Pharmaceutical Membrane Filtration Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-membrane-filtration

Pharmaceutical Membrane Filtration Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Pharmaceutical Membrane Filtration market, covering insights on market trends, size, and forecasts from 2023 to 2033, alongside region-specific developments and company profiles.

| Metric | Value |

|---|---|

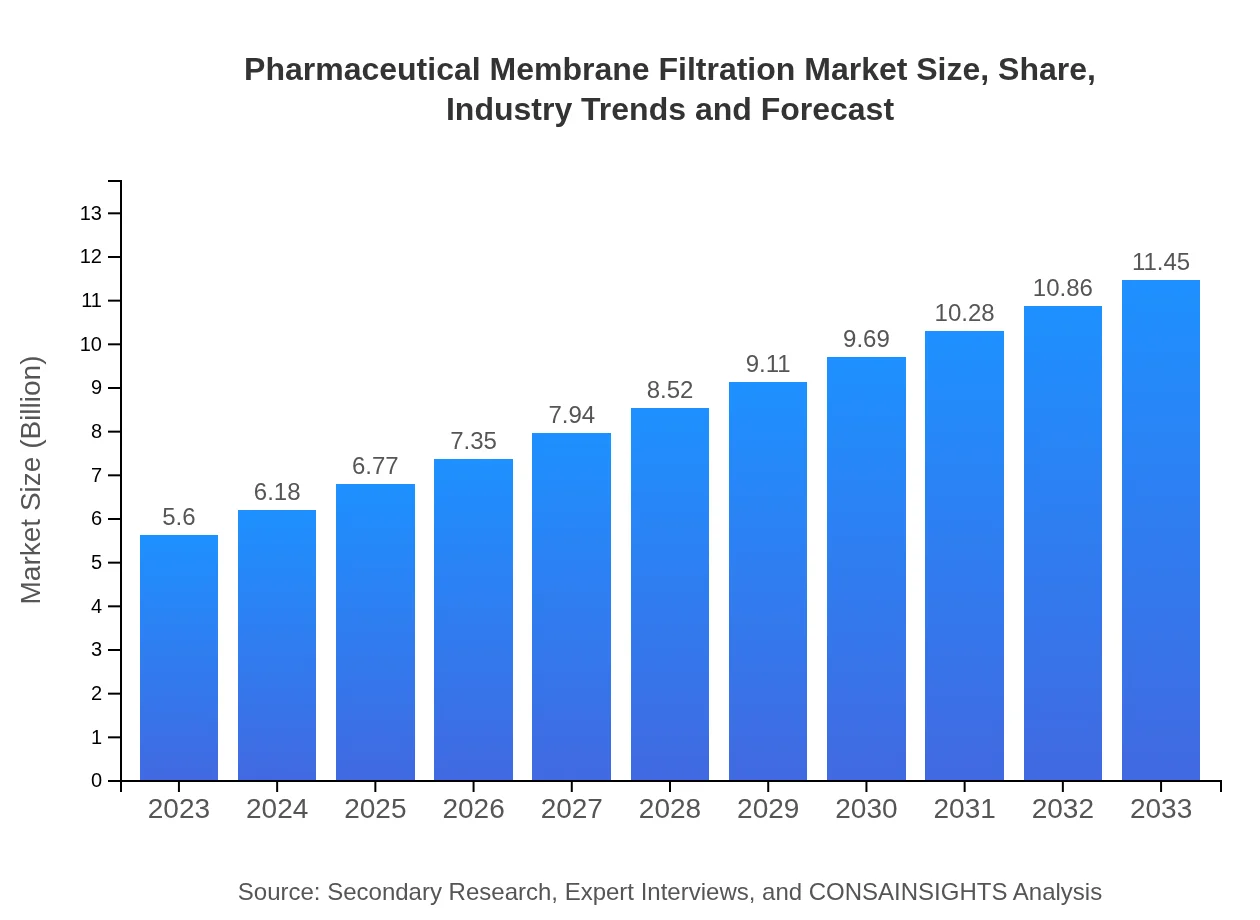

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $11.45 Billion |

| Top Companies | Merck Group, Pall Corporation, Sartorius AG, MilliporeSigma, GE Healthcare |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Membrane Filtration Market Overview

Customize Pharmaceutical Membrane Filtration Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Membrane Filtration market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Membrane Filtration's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Membrane Filtration

What is the Market Size & CAGR of Pharmaceutical Membrane Filtration market in 2023?

