Pharmacy Management System Market Report

Published Date: 31 January 2026 | Report Code: pharmacy-management-system

Pharmacy Management System Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Pharmacy Management System market, covering key trends, growth forecasts, and industry dynamics from 2023 to 2033. It encompasses detailed analyses of regional markets, technologies, and competitive landscapes.

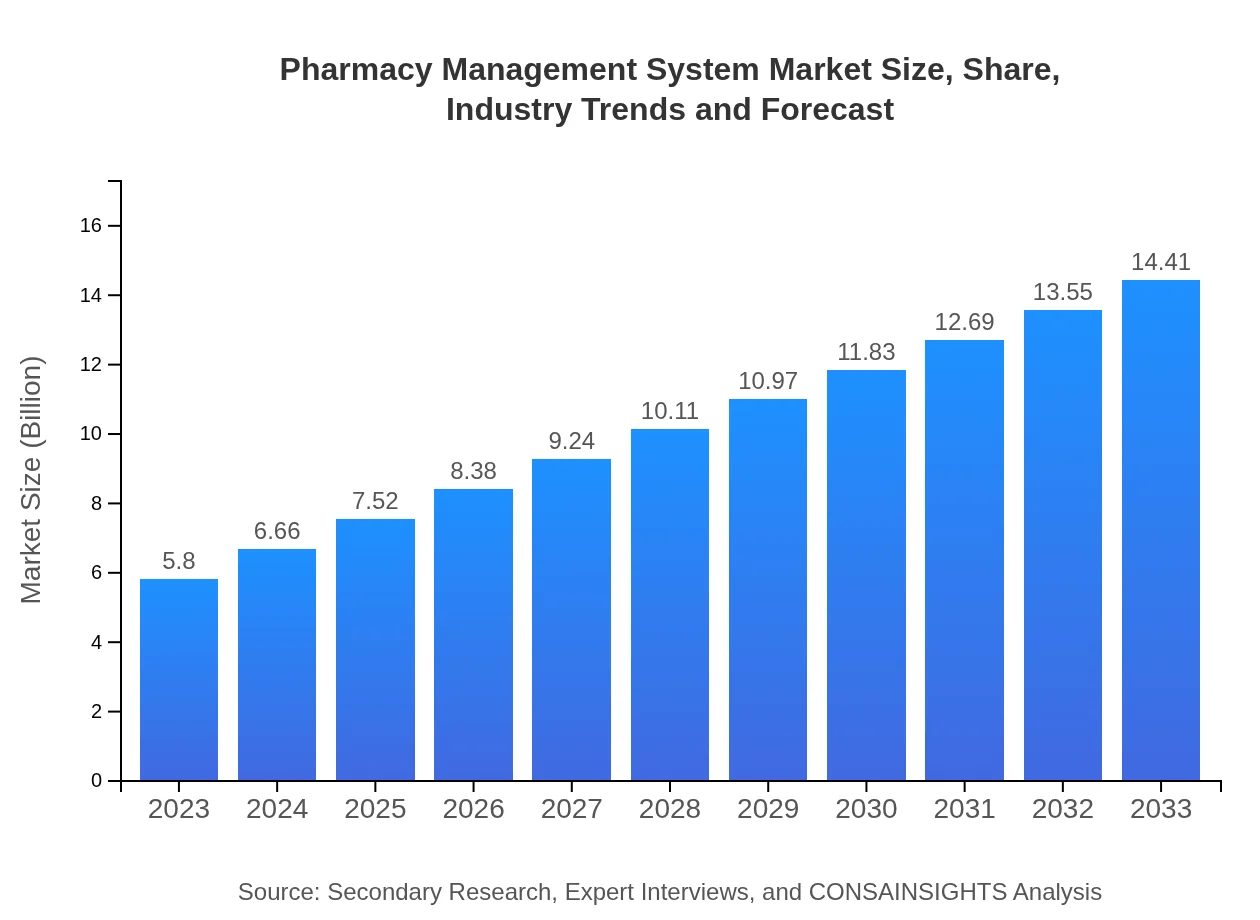

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.80 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $14.41 Billion |

| Top Companies | Cerner Corporation, McKesson Corporation, Allscripts Healthcare Solutions, Epic Systems Corporation, QS/1 |

| Last Modified Date | 31 January 2026 |

Pharmacy Management System Market Overview

Customize Pharmacy Management System Market Report market research report

- ✔ Get in-depth analysis of Pharmacy Management System market size, growth, and forecasts.

