Pharmaceutical Packaging Equipment Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-packaging-equipment

Pharmaceutical Packaging Equipment Market Size, Share, Industry Trends and Forecast to 2033

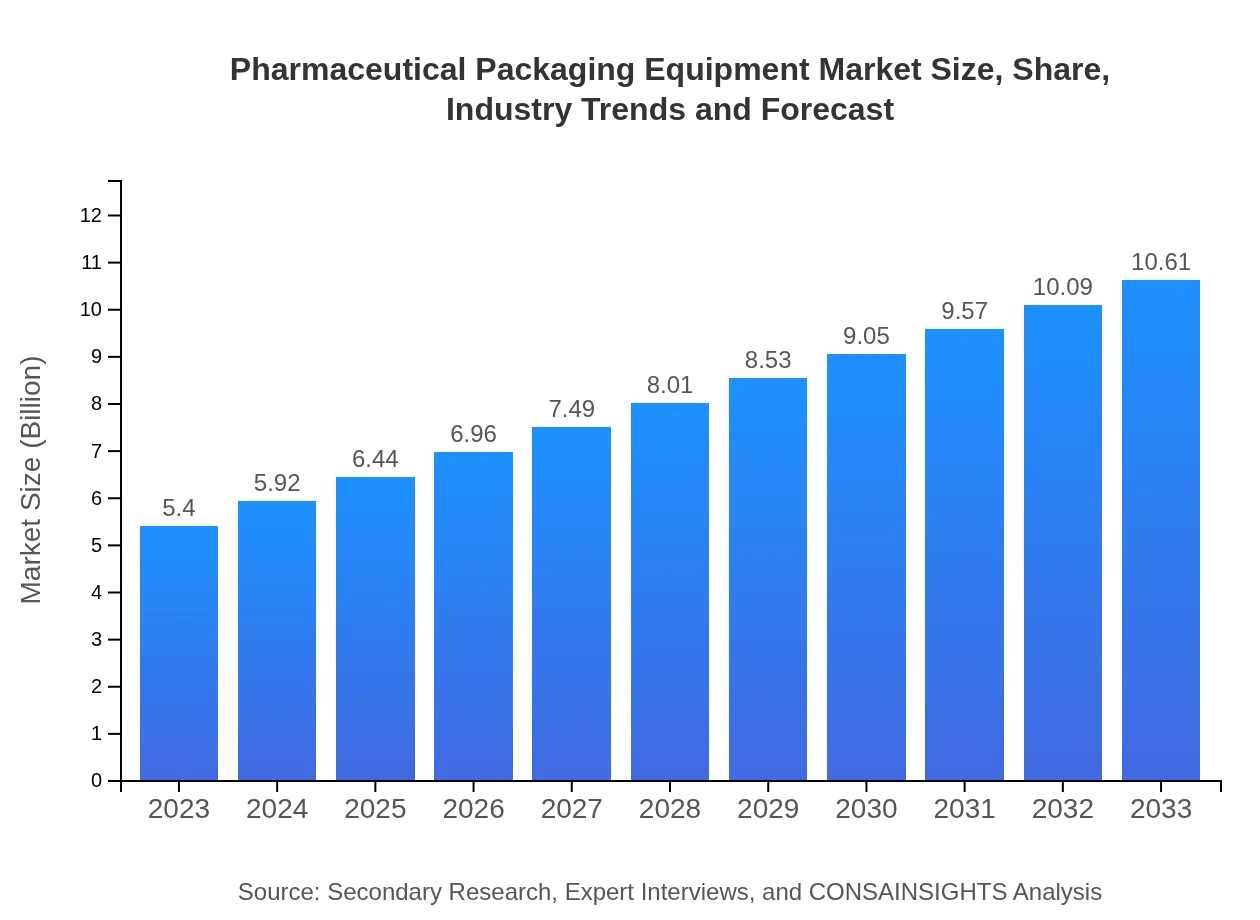

This report delivers a comprehensive analysis of the Pharmaceutical Packaging Equipment market, covering current trends, market size, segmentation, and regional insights. The forecast period extends from 2023 to 2033, providing valuable data for stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.40 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $10.61 Billion |

| Top Companies | Bosch Packaging Technology, IMA Group, Körber AG, Seidenader Maschinenbau GmbH, Marchesini Group |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Packaging Equipment Market Overview

Customize Pharmaceutical Packaging Equipment Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Packaging Equipment market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Packaging Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Packaging Equipment

What is the Market Size & CAGR of Pharmaceutical Packaging Equipment market in 2023?

