Pharmaceutical Intermediates Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-intermediates

Pharmaceutical Intermediates Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Pharmaceutical Intermediates market, covering insights from 2023 to 2033, including market size, trends, regional analysis, and key players shaping the industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

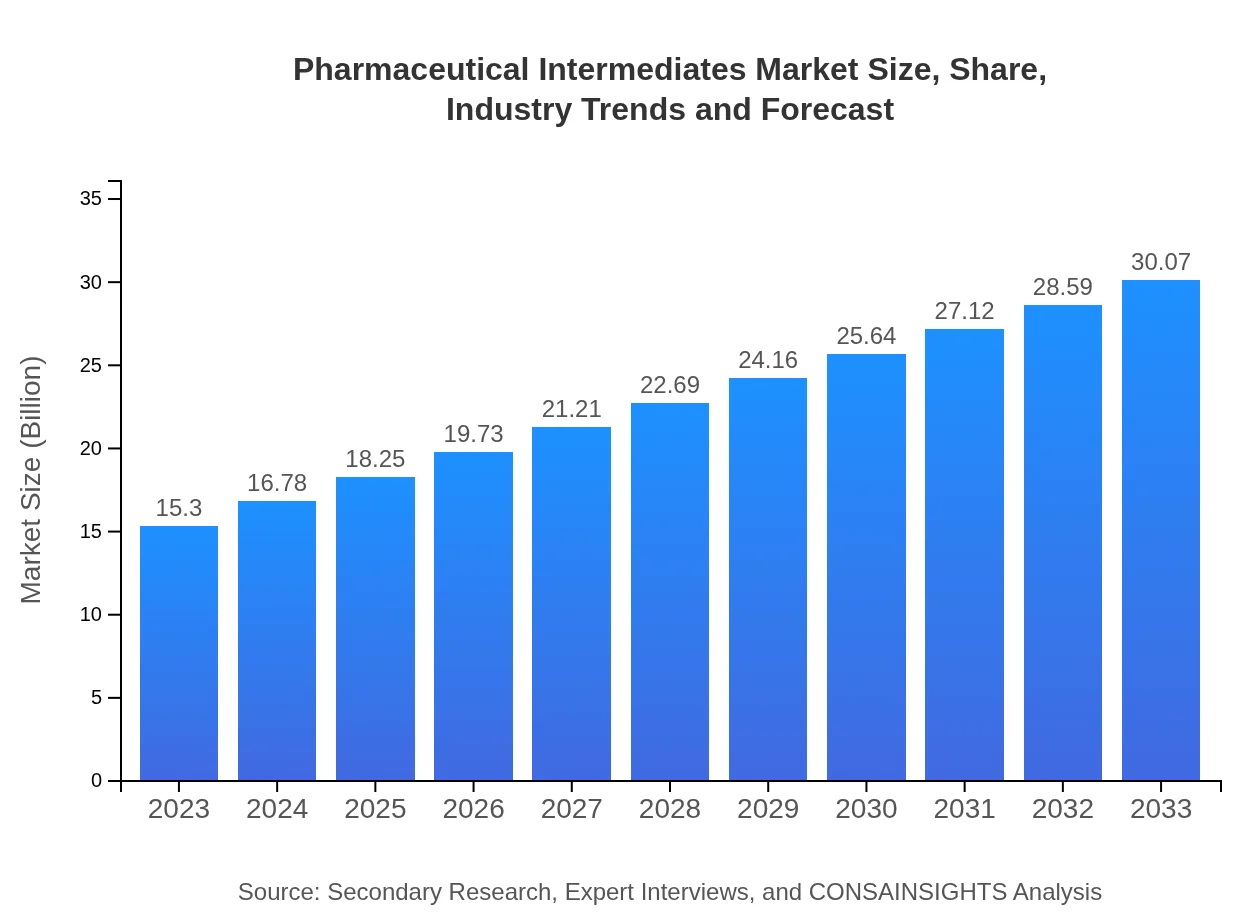

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $30.07 Billion |

| Top Companies | BASF SE, Boehringer Ingelheim, Lonza Group AG, Hermes Pharma, Solvay S.A. |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Intermediates Market Overview

Customize Pharmaceutical Intermediates Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Intermediates market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Intermediates's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Intermediates

What is the Market Size & CAGR of Pharmaceutical Intermediates market in 2023?

