Pharmaceutical Glycerine Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-glycerine

Pharmaceutical Glycerine Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Pharmaceutical Glycerine market from 2023 to 2033, analyzing market trends, size, segmentation, and regional dynamics along with forecasts and industry leaders.

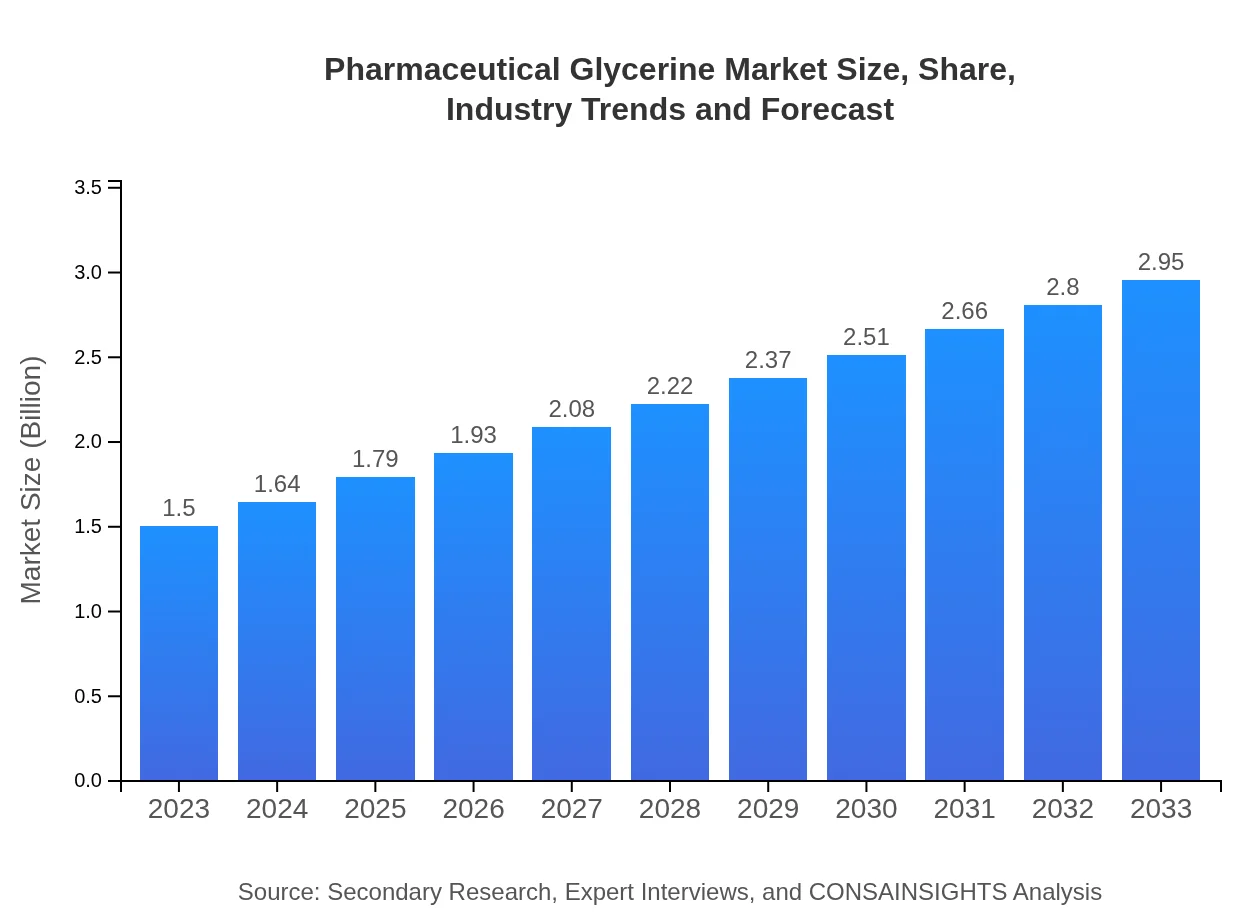

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $2.95 Billion |

| Top Companies | Newell Brands, Cargill, Inc., Procter & Gamble Co., Wilmar International Limited, Kraton Corporation |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Glycerine Market Overview

Customize Pharmaceutical Glycerine Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Glycerine market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Glycerine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Glycerine

What is the Market Size & CAGR of Pharmaceutical Glycerine market in 2023?

