Pharmaceutical Grade Sodium Chloride Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-grade-sodium-chloride

Pharmaceutical Grade Sodium Chloride Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pharmaceutical Grade Sodium Chloride market, covering market size, growth forecasts, technology trends, and segment breakdowns from 2023 to 2033.

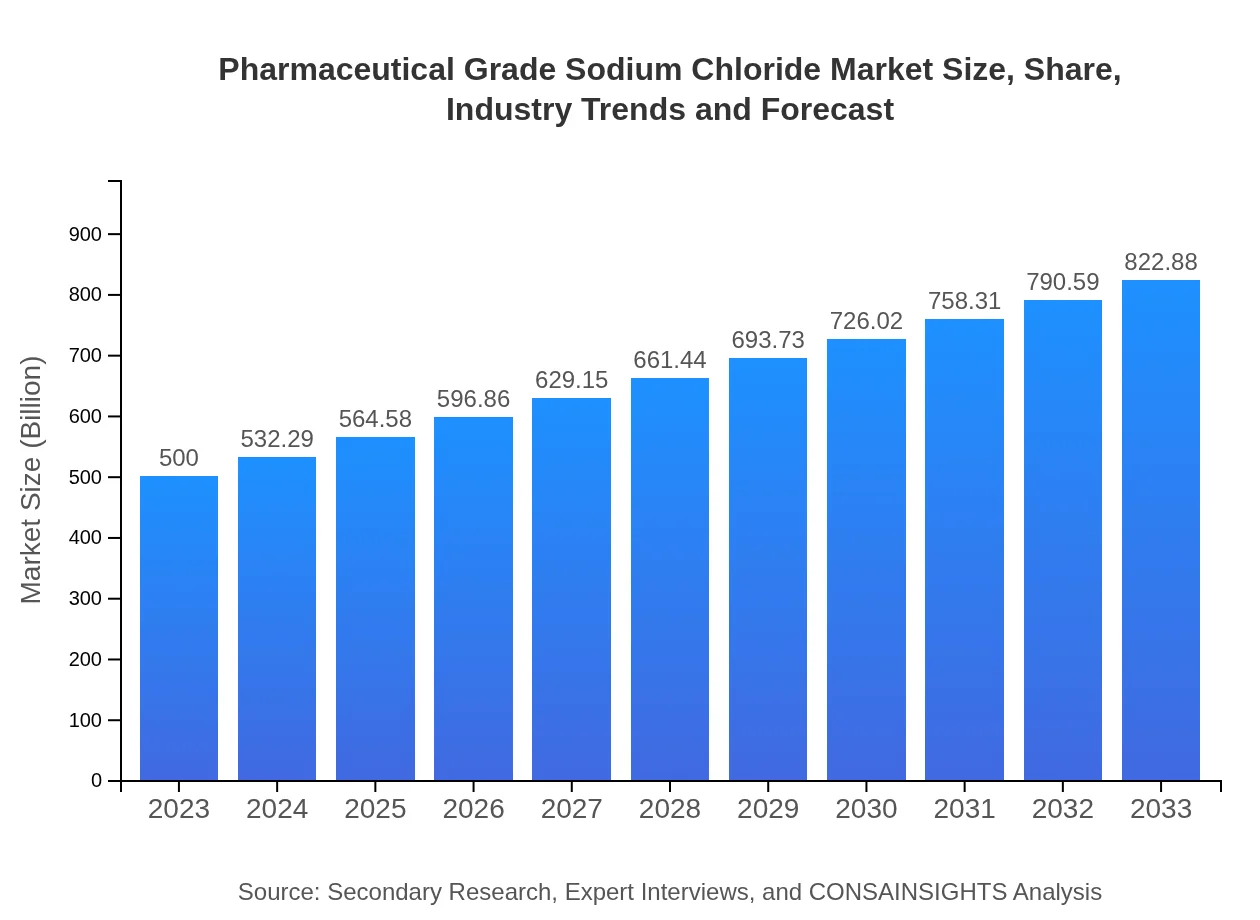

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $500.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $822.88 Million |

| Top Companies | Baxter International Inc., Fresenius Kabi AG, Hospira (a subsidiary of Pfizer Inc.) |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Grade Sodium Chloride Market Overview

Customize Pharmaceutical Grade Sodium Chloride Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Grade Sodium Chloride market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Grade Sodium Chloride's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Grade Sodium Chloride

What is the Market Size & CAGR of Pharmaceutical Grade Sodium Chloride market in 2023?

