Pharmaceutical Waste Management Market Report

Published Date: 31 January 2026 | Report Code: pharmaceutical-waste-management

Pharmaceutical Waste Management Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Pharmaceutical Waste Management market, covering key insights and structured data from 2024 to 2033. It examines market size, growth trends, segmentation, regional dynamics, technological innovations, and regulatory frameworks. The report offers comprehensive forecast data and strategic insights to help stakeholders navigate this evolving landscape.

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $5.60 Billion |

| CAGR (2024-2033) | 6.9% |

| 2033 Market Size | $10.38 Billion |

| Top Companies | EcoPharm Solutions Inc., GreenMed Waste Technologies |

| Last Modified Date | 31 January 2026 |

Pharmaceutical Waste Management Market Overview

Customize Pharmaceutical Waste Management Market Report market research report

- ✔ Get in-depth analysis of Pharmaceutical Waste Management market size, growth, and forecasts.

- ✔ Understand Pharmaceutical Waste Management's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmaceutical Waste Management

What is the Market Size & CAGR of Pharmaceutical Waste Management market in {Year}?

Pharmaceutical Waste Management Industry Analysis

Pharmaceutical Waste Management Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmaceutical Waste Management Market Analysis Report by Region

Europe Pharmaceutical Waste Management Market Report:

Europe is characterized by stringent regulatory policies and a high emphasis on environmental sustainability. With strong enforcement of international standards, European countries are investing in state-of-the-art waste treatment technologies, thereby significantly enhancing market growth.Asia Pacific Pharmaceutical Waste Management Market Report:

The Asia Pacific region is witnessing rapid growth in pharmaceutical waste management due to expanding healthcare infrastructure and increasing pharmaceutical manufacturing. Government initiatives aimed at improving waste management protocols are also driving investments, as emerging economies focus on sustainable practices.North America Pharmaceutical Waste Management Market Report:

North America remains a mature market with advanced waste management systems in place. Continuous innovations, stringent environmental regulations, and high healthcare standards support steady growth in this region.South America Pharmaceutical Waste Management Market Report:

South America presents a growing market with a focus on improving waste processing capabilities. Although currently smaller in scale, increasing regulatory pressures and environmental awareness are expected to contribute to gradual market expansion.Middle East & Africa Pharmaceutical Waste Management Market Report:

In the Middle East and Africa, market growth is driven by rapid urbanization and improvements in healthcare services. Although regulatory frameworks are still evolving, increasing investments in waste management infrastructure point to a positive long-term outlook for the region.Tell us your focus area and get a customized research report.

