Pharmaceutical Excipients Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-excipients

Pharmaceutical Excipients Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the pharmaceutical excipients market, including insights on market size, growth trends, regional performance, segmentation by product type, and key players through the forecast period of 2023 to 2033.

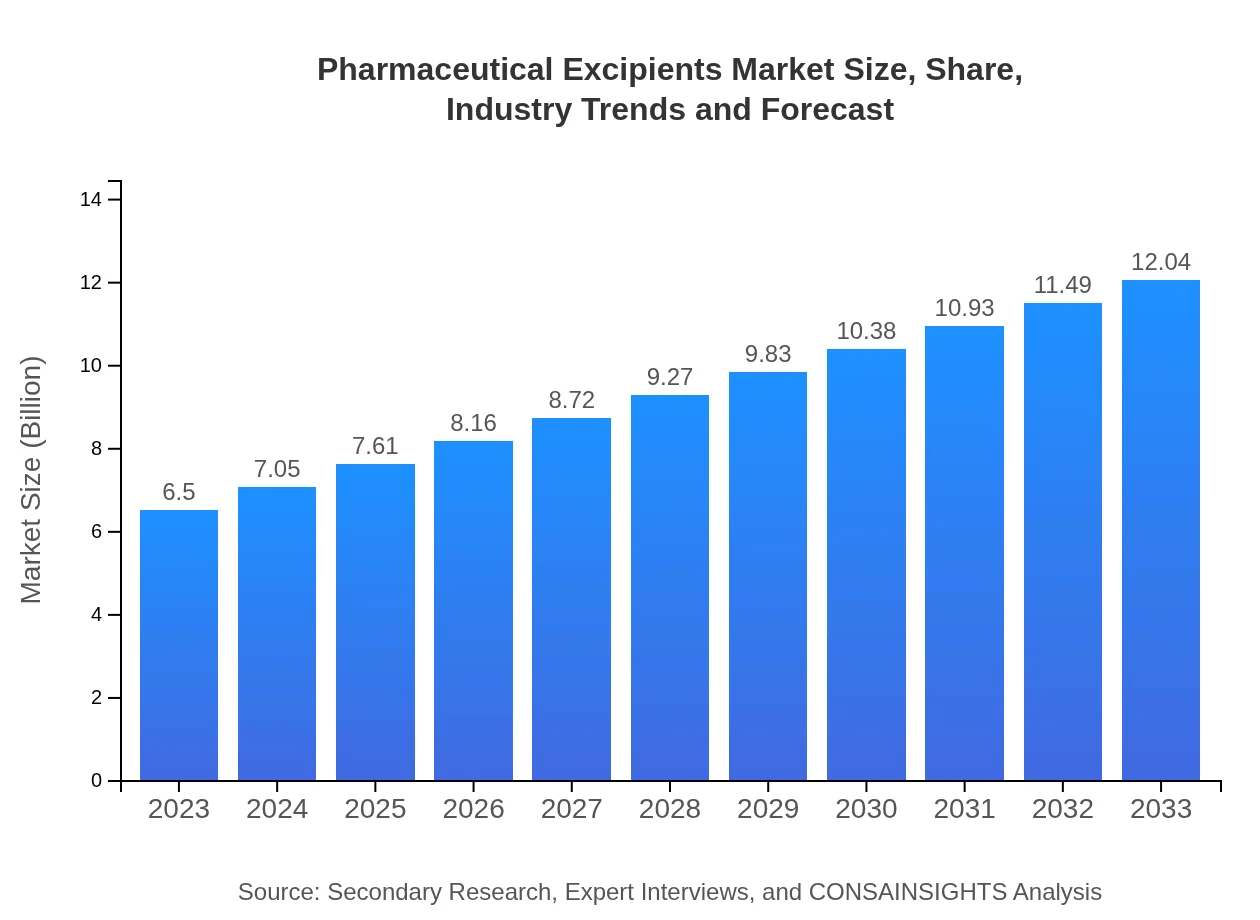

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $6.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $12.04 Billion |

| Top Companies | BASF SE, Evonik Industries AG, FMC Corporation, Ashland Global Holdings Inc. |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Excipients Market Overview

Customize Pharmaceutical Excipients Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Excipients market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Excipients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Excipients

What is the Market Size & CAGR of Pharmaceutical Excipients market in 2023 and 2033?

