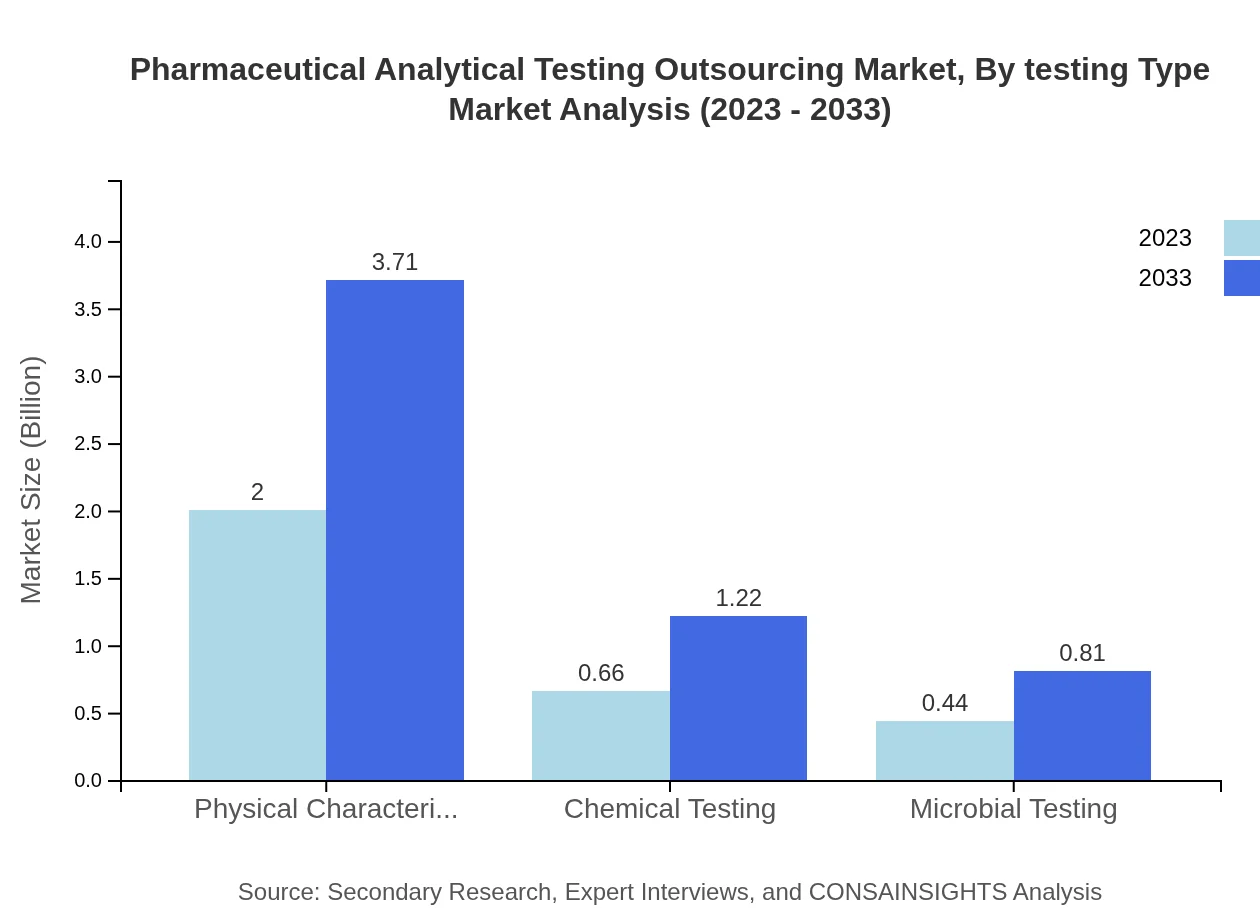

Pharmaceutical Analytical Testing Outsourcing Market Analysis By Testing Type

Clinical testing dominates the market size, forecasted to grow from $2.75 billion in 2023 to $5.10 billion by 2033, constituting a dominant market share of 88.82% throughout this period. Commercial testing, while smaller, is set to increase from $0.35 billion to $0.64 billion, maintaining an 11.18% market share. Physical characterization will also continue to play a significant role in the market, anticipated to grow from $2.00 billion to $3.71 billion with a share of 64.56%.