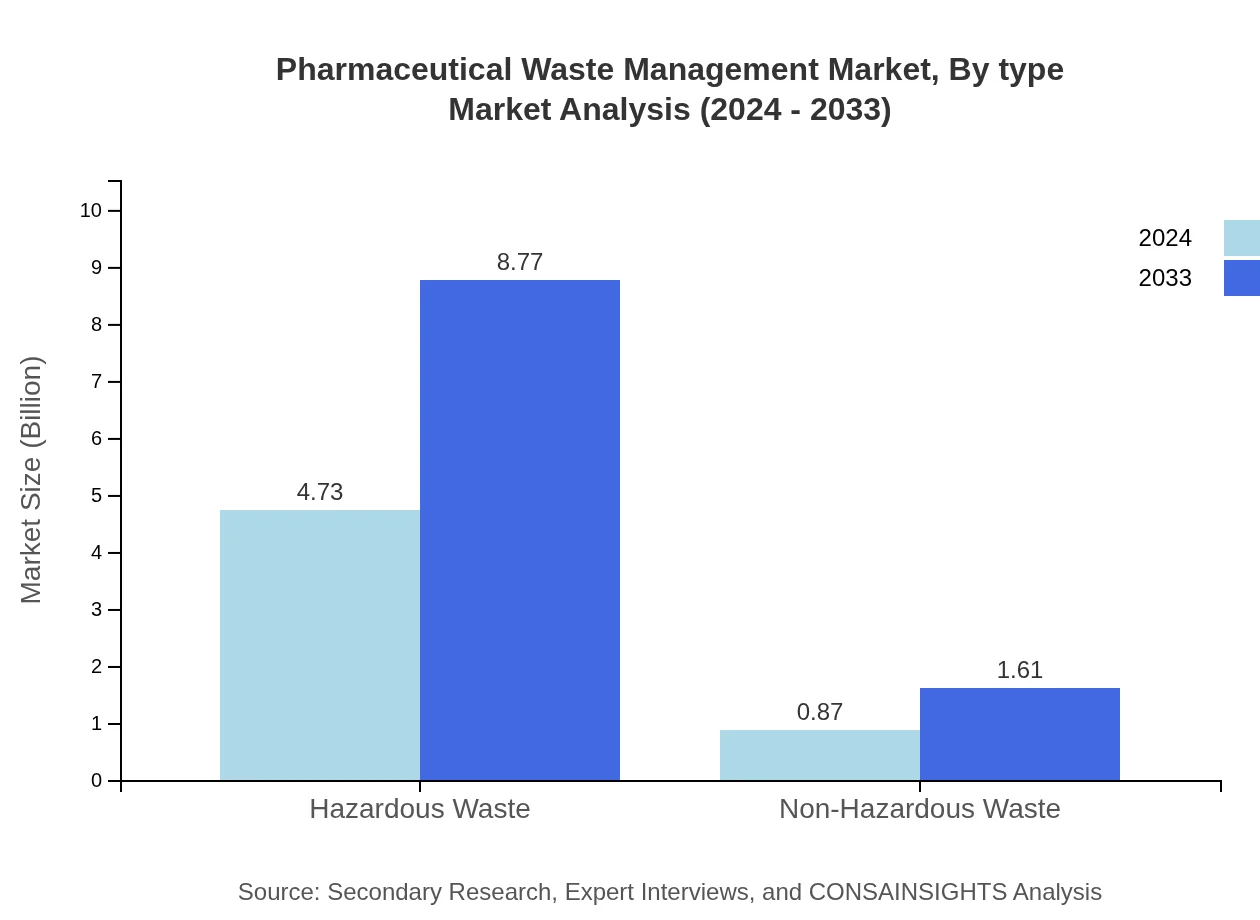

Pharmaceutical Waste Management Market Analysis By Type

Analysis by type highlights the division between hazardous and non-hazardous waste. Hazardous waste, with a market size of 4.73 billion USD in 2024 growing to 8.77 billion USD in 2033, commands approximately 84.51% share consistently. In contrast, non-hazardous waste represents a smaller, yet significant, portion of the market. Detailed evaluation of these categories provides insight into distinct handling, processing, and regulatory challenges influencing overall market dynamics.

