Pharmaceutical Processing Seals Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-processing-seals

Pharmaceutical Processing Seals Market Size, Share, Industry Trends and Forecast to 2033

This report delves into the Pharmaceutical Processing Seals market, providing comprehensive insights into market trends, size, and projections from 2023 to 2033. It covers industry analysis, regional breakdowns, product performance, and the competitive landscape.

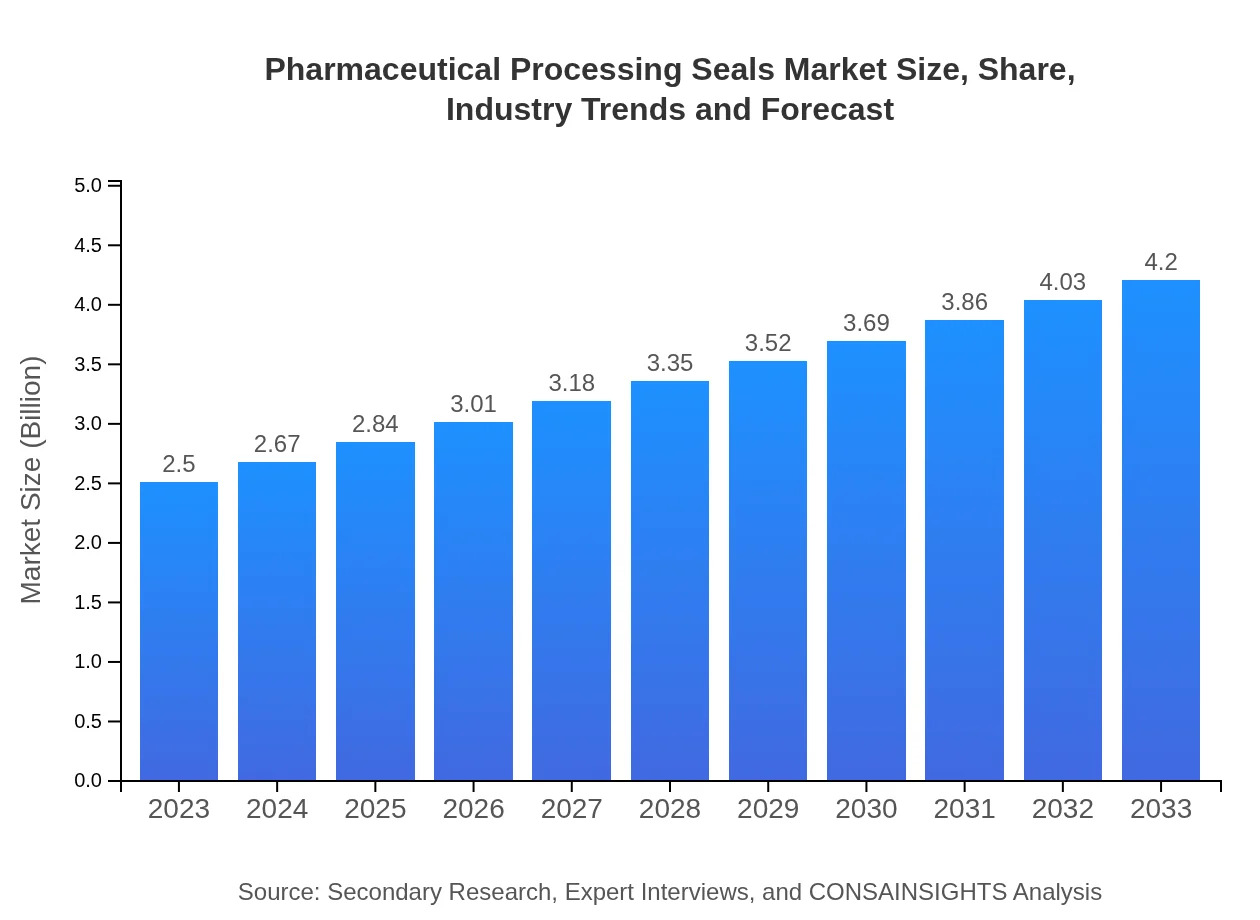

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.2% |

| 2033 Market Size | $4.20 Billion |

| Top Companies | Parker Hannifin, Trelleborg Sealing Solutions, Saint-Gobain |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Processing Seals Market Overview

Customize Pharmaceutical Processing Seals Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Processing Seals market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Processing Seals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Processing Seals

What is the Market Size & CAGR of Pharmaceutical Processing Seals market in 2023?