Pharmaceutical Grade Sodium Chloride Industry Analysis

Pharmaceutical Grade Sodium Chloride Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Grade Sodium Chloride Market Analysis Report by Region

Europe Pharmaceutical Grade Sodium Chloride Market Report:

In Europe, the market size for 2023 is approximately USD 157.90 million, anticipated to reach USD 259.87 million by 2033. The increase is supported by stringent regulatory standards ensuring product safety and efficacy.Asia Pacific Pharmaceutical Grade Sodium Chloride Market Report:

In 2023, the market size in the Asia Pacific region is valued at USD 94.20 million, projected to grow to USD 155.03 million by 2033. This growth is largely driven by increasing healthcare expenditure and improving access to medical facilities.North America Pharmaceutical Grade Sodium Chloride Market Report:

North America leads the market with an initial valuation of USD 181.35 million in 2023 and rising to USD 298.46 million by 2033. This growth is propelled by advanced healthcare systems and high demand for intravenous therapies.South America Pharmaceutical Grade Sodium Chloride Market Report:

For South America, the market size is estimated at USD 10.15 million in 2023, with an expected rise to USD 16.70 million by 2033. The growth reflects the enhancement of healthcare infrastructure and rising awareness regarding pharmaceutical-grade products in the region.Middle East & Africa Pharmaceutical Grade Sodium Chloride Market Report:

The Middle East and Africa's market size stands at USD 56.40 million in 2023, expected to grow to USD 92.82 million by 2033. Growth factors include increasing population health awareness and the expansion of health services.Tell us your focus area and get a customized research report.