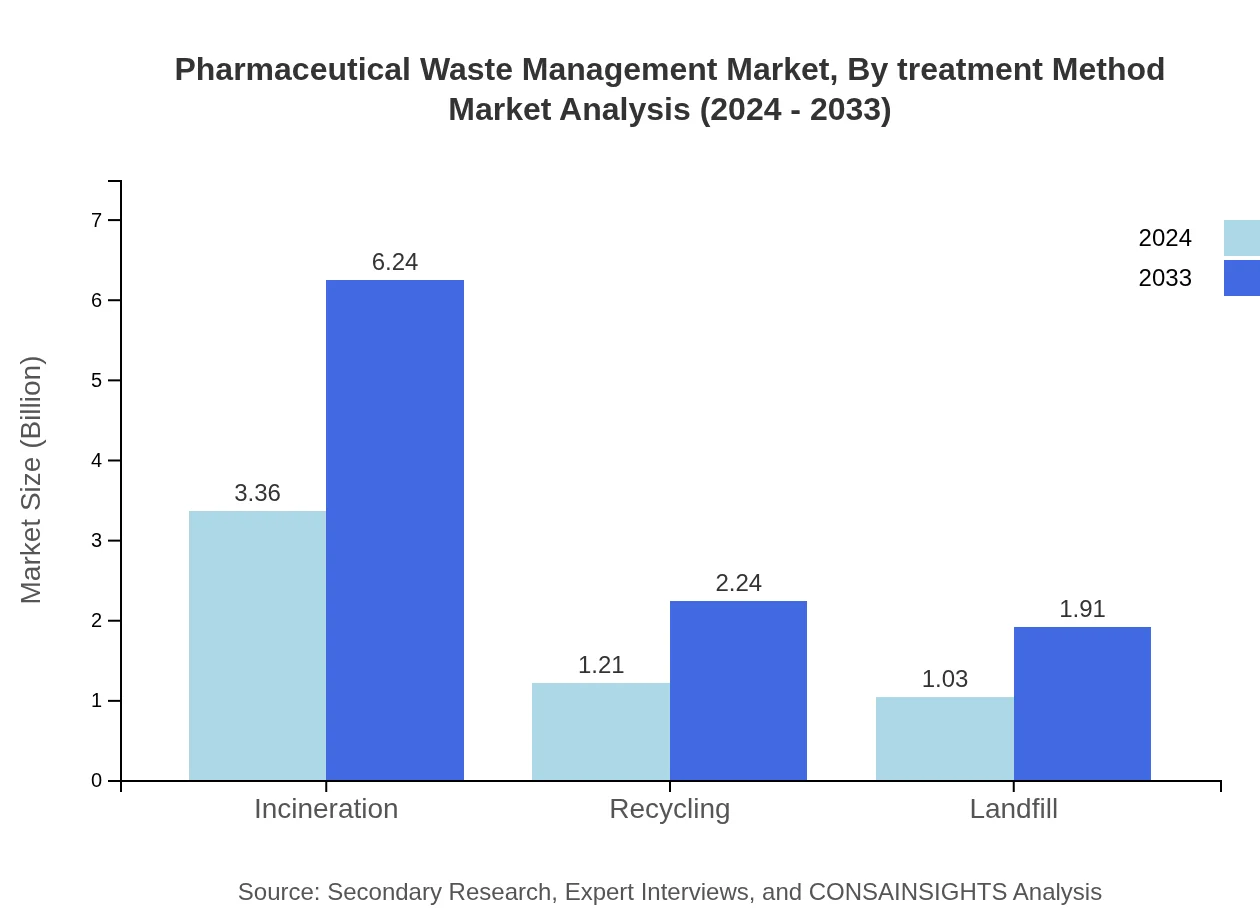

Pharmaceutical Waste Management Market Analysis By Treatment Method

The treatment method segment focuses on incineration, recycling, and landfill processes. Incineration, holding a leading share of 60.08%, is projected to expand from 3.36 billion USD in 2024 to 6.24 billion USD in 2033. Recycling and landfill methods, while smaller, are critical for sustainable practices and are expected to grow at comparable rates. This segment analysis underscores the importance of selecting the right treatment method to meet environmental standards and cost efficiency.

