Pharmaceutical Fill And Finish Outsourcing Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-fill-and-finish-outsourcing

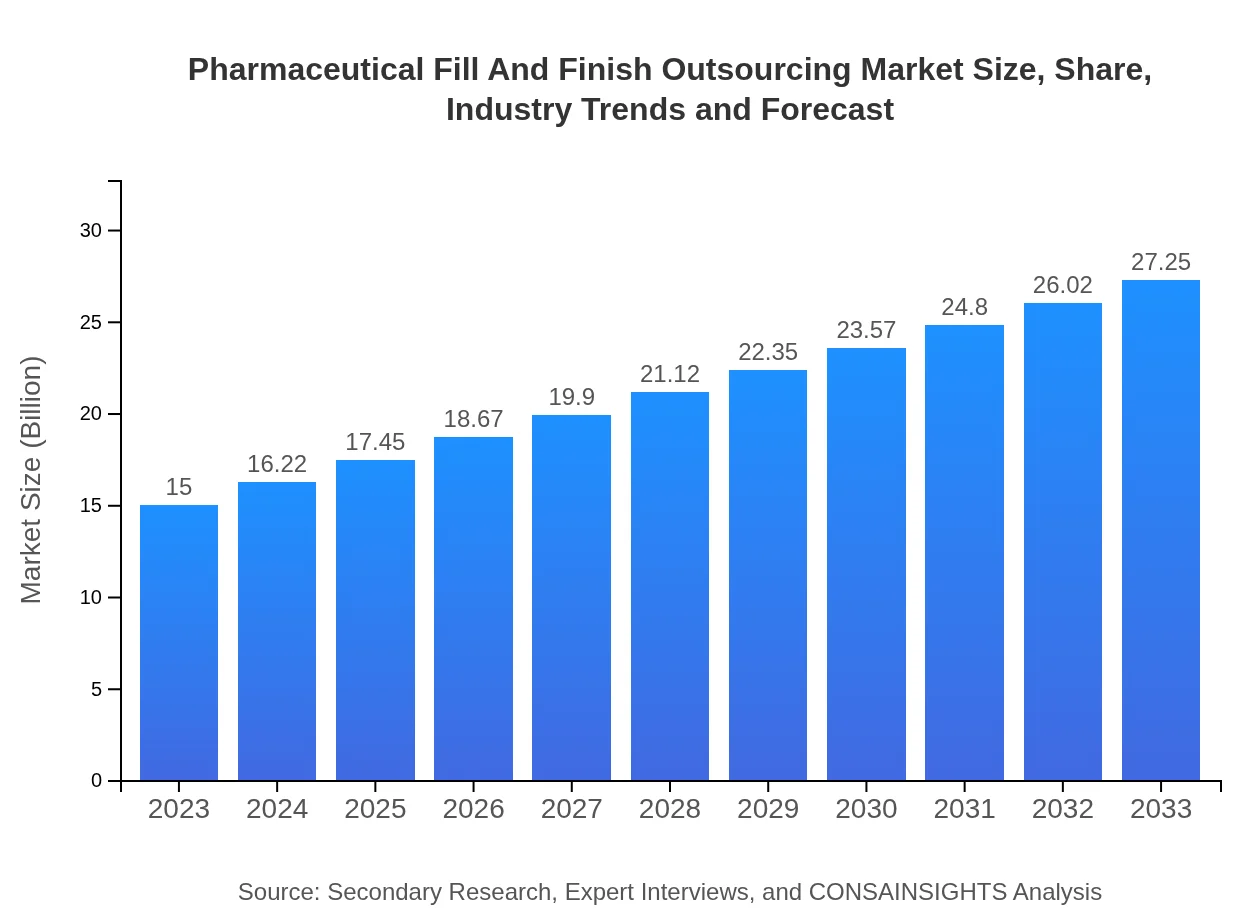

Pharmaceutical Fill And Finish Outsourcing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pharmaceutical Fill And Finish Outsourcing market, covering market size, growth forecasts, trends, competitive landscape, and regional insights from 2023 to 2033.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $27.25 Billion |

| Top Companies | Boehringer Ingelheim, Lonza Group Ltd, Catalent, Inc., Fujifilm Diosynth Biotechnologies |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Fill And Finish Outsourcing Market Overview

Customize Pharmaceutical Fill And Finish Outsourcing Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Fill And Finish Outsourcing market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Fill And Finish Outsourcing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Fill And Finish Outsourcing

What is the Market Size & CAGR of Pharmaceutical Fill And Finish Outsourcing market in 2023 & 2033?