Pharmaceutical Membrane Filtration Industry Analysis

Pharmaceutical Membrane Filtration Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Membrane Filtration Market Analysis Report by Region

Europe Pharmaceutical Membrane Filtration Market Report:

In Europe, the market is set to rise from $1.74 billion in 2023 to approximately $3.56 billion by 2033, supported by strong regulatory frameworks that prioritize product safety and technological advancements in membrane filtration.Asia Pacific Pharmaceutical Membrane Filtration Market Report:

In the Asia Pacific region, the Pharmaceutical Membrane Filtration market is projected to grow from $1.06 billion in 2023 to approximately $2.17 billion by 2033. This growth is driven by expanding pharmaceutical industries in countries like China and India, alongside increasing investments in research and development for biopharmaceuticals.North America Pharmaceutical Membrane Filtration Market Report:

North America remains a leading market, growing from $1.98 billion in 2023 to about $4.05 billion in 2033. This region benefits from established pharmaceutical companies and a robust R&D environment pushing forward innovations in membrane technologies.South America Pharmaceutical Membrane Filtration Market Report:

The South American market is expected to grow modestly, from $0.37 billion in 2023 to $0.75 billion by 2033, as healthcare systems improve and local demand for advanced filtration techniques rises in both pharmaceuticals and food industries.Middle East & Africa Pharmaceutical Membrane Filtration Market Report:

The Middle East and Africa region shows potential growth from $0.45 billion in 2023 to $0.92 billion by 2033, largely due to improving healthcare infrastructure and increasing awareness of advanced filtration technologies.Tell us your focus area and get a customized research report.