- ✔ Understand Pharmacy Management System's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Pharmacy Management System

What is the Market Size & CAGR of Pharmacy Management System market in 2023?

Pharmacy Management System Industry Analysis

Pharmacy Management System Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Pharmacy Management System Market Analysis Report by Region

Europe Pharmacy Management System Market Report:

The European market is forecasted to grow significantly from $1.60 billion in 2023 to $3.98 billion by 2033. Strict regulatory frameworks and an increasing focus on operational efficiencies are key growth factors.Asia Pacific Pharmacy Management System Market Report:

In the Asia Pacific region, the Pharmacy Management System market is anticipated to grow from $1.11 billion in 2023 to approximately $2.75 billion by 2033. This increase is due to the rapid adoption of technology in healthcare and the growing patient population requiring efficient management systems.North America Pharmacy Management System Market Report:

North America leads the market with a size projected to rise from $2.17 billion in 2023 to $5.39 billion by 2033. Strong healthcare infrastructure and high investments in pharmacy management technologies drive this growth.South America Pharmacy Management System Market Report:

South America is expected to see growth from $0.57 billion in 2023 to around $1.42 billion by 2033. This growth is supported by an expanding middle class and improved access to healthcare technology.Middle East & Africa Pharmacy Management System Market Report:

In the Middle East and Africa, the market is expected to expand from $0.35 billion in 2023 to $0.88 billion by 2033. Growing populations and healthcare demands are fostering increased investments in pharmacy management systems.Tell us your focus area and get a customized research report.

