Pharmaceutical Gelatin Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-gelatin

Pharmaceutical Gelatin Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Pharmaceutical Gelatin market, covering market size, forecasts, segmentation, and key trends from 2023 to 2033. It aims to equip stakeholders with valuable data for strategic planning and decision-making.

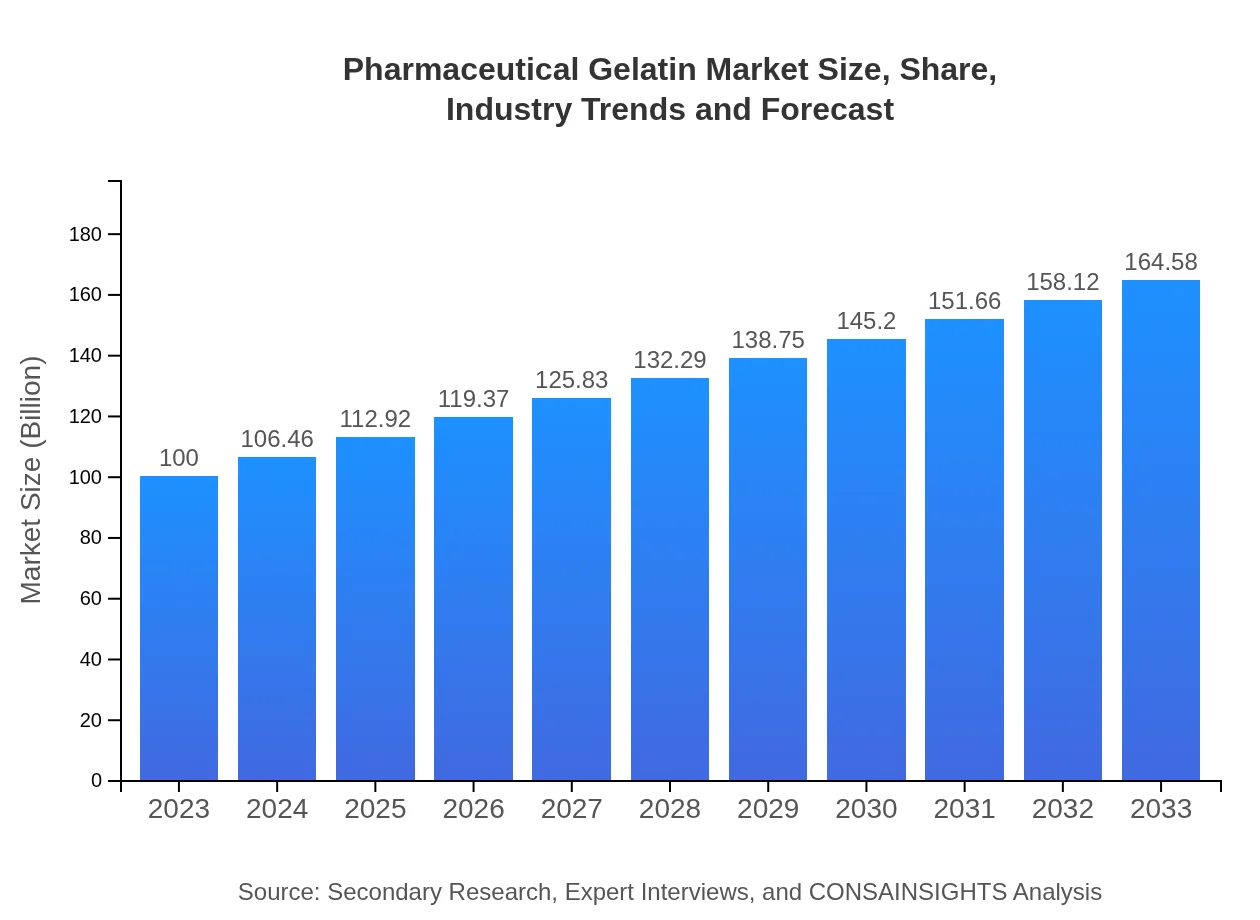

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Gelita AG, PB Gelatins, Bloomage Freda Biopharm, Ewald Gelatine |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Gelatin Market Overview

Customize Pharmaceutical Gelatin Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Gelatin market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Gelatin's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Gelatin

What is the Market Size & CAGR of Pharmaceutical Gelatin market in 2023 and 2033?