Pharmaceutical Fill And Finish Outsourcing Industry Analysis

Pharmaceutical Fill And Finish Outsourcing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Fill And Finish Outsourcing Market Analysis Report by Region

Europe Pharmaceutical Fill And Finish Outsourcing Market Report:

The European region is anticipated to grow from $4.79 billion in 2023 to $8.70 billion by 2033. The stringent regulatory environments and a high standard of quality in pharmaceutical manufacturing foster a robust outsourcing ecosystem.Asia Pacific Pharmaceutical Fill And Finish Outsourcing Market Report:

The Asia Pacific region is expected to witness significant growth, with a market size reaching $5.32 billion by 2033 from $2.93 billion in 2023. The region's expansion is propelled by lower manufacturing costs, a growing number of CMOs, and increasing investments in biotechnology and pharmaceutical research.North America Pharmaceutical Fill And Finish Outsourcing Market Report:

North America, currently valued at $4.87 billion in 2023, is expected to reach $8.85 billion by 2033. Key factors include the presence of leading pharmaceutical companies, advanced healthcare infrastructure, and a strong focus on innovation and quality in fill and finish operations.South America Pharmaceutical Fill And Finish Outsourcing Market Report:

In South America, the market is projected to grow from $0.79 billion in 2023 to $1.44 billion by 2033. This growth is driven by increasing healthcare spending and modernization of pharmaceutical manufacturing facilities.Middle East & Africa Pharmaceutical Fill And Finish Outsourcing Market Report:

The Middle East and Africa market, valued at $1.62 billion in 2023, is expected to grow to $2.94 billion by 2033. This region is experiencing growth due to increasing healthcare investments and the establishment of new pharmaceutical hubs.Tell us your focus area and get a customized research report.