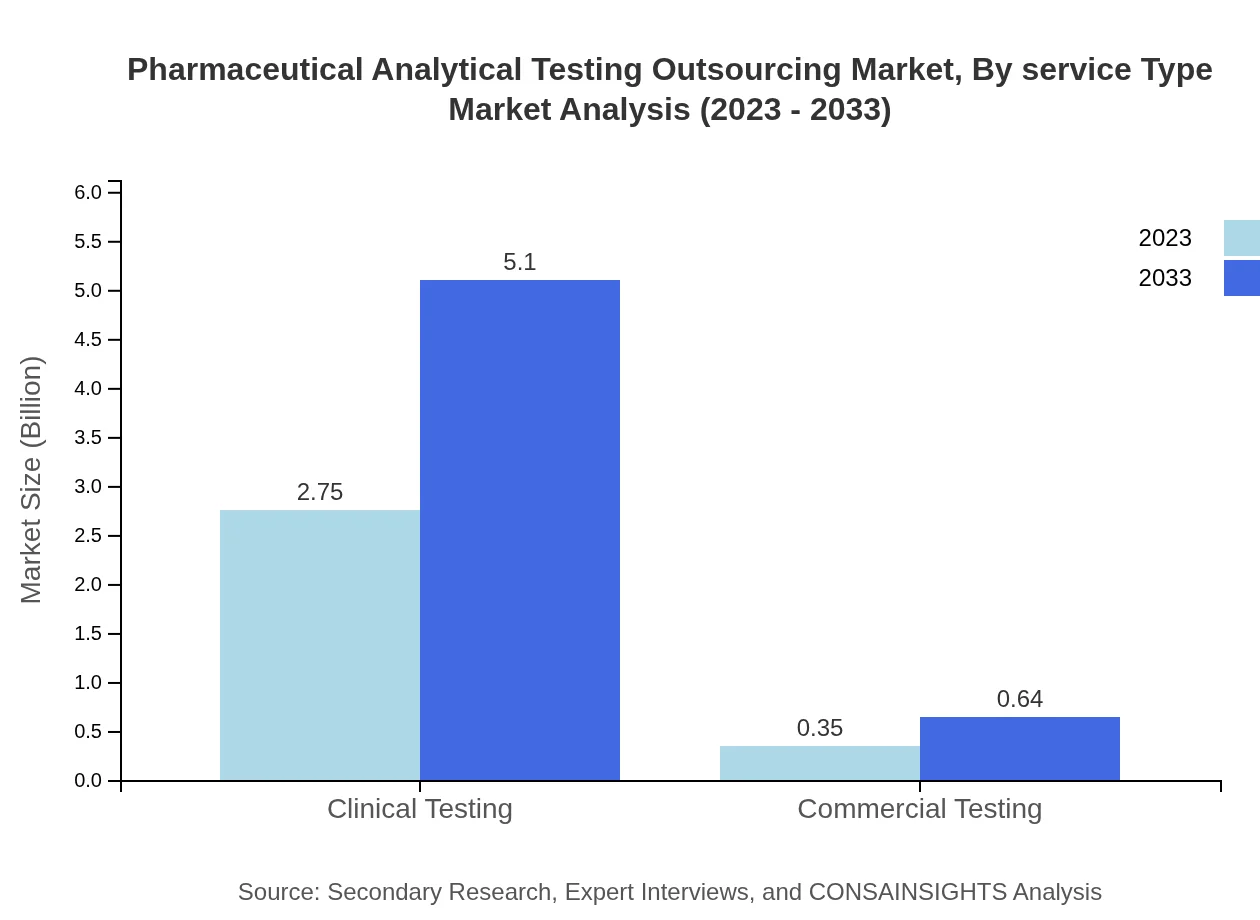

Pharmaceutical Analytical Testing Outsourcing Market Analysis By Service Type

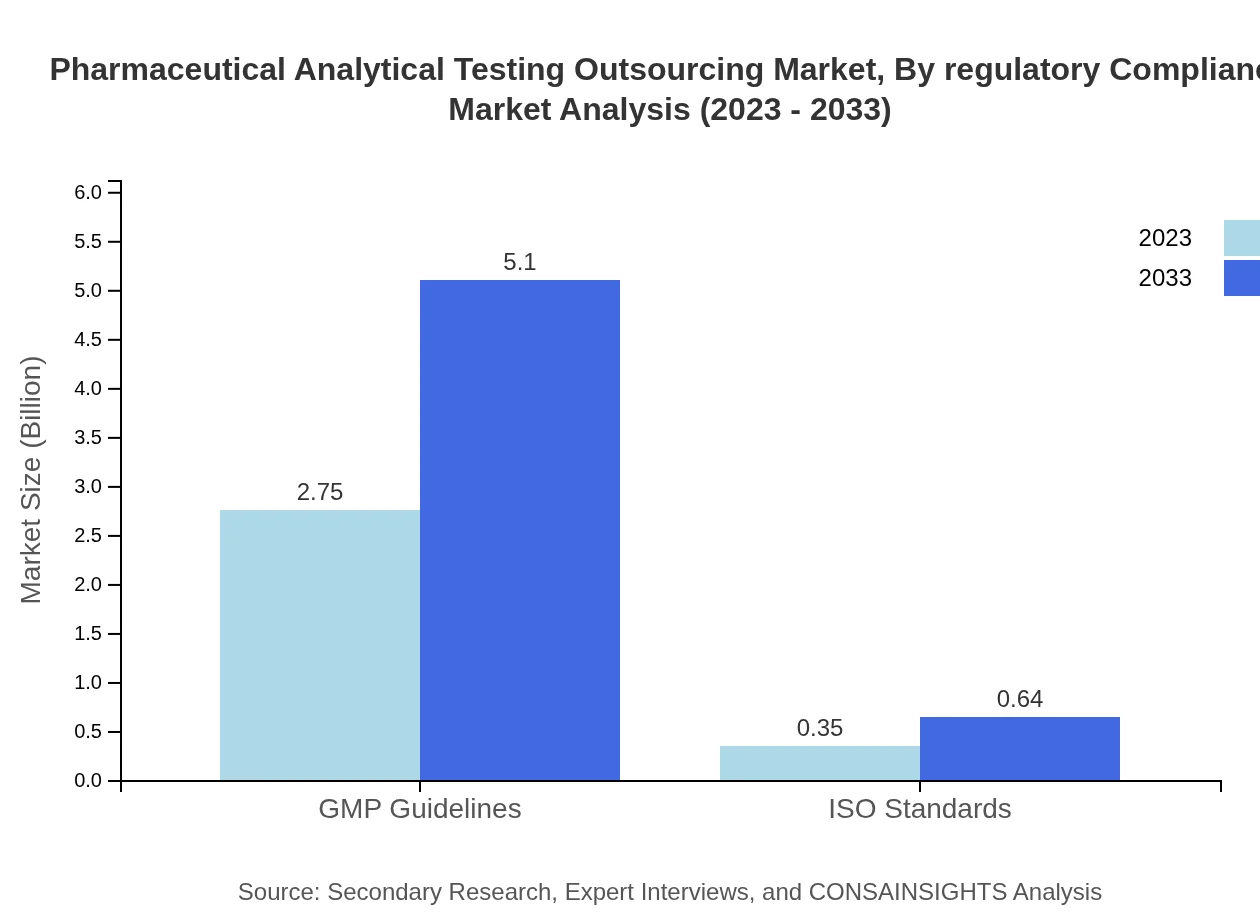

The outsourcing market is categorized by various service types including GMP guidelines and ISO standards. The GMP guidelines segment is expected to grow from $2.75 billion to $5.10 billion by 2033, representing a critical compliance aspect for drug manufacturers. Similarly, ISO standards are forecast to rise from $0.35 billion to $0.64 billion over the same period. Both segments emphasize the importance of quality assurance in pharmaceutical testing.