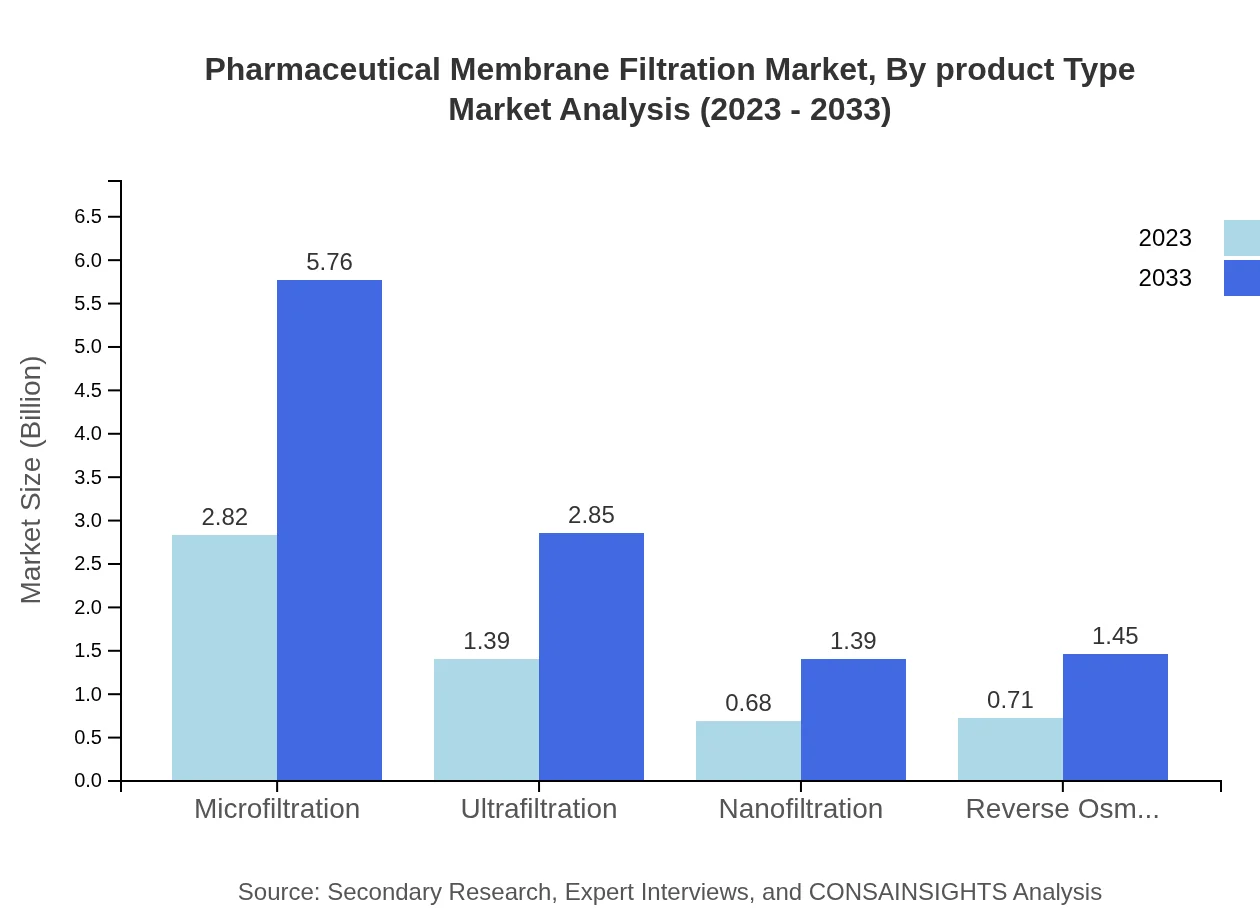

Pharmaceutical Membrane Filtration Market Analysis By Product Type

Segmentation by product type reveals that microfiltration, ultrafiltration, and sterile filtration represent the largest shares of the market, with microfiltration boasting significant growth due to its applications in various pharmaceutical processes. This reflects a shift towards more sophisticated methods of purification and separation in drug development.