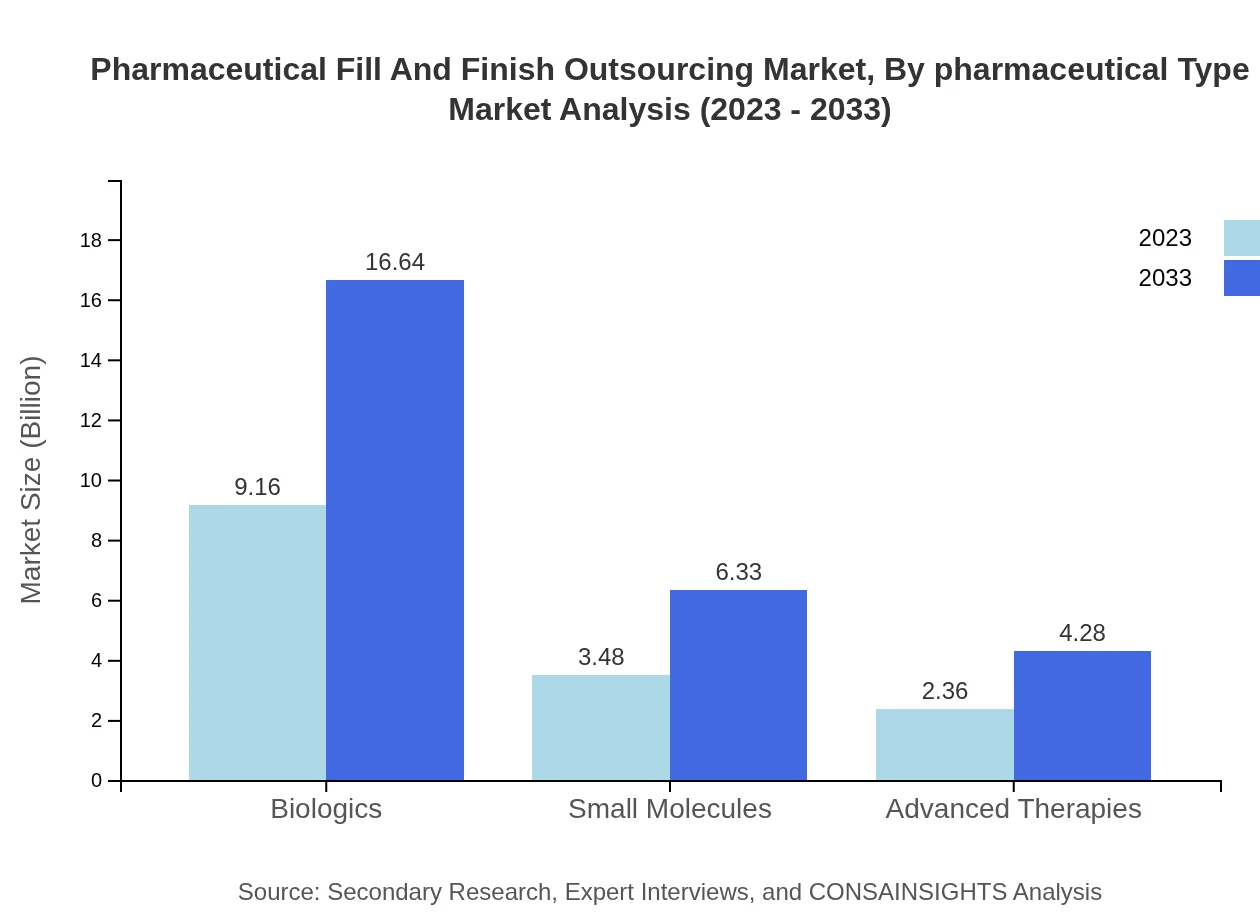

Pharmaceutical Fill And Finish Outsourcing Market Analysis By Pharmaceutical Type

