Pharmaceutical Robots Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-robots

Pharmaceutical Robots Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Pharmaceutical Robots market, highlighting market size, trends, technological advancements, and regional insights. Forecasting through 2033, it delivers critical insights for stakeholders seeking to navigate this evolving landscape.

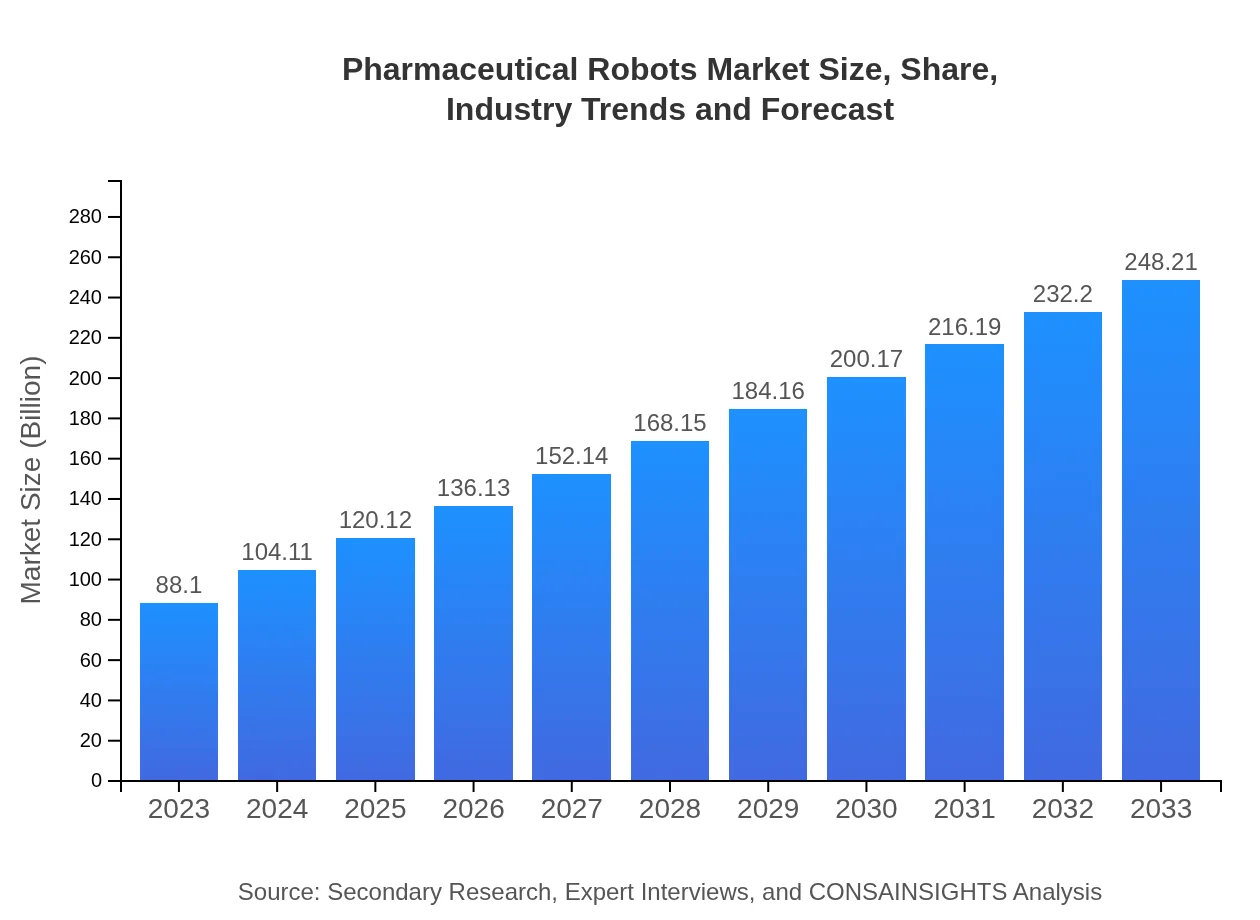

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $88.10 Million |

| CAGR (2023-2033) | 10.5% |

| 2033 Market Size | $248.21 Million |

| Top Companies | ABB Ltd., KUKA AG, FANUC Corporation, Yaskawa Electric Corporation |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Robots Market Overview

Customize Pharmaceutical Robots Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Robots market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Robots's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Robots

What is the Market Size & CAGR of Pharmaceutical Robots market in 2023?