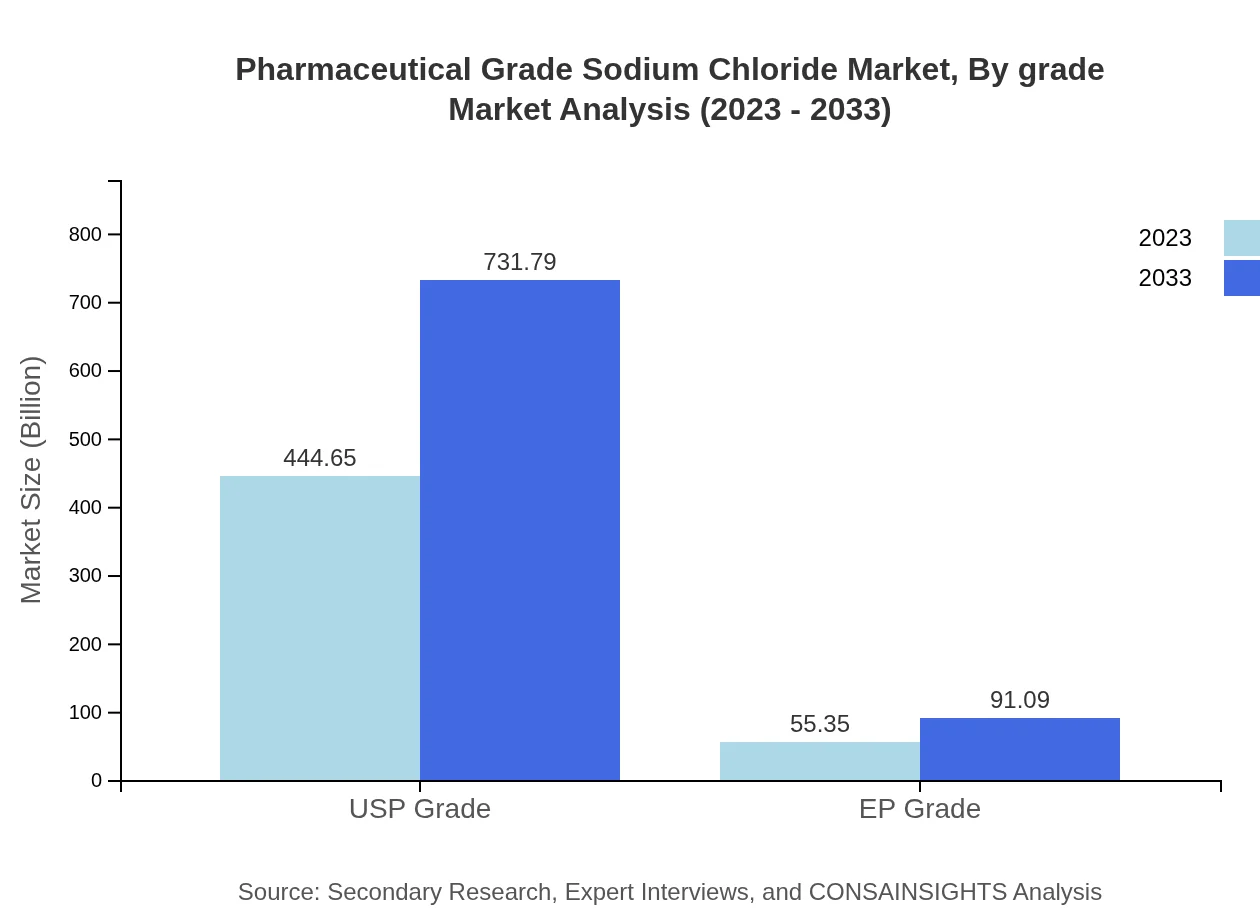

Pharmaceutical Grade Sodium Chloride Market Analysis By Grade

The market for pharmaceutical-grade sodium chloride is divided primarily into USP and EP grades. In 2023, the market for these grades is expected to be around USD 444.65 million, representing a significant share of 88.93%. By 2033, it is projected to grow to USD 731.79 million. The USP grade predominantly caters to the North American market, while EP is essential for compliance in European markets.