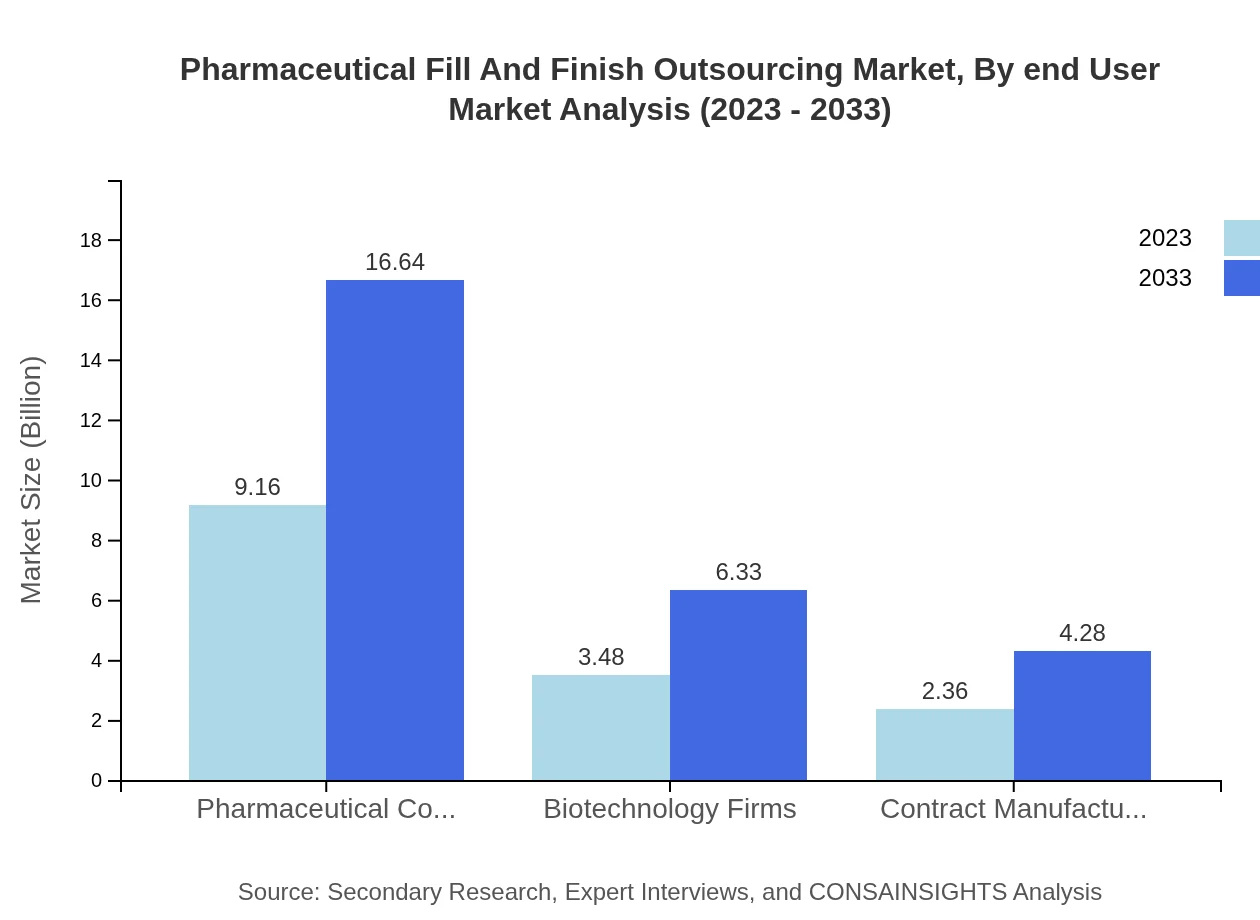

The pharmaceutical fill and finish market comprises various types including biologics, small molecules, and advanced therapies. Biologics dominated the market in 2023 with a size of $9.16 billion, expected to grow to $16.64 billion by 2033. Small molecules and advanced therapies are also anticipated to grow, reaching $6.33 billion and $4.28 billion respectively by 2033.