Pharmaceutical Intermediates Industry Analysis

Pharmaceutical Intermediates Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Intermediates Market Analysis Report by Region

Europe Pharmaceutical Intermediates Market Report:

Europe's Pharmaceutical Intermediates market stands at about $4.54 billion in 2023, anticipated to nearly double to $8.92 billion by 2033. The region benefits from rigorous quality standards and an established pharmaceutical infrastructure promoting innovation and manufacturing excellence.Asia Pacific Pharmaceutical Intermediates Market Report:

In 2023, the Asia Pacific region holds a market value of approximately $2.83 billion, anticipated to grow to about $5.56 billion by 2033. The growth is propelled by increasing investments in pharmaceutical R&D, expanding manufacturing capabilities, and favorable regulatory environments in countries like China and India.North America Pharmaceutical Intermediates Market Report:

North America dominates the market with a value of $5.73 billion in 2023, expected to escalate to $11.26 billion by 2033. Factors driving this growth include a strong pharmaceutical sector, increased adoption of contract manufacturing, and substantial investment in biotechnology.South America Pharmaceutical Intermediates Market Report:

The South American market for Pharmaceutical Intermediates is valued at around $0.72 billion in 2023, projected to reach $1.41 billion by 2033. This growth can be attributed to rising healthcare demands, along with government initiatives to bolster local pharmaceutical production.Middle East & Africa Pharmaceutical Intermediates Market Report:

Valued at $1.49 billion in 2023, the Middle East and Africa market is projected to grow to $2.92 billion by 2033. Key growth drivers include improving healthcare systems, increasing pharmaceutical supplies, and growing demand for affordable medicines.Tell us your focus area and get a customized research report.