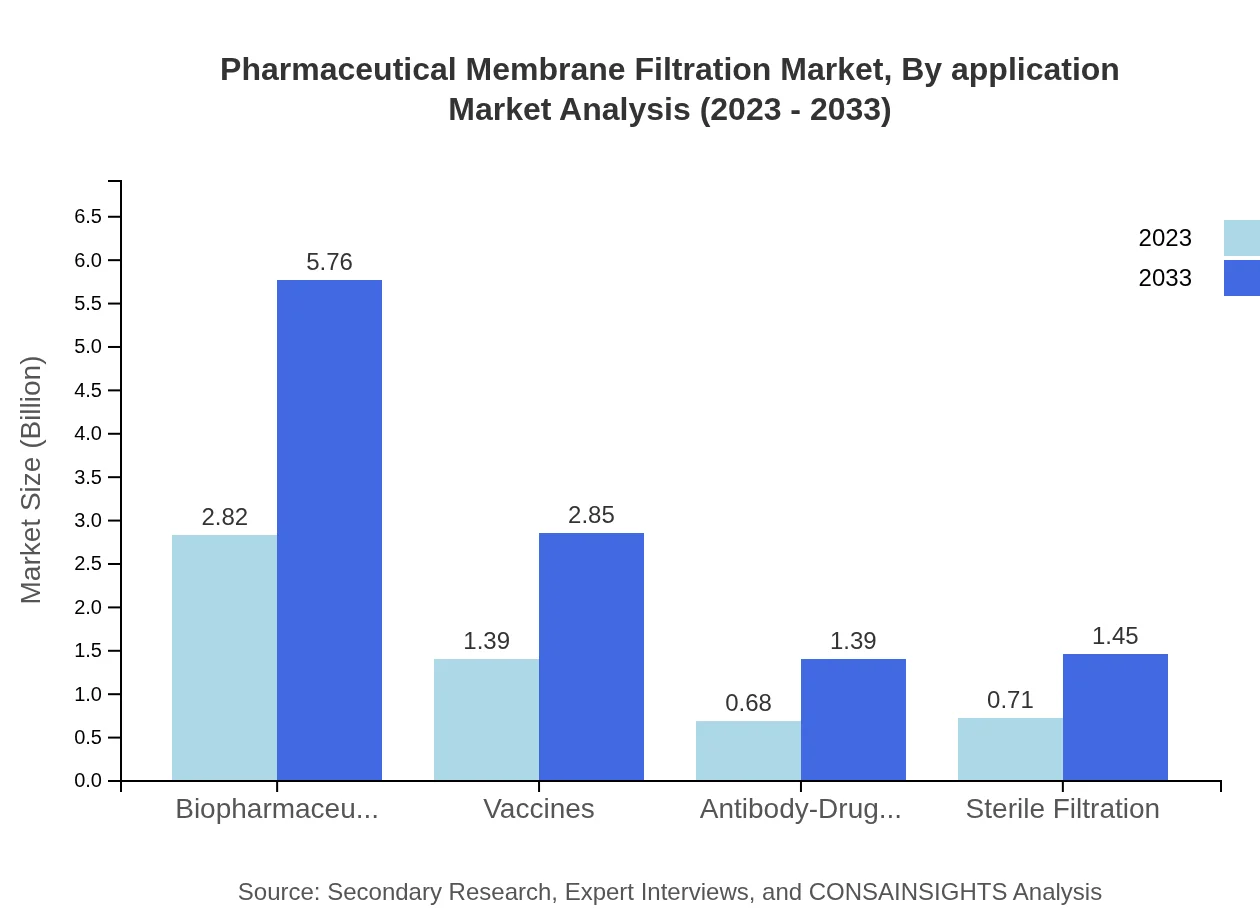

Pharmaceutical Membrane Filtration Market Analysis By Application

The application segment is diversified, encompassing biopharmaceutical production, vaccine development, and research applications. The increasing use of filtration in the production of monoclonal antibodies highlights the growing requirement for effective filtration methods tailored to specific applications, driving overall market growth.

