Pharmaceutical Filtration Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-filtration

Pharmaceutical Filtration Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Pharmaceutical Filtration market from 2023 to 2033, including market size, growth forecasts, trends, regional insights, and industry dynamics to help stakeholders make informed decisions.

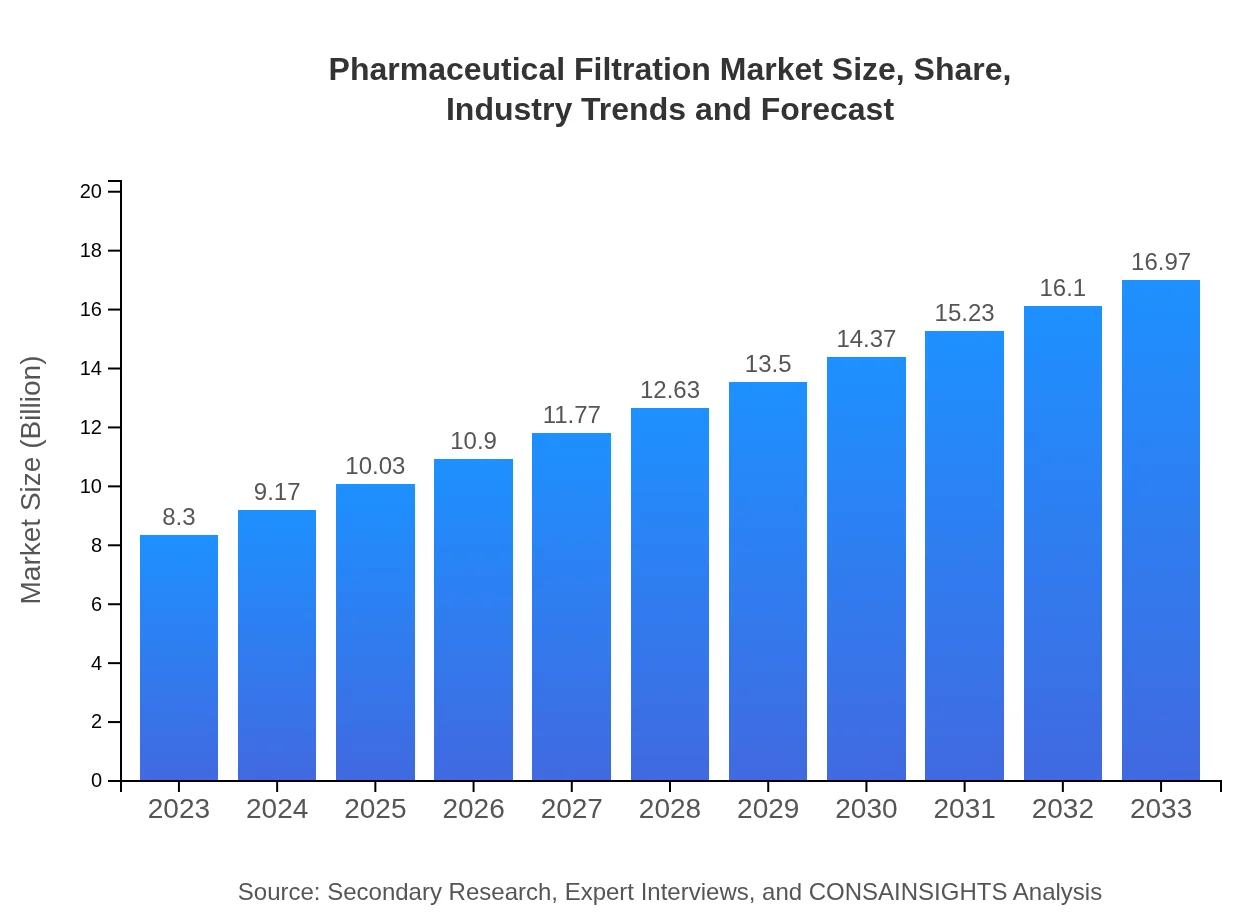

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $8.30 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $16.97 Billion |

| Top Companies | Merck KGaA, Pall Corporation, Parker Hannifin, Sartorius AG, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Filtration Market Overview

Customize Pharmaceutical Filtration Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Filtration market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Filtration's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Filtration

What is the Market Size & CAGR of Pharmaceutical Filtration market in 2023?

