Pharmaceutical Packaging Machinery Market Size & CAGR

The Pharmaceutical Packaging Machinery market is projected to reach a size of USD 10.5 billion by 2023, with a Compound Annual Growth Rate (CAGR) of 6.2% from 2023 to 2030. The forecasted growth rate indicates a steady increase in demand for pharmaceutical packaging machinery due to the rise in pharmaceutical production, stringent regulations, and the need for efficient packaging solutions.

COVID-19 Impact on the Pharmaceutical Packaging Machinery Market

The COVID-19 pandemic has significantly impacted the Pharmaceutical Packaging Machinery market. The global lockdowns, disruptions in the supply chain, and increased demand for pharmaceutical products have led to a surge in the need for advanced packaging machinery. Companies operating in the market have ramped up production to meet the rising demand for packaging solutions for vaccines, medicines, and other healthcare products.

Pharmaceutical Packaging Machinery Market Dynamics

The Pharmaceutical Packaging Machinery market dynamics are driven by factors such as technological advancements, increasing automation in the pharmaceutical industry, and growing demand for sustainable packaging solutions. The market is also influenced by regulatory requirements, quality standards, and the need for cost-effective packaging solutions.

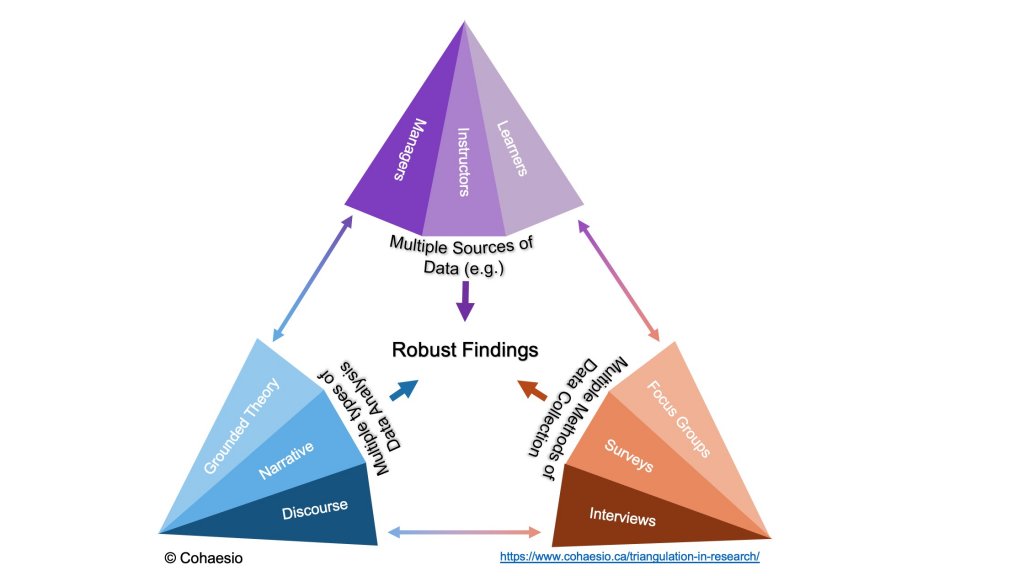

Segments and Related Analysis of the Pharmaceutical Packaging Machinery Market

The Pharmaceutical Packaging Machinery market can be segmented based on technology, product, application, and end-user. Each segment plays a crucial role in the overall market dynamics and offers unique opportunities for growth and innovation. The analysis of these segments provides valuable insights into the market trends and customer preferences.

Pharmaceutical Packaging Machinery Market Analysis Report by Region

Asia Pacific Pharmaceutical Packaging Machinery Market Report

The Asia Pacific region is a significant market for pharmaceutical packaging machinery, driven by the rapid growth of the pharmaceutical industry, increasing investments in healthcare infrastructure, and a growing population. Countries like China, India, Japan, and South Korea are key players in the Asia Pacific market, offering opportunities for market expansion and technological advancements.