Pharmaceutical Glycerine Industry Analysis

Pharmaceutical Glycerine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Glycerine Market Analysis Report by Region

Europe Pharmaceutical Glycerine Market Report:

Europe's Pharmaceutical Glycerine market is anticipated to rise from $0.40 billion in 2023 to $0.79 billion by 2033. Growth is supported by favorable regulations concerning natural product use in pharmaceuticals, along with the region's established pharmaceutical sector, particularly in Germany, France, and the UK, driving the adoption of glycerine-based products.Asia Pacific Pharmaceutical Glycerine Market Report:

In the Asia Pacific region, the Pharmaceutical Glycerine market was valued at $0.30 billion in 2023 and is anticipated to grow to $0.58 billion by 2033. This growth can be attributed to the expanding pharmaceutical industry, rising health awareness, and increased investment in healthcare infrastructure. Countries like China and India are leading in the production and consumption of glycerine, aligning with the demand from the growing geriatric population.North America Pharmaceutical Glycerine Market Report:

In North America, the market for Pharmaceutical Glycerine is projected to grow from $0.50 billion in 2023 to $0.99 billion in 2033. Key drivers for this growth include stringent product quality standards, a robust presence of major pharmaceutical companies, and the increasing emphasis on natural and organic ingredients in drug formulations.South America Pharmaceutical Glycerine Market Report:

South America's Pharmaceutical Glycerine market is estimated at $0.11 billion in 2023, expected to double to $0.21 billion by 2033. Key factors affecting this growth include rising pharmaceutical consumption and increased regulatory approvals for glycerine in various products. Brazil and Argentina are at the forefront, fostering growth through locally sourced glycerine production.Middle East & Africa Pharmaceutical Glycerine Market Report:

The Middle East and Africa Pharmaceutical Glycerine market is estimated to grow from $0.19 billion in 2023 to $0.37 billion by 2033, supported by increasing healthcare investments and the development of pharmaceutical research and manufacturing facilities in countries like South Africa and the UAE.Tell us your focus area and get a customized research report.