Pharmaceutical Filtration Industry Analysis

Pharmaceutical Filtration Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Filtration Market Analysis Report by Region

Europe Pharmaceutical Filtration Market Report:

In Europe, the market is forecasted to grow from $2.09 billion in 2023 to $4.27 billion by 2033. Stringent regulatory frameworks and the presence of leading pharmaceutical companies bolster the demand for high-quality filtration solutions in the region.Asia Pacific Pharmaceutical Filtration Market Report:

In the Asia Pacific region, the Pharmaceutical Filtration market is valued at $1.78 billion in 2023 and is expected to reach $3.65 billion by 2033, driven by the growing pharmaceutical industry in countries like China and India. The increasing demand for biologics and generics contributes to this growth, supported by favorable government policies.North America Pharmaceutical Filtration Market Report:

North America holds a significant position in the Pharmaceutical Filtration market with a value of $2.87 billion in 2023, projected to grow to $5.87 billion by 2033. The well-established pharmaceutical industry, high R&D expenditure, and demand for advanced filtration techniques are central to this growth.South America Pharmaceutical Filtration Market Report:

The South American market is projected to grow from $0.56 billion in 2023 to $1.15 billion by 2033. Factors such as rising healthcare spending and a growing pharmaceutical sector in Brazil and Argentina are essential drivers of this market.Middle East & Africa Pharmaceutical Filtration Market Report:

The Middle East and Africa market is expected to expand from $1.00 billion in 2023 to $2.03 billion by 2033. Growing healthcare infrastructure and the increasing production of pharmaceutical products in Dubai and South Africa are contributing factors.Tell us your focus area and get a customized research report.