Pharmaceutical Robots Industry Analysis

Pharmaceutical Robots Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Robots Market Analysis Report by Region

Europe Pharmaceutical Robots Market Report:

The European market will increase from USD 22.40 billion in 2023 to USD 63.09 billion by 2033, owing to stringent regulations necessitating automation for compliance and efficiency.Asia Pacific Pharmaceutical Robots Market Report:

The Asia Pacific region is projected to see significant market growth from USD 18.84 billion in 2023 to USD 53.09 billion by 2033, driven by increasing investments in healthcare infrastructure and automation technologies.North America Pharmaceutical Robots Market Report:

North America, leading the market with a value of USD 28.61 billion in 2023 and forecasted to reach USD 80.62 billion by 2033, benefits from technological advancements and an established pharmaceutical manufacturing base.South America Pharmaceutical Robots Market Report:

In South America, the market size will grow from USD 6.02 billion in 2023 to USD 16.95 billion in 2033, supported by expanding pharmaceutical production capacities and modernization of existing facilities.Middle East & Africa Pharmaceutical Robots Market Report:

The Middle East and Africa region is expected to grow from USD 12.23 billion in 2023 to USD 34.45 billion by 2033, driven by the growing demand for high-quality pharmaceuticals and the introduction of automation in manufacturing processes.Tell us your focus area and get a customized research report.