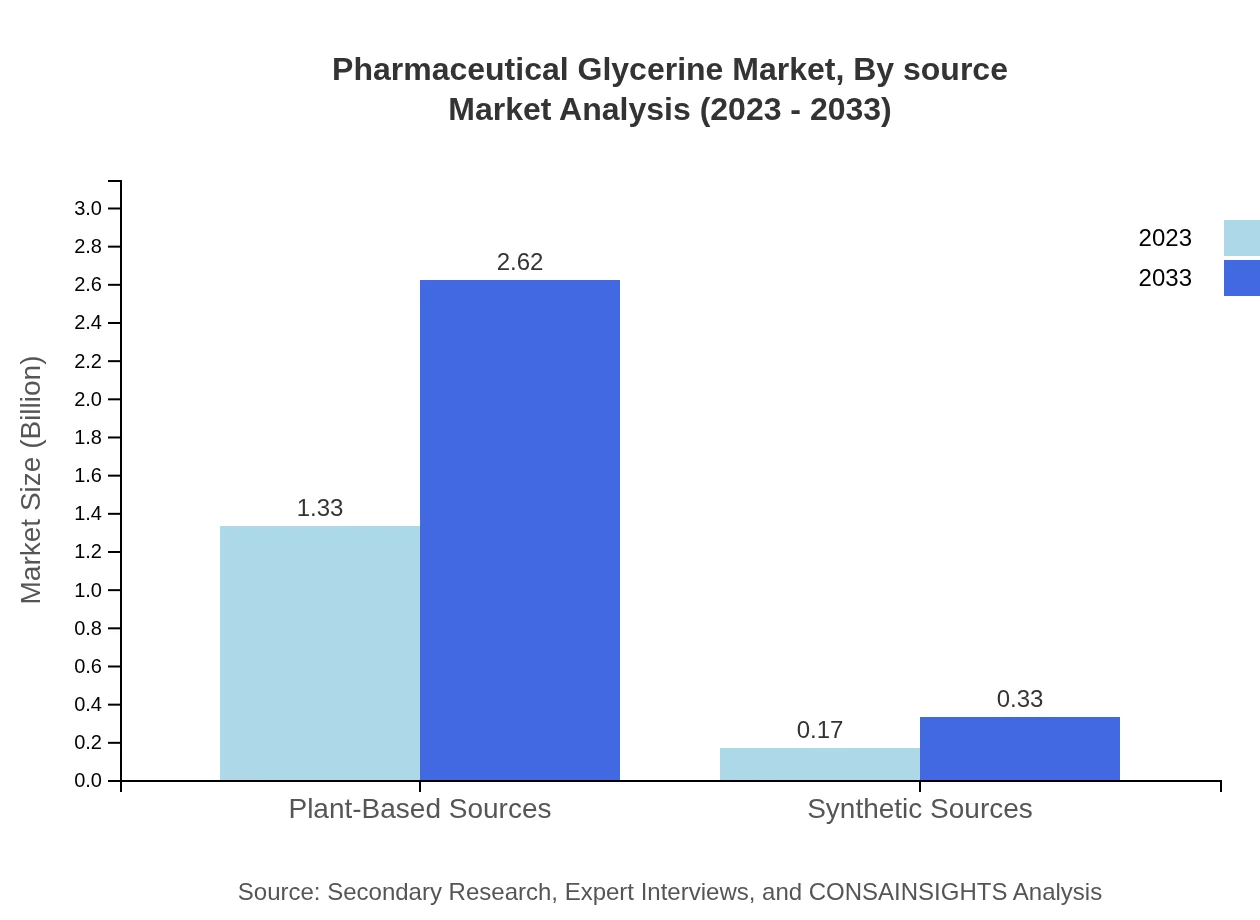

Pharmaceutical Glycerine Market Analysis By Source

The market is primarily segmented by source into plant-based and synthetic sources. The plant-based category dominates, accounting for a significant market share of approximately 88.97% in 2023, which will remain stable through 2033. This segment's growth is driven by consumer preference for natural ingredients. The synthetic source holds a smaller portion of the market, indicating a growing preference for the former.