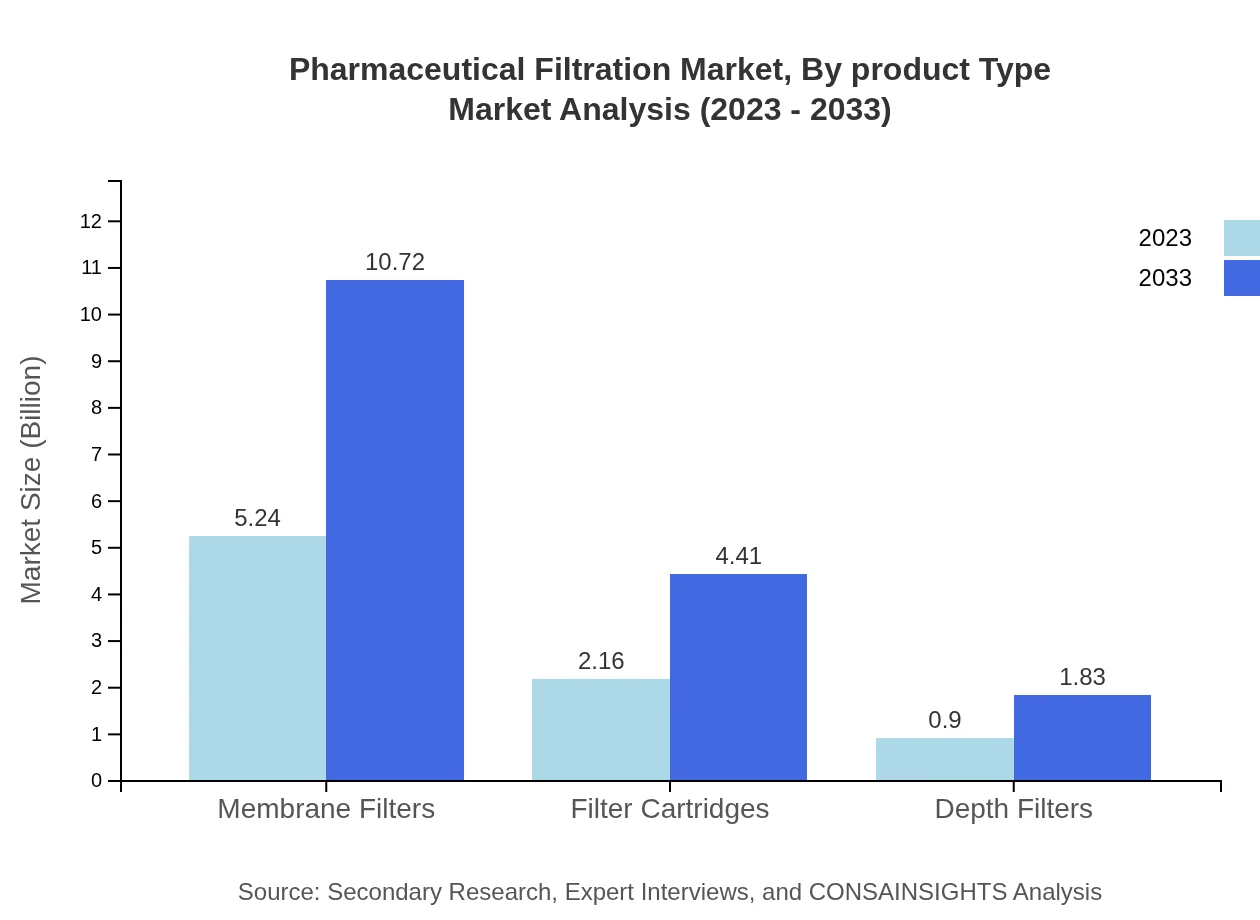

Pharmaceutical Filtration Market Analysis By Product Type

The segmentation by product type highlights various filtration technologies. Microfiltration dominates the market with a size of $5.24 billion in 2023 and projected to reach $10.72 billion by 2033. Ultrafiltration and sterile filtration also exhibit significant market shares, currently at $2.16 billion and anticipated to grow similarly. The product type segment contributes heavily to the overall growth, attributed to their critical roles in purification and separation processes.