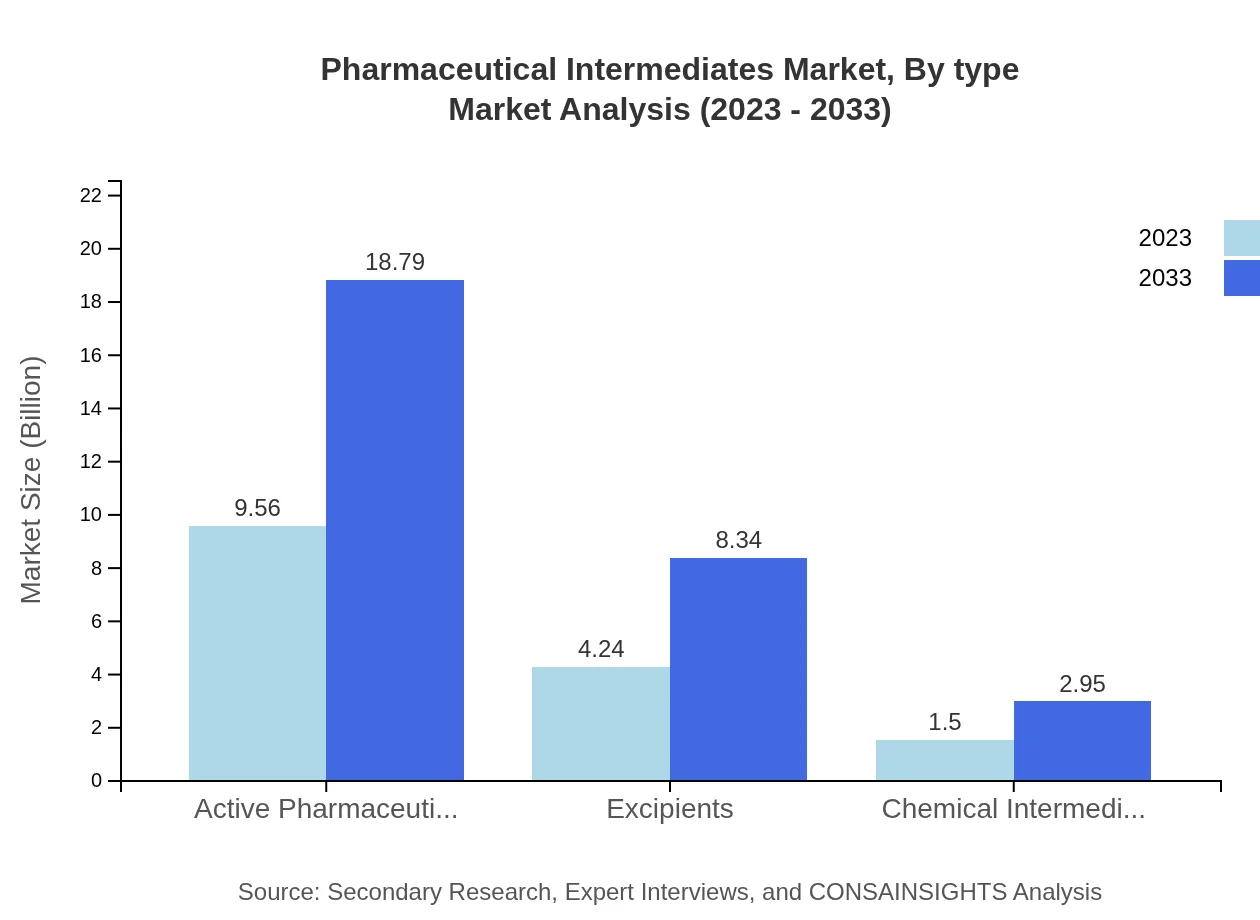

Pharmaceutical Intermediates Market Analysis By Type

In the Pharmaceutical Intermediates market, Active Pharmaceutical Ingredients (APIs) dominate with a market size of $9.56 billion in 2023, expected to reach $18.79 billion by 2033, representing a share of 62.48%. Excipients follow with a market size growing from $4.24 billion to $8.34 billion, maintaining a 27.72% share. Chemical Intermediates represent a smaller but crucial segment, with a growth projection from $1.50 billion to $2.95 billion, holding 9.8% share.

