Phoropters Market Report

Published Date: 31 January 2026 | Report Code: phoropters

Phoropters Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Phoropters market, offering insights into market size, CAGR forecasts, segmentation, technological advancements, and key players from 2023 to 2033.

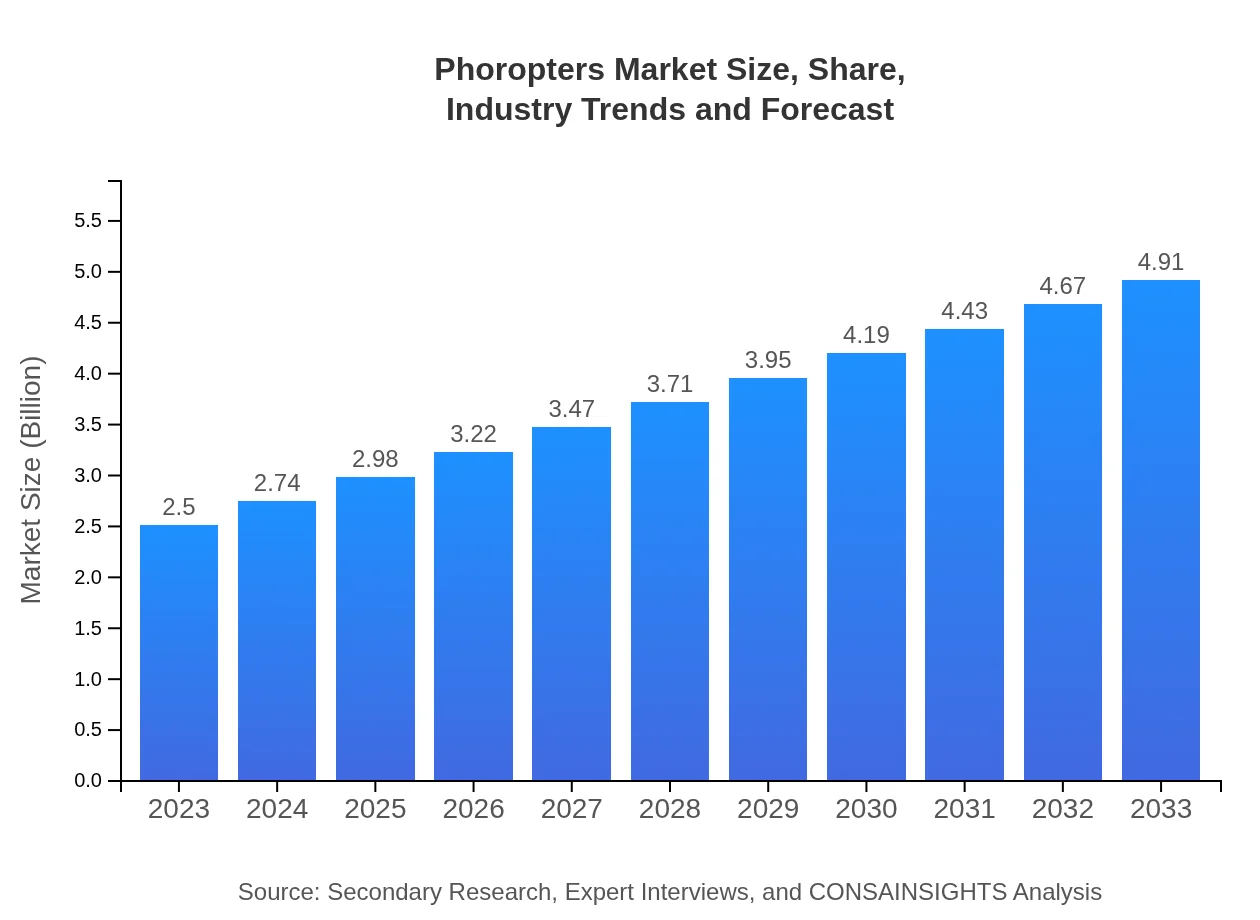

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $4.91 Billion |

| Top Companies | Carl Zeiss AG, Nidek Co., Ltd., Topcon Corporation, Reichert Technologies, Huvitz Co., Ltd. |

| Last Modified Date | 31 January 2026 |

Phoropters Market Overview

Customize Phoropters Market Report market research report

- ✔ Get in-depth analysis of Phoropters market size, growth, and forecasts.