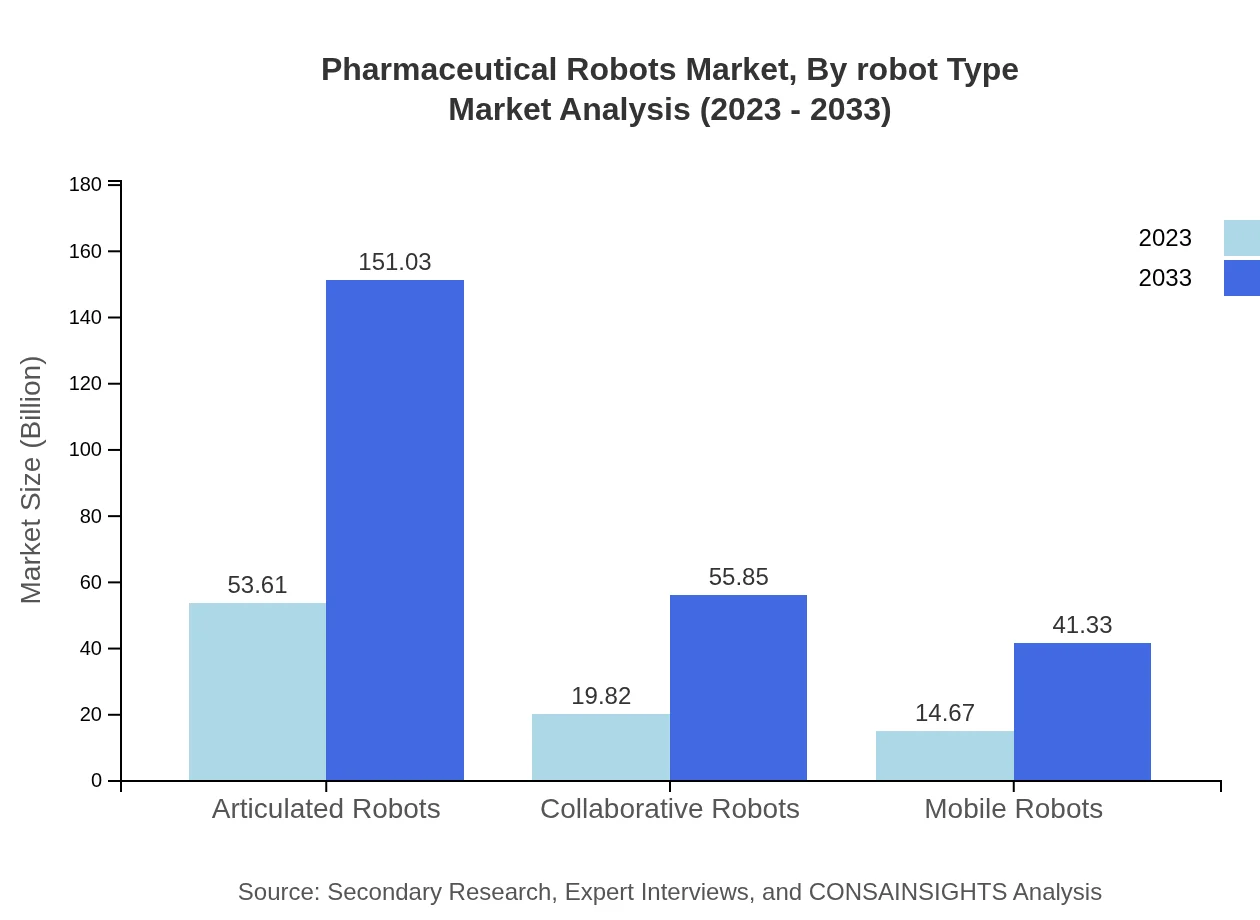

Pharmaceutical Robots Market Analysis By Robot Type

Articulated robots dominate the market with a size of USD 53.61 billion in 2023, projected to reach USD 151.03 billion by 2033. Collaborative robots and mobile robots are also gaining traction due to their flexibility and ease of integration.