Pharmaceutical Excipients Industry Analysis

Pharmaceutical Excipients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Excipients Market Analysis Report by Region

Europe Pharmaceutical Excipients Market Report:

The European pharmaceutical excipients market is predicted to grow from $1.70 billion in 2023 to $3.15 billion by 2033. This growth is fueled by stringent pharmaceutical regulations, a strong emphasis on innovation, and the presence of major pharmaceutical companies that promote extensive R&D efforts.Asia Pacific Pharmaceutical Excipients Market Report:

In the Asia Pacific region, the pharmaceutical excipients market is anticipated to grow from $1.33 billion in 2023 to $2.47 billion by 2033. This growth is driven by the expanding pharmaceutical industry, increasing healthcare expenditure, and rising demand for generic medicines, particularly in countries like China and India.North America Pharmaceutical Excipients Market Report:

North America is expected to maintain a significant market presence, with an increase from $2.17 billion in 2023 to $4.02 billion by 2033. The market growth is driven by the high demand for advanced drug formulations and robust research and development activities in pharmaceutical companies across the United States and Canada.South America Pharmaceutical Excipients Market Report:

The South American market for pharmaceutical excipients is projected to expand from $0.58 billion in 2023 to $1.07 billion by 2033. Factors influencing this growth include improvements in healthcare infrastructure, increased focus on pharmaceutical manufacturing, and the rising prevalence of diseases requiring advanced treatments.Middle East & Africa Pharmaceutical Excipients Market Report:

In the Middle East and Africa, the pharmaceutical excipients market is likely to rise from $0.72 billion in 2023 to $1.33 billion by 2033. The growth is supported by emerging pharmaceutical markets in countries like South Africa and the UAE, along with government initiatives to enhance healthcare systems.Tell us your focus area and get a customized research report.