Pharmaceutical Packaging Equipment Industry Analysis

Pharmaceutical Packaging Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Packaging Equipment Market Analysis Report by Region

Europe Pharmaceutical Packaging Equipment Market Report:

Europe holds a strong position in the market with a current value of USD 1.73 billion, projected to grow to USD 3.39 billion by 2033. The region is characterized by an advanced pharmaceutical industry, supported by a well-established regulatory framework promoting safe packaging standards.Asia Pacific Pharmaceutical Packaging Equipment Market Report:

In 2023, the Asia Pacific region is valued at USD 0.94 billion, projected to reach USD 1.84 billion by 2033. The growing pharmaceutical industry, along with increasing disposable incomes in emerging economies like China and India, are key drivers. The region is likely to bolster its research and development capabilities, further enhancing demand for sophisticated packaging technologies.North America Pharmaceutical Packaging Equipment Market Report:

North America is a leading region in the pharmaceutical packaging equipment market, valued at USD 2.05 billion in 2023 and projected to reach USD 4.03 billion by 2033. The presence of major pharmaceutical companies and stringent regulatory frameworks drive demand for innovative and compliant packaging solutions.South America Pharmaceutical Packaging Equipment Market Report:

The South American market for pharmaceutical packaging equipment is valued at USD 0.50 billion in 2023, expected to grow to USD 0.98 billion by 2033. The rising health awareness and expanding pharmaceutical sector in countries like Brazil and Argentina offer growth opportunities, although economic fluctuations pose challenges.Middle East & Africa Pharmaceutical Packaging Equipment Market Report:

In the Middle East and Africa, the market is valued at USD 0.18 billion in 2023, expected to rise to USD 0.36 billion by 2033. Economic development, improvements in healthcare infrastructure, and growing pharmaceutical manufacturing capabilities are noteworthy growth catalysts in this region.Tell us your focus area and get a customized research report.