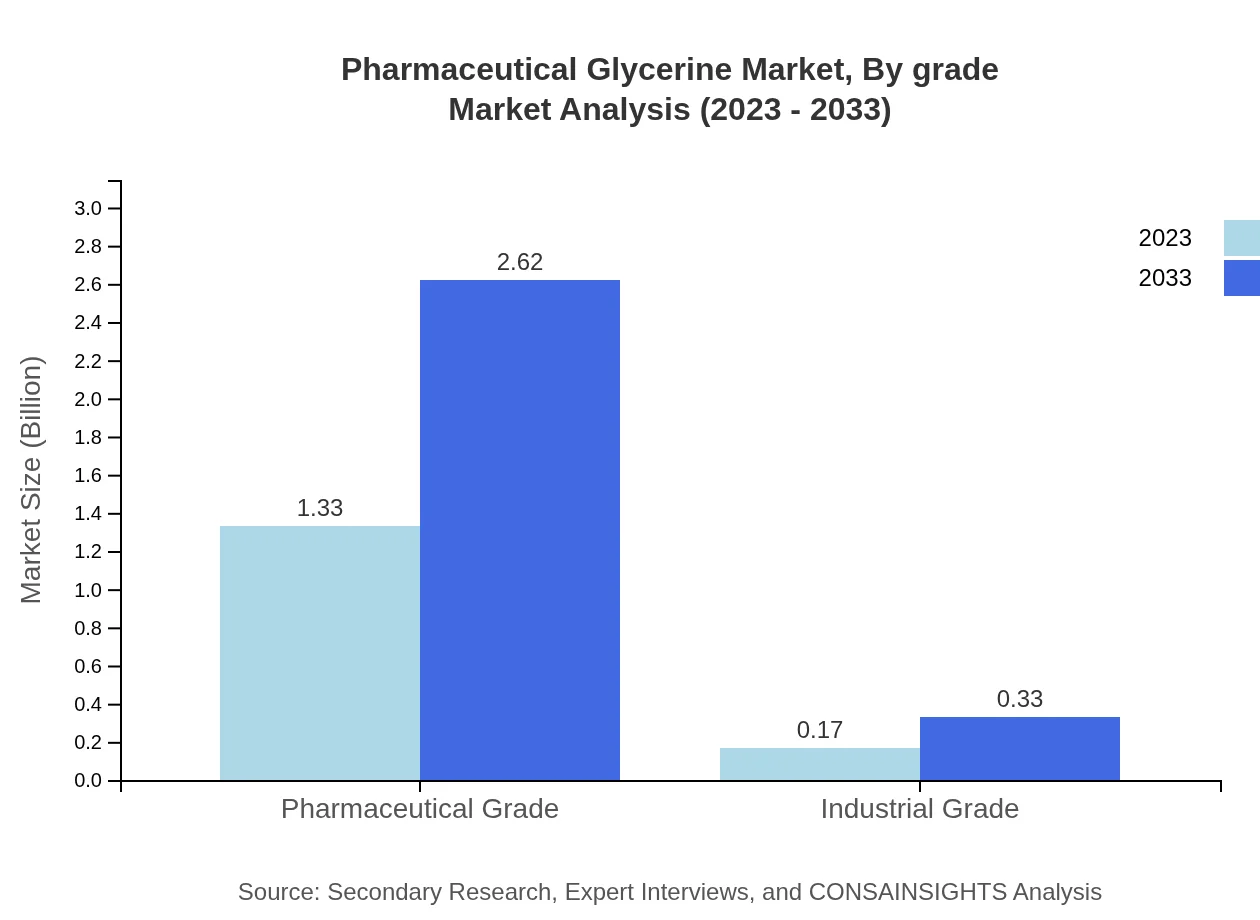

Pharmaceutical Glycerine Market Analysis By Grade

In terms of grade, the market is segmented into Pharmaceutical Grade and Industrial Grade, with the Pharmaceutical Grade segment holding a market share of 88.97% in 2023. The demand for high-purity glycerine continues to proliferate, especially in drug formulation applications, ensuring this segment's leading position throughout the forecast period. Industrial Grade glycerine, while smaller, continues to see steady growth due to its applications in non-pharmaceutical sectors.