Pharmaceutical Processing Seals Industry Analysis

Pharmaceutical Processing Seals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Processing Seals Market Analysis Report by Region

Europe Pharmaceutical Processing Seals Market Report:

The European Pharmaceutical Processing Seals market is anticipated to grow from USD 0.92 billion in 2023 to USD 1.54 billion by 2033. This growth is attributed to a robust pharmaceutical industry supported by strong regulations and a focus on innovation and sustainability in manufacturing processes.Asia Pacific Pharmaceutical Processing Seals Market Report:

In the Asia Pacific region, the Pharmaceutical Processing Seals market is anticipated to grow from USD 0.44 billion in 2023 to USD 0.73 billion by 2033. This growth is fueled by increasing investments in pharmaceutical manufacturing, particularly in countries like China and India, which are expanding their production capacities to meet global demand.North America Pharmaceutical Processing Seals Market Report:

North America holds a significant share of the Pharmaceutical Processing Seals market, projected to expand from USD 0.83 billion in 2023 to USD 1.39 billion by 2033. The region is characterized by stringent regulatory frameworks and advanced manufacturing technologies, which drive the demand for high-quality sealing solutions for reliable pharmaceutical production.South America Pharmaceutical Processing Seals Market Report:

The South American market for Pharmaceutical Processing Seals is expected to see growth from USD 0.20 billion in 2023 to USD 0.34 billion by 2033, driven by an increasing focus on healthcare reforms and improved pharmaceutical infrastructure in nations like Brazil and Argentina.Middle East & Africa Pharmaceutical Processing Seals Market Report:

In the Middle East and Africa, the Pharmaceutical Processing Seals market is expected to rise from USD 0.12 billion in 2023 to USD 0.19 billion by 2033. The growth in this region is bolstered by increasing healthcare investments and the development of local pharmaceutical production capabilities.Tell us your focus area and get a customized research report.