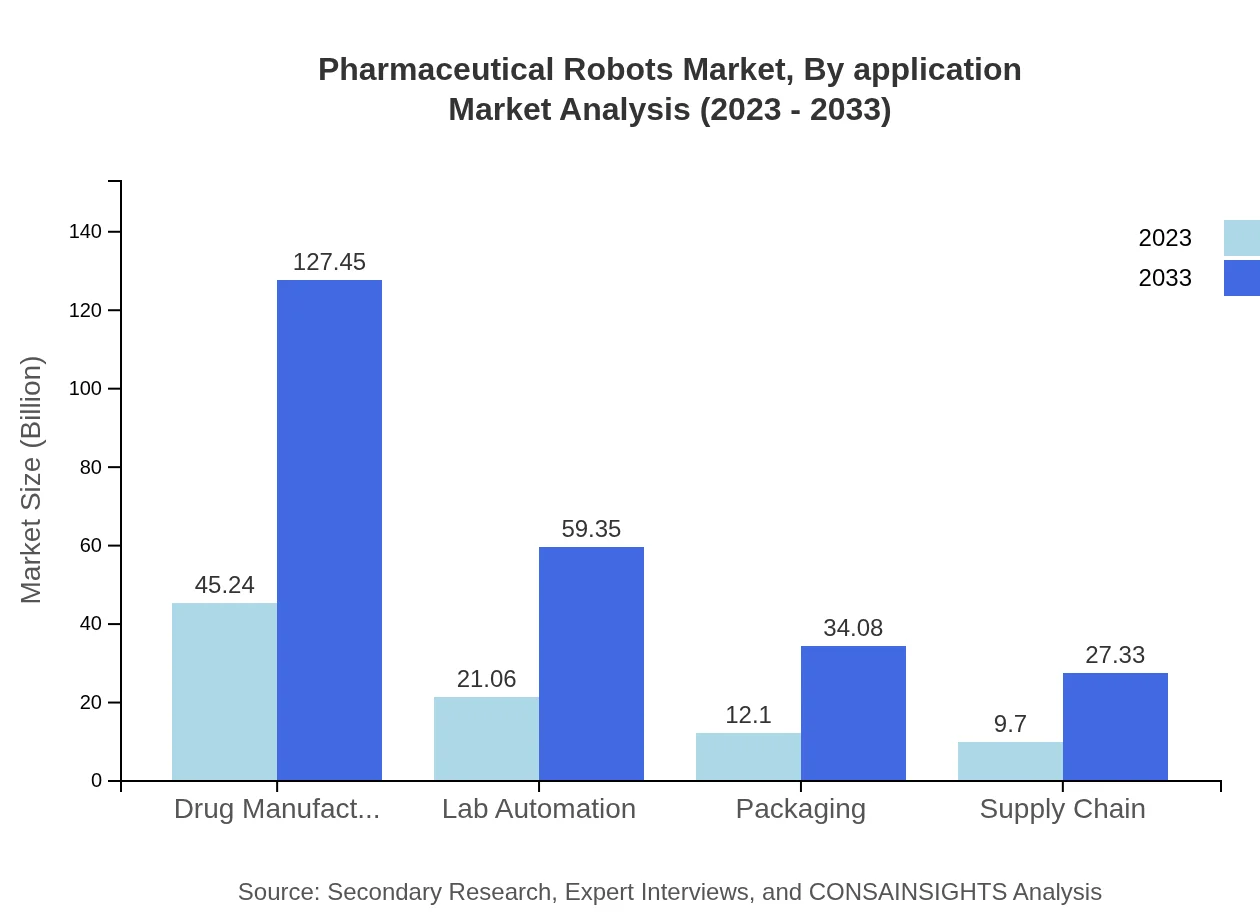

Pharmaceutical Robots Market Analysis By Application

In drug manufacturing, the market is expected to grow significantly from USD 45.24 billion in 2023 to USD 127.45 billion by 2033, reflecting increased demand for efficient manufacturing solutions.