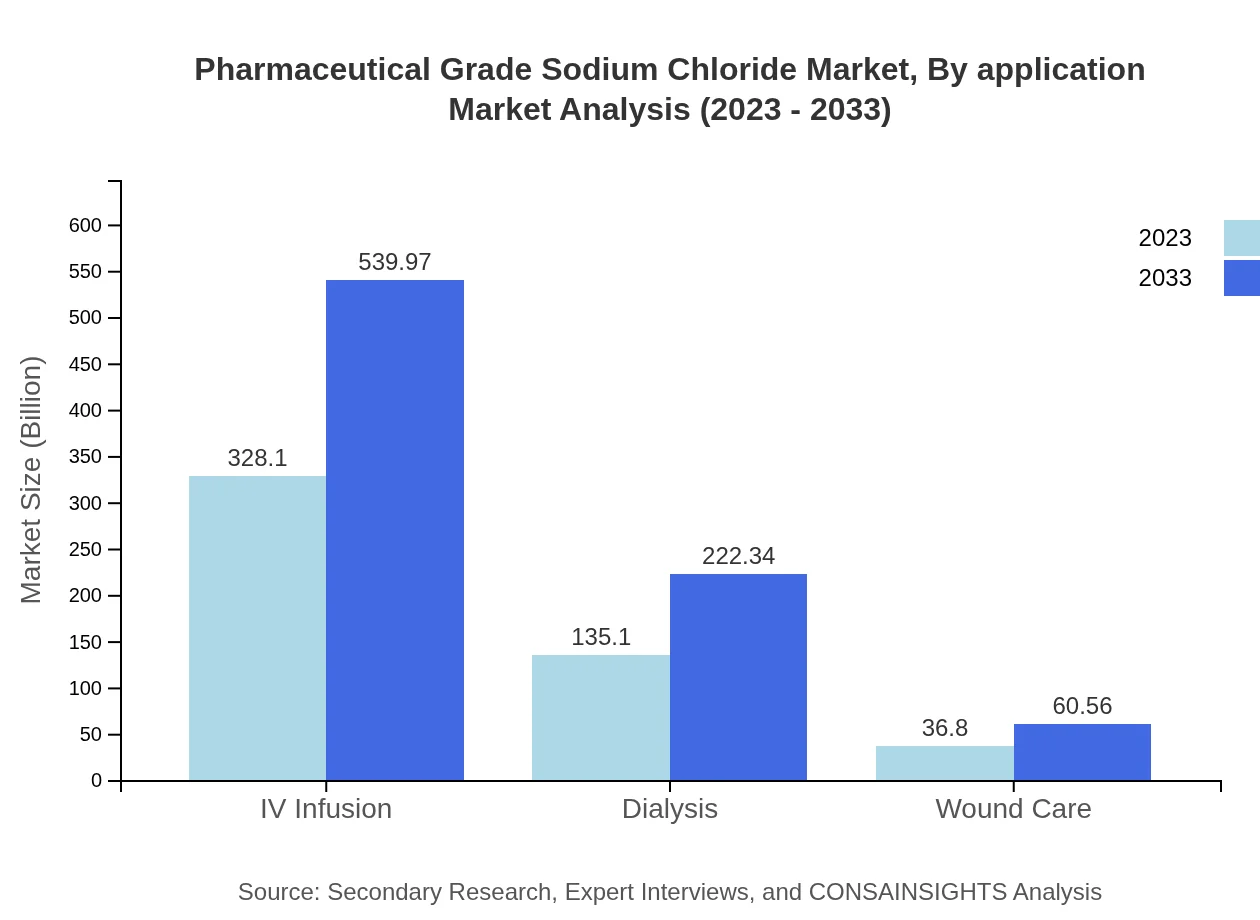

Pharmaceutical Grade Sodium Chloride Market Analysis By Application

Applications of Pharmaceutical Grade Sodium Chloride include IV Infusions, Dialysis, and Wound Care. The IV Infusion segment alone is projected to grow from USD 328.10 million in 2023 to USD 539.97 million by 2033, constituting 65.62% of the market. Each application area is critical in the healthcare system, indicating robust future growth.