- ✔ Understand Phoropters's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Phoropters

What is the Market Size & CAGR of Phoropters market in 2023?

Phoropters Industry Analysis

Phoropters Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Phoropters Market Analysis Report by Region

Europe Phoropters Market Report:

The European market is predicted to grow from $0.68 billion in 2023 to $1.34 billion by 2033, at a CAGR of around 7.1%. The rise in elderly populations coupled with the demand for improved optical services plays a crucial role in this growth.Asia Pacific Phoropters Market Report:

In the Asia Pacific region, the phoropters market is projected to grow from $0.47 billion in 2023 to $0.93 billion by 2033, reflecting a CAGR of approximately 7.4%. The increase in population and higher rates of uncorrected vision problems are significant drivers. Countries like China and India are leading the way in adopting advanced optical technologies.North America Phoropters Market Report:

North America remains the largest market, anticipated to grow from $0.97 billion in 2023 to $1.91 billion by 2033, showcasing a CAGR of 7.3%. The presence of advanced healthcare infrastructure and high expenditures on healthcare services substantially contribute to this growth.South America Phoropters Market Report:

The South American phoropters market, although smaller, is expected to double from $0.03 billion in 2023 to $0.06 billion by 2033, at a CAGR of 6.6%. Growth is being propelled by increasing urbanization and awareness of eye health, along with government initiatives for healthcare improvement.Middle East & Africa Phoropters Market Report:

The Middle East and Africa market is expected to double from $0.34 billion in 2023 to $0.67 billion by 2033, translating to a CAGR of 7.1%. Increased investments in healthcare infrastructure and the introduction of advanced optical devices in the region boost market potential.Tell us your focus area and get a customized research report.