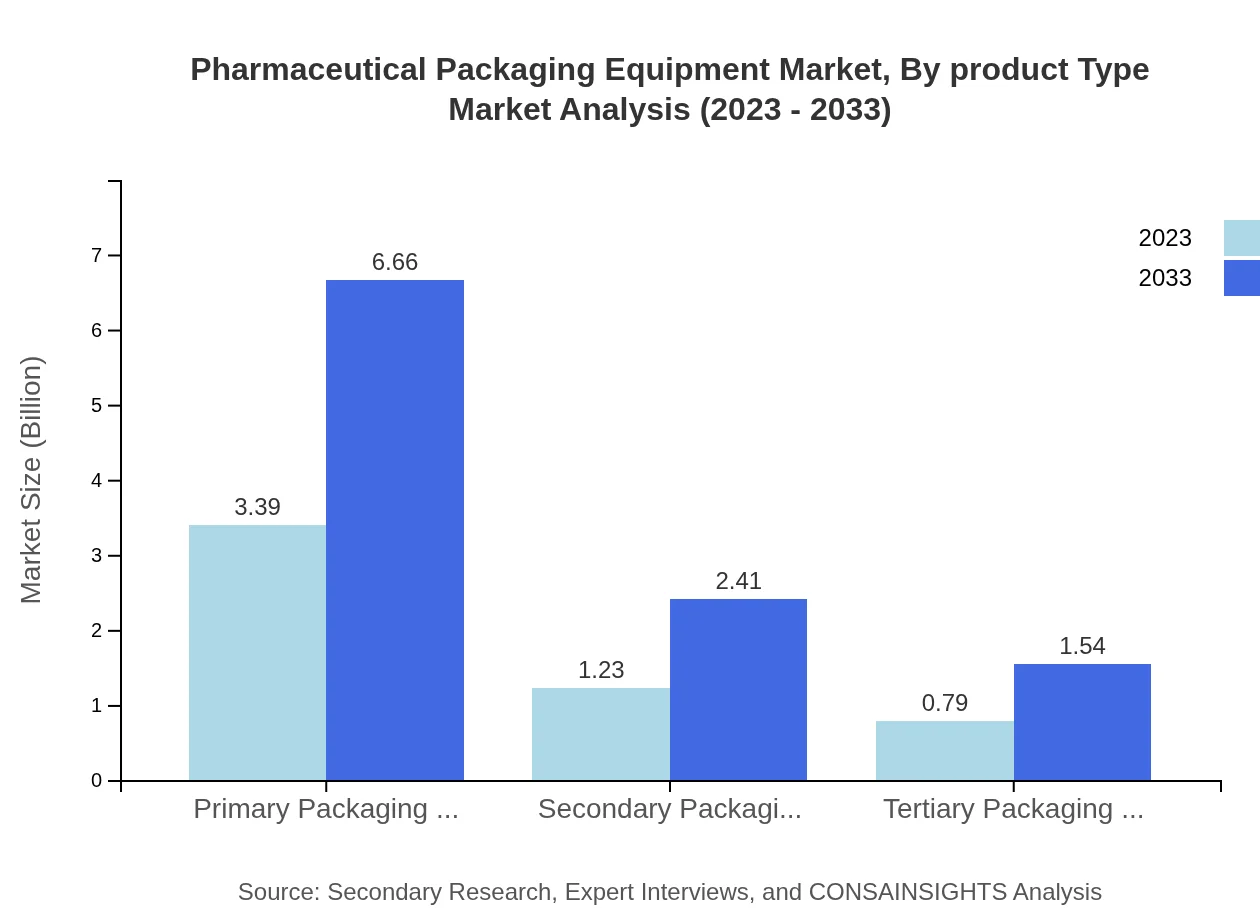

Pharmaceutical Packaging Equipment Market Analysis By Product Type

The market is dominated by Primary Packaging Equipment, valued at USD 3.39 billion in 2023 and expected to reach USD 6.66 billion by 2033, holding a significant market share of 62.73%. Secondary Packaging Equipment follows, valued at USD 1.23 billion in 2023 with a projected market size of USD 2.41 billion by 2033, representing a share of 22.72%. Tertiary Packaging Equipment, although smaller in size, is also seeing growth, expected to grow from USD 0.79 billion in 2023 to USD 1.54 billion by 2033 with a share of 14.55%.