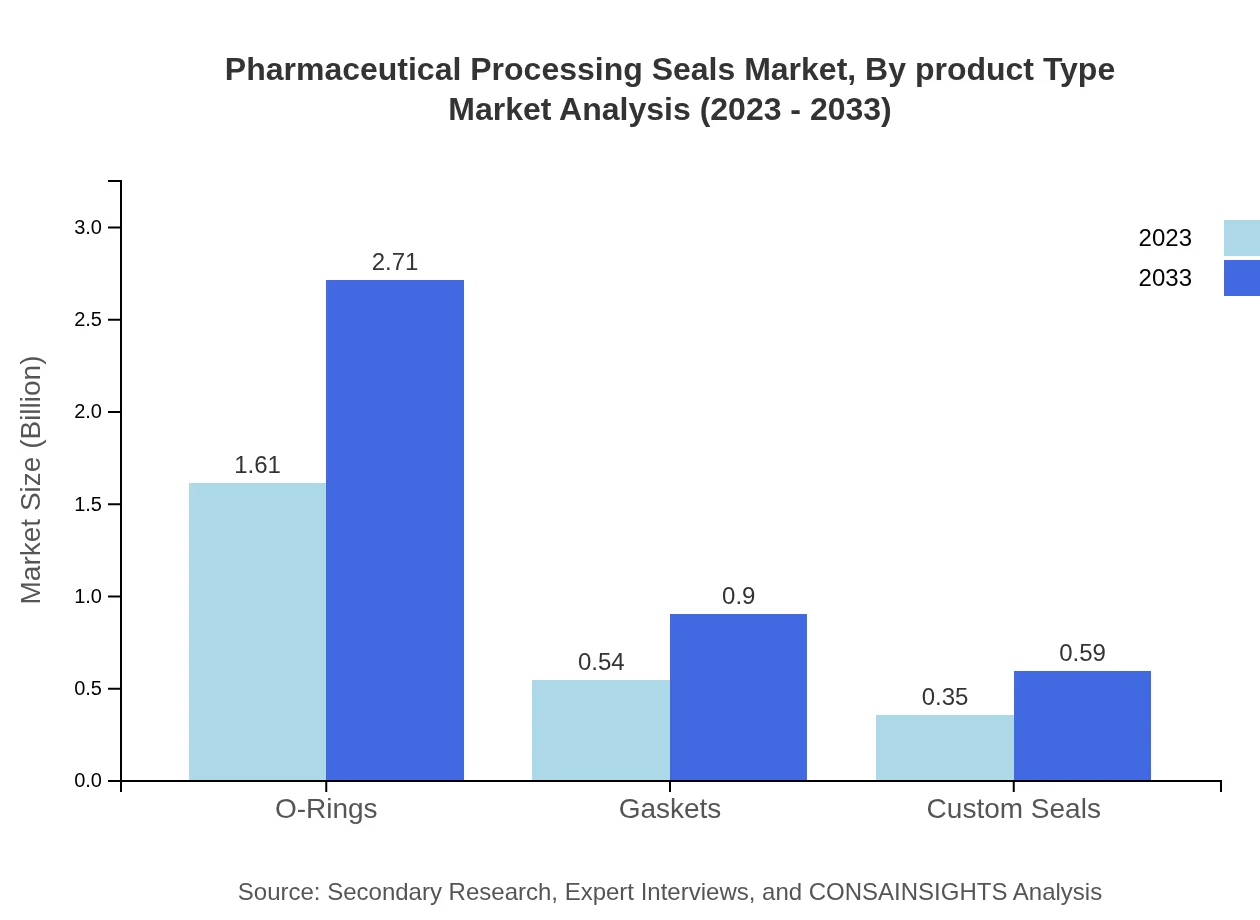

Pharmaceutical Processing Seals Market Analysis By Product Type

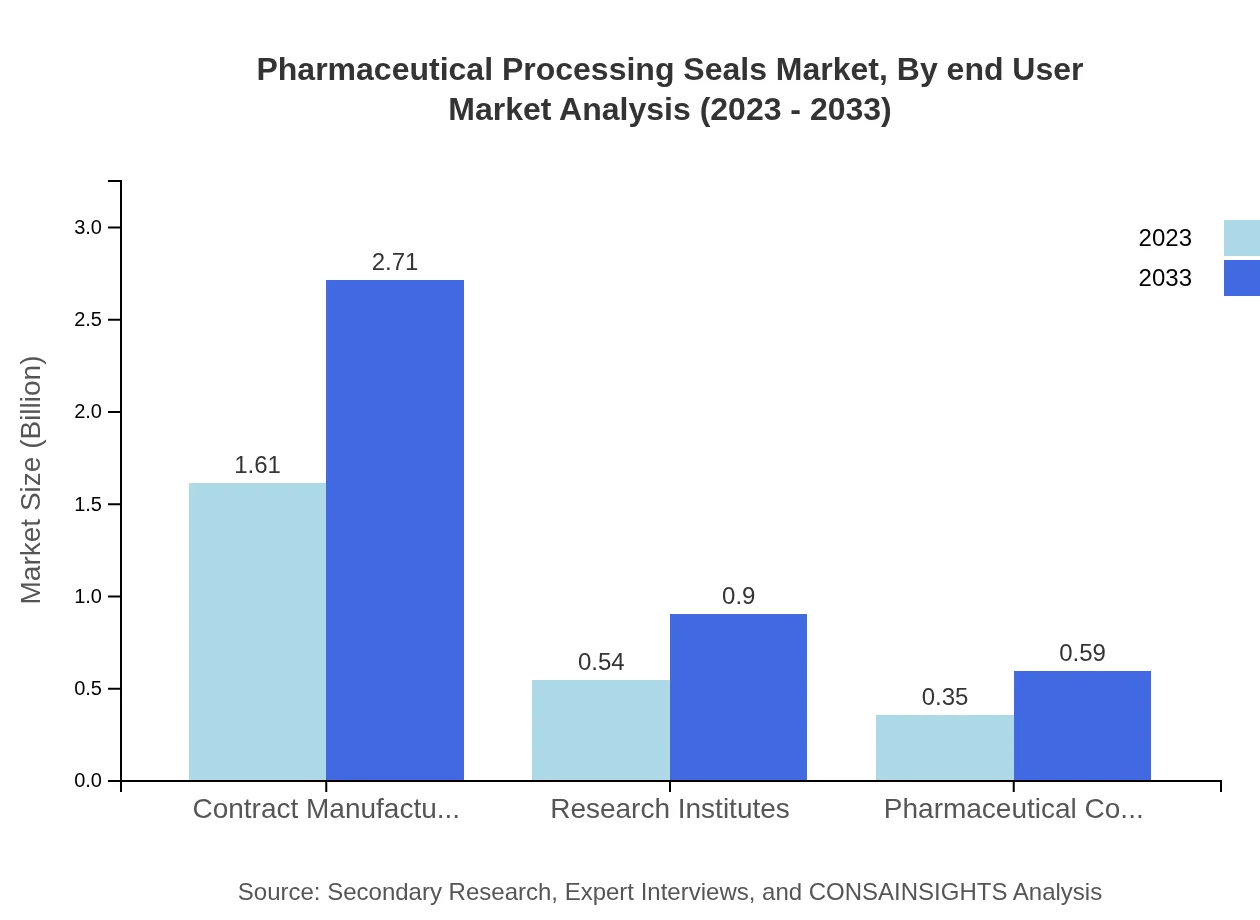

The market is predominantly characterized by O-rings, which will grow significantly, from 1.61 billion in 2023 to 2.71 billion by 2033, reflecting their crucial role in preventing leaks and ensuring sterile environments. Gaskets follow closely, rising from 0.54 billion in 2023 to 0.90 billion by 2033, while custom seals make a notable impact.