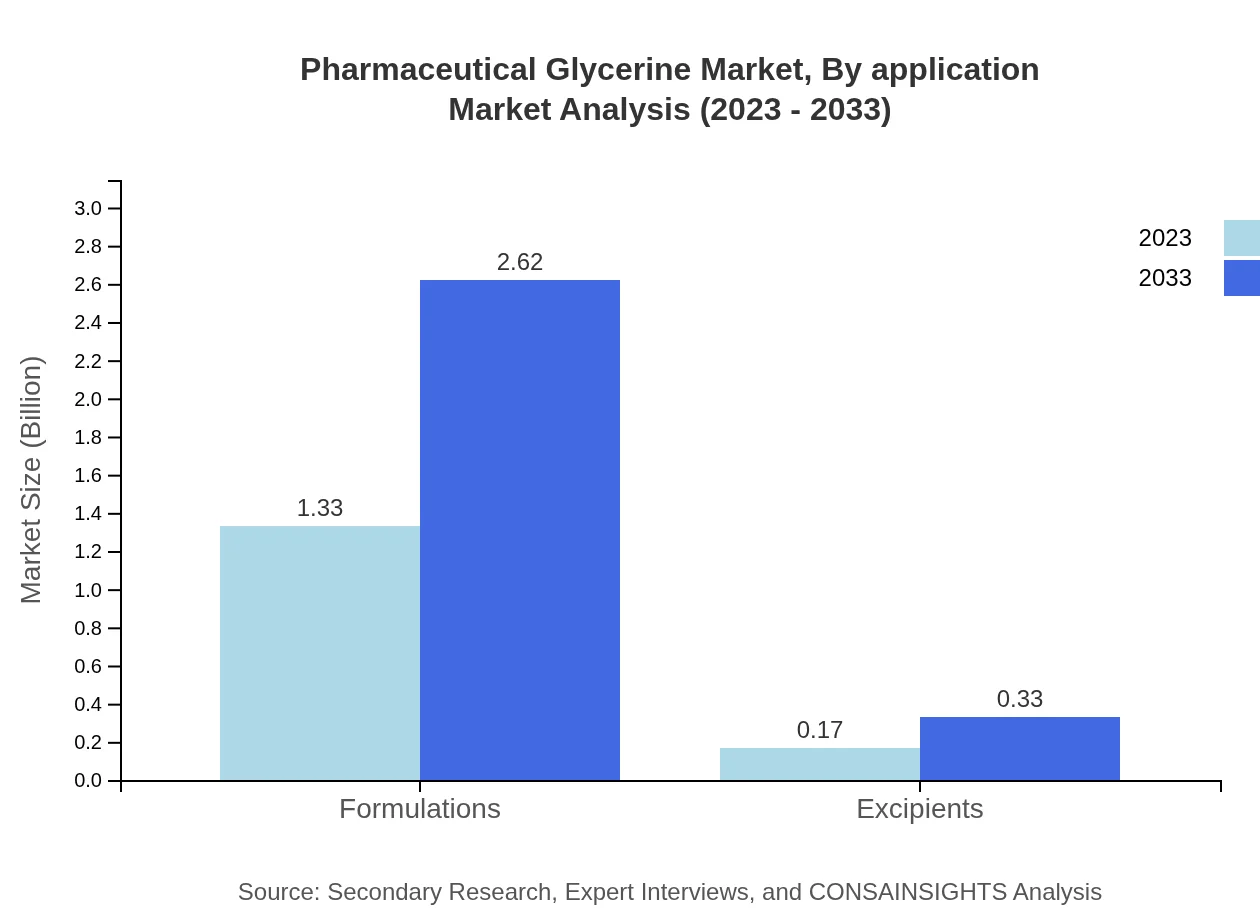

Pharmaceutical Glycerine Market Analysis By Application

The market segmentation by application comprises formulations, excipients, and others, with formulations being the largest segment, capturing 88.97% of the market in 2023. This highlights the essential role of glycerine in drug formulations and delivery systems, driving continuous innovations and advancements in its utilization.