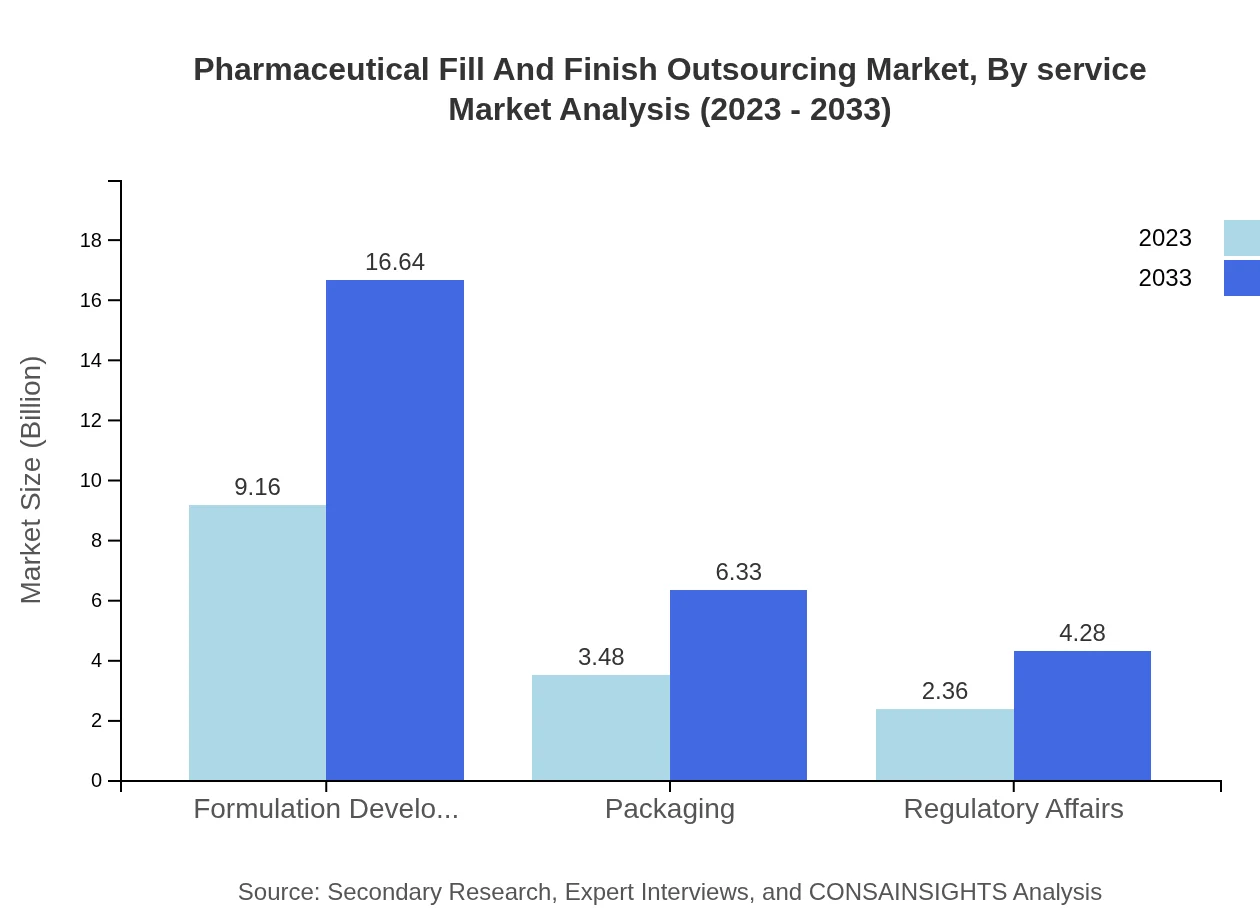

Pharmaceutical Fill And Finish Outsourcing Market Analysis By Finish Type

Segments include formulation development, packaging, and regulatory affairs. Formulation development is key, valued at $9.16 billion in 2023 and projected to grow to $16.64 billion by 2033, accounting for 61.06% market share consistently.