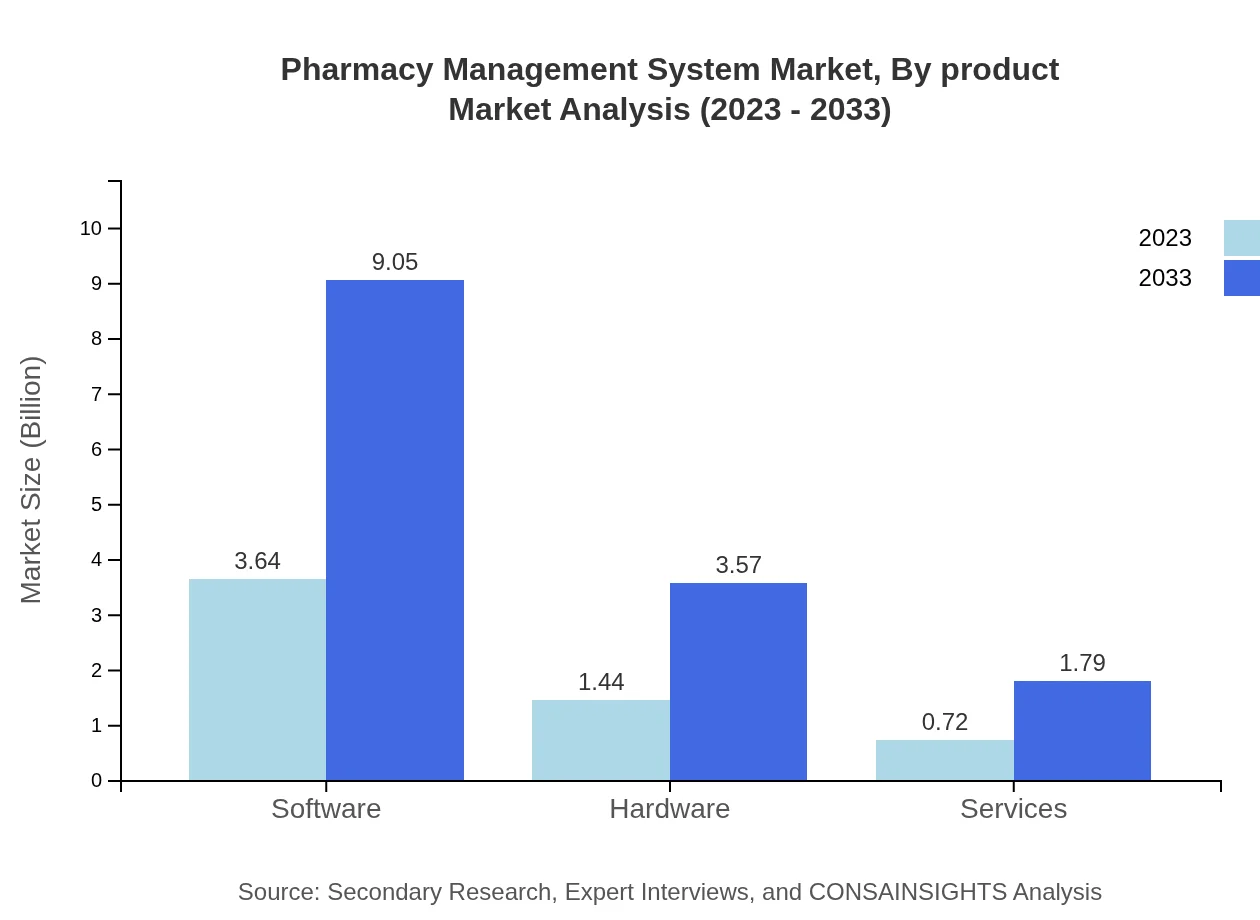

Pharmacy Management System Market Analysis By Product

The software segment of the Pharmacy Management System market will see its size increase from $3.64 billion in 2023 to an estimated $9.05 billion by 2033, reflecting a continuously rising need for advanced management features. The hardware component will grow from $1.44 billion to approximately $3.57 billion, supporting the underlying infrastructure for improved operational capabilities. The services segment is expected to grow from $0.72 billion to $1.79 billion, emphasizing the importance of ongoing technical support and system maintenance.