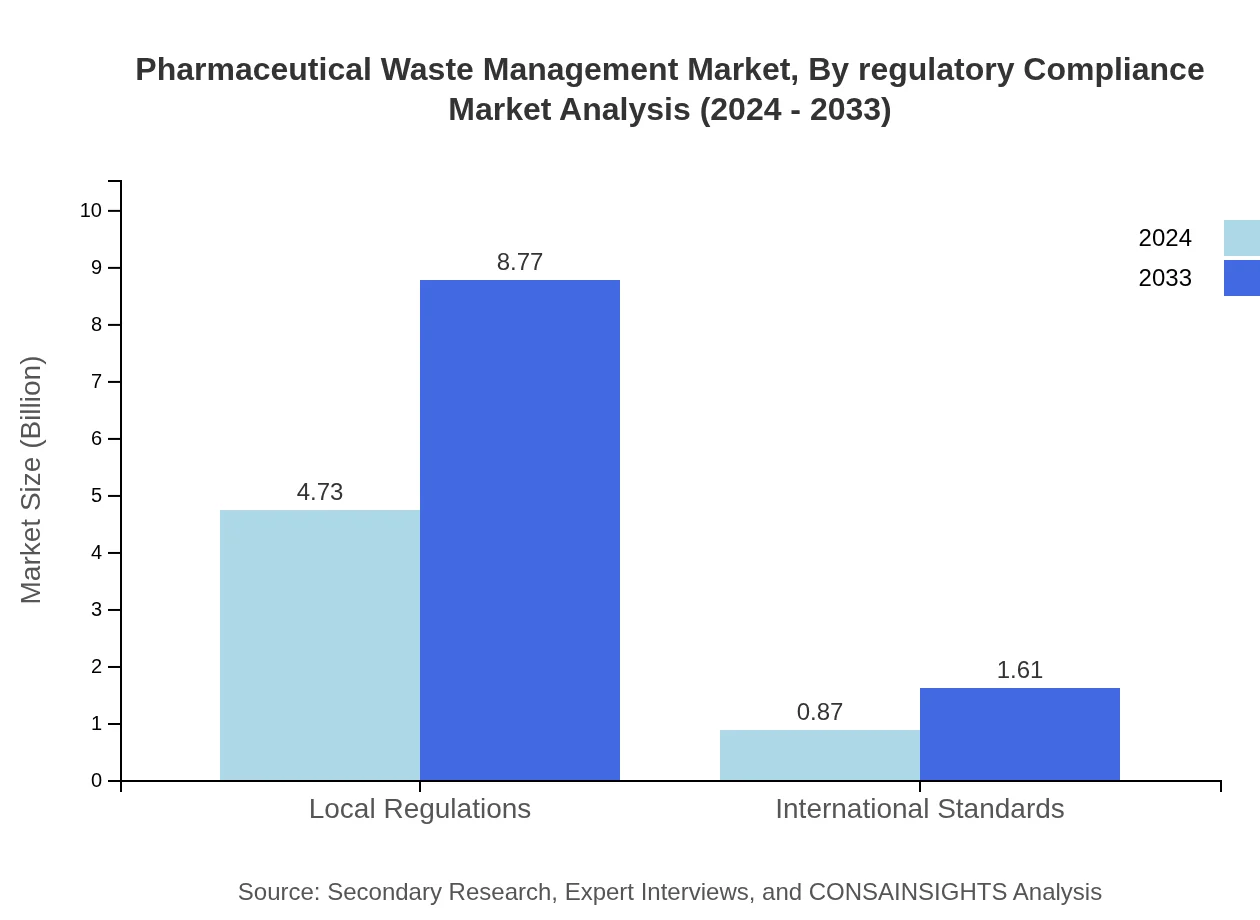

Pharmaceutical Waste Management Market Analysis By Regulatory Compliance

Regulatory compliance is segmented into local regulations and international standards. With local regulations commanding a dominant share of 84.51%, driven by robust national policies, the segment is projected to grow significantly. International standards, while accounting for a smaller share of 15.49%, ensure global best practices and safe disposal procedures. This analysis emphasizes how adherence to these standards is essential for operational integrity and market credibility.