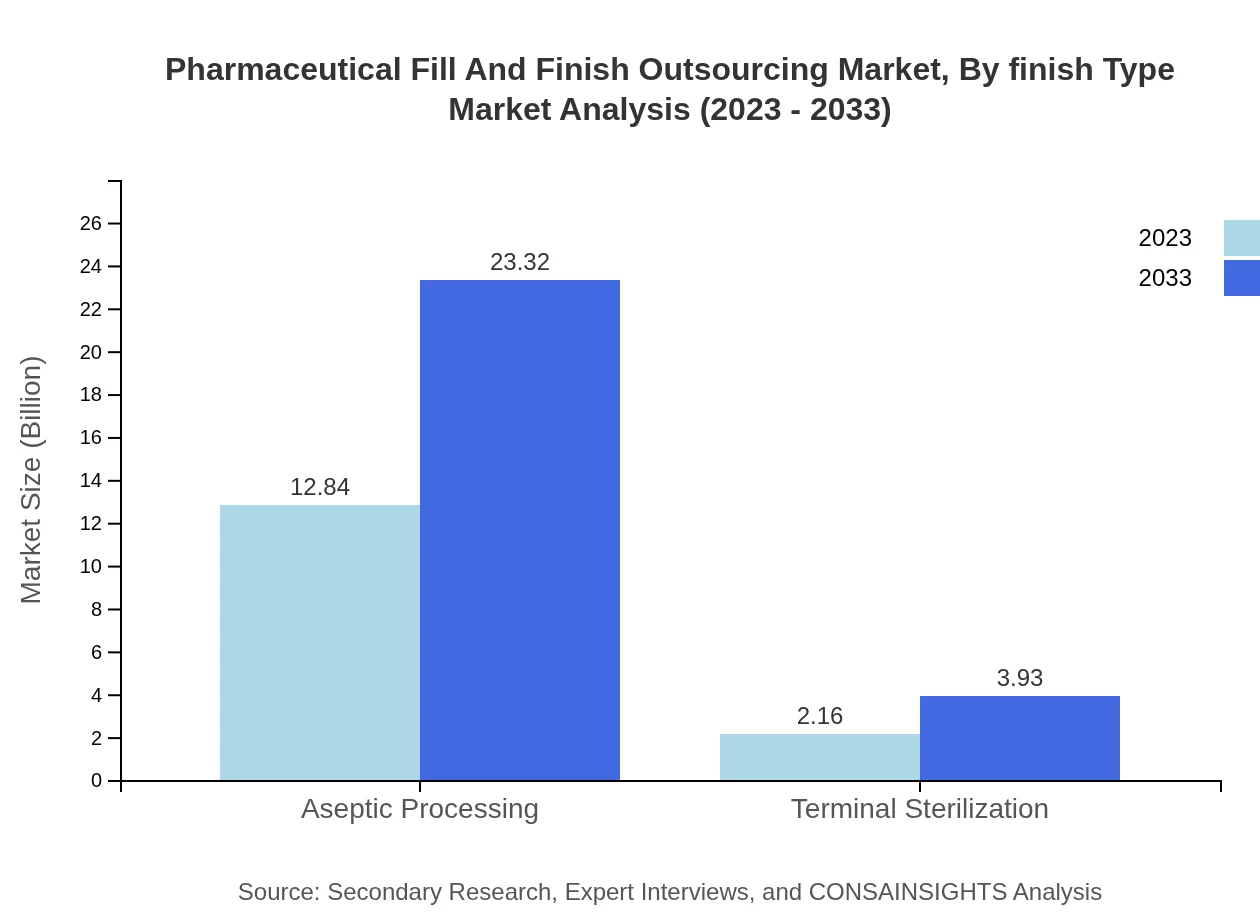

Pharmaceutical Fill And Finish Outsourcing Market Analysis By Service

The services offered include aseptic processing, terminal sterilization, and regulatory services. Aseptic processing leads with a market size of $12.84 billion in 2023, expected to reach $23.32 billion by 2033, holding a consistent 85.59% market share.