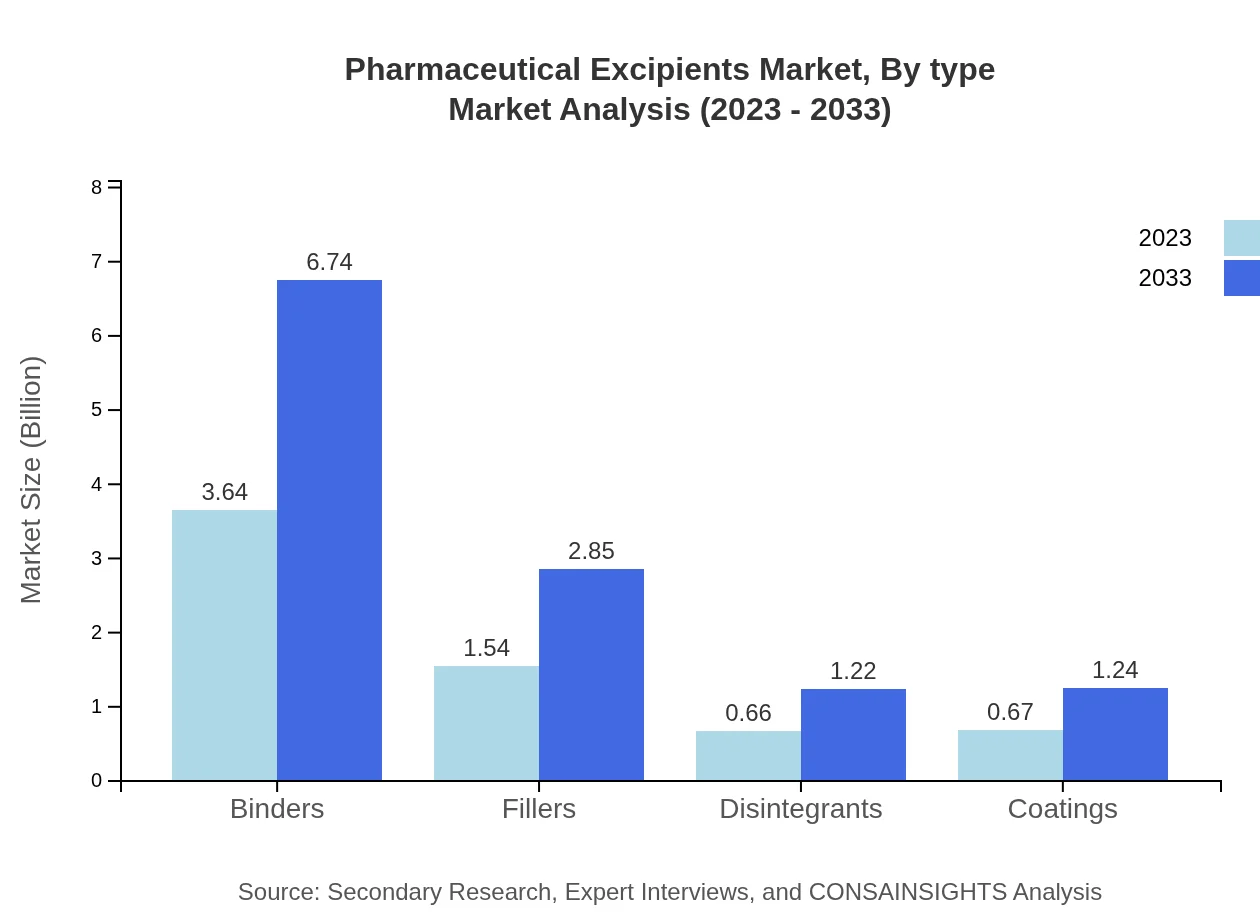

Pharmaceutical Excipients Market Analysis By Type

Binders dominate the pharmaceutical excipients market with a size of $3.64 billion in 2023, projected to reach $6.74 billion by 2033. They hold a market share of 55.94%. Fillers, with a current market size of $1.54 billion and a projected size of $2.85 billion, represent 23.65% of the market share. Other significant segments include disintegrants and coatings, contributing to the overall industry dynamics.