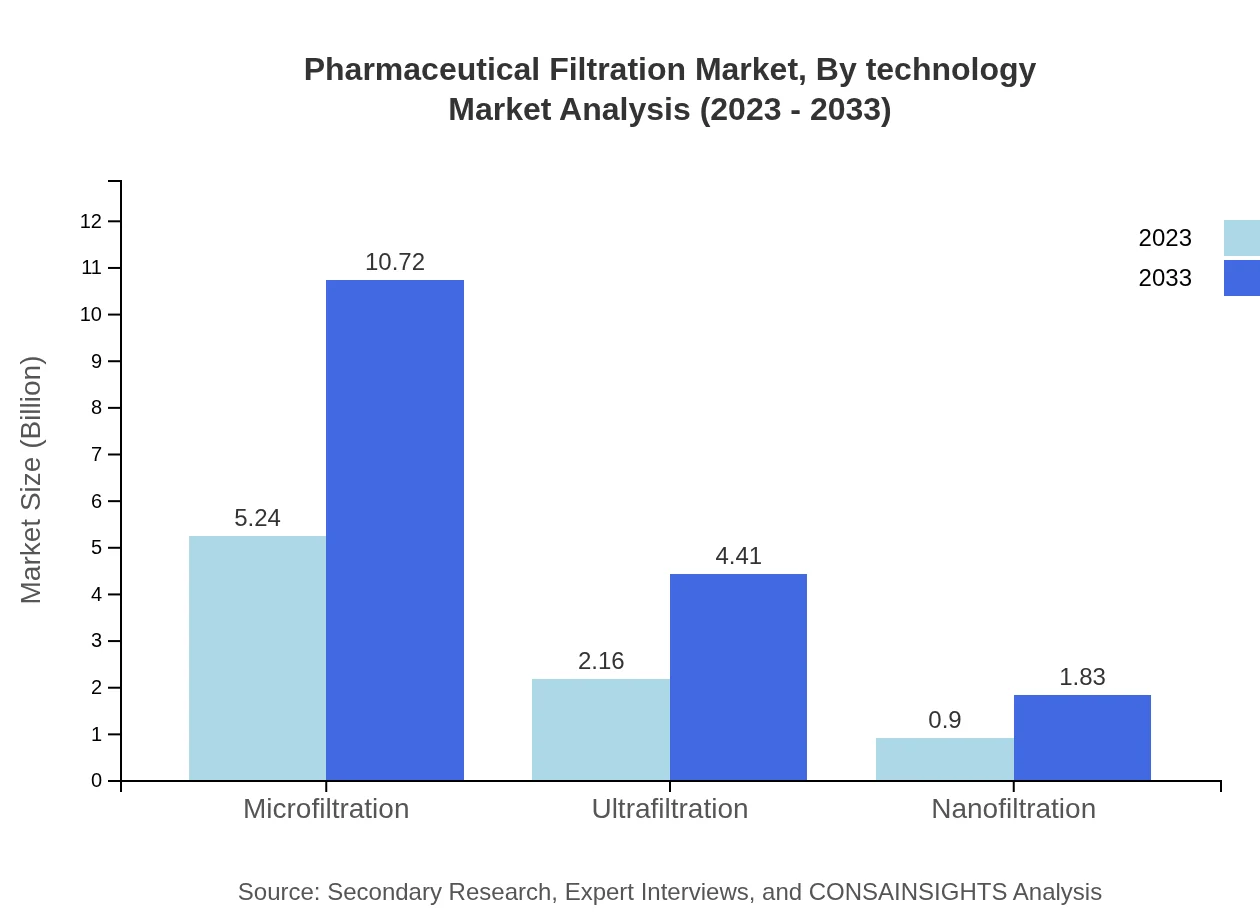

Pharmaceutical Filtration Market Analysis By Technology

The technology segmentation reveals that membrane filters lead the market, accounting for a substantial revenue share in both 2023 and 2033. Additionally, advancements in filter cartridges and depth filters are noteworthy. Innovations in filtration technology continue to enhance efficiency and compatibility with a wide range of pharmaceutical applications.