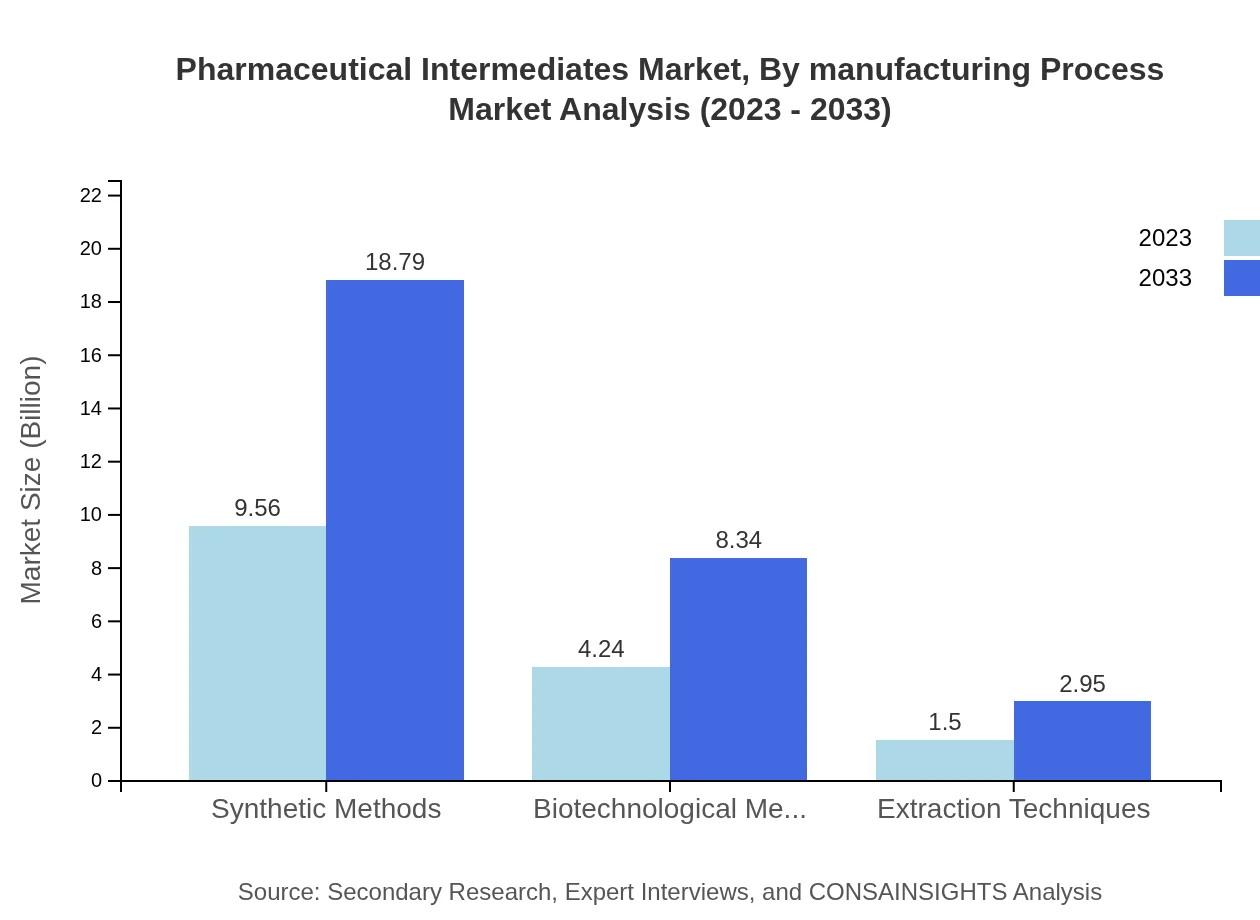

Pharmaceutical Intermediates Market Analysis By Manufacturing Process

This market segment reflects the methodologies employed in the production of intermediates. Synthetic Methods lead the segment with a market value of $9.56 billion in 2023, doubling to $18.79 billion by 2033, while Biotechnological Methods and Extraction Techniques showcase a steady growth from $4.24 billion and $1.50 billion respectively, reflecting ongoing advancements in green manufacturing techniques.