Pharmaceutical Gelatin Industry Analysis

Pharmaceutical Gelatin Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Gelatin Market Analysis Report by Region

Europe Pharmaceutical Gelatin Market Report:

The European market for pharmaceutical gelatin is estimated to grow from $24.69 million in 2023 to $40.63 million by 2033. This growth is supported by a strong regulatory framework, increasing emphasis on health products, and consumer preference for high-quality gelatin applications.Asia Pacific Pharmaceutical Gelatin Market Report:

The Asia Pacific region is set to experience significant growth, with the market size projected to expand from $19.54 million in 2023 to $32.16 million by 2033. This growth is fueled by rising healthcare spending and a robust pharmaceutical industry, particularly in countries like China and India.North America Pharmaceutical Gelatin Market Report:

North America remains one of the largest markets for pharmaceutical gelatin, projected to grow from $32.54 million in 2023 to $53.55 million by 2033. The region benefits from a mature pharmaceutical industry, high levels of research and development, and strong customer demand for specialty pharmaceutical products.South America Pharmaceutical Gelatin Market Report:

In South America, the pharmaceutical gelatin market is expected to grow from $9.90 million in 2023 to $16.29 million by 2033. The increasing demand for pharmaceutical formulations and supplements is driving the market, along with a growing focus on health and wellness among consumers.Middle East & Africa Pharmaceutical Gelatin Market Report:

In the Middle East and Africa, the pharmaceutical gelatin market is forecasted to increase from $13.33 million in 2023 to $21.94 million by 2033, driven by rising healthcare investments and increasing access to pharmaceuticals across various nations.Tell us your focus area and get a customized research report.