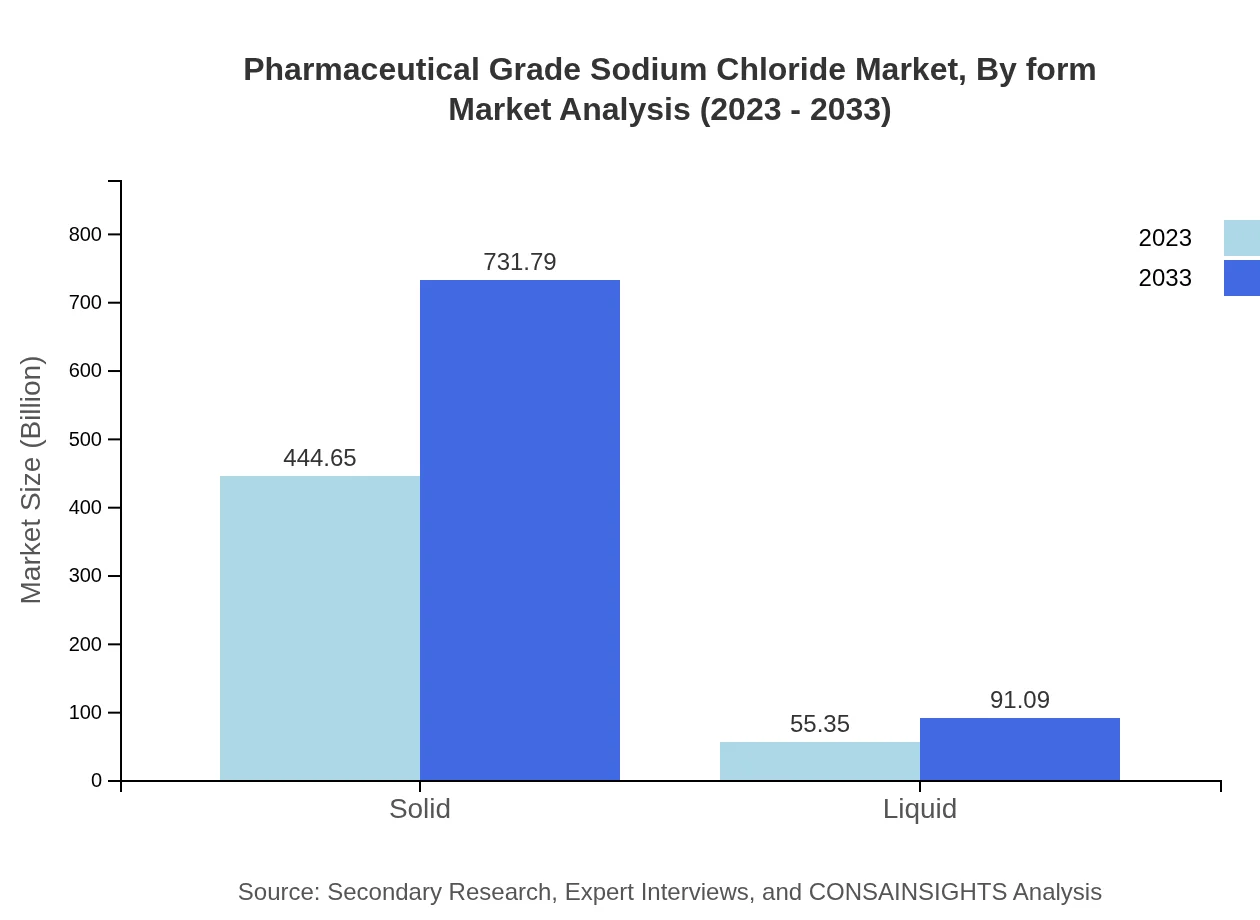

Pharmaceutical Grade Sodium Chloride Market Analysis By Form

Pharmaceutical Grade Sodium Chloride is available primarily in solid and liquid forms. The solid segment is expected to account for USD 444.65 million in 2023, with significant growth to USD 731.79 million by 2033. The liquid form, though smaller in volume, will increase from USD 55.35 million to USD 91.09 million, providing flexibility in medical applications.