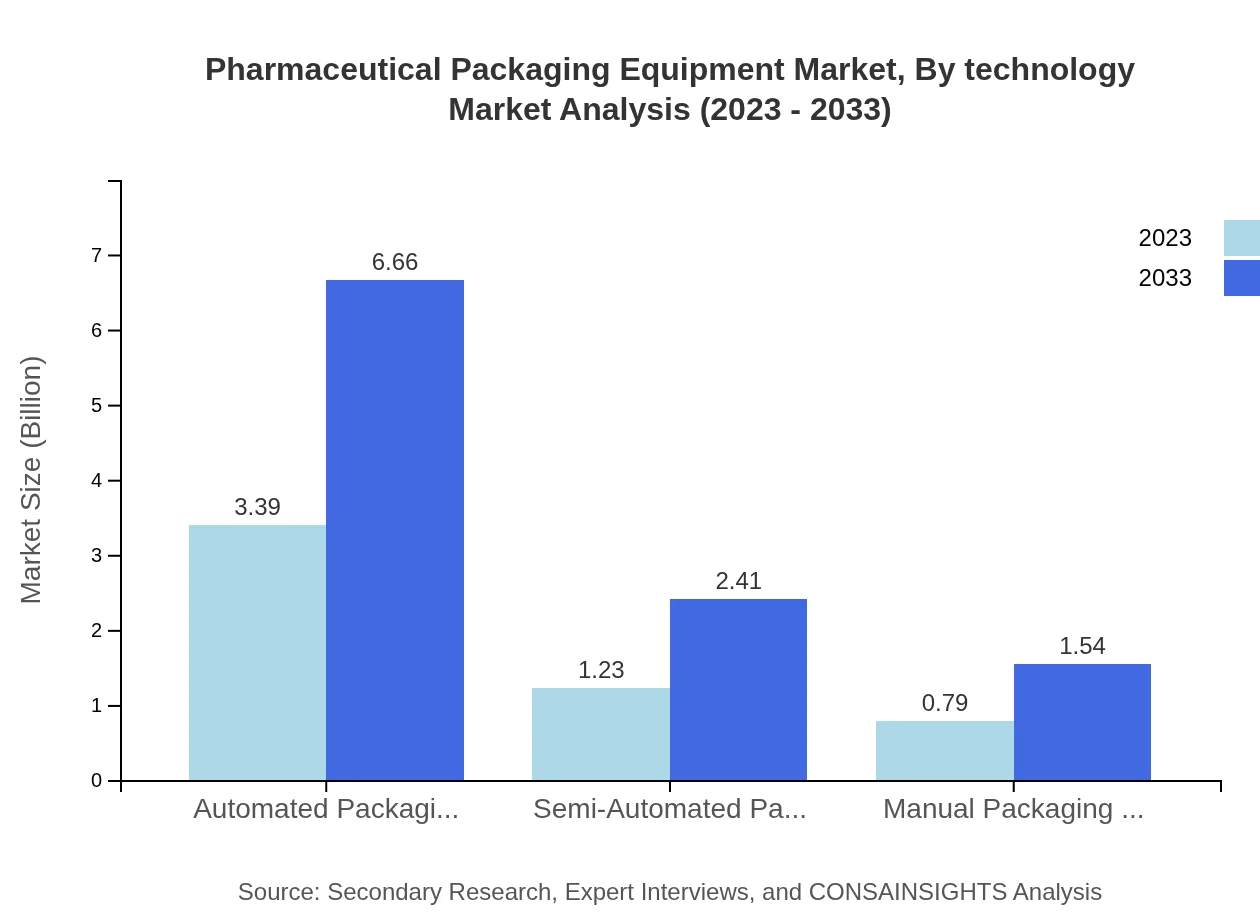

Pharmaceutical Packaging Equipment Market Analysis By Technology

Automated Packaging Technology leads the market with a value of USD 3.39 billion in 2023 and a market share of 62.73%. Semi-Automated Packaging Technology holds value at USD 1.23 billion with a 22.72% share, while Manual Packaging Technology, though smaller, is expected to grow from USD 0.79 billion in 2023 to USD 1.54 billion by 2033, equating to 14.55%.