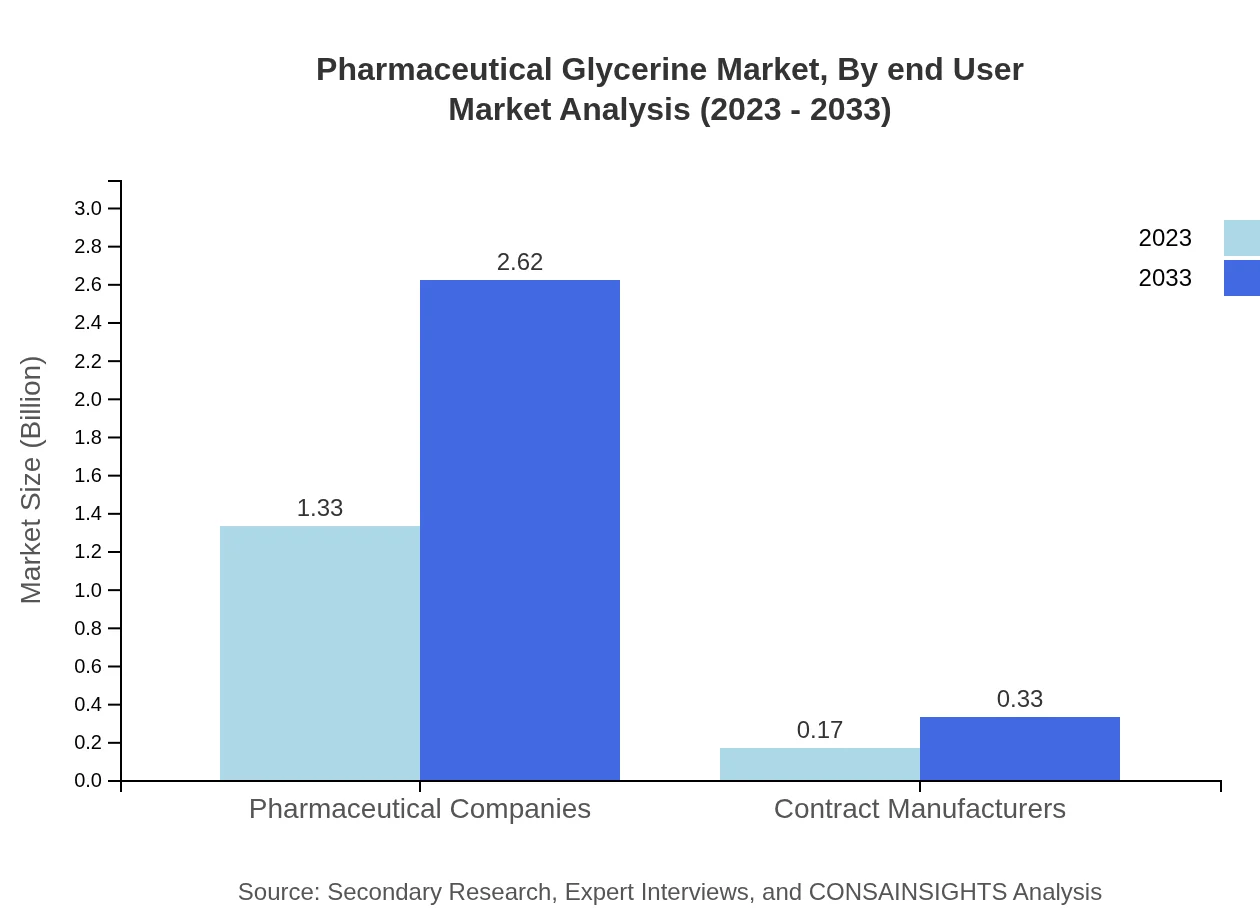

Pharmaceutical Glycerine Market Analysis By End User

The end-user segmentation includes pharmaceutical companies and contract manufacturers, where pharmaceutical companies dominate, holding 88.97% of the market in 2023. This is indicative of the increasing reliance on glycerine for various pharmaceutical applications amid growing product demand.