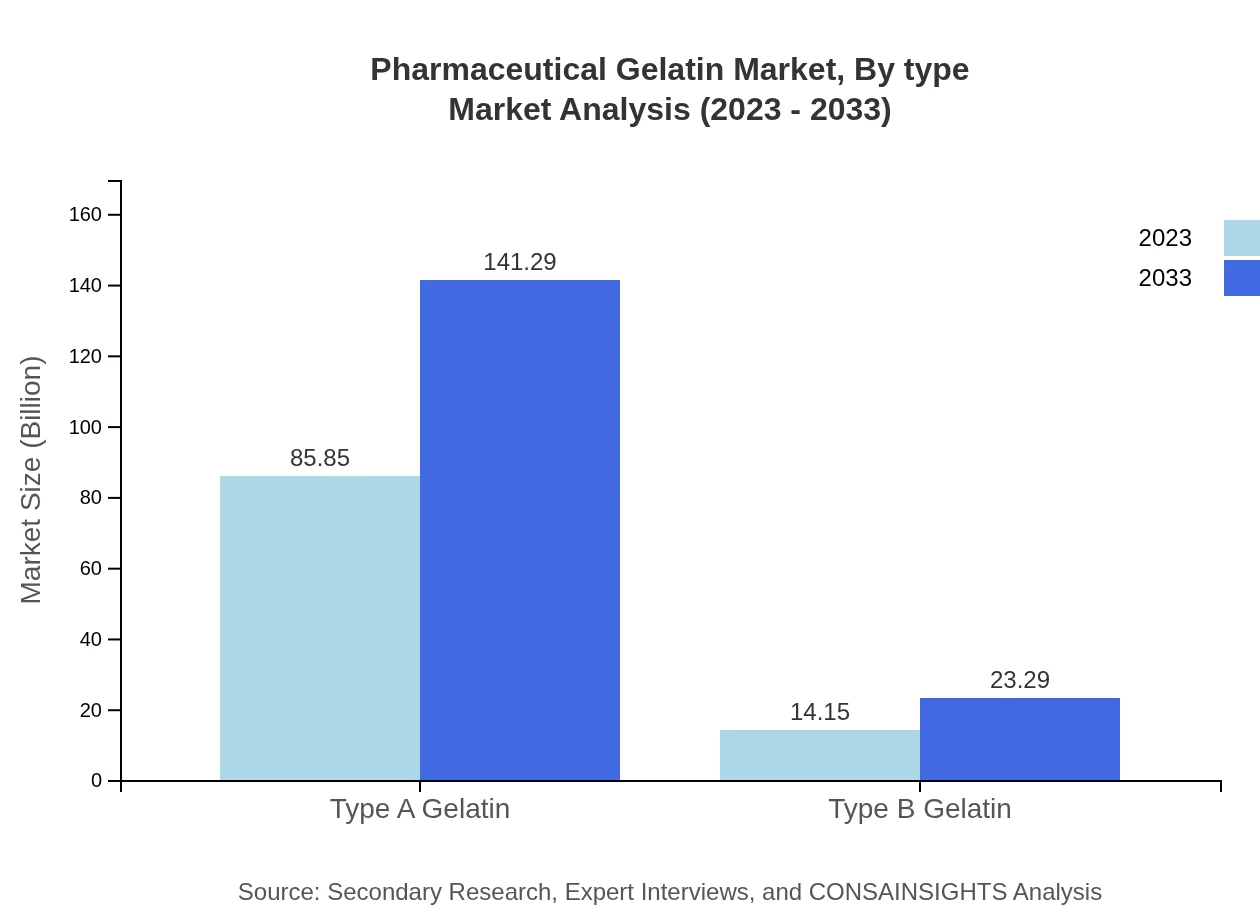

Pharmaceutical Gelatin Market Analysis By Type

The market is primarily divided into Type A Gelatin, which constitutes a significant share, accounting for $85.85 million in 2023, and Type B Gelatin, valued at $14.15 million. By 2033, Type A's market size will increase to $141.29 million while Type B will rise to $23.29 million.