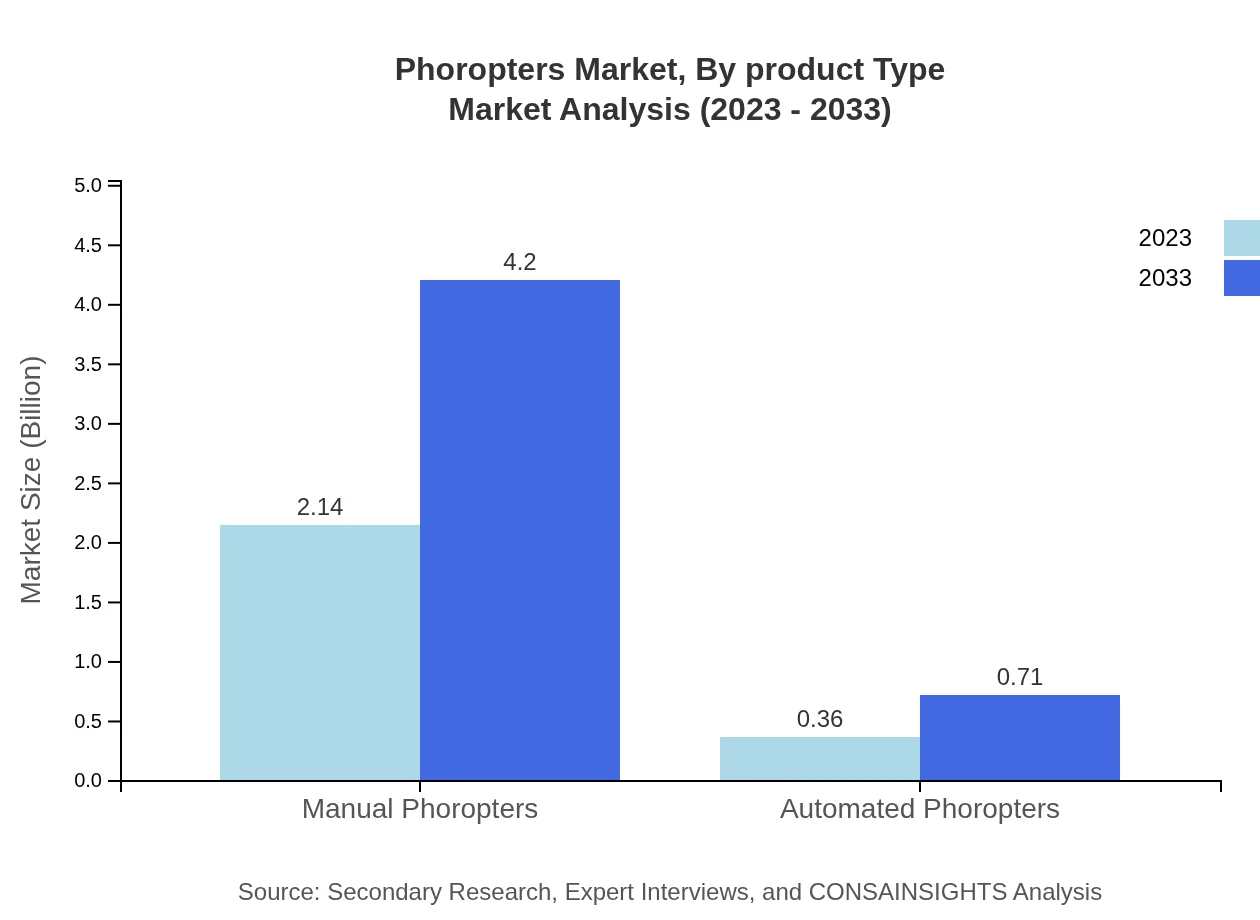

Phoropters Market Analysis By Product Type

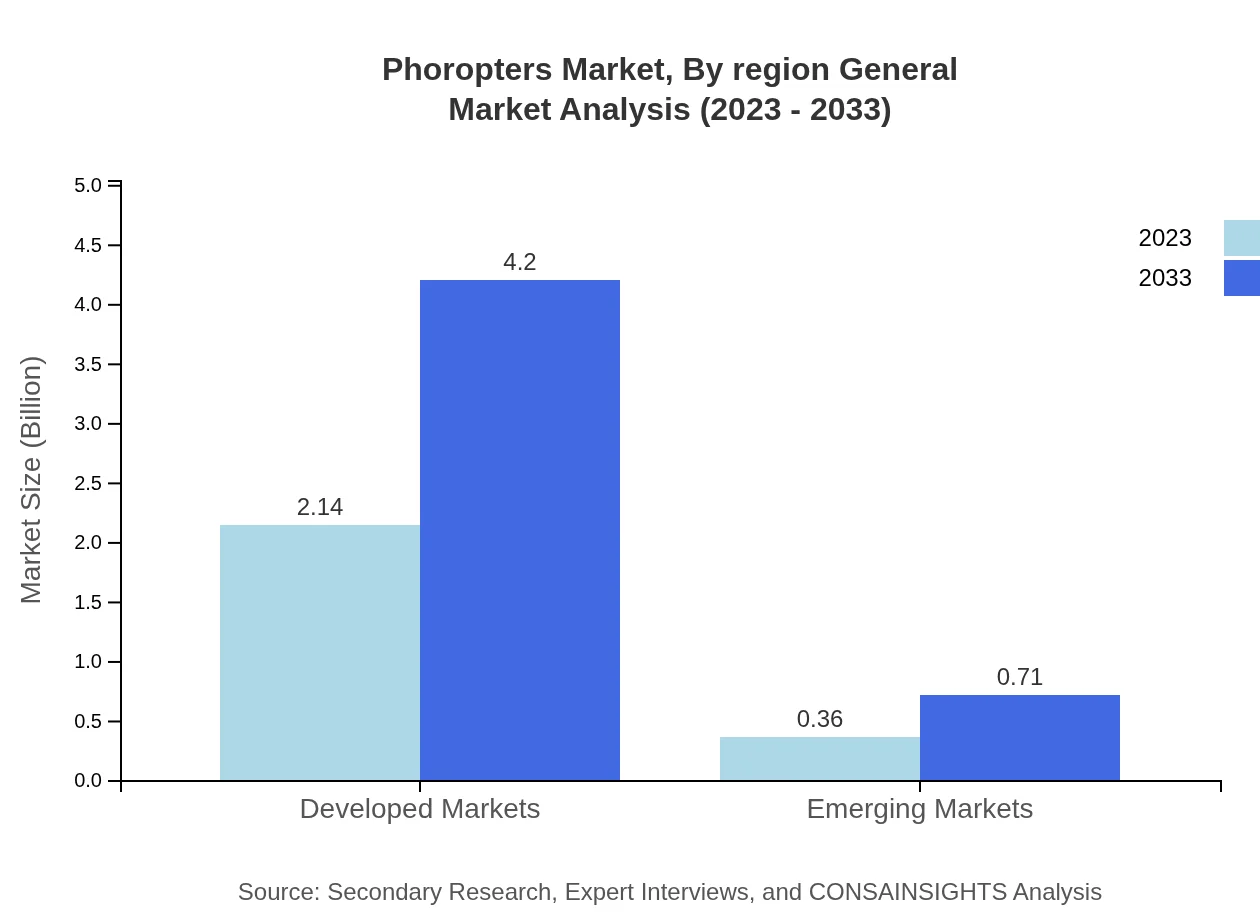

The manual phoropters market, valued at $2.14 billion in 2023, is expected to grow to $4.20 billion by 2033, maintaining a share of 85.56%. On the other hand, the automated phoropters market is small but growing, projected to reach $0.71 billion, comprising 14.44% of the market share by 2033.