South America Pharmaceutical Packaging Machinery Market Report

South America is witnessing a surge in demand for pharmaceutical packaging machinery due to the rising healthcare expenditure, increasing pharmaceutical exports, and government initiatives to boost the local manufacturing sector. Countries like Brazil, Argentina, and Colombia are driving growth in the South American market, presenting opportunities for market players to expand their presence in the region.

North America Pharmaceutical Packaging Machinery Market Report

North America is a mature market for pharmaceutical packaging machinery, characterized by technological innovation, strict regulatory standards, and a high level of automation in the pharmaceutical sector. The United States and Canada are prominent players in the North American market, with a focus on sustainability, efficiency, and quality in pharmaceutical packaging solutions.

Europe Pharmaceutical Packaging Machinery Market Report

Europe is a key region in the pharmaceutical packaging machinery market, driven by the presence of leading pharmaceutical companies, advanced healthcare infrastructure, and stringent quality regulations. Countries like Germany, France, the United Kingdom, and Italy are at the forefront of innovation and development in the European market, offering lucrative opportunities for market expansion and collaboration.

Middle East and Africa Pharmaceutical Packaging Machinery Market Report

The Middle East and Africa region are experiencing growth in the pharmaceutical packaging machinery market due to the increasing healthcare investment, rising demand for pharmaceutical products, and government initiatives to strengthen the healthcare infrastructure. Countries like Saudi Arabia, UAE, South Africa, and Egypt are emerging as key players in the market, providing avenues for market players to capitalize on the growing demand for pharmaceutical packaging solutions.

Pharmaceutical Packaging Machinery Market Analysis Report by Technology

The pharmaceutical packaging machinery market can be analyzed based on technology, including primary packaging technology, secondary packaging technology, and tertiary packaging technology. Each technology segment offers unique solutions for packaging processes, ensuring product safety, efficiency, and compliance with regulatory standards.

Pharmaceutical Packaging Machinery Market Analysis Report by Product

The pharmaceutical packaging machinery market comprises a range of products, including blister packaging machines, tube filling machines, cartoning machines, labeling machines, and others. These products cater to different packaging requirements in the pharmaceutical industry, offering reliability, precision, and flexibility in packaging operations.

Pharmaceutical Packaging Machinery Market Analysis Report by Application

The pharmaceutical packaging machinery market serves various applications in the pharmaceutical sector, such as solid dose packaging, liquid dose packaging, sterile packaging, and others. Each application requires specialized packaging solutions to ensure product integrity, safety, and compliance with industry standards.

Pharmaceutical Packaging Machinery Market Analysis Report by End-User

The pharmaceutical packaging machinery market caters to different end-users, including pharmaceutical companies, contract packaging organizations, and others. Understanding the diverse needs and preferences of end-users is crucial for market players to develop tailored solutions and enhance customer satisfaction.

Key Growth Drivers and Key Market Players of Pharmaceutical Packaging Machinery Market

Key growth drivers in the pharmaceutical packaging machinery market include increasing pharmaceutical production, stringent regulatory requirements, technological advancements, and growing demand for sustainable packaging solutions. Key market players operating in the pharmaceutical packaging machinery market include:

- Robert Bosch GmbH

- Marchesini Group

- I.M.A. Industria Macchine Automatiche S.p.A.

- Uhlmann Group

- Körber AG

Pharmaceutical Packaging Machinery Market Trends and Future Forecast

The pharmaceutical packaging machinery market is witnessing trends such as the adoption of smart packaging solutions, integration of automation and robotics, emphasis on sustainable packaging materials, and the focus on modular and flexible packaging systems. The future forecast for the market indicates a continued emphasis on innovation, compliance with regulatory standards, and customization of packaging solutions to meet evolving market demands.

Recent Happenings in the Pharmaceutical Packaging Machinery Market

Recent developments in the pharmaceutical packaging machinery market include collaborations, acquisitions, product launches, and investments in research and development. These activities reflect the dynamic nature of the market, with companies striving to enhance their product offerings, expand their market presence, and innovate in response to changing customer needs.