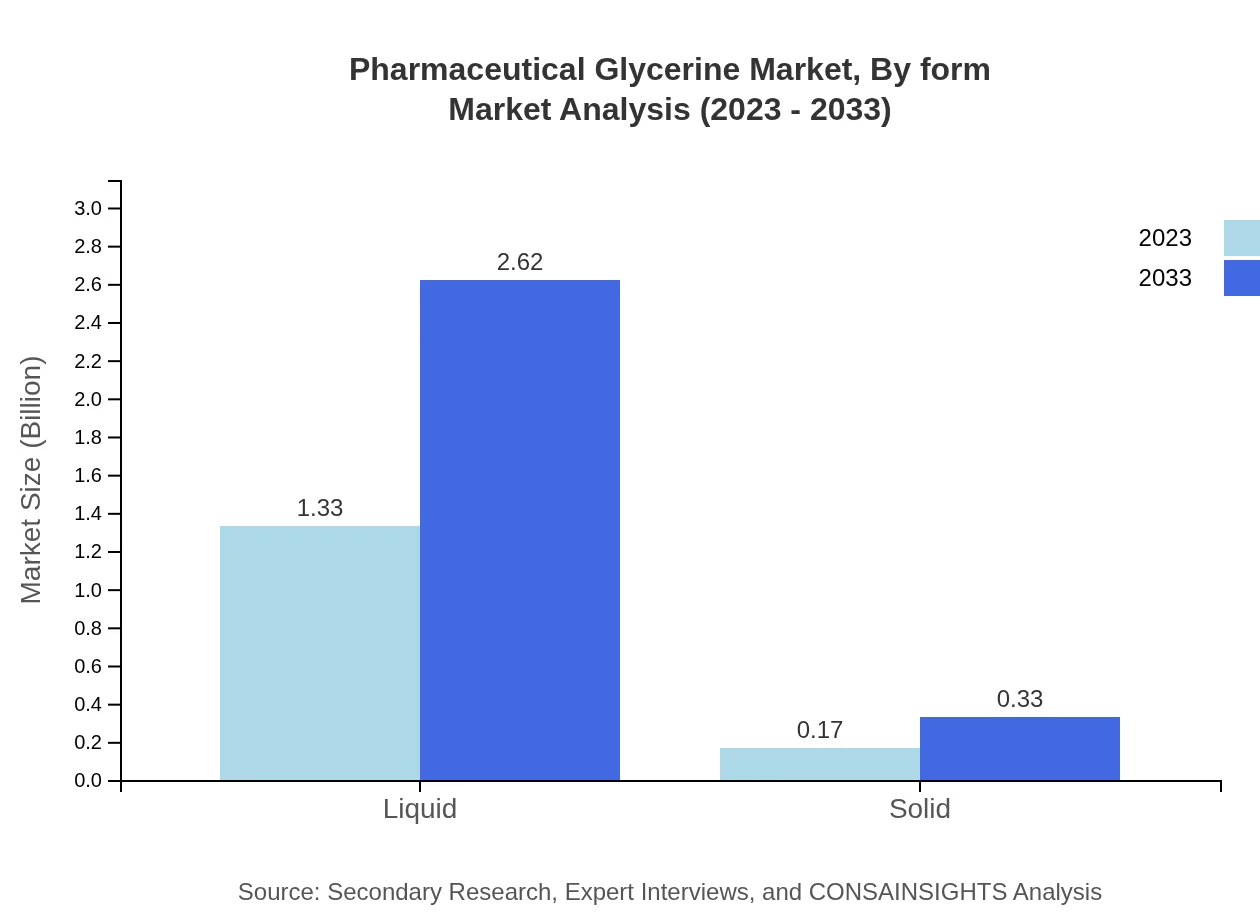

Pharmaceutical Glycerine Market Analysis By Form

The market by form includes liquid and solid categories, with liquid glycerine leading in market performance with 88.97% market share in 2023. The preference for liquid forms in pharmaceutical formulations reinforces this trend, showcasing the technological advancements in glycerine application processes.

Pharmaceutical Glycerine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Glycerine Industry

Newell Brands:

A leading player in specialty chemicals, Newell Brands manufacturers high-quality glycerin through innovative processes and sustainable practices, serving the pharmaceutical industry's growing needs.Cargill, Inc.:

Cargill is a global leader in food and agricultural products, producing glycerine that meets pharmaceutical standards to enhance product formulation and development in various health applications.Procter & Gamble Co.:

As a major consumer goods company, Procter & Gamble offers glycerine solutions that cater to pharmaceutical and cosmetic formulations, focusing on product safety and sustainability.Wilmar International Limited:

Wilmar is a significant player in the integrated agri-business sector, producing high-purity glycerine and emphasizing sustainable production methods to meet pharmaceutical demands.Kraton Corporation:

Kraton specializes in producing bio-based chemicals and offers glycerine solutions and derivatives that contribute to innovative pharmaceutical applications worldwide.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical glycerine?

The pharmaceutical glycerine market is valued at approximately $1.5 billion in 2023 and is projected to grow at a CAGR of 6.8%, indicating substantial growth potential over the next decade.

What are the key market players or companies in the pharmaceutical glycerine industry?

Key players in the pharmaceutical glycerine market include major pharmaceutical companies and contract manufacturers, which dominate with an 88.97% market share in pharmaceutical-grade products, ensuring consistent quality and availability.

What are the primary factors driving the growth in the pharmaceutical glycerine industry?

The growth in the pharmaceutical glycerine market is driven by increasing demand in pharmaceutical formulations, rising awareness of plant-based ingredients, and innovations in formulations that improve drug efficacy and stability.

Which region is the fastest Growing in the pharmaceutical glycerine market?

The Asia Pacific region is the fastest-growing market for pharmaceutical glycerine, projected to increase from $0.30 billion in 2023 to $0.58 billion by 2033, bolstered by emerging pharmaceutical sectors.

Does ConsaInsights provide customized market report data for the pharmaceutical glycerine industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs in the pharmaceutical glycerine industry, ensuring precise insights and market forecasts essential for strategic planning.

What deliverables can I expect from this pharmaceutical glycerine market research project?

Deliverables include comprehensive market analysis, segmentation data by type and region, trend forecasts, competitive landscape assessment, and actionable insights to guide market entry strategies.

What are the market trends of pharmaceutical glycerine?

Current trends in the pharmaceutical glycerine market include a shift towards natural and plant-based sources, increased utilization in excipients, and a growing emphasis on sustainability and eco-friendly manufacturing processes.