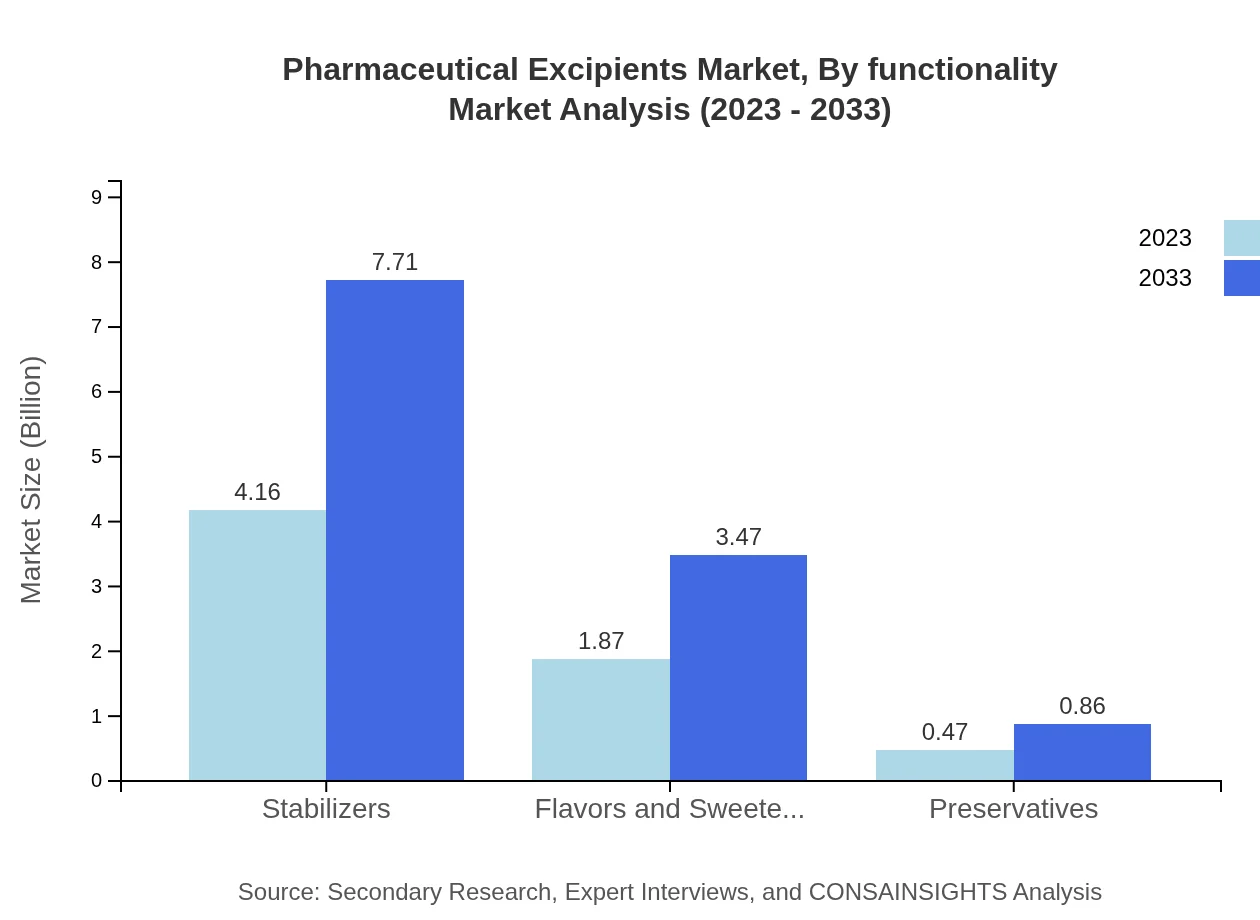

Pharmaceutical Excipients Market Analysis By Functionality

Functionality is critical in the excipients market, where stabilizers account for a substantial portion, with $4.16 billion in 2023 and projected growth to $7.71 billion by 2033, holding a market share of 64.01%. Coating agents and preservatives also play important roles, indicating the necessity for advanced and effective excipients in drug formulations.