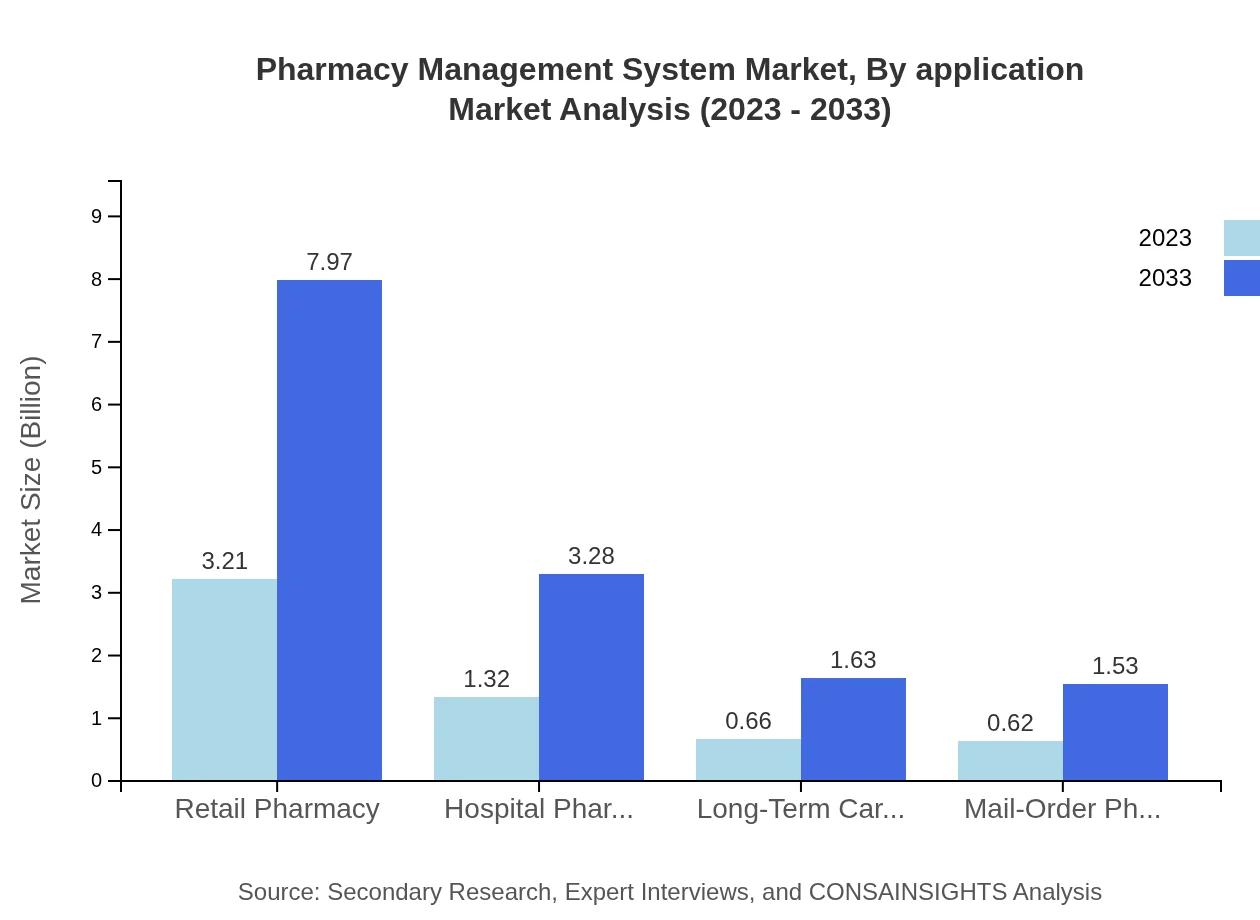

Pharmacy Management System Market Analysis By Application

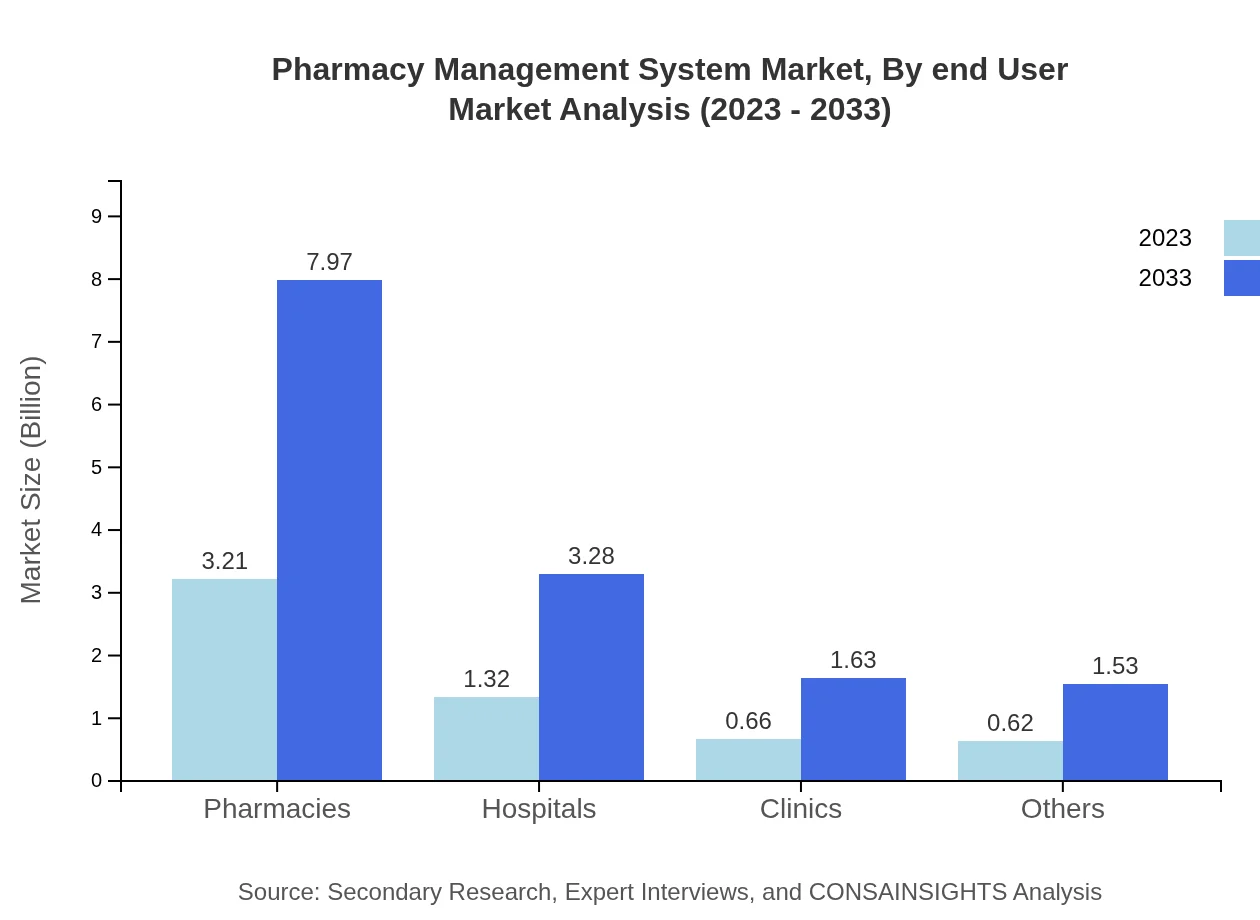

Pharmacies will continue to dominate the market, growing from $3.21 billion in 2023 to $7.97 billion by 2033, driven by the increasing number of retail pharmacies optimizing their workflows. Hospitals are projected to grow from $1.32 billion to $3.28 billion, as more hospitals integrate pharmacy management systems to improve patient care and medication safety.