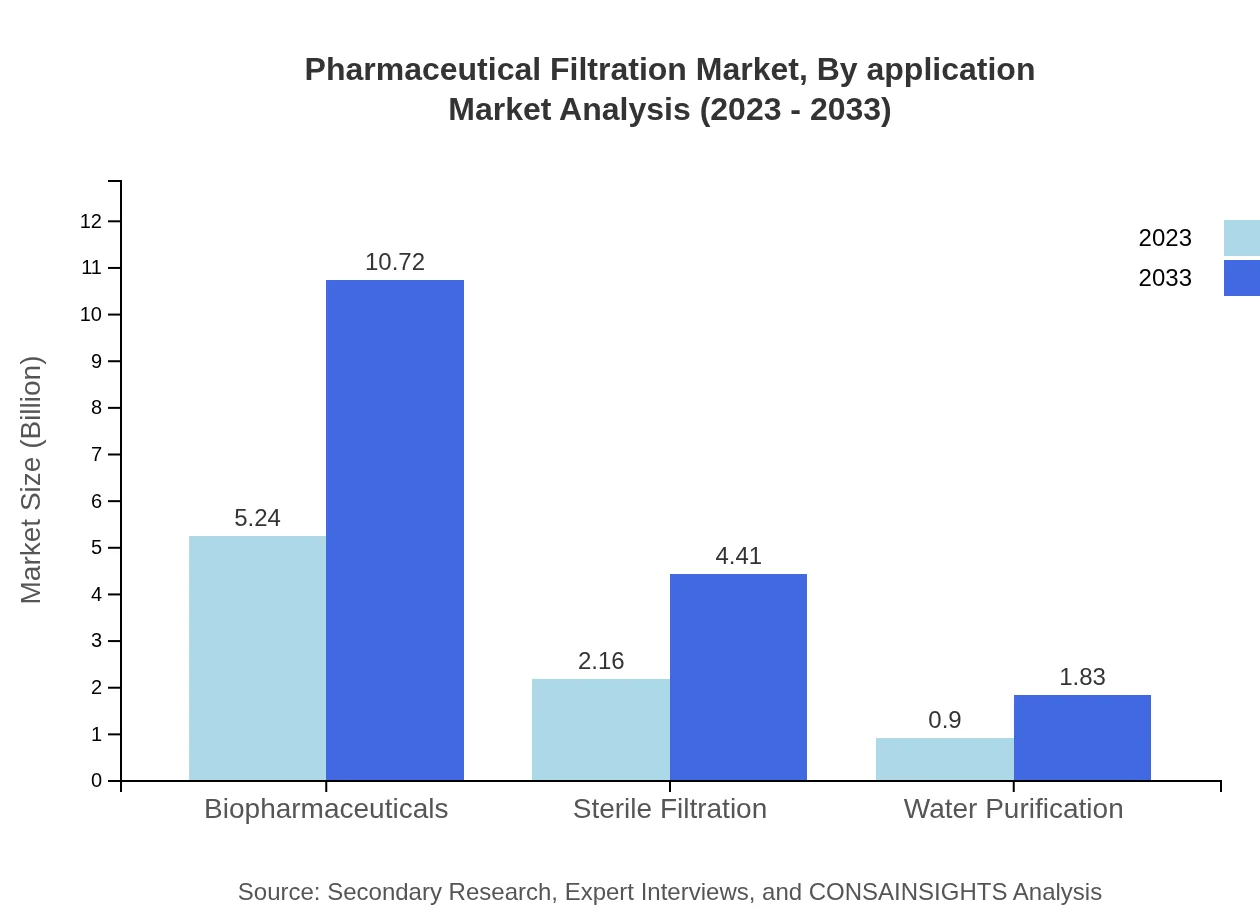

Pharmaceutical Filtration Market Analysis By Application

Applications within the Pharmaceutical Filtration Market include drug manufacturing, biopharmaceuticals, and water purification, with drug manufacturing being the largest segment. The increasing focus on biologics and complex drugs drives the demand for advanced filtration solutions within this sector.