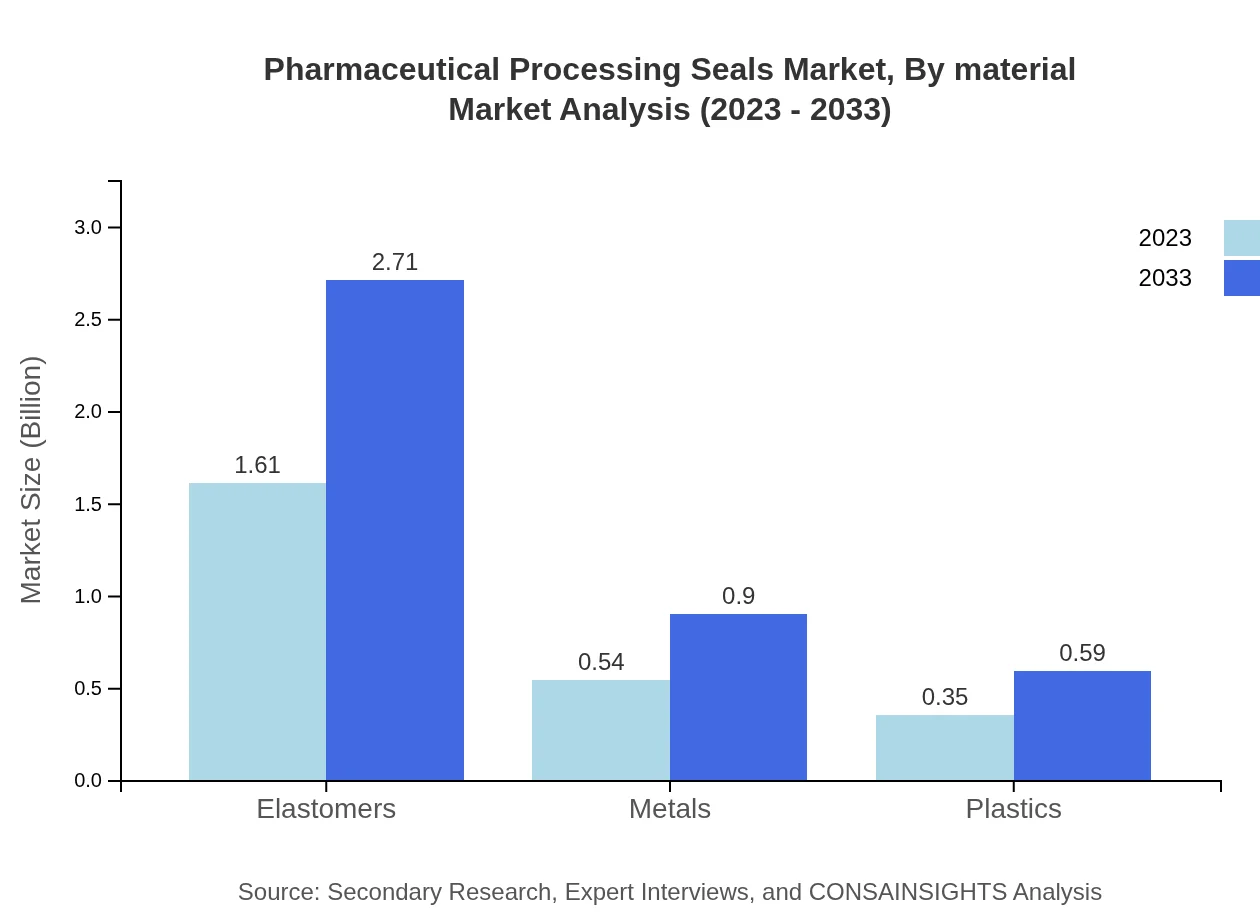

Pharmaceutical Processing Seals Market Analysis By Material

Elastomers dominate the material segment with a steady market share of 64.54%, growing from 1.61 billion in 2023 to 2.71 billion by 2033. Metals account for 21.47%, projecting increased use in high-strength applications; plastics represent 13.99% and are anticipated to grow alongside sustainability trends.