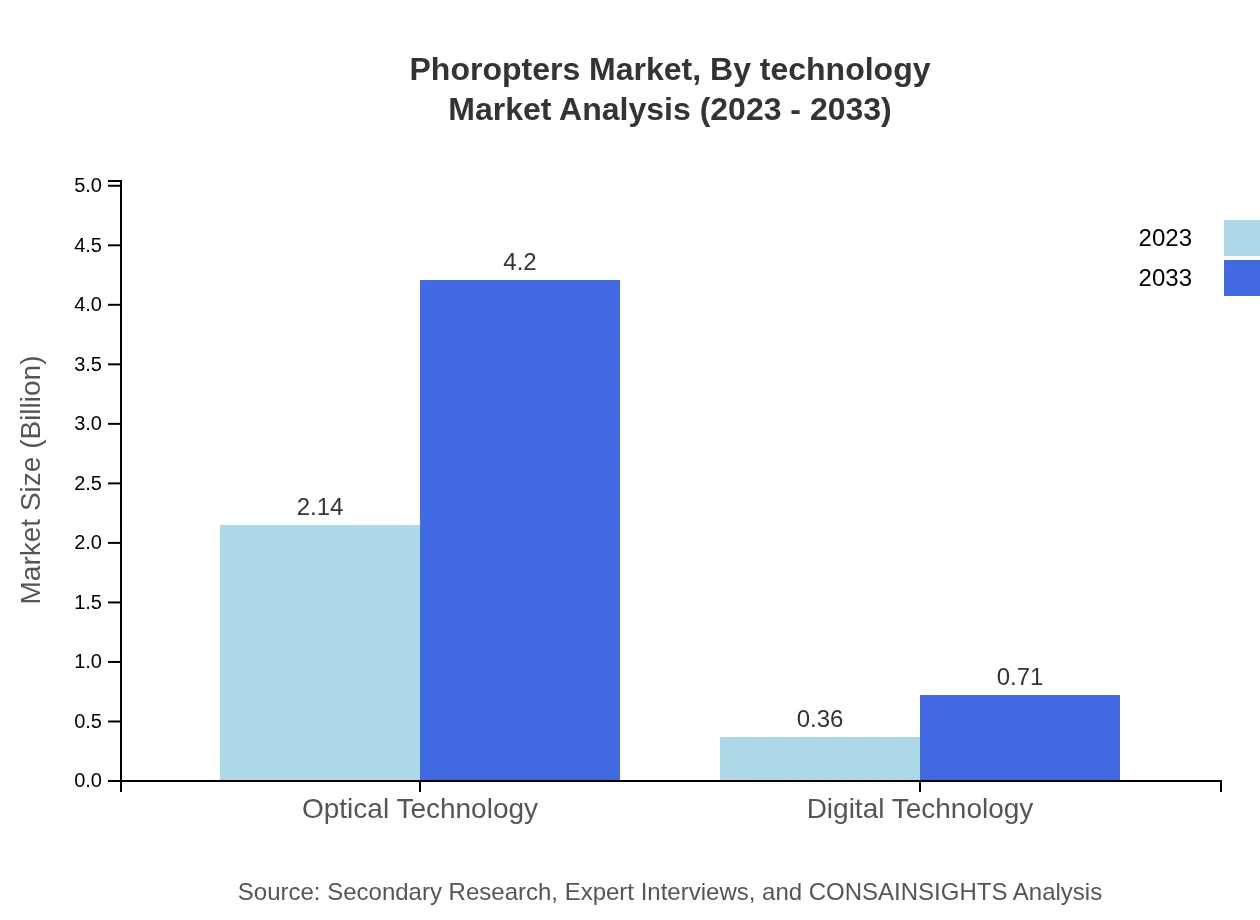

Phoropters Market Analysis By Technology

Phoropters are categorized by technology with optical technology holding 85.56% of the market at $2.14 billion in 2023 and expecting a rise to $4.20 billion by 2033. Digital technology currently holds a smaller segment but is projected for growth from $0.36 billion in 2023 to $0.71 billion in 2033.