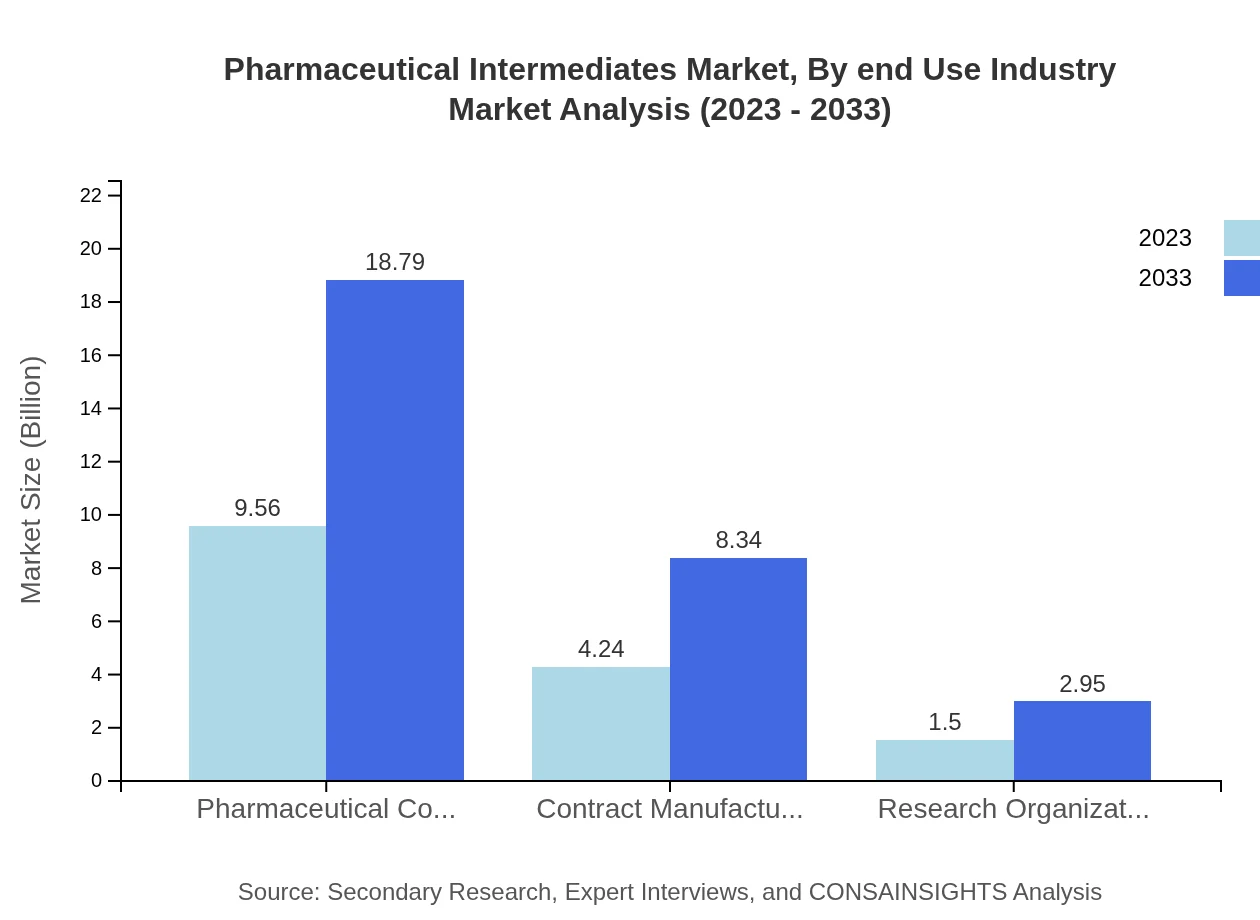

Pharmaceutical Intermediates Market Analysis By End Use Industry

Pharmaceutical Companies are significant stakeholders, commanding a market size of $9.56 billion in 2023 and projected to grow alongside the increased demand for generic and branded medications. Contract Manufacturers and Research Organizations also represent substantial portions of the market, growing from $4.24 billion and $1.50 billion respectively, driven by enhanced outsourcing trends.