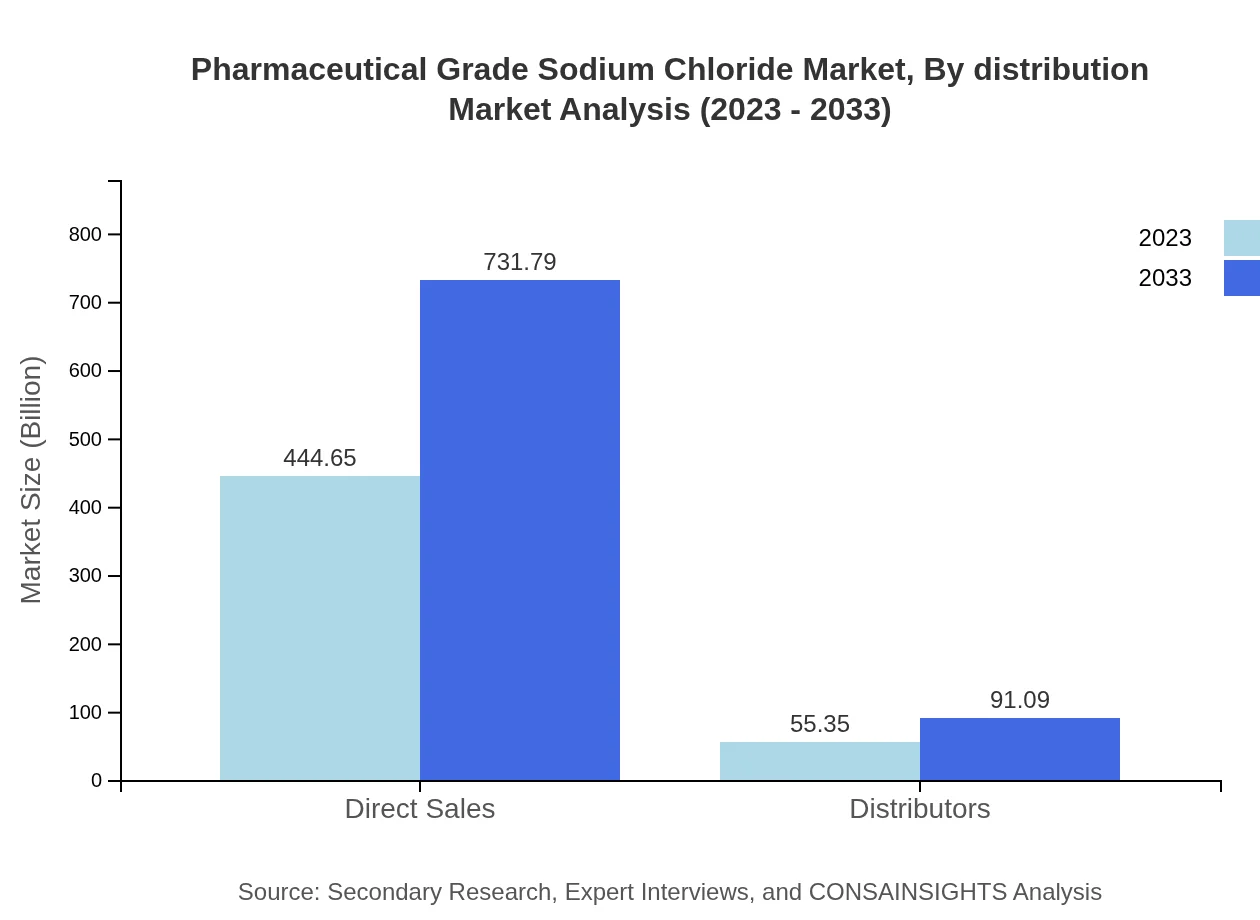

Pharmaceutical Grade Sodium Chloride Market Analysis By Distribution

The distribution of Pharmaceutical Grade Sodium Chloride occurs mainly through Direct Sales and Distributors. Direct sales are projected to represent 88.93% of the market share, indicating strong manufacturer-consumer relationships that ensure product integrity and quality assurance.