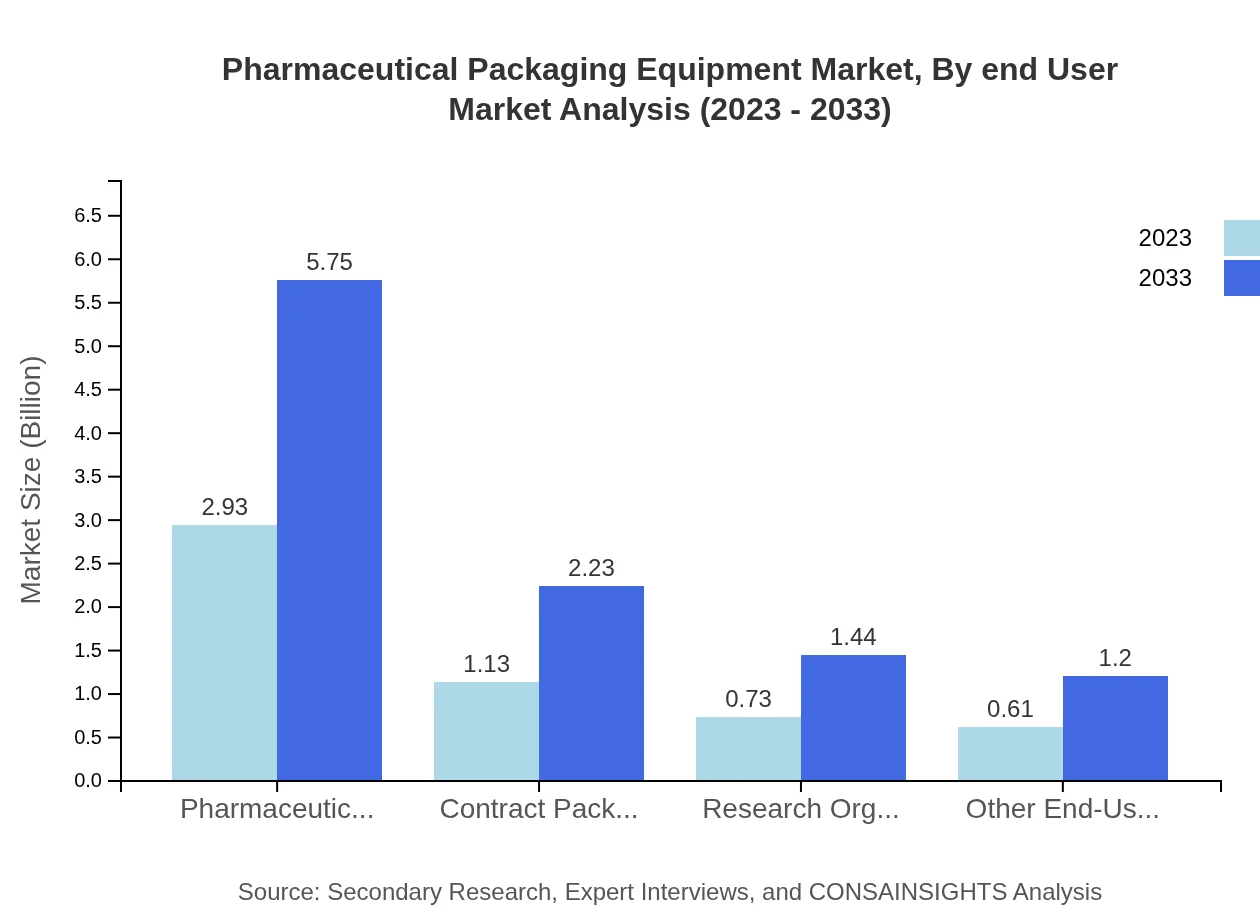

Pharmaceutical Packaging Equipment Market Analysis By End User

Pharmaceutical Manufacturers dominate the end-user market with a size of USD 2.93 billion in 2023 and holding a market share of 54.17%. Following them are Contract Packagers at USD 1.13 billion (20.97% share). Research Organizations and Other End Users are also critical, valued at USD 0.73 billion and USD 0.61 billion respectively, accounting for 13.56% and 11.3% share.