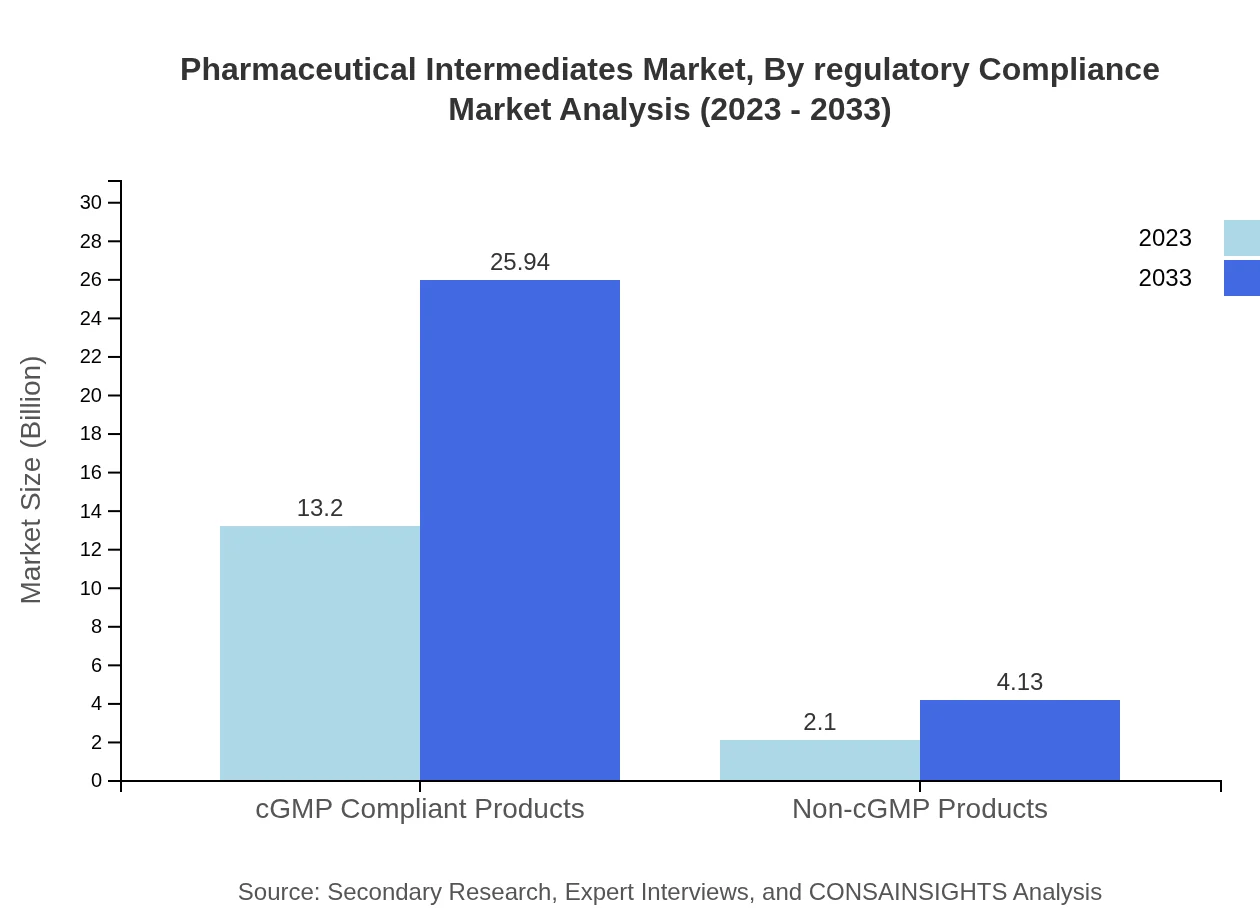

Pharmaceutical Intermediates Market Analysis By Regulatory Compliance

The market segment shows a division between cGMP Compliant Products, valued at $13.20 billion in 2023 and expected to grow to $25.94 billion by 2033, reflecting stringent regulatory adherence. Non-cGMP Products, while smaller in size, hold relevance with growth from $2.10 billion to $4.13 billion as the regulatory framework evolves.