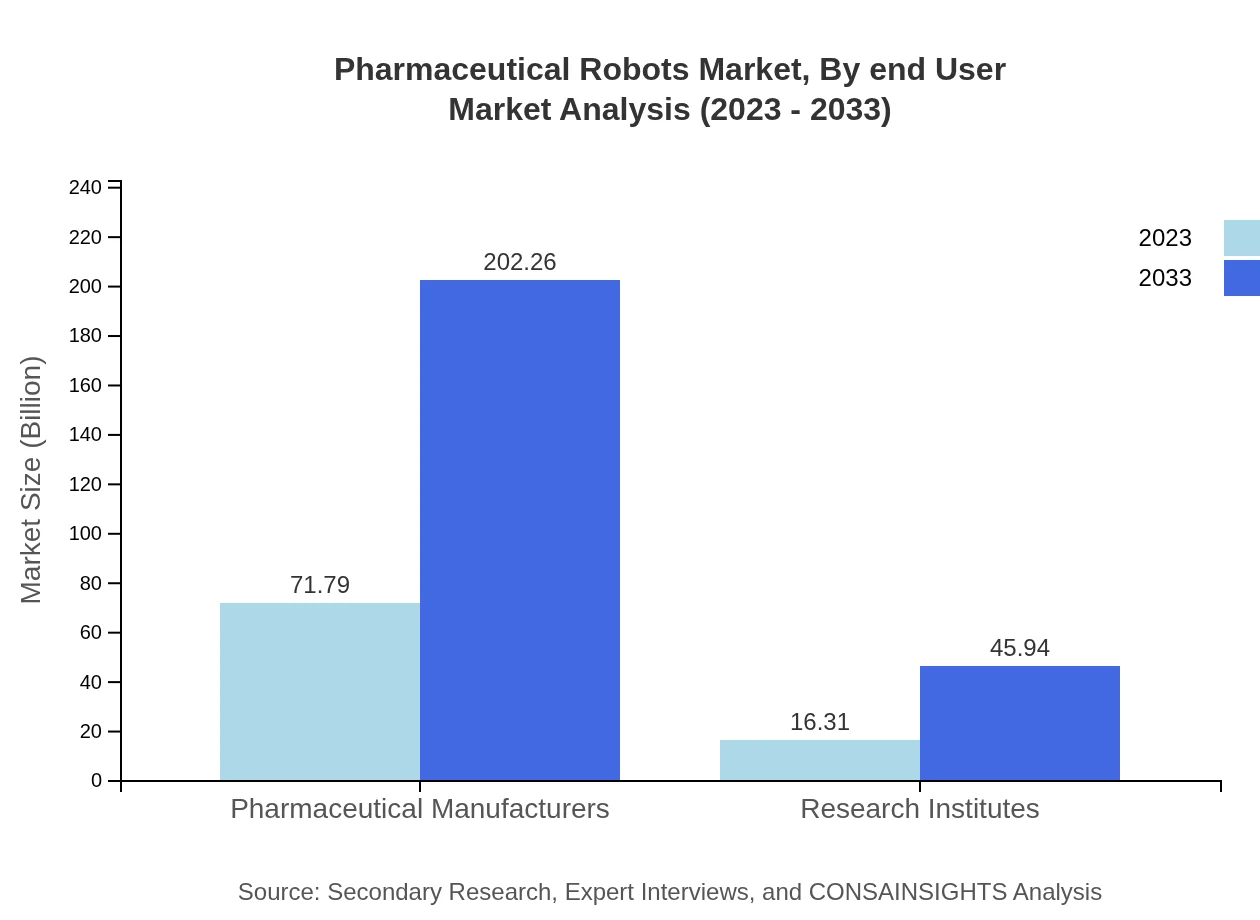

Pharmaceutical Robots Market Analysis By End User

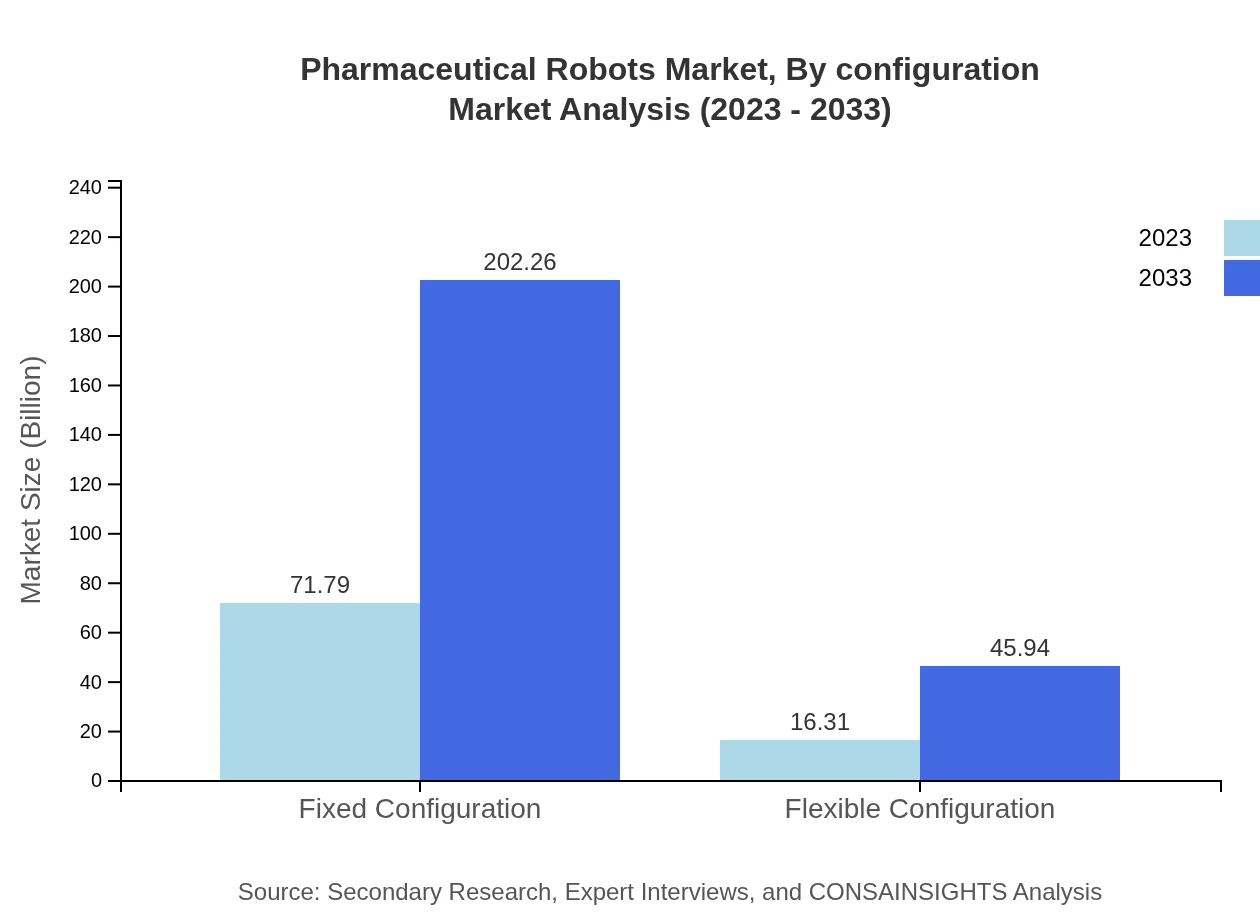

Pharmaceutical manufacturers hold a significant share with a market size of USD 71.79 billion in 2023. Research institutes also contribute to market growth, with sizes reaching USD 16.31 billion.