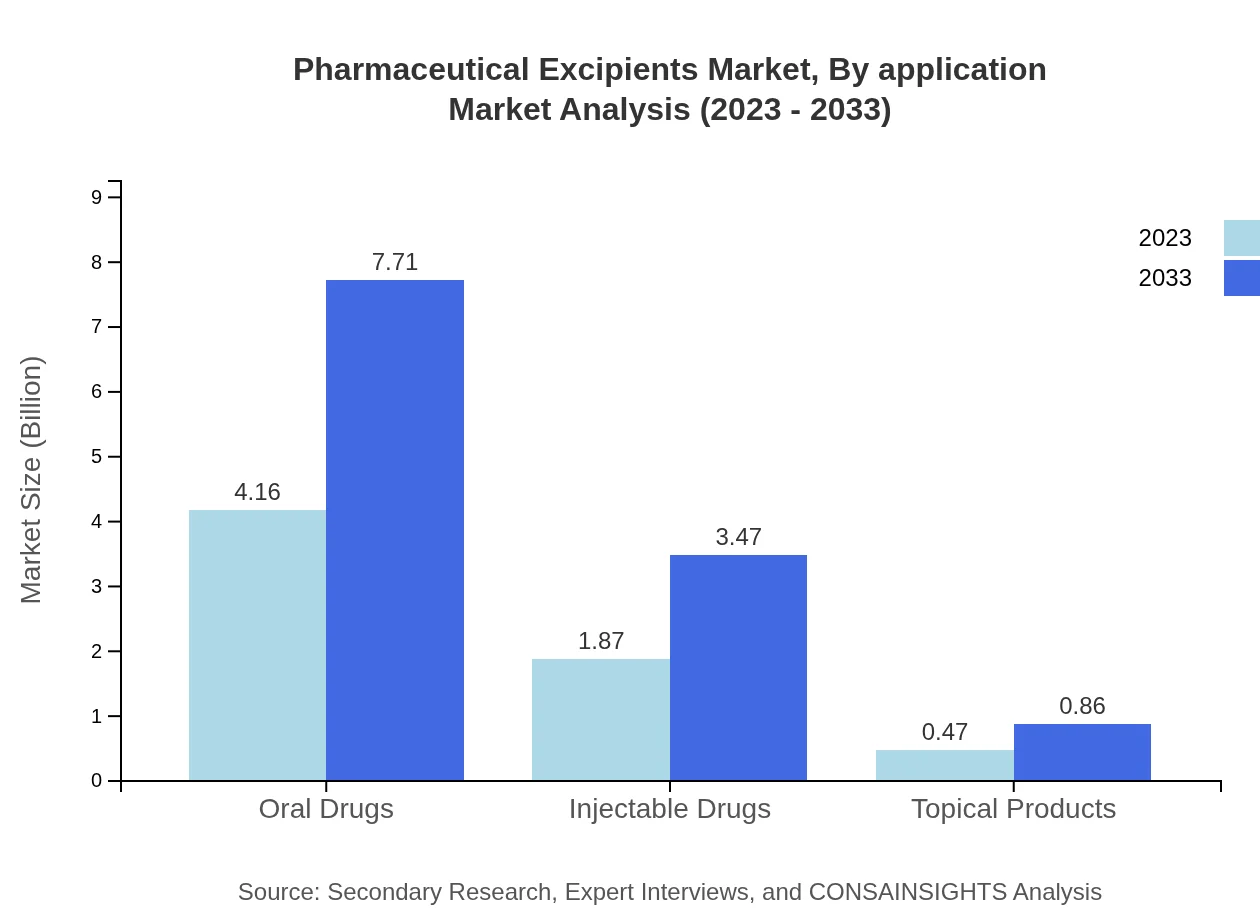

Pharmaceutical Excipients Market Analysis By Application

The application-driven analysis shows that oral drugs account for a considerable portion with a market size of $4.16 billion and are forecasted to grow to $7.71 billion by 2033. Injectable drugs also highlight significant growth, reflecting the shift towards more biologic and innovative therapies in terms of excipient-demanding formulations.