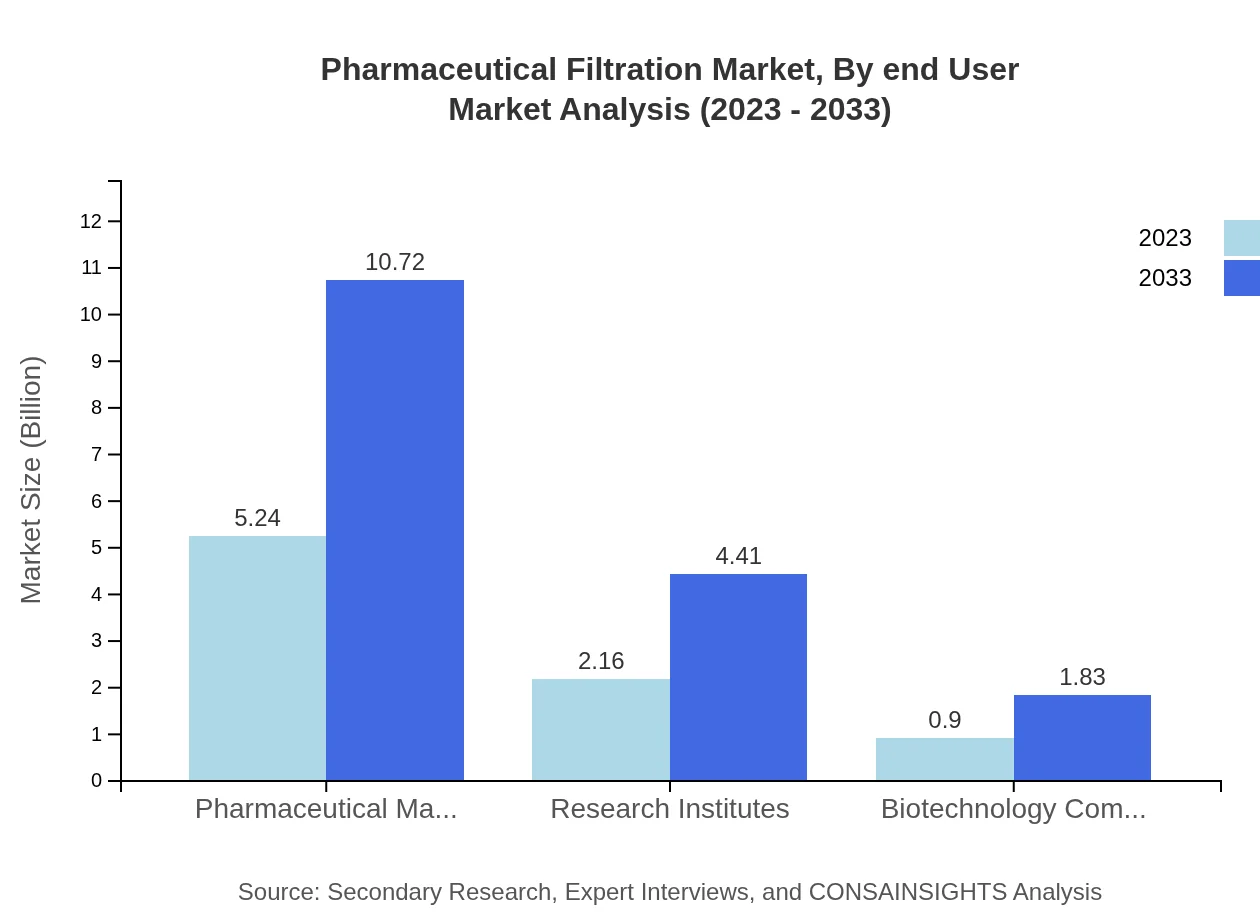

Pharmaceutical Filtration Market Analysis By End User

Pharmaceutical manufacturers dominate the end-user segment, contributing approximately 63.18% market share in 2023. Research institutes and biotechnology companies also represent significant segments focused on advancing research and drug development, enhancing competition and collaboration in the field.

Pharmaceutical Filtration Market Analysis By Region

Global Pharmaceutical Filtration Market, By Region Market Analysis (2023 - 2033)

As highlighted in the regional analysis, North America and Europe represent major markets, driven by innovation and investments in technology and R&D. The Asia Pacific region is witnessing rapid growth due to increased pharmaceutical production and investments in healthcare.

Pharmaceutical Filtration Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Filtration Industry

Merck KGaA:

Merck KGaA is a leading global player, providing a wide range of filtration solutions aimed at the pharmaceutical sector, enhancing product integrity and purity.Pall Corporation:

Pall Corporation offers innovative filtration solutions and technologies that cater to the pharmaceutical industry, focusing on advanced Sterilization and Separation technologies.Parker Hannifin:

Parker Hannifin is noted for its filtration and separation technologies, contributing significantly to the pharmaceutical manufacturing processes and ensuring compliance with regulatory standards.Sartorius AG:

Sartorius AG is renowned for its bioprocess solutions and filtrations systems that streamline the production of biological drugs, ensuring purity and safety.GE Healthcare:

GE Healthcare designs and delivers filtration products used in the manufacturing of biologics, leveraging innovative technology to provide effective solutions.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical filtration?

The pharmaceutical filtration market size is currently valued at approximately $8.3 billion in 2023, expected to grow at a CAGR of 7.2% through 2033, significantly expanding its reach in the healthcare sector.

What are the key market players or companies in the pharmaceutical filtration industry?

Key players in the pharmaceutical filtration market include Pall Corporation, Merck KGaA, Sartorius AG, 3M Company, and GE Healthcare, contributing to innovation and market growth through advanced filtration technologies.

What are the primary factors driving the growth in the pharmaceutical filtration industry?

Growth in the pharmaceutical filtration sector is primarily driven by increasing regulatory demands for sterile environments, rising biopharmaceutical product development, and advancements in filtration technologies ensuring product safety and efficacy.

Which region is the fastest Growing in the pharmaceutical filtration?

The fastest-growing region in pharmaceutical filtration is North America, projected to grow from $2.87 billion in 2023 to $5.87 billion by 2033, driven by high-demand biopharmaceuticals and stringent regulatory environments.

Does ConsaInsights provide customized market report data for the pharmaceutical filtration industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, allowing for comprehensive insights and analysis based on unique business requirements and market dynamics.

What deliverables can I expect from this pharmaceutical filtration market research project?

Deliverables from the pharmaceutical filtration market research project include detailed market analysis, segment insights, growth forecasts, competitive landscape studies, and strategic recommendations based on current trends.

What are the market trends of pharmaceutical filtration?

Current market trends in pharmaceutical filtration include rising investments in biotechnology, the increasing use of single-use systems, and enhanced focus on sustainability and efficiency in filtration processes.