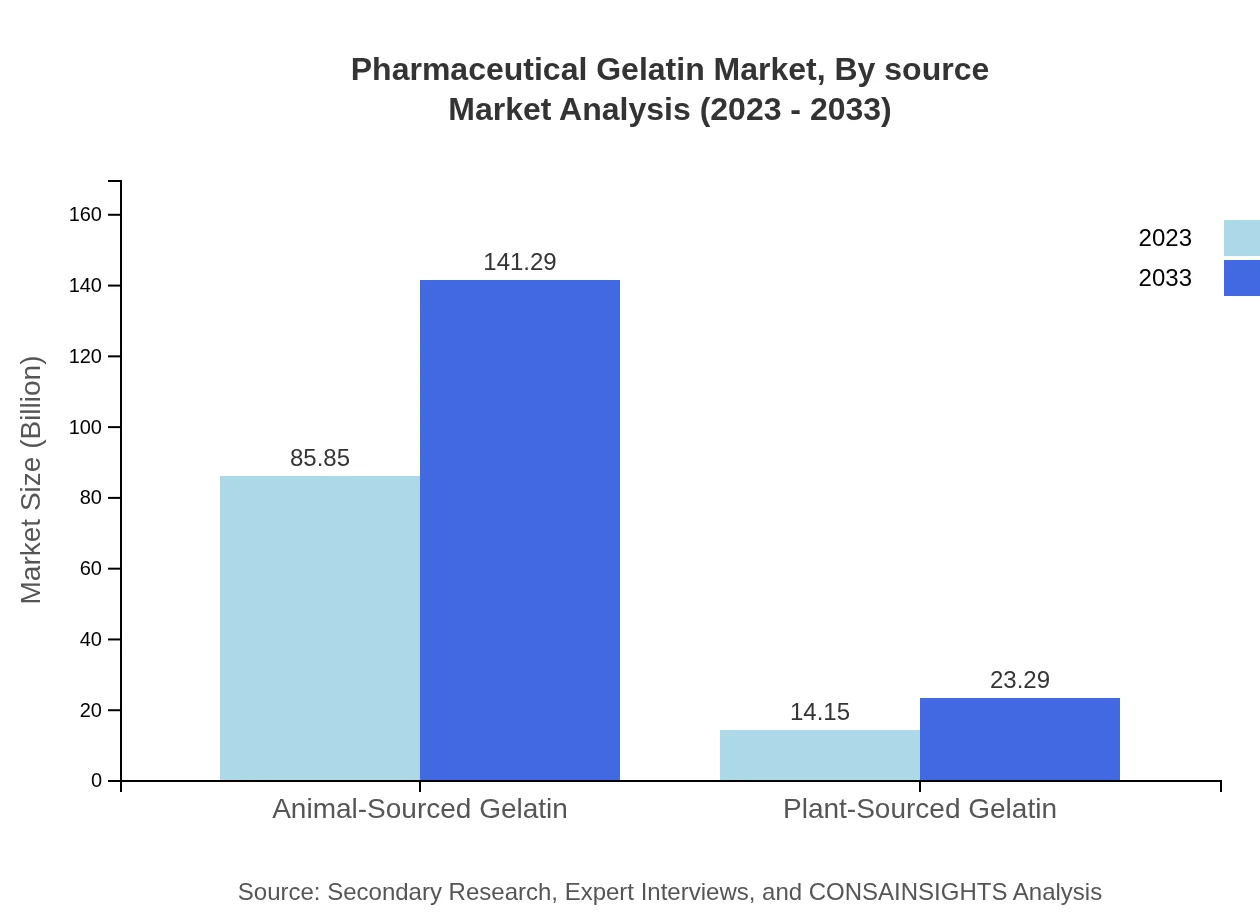

Pharmaceutical Gelatin Market Analysis By Source

Animal-sourced gelatin leads the market with a size of $85.85 million in 2023 and is expected to reach $141.29 million by 2033. In contrast, plant-sourced gelatin, although smaller, is gaining traction due to dietary preferences, growing from $14.15 million in 2023 to $23.29 million by 2033.