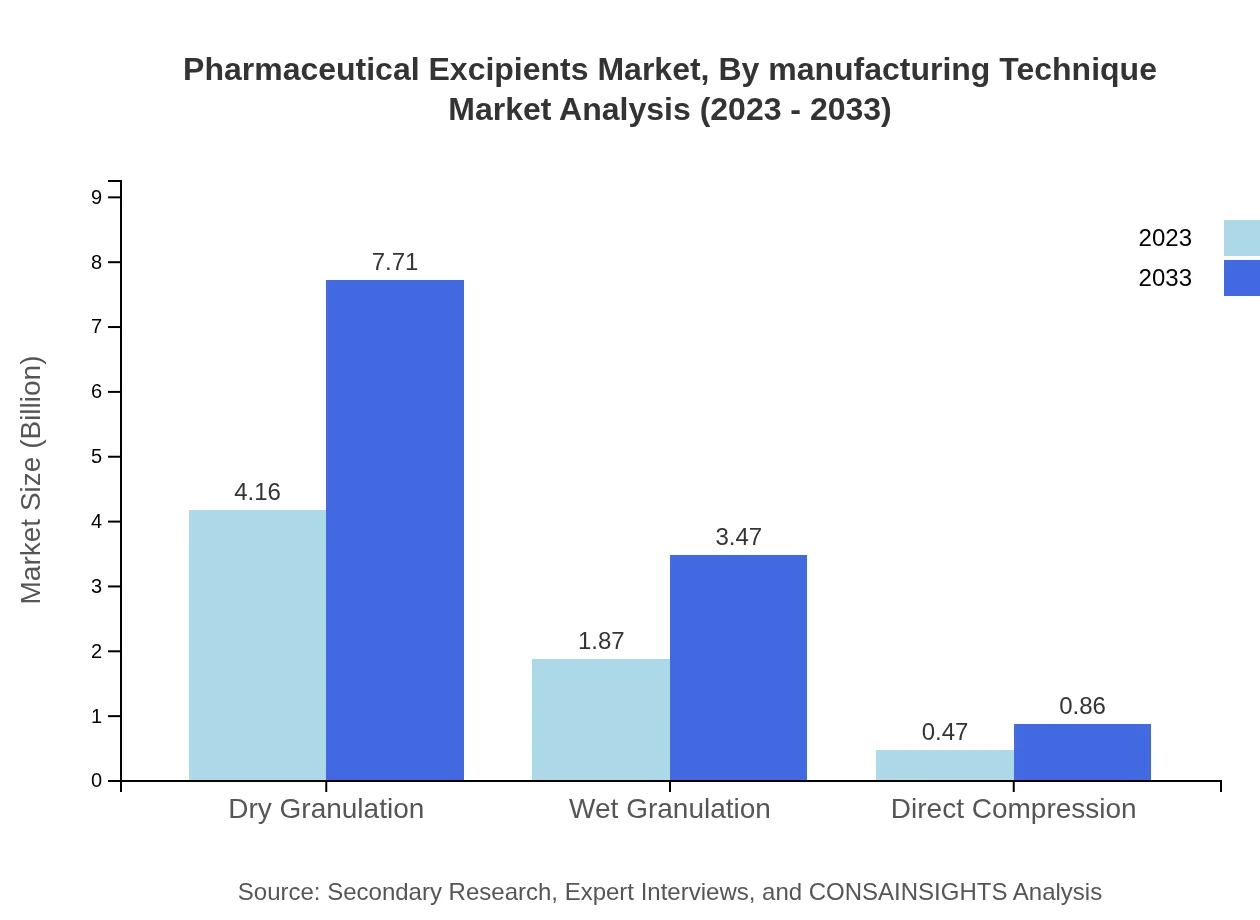

Pharmaceutical Excipients Market Analysis By Manufacturing Technique

Various manufacturing techniques play a role in excipient production, with dry granulation showing a strong market presence. With a current market size of $4.16 billion and growth expected, techniques like wet granulation and direct compression also contribute significantly, reflecting advances in manufacturing capabilities.