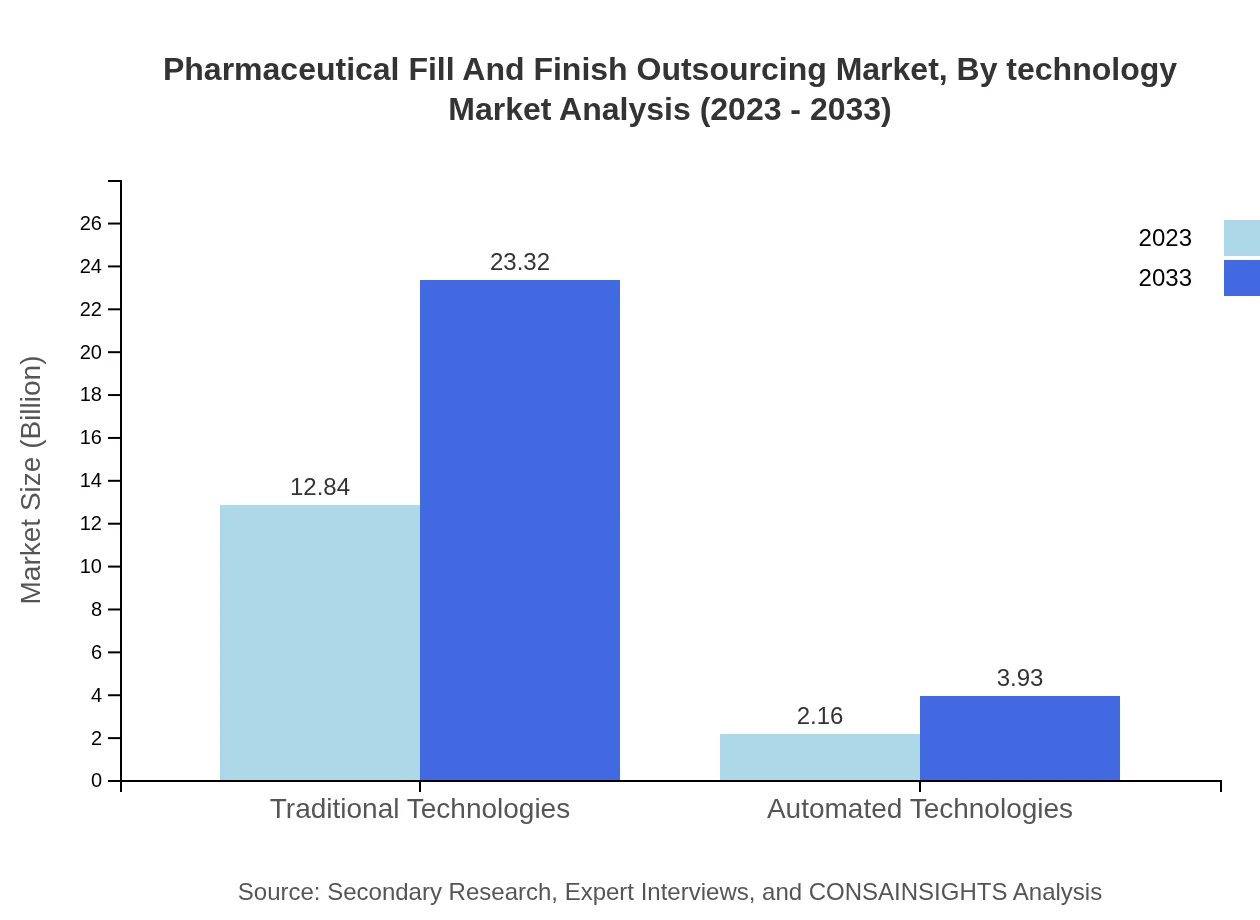

Pharmaceutical Fill And Finish Outsourcing Market Analysis By Technology

The market involves traditional and automated technologies. Traditional technologies dominate with $12.84 billion in 2023, while automated technologies are valued at $2.16 billion, expected to grow to $3.93 billion by 2033, claiming a 14.41% market share.

Pharmaceutical Fill And Finish Outsourcing Market Analysis By End User

Key end-users include pharmaceutical companies, biotechnology firms, and contract manufacturing organizations. Pharmaceutical companies are leading with $9.16 billion in 2023 and are anticipated to maintain a steady share of 61.06% throughout the forecast period.

Pharmaceutical Fill And Finish Outsourcing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Fill And Finish Outsourcing Industry

Boehringer Ingelheim:

A leading global pharmaceutical company known for its extensive capabilities in biopharmaceutical contract manufacturing including fill and finish services.Lonza Group Ltd:

A top-tier global supplier to the pharmaceutical and biotechnology sectors, offering comprehensive fill and finish services focused on biologics.Catalent, Inc.:

A major player in the pharmaceutical outsourcing space providing innovative drug delivery solutions and fill and finish services.Fujifilm Diosynth Biotechnologies:

A recognized name in biologics development and manufacturing with robust fill and finish offerings.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical fill and finish outsourcing?

The pharmaceutical fill and finish outsourcing market is estimated to be valued at approximately $15 billion in 2023, with a projected CAGR of 6% through 2033, highlighting significant growth potential in the industry.

What are the key market players or companies in this pharmaceutical fill and finish outsourcing industry?

Key players in this market include major pharmaceutical companies and specialized contract manufacturing organizations (CMOs) that provide comprehensive fill and finish services, effectively meeting the growing demand within the global pharmaceutical sector.

What are the primary factors driving the growth in the pharmaceutical fill and finish outsourcing industry?

Key growth drivers include the rising demand for complex biologics, the need for cost-effective manufacturing solutions, advancements in technology, and increased regulatory compliance requirements that push companies to consider outsourcing.

Which region is the fastest Growing in the pharmaceutical fill and finish outsourcing?

Asia Pacific is emerging as the fastest-growing region, with market growth projected from $2.93 billion in 2023 to $5.32 billion by 2033, driven by expanding healthcare markets and production capabilities.

Does ConsaInsights provide customized market report data for the pharmaceutical fill and finish outsourcing industry?

Yes, ConsaInsights offers tailored market report data, allowing clients to obtain specific insights related to their needs in the pharmaceutical fill and finish outsourcing industry, enhancing strategic decisions.

What deliverables can I expect from this pharmaceutical fill and finish outsourcing market research project?

Expect comprehensive reports detailing market analysis, growth forecasts, competitive landscape, regional insights, and segment data that influence strategic planning in the pharmaceutical fill and finish outsourcing market.

What are the market trends of pharmaceutical fill and finish outsourcing?

Trends include increased adoption of automated technologies, focus on aseptic processing, and a growing emphasis on sustainability practices in fill and finish operations, reflecting broader industry shifts.