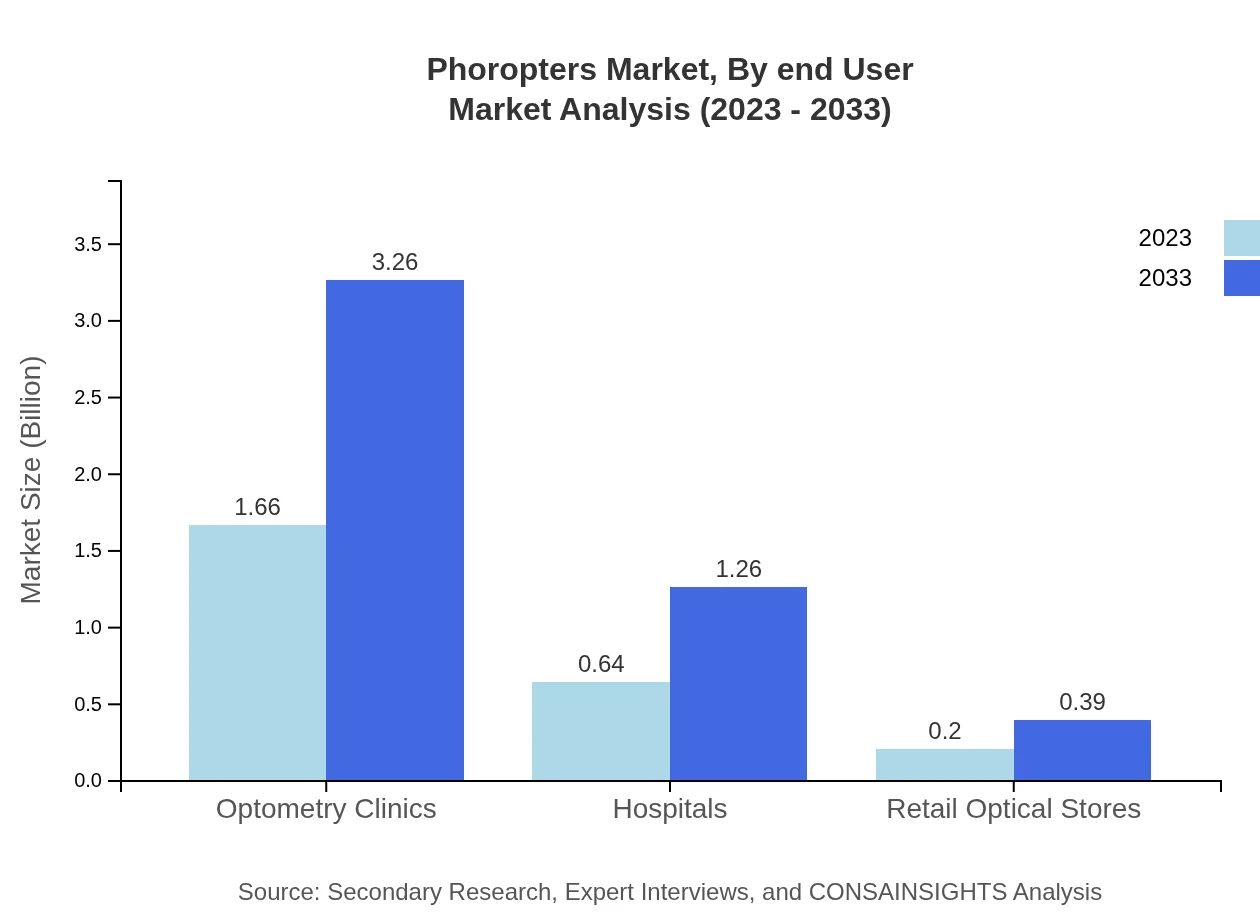

Phoropters Market Analysis By End User

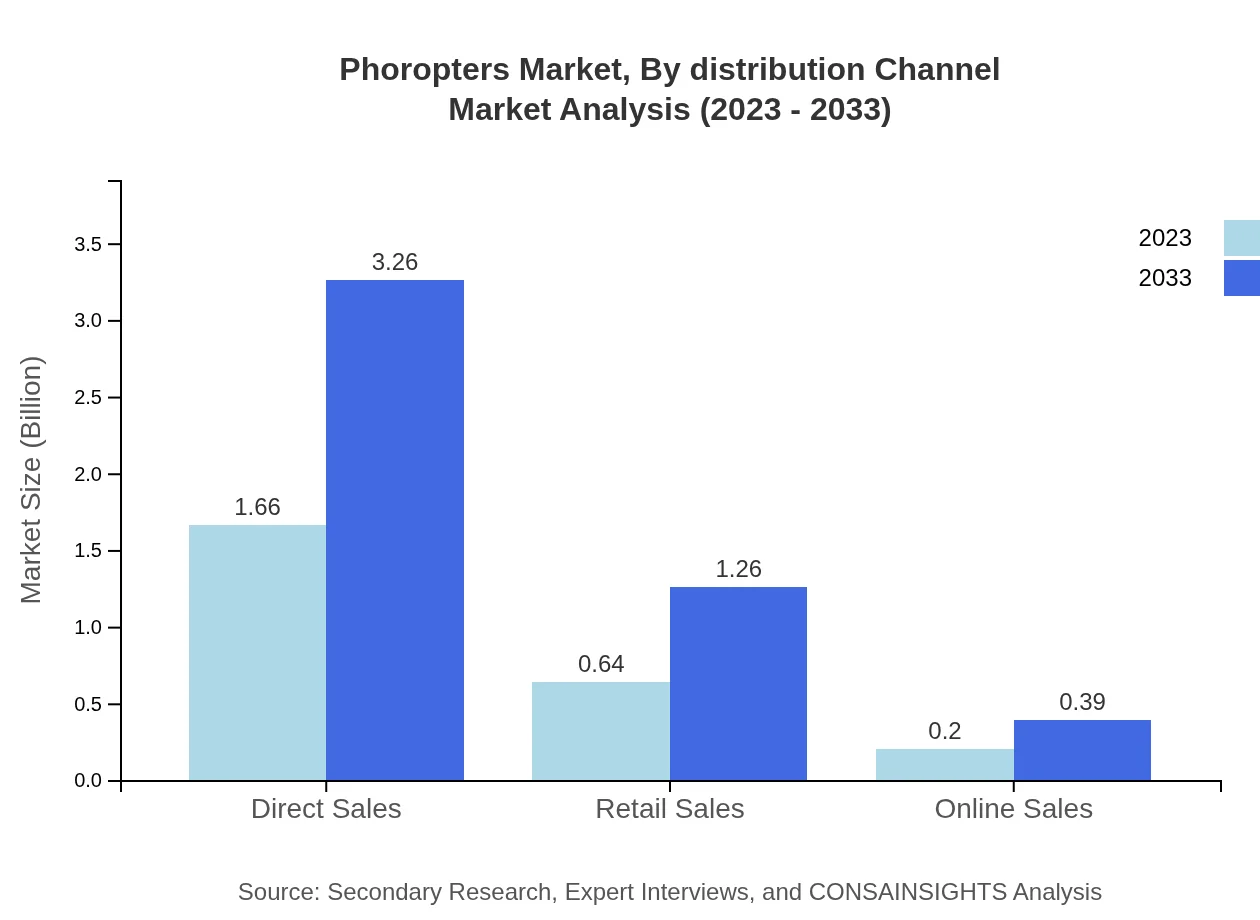

Optometry clinics lead the market substantially, valued at $1.66 billion in 2023 and anticipated to reach $3.26 billion by 2033. Hospitals follow closely, increasing from $0.64 billion to $1.26 billion during the same period, while retail optical stores show modest growth.

Phoropters Market Analysis By Region General

The global phoropters market, segmented by region, highlights North America as the dominant player, followed by Europe and Asia Pacific. Each region is poised for significant growth due to technological advancements, increasing healthcare access, and rising awareness of eye health.

Phoropters Market Analysis By Distribution Channel

Direct sales account for $1.66 billion in 2023 and are expected to grow to $3.26 billion by 2033, maintaining a significant market share. Retail and online sales follow, with online channels showing an upward trend as consumer preferences shift towards e-commerce.

Phoropters Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Phoropters Industry

Carl Zeiss AG:

Carl Zeiss AG is a leading global optics and optoelectronics company, providing high-quality phoropters with advanced technology for accurate refractive measurements.Nidek Co., Ltd.:

Nidek Co., Ltd. specializes in manufacturing innovative ophthalmic equipment, including premium phoropters known for their user-friendly design and precision.Topcon Corporation:

Topcon Corporation offers a wide range of optical devices, including automated phoropters, setting standards for accuracy and efficiency in eye examinations.Reichert Technologies:

Reichert Technologies is known for its advanced optical equipment and is a trusted name in the manufacture of reliable, high-performance phoropters.Huvitz Co., Ltd.:

Huvitz Co., Ltd. focuses on producing high-precision phoropters and is recognized for continuous innovation and commitment to eye care technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of phoropters?