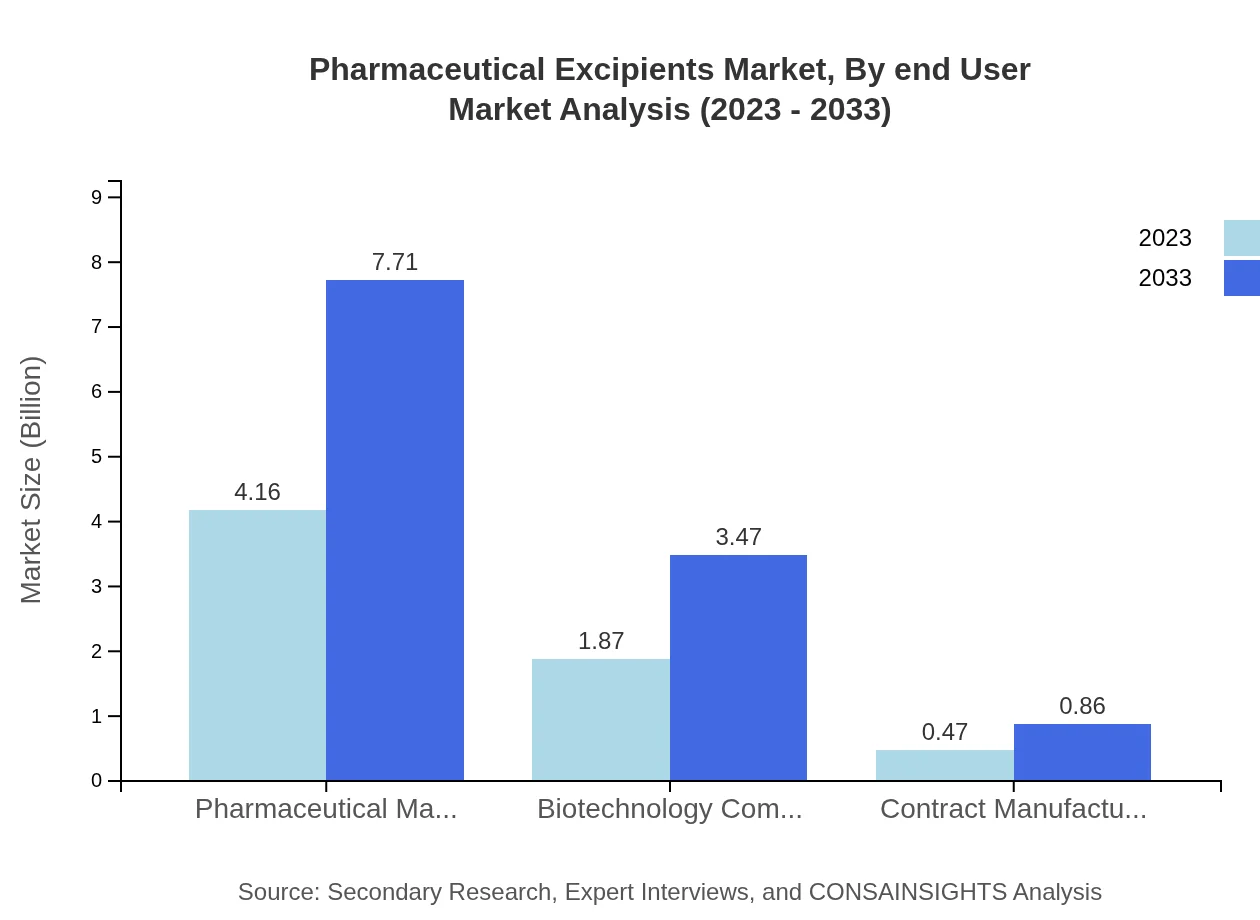

Pharmaceutical Excipients Market Analysis By End User

Pharmaceutical manufacturers dominate this segment with a market size of $4.16 billion in 2023. Biotechnology companies also hold a critical position with a market size of $1.87 billion, indicative of the increasing production of biologics and the need for specialized excipients.

Pharmaceutical Excipients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Excipients Industry

BASF SE:

A global leader in chemical production that also specializes in pharmaceutical excipients, offering a wide range of high-quality solutions to enhance drug formulation.Evonik Industries AG:

Known for its diverse product portfolio, Evonik focuses on excipients for biopharmaceuticals and advanced drug delivery systems.FMC Corporation:

FMC provides innovative excipients and has a strong commitment to sustainability and improving patient outcomes through effective drug formulation.Ashland Global Holdings Inc.:

With a focus on specialty chemicals, Ashland develops excipients for key pharmaceutical applications, supporting global pharmaceutical manufacturers.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical excipients?

The pharmaceutical excipients market is projected to reach $6.5 billion by 2033, growing with a CAGR of 6.2% from 2023 onwards. This growth is driven by the increasing demand for advanced drug formulations.

What are the key market players or companies in the pharmaceutical excipients industry?

Key players in the pharmaceutical excipients market include major pharmaceutical manufacturers, biotechnology companies, and contract manufacturing organizations, all vying for market share and innovation.

What are the primary factors driving the growth in the pharmaceutical excipients industry?

Factors driving growth include the rise of personalized medicine, technological advancements in drug formulation, and an increasing emphasis on biopharmaceutical products, which all require specific excipients.

Which region is the fastest Growing in the pharmaceutical excipients market?

The fastest-growing region is North America, anticipated to grow from $2.17 billion in 2023 to $4.02 billion by 2033, followed closely by Europe and Asia Pacific.

Does ConsaInsights provide customized market report data for the pharmaceutical excipients industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the pharmaceutical excipients industry, ensuring detailed insights for strategic decision-making.

What deliverables can I expect from this pharmaceutical excipients market research project?

Expect comprehensive reports, detailed market trends, segmentation analysis, competitive landscape summaries, and forecasts that cover regional and global market dynamics.

What are the market trends of pharmaceutical excipients?

Current trends include a shift towards bio-based excipients, increasing demand for multifunctional excipients, and greater regulatory focus on the quality and safety of excipients used in formulations.