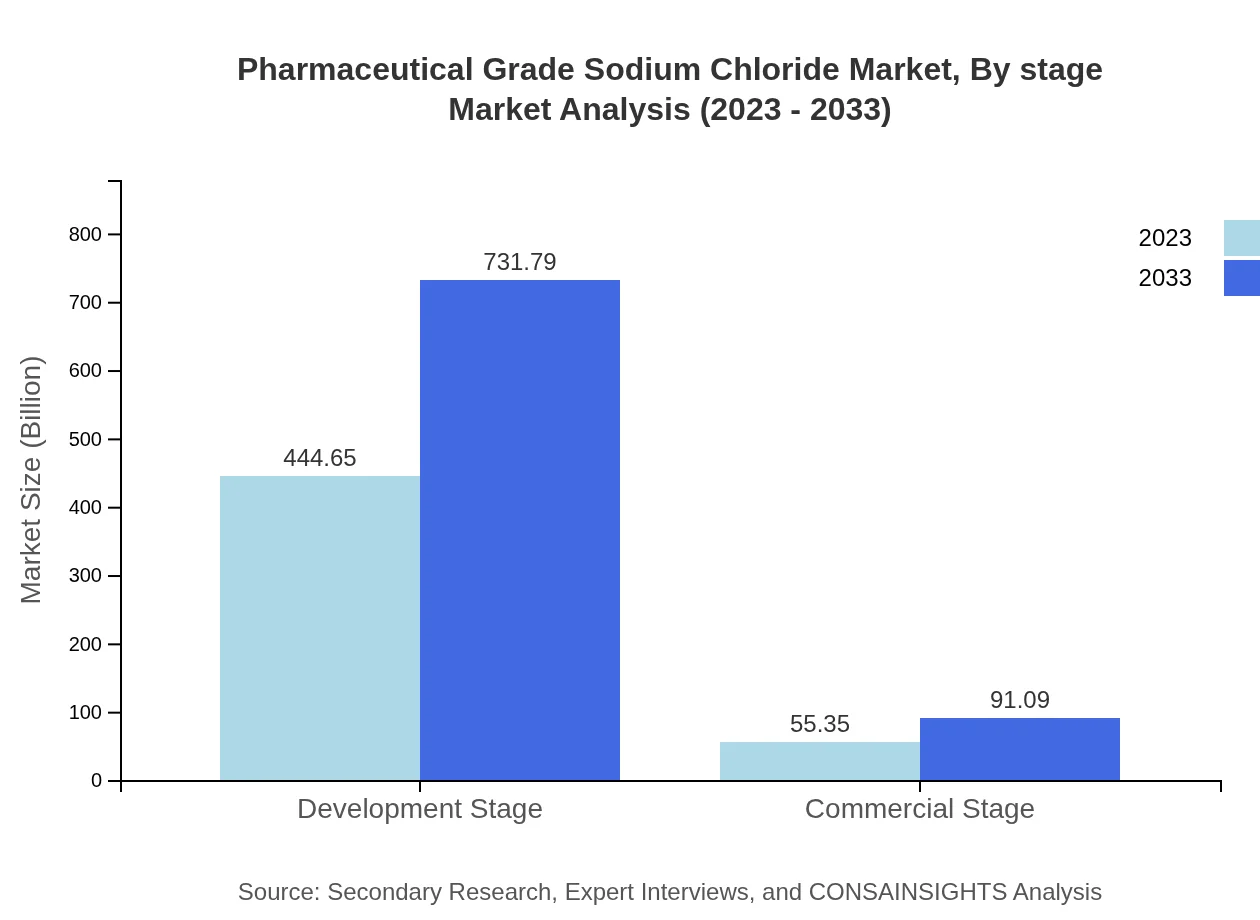

Pharmaceutical Grade Sodium Chloride Market Analysis By Stage

The market can be segmented into Development Stage and Commercial Stage. The development stage segment will absorb the most significant share at 88.93% in 2023, illustrating the ongoing research and innovation in the development of pharmaceutical-grade products.

Pharmaceutical Grade Sodium Chloride Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Grade Sodium Chloride Industry

Baxter International Inc.:

Baxter is a renowned leader in the global pharmaceutical industry, specializing in water-soluble formulations and infusion solutions, with a strong focus on quality and compliance.Fresenius Kabi AG:

Fresenius Kabi is a prominent manufacturer of generic pharmaceuticals and provides high-quality intravenous solutions, positioning itself as a major player in the sodium chloride market.Hospira (a subsidiary of Pfizer Inc.):

Hospira delivers a wide range of injectable drugs and is committed to maintaining the highest standards of quality, including pharmaceutical-grade sodium chloride for various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical Grade Sodium Chloride?

The pharmaceutical-grade sodium chloride market is valued at approximately $500 million in 2023, expecting a compound annual growth rate (CAGR) of 5% through 2033, reflecting a sustainable growth trend in the industry.

What are the key market players or companies in this pharmaceutical Grade Sodium Chloride industry?

Key players in the pharmaceutical-grade sodium chloride market include global giants like Fresenius Kabi, Baxter International, and Otsuka Pharmaceutical, which provide essential sodium chloride products for various medical applications, enhancing industry competition.

What are the primary factors driving the growth in the pharmaceutical Grade Sodium Chloride industry?

Growth factors include increasing healthcare demands, expansion of healthcare infrastructure, rising applications in IV infusions, and the growing prevalence of chronic diseases necessitating efficient saline solutions and wound care treatments.

Which region is the fastest Growing in the pharmaceutical Grade Sodium Chloride market?

North America stands out as the fastest-growing region, with market growth from $181.35 million in 2023 to $298.46 million in 2033, driven by advanced healthcare systems and increased demand for pharmaceutical products.

Does ConsaInsights provide customized market report data for the pharmaceutical Grade Sodium Chloride industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the pharmaceutical-grade sodium chloride industry, enabling stakeholders to gain insights that align precisely with their strategic goals.

What deliverables can I expect from this pharmaceutical Grade Sodium Chloride market research project?

Deliverables include comprehensive market analysis reports, future growth projections, competitive landscape assessments, and segment-wise data, providing clear insights to aid in decision-making processes.

What are the market trends of pharmaceutical Grade Sodium Chloride?

Current trends include a steady shift towards higher purity grades, increased adoption in innovative medical applications, and rising demand for sodium chloride in manufacturing, driven by advancements in pharmaceutical processes.