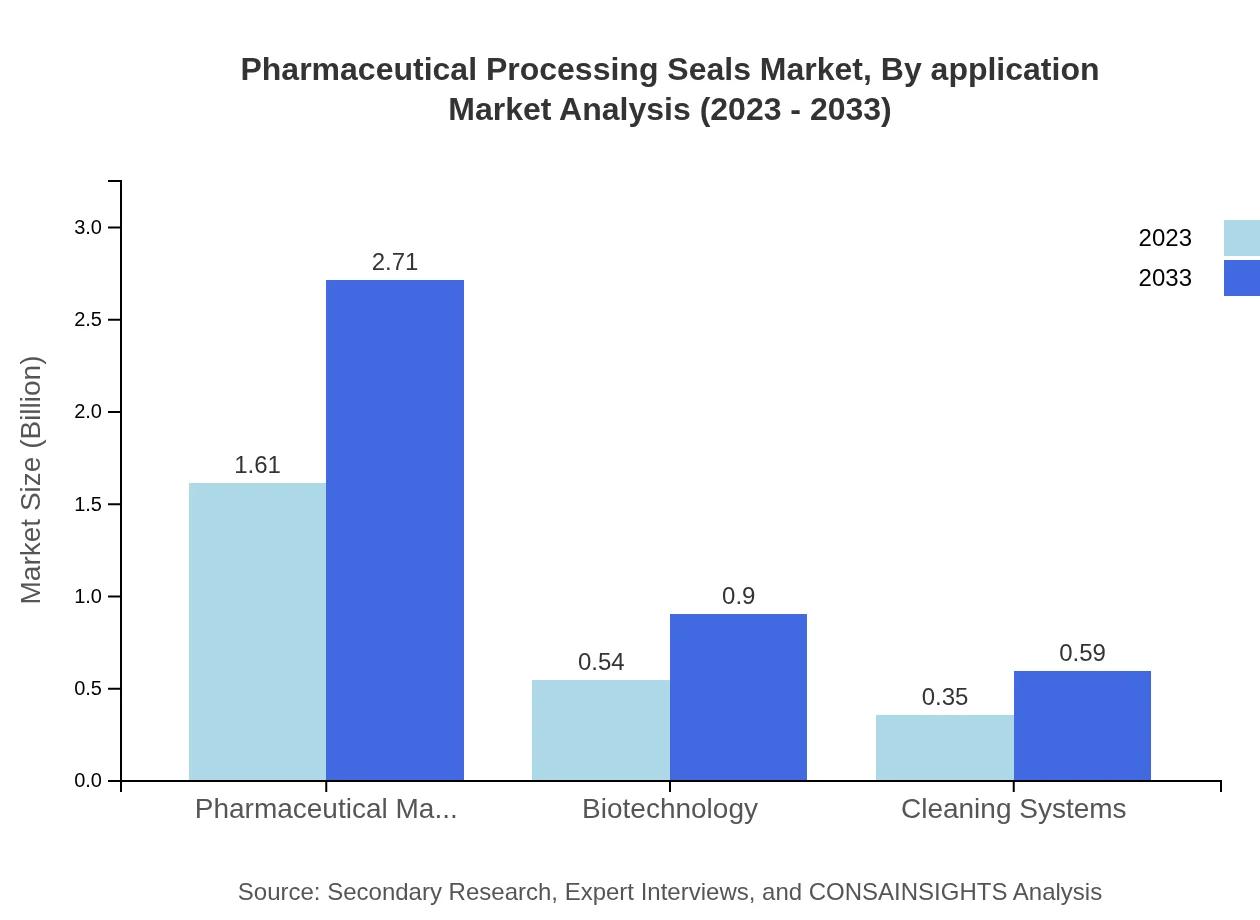

Pharmaceutical Processing Seals Market Analysis By Application

Within the pharmaceutical production chain, seals play crucial roles across applications such as manufacturing (2.71 billion by 2033) and process sealing. Research and development segments are also significant, accounting for a considerable market share.

Pharmaceutical Processing Seals Market Analysis By End User

Key end-users include pharmaceutical manufacturers, contract manufacturers, and research institutes, highlighting a strong demand for reliable and effective sealing solutions across the spectrum of the pharmaceutical industry.