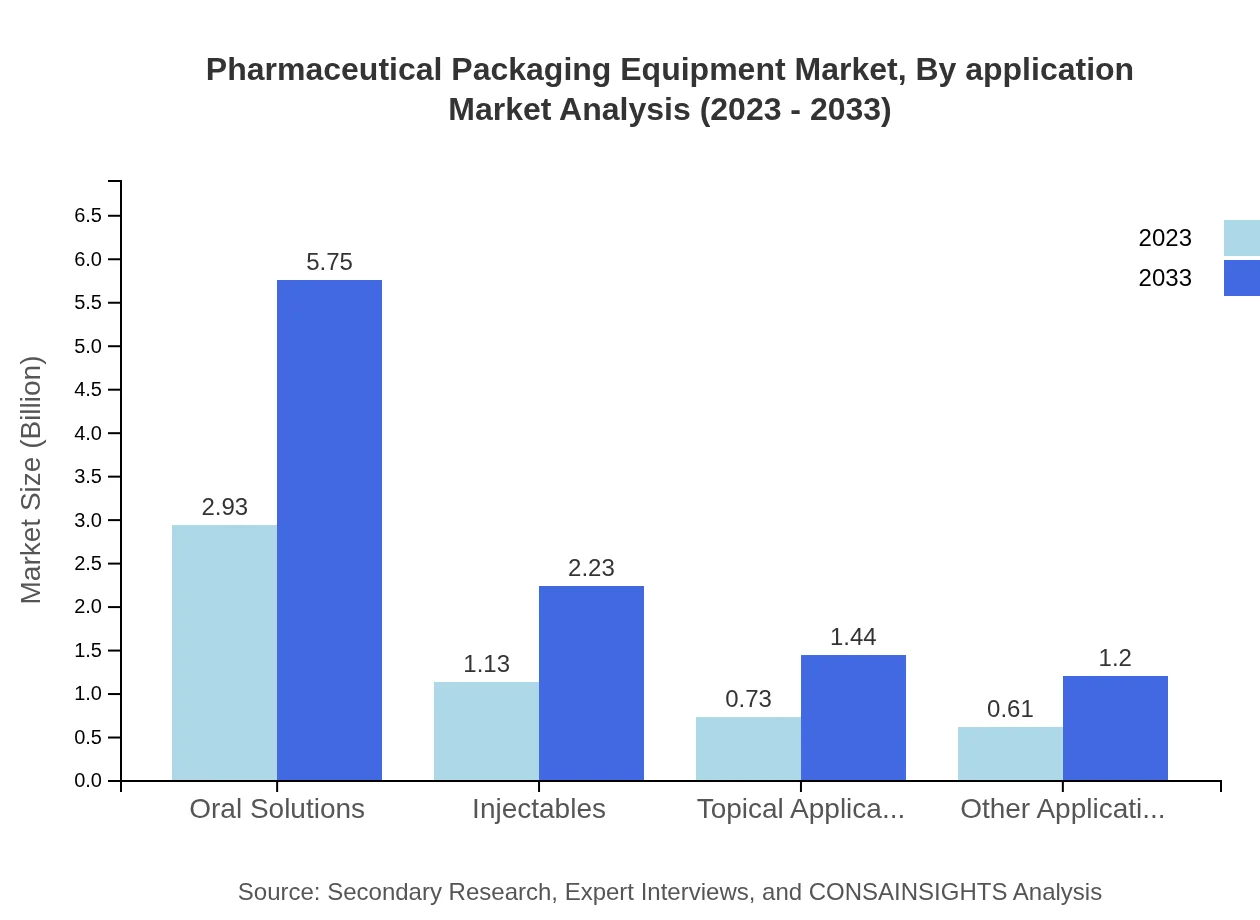

Pharmaceutical Packaging Equipment Market Analysis By Application

In terms of application, Oral Solutions lead with a valuation of USD 2.93 billion and a share of 54.17%. Injectables follow at USD 1.13 billion (20.97% share), with Topical Applications and Other Applications contributing USD 0.73 billion and USD 0.61 billion, representing 13.56% and 11.3% market shares respectively.

Pharmaceutical Packaging Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Packaging Equipment Industry

Bosch Packaging Technology:

A leader in the pharmaceutical packaging industry, Bosch specializes in developing and manufacturing innovative packaging systems that enhance efficiency and compliance.IMA Group:

A prominent player with a wide range of packaging solutions, IMA Group is known for incorporating advanced technologies to meet the specific needs of the pharmaceutical sector.Körber AG:

Körber AG offers smart and innovative solutions for the pharmaceutical packaging process, focusing on automation and digitization.Seidenader Maschinenbau GmbH:

Specializing in high-quality primary packaging machines, Seidenader provides tailored solutions to meet precise pharmaceutical packaging demands.Marchesini Group:

This group delivers complete packaging lines encompassing various types of pharmaceutical packaging, ensuring efficiency and quality.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical Packaging Equipment?

The global pharmaceutical packaging equipment market is projected to reach approximately $5.4 billion by 2033, growing at a CAGR of 6.8%. This indicates significant growth potential in the sector, driven by increased demand for efficient packaging solutions.

What are the key market players or companies in this pharmaceutical Packaging Equipment industry?

Key players in the pharmaceutical packaging equipment industry include renowned companies such as Bosch Packaging Technology, IMA Group, and Uhlmann Pac-Systeme. These companies are pivotal in innovating packaging solutions to meet regulatory standards and market demands.

What are the primary factors driving the growth in the pharmaceutical packaging equipment industry?

Growth drivers for the pharmaceutical packaging equipment market include rising demand for efficient and compliant packaging, advancements in packaging technologies, and increasing focus on safety and sustainability. The growing pharmaceutical industry and aging populations further amplify this demand.

Which region is the fastest Growing in the pharmaceutical Packaging Equipment?

The fastest-growing region in the pharmaceutical packaging equipment market is North America. The market size is expected to expand from $2.05 billion in 2023 to $4.03 billion by 2033, driven by robust R&D activities and an established pharmaceutical sector.

Does ConsaInsights provide customized market report data for the pharmaceutical Packaging Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs and preferences of clients in the pharmaceutical packaging equipment sector. This service allows businesses to gain insights specific to their strategic goals.

What deliverables can I expect from this pharmaceutical Packaging Equipment market research project?

Deliverables from the pharmaceutical packaging equipment market research project typically include comprehensive reports, statistical analyses, market forecasts, segmentations by technology and application, as well as competitive assessments and regional analysis.

What are the market trends of pharmaceutical Packaging Equipment?

Current trends in the pharmaceutical packaging equipment market include increasing automation, a shift towards environmentally friendly materials, and the adoption of smart packaging technologies. These trends reflect the industry's focus on enhancing efficiency and sustainability.