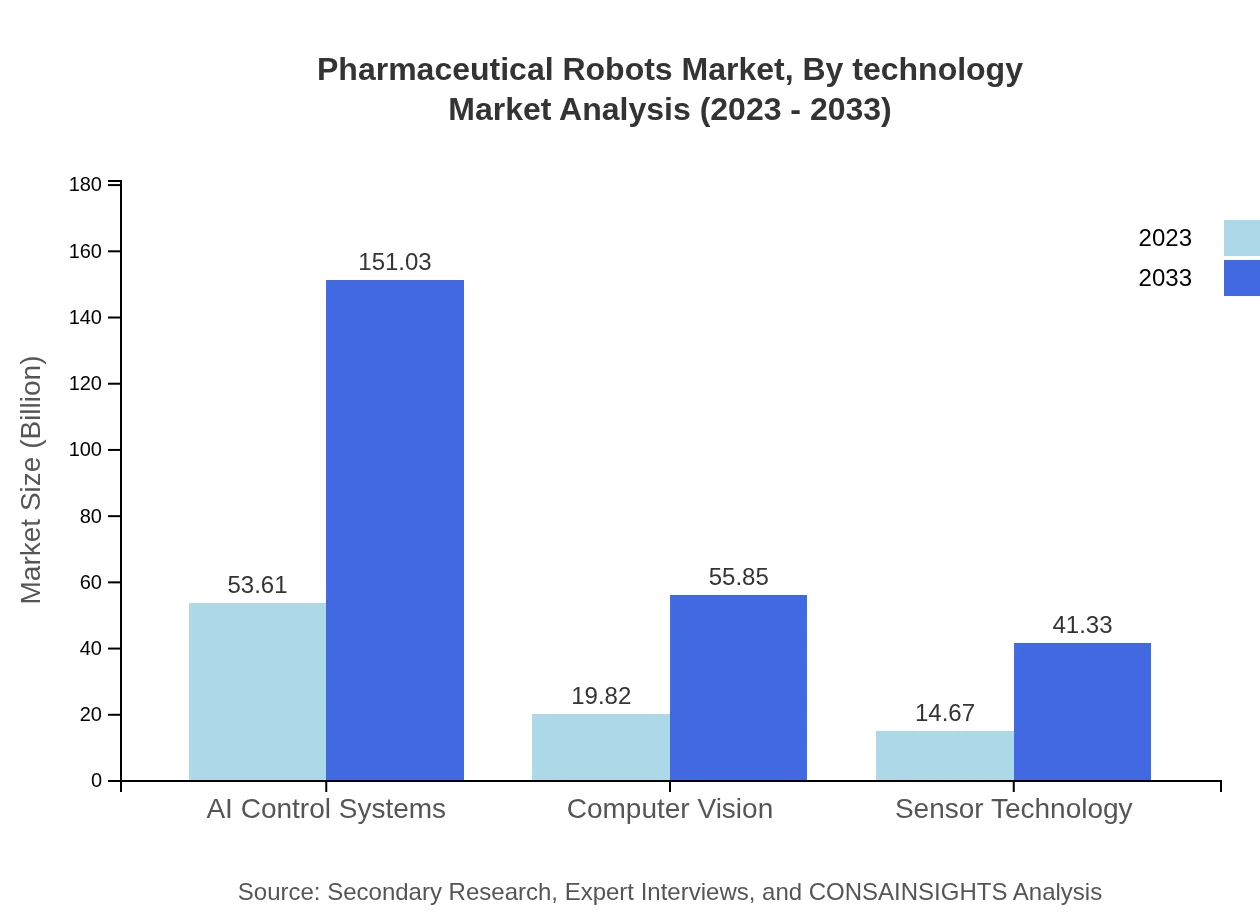

Pharmaceutical Robots Market Analysis By Technology

AI control systems and sensor technologies are leading trends, with market sizes of USD 53.61 billion and USD 14.67 billion respectively in 2023, showcasing the market's reliance on innovative technology for efficiency.

Pharmaceutical Robots Market Analysis By Configuration

Fixed configuration robots hold a significant market share, valued at USD 71.79 billion in 2023, while flexible configurations are increasingly adopted, with sizes growing from USD 16.31 billion to USD 45.94 billion by 2033.

Pharmaceutical Robots Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Robots Industry

ABB Ltd.:

A pioneer in robotics and automation, ABB provides solutions that enhance productivity in pharmaceutical manufacturing systems.KUKA AG:

KUKA specializes in industrial automation and robotics, offering innovative solutions tailored for the pharmaceutical industry.FANUC Corporation:

FANUC is a leading provider of robotics and factory automation solutions, focusing on increasing efficiency and reliability in pharmaceutical operations.Yaskawa Electric Corporation:

Yaskawa is notable for its advanced robotic systems, providing flexible automation options for pharmaceutical processes.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmaceutical Robots?

The pharmaceutical robots market is valued at $88.1 million in 2023 and is projected to grow at a CAGR of 10.5% to reach significant levels by 2033.

What are the key market players or companies in the pharmaceutical Robots industry?

Key players in the pharmaceutical robots market include ABB, KUKA AG, Fanuc Corporation, Omron Corporation, and Yaskawa Electric Corporation, which lead in innovation and supply.

What are the primary factors driving the growth in the pharmaceutical robots industry?

The growth in the pharmaceutical robots industry is driven by increasing demand for automation in drug manufacturing, advancements in robot technology, and the need for efficiency and precision in pharmaceutical operations.

Which region is the fastest Growing in the pharmaceutical robots market?

North America is the fastest-growing region, projected to expand from $28.61 million in 2023 to $80.62 million by 2033, followed closely by Europe and Asia Pacific during the forecast years.

Does ConsaInsights provide customized market report data for the pharmaceutical robots industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the pharmaceutical robots industry, focusing on essential insights and market trends.

What deliverables can I expect from the pharmaceutical robots market research project?

Deliverables include detailed market analysis reports, segment analysis, regional insights, forecasts, trends, and strategic recommendations tailored to your business needs.

What are the market trends of pharmaceutical robots?

Current trends in the pharmaceutical robots market include increased adoption of AI technology, a rise in collaborative robotic solutions, and greater integration of automation for enhanced operational efficiency.