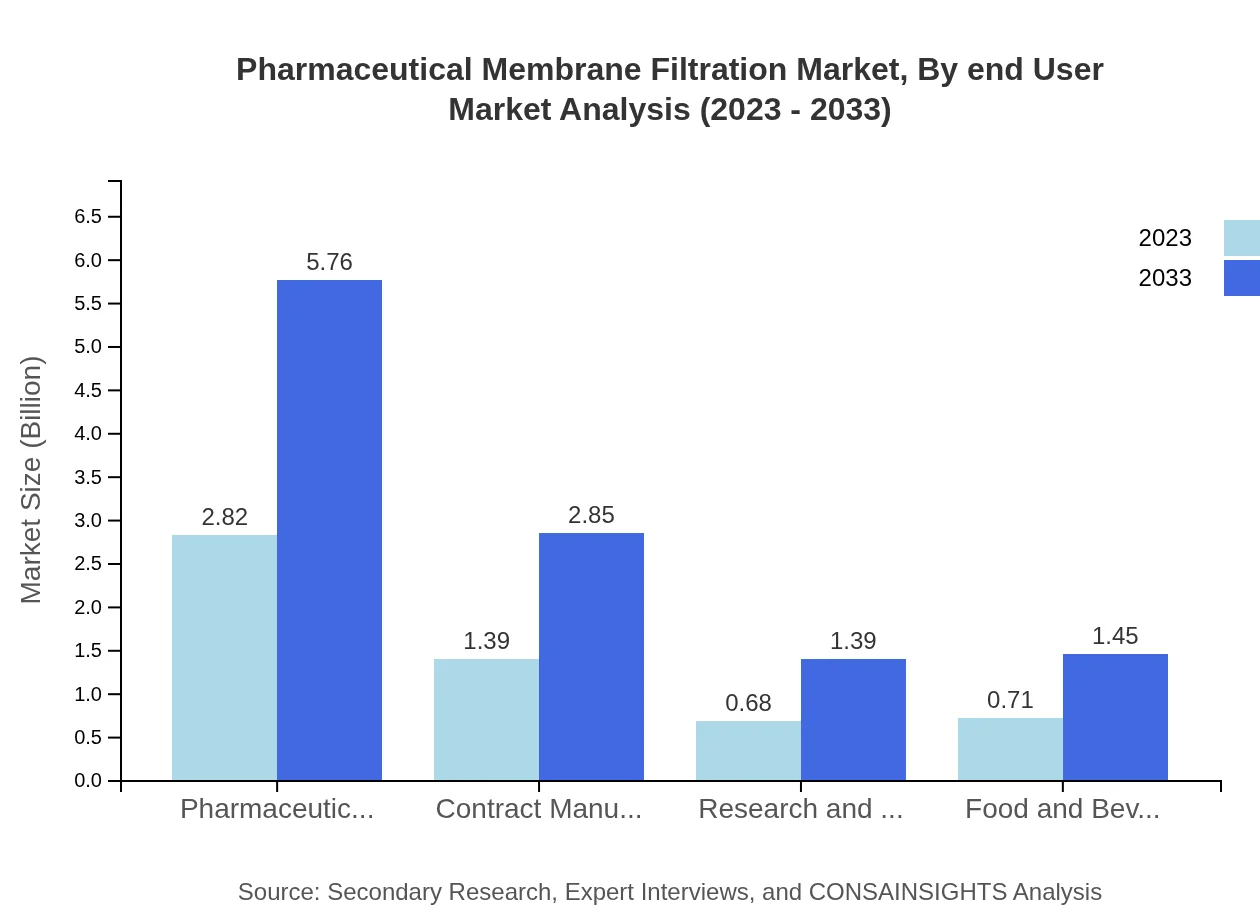

Pharmaceutical Membrane Filtration Market Analysis By End User

Pharmaceutical manufacturers and biopharmaceutical companies represent the largest shares of the market, responsible for over 50% of market activity. Additionally, contract manufacturing organizations are emerging as significant users of membrane filtration technologies, indicating an evolving landscape within contract-based manufacturing models.