Pharmaceutical Intermediates Market Analysis By Application Area

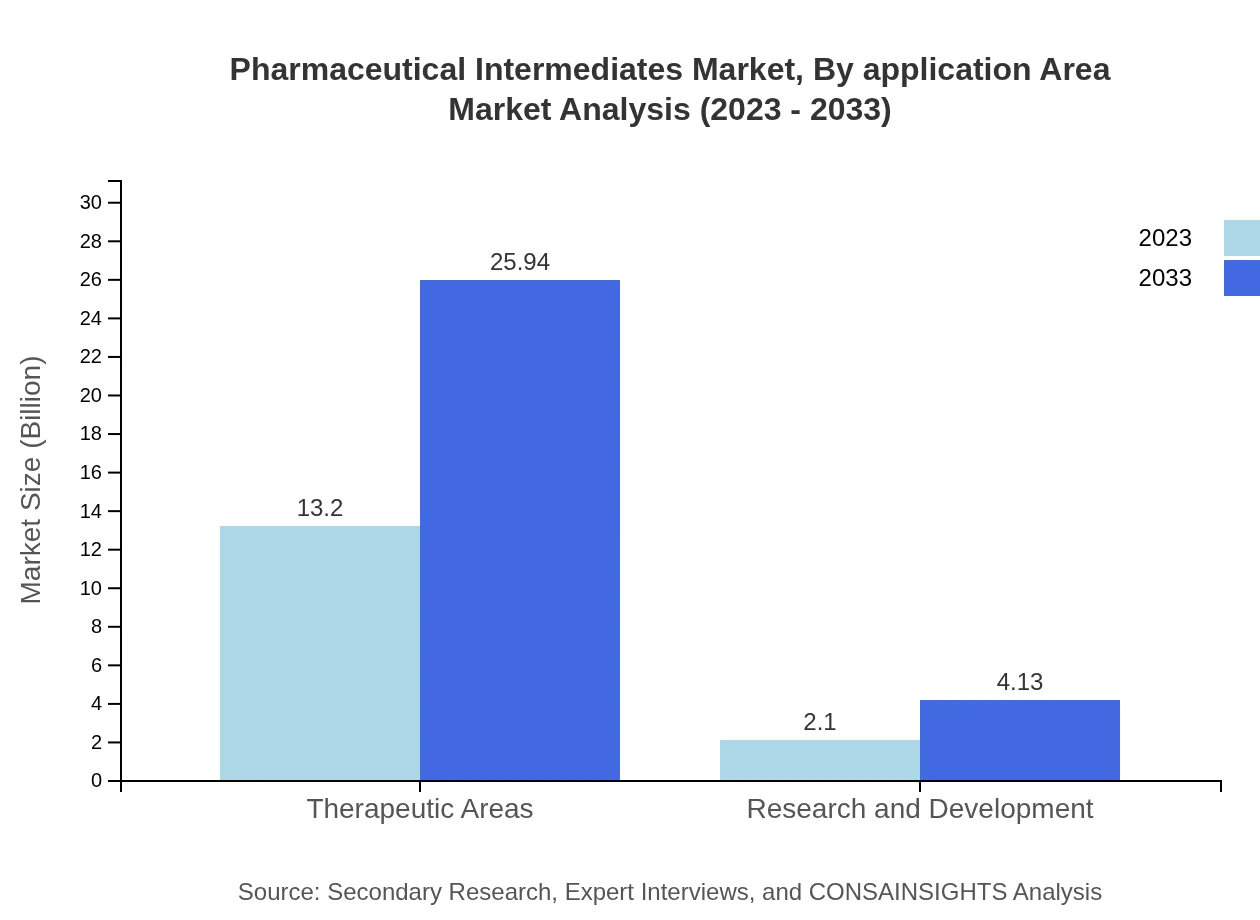

The Therapeutic Areas represent a notable segment, with a market size of $13.20 billion in 2023, expected to expand to $25.94 billion by 2033. Research and Development also plays a critical role, highlighting sustained investment in novel therapies as evidenced by growth from $2.10 billion to $4.13 billion.

Pharmaceutical Intermediates Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Intermediates Industry

BASF SE:

A leading chemical producer, BASF SE delivers a wide range of pharmaceutical intermediates, leveraging advanced production technologies and sustainable practices to meet industry needs.Boehringer Ingelheim:

Specializing in biopharmaceuticals, Boehringer Ingelheim manufactures high-quality intermediates, playing a significant role in the global pharmaceutical supply chain.Lonza Group AG:

Lonza is a prominent player in the pharmaceutical intermediates sector, offering integrated solutions from drug development to manufacturing.Hermes Pharma:

Recognized for its efficient production methods, Hermes Pharma provides various intermediates essential for pharmaceutical applications.Solvay S.A.:

With a strong focus on innovation, Solvay delivers high-performance intermediates for pharmaceutical manufacturing, contributing to various therapeutic applications.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical intermediates?

The pharmaceutical intermediates market is valued at approximately $15.3 billion in 2023 and is expected to grow at a CAGR of 6.8%, reaching significant growth by 2033.

What are the key market players or companies in the pharmaceutical intermediates industry?

Key players in the pharmaceutical intermediates industry include global pharmaceutical companies, contract manufacturers, and research organizations, which contribute to a competitive landscape focused on innovation and supply chain optimization.

What are the primary factors driving the growth in the pharmaceutical intermediates industry?

Growth in the pharmaceutical intermediates industry is driven by increasing pharmaceutical manufacturing, rising demand for APIs, and advancements in drug development technologies, alongside regulatory support enhancing production capabilities.

Which region is the fastest Growing in the pharmaceutical intermediates?

The fastest-growing region in the pharmaceutical intermediates market is North America, which is projected to expand from $5.73 billion in 2023 to $11.26 billion in 2033, reflecting a strong growth trajectory.

Does ConsaInsights provide customized market report data for the pharmaceutical intermediates industry?

Yes, ConsaInsights offers customized market report data for the pharmaceutical intermediates industry, tailoring insights to meet the specific business needs of clients across various sectors.

What deliverables can I expect from this pharmaceutical intermediates market research project?

Clients can expect comprehensive deliverables, including detailed market analysis, segment performance, regional insights, and forecasts, all designed to support strategic decision-making in the pharmaceutical intermediates market.

What are the market trends of pharmaceutical intermediates?

Current trends in the pharmaceutical intermediates market include a shift towards biotechnology, increased demand for cGMP-compliant products, and the adoption of sustainable practices in manufacturing and development.