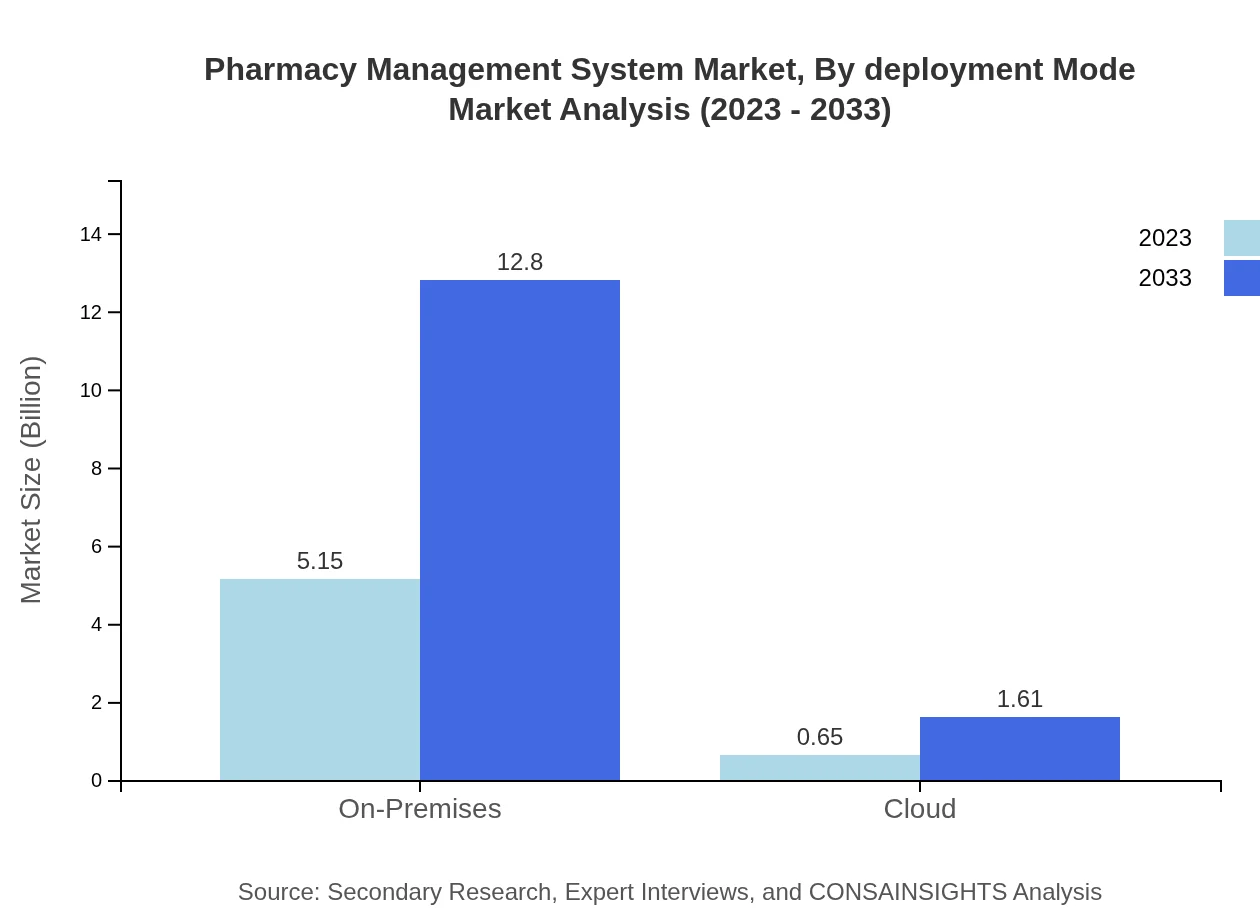

Pharmacy Management System Market Analysis By Deployment Mode

The on-premises segment is expected to maintain its dominance, growing from $5.15 billion to $12.80 billion by 2033. Cloud-based solutions are also gaining traction, expected to rise from $0.65 billion to $1.61 billion, as stakeholders look for scalable alternatives that enhance accessibility and reduce costs.

Pharmacy Management System Market Analysis By End User

Retail pharmacies will hold the largest market share, expected to see growth from $3.21 billion to $7.97 billion. Hospitals will expand in significance, projected to grow from $1.32 billion to $3.28 billion, reflecting the pressing need for improved pharmacy operations in healthcare facilities.