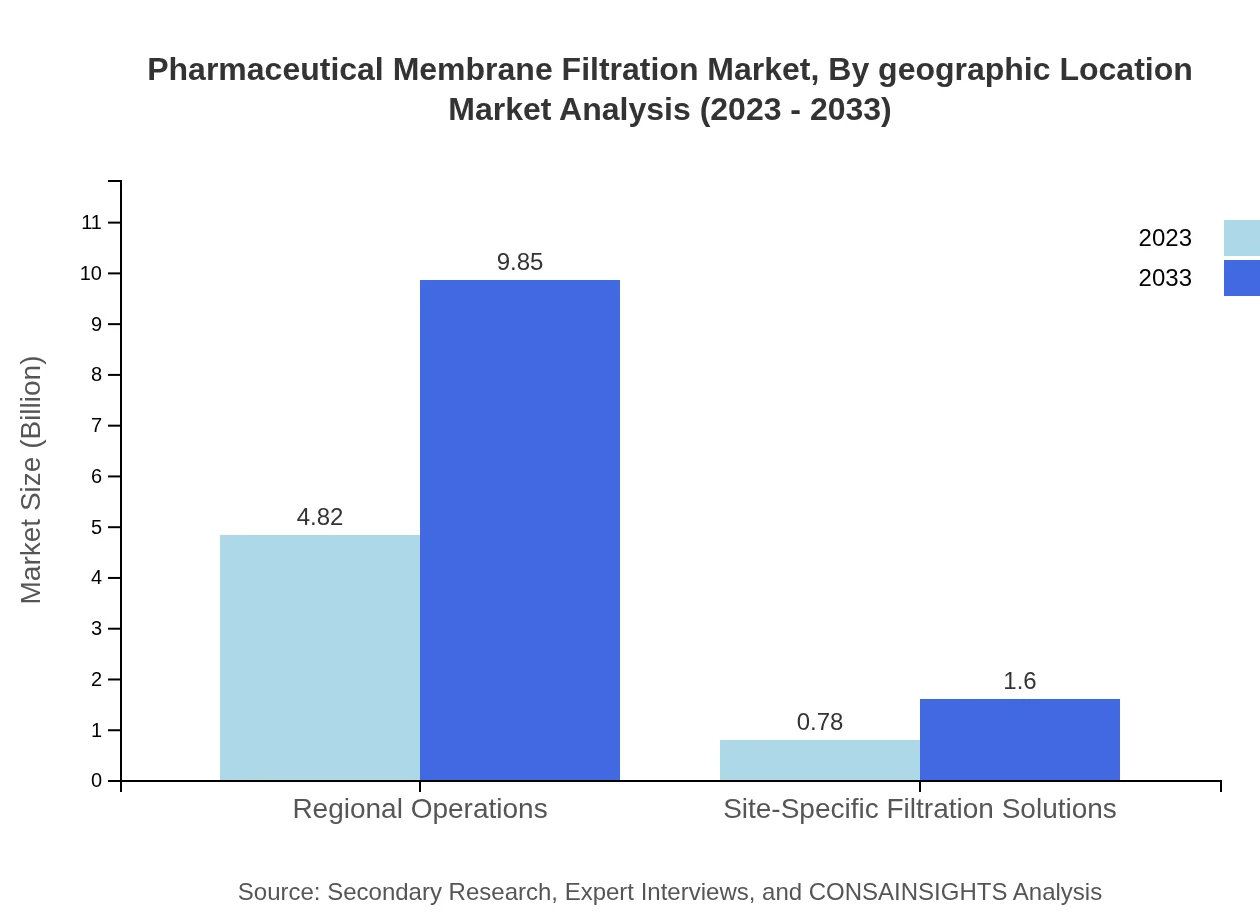

Pharmaceutical Membrane Filtration Market Analysis By Geographic Location

Geographically, North America and Europe lead the market, driven by technological advancements and stringent regulatory requirements. However, the Asia Pacific region is expected to exhibit the fastest growth rate as investments in pharmaceutical manufacturing increase, and the demand for high-quality filtration solutions escalates.

Pharmaceutical Membrane Filtration Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Membrane Filtration Industry

Merck Group:

A leading player in the biopharmaceutical filtration market, Merck offers comprehensive filtration solutions and has a strong presence in the global market.Pall Corporation:

Known for their advanced filtration systems, Pall Corporation is a key market player dedicated to providing innovative solutions for drug manufacturing.Sartorius AG:

Sartorius specializes in biopharmaceuticals and offers cutting-edge membrane filtration technologies, focusing on enhancing operational efficiency.MilliporeSigma:

A global leader in bioprocessing solutions, focusing on membrane technology to help customers optimize their pharmaceutical processes.GE Healthcare:

GE Healthcare provides advanced filtration technologies and services primarily for the biopharma industry, facilitating breakthroughs in drug development.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical Membrane Filtration?

The pharmaceutical membrane filtration market is valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 7.2% through to 2033, reflecting the increasing demand for advanced filtration solutions.

What are the key market players or companies in this pharmaceutical Membrane Filtration industry?

Key players in the pharmaceutical membrane filtration market include top-tier companies specializing in filtration technologies, such as Merck KGaA, 3M, Pall Corporation, and Sartorius AG, who significantly influence market trends and product offerings.

What are the primary factors driving the growth in the pharmaceutical Membrane Filtration industry?

Growth factors in this industry include increasing regulatory demands for purity in pharmaceuticals, the rise in biopharmaceutical production, and advancements in membrane technology that enhance filtration efficiency and reduce costs.

Which region is the fastest Growing in the pharmaceutical Membrane Filtration?

Asia Pacific is the fastest-growing region in the pharmaceutical membrane filtration market, with growth projections from $1.06 billion in 2023 to $2.17 billion by 2033, fueled by expanding pharmaceutical manufacturing and investment.

Does ConsaInsights provide customized market report data for the pharmaceutical Membrane Filtration industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the pharmaceutical membrane filtration industry, allowing clients to obtain insights that align with their strategic objectives and market interests.

What deliverables can I expect from this pharmaceutical Membrane Filtration market research project?

Deliverables from this market research project encompass detailed reports, data sets on market size and growth, competitive analysis, and insights into emerging trends, ensuring comprehensive understanding and actionable intelligence.

What are the market trends of pharmaceutical Membrane Filtration?

Current trends in the pharmaceutical membrane filtration market include the adoption of cross-flow systems, increasing utilization of single-use technologies, and the push for green filtration solutions, aligning with sustainability initiatives in healthcare.