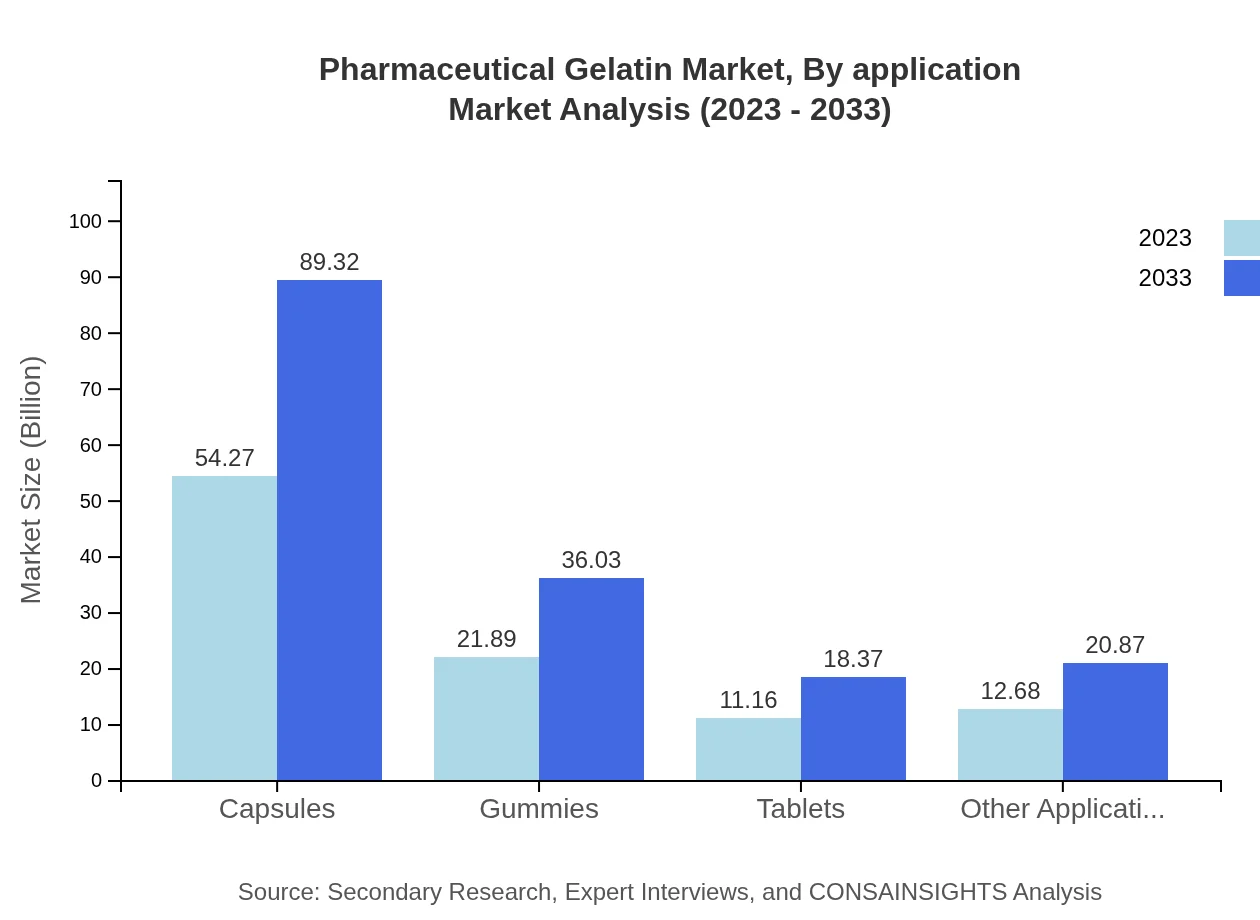

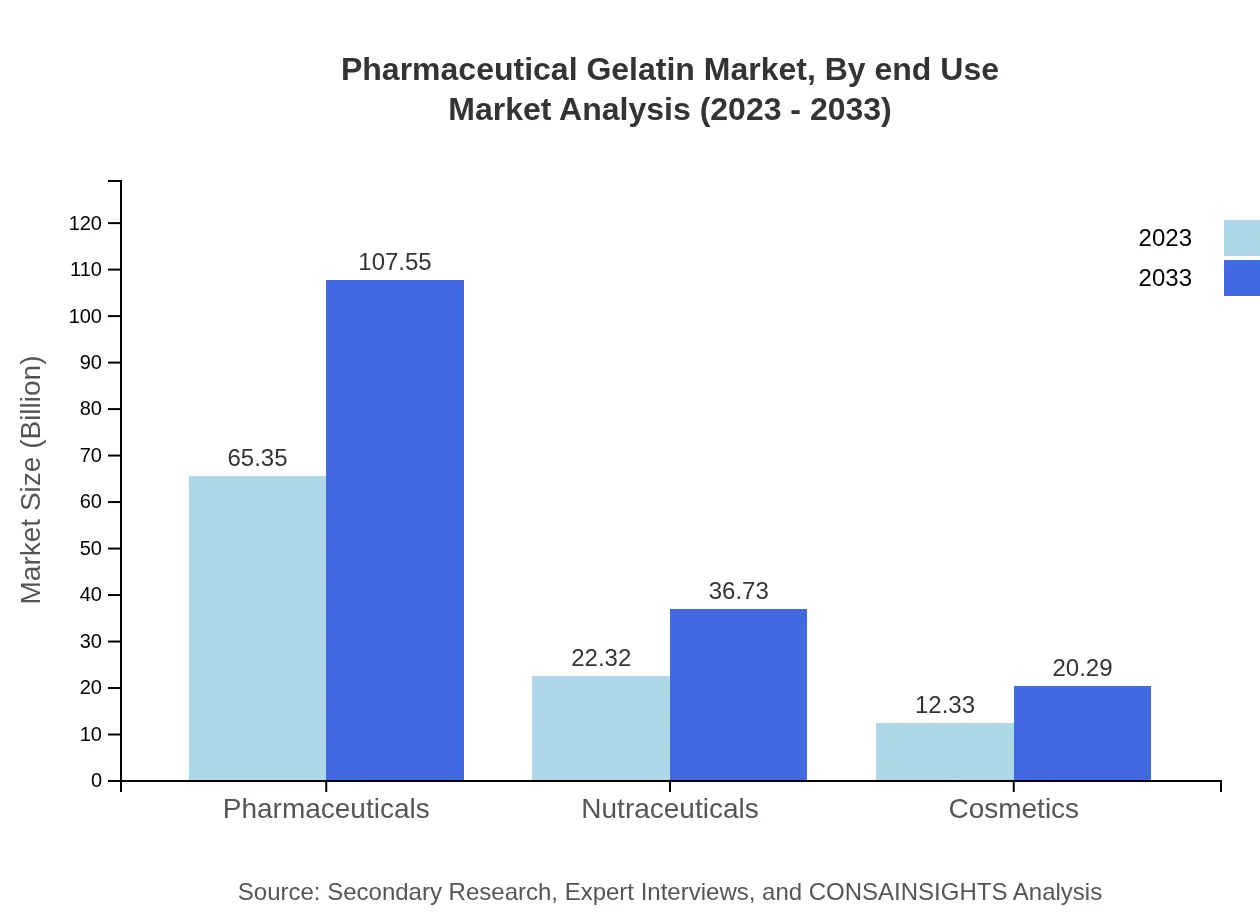

Pharmaceutical Gelatin Market Analysis By Application

The pharmaceutical sector holds the largest share, valued at $65.35 million in 2023, projected to grow to $107.55 million by 2033. This is followed by nutraceuticals and cosmetics, which are also expanding rapidly, with sizes of $22.32 million and $12.33 million respectively in 2023.