The global phoropters market is projected to reach $2.5 billion by 2033, growing at a CAGR of 6.8%. This growth reflects increasing demand for vision assessment tools across various healthcare settings, signifying a robust expansion of the industry.

What are the key market players or companies in the phoropters industry?

Key players in the phoropters industry include major optical equipment manufacturers and technology suppliers that offer innovative vision testing solutions. Their competitive strategies focus on expanding product portfolios and enhancing customer experience.

What are the primary factors driving the growth in the phoropters industry?

Growth in the phoropters industry is driven by factors such as an increase in the aging population, a rise in the prevalence of vision disorders, advancements in optical technology, and growing awareness of eye health among consumers.

Which region is the fastest Growing in the phoropters?

The Europe region is projected to grow from $0.68 billion in 2023 to $1.34 billion by 2033, making it the fastest-growing market for phoropters. Asia-Pacific is also significant, expected to reach $0.93 billion.

Does ConsaInsights provide customized market report data for the phoropters industry?

Yes, ConsaInsights offers customized market report data tailored to client specifications within the phoropters industry. This service ensures that insights align with specific business needs and market dynamics.

What deliverables can I expect from this phoropters market research project?

Expect detailed deliverables including comprehensive market analysis, growth forecasts, segment breakdowns, competitive landscaping, and regional insights, empowering informed decision-making for stakeholders in the phoropters market.

What are the market trends of phoropters?

Current trends in the phoropters market include the increasing adoption of digital and automated phoropters, a growing inclination towards teleoptometry, and an emphasis on patient-centric eye care solutions to enhance service delivery.