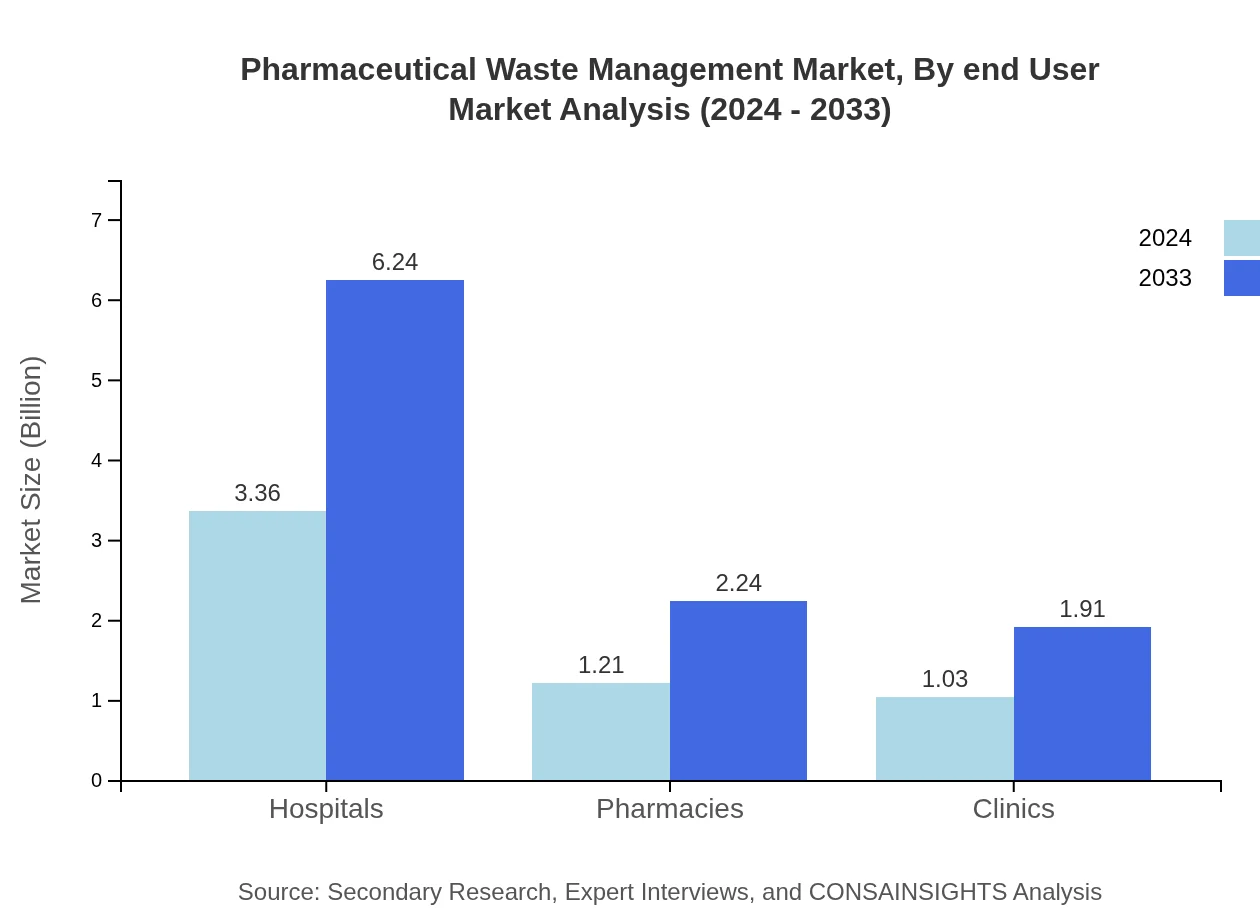

Pharmaceutical Waste Management Market Analysis By End User

The end-user segment comprises hospitals, pharmacies, and clinics. Hospitals, representing 60.08% of the market share, lead with waste management expenditures rising from 3.36 billion USD in 2024 to 6.24 billion USD in 2033. Pharmacies and clinics follow, reflecting the diverse waste generation patterns across the healthcare spectrum. This segmentation enables targeted service delivery to meet the specific needs of each end-user group, ensuring efficiency and compliance.