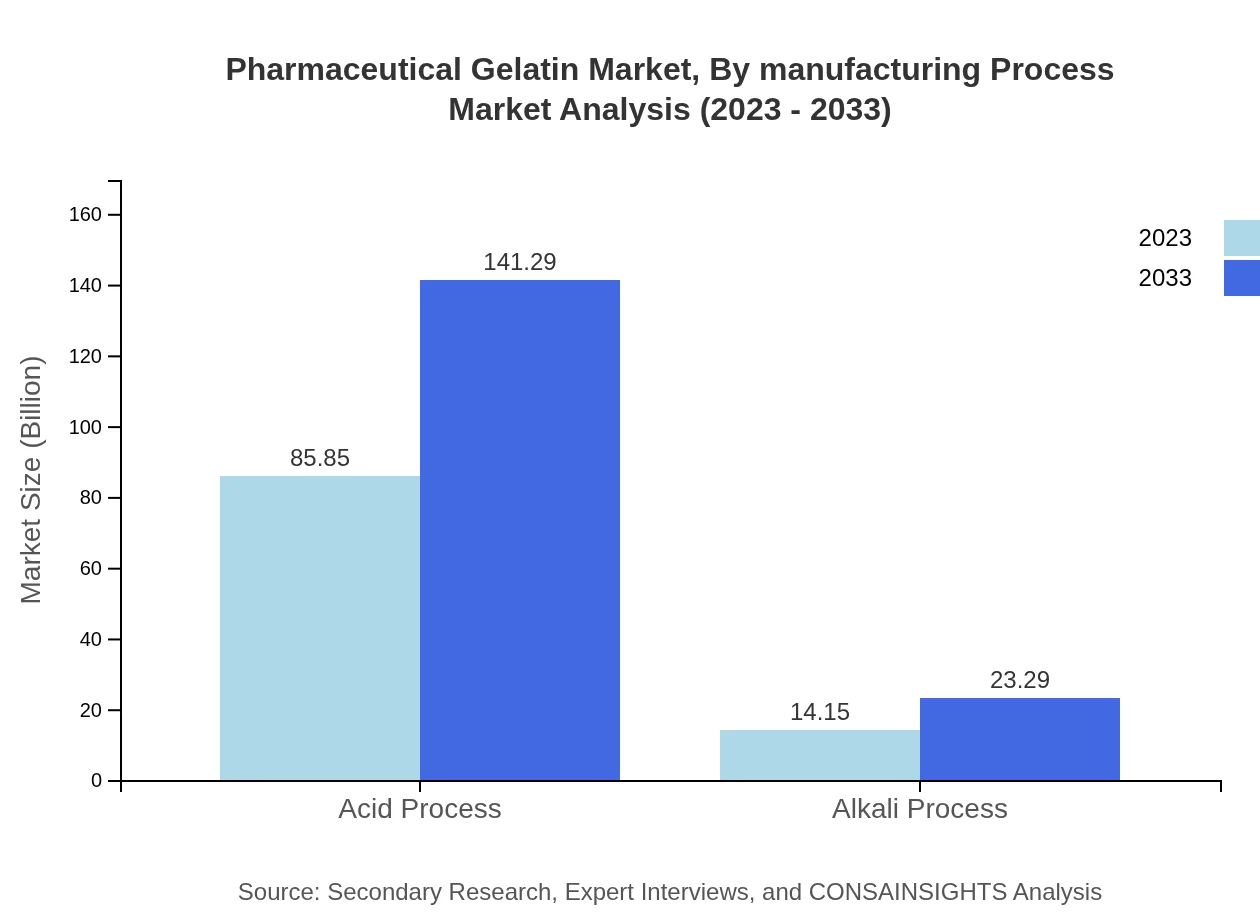

Pharmaceutical Gelatin Market Analysis By Manufacturing Process

Gelatin is produced via both Acid Process and Alkali Process. The Acid Process currently dominates the landscape, expected to grow from $85.85 million in 2023 to $141.29 million by 2033, while the Alkali Process will rise from $14.15 million to $23.29 million in the same timeframe.

Pharmaceutical Gelatin Market Analysis By End Use

The key end-use industries for pharmaceutical gelatin include capsules, gummies, and tablets, with capsules dominating the market at $54.27 million in 2023, set to increase to $89.32 million by 2033. Gummies and tablets are also expected to see growth, indicating a diverse application landscape.

Pharmaceutical Gelatin Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Gelatin Industry

Gelita AG:

A leading manufacturer of gelatin, Gelita AG offers a wide range of products to the pharmaceutical, food, and nutrition sectors, known for their high-quality standards and innovative solutions.PB Gelatins:

Specializing in collagen and gelatin products, PB Gelatins supplies various industries, emphasizing environmental responsibility and quality assurance.Bloomage Freda Biopharm:

A key player in the biopharmaceutical gelatin market, this company focuses on advanced gelatin derivatives for drug formulations and delivery systems.Ewald Gelatine:

With a strong presence in the global gelatin market, Ewald Gelatine produces high-purity gelatins and has a commitment to sustainable practices in sourcing and production.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical Gelatin?

The global pharmaceutical gelatin market size was valued at approximately USD 100 million in 2023, with a projected CAGR of 5% from 2023 to 2033, indicating substantial growth and expansion in the coming decade.

What are the key market players or companies in this pharmaceutical Gelatin industry?

Key players in the pharmaceutical gelatin market include major companies such as Gelita AG, PPD, PB Gelatins, and Nitta Gelatin, which are known for their significant contributions to gelatin production and innovation in pharmaceutical applications.

What are the primary factors driving the growth in the pharmaceutical Gelatin industry?

The primary factors driving growth include increasing demand for pharmaceutical formulations, the rise in health supplements, technological advancements in production techniques, and the growing adoption of gelatin in drug delivery systems due to its biocompatibility.

Which region is the fastest Growing in the pharmaceutical Gelatin?

North America is the fastest-growing region in the pharmaceutical gelatin market, with a market size projected to grow from USD 32.54 million in 2023 to USD 53.55 million by 2033, fueled by high healthcare expenditures and consumer awareness.

Does ConsaInsights provide customized market report data for the pharmaceutical Gelatin industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the pharmaceutical-gelatin industry, allowing for in-depth analysis and targeted insights based on varying market segments and geographic regions.

What deliverables can I expect from this pharmaceutical Gelatin market research project?

Expect comprehensive deliverables including detailed reports, market segmentation analysis, regional market insights, forecasts, competitive analysis of key players, and strategic recommendations tailored for effective decision-making in the pharmaceutical-gelatin sector.

What are the market trends of pharmaceutical Gelatin?

Market trends include a shift towards plant-based gelatin sources, increased integration of technology in production, growing demand for customizable pharmaceutical products, and rising consumer preferences for functional nutraceuticals incorporating gelatin.