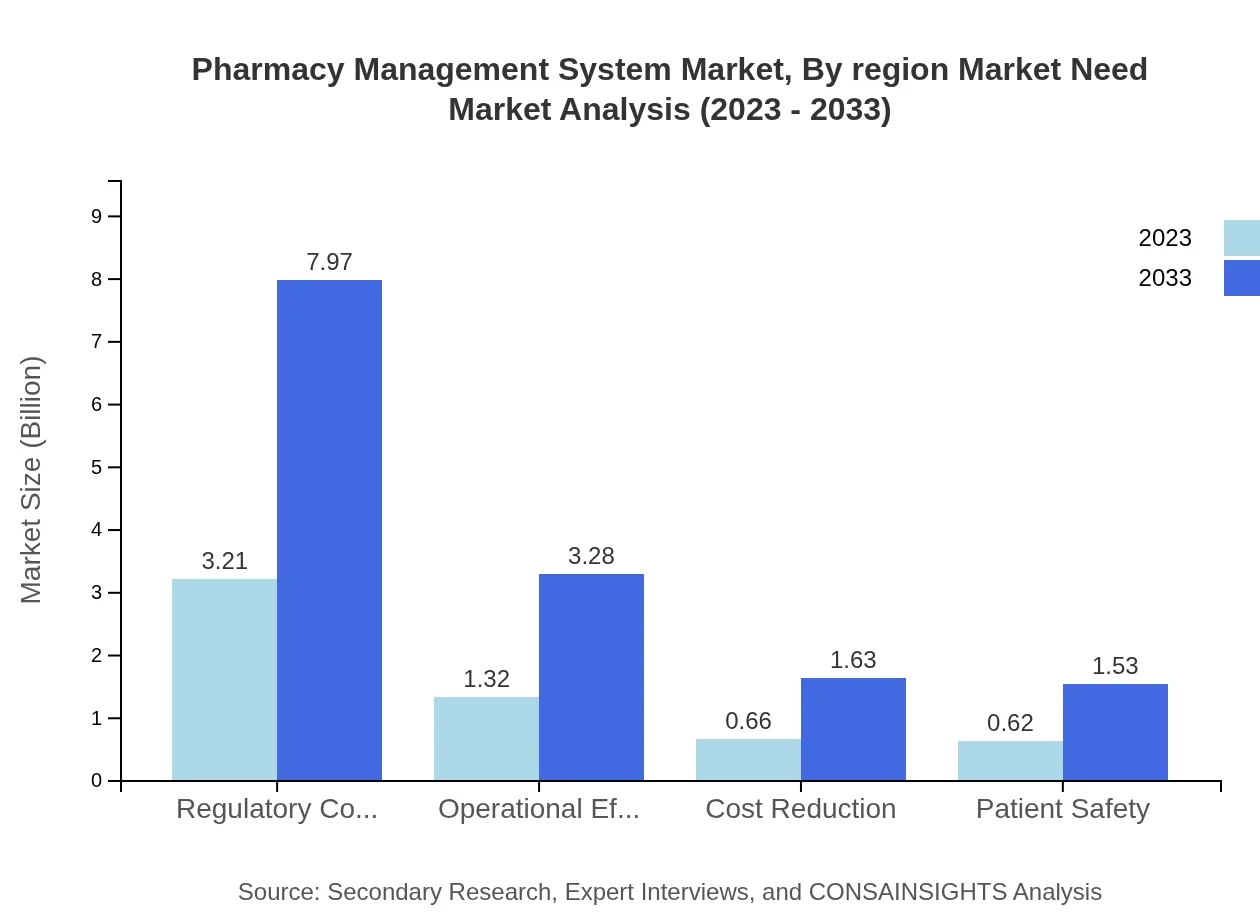

Pharmacy Management System Market Analysis By Region Market Need

Regulatory compliance needs will dominate the market, expanding from $3.21 billion to $7.97 billion. Operational efficiency will also see a notable increase from $1.32 billion to $3.28 billion, with systems helping to reduce errors and streamline operations, ultimately improving patient safety.

Pharmacy Management System Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Pharmacy Management System Industry

Cerner Corporation:

Cerner provides comprehensive pharmacy management solutions helping healthcare systems manage medications efficiently and ensure compliance with regulations.McKesson Corporation:

As one of the largest pharmaceutical distributors, McKesson also offers pharmacy management systems that streamline operations and improve inventory control.Allscripts Healthcare Solutions:

Allscripts offers an array of pharmacy management solutions designed to enhance the management of medications and clinical workflows.Epic Systems Corporation:

Epic provides integrated systems that include advanced pharmacy management capabilities, ensuring comprehensive healthcare delivery.QS/1:

QS/1 specializes in pharmacy management software solutions designed to streamline operations in community pharmacies and healthcare facilities.We're grateful to work with incredible clients.

FAQs

What is the market size of pharmacy management system?

The global pharmacy management system market is projected to reach approximately $5.8 billion by 2033, growing at a CAGR of 9.2% from 2023 to 2033. This illustrates strong demand and investment in advanced pharmacy management technologies.

What are the key market players or companies in this pharmacy management system industry?

The pharmacy management system industry features significant players, including McKesson Corporation, Cerner Corporation, Allscripts Healthcare Solutions, and QS/1. These companies lead by providing innovative solutions, enhancing operational efficiency and regulatory compliance.

What are the primary factors driving the growth in the pharmacy management system industry?

Key drivers for growth in the pharmacy management system industry include increasing demand for automation, the push for regulatory compliance, improving patient safety, and the need for operational efficiency in healthcare services, enhancing overall pharmacy operations.

Which region is the fastest Growing in the pharmacy management system?

The pharmacy management system market is experiencing rapid growth in regions such as North America, projected to expand from $2.17 billion in 2023 to $5.39 billion by 2033, indicating a robust demand for pharmacy solutions.

Does ConsaInsights provide customized market report data for the pharmacy management system industry?

Yes, ConsaInsights specializes in providing tailored market report data for the pharmacy management system industry. Our reports are customized based on unique client requirements, offering deep insights into market trends and forecasts.

What deliverables can I expect from this pharmacy management system market research project?

You can expect comprehensive deliverables including detailed market size analyses, segment performance, competitive landscapes, growth forecasts, and strategic recommendations tailored to enhance your business decision-making process.

What are the market trends of pharmacy management system?

Current market trends indicate a shift towards cloud-based solutions, integration with electronic health records (EHR), increased focus on patient safety, and automation of pharmaceutical processes, shaping the future of the pharmacy management systems.