Pharmaceutical Waste Management Market Analysis By Region

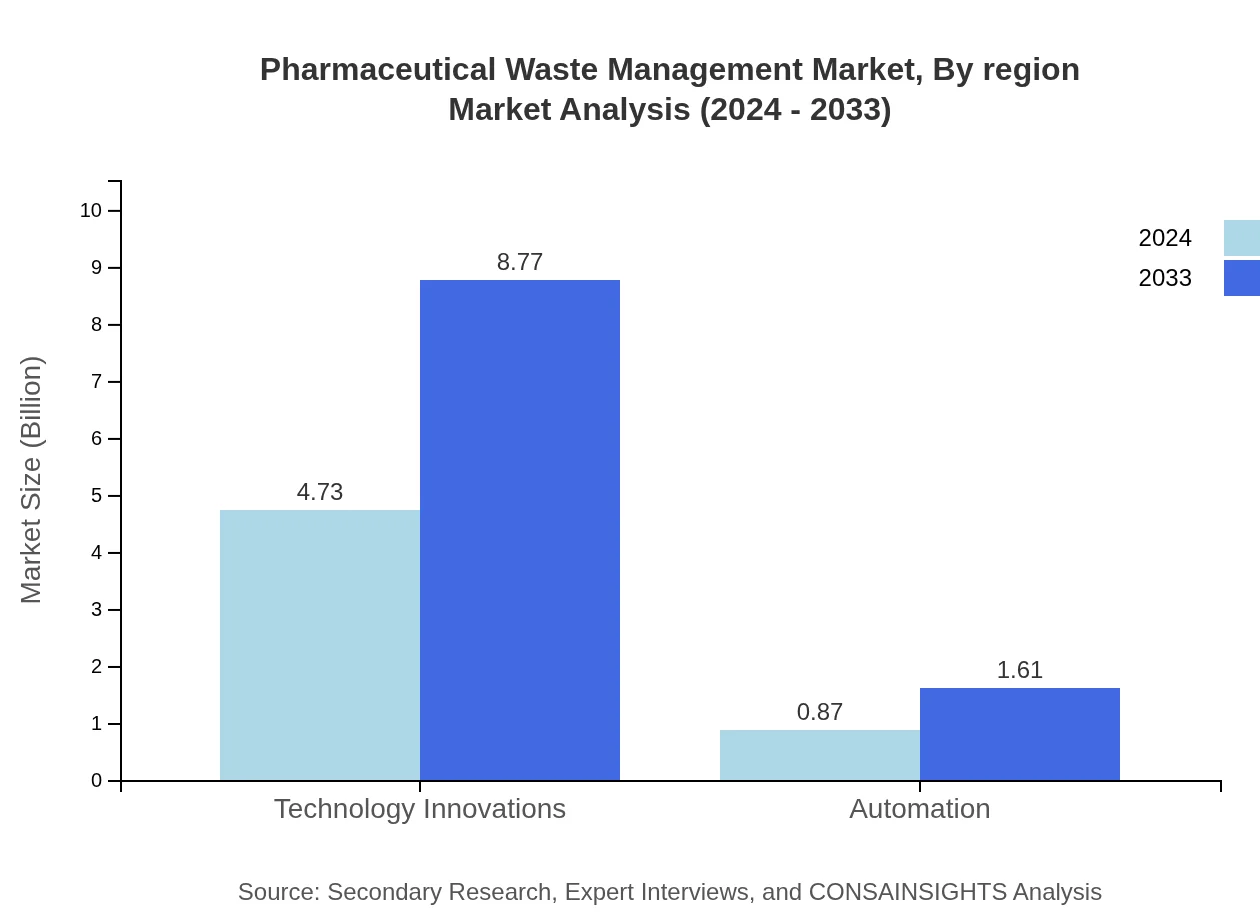

The technology segment is driven by advancements in technology innovations and automation. Technology innovations, with a market value growing from 4.73 billion USD in 2024 to 8.77 billion USD in 2033, dominate with an 84.51% share. Automation systems, while constituting a smaller 15.49% share, are critical for streamlining waste processing and reducing human error. This segment analysis highlights how technological integration is reshaping operational efficiencies and regulatory compliance within the market.

Pharmaceutical Waste Management Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmaceutical Waste Management Industry

EcoPharm Solutions Inc.:

EcoPharm Solutions Inc. leads the market by offering innovative and sustainable waste management solutions. The company specializes in cutting-edge treatment technologies and comprehensive compliance services that help manage hazardous pharmaceutical waste effectively.GreenMed Waste Technologies:

GreenMed Waste Technologies is renowned for its advanced waste processing systems and automation capabilities. Their commitment to research and development has positioned them as a key player in delivering environmentally responsible and technologically advanced waste management solutions globally.We're grateful to work with incredible clients.

FAQs

What is the market size of Pharmaceutical Waste Management?

The Pharmaceutical Waste Management market is currently valued at approximately $5.6 billion in 2023, with expectations for substantial growth, projecting a CAGR of 6.9% over the next decade, reaching a significantly larger market value by 2033.

What are the key market players or companies in the Pharmaceutical Waste Management industry?

Key players in the Pharmaceutical Waste Management industry include companies specializing in hazardous waste management, pharmaceutical disposal services, and consulting services, leveraging advanced technologies and strategic compliance with regulations to drive market success.

What are the primary factors driving the growth in the Pharmaceutical Waste Management industry?

The growth in the Pharmaceutical Waste Management industry is primarily driven by increased environmental regulations, rising awareness about the hazards of pharmaceutical waste, and the growing need for sustainable and compliant waste management solutions among healthcare facilities and pharmaceutical manufacturers.

Which region is the fastest Growing in the Pharmaceutical Waste Management?

The fastest-growing region in the Pharmaceutical Waste Management market is Europe, expected to grow from $1.61 billion in 2023 to $3.19 billion by 2033, driven by stringent regulations and enhanced waste management practices for pharmaceuticals.

Does ConsaInsights provide customized market report data for the Pharmaceutical Waste Management industry?

Yes, ConsaInsights provides customized market report data tailored to specific needs within the Pharmaceutical Waste Management industry, ensuring clients receive valuable insights that align with their business strategies and objectives.

What deliverables can I expect from this Pharmaceutical Waste Management market research project?

From the Pharmaceutical Waste Management market research project, you can expect comprehensive reports featuring market size, growth forecasts, detailed segment analysis, competitive landscape insights, and actionable recommendations based on the latest market data.

What are the market trends of Pharmaceutical Waste Management?

Current market trends in Pharmaceutical Waste Management include a shift towards eco-friendly disposal methods, advancements in waste processing technologies, and increased partnerships between healthcare organizations and waste management firms, all aimed at enhancing efficiency and compliance.