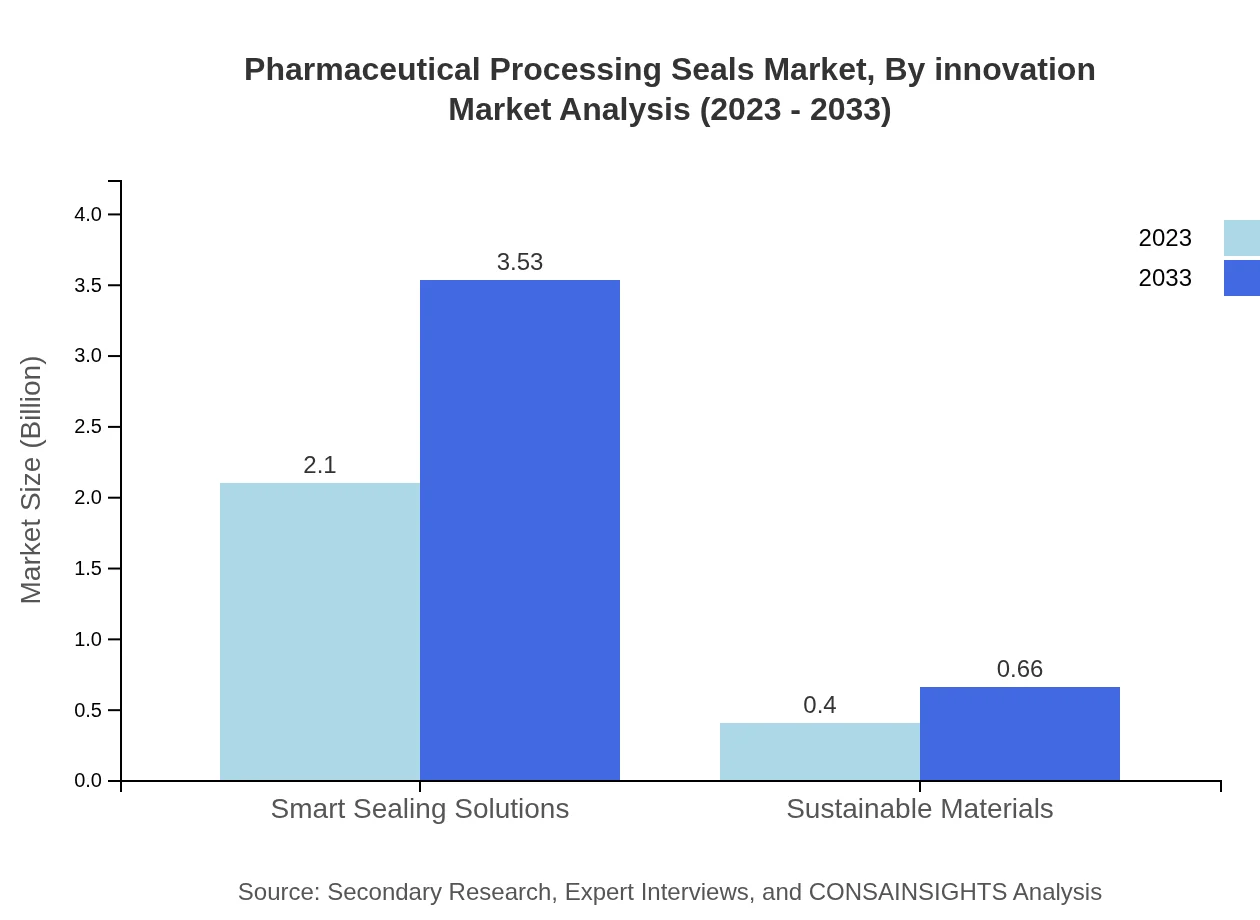

Pharmaceutical Processing Seals Market Analysis By Innovation

Innovations such as smart sealing solutions, projected to grow from 2.10 billion in 2023 to 3.53 billion by 2033, showcase the market's pivot towards enhanced performance and data integration to monitor seal integrity in real-time.

Pharmaceutical Processing Seals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Processing Seals Industry

Parker Hannifin:

A leading manufacturer of sealing solutions, Parker Hannifin excels in producing high-performance seals for various applications within the pharmaceutical industry.Trelleborg Sealing Solutions:

Trelleborg is recognized for its innovative sealing technologies and advanced materials that are designed to meet the stringent requirements of the pharmaceutical sector.Saint-Gobain:

With a strong portfolio in materials science, Saint-Gobain provides engineered seals that ensure performance reliability in crucial pharmaceutical applications.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical Processing Seals?

The pharmaceutical-processing-seals market is valued at approximately $2.5 billion in 2023, with a projected CAGR of 5.2% from 2023 to 2033. This growth indicates a strong demand and potential expansion in this sector.

What are the key market players or companies in this pharmaceutical Processing Seals industry?

Key players in the pharmaceutical-processing-seals industry include leading manufacturers that focus on innovation and quality assurance. They play a vital role in maintaining standards set forth by regulatory bodies in the pharmaceutical sector.

What are the primary factors driving the growth in the pharmaceutical Processing Seals industry?

The growth in the pharmaceutical-processing-seals industry is driven by increasing demand for high-quality seals ensuring containment, improved manufacturing processes, and the rising need for contamination-preventive measures across pharmaceutical production operations.

Which region is the fastest Growing in the pharmaceutical Processing Seals?

The fastest-growing region in the pharmaceutical-processing-seals market from 2023 to 2033 is Europe, projected to grow from $0.92 billion to $1.54 billion, showcasing strong market potential driven by pharmaceutical advancements.

Does ConsaInsights provide customized market report data for the pharmaceutical Processing Seals industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs and focuses on various segments within the pharmaceutical-processing-seals industry, providing in-depth analysis and insights.

What deliverables can I expect from this pharmaceutical Processing Seals market research project?

From this pharmaceutical-processing-seals market research project, expect comprehensive reports, strategic recommendations, detailed market segmentation data, and insights on growth trends and competitive landscapes in the industry.

What are the market trends of pharmaceutical Processing Seals?

Market trends in the pharmaceutical-processing-seals industry include the adoption of smart sealing solutions, increasing use of sustainable materials, and a shift towards advanced elastomers to meet regulatory requirements and enhance product efficiency.