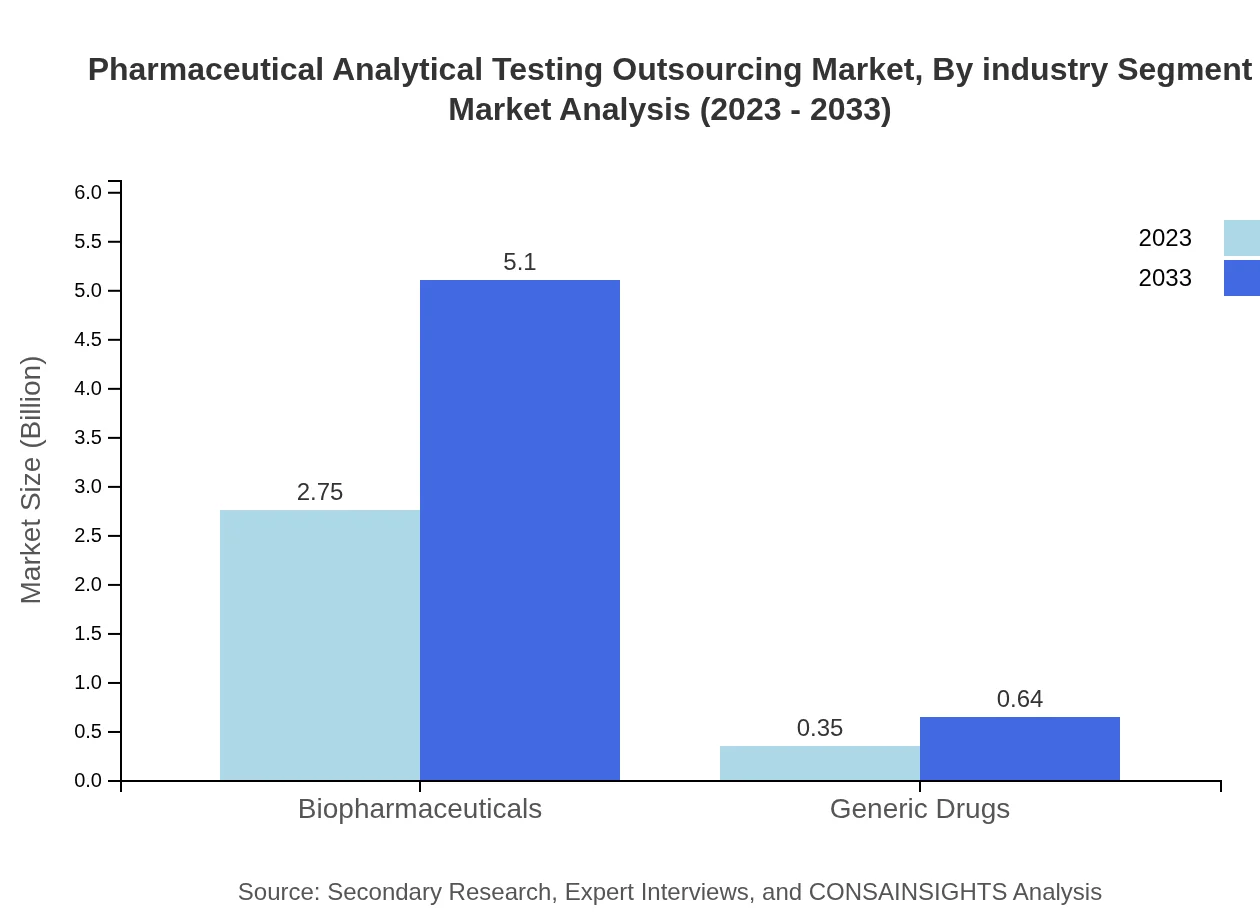

Pharmaceutical Analytical Testing Outsourcing Market Analysis By Industry Segment

This market analysis indicates a focus on the biopharmaceuticals sector, which is estimated to maintain its share at 88.82% from $2.75 billion in 2023 to $5.10 billion in 2033, alongside generic drugs expected to grow from $0.35 billion to $0.64 billion (11.18% share). This highlights a sustained need for analytical services across diverse pharmaceutical products.

Pharmaceutical Analytical Testing Outsourcing Market Analysis By Regulatory Compliance

Compliance with regulatory frameworks such as GMP and ISO standards forms the backbone of the pharmaceutical analytical testing market. These segments are poised to deliver continuous growth, with GMP guidelines expanding from $2.75 billion to $5.10 billion, and ISO standards from $0.35 billion to $0.64 billion, both enhancing the credibility and safety of pharmaceutical products.

Pharmaceutical Analytical Testing Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Analytical Testing Outsourcing Industry

Covance:

A leading global contract research organization providing comprehensive drug development and approval services, including analytical testing.Charles River Laboratories:

Specializes in preclinical and clinical laboratory services for the pharmaceutical, medical device, and biotechnology industries.SGS Life Sciences:

Offers a range of analytical testing services, focusing on safety, quality, and compliance for the pharmaceutical and life sciences sectors.Eurofins Scientific:

A global group of laboratories providing a diverse range of laboratory services to the pharmaceuticals and biotechnology sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical Analytical Testing Outsourcing?

The pharmaceutical analytical testing outsourcing market is valued at approximately $3.1 billion in 2023, with an expected compound annual growth rate (CAGR) of 6.2% projected through 2033.

What are the key market players or companies in this pharmaceutical Analytical Testing Outsourcing industry?

Key players in the pharmaceutical analytical testing outsourcing market include Covance, Charles River Laboratories, Eurofins Scientific, SGS SA, and Labcorp, who provide extensive testing and analytical services to support drug development.

What are the primary factors driving the growth in the pharmaceutical Analytical Testing Outsourcing industry?

Growth is primarily driven by increasing R&D expenditure, stringent regulatory requirements, rising demand for bioanalytical testing, and an emphasis on outsourcing to enhance operational efficiency and focus on core competencies.

Which region is the fastest Growing in the pharmaceutical Analytical Testing Outsourcing?

Asia-Pacific is the fastest-growing region, expected to grow from $0.63 billion in 2023 to $1.16 billion by 2033, attributed to expanding pharmaceutical markets and growing outsourcing trends in the region.

Does ConsaInsights provide customized market report data for the pharmaceutical Analytical Testing Outsourcing industry?

Yes, ConsaInsights specializes in providing tailored market reports that cater to specific needs, including the pharmaceutical analytical testing outsourcing sector, ensuring clients receive relevant and actionable insights.

What deliverables can I expect from this pharmaceutical Analytical Testing Outsourcing market research project?

Deliverables include comprehensive market analysis, regional insights, competitive landscape evaluation, detailed segment analysis, and tailored recommendations to support strategic decision-making.

What are the market trends of pharmaceutical Analytical Testing Outsourcing?

Current trends include increasing adoption of cloud-based solutions, rising interest in biopharmaceutical testing, growing partnerships between pharmaceutical companies and CROs, and a shift towards environmentally sustainable testing practices.